As tariff concerns are digested

By markets, Chair Powell’s been tested

Is cutting the move

They need to improve?

Or are they, to tightness, still vested

It sounds as though he’s not persuaded

A rate cut will soon be paraded

But markets still price

He’ll be cutting thrice

It could be that view should be fade

Perusing the WSJ this morning, I stumbled across the following article, “What the Weak Dollar Means for the Global Economy” and couldn’t help but chuckle. It was not that long ago when the punditry was complaining about the strong dollar as a problem for the global economy. The current thesis is that the weakening dollar will make foreign exports to the US more expensive, on top of the tariffs, and will reduce the number of US tourists traveling abroad. Foreign companies will also suffer as they translate their US sales into their respective local currencies, negatively impacting their earnings. A moment as I shed a tear.

Of course, when the dollar was strong, the concern for the global economy was that it was increasingly expensive in local currency terms to obtain the dollars necessary to service the massive amounts of USD debt that foreign companies and nations have issued, thus reducing their ability to spend money on other things to drive their domestic economy.

As they say, you can’t have it both ways. While there is no doubt the dollar’s decline this year has been swift, it is important to remember we are nowhere near an extremely weak dollar. As you can see from the below chart, the euro was trading near 1.60 back in 2008 and as high as 1.38 even in 2014. When looking at today’s price of 1.1375, it is hard to feel overly concerned.

Source: finance.yahoo.com

As it happens, this morning the single currency has slipped back -0.3% from yesterday’s levels. The dollar’s future remains highly uncertain given the potential policy changes that may unfold as the tariff situation becomes clearer. Which leads us to the Fed.

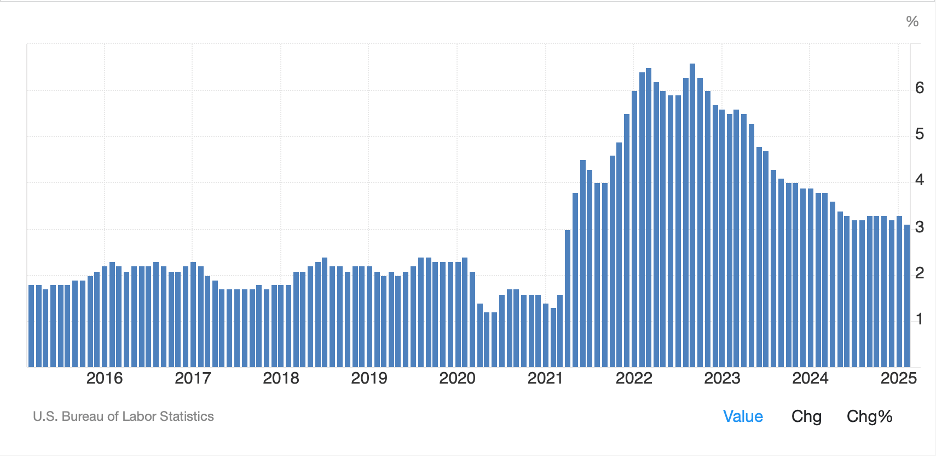

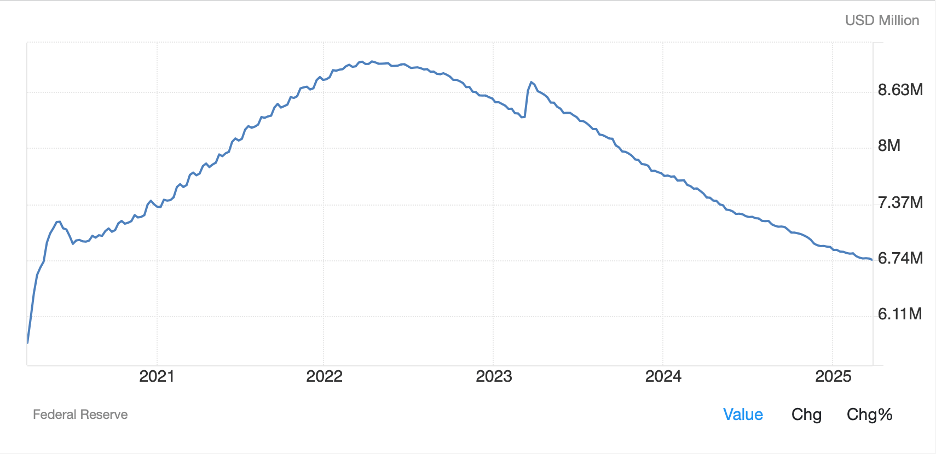

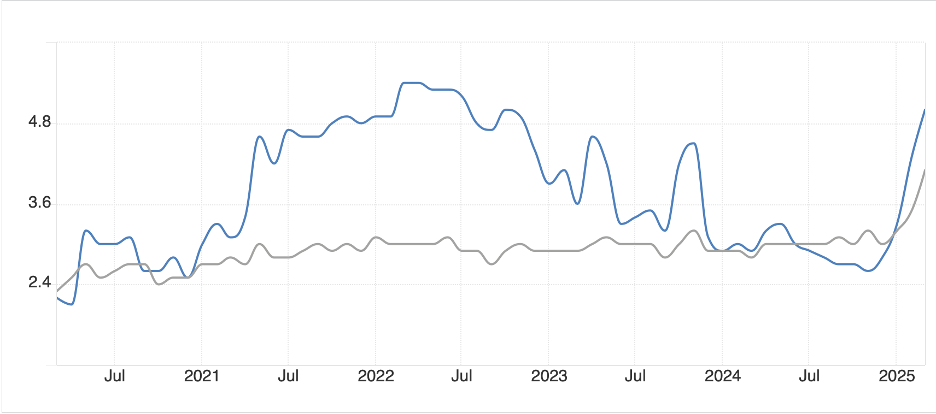

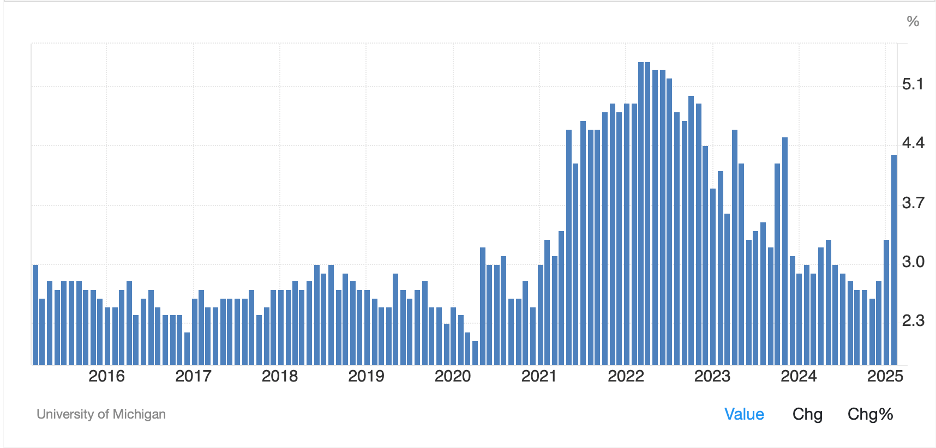

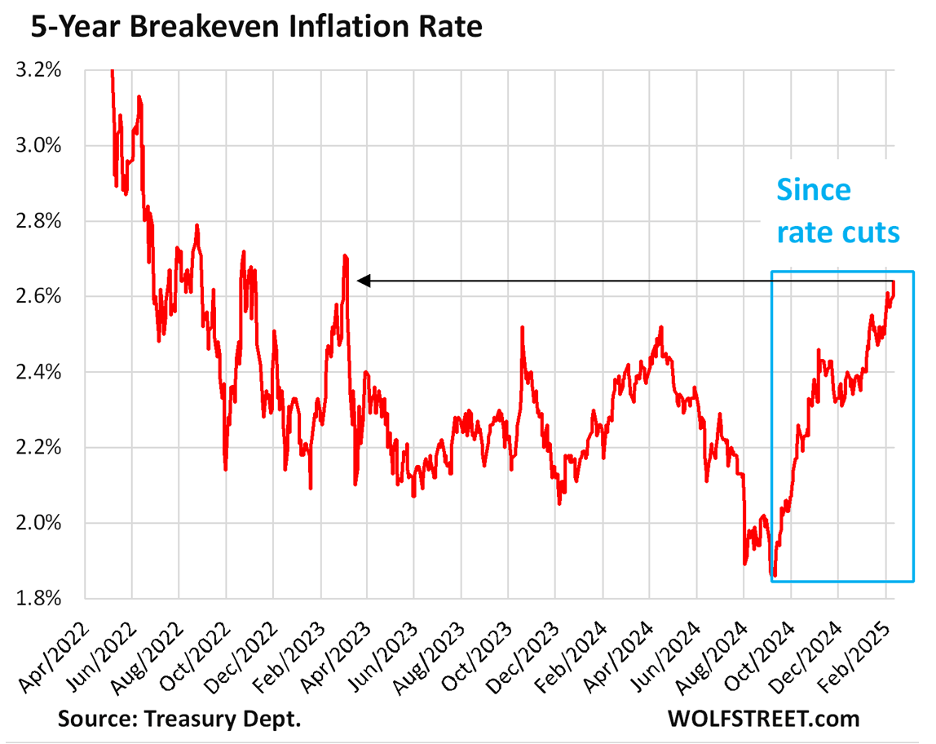

For the first time in many weeks, the Fed became a topic of conversation for the market when Chairman Powell spoke to the Economic Club of Chicago. “Our obligation is to keep longer-term inflation expectations well anchored and to make certain that a one-time increase in the price level does not become an ongoing inflation problem,” Powell explained. “We may find ourselves in the challenging scenario in which our dual-mandate goals are in tension. If that were to occur, we would consider how far the economy is from each goal, and the potentially different time horizons over which those respective gaps would be anticipated to close.”

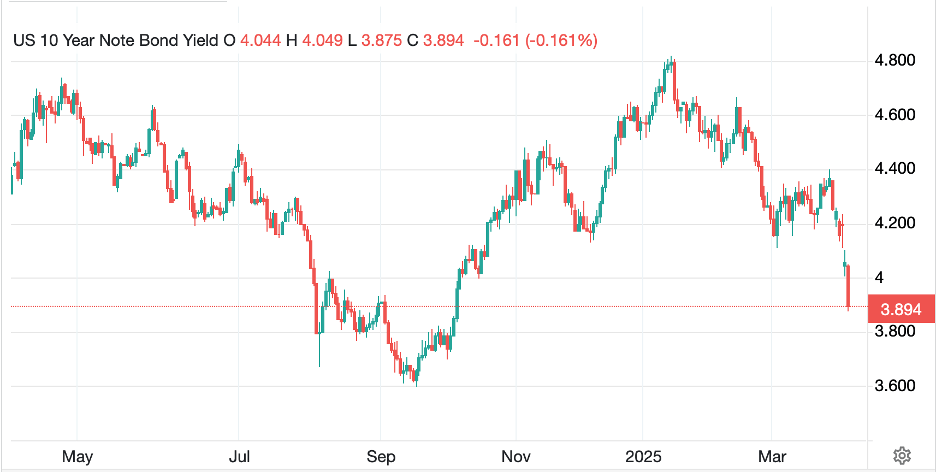

Let me start by saying, the Fed’s track record in anticipating economic outcomes is not stellar. Equity markets were not encouraged by these comments and sold off during the discussion, although they retraced some of those losses before the end of the session. At the same time, the Fed funds futures market, while having reduced the probability of a rate cut next month to just 15%, continues to price 88bps of cuts into the market by the December meeting. Assuming there is no cut in May, that leaves five meetings for between three and four cuts. Based on Powell’s comments, that seems like aggressive market pricing.

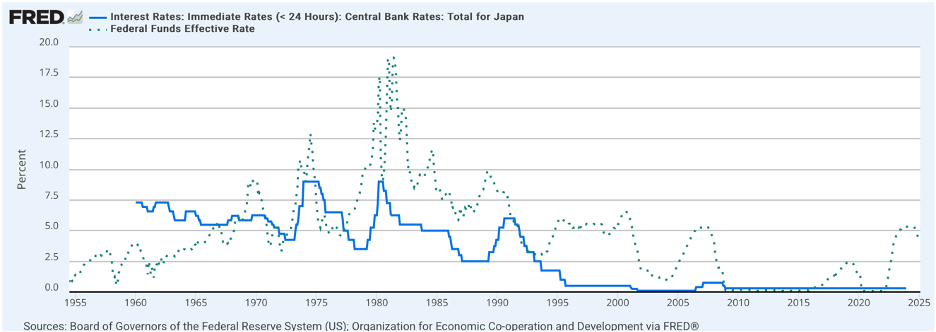

It appears that there is a growing belief that a recession is on its way and that will both reduce inflationary pressures and force allow the Fed to start to reduce rates further. Of course, there are those, Powell included, who seem to believe that stagflation is a strong possibility. If that were the case, especially given Powell’s new-found belief that price stability matters, and his clear distaste for the president, my sense is they will focus on inflation not growth if financial conditions (aka bond markets) remain in good shape. Will the dollar continue to decline under that scenario? That is a very tough call as a US recession would almost certainly spread globally, and other central banks will likely ease policy. If the Fed stands pat amidst a global reduction in interest rates, I don’t see the dollar declining. If for no other reason, the cost of carrying short dollar positions would become too prohibitive.

As usual, the future remains quite cloudy. Cases can be made for Fed cuts, and against them. Cases can be made for dollar weakness and dollar strength. Arguably, the biggest unknown is how the trade talks are going to resolve. Yesterday, President Trump explained that “big progress” has been made on the Japanese tariff talks. If Trump is successful in creating a coalition of nations that have closer trade relations with lower tariffs, I expect that would be taken quite positively by the markets. On the other hand, if those talks fall apart, I expect equity markets to start the next leg lower, and that is a global phenomenon, while the dollar sinks further. There is much yet to come.

Ok, let’s see how things played out overnight. After yesterday’s US rout, Trump’s comments on trade talks with Japan clearly helped the market there as the Nikkei (+1.35%) rallied nicely as did the Hang Seng (+1.6%). In fact, gains were widespread with Korea, India and Australia, to name three, all rising nicely. Alas, Chinese shares did not participate, and Taiwan actually slipped a bit. In Europe, investors await the ECB’s outcome this morning, where a 25bp cut is the median forecast, but there are those hinting at a 50bp cut to help moderate strength in the euro as well as support the economy given the tariff situation. Remember, we have heard from a number of ECB members that they are confident inflation is heading back to their target. Ahead of the news, shares are softer across the board with declines on the order of -0.5% to -0.8% throughout the continent and the UK. Remember, too, their tariff talks are after Japan. Interestingly, US futures are mixed with DJIA (-1.3%) the laggard while the other two are both higher about 0.5%. It seems United Health shares have fallen enough to take the DJIA down with it.

In the bond market, Treasury yields have regained the 3bps they fell during yesterday’s US session, so are unchanged over two days. We have also seen European sovereign yields climb between 2bps and 4bps, rising alongside Treasuries and JGB yields jumped 5bps, responding to confidence that the US-Japan trade dialog will be successful and support Japanese risk.

Despite all the reasons for oil to decline, including recession fears and continued pumping by pariahs like Iran and Venezuela, the black sticky stuff is higher by 1.1% this morning, its highest level in two weeks. But as you can see in the chart below, there remains a huge gap to be filled more than $8/bbl higher than current prices. It is difficult to see a significant rally on the horizon absent a major change in the supply situation.

Source: tradingeconomics.com

As to the metals markets, gold (-0.6%) blasted higher to another new high yesterday, above $3300/oz, and while it is backing off a bit today, shows no signs of stopping for now. Both silver and copper rallied yesterday as well, and both are also falling back this morning (Ag -1.4%, Cu -2.1%).

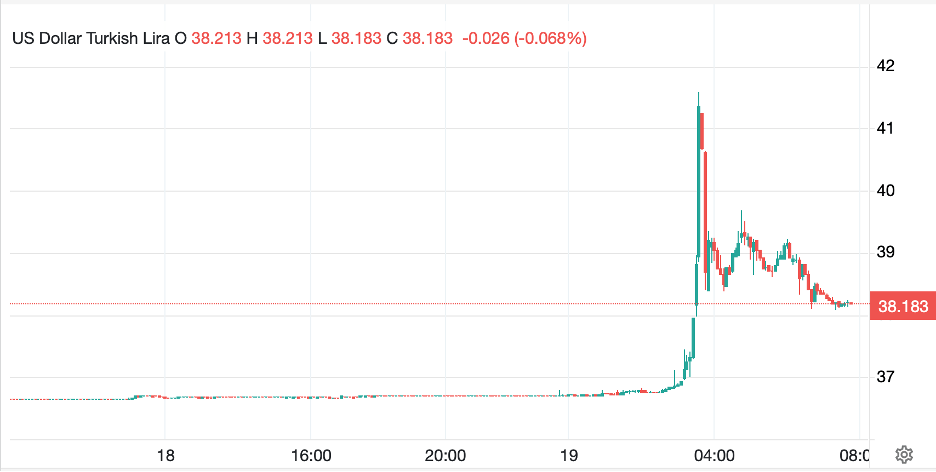

Finally, the dollar is modestly firmer across the board this morning, with the DXY seeming to find 99.50 as a key trading pivot level. In the G10, JPY (-0.45%) is the laggard along with CHF (-0.4%) while other currencies in the bloc have fallen around -0.2%. The exception here is NOK (+0.3%) as it benefits from oil’s rebound. In the EMG bloc, the dollar is mostly firmer, but most of the movement has been of the 0.3% variety, so especially given the overall decline in the dollar, this looks an awful lot like position adjustments ahead of the long weekend with no new trend to discern.

On the data front, yesterday’s Retail Sales was stronger than expected, and not just goods that were bought ahead of tariffs, but also services and dining out, which would seem less impacted. This morning, we see a bunch of stuff as follows: Housing Starts (exp 1.42M), Building Permits (1.45M), Philly Fed (2.0), Initial Claims (225K) and Continuing Claims (1870K). As long as the employment data continues to hold up, my take is the Fed will sit on the sidelines. If that is the case, I sense we have found a new range for the dollar, 99/101 in the DXY and we will need a headline of note to break that.

As tomorrow is Good Friday and markets are essentially closed throughout Europe, as well as US exchanges, there will be no poetry.

Good luck and good weekend

Adf