Investors are showing concern

‘Bout tariffs and Trump, so they spurn

The riskiest stuff

But that’s not enough

To help generate a return

Seems most of the holdings in favor

Are no longer risk takers’ flavor

How long before Jay

Will finally say

QE is here, I am your savior

Have you bailed out on your risk exposures yet? Because if not, it certainly seems you are behind the curve! At least, that’s what it feels like this morning as trepidation underlies every player’s market activity. Based on the commentary, as well as the Fear & Greed Index, you might think we are in a depression!

Source: cnn.com

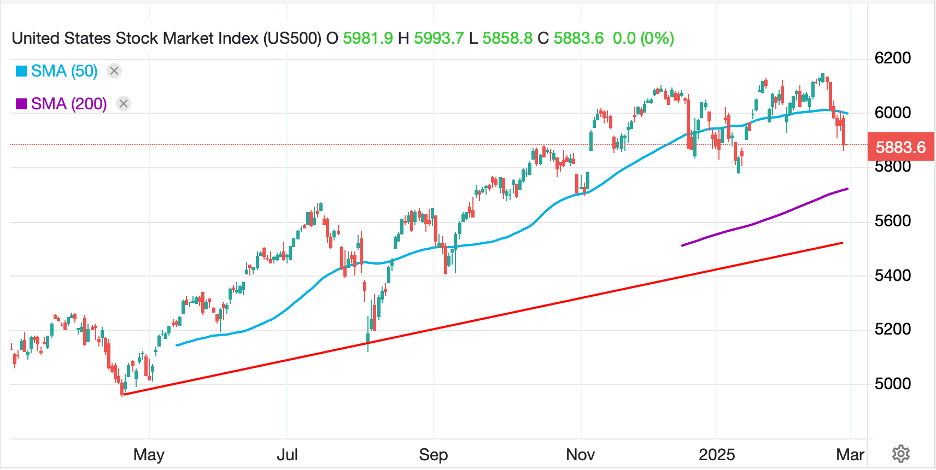

But are things really that bad? I know that the past week has seen a modest drawdown in equity prices, but after all, on February 20th, they reached yet another new all-time high, at least as per the S&P 500. Since then, as you can see below, the decline has been less than 5%. And while the market has traded below its 50-day moving average (blue line), a key technical indicator, it remains well above both the 200-day version of the same (purple line) and the longer-term trend line. My point is it feels like the narrative is overstating the magnitude of the move thus far.

Source: tradingeconomics.com

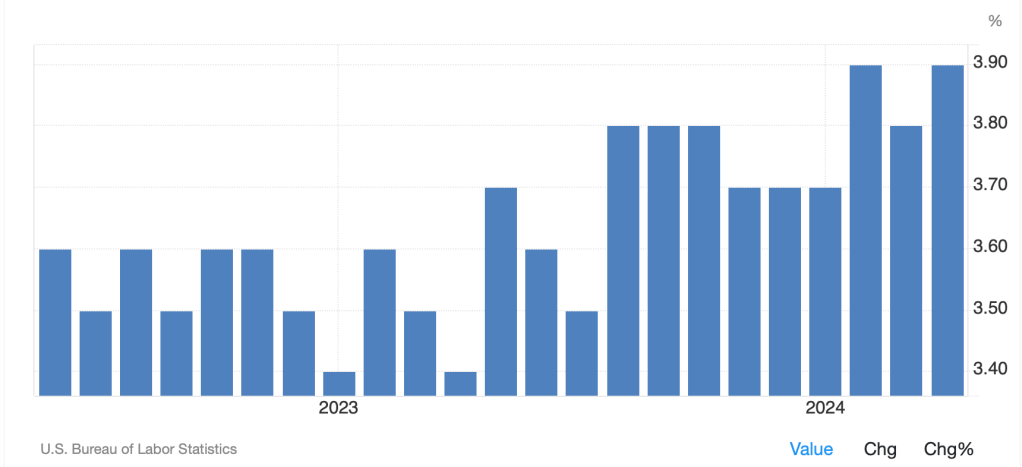

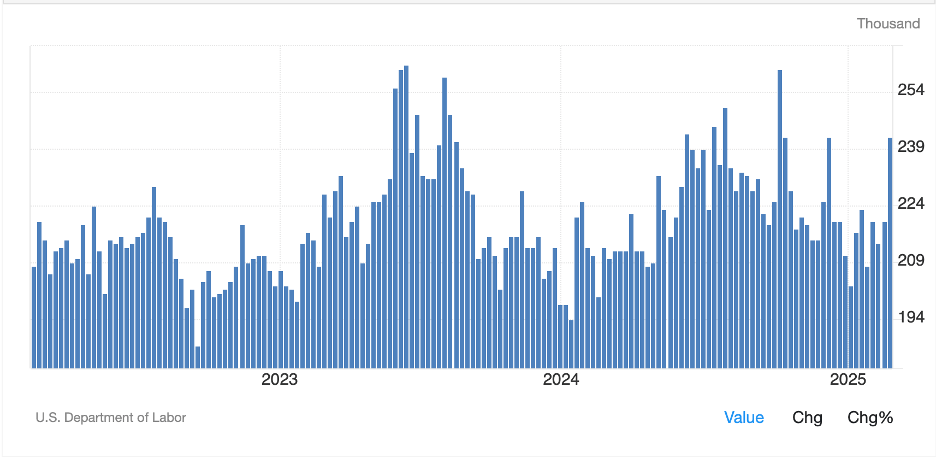

Is this the beginning of the end? While you can never rule that out, as major corrections can occur at any time, I have no reason to believe this will be the case. Much has been made of yesterday’s Initial Claims print at 242K, much higher than forecast as a harbinger of future economic weakness. However, looking at the past 3 years of weekly data here, while certainly in the upper levels of readings, it is not nearly the only occurrence and not nearly the highest reading.

Source: tradingeconomics.com

One data point does not make a trend and to my eye, looking at this chart, there is no discernible trend in either direction. Yet part of the narrative evolution is that the DOGE cuts in government jobs, along with all the headline spending cuts, is setting the economy up for much slower growth in the short run.

In fact, this issue goes back to one about which I wrote several days ago here regarding the impact of government spending on actual economic activity. The current view of economic activity includes government spending. If President Trump’s goal is to reduce that spending, regardless of the net long-term benefits of such actions, GDP readings are going to decline initially. Yes, there will be more productive use of capital with less regulation and less government, but that will take some time to become evident. In the meantime, weaker economic activity is likely to be the outcome.

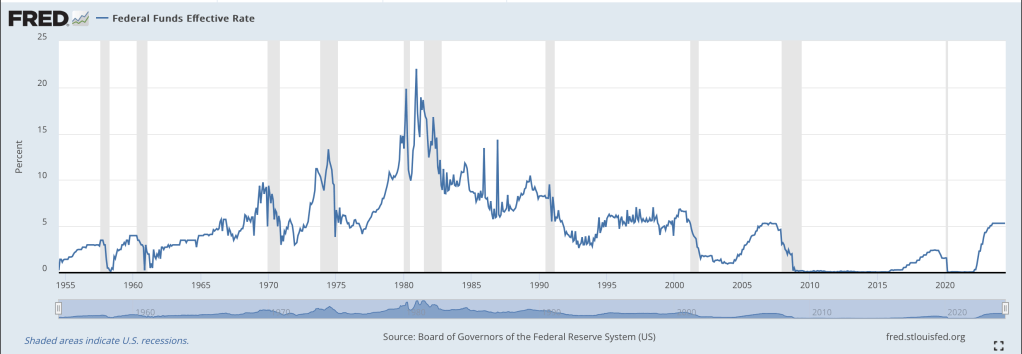

I have frequently written that there has not been a market clearing event since, arguably, October 1987, when equity markets plunged and erased significant excess and speculation. Alas, newly minted (at the time) Fed Chair Greenspan stepped in and promised to support markets with ample liquidity the next day which opened the way for far more Fed intervention in markets leading up to Ben Bernanke and the first QE programs in the wake of the GFC in 2009 and every QE version since then. While the movement so far does not remotely indicate the end of the world, based on the Fed’s history, once equity markets correct about 20%, they tend to become far more active in supporting the markets economy. Will this time be different? Given the Fed’s seeming underlying desperation to cut rates to begin with, my take is if the correction reaches 15% – 20%, we will see just that.

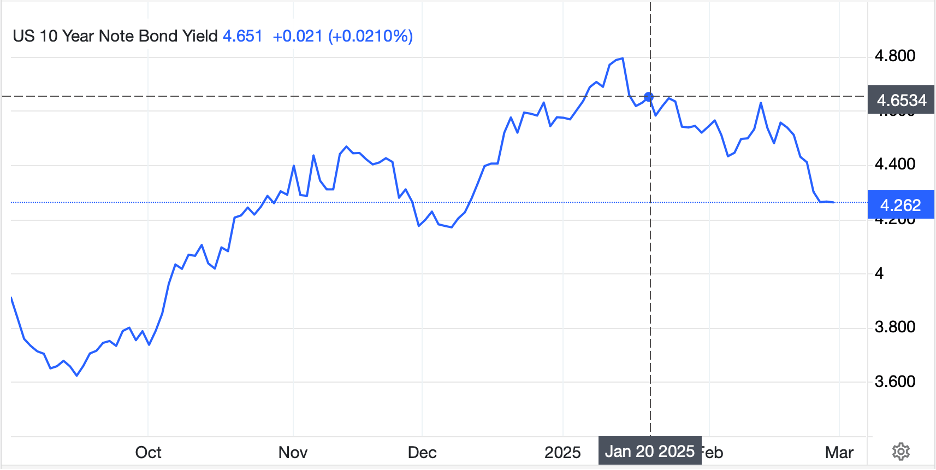

To sum things up, risk assets are under pressure on the basis of 1) excessive valuations, 2) the Trump efforts to reduce wasteful spending (which while wasteful is still spending and counted as economic activity), and 3) the idea that Trump’s imposition of tariffs is going to dramatically raise inflation and slow growth further. Given the mainstream media’s inherent hatred of the president, they will certainly be playing up this theme for as long as they can as they try to force Trump to change tack. But Trump, and Treasury Secretary Bessent, have been clear that their concern is 10-year bond yields, and getting them to lower levels. A natural corollary of the current risk-off sentiment is that bond yields tend to decline. Look at the chart below which shows that since Trump’s inauguration, 10-year yields are down nearly 40bps. I would argue that Trump and Bessent are perfectly comfortable with the market right now.

Source: tradingeconomics.com

Ok, let’s move on to the overnight activity. Sticking to the bond theme, while Treasuries, this morning, are unchanged, they did decline all yesterday afternoon and this morning European sovereigns are all lower by -2bps. As well, JGB yields have also slipped by -3bps as we are seeing risk aversion evident all around the world. Of course, the problem with all G10 nations (Germany excepted) is that they all have very high debt/GDP ratios and in Europe, especially, this is a problem as they have begun to realize they need to spend a great deal more on defense than they have in the past. And all that spending is going to be funded by more borrowing. The tension between additional issuance driving yields higher and risk aversion driving yields lower is going to be the theme of European bond markets for a while.

In the equity world, it is not a pretty picture anywhere in the world. After yesterday’s US rout, with the NASDAQ (-2.8%) leading the way lower, Asian bourses were all in the red. Japan (-2.9%), Hong Kong (-3.3%), China (-2.0%), Korea (-3.4%), India (-1.9%)… the list goes on across the entire region with only New Zealand (+0.5%) bucking the trend on some better than expected local earnings and consumer confidence data. European markets, though, are in a bit better shape as they suffered yesterday and are consolidating those losses this morning with most markets trading +/- 0.3% on the session. We have seen a lot of European inflation data this morning, most of it lower than forecast which has encouraged the view that the ECB will be cutting rates more aggressively going forward. US futures, too, are higher at this hour (7:00), on the order of 0.5% as they bounce from yesterday’s, and truly the past week’s, declines.

In the commodity markets, oil (-1.25%) is back under pressure and back under $70/bbl. The latest fear is that slowing economic activity around the world will reduce demand for the black sticky stuff and drive prices lower still. Remember this, oil supply is restricted not by geology, but by politics. As nations determine that cheaper energy is critical to their future, expect to see more effort to produce more oil. Meanwhile, metals markets are also under pressure with gold (-0.5%) still falling despite its ostensible risk profile. However, the barbarous relic remains well above $2800/oz and I continue to believe that this correction is just that, and not the reversal of a trend. Too many things are happening around the world to induce more fear and in that scenario, gold is the oldest store of value around. The rest of the metals complex is also under pressure with copper (-1.2%) slipping back a bit. It is important to remember, though, that despite the recent declines, all the major metals are still nicely higher on the month.

Finally, the dollar is a bit firmer again this morning after a rally yesterday as well. In classic risk-off fashion, investors flocked to the dollar, arguably to buy Treasuries. So, we are seeing weakness in NZD (-0.6%), JPY (-0.4%) and CHF (-0.3%) in the G10 and weakness in KRW (-0.5%), ZAR (-0.2%) amongst others in the EMG bloc. Here the story remains the impacts of Trump’s tariffs and how they will be applied, if they will be applied, as well as a general fear factor which tends to help the dollar. Consider, too, ideas that the ECB is going to cut rates will not help the single currency.

On the data front, this morning brings Personal Income (exp +0.3%), Personal Spending (0.1%), and the PCE data where Headline (0.3%, 2.5% Y/Y) and Core (0.3%, 2.6% Y/Y) will be the most important data points. As well, we will see Chicago PMI (40.6) which has been below 50.0 in every month but one since August 2022.

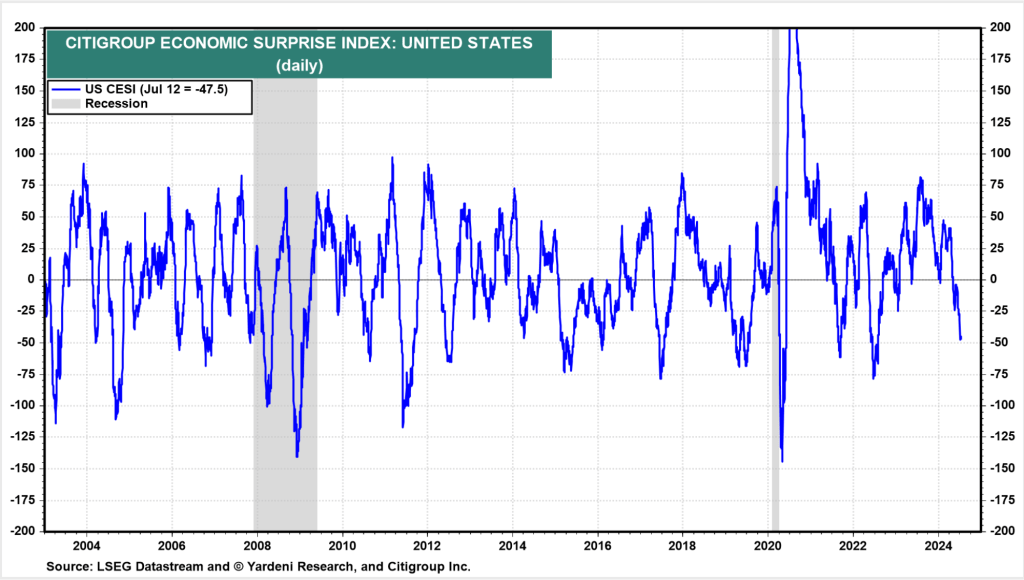

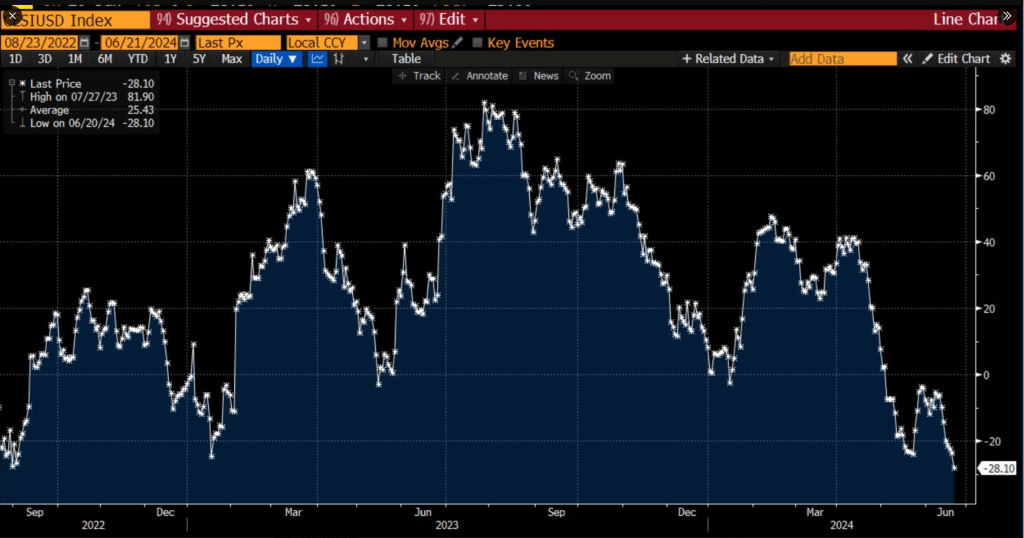

There is no question that the economic data has been softening lately. We saw that with the Citi Surprise Index as well as the continuous stream of commentary by the economic bears who point to underlying pieces of data that point in that direction (whether housing or employment indicators and the recent weak PMI data).

Consider this, an early recession in Trump’s term can be blamed on the Biden administration as well as set things up for future growth, certainly in time for the mid-term elections. As well, it will likely help reduce the yield on the 10-year, an explicit goal. This scenario likely means short-term weakness with an eye to longer term growth. The dollar is likely to benefit early on, at least until the Fed steps in.

Good luck and good weekend

Adf