The answer this morning is clear

The president starting next year

Is Donald J Trump

Who always could pump

Excitement when he did appear

The market response has been swift

With equities getting a lift

The dollar, too, rose

But bonds felt the throes

Of anguish while getting short shrift

The punditry was quite convinced that it would be a long time before the results of the election were clear as they anticipated significant delays in the vote count in the battleground states. Fears were fanned that if Trump were to lose, he wouldn’t accept the election. As well, virtually every pundit in the mainstream media portrayed the race as “tight as a tick’ (a somewhat odd expression in my mind).

But none of that is what happened at all. Instead, somewhere around 3:00am NY time, Donald J Trump was called the winner of the presidential election, effectively in a landslide as he appears set to win > 300 electoral votes and, perhaps more importantly as a signal, the popular vote, and will be inaugurated as the 47thpresident of the United States on January 20th, 2025. Congratulations are in order.

It ought not be surprising that the ‘Trump trade’ is back in full force early on with US equity futures rallying about 2%, Treasury bonds selling off sharply with 10-year yields jumping 20bps and the dollar exploding higher, jumping by about 1.5% as per the DXY, with substantial gains against virtually all its G10 and EMG counterparts. Oil prices are under pressure as the prospect of ‘drill, baby, drill’ is the future and Bitcoin has exploded higher to new all-time highs amid the prospects of a pro-crypto Trump administration.

Much digital ink will be spilled over the next weeks and months as the punditry first tries to understand how they could have been so wrong, and then tries to create the new narrative. However, if we learned nothing else from this election it is that the previous narrative writers, especially the MSM, have lost a great deal of sway and that it will be the new narrative writers, those independents on X and Substack and podcasters, who don’t answer to a corporate master, who will be leading the way imparting information and stories. I’ve no idea how this will play out with respect to financial markets, but I am confident it will have an impact over time.

With all of the votes being tallied

While stocks and the dollar have rallied

We’ll turn to the Fed

Who soon will have said

On rate cuts, we’ve not dilly-dallied

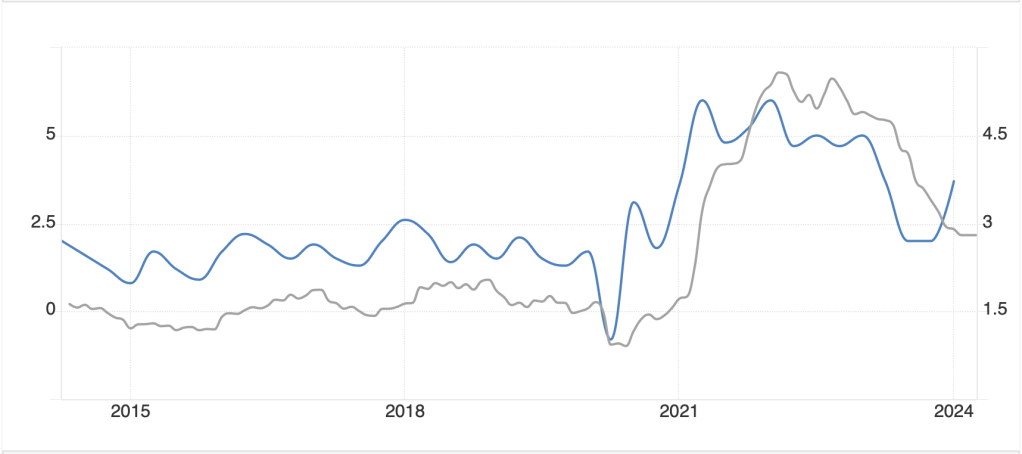

With the election now past, at least as a point of volatility, all eyes will likely turn to the FOMC meeting, which starts this morning and will run until the statement is released tomorrow at 2pm with Chairman Powell’s press conference coming 30 minutes later. The election result has not changed any views on tomorrow’s rate cut, with futures markets still pricing in a 98% probability, but the pricing as we look further out the curve has changed a bit more. For instance, the December meeting is now priced at less than a 70% probability for the next 25bps, and if we look out to December 2025, the market has removed at least one 25bp cut from the future.

This makes sense based on the idea that a Trump administration is going to be heavily pro-growth and one consequence will potentially be more inflationary pressures. Of course, if energy prices decline, that is going to help cap inflation, at least at the headline level, so the impact going forward is very hard to discern at this time. As well, if that pro-growth agenda helps improve the employment situation, the Fed will be far less compelled to cut rates further. In fact, the only reason to do so at that time would be to address the massive debt load and that cannot be ruled out, but my take is Powell is not inclined to try to help President Trump in any way, so will likely feign allegiance to the mandate when the situation arises.

But with all the election excitement today, my sense is the Fed is tomorrow’s market discussion, not today’s. Rather, let’s see how markets around the world have responded to the news.

It seems that yesterday’s US markets foretold the story with a solid rally across the board. Overnight, Japanese shares (+2.65%) were beneficiaries as the yen (-1.7%) weakened sharply along with all the other currencies. Elsewhere in the region, China (-0.5%) and Hong Kong (-2.2%) both suffered on prospects of more tariffs coming and Korea (-0.5%) was also under pressure, but almost every other regional exchange rallied nicely. As to Europe, green is the predominant color with the DAX (+0.9%), CAC (+1.5%) and FTSE 100 (+1.2%) all performing well although Spain’s IBEX (-1.5%) is underperforming allegedly on fears of some tax issues that will impact the Spanish banking sector. But I would look at Spain’s Services PMI falling short of expectations as a better driver.

In the bond market, while US yields have rocketed higher as discussed above, in Europe, that is not the case at all. Instead, we are seeing declines of between 4bps and 5bps across the continent as concerns grow that Eurozone economic activity may suffer with Trump in office as threats of tariffs rise. The market has now priced in further rate cuts by the ECB and that seems to be the driver here.

Aside from oil prices falling, metals, too, are under severe pressure with the dollar’s sharp rally. So precious (Au -1.3%, Ag-2.3%) and industrial (Cu-2.8%, Al -1.0%) are all selling off. Now, this space has seen a strong rally overall lately so a correction can be no real surprise. However, it strikes me that if the growth story is maintained, demand for industrial metals will expand and gold is going to find buyers no matter what.

Finally, the dollar just continues to rock, climbing further since I started writing this morning. the biggest loser is MXN (-2.9%) which has fallen to multi-year lows amid concerns they will be an early target of tariffs. While the dollar, writ large, is stronger across the board today, it is only back to levels last seen in July, hardly a massive breakout. However, do not be surprised if this rally continues over time as investors learn more specifics of how President Trump wants to proceed on all these issues about the economy, taxes and tariffs.

The only meaningful data releases this morning are the EIA Oil inventories, which last week saw a large draw and are expected to see a further one today. Otherwise, European Services PMI data, aside from Spain’s disappointing showing, was actually better than expected, probably helping equity markets there as well. Of course, as the Fed doesn’t come out until tomorrow, there is no Fedspeak so traders will likely continue to push the Trump trade for now. As such, look for the dollar to remain strong until further notice.

Good luck

Adf