The market’s convinced that Chair Jay

Is going far out of his way

To keep rates on hold

‘Cause Trump’s been a scold

And strength’s what Jay wants to portray

But ask yourself why should rates fall?

With stocks at new highs, after all

And crypto’s exploded

Which clearly eroded

The storied liquidity fall

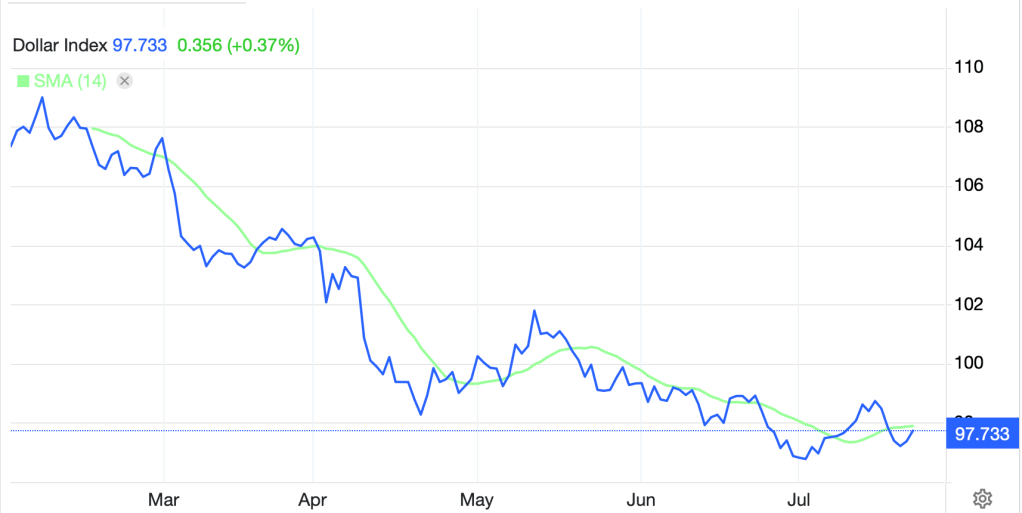

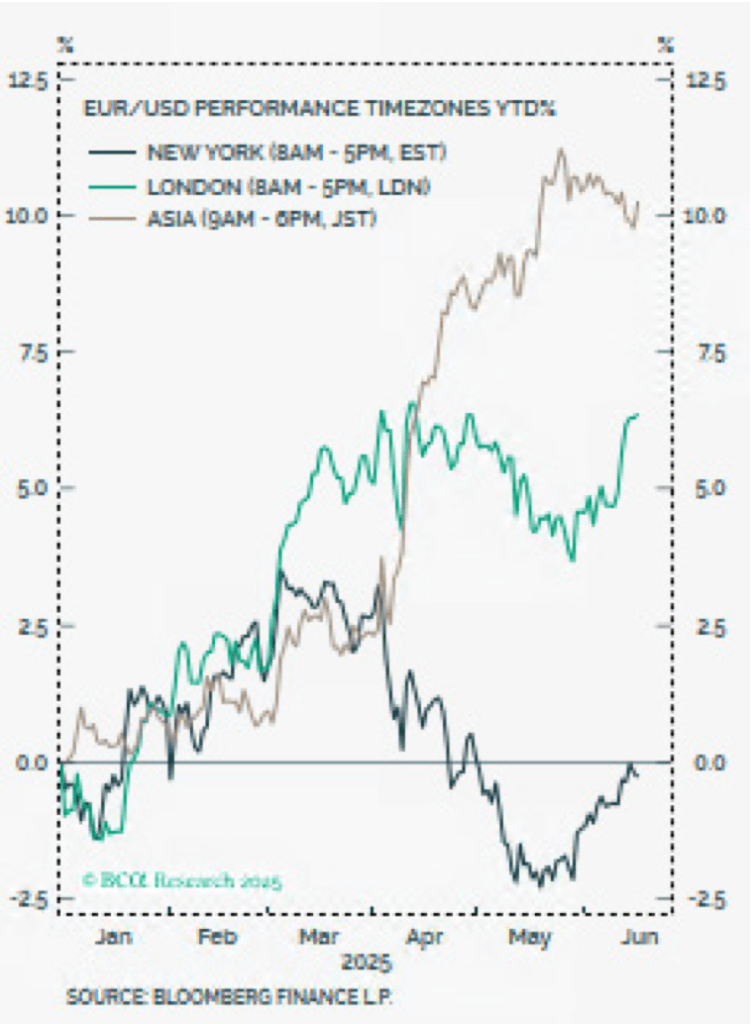

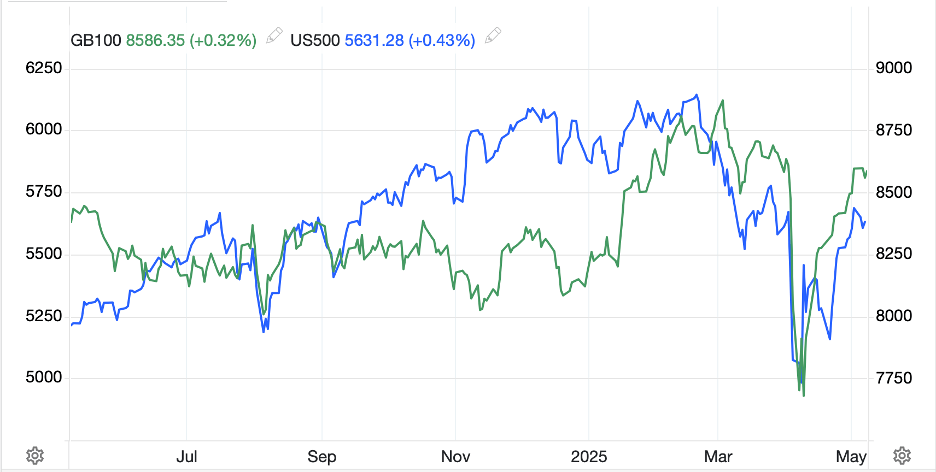

Yesterday’s market activity was benign with modest market movements in both equity and bond markets although the dollar did rally sharply, on the back of the EU trade deal. Of course, economic theory predicts just that, when tariffs on a nation (or bloc of nations) are raised, that currency will decline in value to offset the tariffs. Recall, this was the expectation in the beginning of 2025 when President Trump was just coming into office and calling himself ‘Tariff Man’ as he explained he would be imposing tariffs on virtually all US trading partners. However, back then, the theory didn’t work out very well and the dollar declined throughout the first six months of the year as can be seen below.

Source: tradingeconomics.com

In fact, analysts quickly moved on and were virtually gleeful that the dollar’s decline of roughly 13% was the largest decline during the first six months of the year since the 1980’s. Personally, I’m not sure why classifying the decline in terms of the time of year is relevant, but that was a key talking point in the narrative that described the end of American exceptionalism. Other parts of that narrative were the end of the dollar as the global reserve currency (gold was going to take over) and the onset of other currencies as payment rails for trade.

None of that ever made sense nor do current proclamations that the euro’s status has changed in any significant way. There are still very significant long euro positions outstanding as the dollar decline theory has many adherents, but being long euros, aside from being expensive, just got a bit uglier after yesterday’s and this morning’s declines totaling about -1.5%.

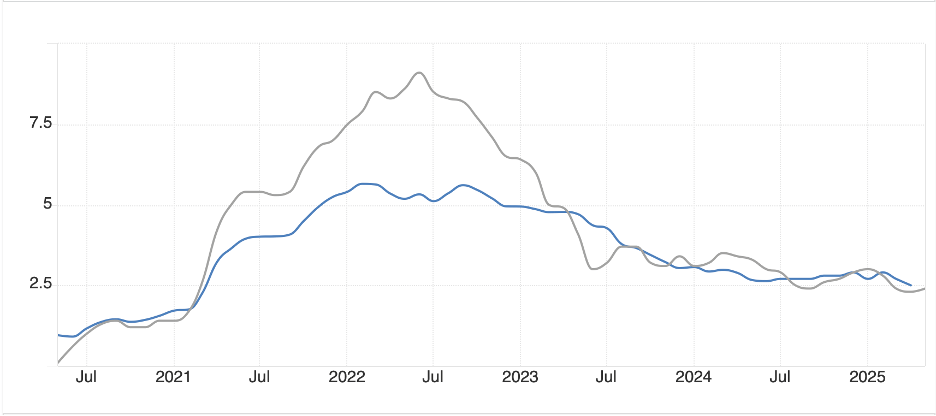

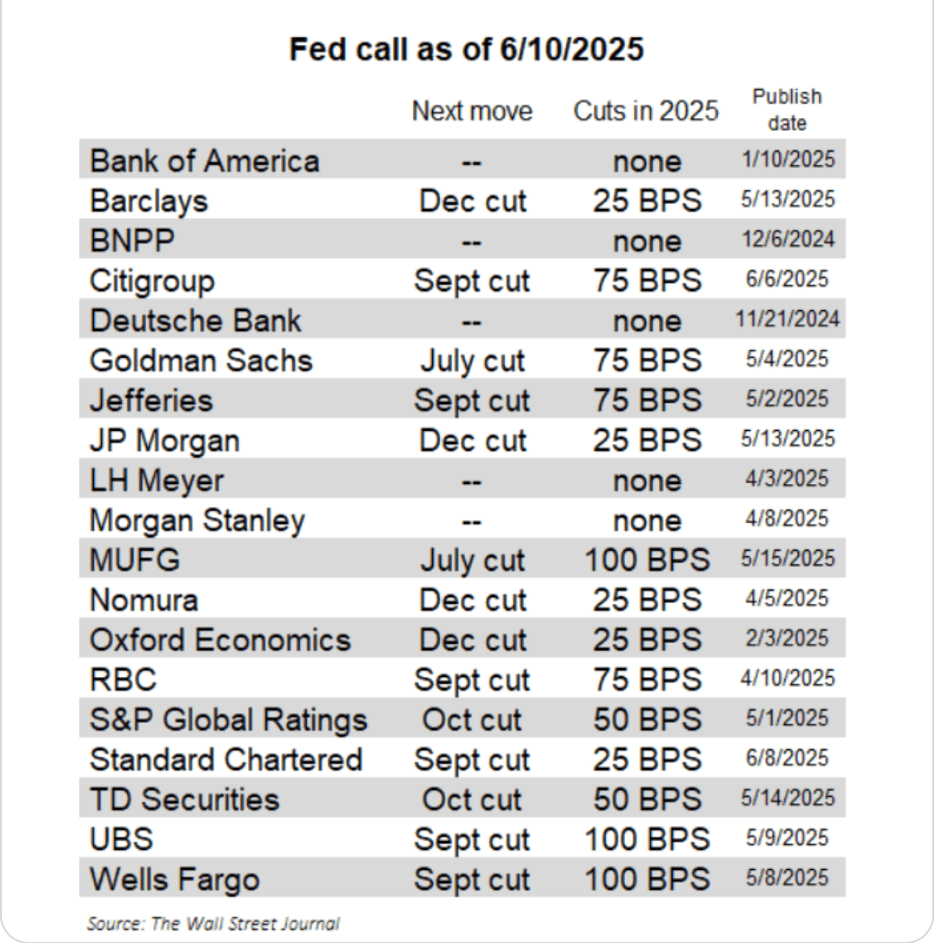

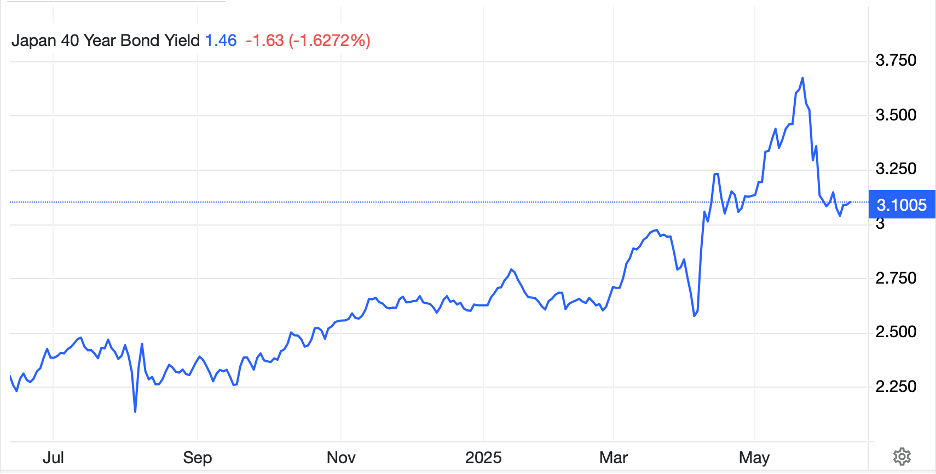

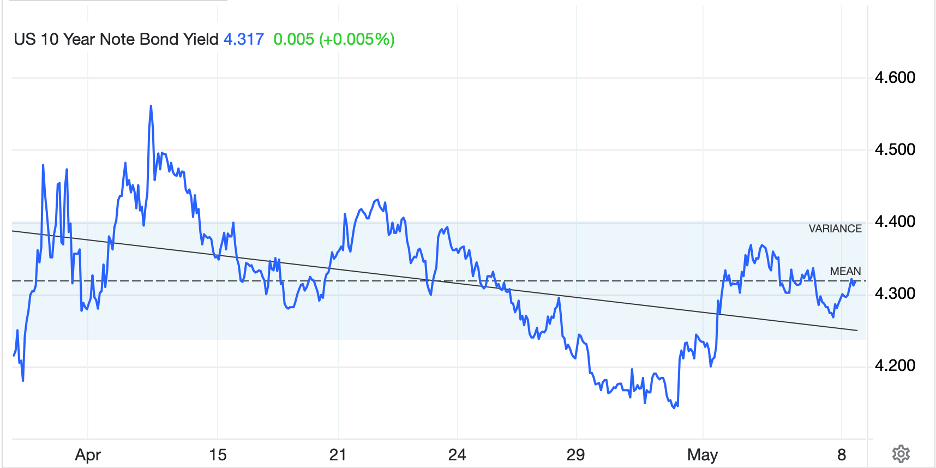

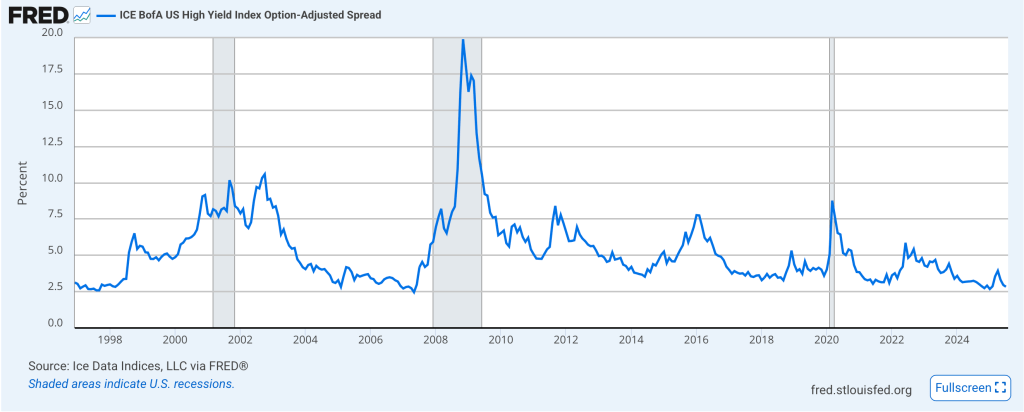

Remember, a key portion of the short dollar thesis is that the Fed is going to cut rates more than other central banks going forward. And now that the FOMC’s meeting is starting this morning, let’s discuss that idea. We all know that President Trump has been a vocal advocate for significant rate cuts immediately. However, let’s look at some evidence. On the one hand, equity markets are at historic highs in terms of prices as well as readings like the Buffett ratio (market cap/GDP) and P/E and P/S ratios as well. Crypto currencies, arguably the most speculative of assets, have been flying, especially things like meme coins, which are literally a play on the greater fool paying someone more than they paid for a token with no intrinsic value whatsoever. Credit spreads, especially for weak credits, are pushing historic lows as per the below chart. All these things point to not merely ample liquidity and policy being appropriate, but excess liquidity and policy being easy.

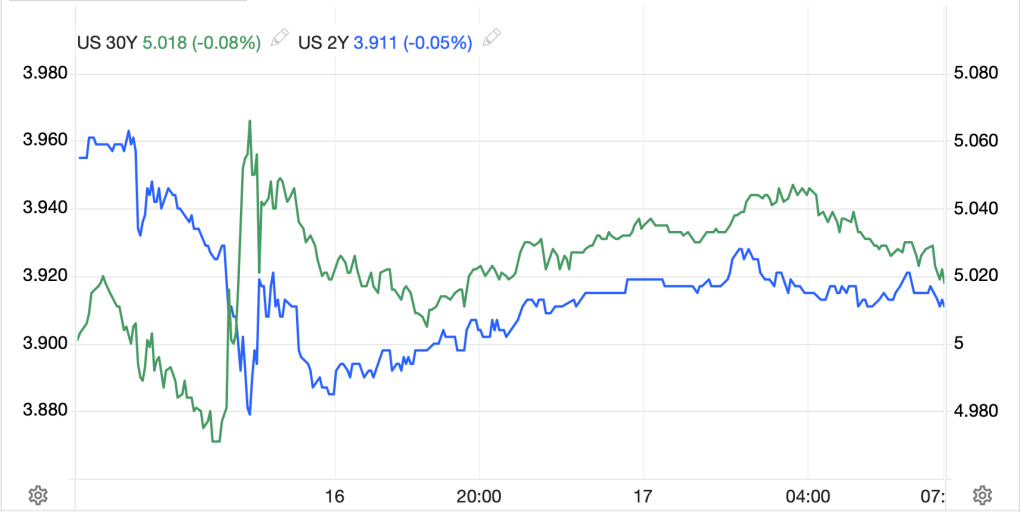

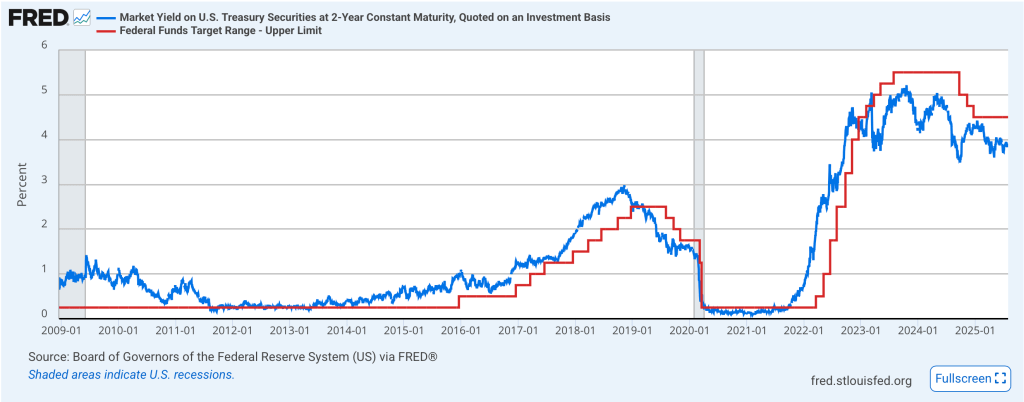

And yet the other side of that coin is a look at 2-year Treasury yields, which have a long history of accurately forecasting future Fed Funds levels. Right now, as you can see in the below chart, they are trading at a 50 basis point discount to Fed Funds, an indication that the market is quite convinced the Fed is going to cut rates. Ironically, I believe that Chairman Powell, a PE guy by background, is a strong believer in lower interest rates and I’m sure all his colleagues from his time at Carlyle Group are also pressing for lower interest rates, but he doesn’t want to seem cowed by Trump.

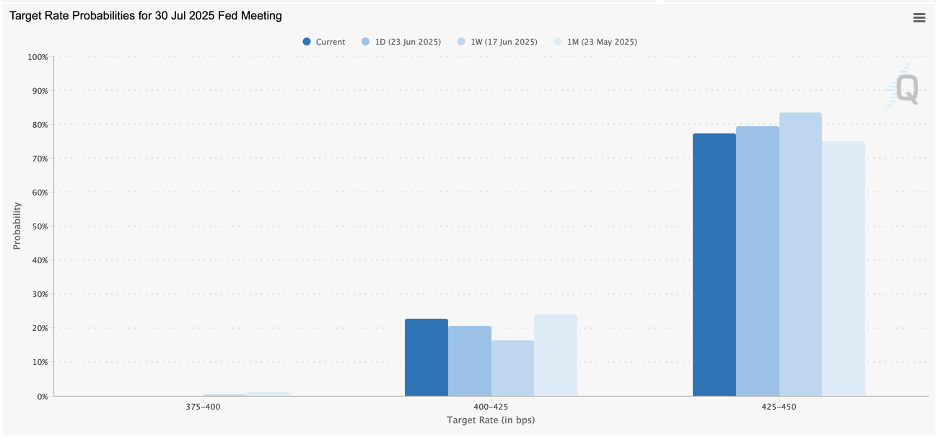

The market is pricing just a 3% probability of a cut tomorrow, but a 65% probability of a cut in September and then another cut in December. It strikes me that we will need to see a major reversal in the economic situation in the US, with Unemployment rising and growth rapidly declining in order to bring about a situation where there is a real case to be made for a cut. But we also know that politics plays an enormous role in this story, and while expectations are that we are going to see two dissents at tomorrow’s meeting, that will not change the outcome of no movement.

Adding this all up I conclude that the weak dollar thesis is largely predicated on the idea that the Fed is going to ease monetary policy going forward, catching down to what most other central banks have already done. And I agree, if the Fed does cut rates, the dollar will fall. But every day I watch market behavior and continue to see economic data that appears to be holding up pretty well despite a great deal of angst from the analyst community, and I find it harder and harder to come up with a reason to cut rates.

Consider the story about the new effort by the Trump administration to remove 100,000 regulations by July 4th2026. Estimates of the value that will unlock are upwards of $1.5 trillion and that assumes no policy changes. That’s more than 5% of GDP. I cannot help but believe that President Trump is going to be successful in completely changing the way the US economy works by changing the way (i.e. reducing) the government’s intrusions in the economy. And if that is successful, it is not clear why interest rates need to decline. Remember, too, there is an enormous amount of data compressed into this week, so by Friday afternoon, we will have much more information.

Ok, a quick turn round markets shows that after a mixed session in the US yesterday, Japan (-0.8%) slipped on concerns over the nature of the trade deal, while China (+0.4%) edged higher as trade talks continue in Stockholm between the US and China. Elsewhere in the region both Korea and India rose a bit, spurred by hopes for trade deals there, and the rest of the area was mixed with no large movement. In Europe, green is today’s color as investors have taken the avoidance of a trade war as a positive and added the euro’s weakness as a positive as well, helping European exporters. So, gains are strong (DAX 1.3%, CAC 1.4%, FTSE 100 0.7%) and things are generally bright despite grumbling by some nations that the trade deal is going to hurt them. And at this hour (7:30), US futures are higher by 0.3% or so.

In the bond market, yields are edging lower this morning (Treasuries -2bps, Gilts -1bp, Bunds unchanged) as investors remain either comfortable with the current situation or uncertain what to do to change things at current yields. I vote for uncertainty.

In the commodity markets, neither oil nor metals markets are moving much at all this morning with daily fluctuations less than 0.2% in all of them. This has all the feel of a consolidation ahead of tomorrow’s Fed and the rest of the week’s data including GDP, PCE and NFP.

Finally, the dollar is firmer again today vs. almost all its counterparts with gains on the order of 0.2% to 0.3% in most G10 and EMG currencies. However, two CE4 currencies (PLN -0.6% and HUF -0.9%) are under pressure with the former complaining that the trade deal will cost them > €2 billion, while the latter is suffering from poor economic data heading into an election where President Orban is on shakier ground that normal. But net, expect to hear about some more dollar strength in the wake of higher tariffs.

On the data front this morning, we see the Goods Trade Balance (exp -$98.4B), Case Shiller Home Prices (3.0%), JOLTS Job Openings (7.55M) and Consumer Confidence (95.8). With so much focus on trade lately, I suspect that number could matter, but really the JOLTS number will be of more interest, especially for the bond market, as any weakness in the labor market will encourage the lower rates story.

And that’s really all for today. Until we hear from Powell, it is hard to make a dollar call in the short-term, and the medium term is dependent on the Fed’s actions.

Good luck

Adf