On Friday, the jobs situation

Explained there was little causation

For loathing or fear

That later this year

Recession would soon drive deflation

Meanwhile, in the Super Bowl’s wake

The president’s set to forsake

Economists’ warning

That tariffs are scorning

Their views, and are quite a mistake

Let’s start with a brief recap of Friday’s employment report which was surprising on several outcomes. While the headline was a touch softer than forecast, at 143K, revisions higher to the prior two months of >100K assuaged concerns and implied that the job market was still doing well. You may recall that there were rumors of a much higher Unemployment Rate coming because of the annual BLS revisions regarding total jobs and population, but in fact, Unemployment fell to 4.0% despite an increase in the employed population of >2 million. Generally, that must be seen as good news all around, even for the Fed because the fact that they have paused their rate cutting cycle doesn’t seem to be having any negative impacts.

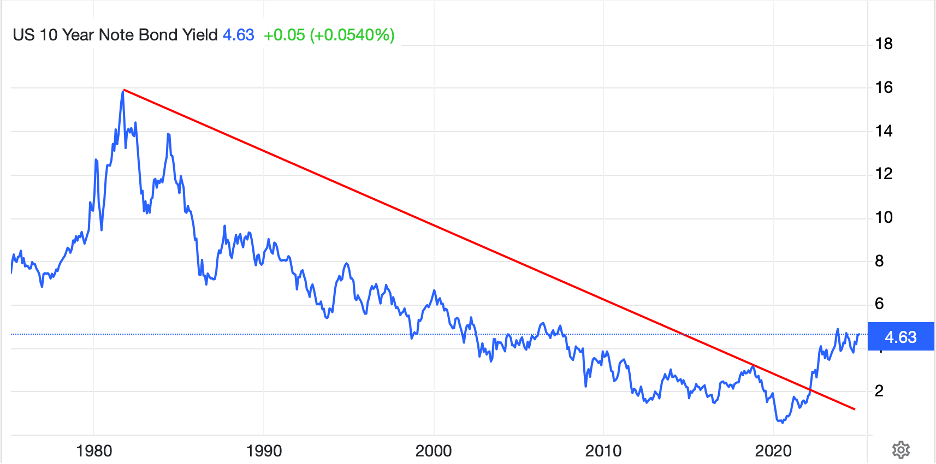

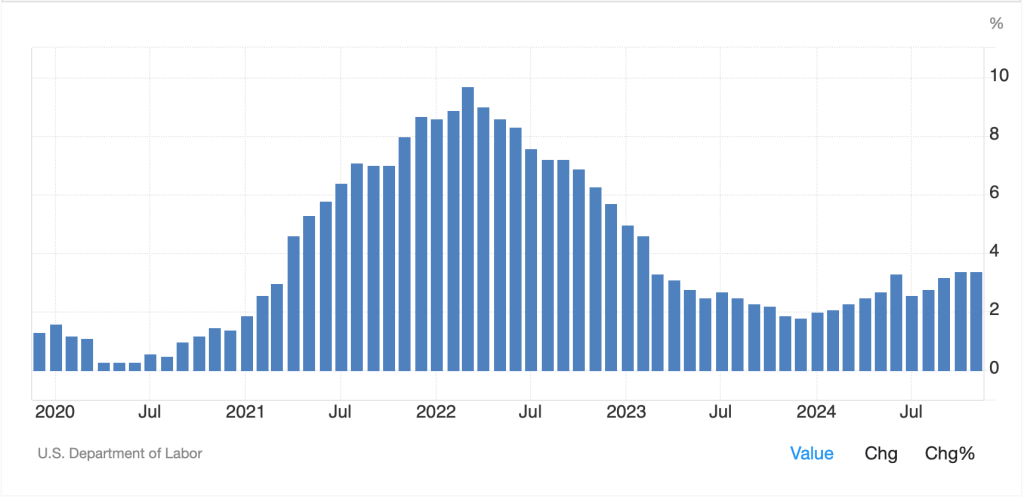

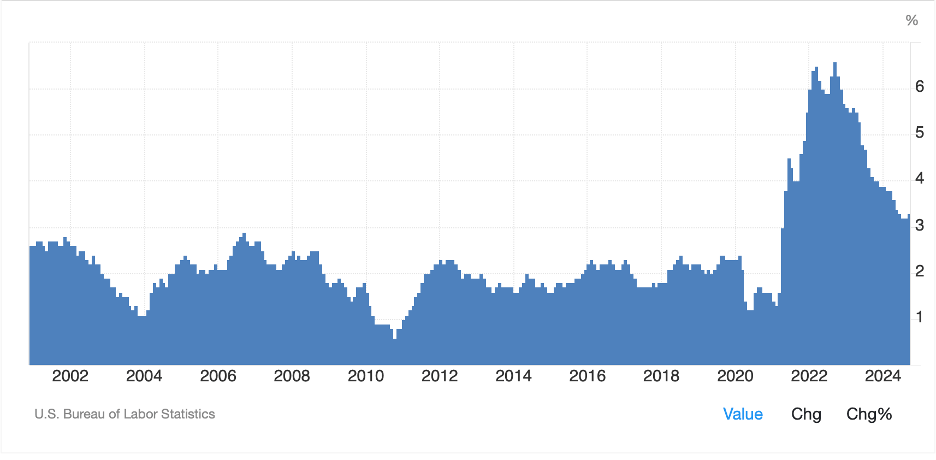

Alas for Powell and friends, although a real positive for the rest of us, the Earnings data was much stronger than expected, up 0.5% on the month taking the annual result to a 4.1% increase. Recall, one of Powell’s key concerns is non-core services inflation, and that is where wages have a big impact. After this data, it becomes much harder to anticipate much in the way of rate cuts soon by the Fed. This was made clear by the Fed funds futures market which is now pricing only an 8.5% probability of a rate cut in March, down from 14% prior to the data, and only 36bps of cuts all year, which is down about 12bps from before.

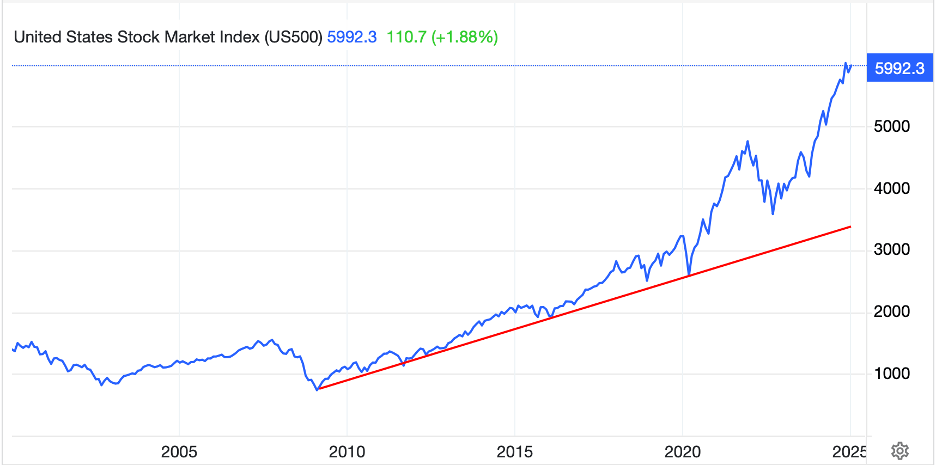

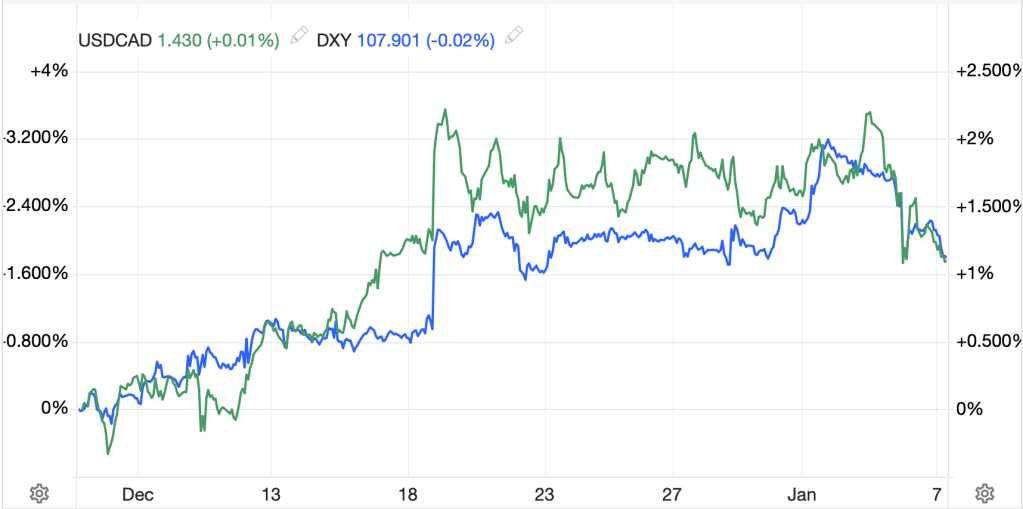

Securities markets didn’t love the data with both stocks and bonds declining in price, although commodities markets continue to rally alongside the dollar, a somewhat unusual outcome, but one that makes sense if you consider the issues. Inflation is not yet dead, hurting bonds, while the fact the Fed is likely to remain on hold for longer supports the dollar. Stocks, meanwhile, need to see more economic growth because lower rates won’t support them while commodities are seen as that inflation fighting haven.

Of course, it wouldn’t be a day ending in Y if we didn’t have another discussion on tariffs during this administration. The word is that the president has two things in mind, first, reciprocal tariffs, meaning the US will simply match the tariff levels of other countries rather than maintaining their current, generally lower, tariff rates. As an example, I believe the EU imposes a 10% tariff on US automobile imports, while the US only imposes a 2.5% tariff on European imports. The latter will now rise to 10%. It will be very interesting to see how the Europeans complain over the US enacting tariffs that are identical to their own.

A side story that I recall from a G-20 meeting during Trump’s first term was that he offered to cut tariffs to 0% for France if they reciprocated and President Macron refused. The point is that while there is a great deal of huffing and puffing about free trade and that Trump is wrecking the world’s trading relationships, the reality appears far different. If I had to summarize most of the world’s view on trade it is, the US should never put tariffs on any other country so they can sell with reckless abandon, while the rest of the world can put any tariffs they want on US stuff to protect their home industries. This is not to say tariffs are necessarily good or bad, just that perspective matters.

The other Trump tariffs to be announced are on steel and aluminum imports amounting to 25% of the value. This will be impactful for all manufacturing industries in the US, at least initially, so we will see how things progress. Interestingly, the dollar has not responded much here because these are not country specific, so a broad rise in the dollar may not be an effective mitigant.

Ultimately, as I have been writing for a while, volatility is the one true change in things now compared to the previous administration. Now, with that as backdrop, and as we look ahead to not only CPI data on Wednesday, but Chair Powell’s semi-annual congressional testimony on Tuesday at the Senate and Wednesday at the House, let’s look at how markets have responded to things.

As mentioned above, US equity markets fell about -1.0% on Friday after digesting the Unemployment data. However, the picture elsewhere, especially after these tariff discussions, was more mixed. In Asia, Japanese shares were essentially unchanged although Hong Kong (+1.8%) was the big winner in the region. But Chinese shares (+0.2%) did little, especially after news that the number of marriages in China fell to their lowest since at least 1986, another sign of the demographic decline in the nation. Elsewhere in the region, there was more red (India, Taiwan, Australia) than green (Singapore). European shares, though, are holding up well, with modest gains of about 0.2% – 0.4% across the board despite no real news. US futures are also ticking higher at this hour (7:10), about 0.5% across the board.

In the bond market, Friday saw Treasury yields jump 6bps with smaller gains seen in Europe. This morning, though, the market is far quieter with Treasury yields unchanged and European sovereigns similarly situated, with prices between -1bp and +1bp compared to Friday’s closing levels. Of note, JGB yields have edged higher by 1bp and now sit at 1.31%, their highest level since April 2010. With that in mind, though, perhaps a little bit of longer-term perspective is in order. A look at the chart below shows 10-year JGB yields and USDJPY since 1970. Two things to note are that they have largely moved in sync and that both spent many years above their current levels. While it has been 15 years since JGB yields were this high, they are still remarkably low, even compared to their own history. I know that many things have changed over that time driving fundamentals, but nonetheless, this cannot be ignored.

Source: tradingeconomics.com

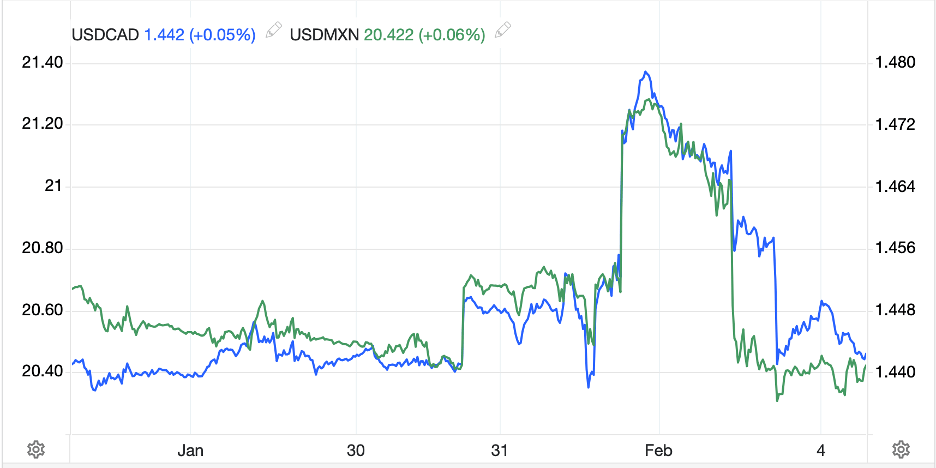

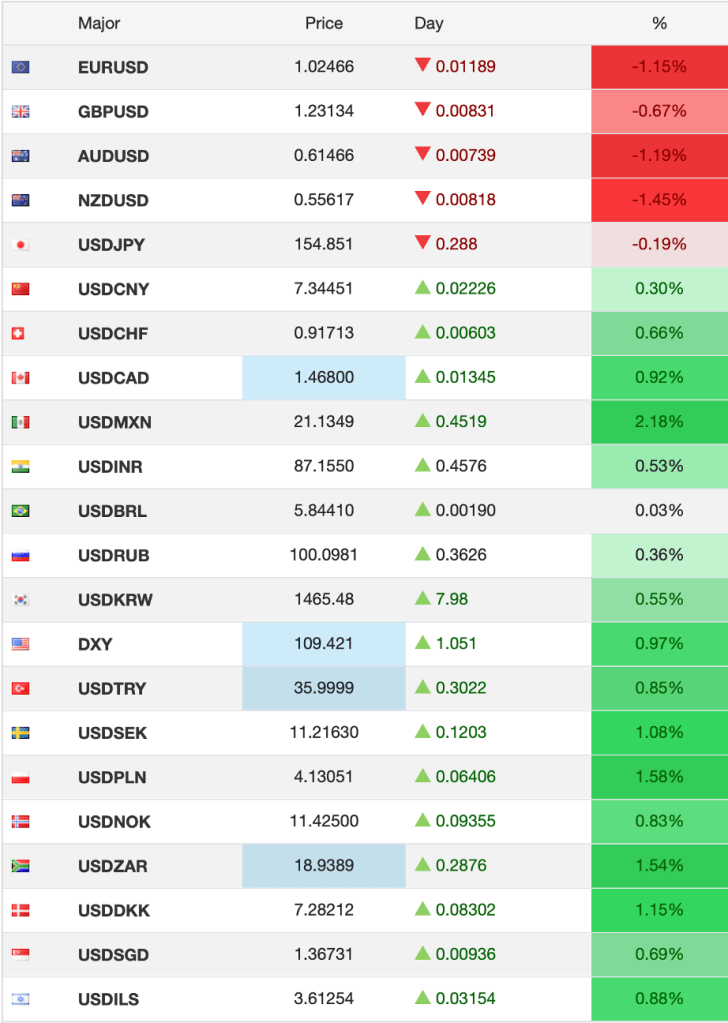

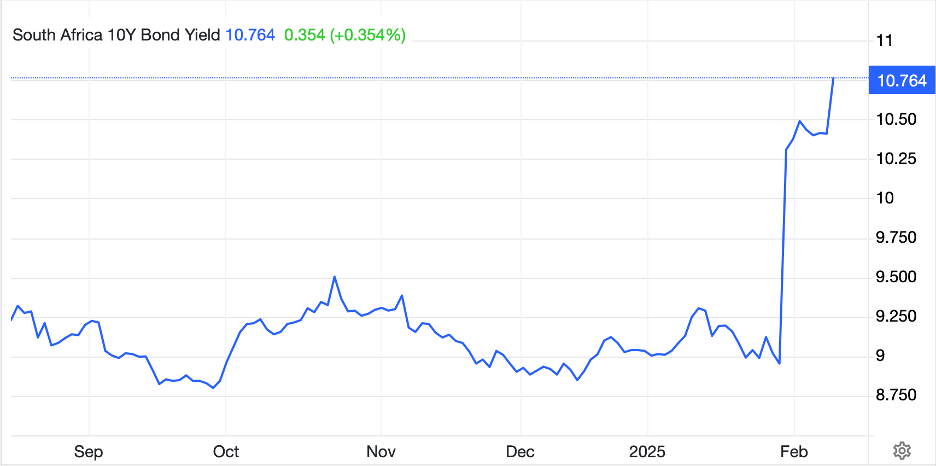

Sticking with the dollar, it has begun to edge higher since I started writing this morning and sits about 0.2% stronger than Friday’s close. USDJPY (+0.5%) is once again the leader in the G10, although weakness is widespread in that bloc. In the EMG bloc, there were a few gainers overnight (INR +0.3%, KRW +0.3%) although the rest of the world is mostly struggling. One interesting note is ZAR (0.0%) which appears to be caught between the massive rally in gold (to be discussed below) and the increased rhetoric about sanctions by the US in the wake of the ruling party’s ostensible call for a genocide of white South Africans to take over their property. This has not been getting much mainstream media press, but it is clear that Mr Trump is aware, especially given that Elon Musk is South African by birth. However, there is no confusion in the South African government bond market, which, as you can see below, has seen yields explode higher in the past week since this story started getting any press at all.

Source: tradingeconomics.com

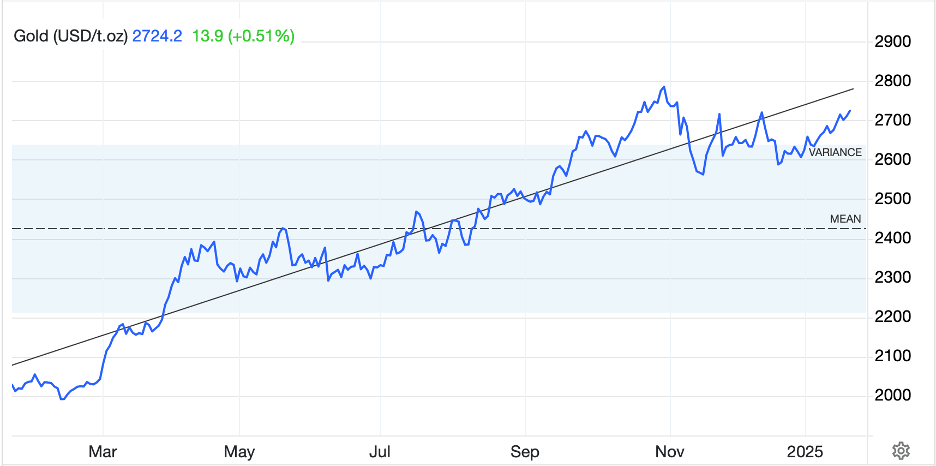

Finally, the commodity markets continue to show significant movement, especially the metals markets. Gold (+1.6%) is now over $2900/oz, another new all-time high and calling into question if this is just an arbitrage between London and New York deliveries. Silver (+1.4%) continues to be along for the ride as is copper (+0.6%) which is the biggest gainer of the past week, up more than 7%. Ironically, aluminum, the only metal where tariffs are involved, is actually a touch softer this morning. As to oil (+1.2%) while the recent trend remains lower, it does appear to be bottoming, at least if we look at the chart below.

Source: tradingeconomics.com

Turning to the data this week, it will be quite important as CPI headlines, but we also see Retail Sales and other stuff and have lots of Fedspeak.

| Tuesday | NFIB Small Biz Optimism | 104.6 |

| Powell Testimony to Senate | ||

| Wednesday | CPI | 0.3% (2.9% Y/Y) |

| -ex food & energy | 0.3% (3.1% Y/Y) | |

| Powell Testimony to House | ||

| Thursday | PPI | 0.3% (3.4% Y/Y) |

| -ex food & energy | 0.3% (3.3% Y/Y) | |

| Initial Claims | 216K | |

| Continuing Claims | 1875K | |

| Friday | Retail Sales | -0.1% |

| -ex autos | 0.3% | |

| IP | 0.2% | |

| Capacity Utilization | 77.7% |

Source: tradingeconmics.com

In addition to Powell, we will hear from five more Fed speakers, although with Powell speaking, I imagine their words will largely be ignored. Overall, the world continues to try to figure out how to deal with Trump and his dramatic policy changes from the last administration. One thing to keep in mind is that so far, polls show a large majority of the nation remains in support of his actions so it would be a mistake to think that his policy set is going to be altered. Net, the market continues to believe this will support the dollar, as will the fact that the Fed seems less and less likely to start cutting rates soon. Keep that in mind as you consider your hedges going forward.

Good luck

Adf