The President said that today

He’d let us know who’ll replace Jay

The favorite is Warsh

But that could be harsh

For markets, or so people say

But really, this morning, the news

Is silver and gold have the blues

It turns out their prices

Were causing a crisis

For players with leverage thumbscrews

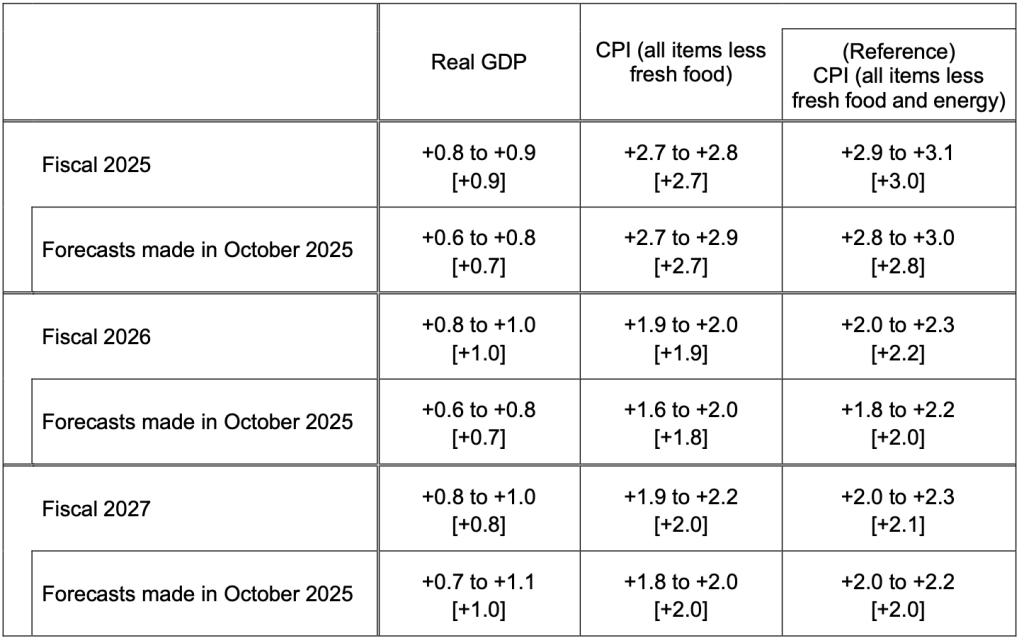

The big news this morning, is that President Trump is ostensibly going to announce former Fed governor Kevin Warsh as his selection for the next Fed Chair. His history has been as someone who has disagreed with many Fed decisions, and he skews to the hawkish side of the spectrum, which seems odd for Trump who everyone expected would nominate a dove. He is clearly quite capable of doing the job and brings a significant amount of intellectual firepower to the role. It remains to be seen, if he is nominated, how the confirmation process will proceed, as well as what Jay Powell will do when his Chairmanship is up (his term runs until 2028).

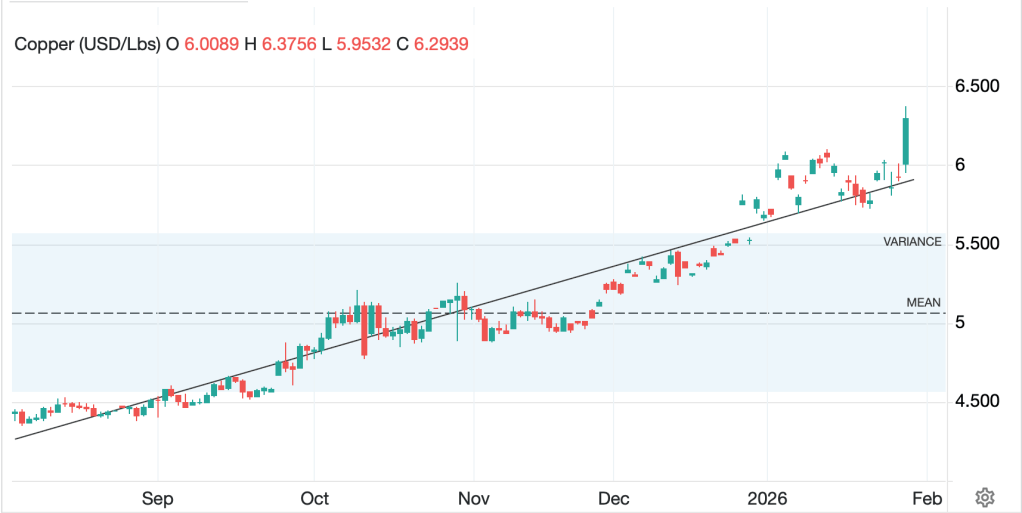

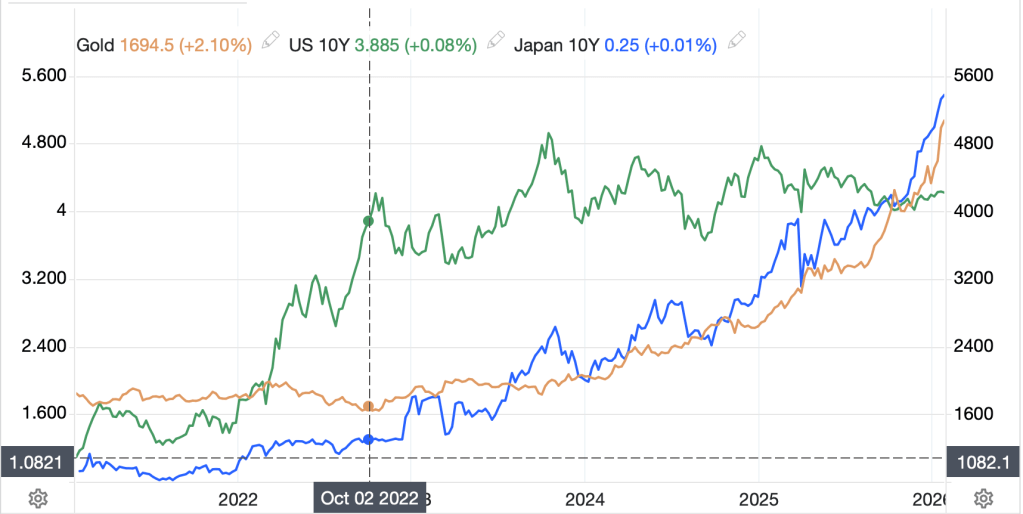

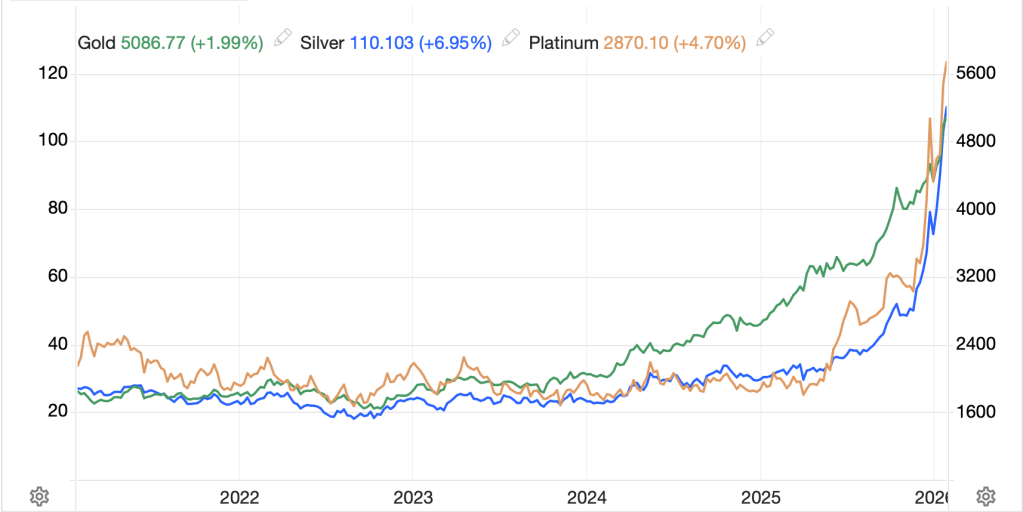

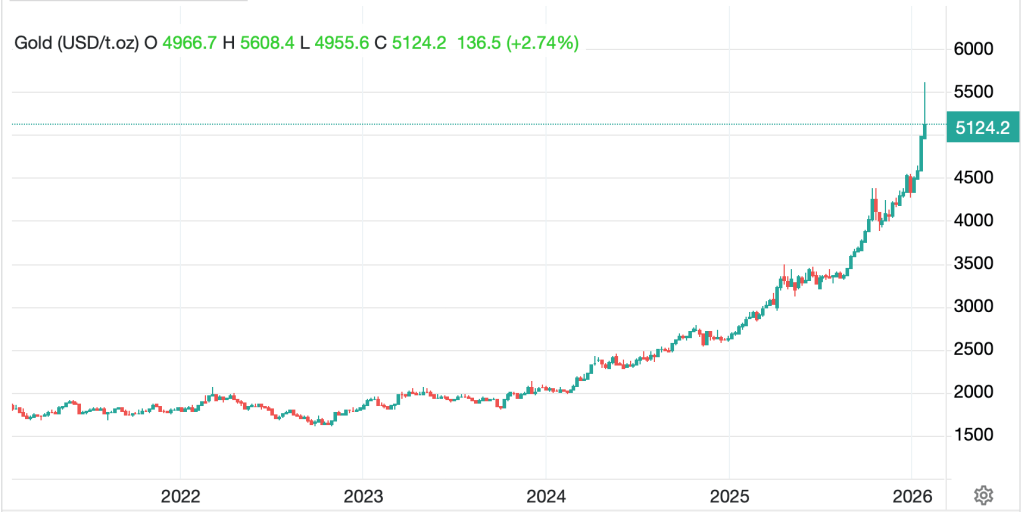

The interesting connection for me is the number of stories that have linked this rumor to major market moves overnight, especially in the precious metals space. So, let’s jump in and look at a few charts to offer some perspective on things.

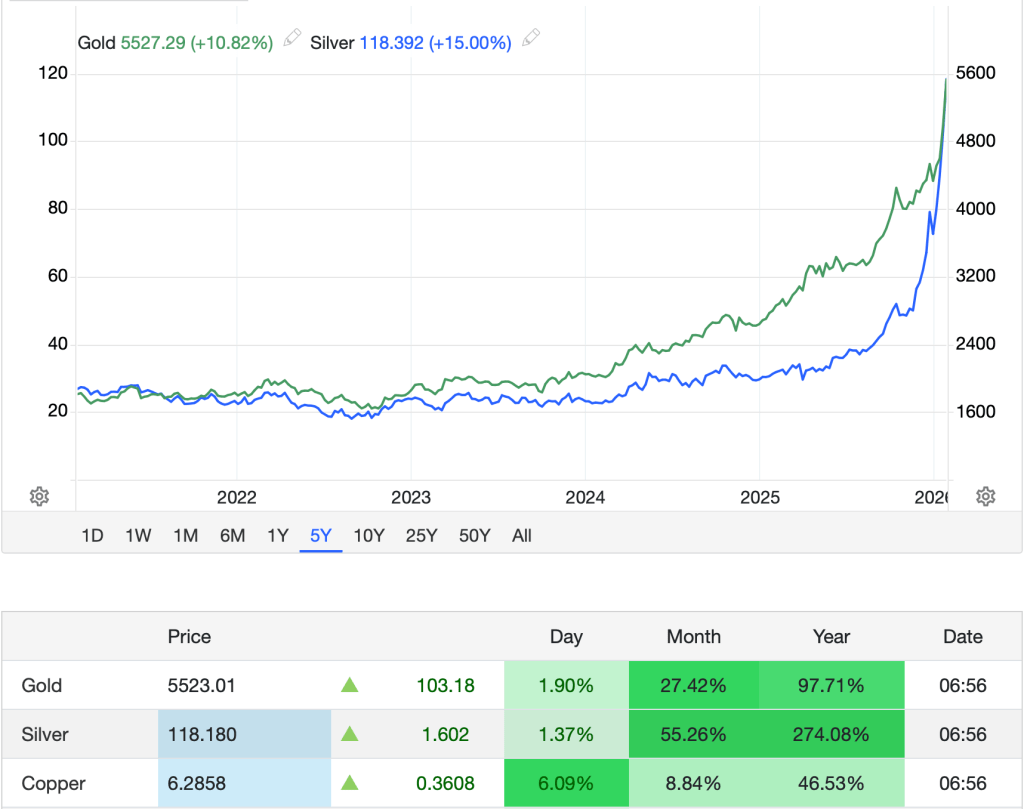

As we all live in the moment, it is often difficult to consider history in its fullness. Look at the three charts of gold (from tradingecomomics.com) that follow, each over a different timespan, 1week, 1year and 5 years.

1 week:

1 year:

5 years:

What do you notice: there is no question that gold (-4.7% or $250/oz) has fallen sharply overnight. that is evident in the first two charts. However, a look at the first chart shows you that despite a decline of that magnitude, the barbarous relic is still higher THIS WEEK! While gold has been exploding higher, it only crossed above $5000/oz for the first time on Sunday night in Asian trading. Now, I expect the bulk of the discussion will center around the 1-year chart which shows the dramatic decline as that is the newsworthy story, the ‘collapse’ in the price. But if we zoom out further, to the 5-year perspective, which has weekly candles, the last down week was in December. Market technicians will point to the shape of the most recent weekly candle, which is typically referred to as a hammer candle, and explain it signals a reversal in trend. And maybe it does. But the fact is volumes on the way up were much higher than those overnight, which does not portend panic selling. Trees don’t grow to the sky, and a reversal was always expected. Here we are.

The price action in silver overnight was almost identical, albeit more violent as has been the case with the rally as well. Platinum too. A couple of other things to consider about this:

- Today is month end, a time when positions are typically adjusted and rebalanced, so given the tremendous rally seen this month in the metals, selling is what rebalances things.

- China has not changed its policy regarding gold purchases nor its policy on license restrictions for the export of silver, so to the extent that those were driving forces in the rally, they still exist

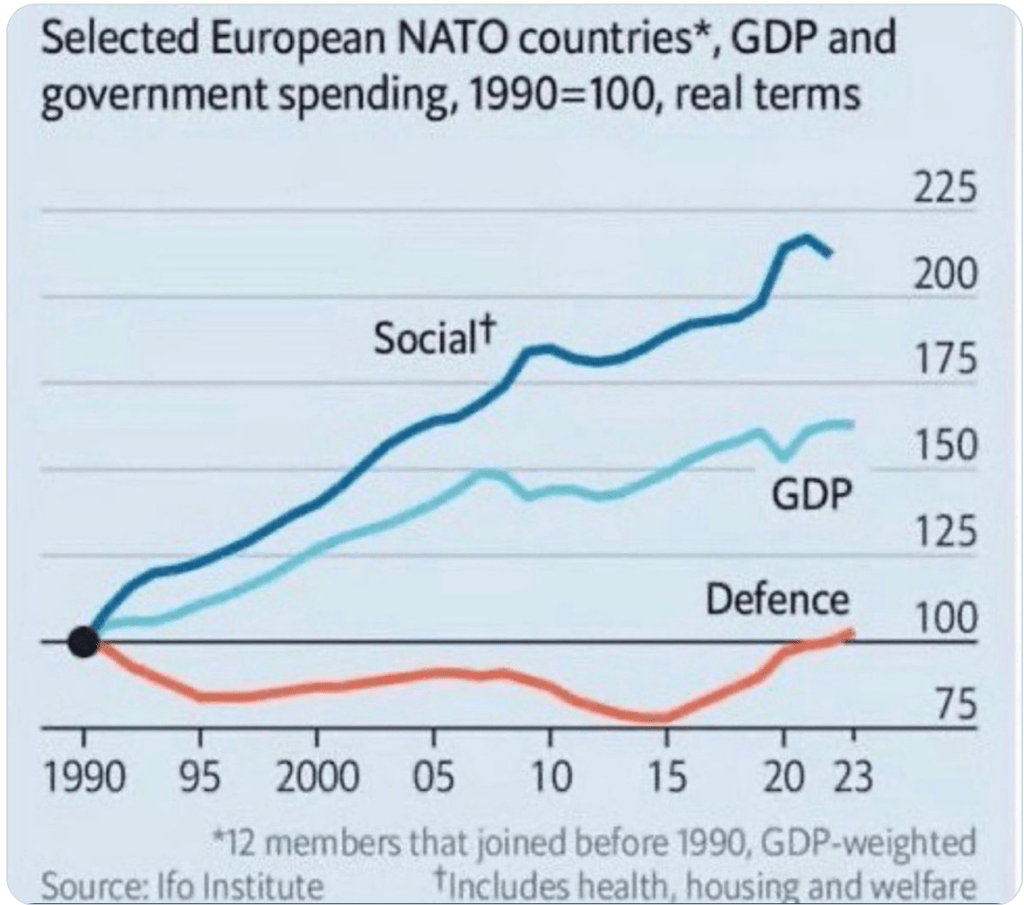

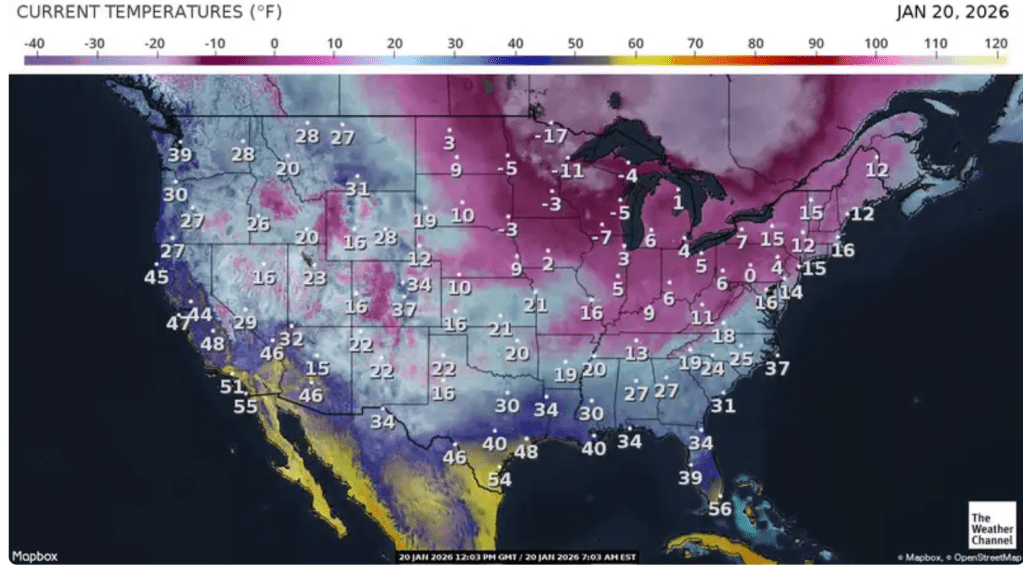

- There is no evidence the world is a safer place this morning than it was yesterday morning. There’s no peace in Ukraine; the Ayatollah has not relinquished power; Cuba and Venezuela remain in the status quo, and Europe continues to try to figure out how to power themselves without relying on the two largest energy exporters in the world, the US and Russia.

It beggar’s belief that this is entirely a reaction to the rumored naming of Kevin Warsh as the next Fed chair. As I type early this morning, the prices of precious metals are already bouncing nicely off their lows. I do not know what drove this move specifically, but I do not believe that the big picture story has changed.

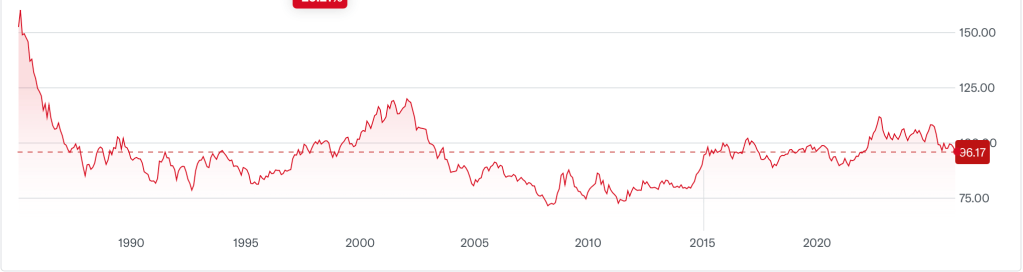

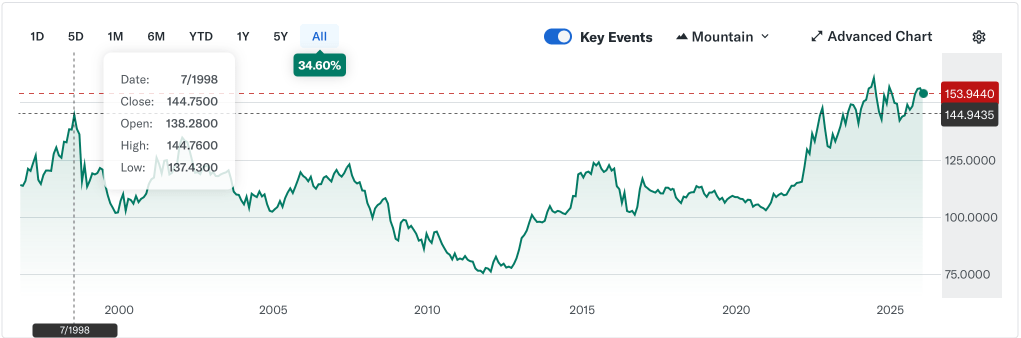

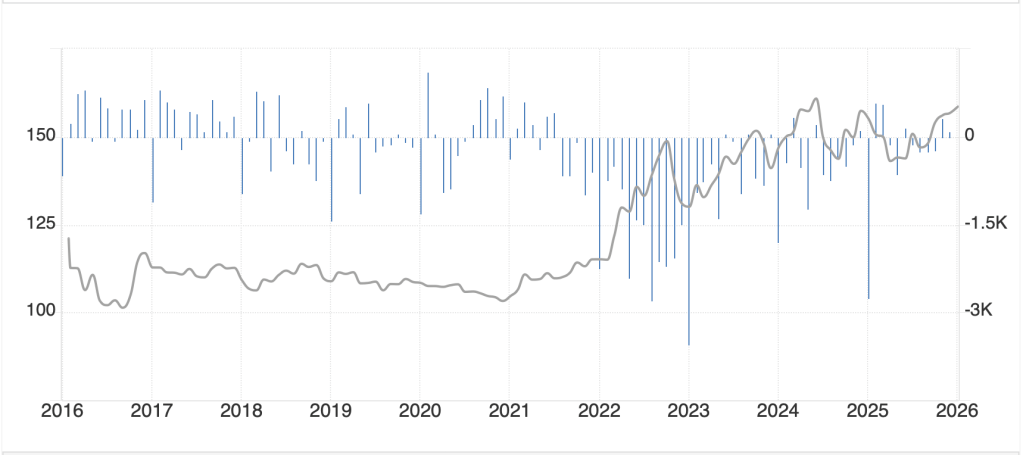

This segues nicely into another key narrative this week, the dollar’s massive break lower. Earlier this week I had written about how the DXY was approaching a double bottom on the charts and many in the market were convinced that if we traded below that level, and more importantly, closed below the level, which was 96.22, that it opened the door for a much more significant leg lower. I addressed this, pointed out that the dollar was still in the broad middle of its long-term trading range, but acknowledged that a move lower was quite realistic. Well, as of yet, we have not closed below the key level, and this move is shaping up as a potential bounce back into the range. As you can see in the chart below, the baseline is still holding on.

Source: tradingeconomics.com

Now, the dollar is stronger across the board this morning (EUR -0.2%, GBP -0.2%, JPY -0.5%, CHF -0.4%, ZAR -1.1%, CLP -0.6%) although these declines are abating in a similar fashion to the precious metals price action this morning. Here, too, portfolio rebalancing would indicate that traders would be buying dollars given its decline this month. Has anything really changed in the FX markets overnight? All the recent policy decisions were exactly as expected. Data overnight showed that European GDP continues to muddle along at just 1.3%, hardly a rationale to invest aggressively on the continent. Is this dollar rebound just a response to the Warsh story and his presumed hawkishness? Or is it the normal ebb and flow of markets. I am not yet willing to concede the dollar is breaking lower, I need more proof for that, but I certainly cannot rule out that outcome, regardless of who the new Fed chair is.

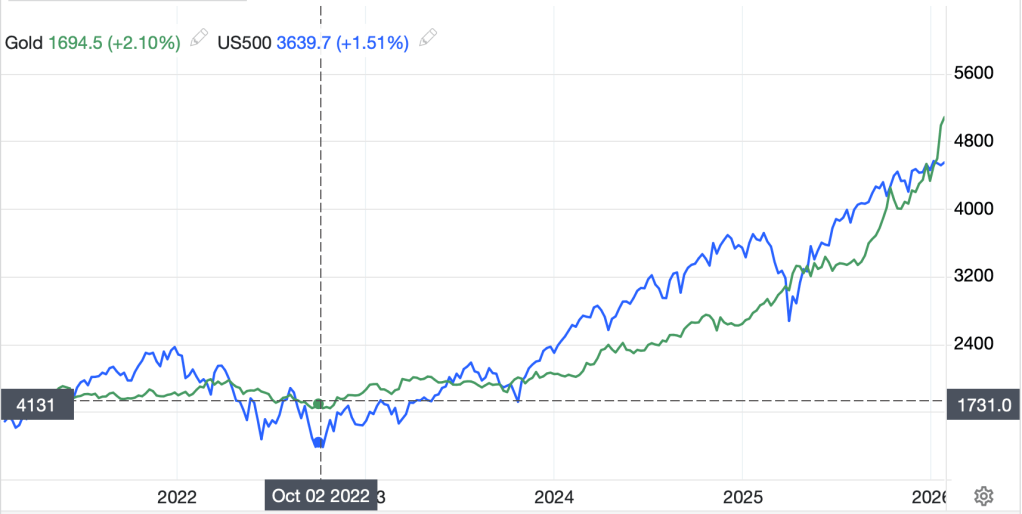

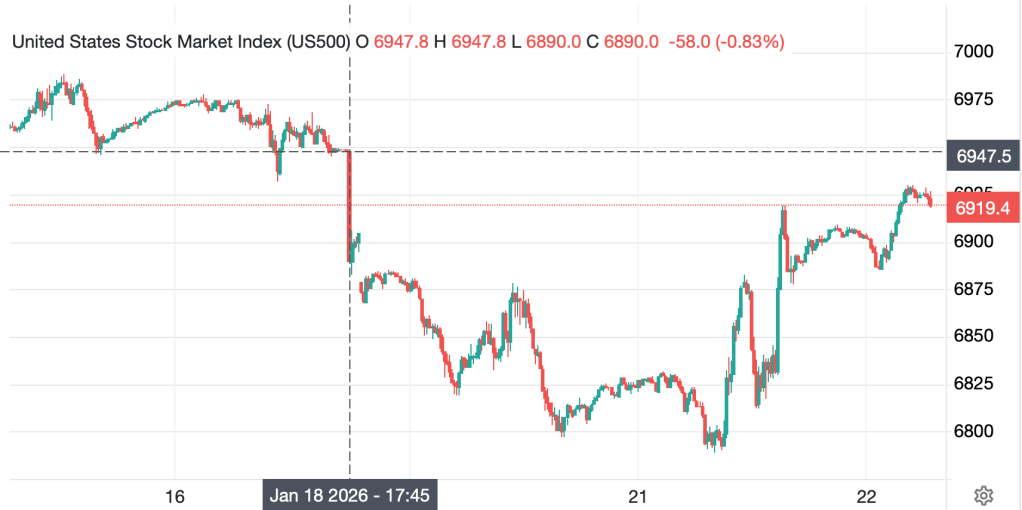

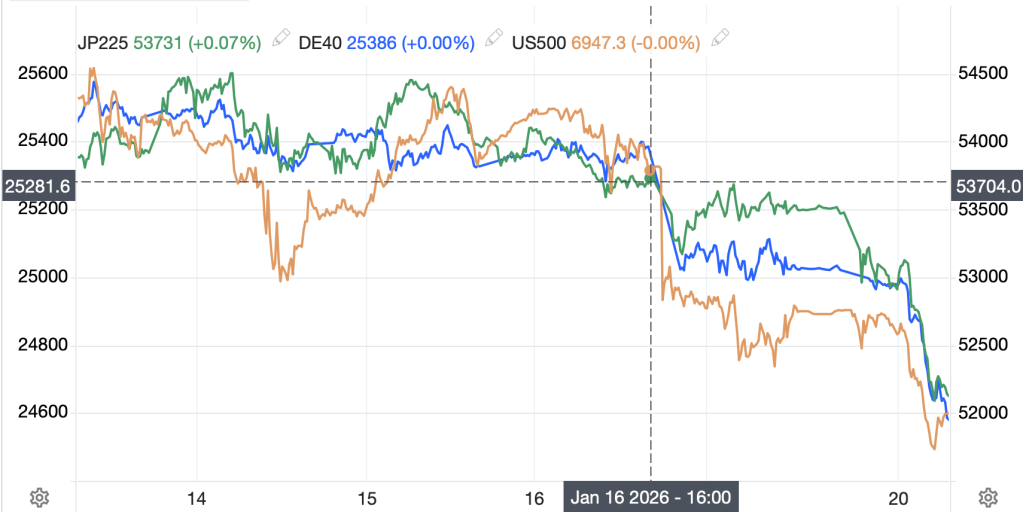

How about other markets? Equities in the US yesterday were hampered by Microsoft’s earnings release Wednesday, with its decline dragging down the NASDAQ, although the DJIA managed to recoup all its early losses and finish in the green (barely). But Asian bourses had a more difficult time. While Japan (-0.1%) was little changed, both China (-1.0%) and HK (-2.1%) fell sharply, and I don’t believe those markets were responding to the Warsh rumor. It appears that HK, especially, was the victim of month end profit taking and rebalancing as it has had quite a good run this month. The other key laggard in the region was Taiwan (-1.45%) while the rest of the markets in the time zone were +/-0.5% or so, or less.

European shares, though, are all firmer this morning led by Spain (+1.6%) after GDP data there was a tick better than expected at 2.6%. But gains are universal (DAX +0.85%, CAC +0.7%, FTSE 100 +0.4%) as earnings results were enough to offset the generally lackluster data. Perhaps the idea of another ECB rate cut is entering the collective consciousness, although according to the ECB’s own forecast tool, there is a 10% probability of a 25bp rate HIKE. I’ll believe that when I see it. As to US futures, they are softer this morning as I type (7:10), with declines on the order of -0.3% across the board, which is also a rebound from levels earlier this morning.

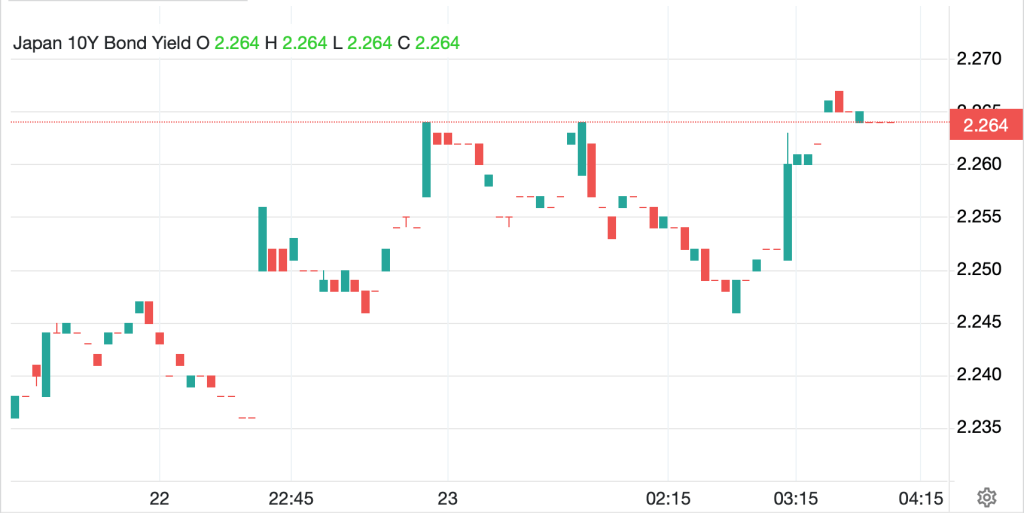

Bonds: nobody seems to care. Yields have edged higher by 1bp virtually across the board this morning and still remain within the recent trading ranges. It is quite interesting how little financial markets are focusing on this key source of information.

And before I leave, oil (-0.5%) has backed off its recent top, although remains higher by 6.5% this week as concerns over a possible US action in Iran continue to haunt traders.

On the data front, this morning brings PPI (exp 0.2%, 2.7% Y/Y) for headline and (0.2%, 2.9% Y/Y) for core as well as Chicago PMI (44.0). Too, we get the first Fed speaker, Governor Bowman, but the only Fed news that is going to matter today is the mooted announcement about the next Chair.

What have we learned this week? Volatility is alive and well in the commodity space, and, although not quite to the same extent, in the equity space. Bonds are boring and the dollar continues to refuse to stick to the narrative that its days in the sun are over. Regarding the dollar, remember that despite all the talk of the dollar’s collapse, the only thing we have heard from ECB members is that if the euro rises too much (i.e. the dollar falls sharply) that is a problem and they will need to respond. It’s been an eventful month in the markets. I suspect that this may be a map for at least the first half of the year.

Good luck and good weekend

Adf