Well, CPI wasn’t as hot

As most of the punditry thought

But bonds don’t believe

The Fed will achieve

Low ‘flation, so they weren’t bought

But maybe, the biggest response

Has been that the buck, at the nonce

Has lost devotees

As though it had fleas

The end of the Trump renaissance?

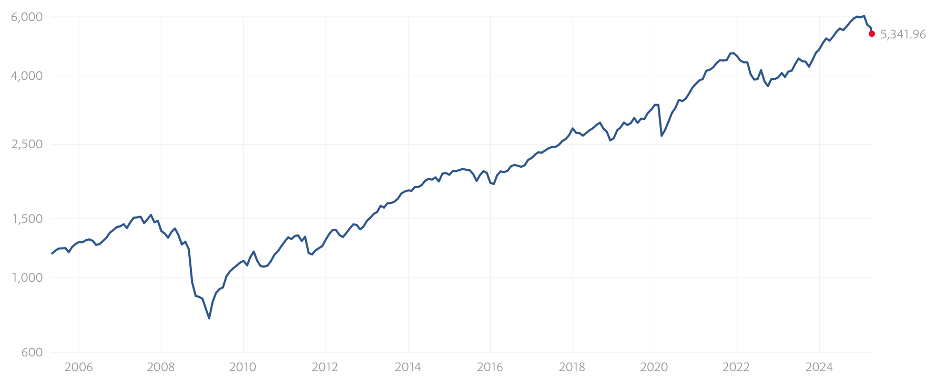

Yesterday’s CPI data was released a touch softer than market expectations with both headline and core monthly numbers printing at 0.2%. If you dig a bit deeper, and look out another decimal place, apparently the miss was just 0.03%, but I don’t think that really matters. As always, when it comes to inflation issues, I rely on @inflation_guy for the scoop, and he provided it here. The essence of the result is that while inflation is not as high as it had been post Covid, it also doesn’t appear likely that it is going to decline much further. I think we all need to be ready for 3.5% inflation as the reality going forward.

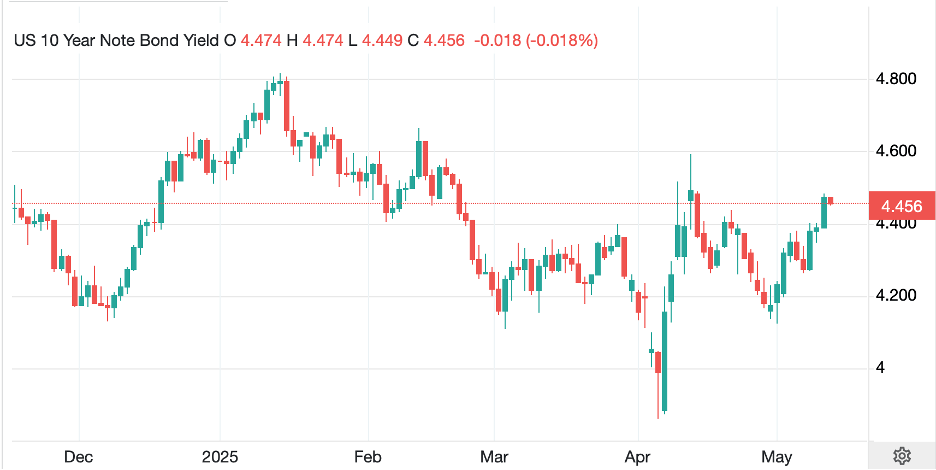

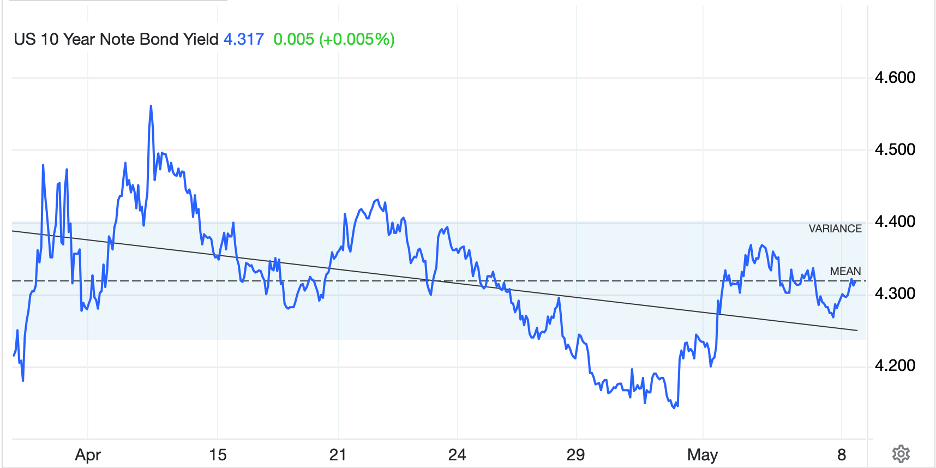

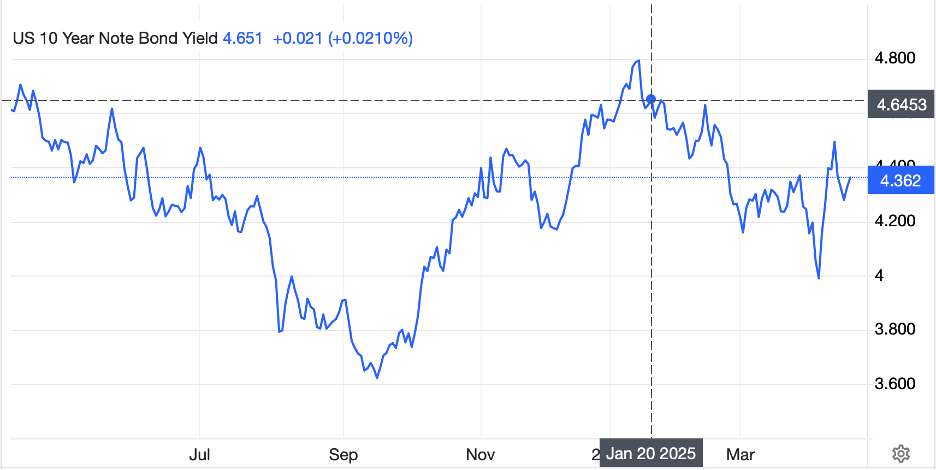

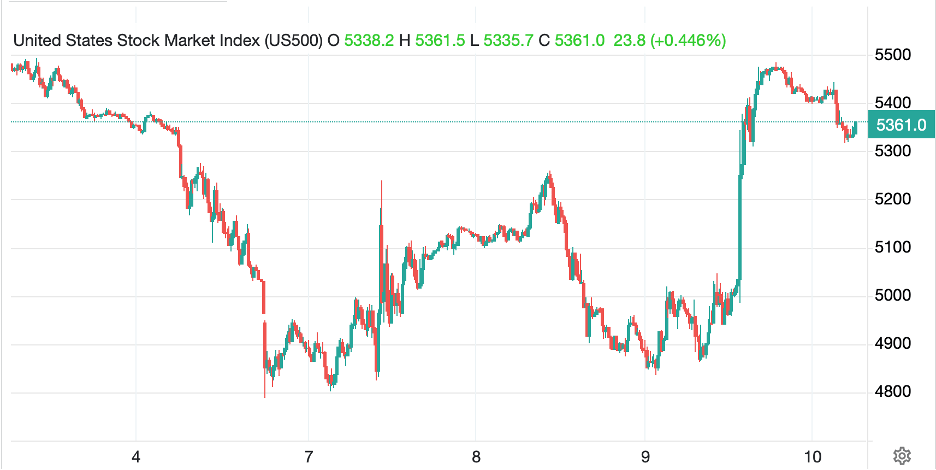

Interestingly, different markets seemed to have taken different messages from the report. For instance, Treasury yields did not see the outcome as particularly positive at all. While yields have edged lower by -2bps this morning, as you can see from the below chart, they remain near their highest level in the past month.

Source: tradingeconomics.com

There are two potential drivers of this price action, I believe, either bond investors don’t believe the headline data is representative of the future, akin to my views of inflation finding a home higher than current readings, or bond investors are losing faith in the full faith and credit of the US. Certainly, the latter would be a much worse scenario for the US, and arguably the world, as the repudiation of the global risk-free asset of long-standing choice will result in a wild scramble to find a replacement. I continue to see comments on X about how that is the case, and that US yields are destined to climb to 6% or 10% over the next couple of years as the dollar declines in importance in the global trading system. However, when I look at the world, especially given my views on inflation, I find that to be a lot of doomporn clickbait and not so much analysis. Alas, higher inflation is not a great outcome either.

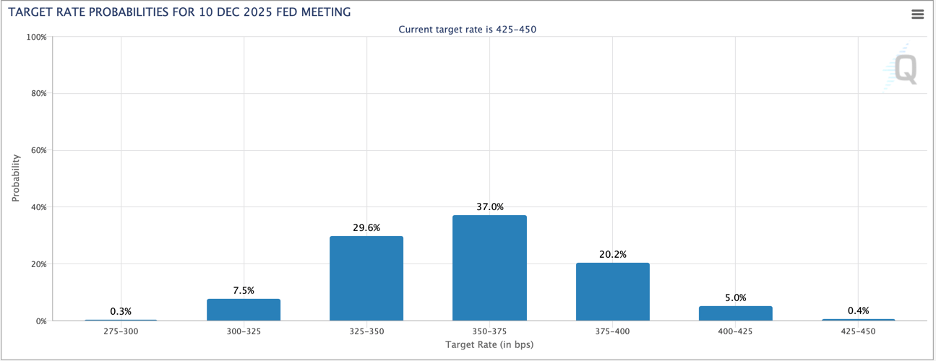

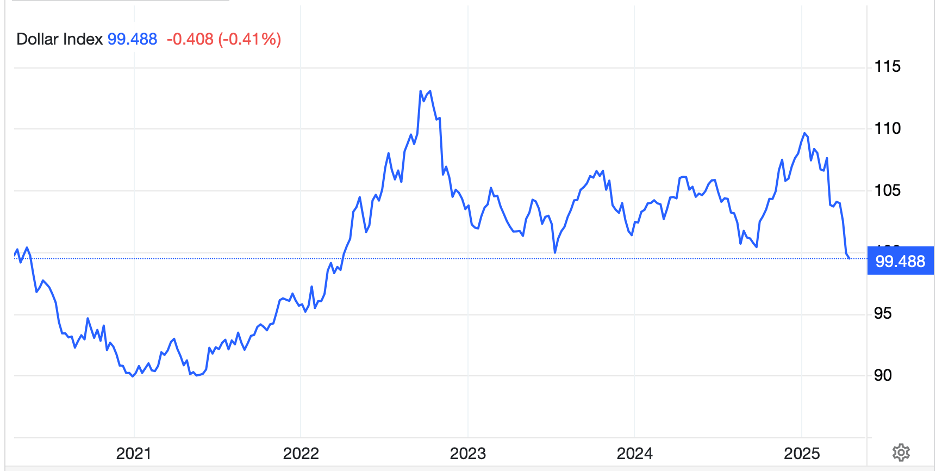

Interestingly, while bond investors did not believe in the idea of lower yields, FX traders took the softer inflation figure as a reason to sell dollars. This is a little baffling to me as there was virtually no change in Fed funds futures expectations with only an 8% probability of a cut next month and only 2 cuts priced for the year. So, if long-dated yields didn’t decline, and short-dated yields didn’t decline, (and equity prices didn’t decline), I wonder what drove the dollar lower.

Yet here we are this morning with the greenback softer against all its G10 counterparts (JPY +1.0%, NOK +0.6%, EUR +0.5%, CHF +0.5%) and almost all its EMG counterparts (KRW +1.5%, MXN +0.3%, ZAR +0.3%, CLP +0.6%, CZK +0.5%). In fact, the only currency bucking the trend is INR (-0.25%) but given the gyrations driven by the Pakistan issues, that may simply be the market adjusting positions.

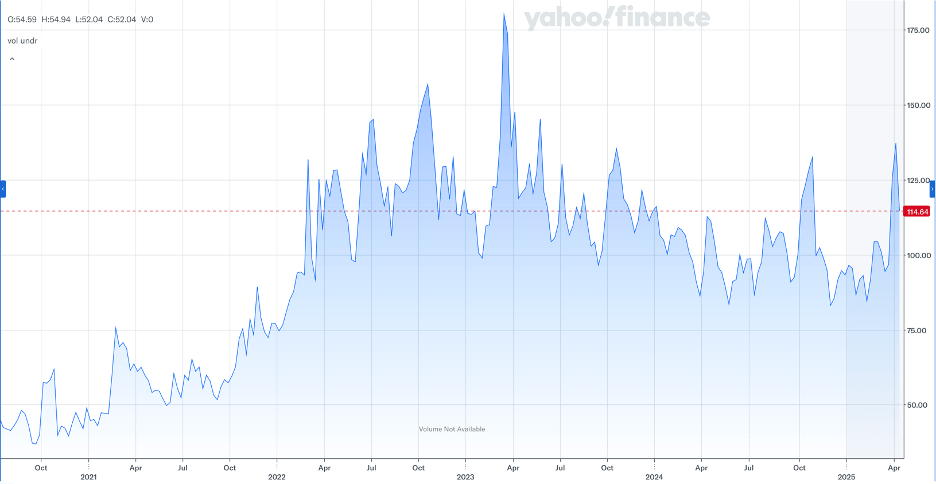

From a technical perspective, we are going to hear a lot about how the dollar failed on its break above the 50-day moving average that was widely touted just two days ago. (see DXY chart below).

Source: tradingeconomics.com

But let’s think about the fundamentals for a bit. First, we know that the Trump administration would prefer a weaker dollar as it helps the competitiveness of US exporters and that is a clear focus. Second, the fact that US yields remain higher than elsewhere in the world is old news, that hasn’t changed since the Fed stopped its brief cutting spree ahead of the election last year while other nations (except Japan) have been cutting rates consistently. What about trade and tariffs? While it is possible that the idea of a reduction in trade will reduce the demand for dollars, arguably, all I have read is that during this 90-day ‘truce’, companies are ordering as much as they can to lock in low tariffs. That sounds like more dollars will be flowing, not less.

As I ponder this question, the first thing to remember is that markets don’t necessarily trade in what appears to be a logical or consistent fashion. I often remark that markets are simply perverse. But going back to the first point regarding President Trump’s desire for a weaker dollar, there was a story overnight that a stronger KRW was part of the trade discussion between the US and South Korea and I have a feeling that is going to be part of the discussion throughout Asia, especially with Japan. As of now, I continue to see more downward pressure on the dollar than upward given the Administration’s desires. I don’t think the Fed is going to do anything, nor should they, but I also don’t foresee a change in the recession narrative in the near future. While that has not been the lead story today, it remains clear that concern about an impending recession is everywhere except, perhaps, the Marriner Eccles Building. My view has been a lower dollar, and perhaps today’s price action is a good example of why that is the case.

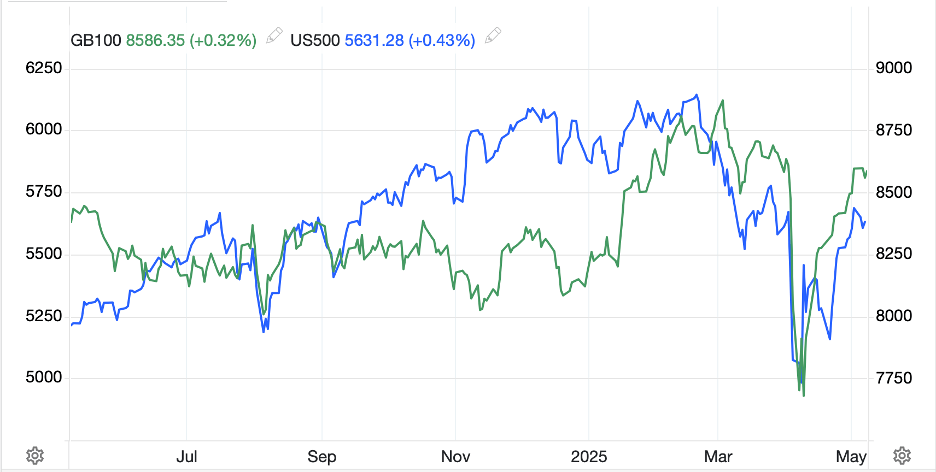

Ok, let’s touch on other markets quickly. After yesterday’s mixed session in the US, Asia saw much more positivity with China (+1.2%) and Hong Kong (+2.3%) leading the way higher with most regional markets having good sessions and only Japan (-0.15%) missing the boat. In Europe, though, the picture is not as bright with both the CAC (-0.6%) and DAX (-0.5%) under some pressure this morning despite benign German inflation data and no French data. Perhaps the euro’s strength is weighing on these markets. As to US futures, at this hour (6:45), they are basically unchanged.

Away from Treasury markets, European sovereign yields have all slipped either -1bp or -2bps on the day with very little to discuss overall here.

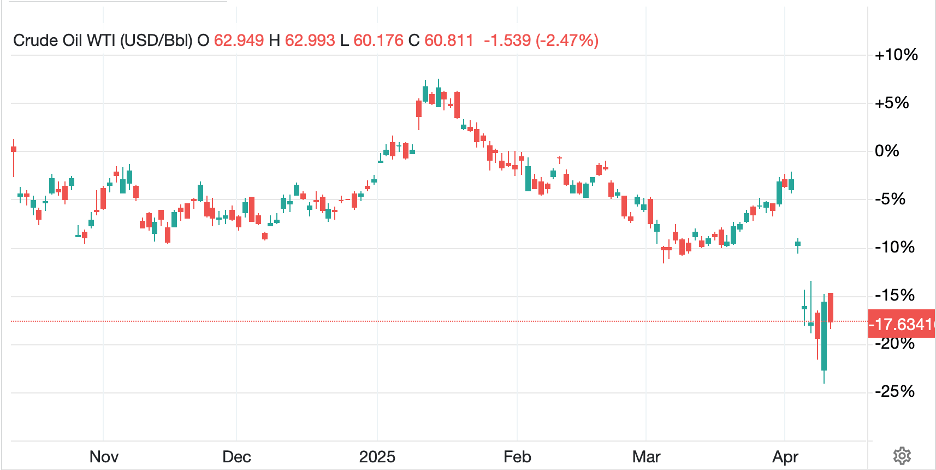

Finally, in the true surprise, commodity prices are under pressure this morning across the board despite the weak dollar. Oil (-1.1%) is slipping, with the proximate cause allegedly being API oil inventory data showed a surprising gain of >4 million barrels. However, given the courteousness of the meeting between President Trump and Saudi Prince MBS, I would not be surprised to hear of an agreement to see prices lower overall. I believe that is Trump’s goal for many reasons, notably to put more pressure on Russia’s finances, as well as Iran’s and to help the inflation story in the US. As to the metals complex, they are all lower this morning with gold (-0.7%) leading the way but both silver (-0.3%) and copper (-0.5%) lagging as well.

On the data front, there is no front-line data to be released, although we do see EIA oil inventories with modest declines expected. However, it is worth noting that Chinese monetary data was released this morning and it showed a significant decline in New Yuan Loans and Total Social Financing, exactly the opposite of what you would expect if the Chinese were seeking to stimulate their economy. It is difficult for me to look at the chart below of New Bank Loans and see any trend of note. I would not hold my breath for the Chinese bazooka of stimulus that so many seem to be counting on.

Source: tradingeconomics.com

Overall, it appears to me the market is becoming inured to the volatility which is Donald Trump. As I have written before, after a while, traders simply get tired and stop chasing things. My take is we will need something truly new, a resolution of the Chinese trade situation, or an Iran deal of some kind, to get things moving again. But until then, choppy trading going nowhere is my call.

Good luck

Adf