Just two days before Halloween

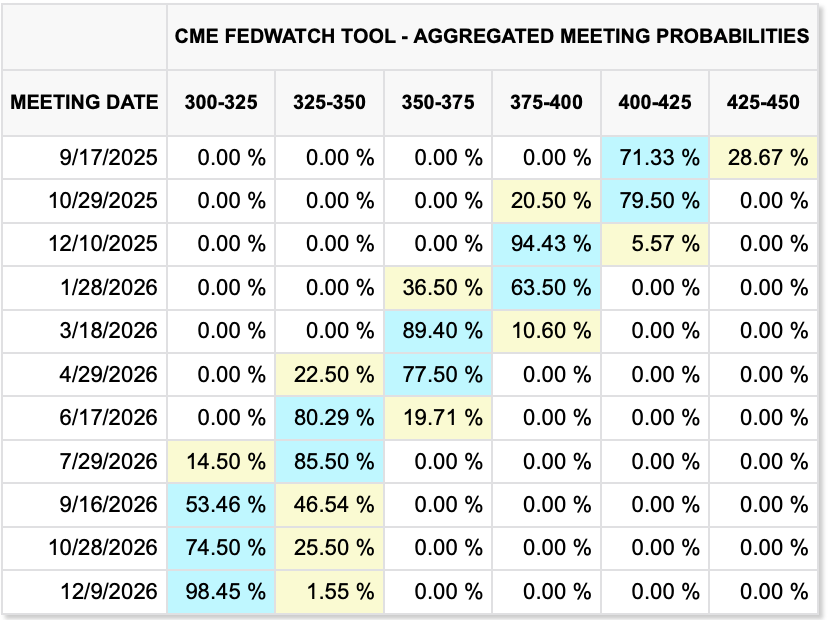

When Jay and his minions convene

With great joie de vivre

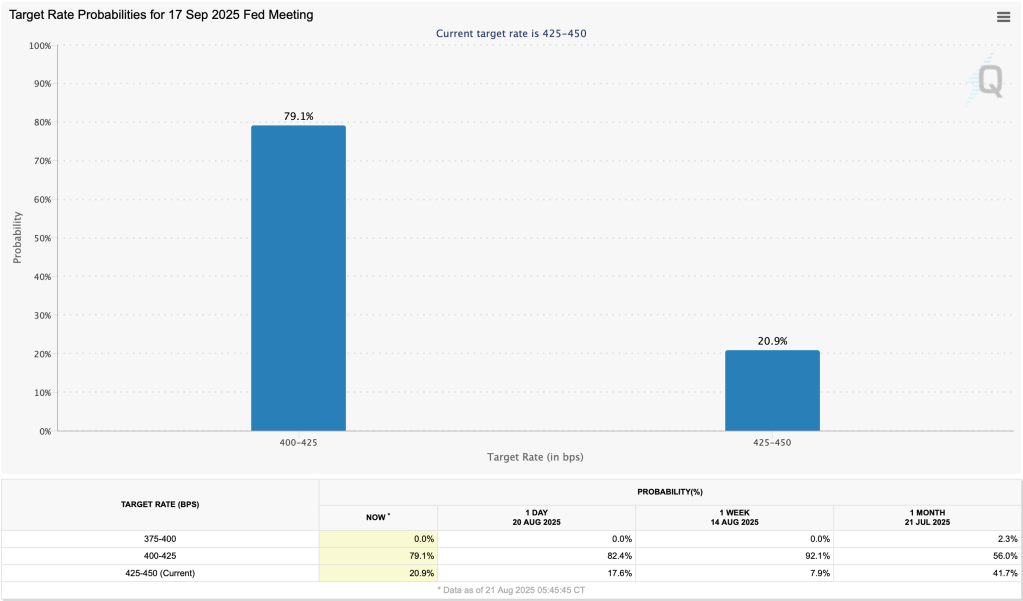

Investors believe

A quarter-point cut will be seen

But what if the model that Jay

Consults might have led him astray

Then Fed fund reductions

May cause many ructions

In markets, and too, the beltway

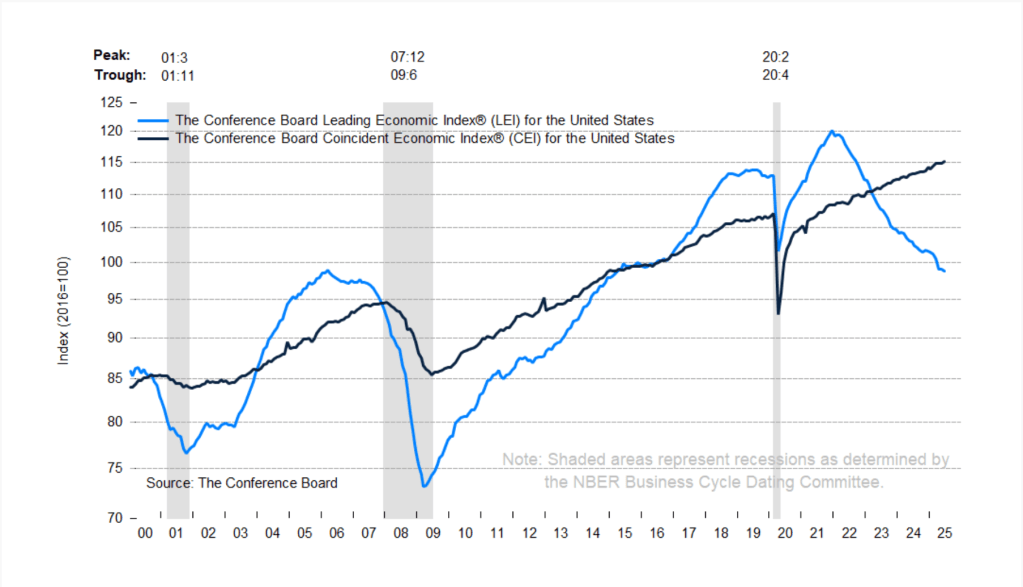

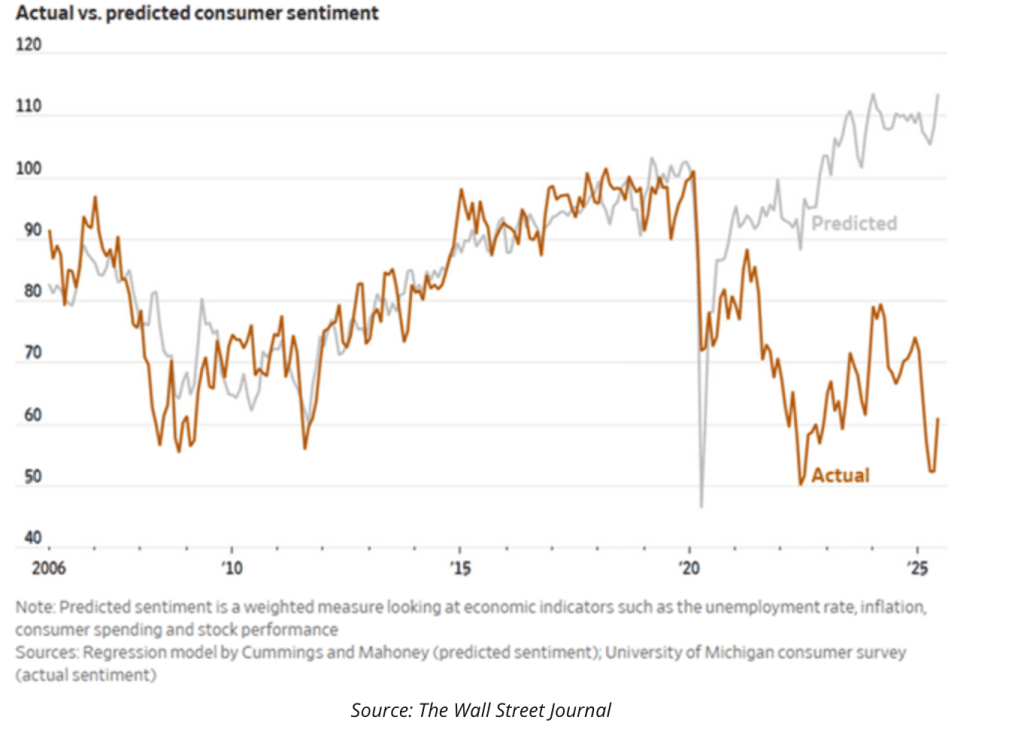

But I am just a poet and my voice is not so loud in financial markets. However, John Mauldin is someone with much greater reach and his letter this week highlighted that exact issue. (For those of you who are not familiar with John, his weekly letter, “Thoughts from the Frontline” is usually an excellent read and completely free, you should sign up.) At any rate, he reprinted a chart originally in the WSJ that I think does an excellent job of demonstrating the flaws in models developed pre-Covid.

It is quite apparent how this particular model, which appears to use the type of inputs that most econometric models utilize, had done a pretty good job, even throughout the GFC, of anticipating changes in consumer sentiment right up until Covid. However, it is also clear that since then, it has a terrible track record.

And this is the problem. I would wager that every one of the models built by the hundreds of PhD’s at the Fed has a similar problem, things that used to drive economic decision making no longer do. I guess when people get used to the government supporting them completely, many are willing to sit back and do nothing. And when that support stops, it appears that people aren’t very happy about that situation. Go figure!

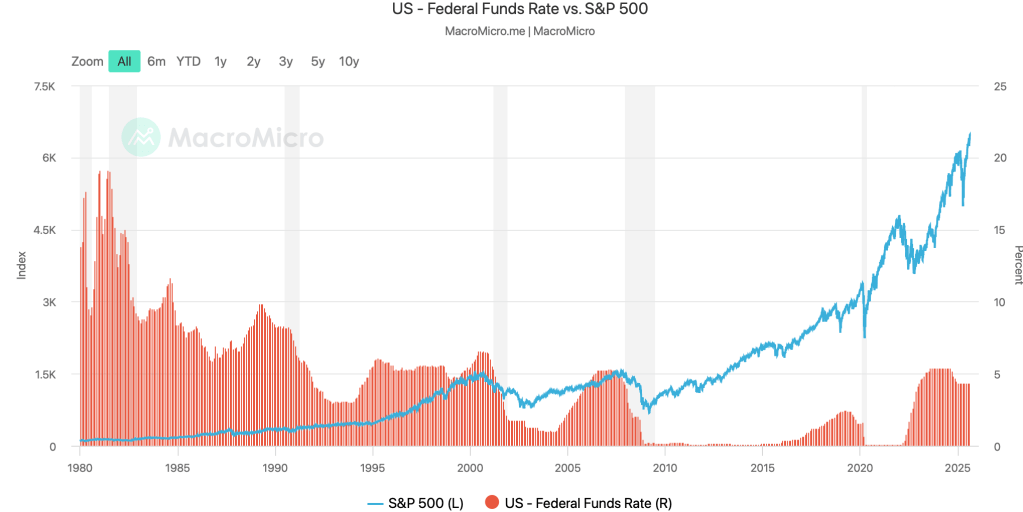

The bigger picture here is that I believe it is time for the Fed to question its own modeling prowess. Consider the situation that with interest rates at their current levels of 4% +/- a bit depending on the tenor, many people, especially retirees, were quite content to clip coupons and were spending those funds supporting the economy. At the same time, interest expense for small companies never really fell that far, so current rates are not deathly.

But you know who benefits from low interest rates? The government and large corporations who have access to capital markets and pay the lowest rates. And even there, companies like Apple, Google and Microsoft have so much cash on hand that they are net earning interest with higher rates.

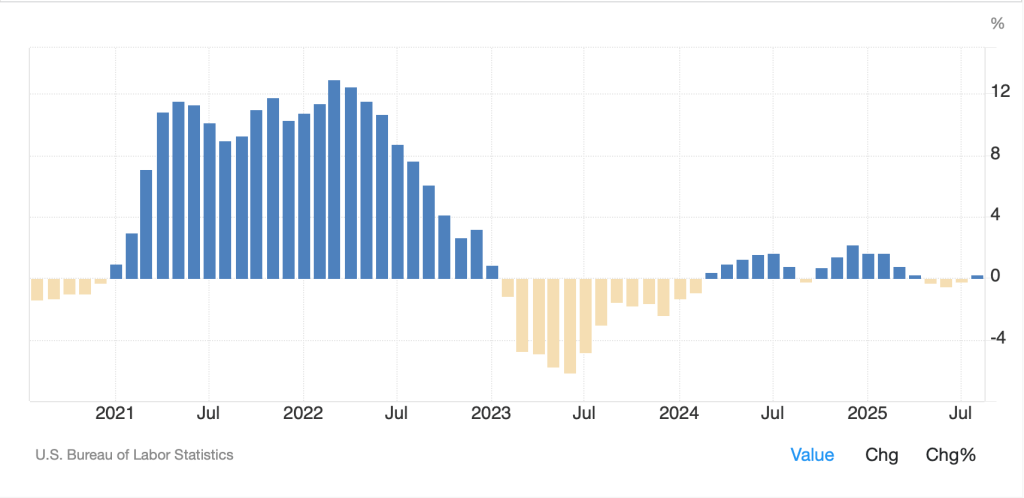

All this begs the question, what is the purpose of the Fed cutting rates? A key risk is that inflation will return with a vengeance. It has been 55 months since core PCE was at or below the Fed’s target level of 2.0% as you can see in the below chart, and I feel confident in saying that when the data is released this Friday, it will not be changing that trend.

Source: tradingeconomics.com

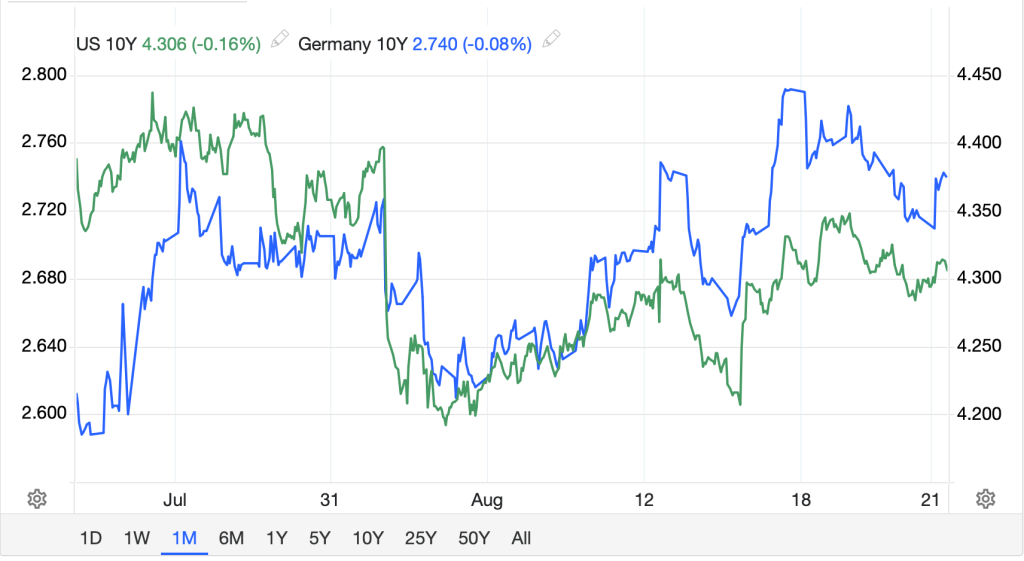

So, savers will suffer as their income will be reduced, the risk of rising inflation will increase as easier monetary policy typically precedes that type of movement, and long-term yields, which have rebounded recently, run the risk of starting higher again. Remember what happened last year when the Fed cut, 10-year Treasury yields rose 100bps. (see chart below)

Source: tradingeconomics.com

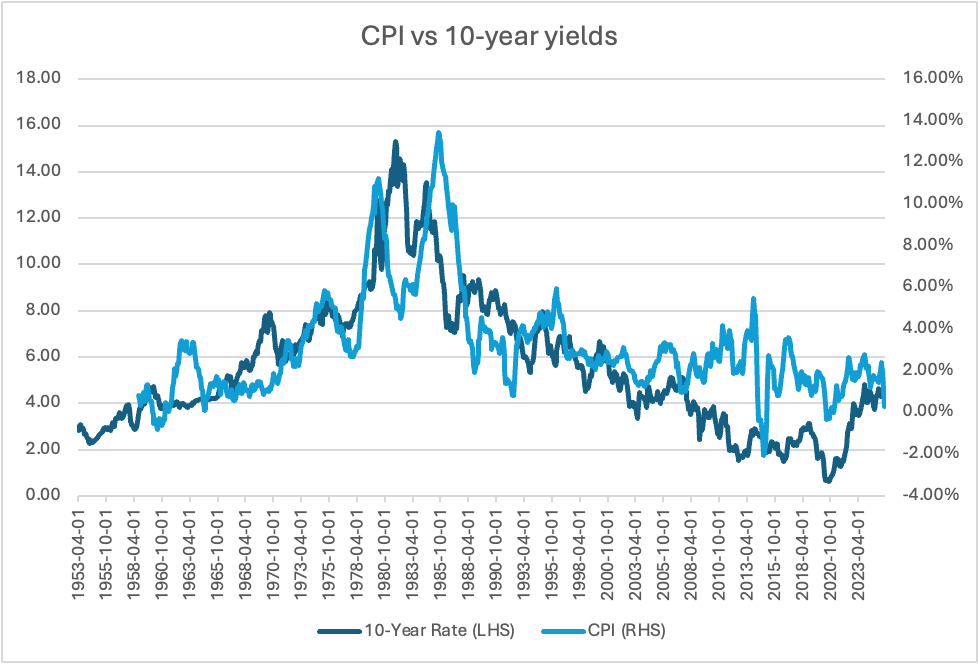

It is far too early to claim the outcome will be the same this time, but it is a real risk. After all, bond yields have a strong relationship with inflation, running at a long-term correlation of 0.36 and as can be seen in the chart below I prepared from FRED data.

Concluding, the current batch of economic models utilized by analysts and the Fed appear to have limited ability to describe the economy, whether it is because of the asynchronous nature of the current state of the world, or because the unprecedented government responses around the world to the Covid pandemic have changed the way everything works. The market is pricing a 93% probability of another rate cut in October, and it appears Chairman Powell believes that to be the case. But is it the right move at this time? I feel like that is not the question being asked, but it needs to be by people more powerful than this poet.

Ok, I’ll step down from my soapbox to survey the market activity overnight. Friday’s US closes at yet more all-time highs were followed by a more mixed session in Asia. While Japanese investors got the joke, with the Nikkei rising 1.0%, Hong Kong (-0.8%) and India (-0.6%) were both under pressure with the former suffering from a strengthening currency and concern about a major typhoon about to hit the island nation, while India is suffering from the backlash of the Trump policy change on H1-b visas, now charging $100,000 for them. It turns out Indian firms were the largest user of those visas and there is concern over a serious economic impact there. Otherwise, the region saw a mixture of green (China, Taiwan, Australia, Malaysia) and red (New Zealand, Indonesia, Singapore, Thailand).

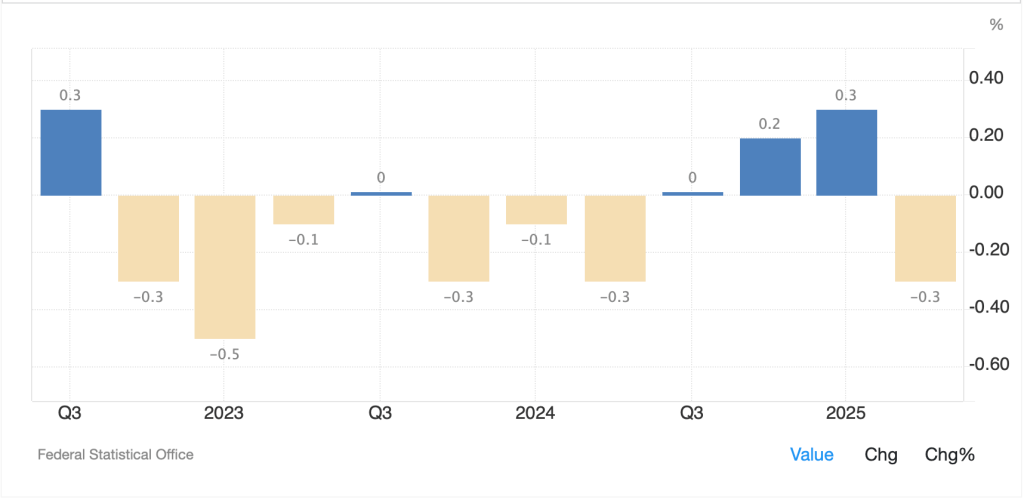

European bourses, though, are having a tougher time this morning with the continental exchanges all under pressure (DAX -0.7%, CAC -0.3%, IBEX -1.0%, FTSE MIB -1.0%) as concerns rise over the Flash PMI data to be released tomorrow and the idea it may show a much weaker economy than previously considered. As well, USD futures are softer at this hour (6:40), with all three major indices showing declines on the order of -0.25%. However, we must keep in mind that the trend in equity markets has been strongly higher so a modest pullback would not be a surprise and perhaps should be welcomed.

In the bond market, yields having moved higher on Friday, are quite stable this morning with Treasury yields unchanged and most of Europe seeing a -1bp decline. The only outlier here is Japan, where JGB yields topped 1.65%, a new high for the move and the highest level since 2008 as per the below chart from marketwatch.com. Ueda-san has to start getting worried soon, I think.

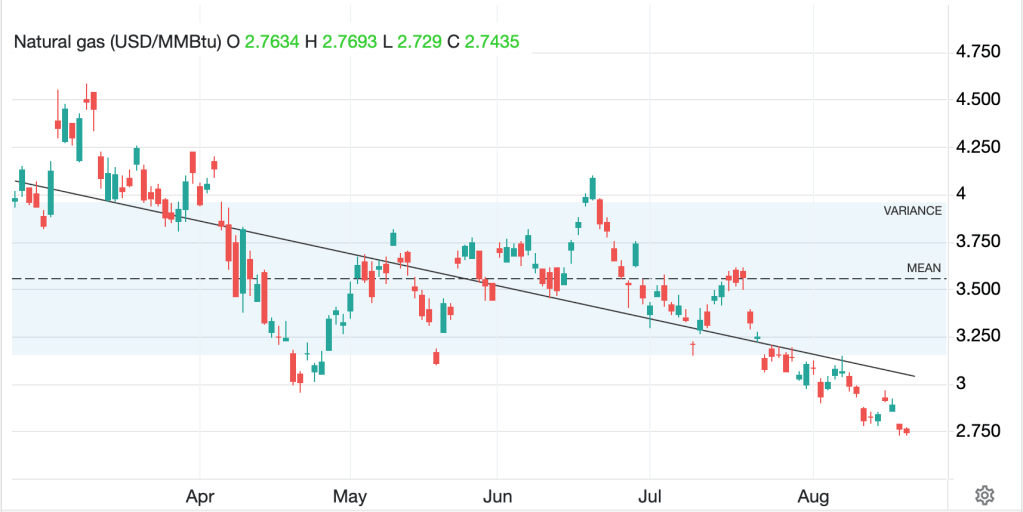

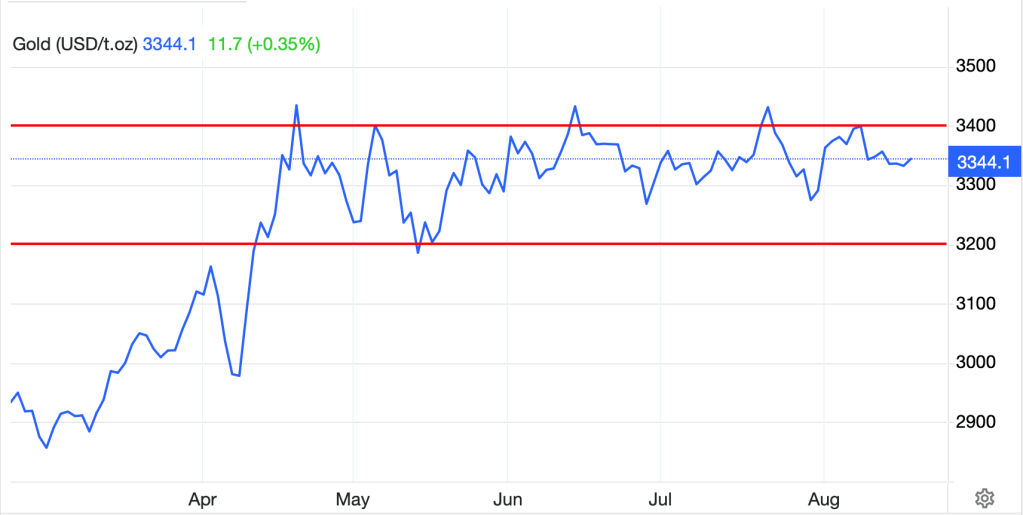

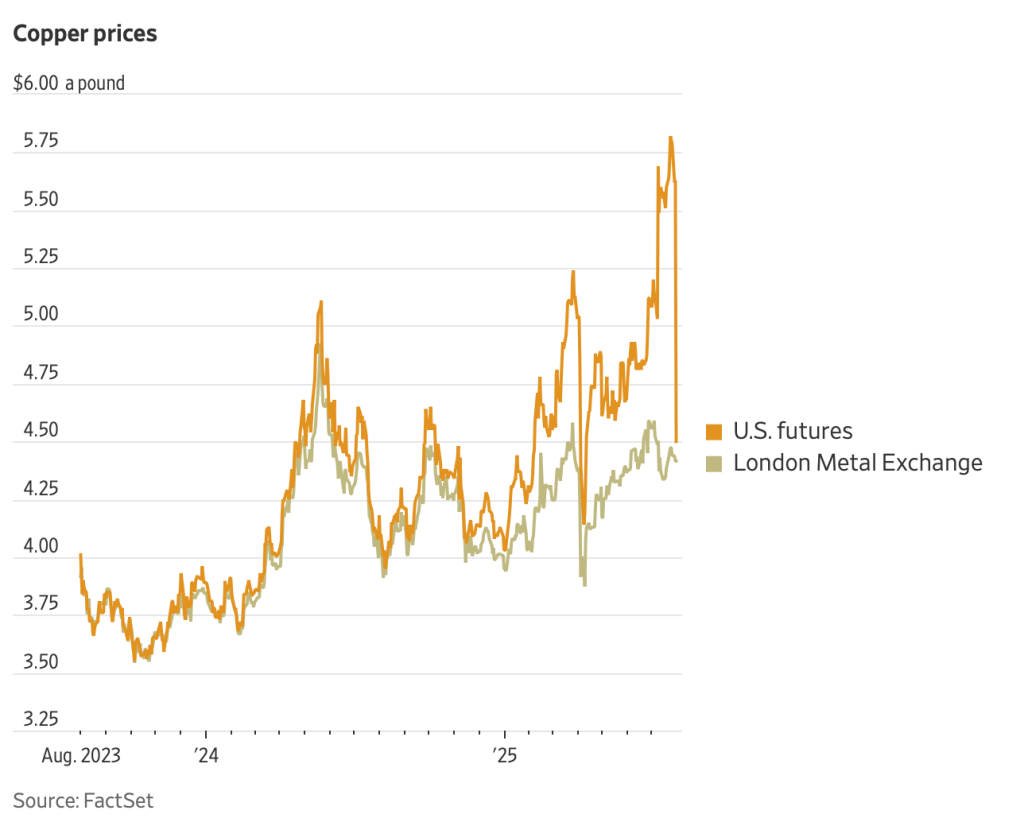

In the commodity space, oil (-0.7%) is continuing its recent decline but remains within the trading range and doesn’t appear to have much impetus in the short term in either direction. However, I continue to look for an eventual decline here. As to gold (+1.15%) and silver (+1.6%), nothing is going to stop this train. Well, certainly there is no indication that policy changes are coming anywhere in the world that would force investors to rethink the idea of continuous depreciation of fiat currencies, and let’s face it, that’s all this represents. I continue to see analysts raise their target price for the barbarous relic and I agree there is plenty of room to run as interest has been modest, at best, by Western investors.

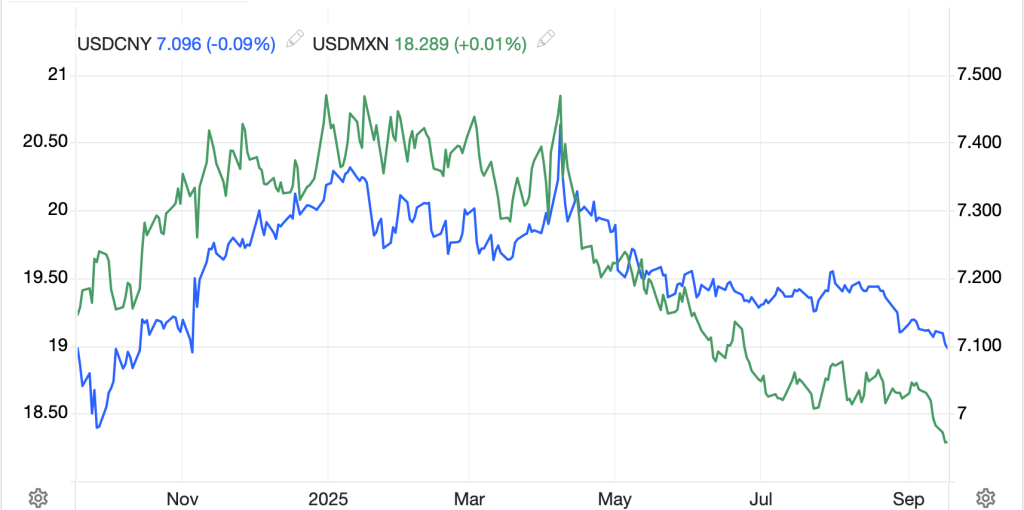

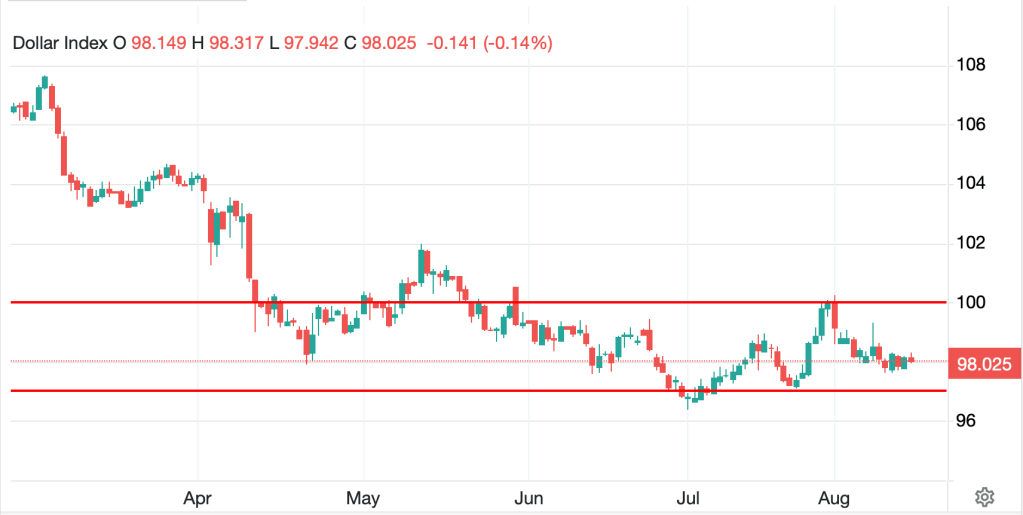

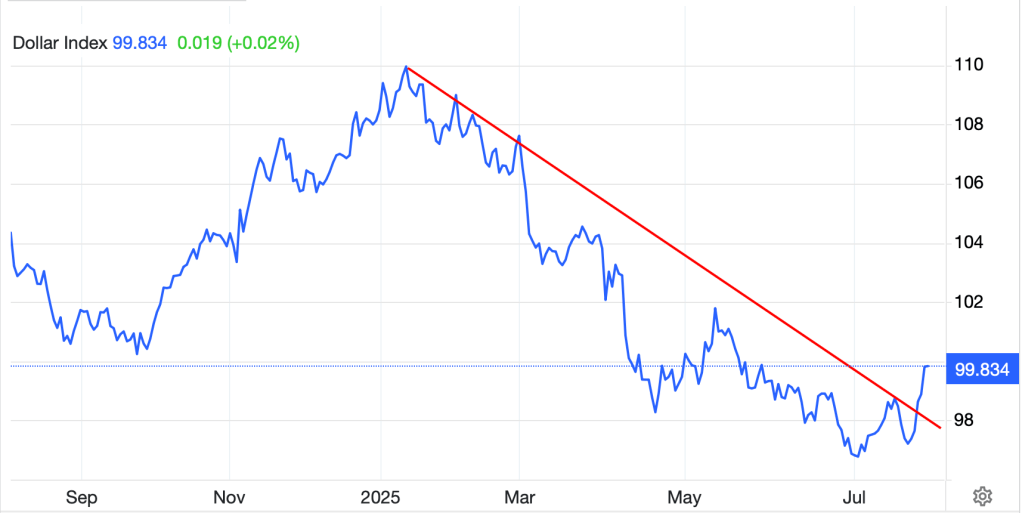

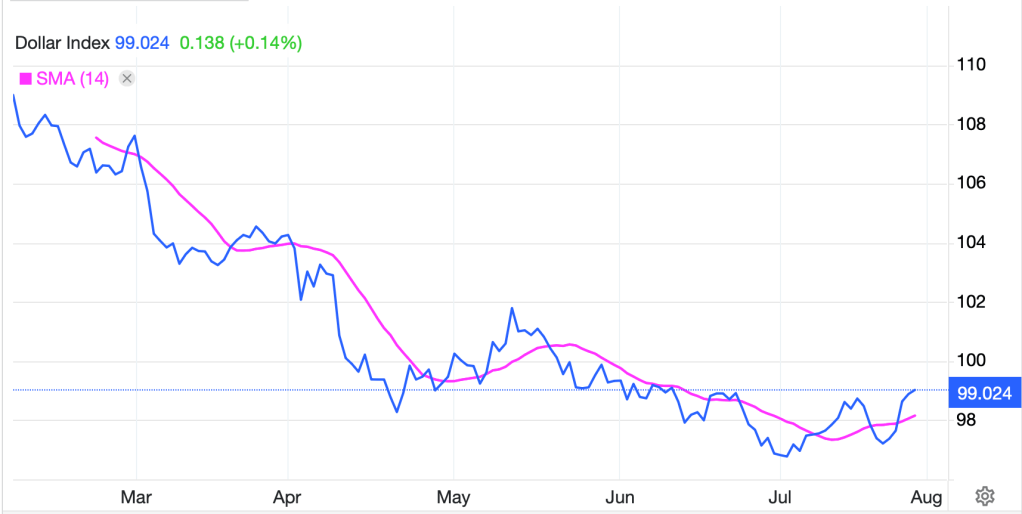

Finally, the dollar is a touch softer this morning with both the euro (+0.25%) and pound (+0.25%) leading the way in the G10, although the yen is basically unchanged. There was an interesting story in Bloombergdiscussing how volatility in the FX markets has been declining rapidly with many attributing this to the rise of algorithmic trading. As well, all over X this morning are stories about how the dollar’s decline this year (about -14% vs. the euro) is unprecedented. It’s not at all which is one of the reasons you need be careful about what people put up there. It seems that some analysts are putting undue emphasis on the starting point being January 1st, rather than when the market tops. But saying the dollar is declining in an unprecedented manner is absurd and picayune. Meanwhile, EMG currencies are all over the place with gainers (KRW +0.4%, ZAR +0.4%) and laggards (MXN -0.5%, INR -0.25%) and everything in between.

On the data front, PCE is Friday’s offering, but before then there is some stuff and more interestingly, there is lots of Fed speak.

| Today | Chicago Fed National Activity | -0.17 |

| Tuesday | Flash Manufacturing PMI | 52.0 |

| Flash Services PMI | 53.9 | |

| Wednesday | New Home Sales | 650K |

| Thursday | Durable Goods | -0.5% |

| -ex transport | -0.2% | |

| GDP (Q2) | 3.3% | |

| Initial Claims | 235K | |

| Continuing Claims | 1930K | |

| Existing Home Sales | 3.96M | |

| Friday | PCE | 0.3% (2.7% Y/Y) |

| Core PCE | 0.2% (2.9% Y/Y) | |

| Personal Income | 0.3% | |

| Personal Spending | 0.5% | |

| Michigan Sentiment | 55.4 |

Source: tradingeconomics.com

On top of the data, we hear from…wait for it…ten different Fed speakers, including Chair Powell tomorrow, across 16 different events. I expected to hear from a lot as there is clearly no real consensus at this point in time there.

People love to hate the dollar, and if the Fed is going to ease more aggressively, I understand that, but longer term, I think the story is different. Just be careful.

Good luck

Adf