On Friday, the news was a sign

Of imminent US decline

The Fed was a hawk

And all of the talk

Was Trump’s actions wiped off the shine

But yesterday, markets decided

That Friday’s response was misguided

They’ve come to believe

A Fed funds reprieve

By Powell will soon be provided

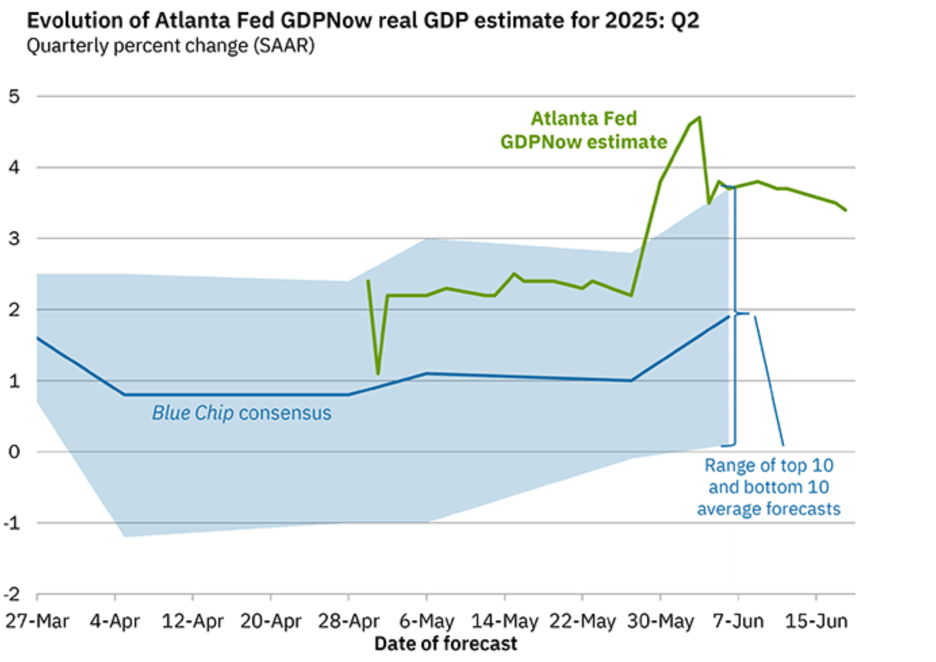

As I have frequently written in the past, markets are perverse. The narrative Friday was about the dire straits in which the US found itself with the employment situation collapsing and the recession that has been forecast for the past three years finally upon us. Part of this story was because of the Fed’s seeming intransigence regarding interest rates as made clear by Chairman Powell’s relatively hawkish comments at the FOMC press conference last week.

But that story is sooo twenty-four hours ago. In the new world, the huge bond market rally that was seen on Friday, and equally importantly, the changing pricing of Fed funds rate cuts has the new narrative as, the Fed is going to cut so buy stonks! Confirmation of this new narrative was provided by SF Fed President Mary Daly who remarked yesterday evening, “time is nearing for rate cuts, may need more than two.” All I can say is wow!

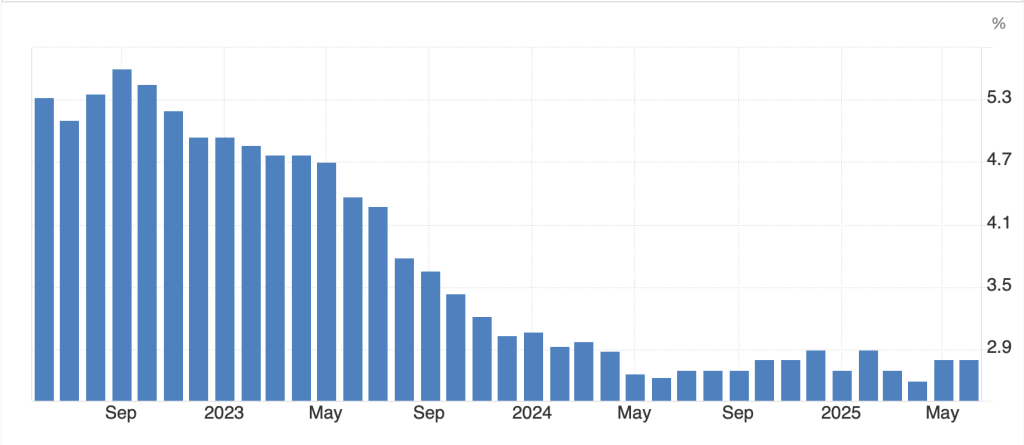

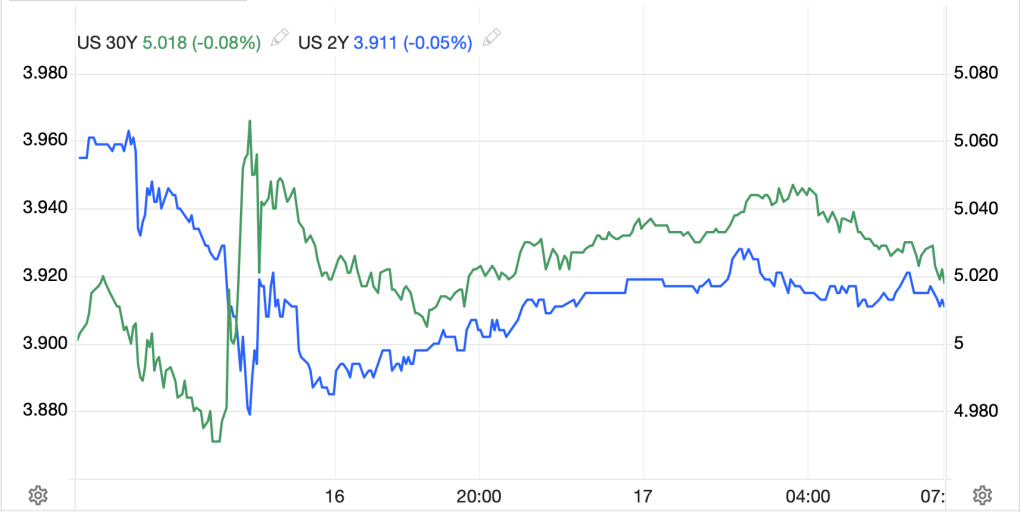

The below chart shows the daily moves, in basis points, of the 2-year Treasury note which is seen as the market’s best indicator or predictor of future Fed funds rates. On Friday, the yield fell nearly 25bps, essentially pricing in one additional rate cut coming, and as we saw with the Fed funds futures market, that pricing is now anticipating three cuts this year. Ms Daly merely reconfirmed that news.

Source: https://x.com/_investinq/status/1951356470877925408?s=46

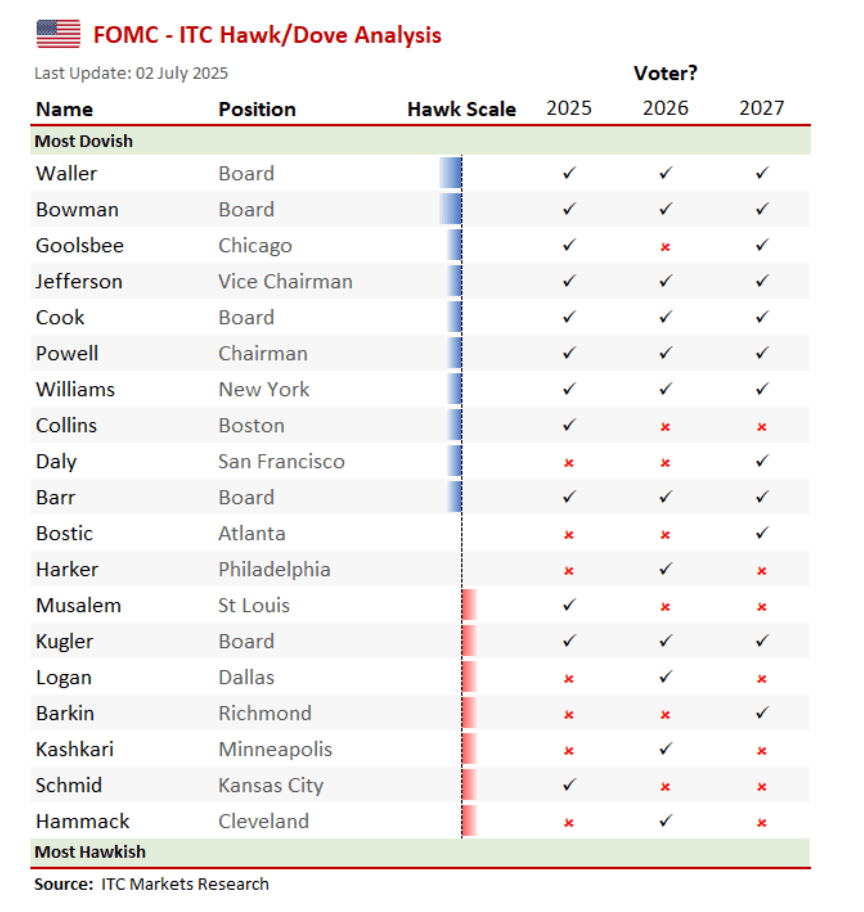

Perhaps it is fair to ask why Daly has taken so long to come around to this view. After all, she is a known dove and has been for her entire time at the Fed. As I have asked before, why haven’t the other known doves, like Governors Cook and Jefferson, been out there talking about rate cuts? For anyone who wants to continue to believe that the Fed is apolitical, nonpartisan or above politics, this is exhibit A as to why it is not. In fact, if you look, only one Board member was considered a hawk in this analysis by In Touch Markets, and she just resigned. The other hawks are all regional Fed presidents. Perhaps this is why they were so slow to raise rates when inflation was roaring in 2022 and why they were so anxious to cut rates in 2024 on virtually no news other than the upcoming election.

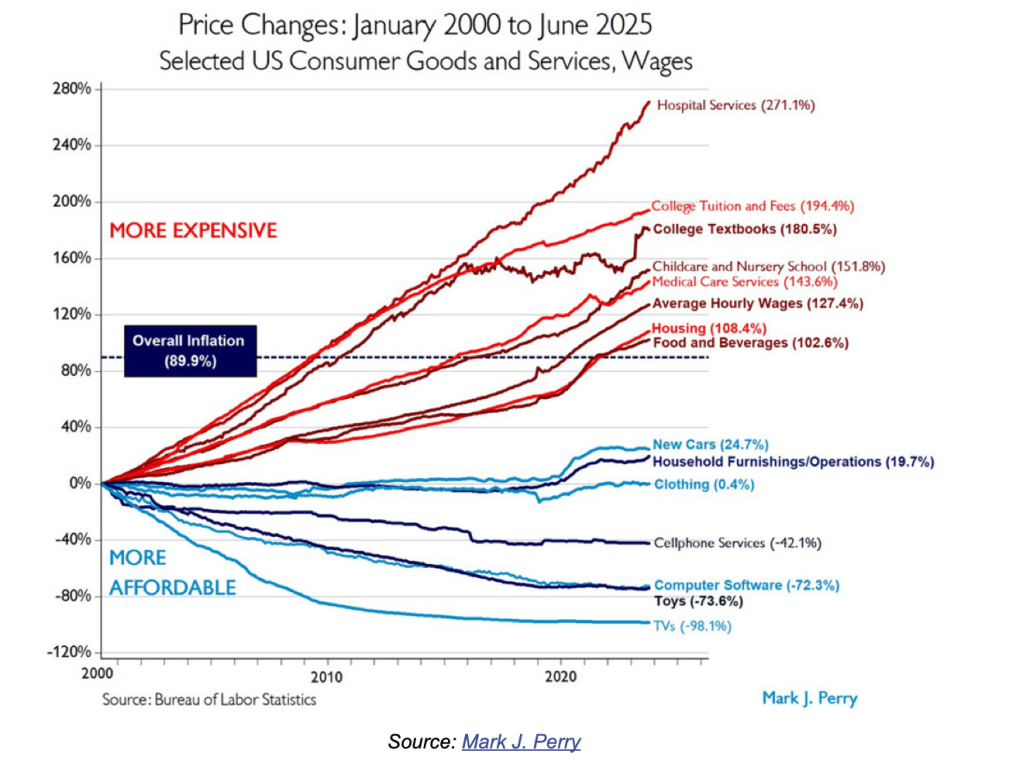

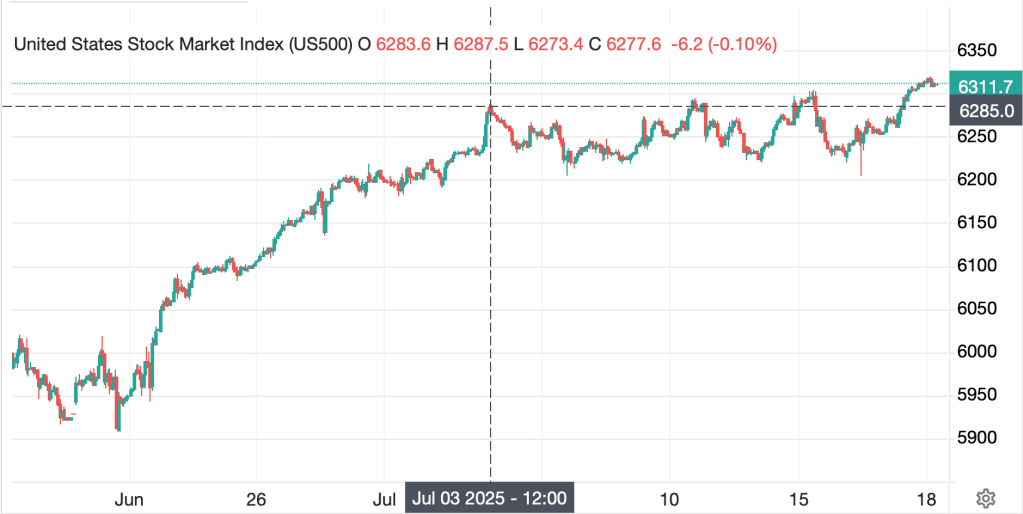

To be clear, until Friday’s NFP data, it was difficult to make the case, in my mind, for a cut because I continue to see inflationary pressures beyond any tariff impacts. But if the labor market is weaker than had been assumed, that will certainly open the door to more cuts. Of course, the conundrum is, if the economy is so weak that the Fed needs to cut, why are stocks rallying? Arguably, a weak economy would foretell weaker earnings growth, a direct negative to equity valuations. But that appears to be old-fashioned thinking. I guess I am just an old-fashioned guy.

Ok, let’s turn to the overnight activity. Starting with bonds, since the big move Friday, Treasury yields have been little changed, climbing 2bps overnight to 4.21%, but still hovering near the bottom of their recent trading range with only the Liberation Day announcement panic showing yields below the current level. This is a great boon for the Treasury as auctions of 3-, 10-, and 30-year Treasuries are due this week starting with the 3-year today.

Source: tradingeconomics.com

European sovereign yields have also edged higher by 1bp across the board after PMI data was released this morning, pretty much exactly at expected levels. The outlier last night was JGB yields which slipped -4bps and continue to slide away from designs of a BOJ rate hike.

In the equity markets, yesterday’s US rally was followed almost universally in Asia (Japan +0.65%, China +0.8%, Hong Kong +0.7%, Australia +1.2%) with only India (-0.3%) lagging there. As to Europe, it too is having a good day with the DAX (+0.8%) leading the way although strength almost everywhere as the PMI data was good enough to keep spirits higher.

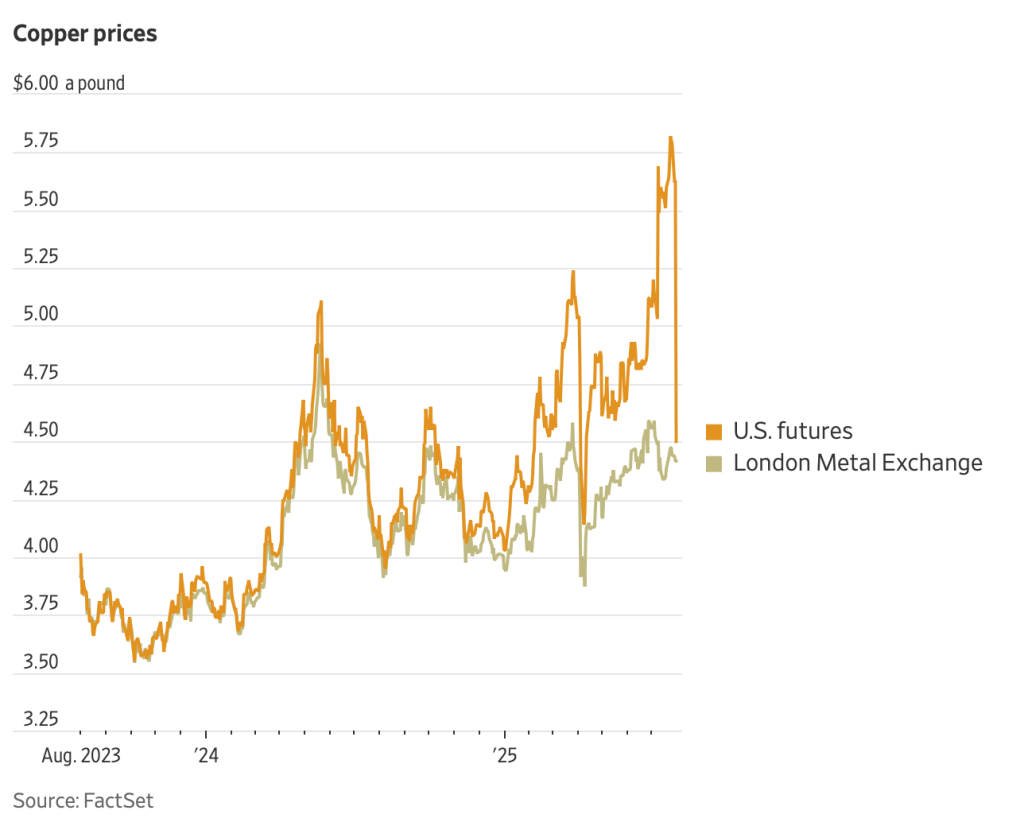

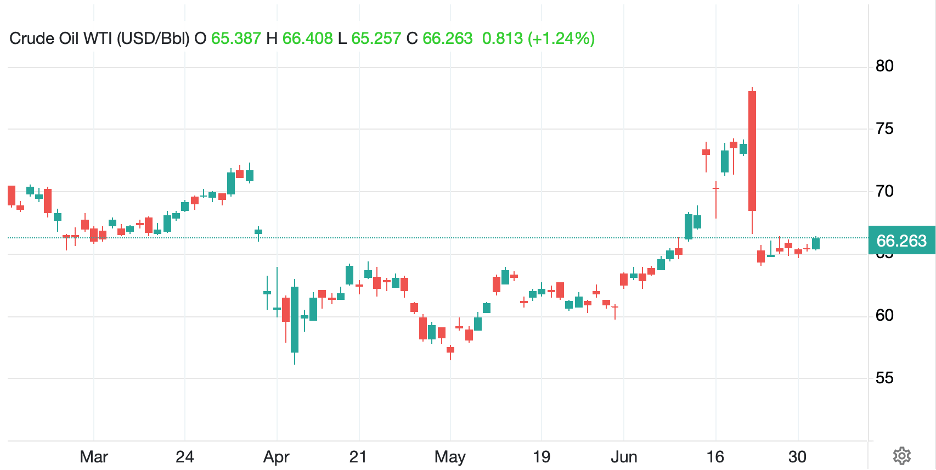

In the commodity markets, oil (-1.1%) is slipping for a fourth consecutive day, but is still right in the middle of its $60 – $70 trading range. There remain so many potential geopolitical issues with saber rattling between the US and Russia and President Trump’s threatened excess tariffs on nations who buy Russian oil that it remains difficult to discern supply/demand characteristics. Certainly, if the US is heading into a recession, that is likely to dampen demand for a while, but that remains unclear at this time. As to the metals, gold (-0.65%) is giving back some of its post NFP gains but if I look at the chart below, all it shows is a relatively narrow trading range with no impetus in either direction.

Source: tradingeconomics.com

The rest of the metals complex is being dragged lower by gold this morning, but not excessively so.

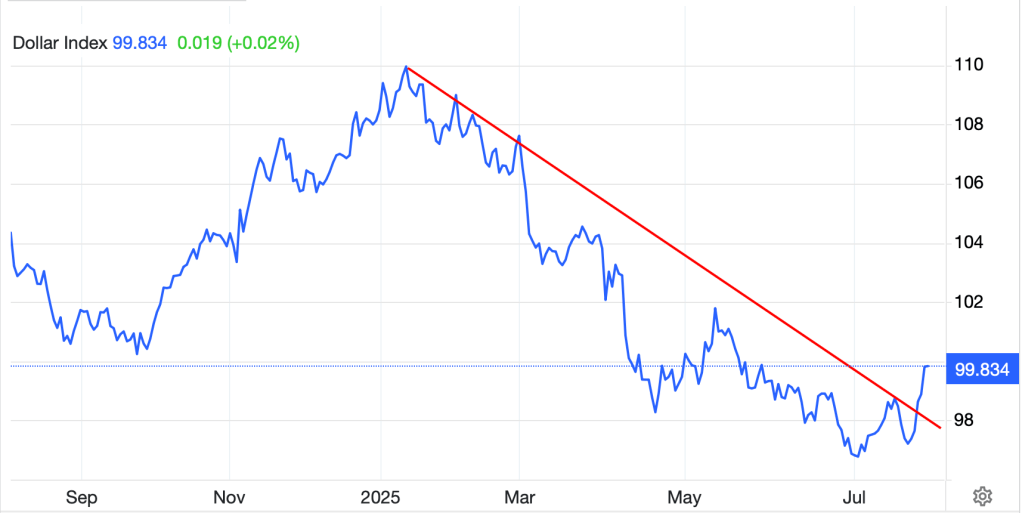

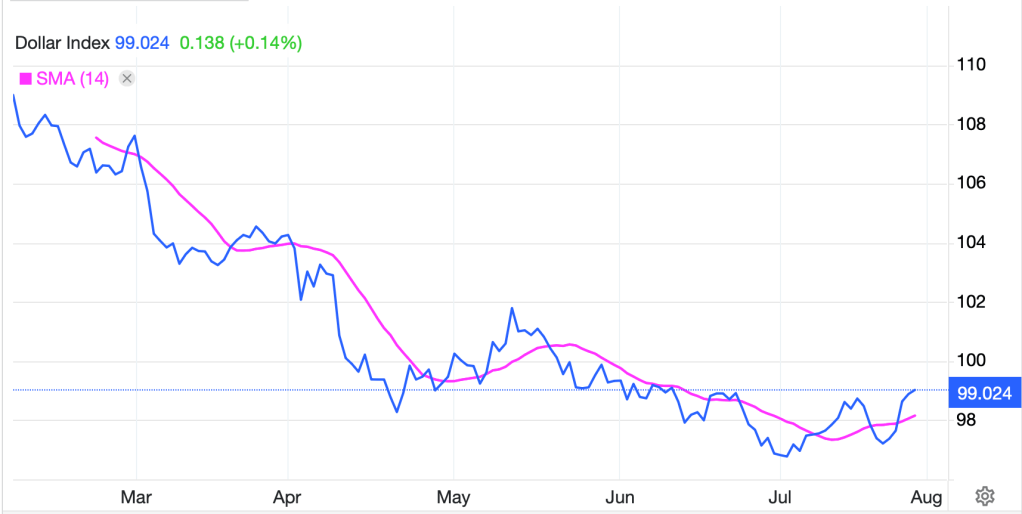

Finally, the dollar is a touch stronger today, despite the rate cut talk, as the euro (-0.4%) and yen (-0.55%) lead the G10 currencies down. While I understand the rationale for the dollar to soften in the short- and medium-term vs its counterparts, it is very difficult for me to look at the political and economic situations elsewhere in the world and think I’d rather be investing there. Europe is a mess as is Japan. And don’t get me started on the emerging market bloc. So, remember, while day-to-day movements can be all over the map and are impacted by things like data releases or announcements, structural strength or weakness remains largely in place, and the US situation appears stronger than most others for now. Touching briefly on EMG currencies, the dollar is firmer vs. virtually all of them, mostly on the order of 0.4% or so.

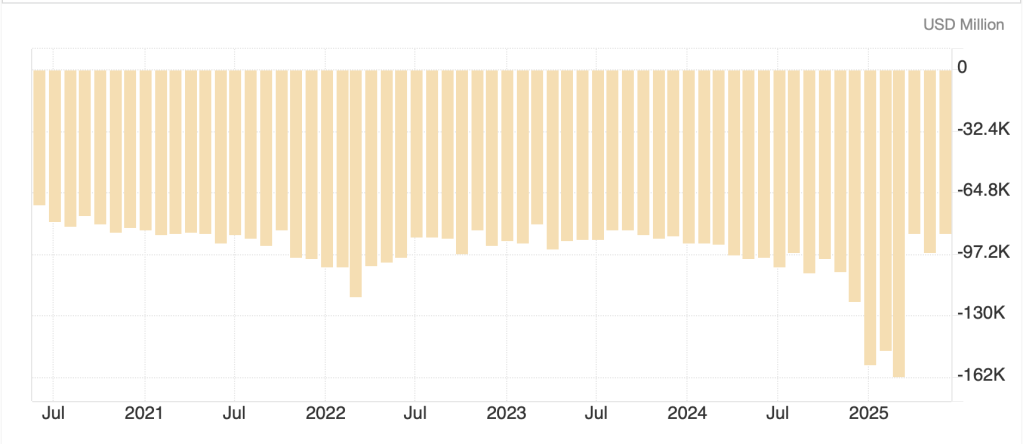

On the data front, today brings the Trade Balance (exp -$61.4B) and then ISM Services (51.5) at 10:00. We don’t get the first post-FOMC speech until tomorrow by Governor Cook, so it will be interesting to see if there are more doves who are willing to show their colors. But in the end, as demonstrated by the quick reversal of the narrative from Friday to Monday, there remains an underlying bid to risk assets and we will need to see substantial economic weakness to remove that bid, even temporarily.

Good luck

Adf