Their mandate includes stable prices

And that they should use all devices

To work to achieve

That goal lest they leave

A legacy chock full of crises

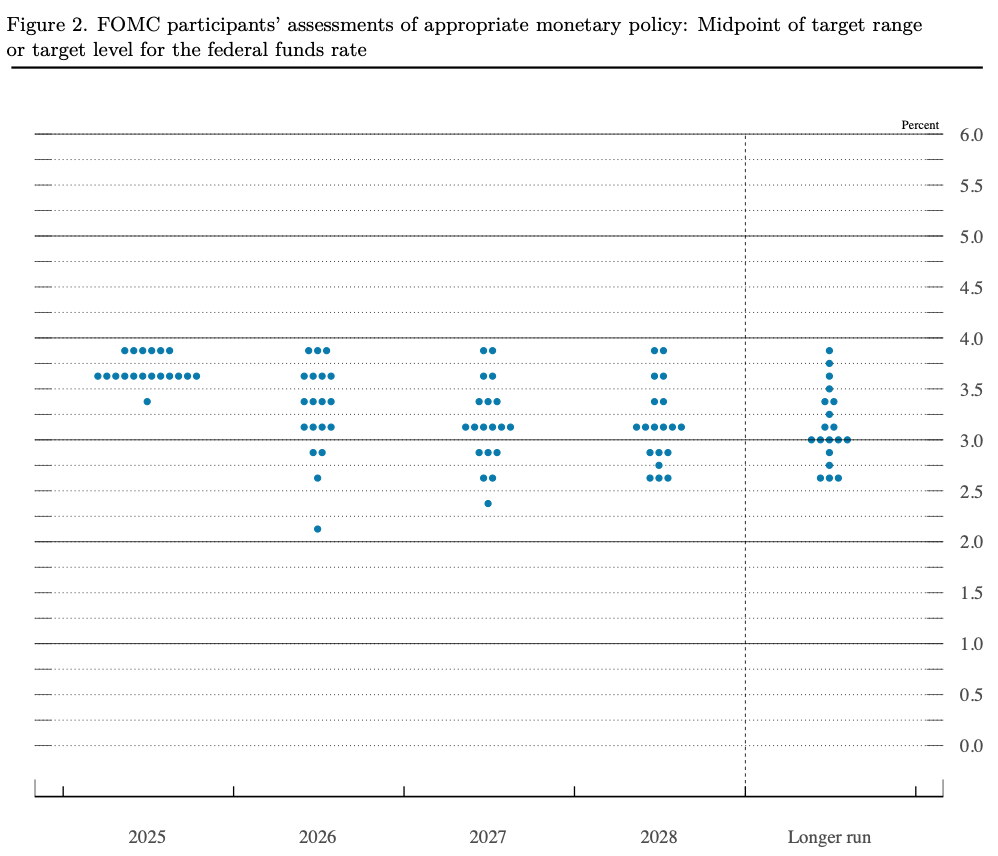

“Most participants, however, cautioned that progress toward the Committee’s 2 percent objective might be slower and more uneven than generally expected and judged that the risk

of inflation running persistently above the Committee’s objective was meaningful.”

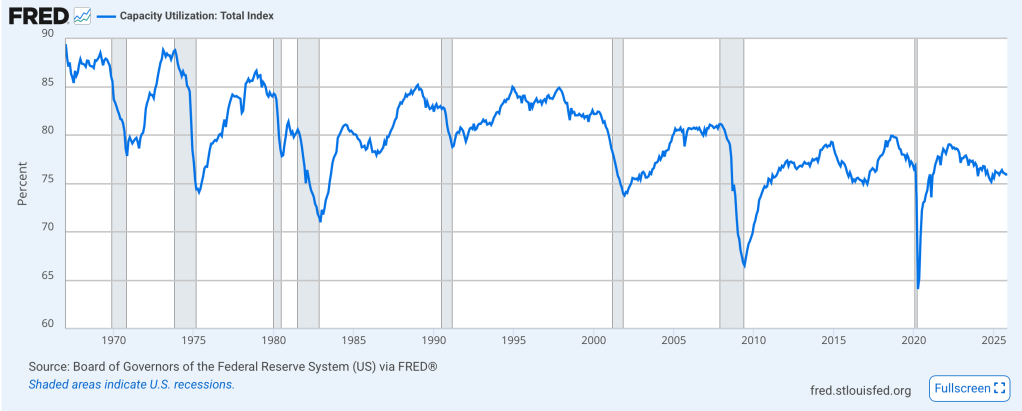

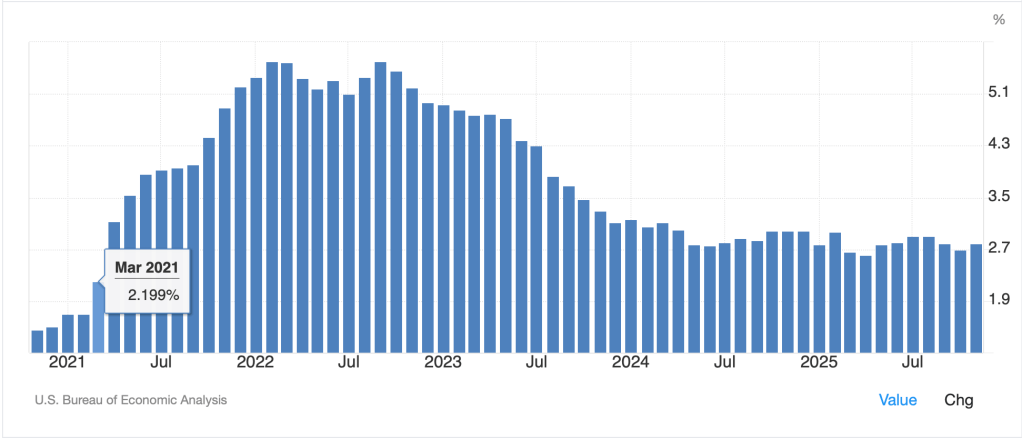

These words [emphasis added] are from the FOMC Minutes released yesterday afternoon. To set the stage, the Fed left rates on hold then, although there were two votes for another cut. However, a full reading of the Minutes shows there were those who would have considered a hike as well. Now, I am just a guy in a room who observes market behavior through the lens of too many years involved on a daily basis, and my resources are virtually nil, especially compared to the Federal Reserve. I don’t have a PhD in economics (although I believe that is a benefit in this context, if not every context). However, the bolded part of the comment seems a tad disingenuous to me based on the below chart which shows the history of their inflation metric, Core PCE prices.

Source: tradingeconomics.com

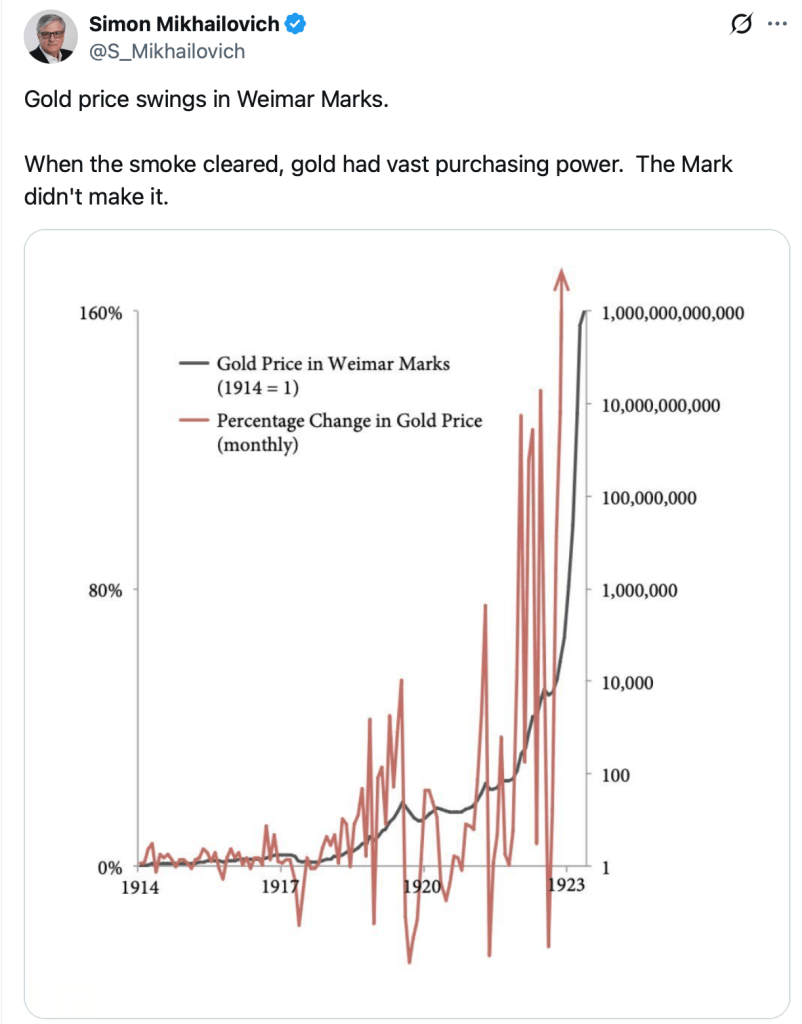

It has been exactly 5 years since their metric was at or below their 2% target by which they defined stable prices. The idea that they are claiming the risk of inflation running hot was a meaningful risk is perhaps the worst gaslighting comments they have made. It is very difficult to believe that the Fed, in its current incarnation, is going to ever address the inflation issue appropriately. Perhaps a Chairman Warsh, if he is successful at reconfiguring their operating procedures will be able to drive positive changes. I am hopeful but not confident. The one thing we know is that changing government institutions requires a mammoth effort. And let’s face it, he will only have two plus years of leeway for sure depending on whoever becomes president in 2028.

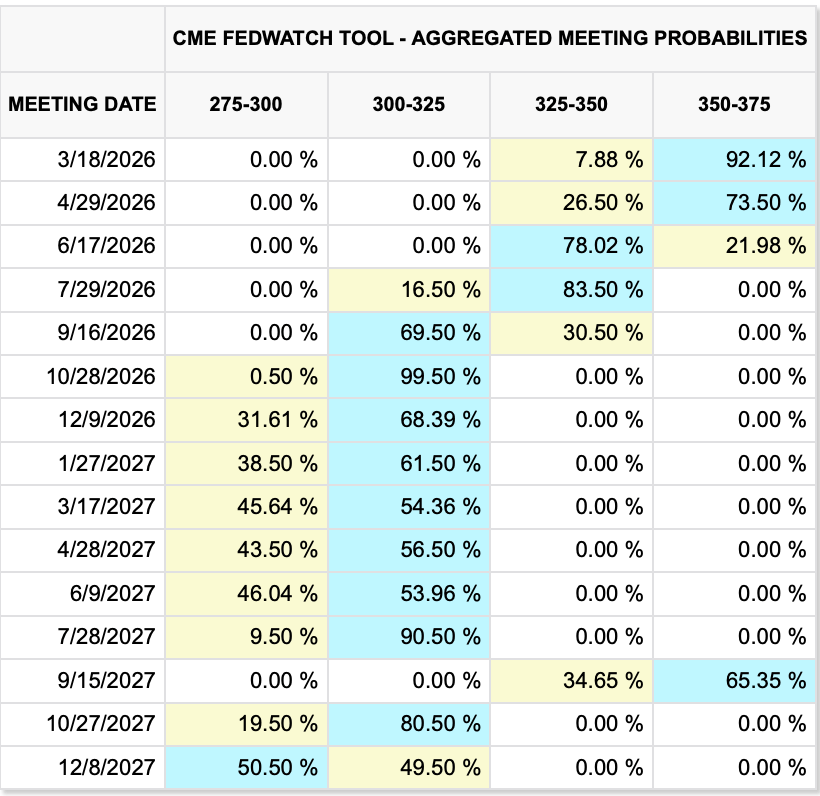

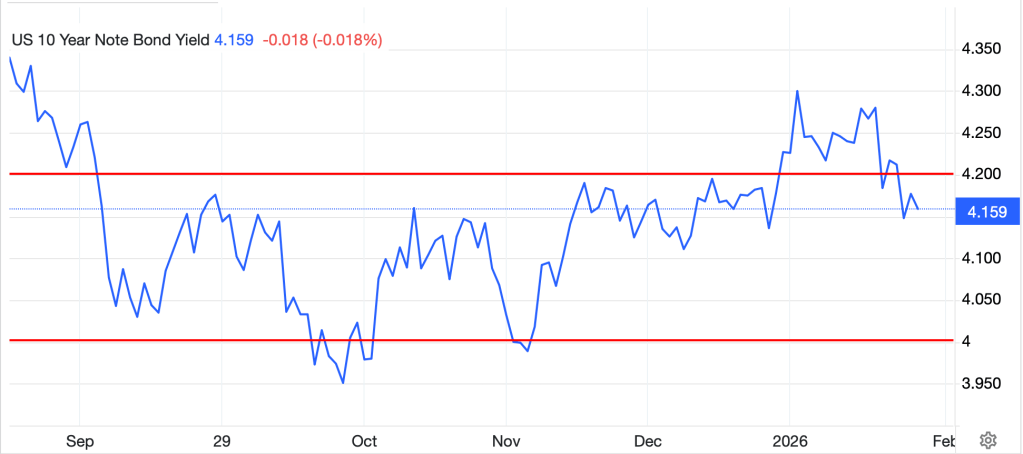

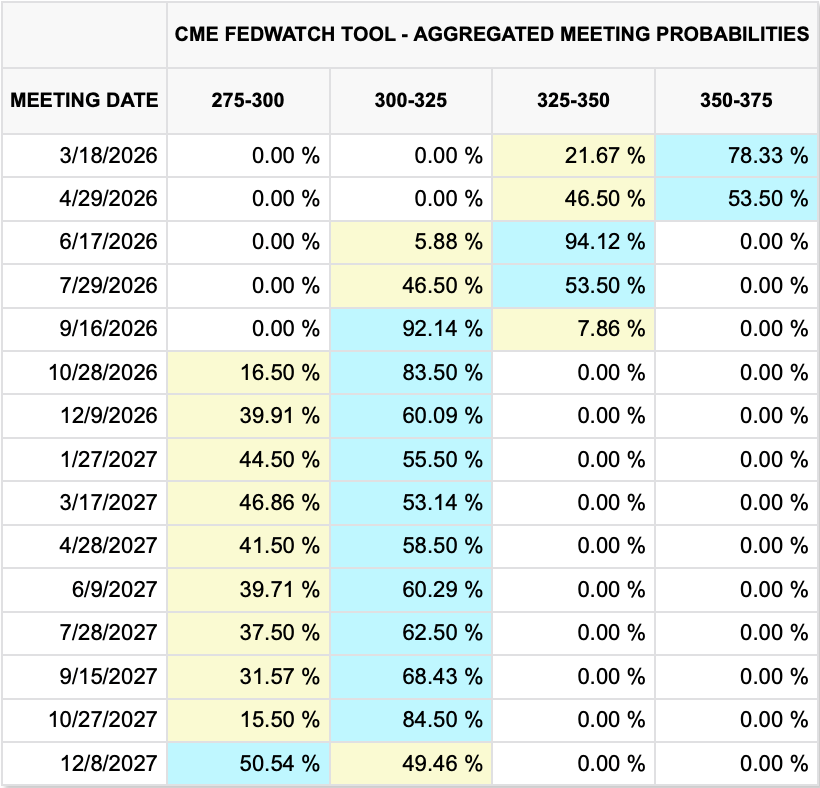

I continue to believe that the market is going to increasingly focus only on Warsh’s comments going forward as the direction he has expressed is very different than the current FOMC membership mindset. We shall see how this all evolves. In the meantime, I expect that Fed funds are not going anywhere before Warsh is confirmed. As to bond yields, that is a very different question and will depend on both the macroeconomic outcomes and the risk perception of investors around the world. For now, that trading range of 4.00%. – 4.20% seems likely to hold absent a major economic data miss in one direction or the other. But as long as we continue to get mixed data, this market will remain on the backburner.

The fear that is growing each day

Trump’s policy might go astray

Regarding Iran

Although not Japan

Thus, oil’s up, up and away

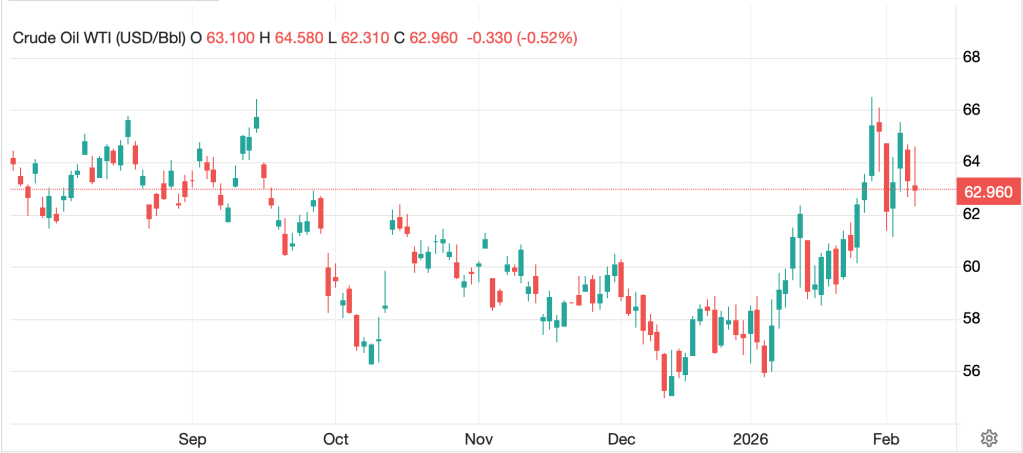

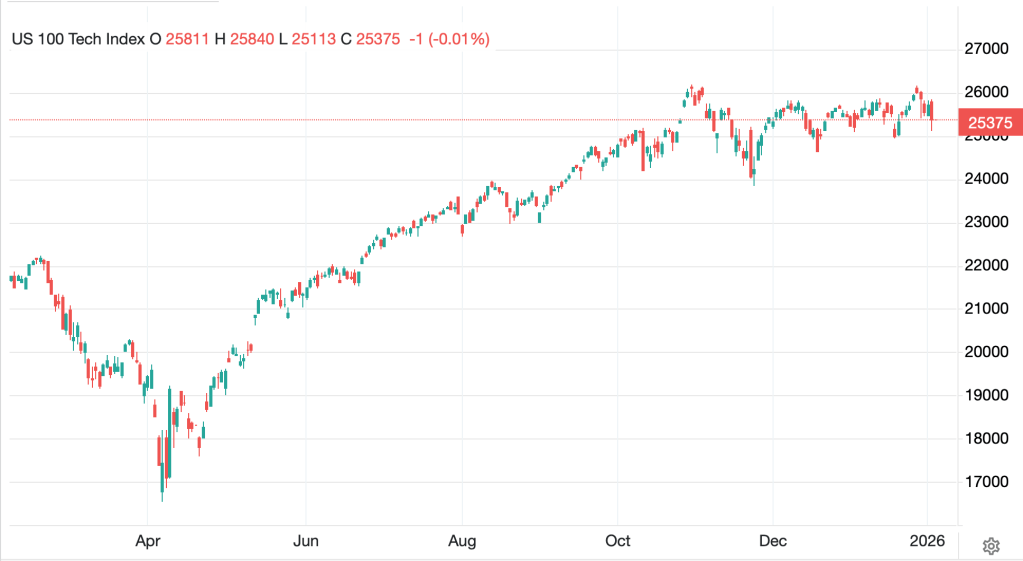

Texas tea (+1.5%) is following yesterday’s 4.6% rise with another strong session and as you can see in the chart below, is showing a very clear trend higher since December.

Source: tradingeconomics.com

This movement is very clearly a response to the ongoing buildup of US military assets in proximity to Iran, with two aircraft carriers, and somewhere above 200 military aircraft as well as the carrier group tenders with Tomahawk missiles in tow. While negotiations are ostensibly ongoing, the one thing that seems clear is that absent a complete capitulation by the Iranian government, something big is going to happen here. Of course, the question is, how much, and for how long, will it impact oil supplies?

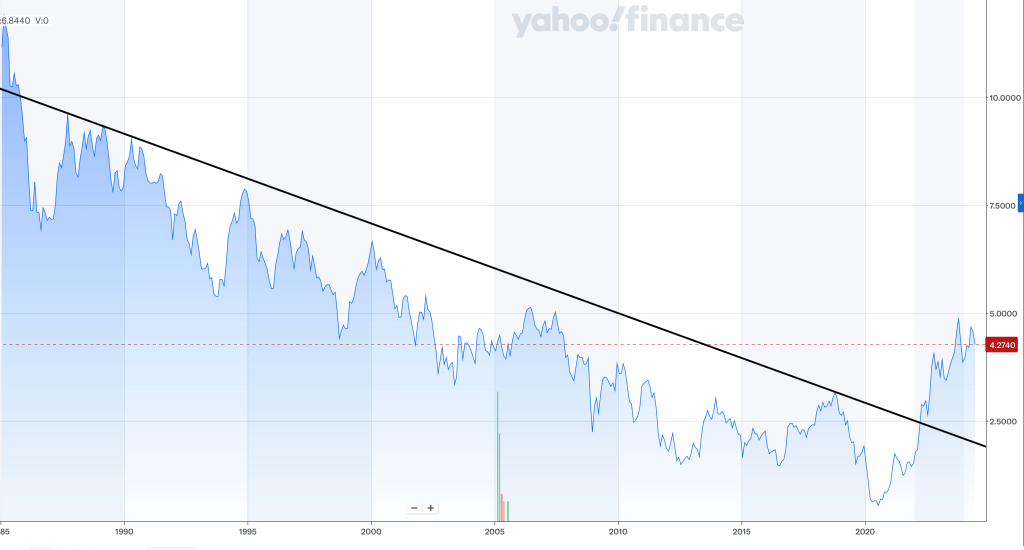

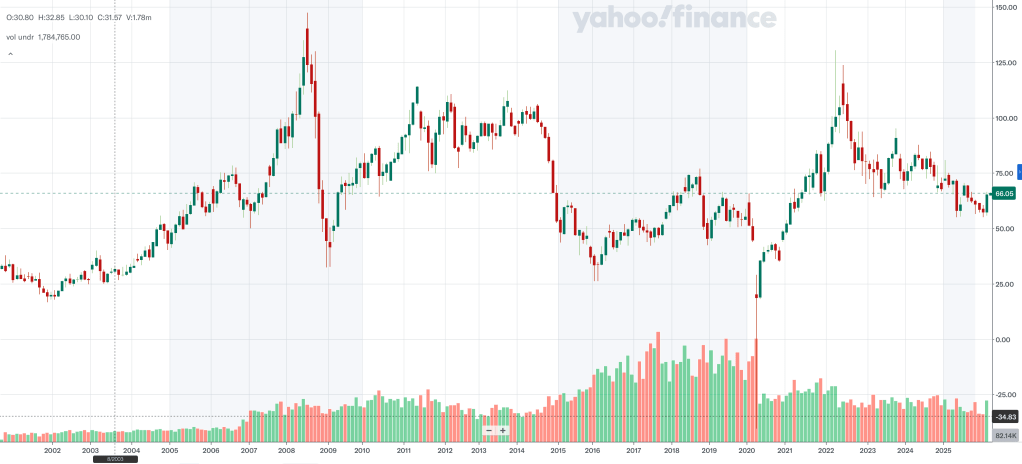

Obviously, nobody knows the answer to that question, but the recent history has shown that every time there was an event in the Middle East, whether the 12-day war several months ago, the killing of Suleimani, the attacks on Saudi oil infrastructure, or others, prices retraced pretty quickly as per the below.

Even the Ukraine invasion in February 2022 saw prices retrace 50% within a few months. Other issues lasted less time than that. This recent history implies that fading the rally is the right trade, but boy, that is hard to do. And of course, in the event that the Iranian government falls, the chaos could result in a significant degradation of Iranian oil production. Given they pump about 5 mm bpd, ~5% of global supply, that would matter a lot at the margin. Certainly, the oil glut narrative would disappear in a hurry. This is a very large risk to both markets and the economy, and one which needs to be hedged, if possible. This will certainly be the focus of markets for the next few weeks, at least, so be prepared. Personally, I do own some stuff here, but I like the drillers generally, as they are going to be employed no matter what!

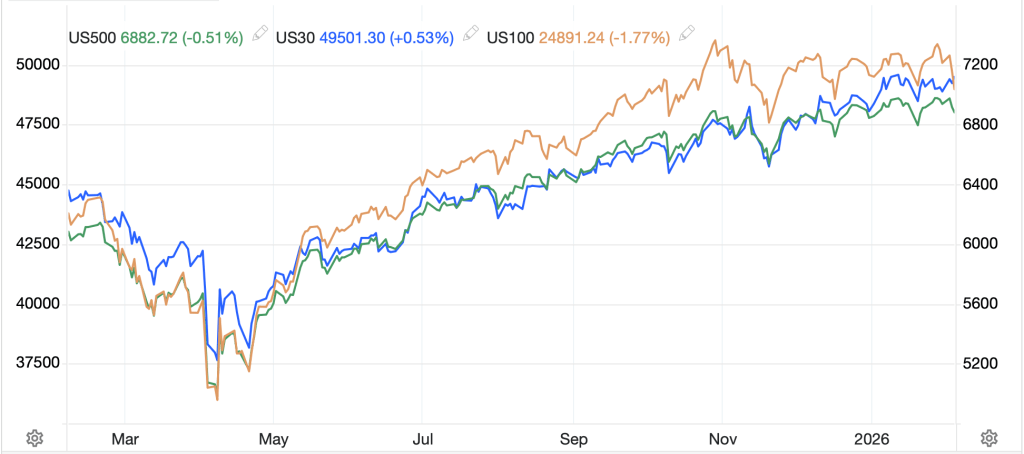

Ok, let’s see what else is happening. After a solid US session yesterday, Asia saw some major positive price action with Korea (+3.1%) the leader although Tokyo (+1.1%) also had a solid session, as did Taiwan, New Zealand, Singapore and Australia. The exception to this rule was India (-1.5%) which suffered after a three-day positive run as traders and investors fled worrying about oil, the Fed, and the future of India’s relationship with Russia after the seizure of more ‘dark fleet’ oil tankers trying to avoid sanctions on Russian oil. Europe, meanwhile, is uniformly lower this morning, with all the major indices slipping -0.8% or so. The narrative is pointing to the escalation in Iran as the cause du jour. US futures are also slipping at this hour (7:20), -0.25% or so across the board.

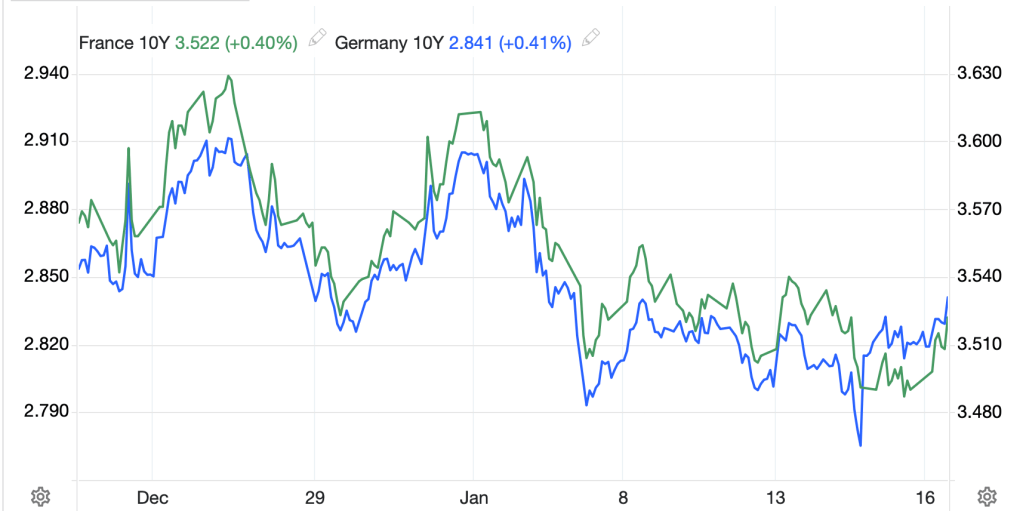

I touched on bonds briefly above, but today’s price action shows yields edging higher by 1bp in Treasury markets and between 1bp and 2bps across European sovereign markets. There has been no data of note to alter views, and the only ECB news is that Spain has thrown their hat into the ring to have the next ECB president.

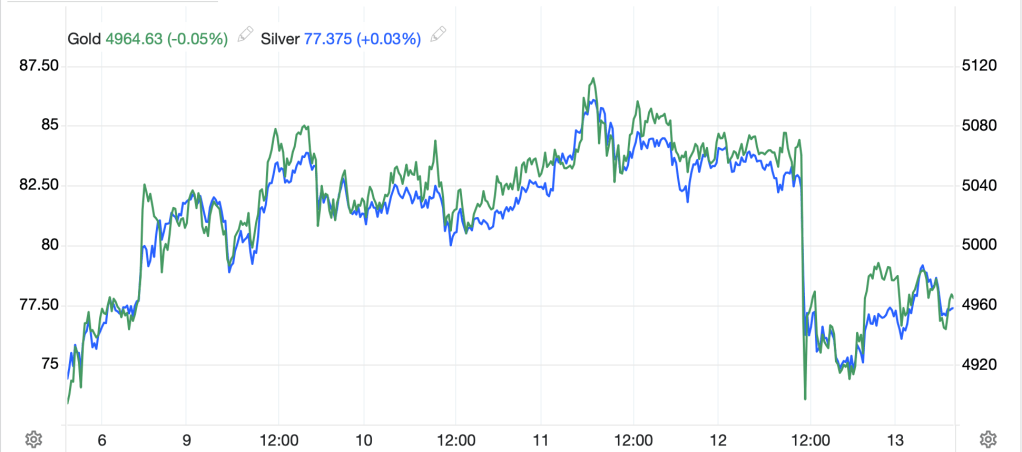

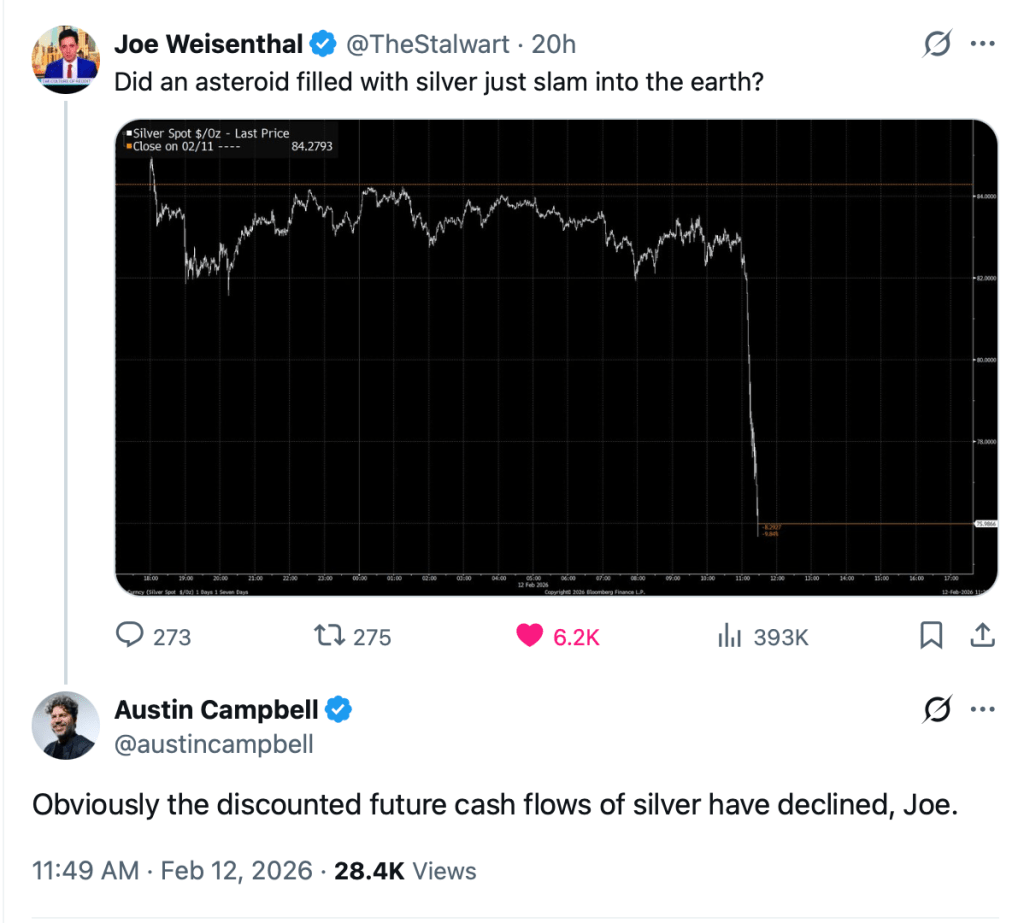

In the metals markets, yesterday’s gains are being followed by a mixed picture with gold (+0.2%) and silver (+0.3%) edging higher while copper (-1.6%) and platinum (-1.8%) cede those gains. However, as I highlighted yesterday, this all still feels like consolidation. FYI, there is much talk in the markets about silver and how there is not enough physical silver in the COMEX vaults to cover open interest, and how that could result in a major squeeze, but my take is most of it will roll forward as the fundamental supply/demand equation does not appeared to have changed.

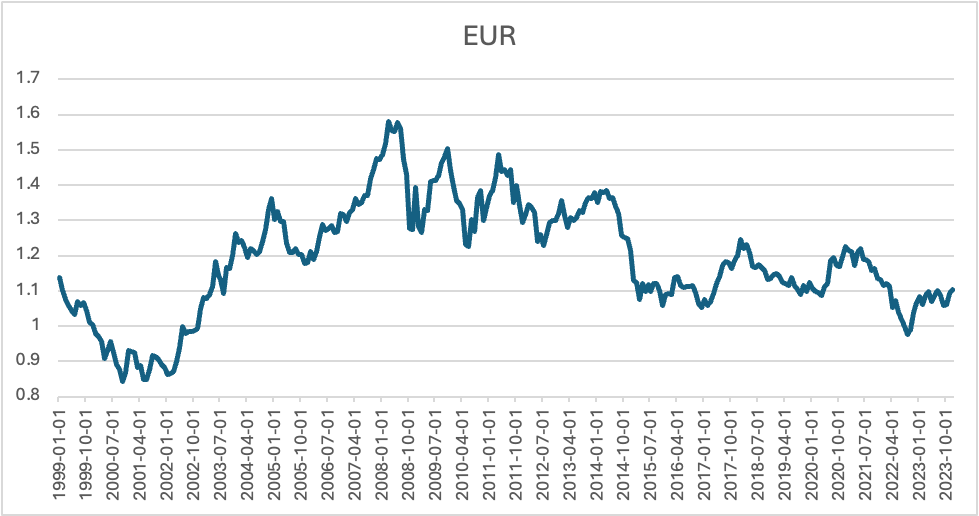

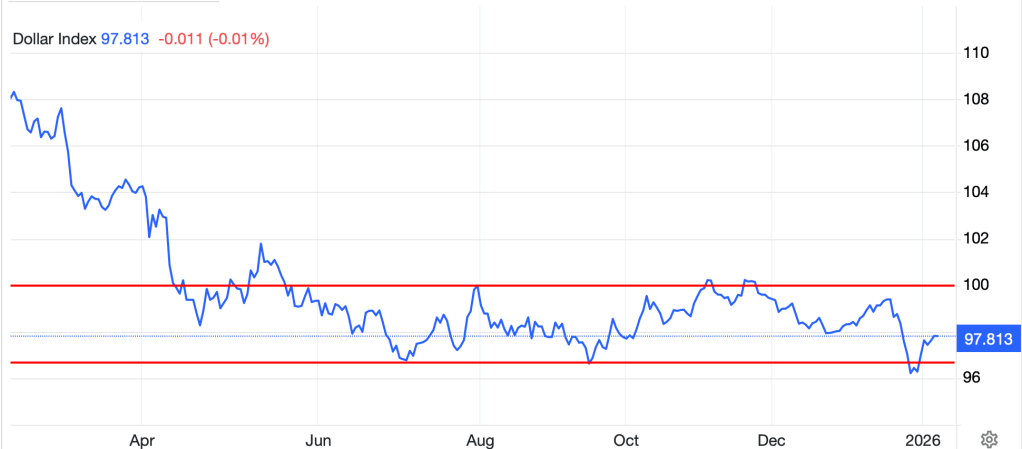

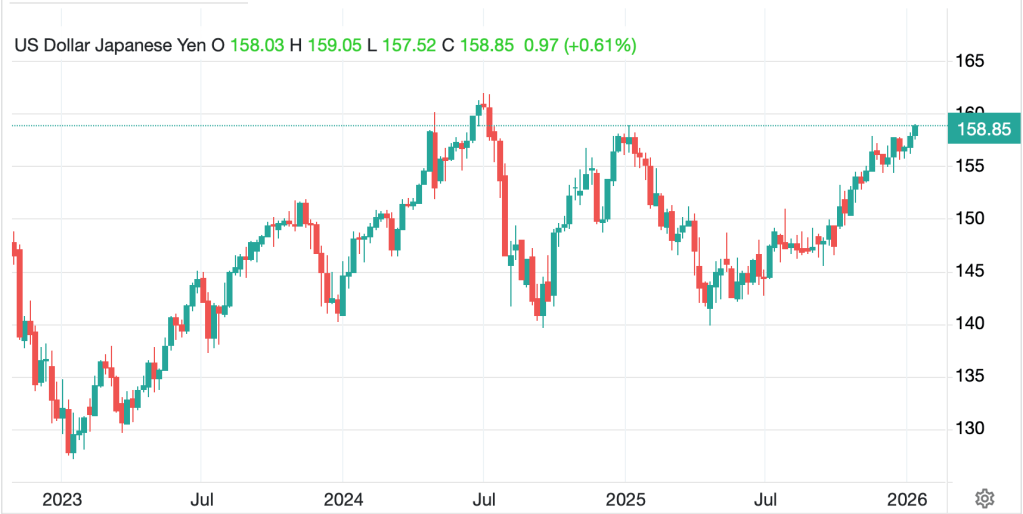

Finally, the dollar had a strong session yesterday, rising 0.6% as measured by the DXY, and making gains vs. almost all currencies. This morning, those trends are continuing with SEK (-0.4%) and GBP (-0.2%) leading the way lower in the G10 space while ZAR (-0.85%), INR (-0.4%) and KRW (-0.4%) are dragging down the EMG bloc. Again, data has been scarce, so I see this as a more traditional risk-off sentiment than some new macro story.

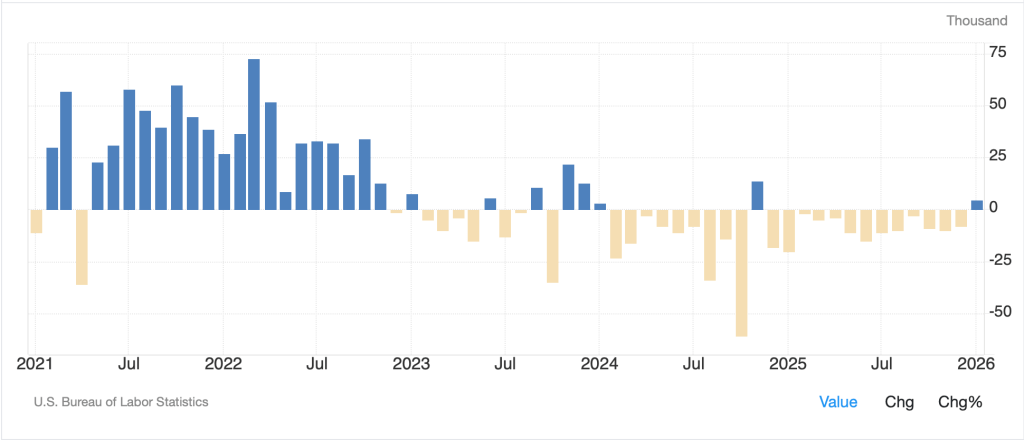

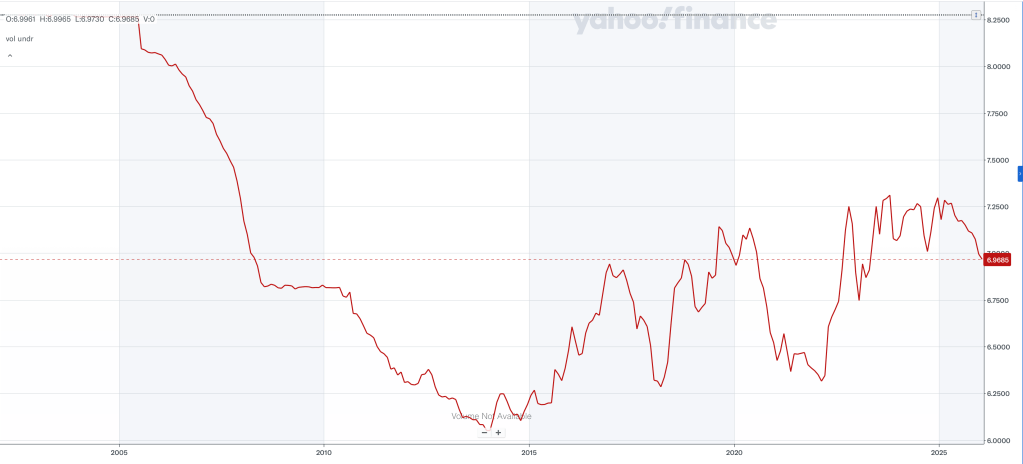

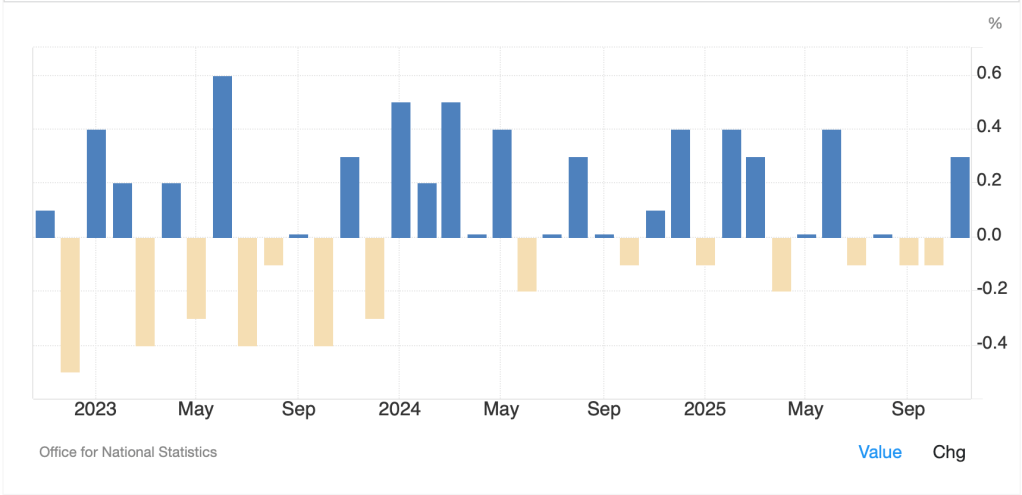

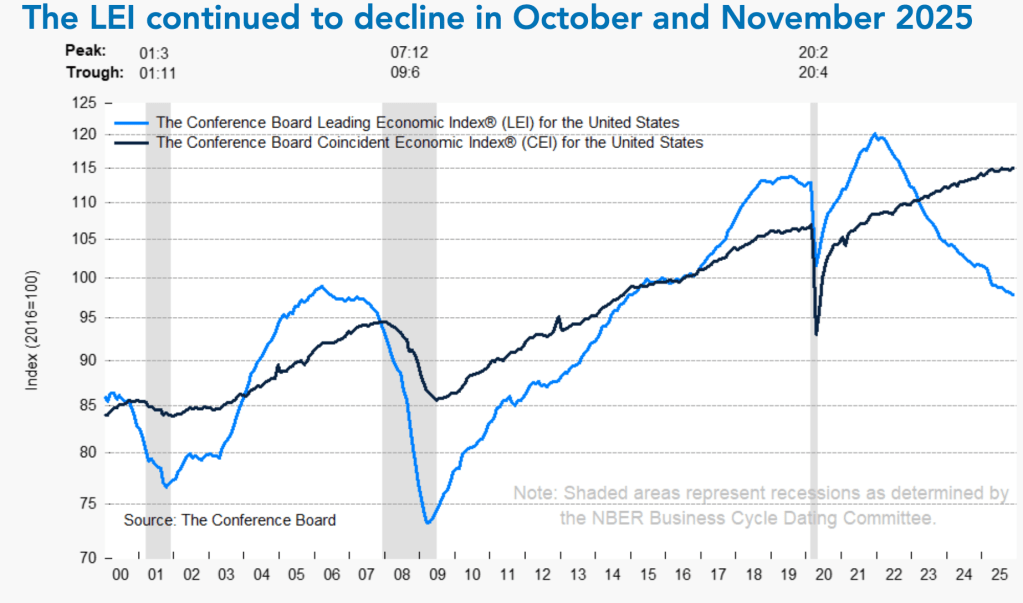

Data yesterday was generally stronger than forecast, notably IP and Capacity Utilization, which showed solid outcomes that were ascribed to AI infrastructure building as well utilities activity. It strikes me this is exactly what the Trump administration is trying to achieve with their reshoring goals. I guess the question is how productive this investment will be and how will it impact inflation readings. This morning, we see the weekly Initial (exp 225K) and Continuing (1860K) claims, as well as the Trade Balance (-$55.5B), Philly Fed (8.5) and Leading Indicators (0.0%). The interesting thing about the Leading Indicators number is that a flat result would be the highest in 4 years. A look at the Conference Board’s chart below shows an interesting thing about this number, and to me, anyway, calls its value into question. Leading Indicators have been declining for four years while coincident indicators (and economic growth) have been moving along just fine. I’m trying to figure out what these indicators lead.

And that’s really it for today. We do see oil inventories as well, with a slight build expected and we will hear from Minneapolis Fed president Kashkari, but I cannot remember the last time he said anything interesting. To me, the concern today, and tomorrow and next week, is that we see an escalation in rhetoric regarding Iran, at the very least, if not an actual military strike. That feels like it would be bad for stocks, good for bonds, the dollar and gold. Hopefully I am wrong there.

Good luck

Adf