From Europe, we’re hearing some squawks

They’ve not been included in talks

‘Bout war and Ukraine

So, to inflict pain

They’ve threatened a US detox

It seems they believe if they sell

All Treasuries held we would yell

Please stop, it’s too much

And lighten our touch

Methinks, for them, it won’t end well

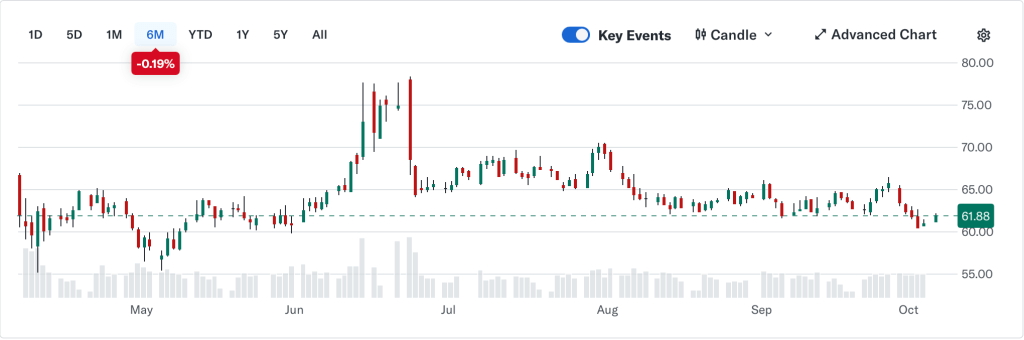

Markets continue to be dull these days. While we are clearly not in the summer (it is 15° here in NJ this morning), doldrums certainly seem to be descriptive of the current situation. Equities bounce back and forth each day, neither trading to new highs, nor falling sharply. The same is true with the dollar, with oil, with gold of late and even, on a slightly longer-term view, of Treasury bonds. I guess that could be the exception, depending on your horizon, but as you can see from the chart below, it has been several months since 10-year yields have traded outside the 4.0% – 4.2% range.

Source: tradingeconomics.com

Now, much digital ink has been spilled trying to explain that the latest 15bp rise in yields is a signal that the US economy is about to collapse under the weight of its $38+ trillion in debt, but I sense that is more about reporters trying to get clicks on their articles than a reflection of reality.

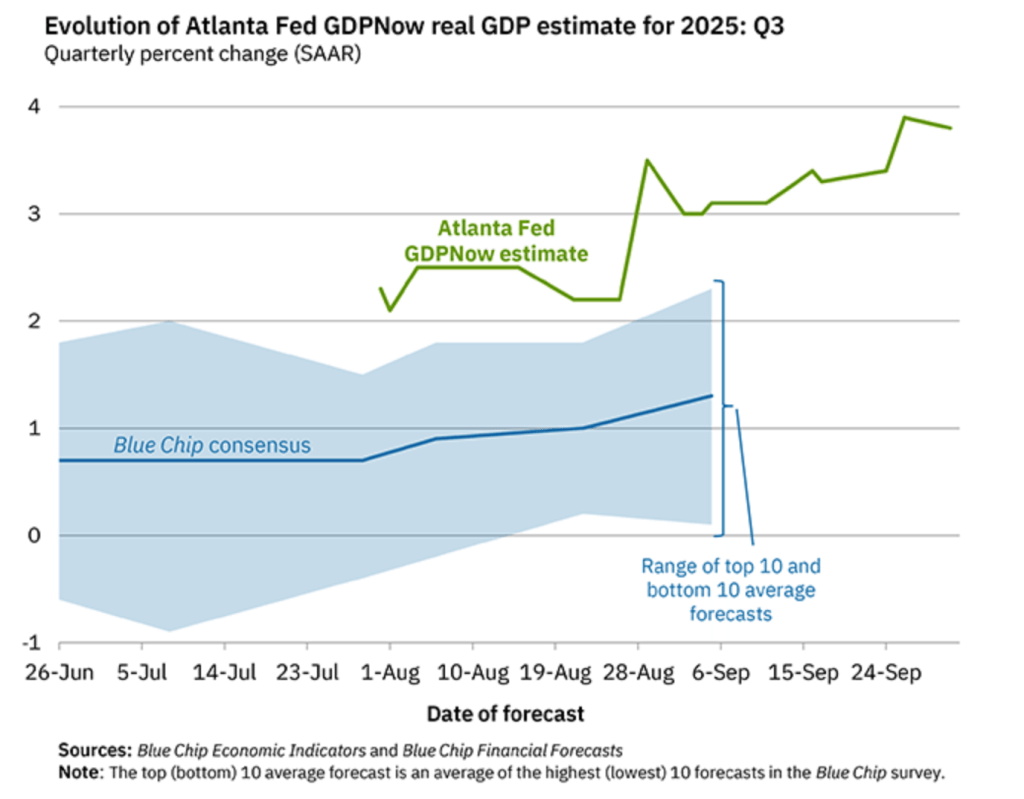

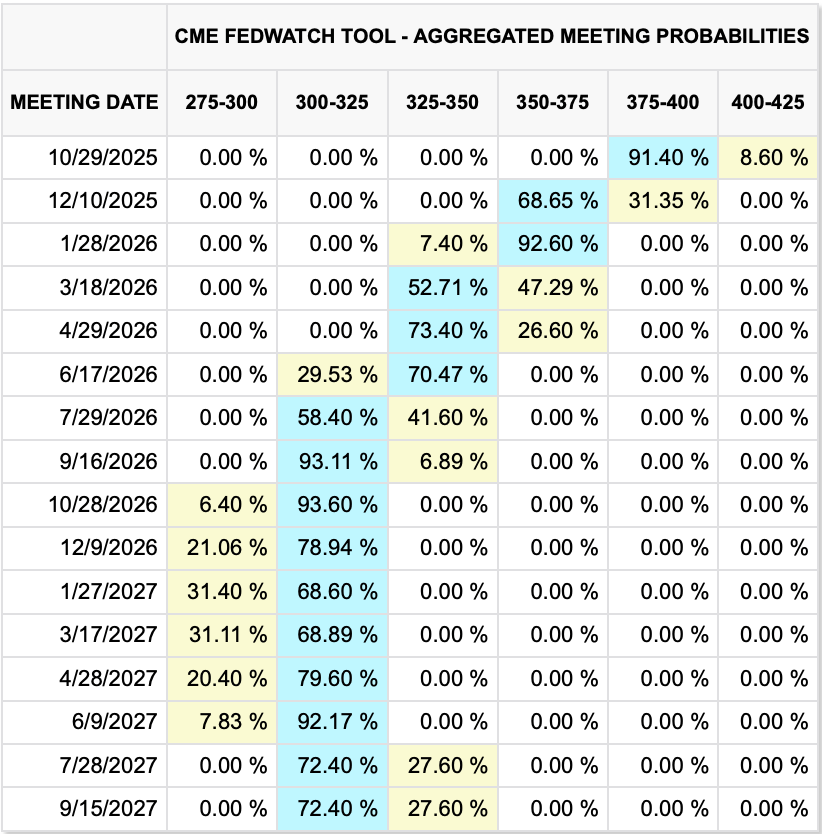

However, this morning I saw a story that I think is worth discussing, even though it is only a hypothetical. Making the rounds is the story that Europe and the UK are extremely unhappy with President Trump’s approach to obtaining a peace in Ukraine and so have threatened their so-called ‘nuclear option’ of selling all their Treasury holdings to crash the US bond market and the US economy alongside it. From what I have seen, if you sum up all the holdings in Europe and the UK it totals $2.3 trillion or so, although it is not clear if that is controlled by the governments, or there are private holdings included. My strong suspicion is the latter, although I have not yet been able to confirm that.

But let’s assume those holdings are completely under the control of European central banks and governments and they decide that’s what they want to do. What do you think will happen? Arguably, much depends on how they go about selling them. After all, it’s not as though there is anybody, other than the Fed, who can step up and show a bid on the full amount. So how can they do this? I figure there are only two viable options:

- They can sell them slowly and steadily over time, perhaps $200 billion/day (FYI daily Treasury market volume averages about $900 billion). That would clearly put significant downward pressure on prices and push yields higher but would likely encourage the hedge fund community to double up on the bond basis trade thus slowing the decline. However, if they did that for 11 days, US yields would undoubtedly be higher. Too, remember that if the market started to get unstable, the Fed would step in and absorb whatever amount they deemed necessary to prevent things from getting out of hand.

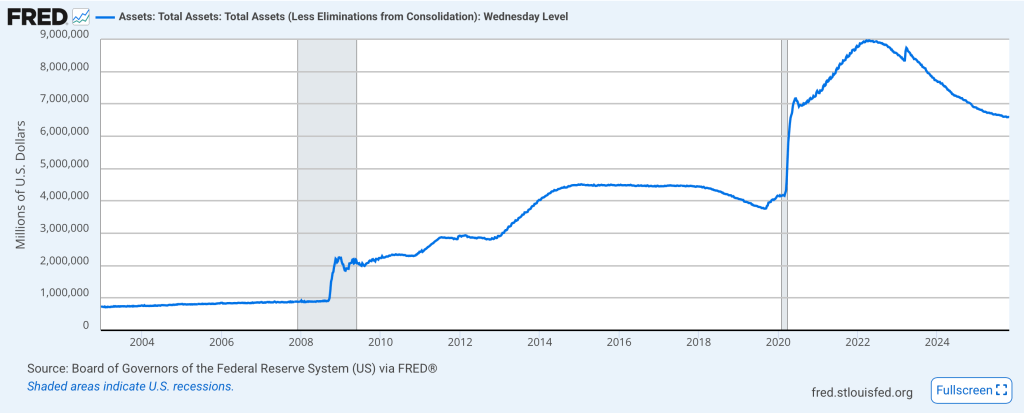

- Perhaps, since their ostensible goal is to destabilize the US bond market, they would literally all coordinate their timing and try to sell them all at once. At that point, since nothing happens in the bond market without the Fed being aware, it would likely have an even smaller impact as the Fed would certainly step in and take down the entire lot. After all, through QT, their balance sheet has shrunk about $2.3 trillion over the past 18 months, so they have plenty of capacity.

My point is, I believe this is an empty threat, as it seems most European threats tend to be. Consider that the Eurodollar market remains the major source of funding throughout Europe, and it requires collateral (i.e. Treasury bills and bonds) in order to function. If Europe no longer had that collateral, it feels like they might have a lot more problems funding anything on the continent.

Another issue is that if we assume they successfully sell all their Treasuries, that means they will be holding $2.3 trillion in cash. Exactly what are they going to do with that? If they convert it into euros and pounds, the dollar will certainly fall sharply, meaning both the euro and pound will rise sharply. Please explain how that will help their economies and their exporters. They are getting killed right now because their energy policies have made manufacturing ridiculously expensive. See how many cars VW or Mercedes sells overseas if the euro rallies 15%.

Now, the article linked above is from the Daily Express, not a website I trust, but they reference a WSJ article. However, despite searching the Journal, and asking Grok to do the same, I can find no actual article that mentions this idea. Ostensibly, if you want to search, it came out on December 1st, although if that is the case, why is it only getting press now?

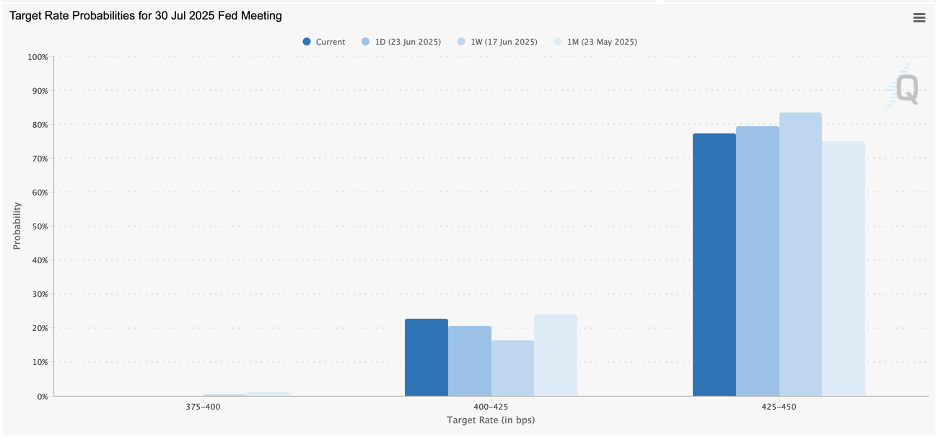

It is a sign of the absence of market news that this is a story at all. With market participants inhaling deeply so they may hold their breath until 2:00 tomorrow afternoon when the FOMC statement is released, they need something to do. I guess this was today’s distraction. As I said above, this is clickbait, not reality.

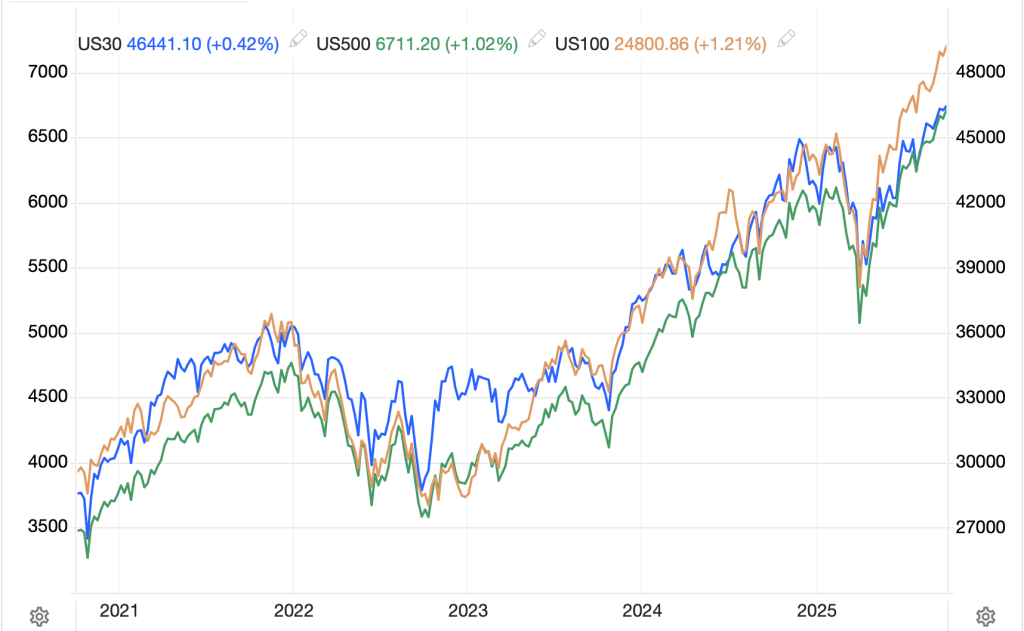

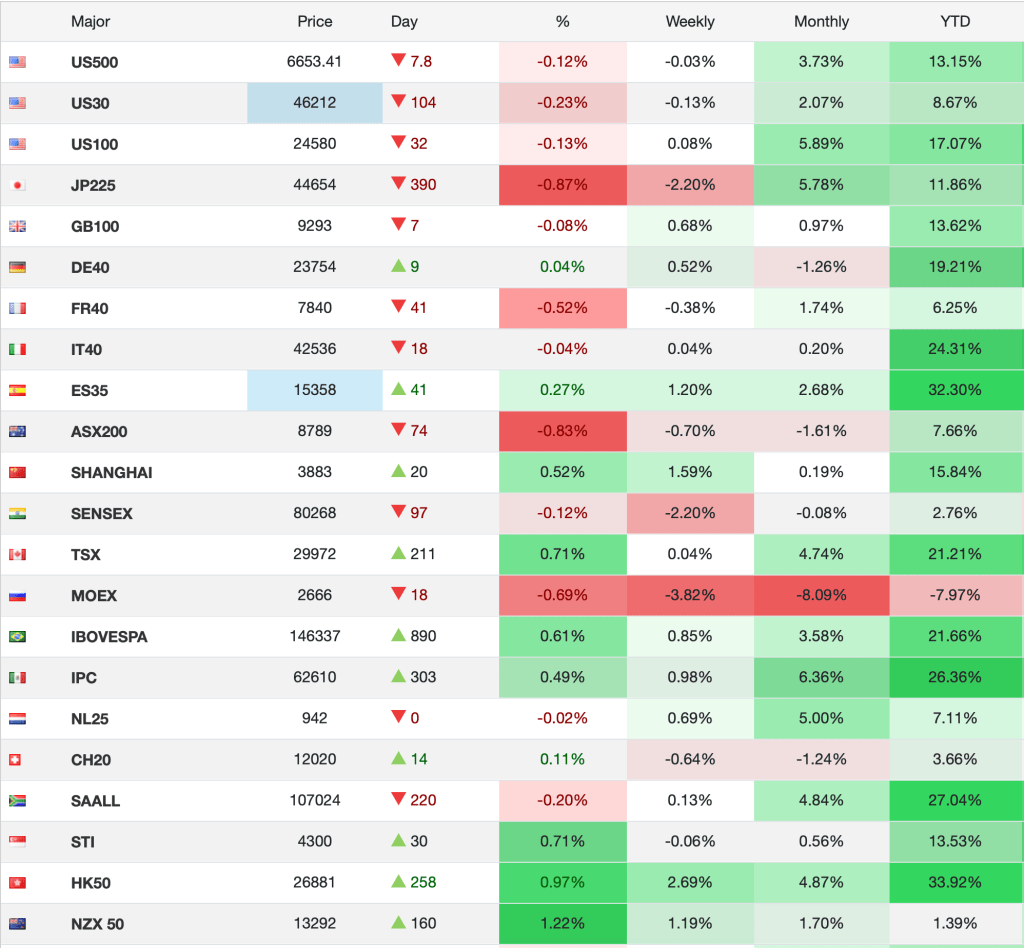

Ok, let’s tour markets. US equity market slipped a bit yesterday and Asian markets were dull as well with modest gains and losses almost everywhere. The exception was HK (-1.3%) which suffered based on concern the FOMC will provide a ‘hawkish’ cut tomorrow and that will be the end of the road. But China (-0.5%) was also soft despite hopes that when the Politburo meets in the next weeks, they will focus on more domestic stimulus (🤣🤣) just like they have been saying for the past three years. Australia (-0.5%) slipped as the RBA left rates on hold and sounded more hawkish, indicating there were no cuts in the offing.

European bourses are mixed, although starting to lean lower. The CAC (-0.6%) is the laggard here although Italy and Spain are also softer while Germany (+0.2%) leads the gainers after a slightly better than expected Trade Balance was reported this morning. The hiccup here is that the balance improved because imports fell (-1.2%) so much more than exports rose (0.1%). Hardly the sign of economic strength.

We’ve discussed bonds on a big picture basis, and recall, yields rose yesterday in both the US and Europe. This morning, though, yields are little changed in the US and in Europe, with sovereign yields, if anything slightly lower. JGB yields also slipped -1bp last night and the big mover was Australia after the RBA, with yields climbing 5bps.

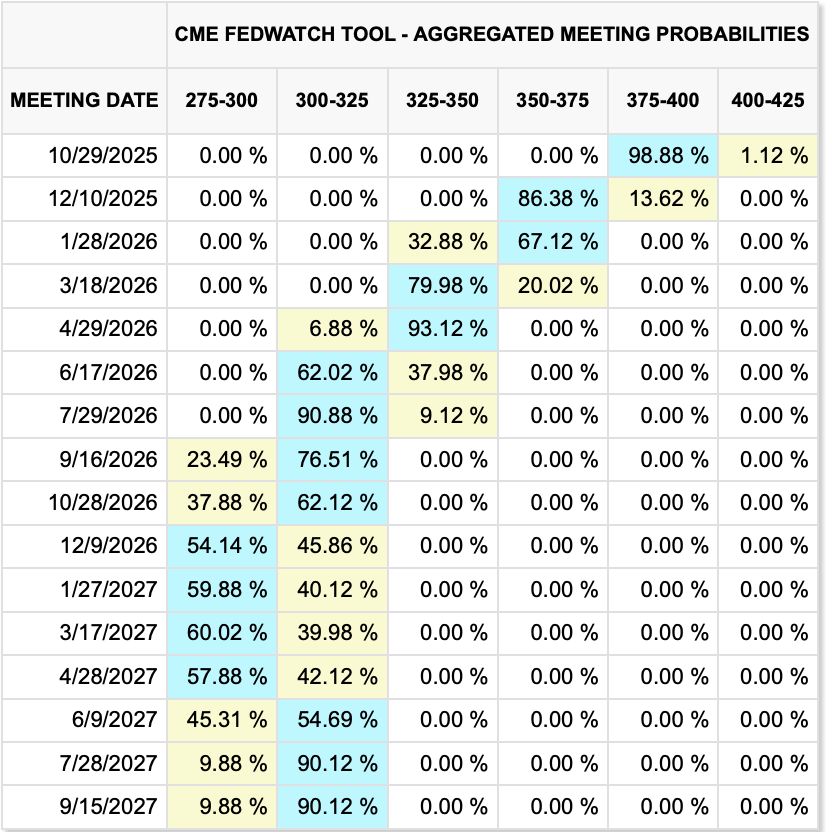

In the commodity markets, while the trend remains slightly lower in oil (+0.3%), as you can see from the chart below, $60/bbl is home. As I have written before, absent an invasion of Venezuela or peace in Ukraine, it is hard to see what changes this for now. I guess if China stops filling up its SPR, demand could shrink and that would accelerate the decline.

Source: tradingeconomics.com

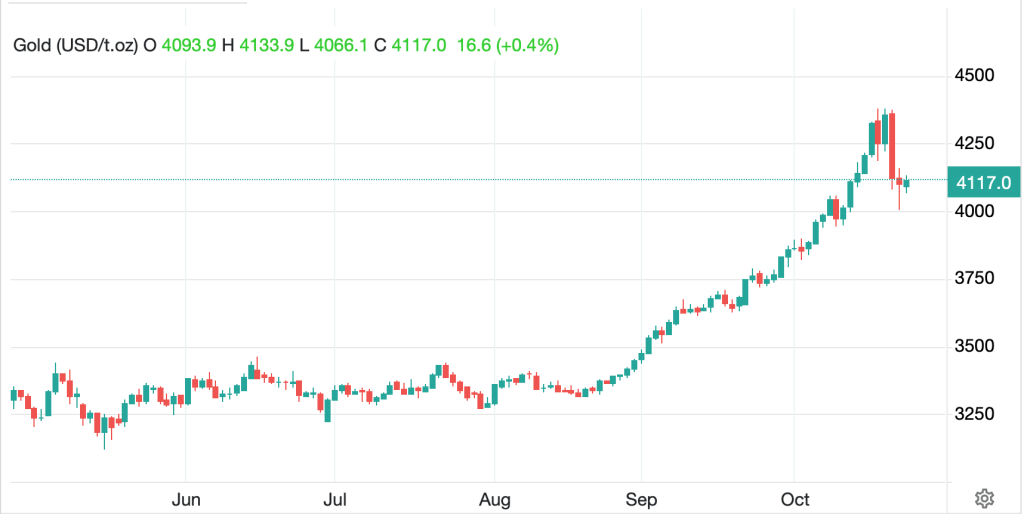

In the metals markets, $4200/oz has become gold’s (+0.3%) home lately while silver (+0.9%) has found comfort between $58/oz and $59/oz. Neither is seeing much in the way of volatility or new interest, but both trends remain strongly higher.

Finally, the dollar, which rallied a bit yesterday, is little changed this morning. USDJPY is interesting as it has traded back above 156 this morning, contradicting all that talk of a Japanese repatriation trade. Again, it is difficult for me to look at the yen chart below and conclude the dollar has peaked.

Source: tradingeconomics.com

Elsewhere in the space, this is one of those days where 0.2% is a major move. Historically, December is not a time when FX traders are active.

On the data front, the NFIB report rose to 99.0 this morning, its highest reading in three months and the underlying comments showed a modest increase in optimism with many businesses looking to hire more people but having trouble finding qualified candidates. This is quite a juxtaposition with the narrative that small businesses are firing workers that I have read in several different places and is backed by things like the recent Challenger Gray survey which indicated that US businesses have fired more than 1.1 million workers so far this year. This lack of clarity is not going to help the FOMC make decisions, that’s for sure. As to the rest, the ADP Weekly Survey is due to be released as well as JOLTS Job Openings (7.2M) and Leading Indicators (-0.3%) at 10:00.

The very fact that the biggest story I could find was a hypothetical is indicative of the idea that there is nothing going on. Look for a quiet one as market participants await Powell and friends tomorrow.

Good luck

Adf