Will Japan hike rates?

How much will it matter if

They do? Or they don’t?

Market activity and discussion has been somewhat lacking this week as the real fireworks appear to be in Washington DC where President-elect Trump’s cabinet nominees are going through their hearings at the Senate. Certainly, between that and the ongoing fires in LA, the news cycle is not very focused on financial markets in the US. This, then, gives us a chance to gaze Eastward to the Land of the Rising Sun and discuss what is happening there.

You may recall yesterday I mentioned a speech by BOJ Deputy Governor Himino where he explained that given the inflation situation as well as the indication that wages would continue to rise at a more robust clip in Japan, a rate hike may be appropriate. Well, last night, Governor Ueda basically told us the same thing. Alas, it seems that the BOJ takes a full day to translate speeches into English because there are no quotes from Ueda, but we now have the entire Himino speech from the day before.

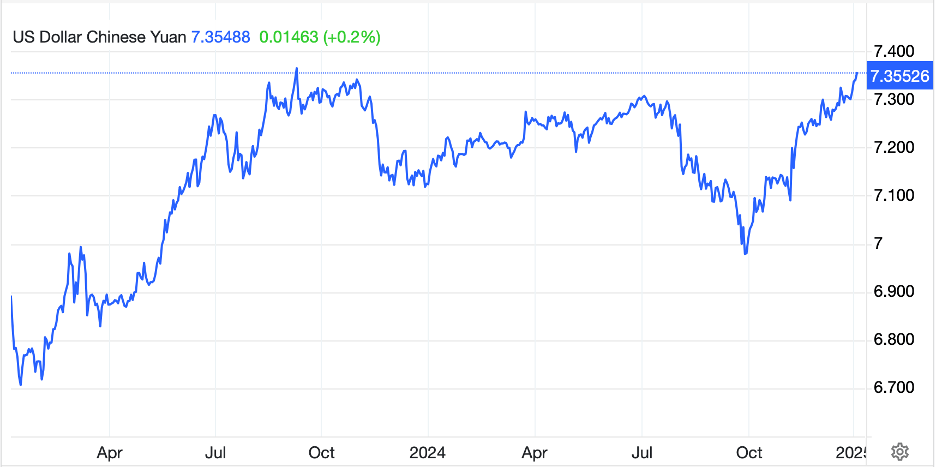

Regardless, the essence of the story is that the BOJ is carefully watching the data and awaiting the Trump inauguration to see if there are any surprise tariff outcomes against Japan (something that has not been discussed) while they await their own meeting at the end of next week. Market pricing now has a 72% probability of a 25bp rate hike next week, up from about 60% yesterday, and last night the yen did rally, climbing 0.7%. However, a quick look at the chart below might indicate that the market is not overly concerned about a major yen revaluation.

Source: tradingeconomics.com

In fact, since the last BOJ meeting in December, when they sounded a bit more dovish than anticipated, the yen has done very little overall, treading water between 156.50 and 158.50. While a BOJ rate hike would likely support the yen somewhat, there is another dynamic playing out that would likely have the opposite effect. At the beginning of the year I prognosticated that the Fed may well hike rates by the end of 2025 as inflation seems unlikely to cooperate with their prayers belief that 2.0% was baked in the cake. At the time, that was not a widely held view. However, in a remarkably short period of time, market participants are starting to discuss the idea that may, in fact, be the case. Even the WSJ today had a piece on the subject from James Mackintosh, one of their economics writers laying out the case. The point here is that if tighter monetary policy by the Fed is in the cards, I suspect the yen will have a great deal of difficulty climbing much further. Let’s keep an eye on the 156.00 level for clues that things are changing.

In England, inflation is rising

Less quickly than some theorizing

Meanwhile in the States

Jay and his teammates

Are hoping for data downsizing

Turning now to the inflation story, European releases were generally right on forecast except for the UK, where the headline rate fell to 2.5% while the core fell to 3.2%, 1 tick and 2 ticks lower than expected respectively. Certainly, that is good news for the beleaguered people in the UK and it has now increased the odds that the BOE cuts rates at their next meeting on February 6th. However, we cannot forget that the BOE’s inflation target, like that of the Fed, is 2.0%, and there is still limited belief that they will achieve that level even in 2025. But the markets did respond to the data with the FTSE 100 (+0.75%) leading the European bourses higher while 10-year Gilt yields (-8bps) have seen their largest decline in several weeks and are also leading European sovereign yields lower. Interestingly, the pound has been left out of this movement as it is essentially unchanged on the day. Perhaps there is a message there.

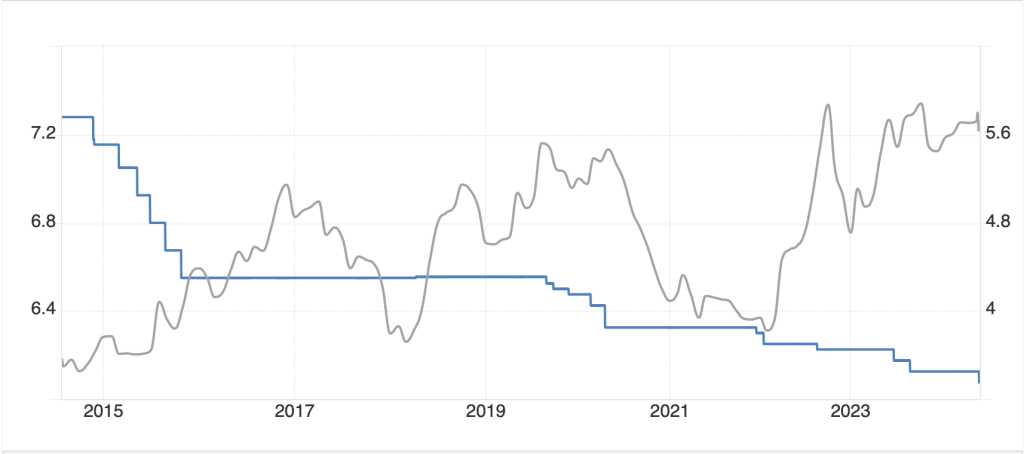

Which brings us to the US CPI data this morning. after yesterday’s PPI data printed softer than expected at both the headline and core levels, excitement is building for a soft print and the resumption of the Fed cutting cycle. However, it is important to remember that despite the concept that these prices should move together, the reality is they really don’t. Looking at the monthly core movements below, while the sign is generally the same, the relationship is far weaker than one might imagine.

Source: tradingeconomics.com

In fact, since January 2000, the correlation between the two headline series is 0.04%, or arguably no relationship at all. I would not count on a soft CPI print this morning based on yesterday’s PPI. Rather, I am far more concerned that the ISM Services Prices Paid index last week was so hot at 64.1, a better indicator that inflation remains sticky. But I guess we will all learn in an hour or two how it plays out.

Ahead of that, let’s look at the rest of the overnight session. Yesterday’s mixed US equity performance (the NASDAQ lagged) was followed by mixed price action overnight with the Nikkei (-0.1%) edging lower on the modestly stronger yen and talk of a rate hike, while the Hang Seng (+0.3%) managed a gain on the back of Chinese central bank activity as the PBOC added more than $130 billion in liquidity ahead of the Lunar New Year holiday upcoming. However, mainland shares (CSI 300 -0.6%) did not share the Hong Kong view. Elsewhere in the region Taiwan (-1.25%) was the laggard while Indonesia (+1.8%) jumped on a surprise rate cut by the central bank there.

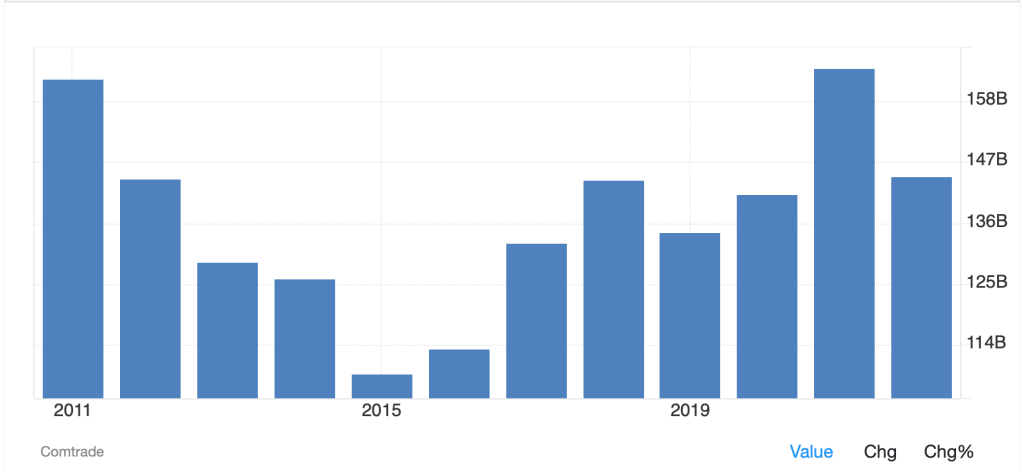

In Europe, though, all is green as gains of 0.4% (CAC) to 0.8% (DAX) have been driven by ECB comments that rate cuts are coming as concerns grow over the weakness of the economies there. Germany released its GDP data and in 2024, Germany’s GDP shrank by -0.2%, the second consecutive annual decline and the truth is, given the combination of their insane energy policy and the fact that China is eating their proverbial lunch with respect to manufacturing, especially in the auto sector, it is hard to look ahead and see any positivity at all. Meanwhile, US futures are higher by 0.5% or so at this hour (7:00) clearly with traders looking for a soft CPI print.

In the bond market, Treasury yields are lower by 3bps this morning but remain just below 4.80% and the 5.0% watch parties are still hot tickets. European yields have also softened away from Gilts, with the entire continent lower by between -2bps and -4bps. Right now, with dreams of a soft CPI, bond bulls are active. We shall see how that plays out.

In the commodity space, oil (+0.3%) is modestly firmer after a reactionary sell-off yesterday. The IEA modestly raised its demand forecast and supplies in the US, according to the API, were a bit tighter yesterday, so that seems to be the support. NatGas is little changed right now while metals markets (Au +0.4%, Ag +0.5%, Cu +0.4%) are edging higher although mostly remain in a trading range lately. Activity here has been lackluster with no new story to drive either direction.

Finally, the dollar is a touch softer overall, but away from USDJPY, most movement is of the 0.1% variety. Right now, the FX markets are not garnering much interest overall.

On the data front, expectations for CPI are as follows: Headline (0.3%, 2.9% Y/Y) and Core (0.2%, 3.3% Y/Y). As well, we see Empire State Manufacturing (3.0) and then the Beige Book at 2:00pm. We also have three Fed speakers, Williams, Kashkari and Barkin, but are they really going to alter the cautionary message? I doubt it and the market continues to price a single 25bp cut for all of 2025. The real fireworks will only come if/when price hikes start to get priced in as discussed above.

It is hard to get excited for market activity today as all eyes remain on the confirmation hearings and LA. As such, I suspect there will be very little to see today.

Good luck

Adf