Though many will claim it’s deceit

The Chinese declared they did meet

The target that Xi

Expected to see

Though skeptics remain on the Street

In fact, it appears there’s a trend

That data surprises all tend

To flatter regimes

And their stated dreams

As policy faults they defend

Last night, the Chinese released their monthly data barrage with final 2024 numbers as part of the mix. Despite numerous indications that Chinese growth is slowing, somehow, they managed to show a 5.4% annualized GDP growth rate for Q4 and a 5.0% GDP growth rate for all of 2024, right on President Xi’s target.

Now, the government did add some stimulus in Q4 as they recognized things are not going well, and I continue to read articles that President Xi is starting to feel increased pressure from CCP insiders as to his stewardship of the nation and the economy. Statistics like electricity usage and travel don’t really jive with the data, although it is certainly possible that ahead of the mooted tariffs that President Trump has threatened to impose starting next week, many companies preordered extra inventory to beat the rush, and that goosed growth.

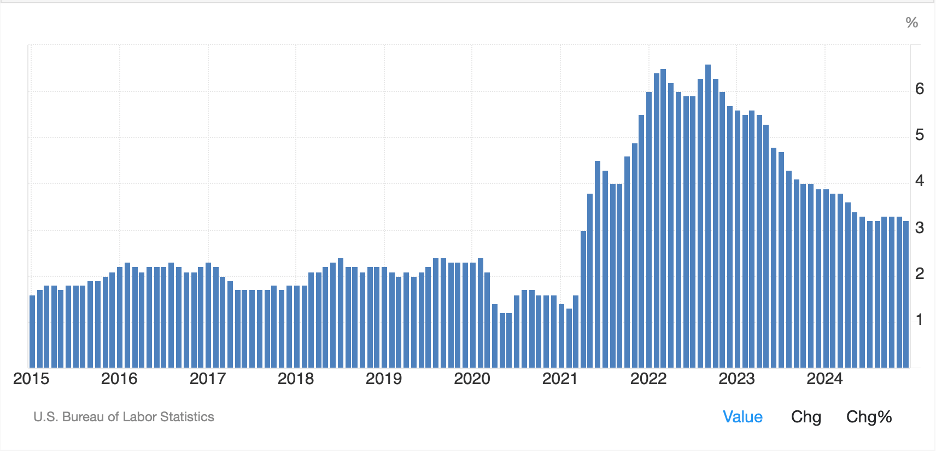

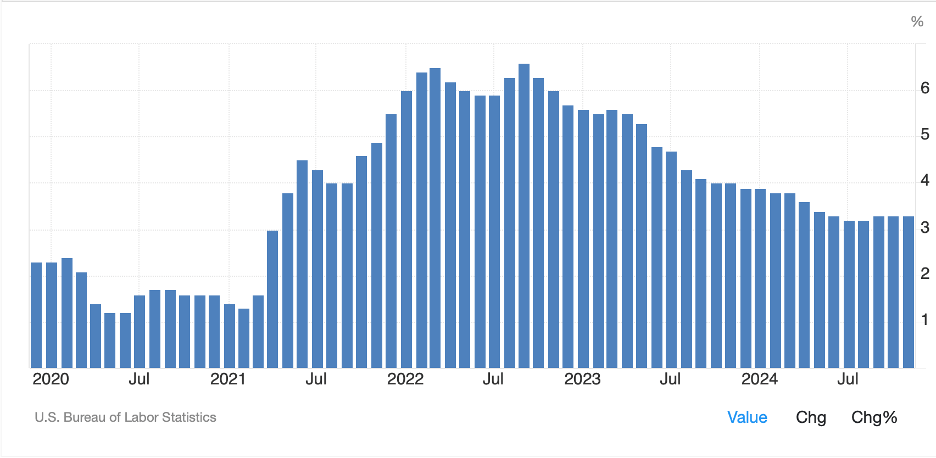

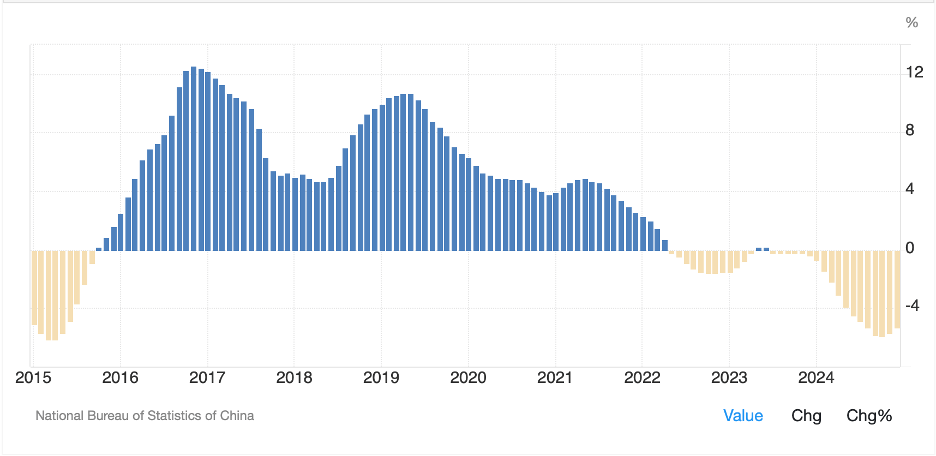

But there are a couple of things that continue to drag on the Chinese economy, with the primary issue the continuing implosion of the property market there. For instance, while house price declines have been slightly slower, (only -5.3% last month) it has basically been three years since there was any gain at all as shown in the chart below.

Source: tradingeconomics.com

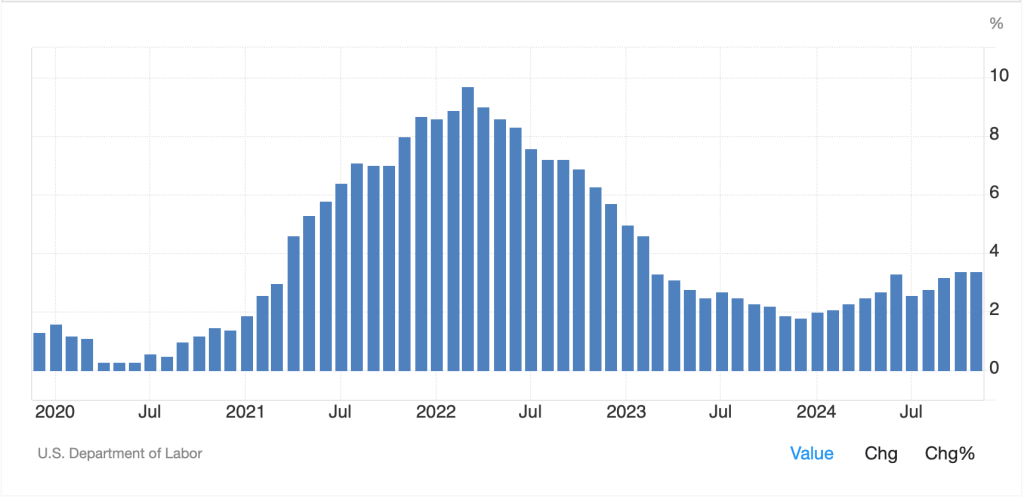

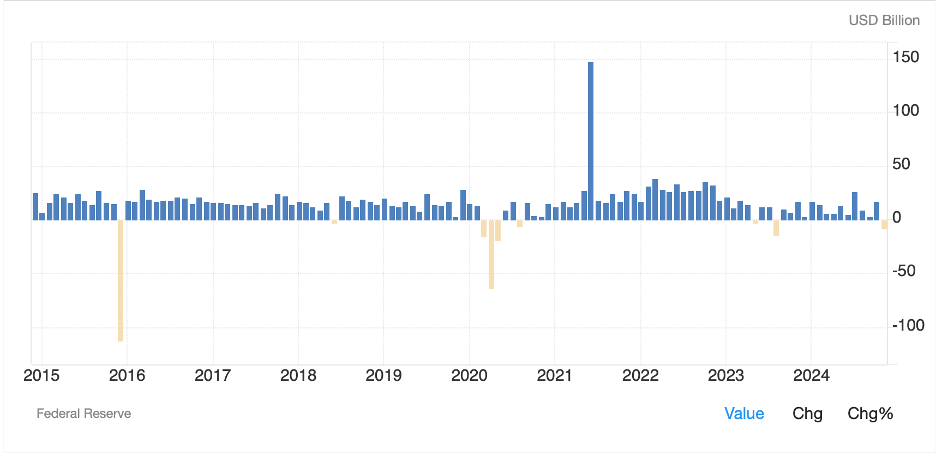

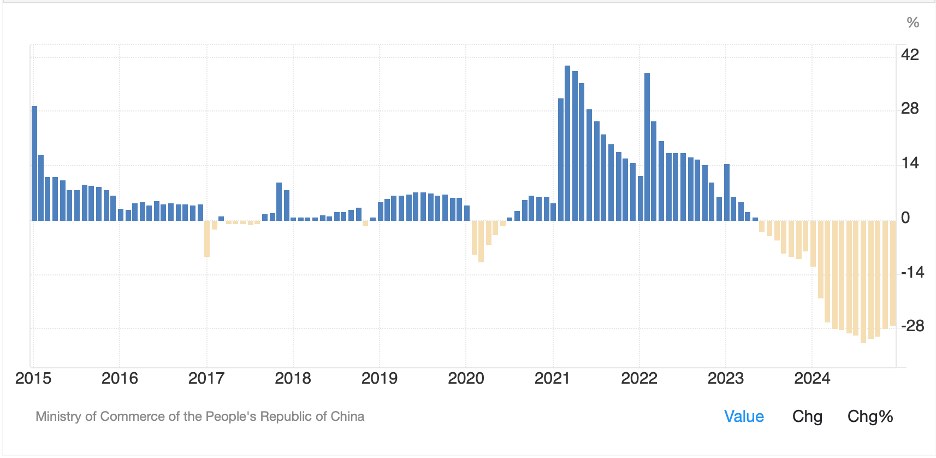

As well, one of the key concerns about China has been Foreign Direct Investment, which has not merely slowed down but has actually been reversing (companies leaving China) over the past two years as per the next chart.

Source: tradingeconomics.com

Meanwhile, a WSJ headline, China’s Population Fell Again Despite a Surprise Rise in Births, highlights yet another issue President Xi faces, the ongoing aging and shrinking of his nation. Remember, GDP is basically the product of the number of people working * how much they each produce. If that first number is shrinking, and the working age population in China is doing just that, it is awfully difficult to generate GDP growth. Finally, I couldn’t help but notice in yesterday’s confirmation hearings for Treasury secretary, where Scott Bessent offered his view that China is actually in a recession, with massive deflation and are struggling to export their way out of the problems, rather than address their internal imbalances. This is a theme that has been discussed widely in the past, and ostensibly, China has admitted they want to be more consumption focused in their economy, but it doesn’t appear that is the direction they are heading.

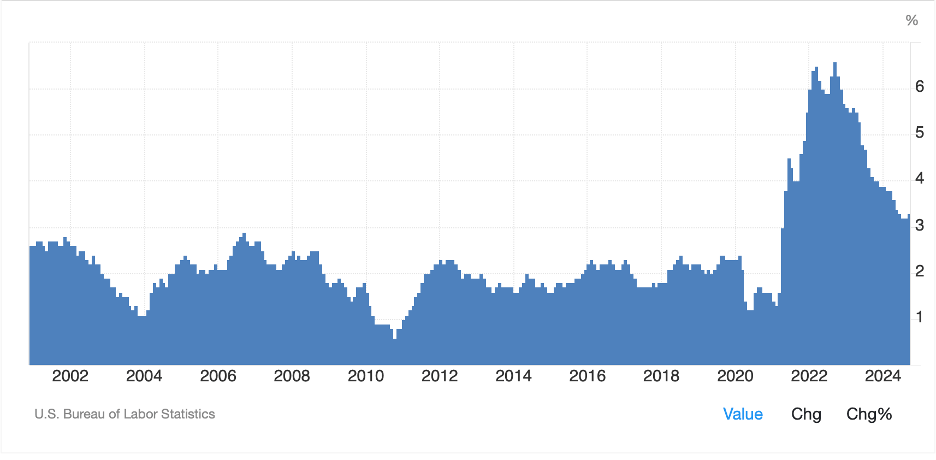

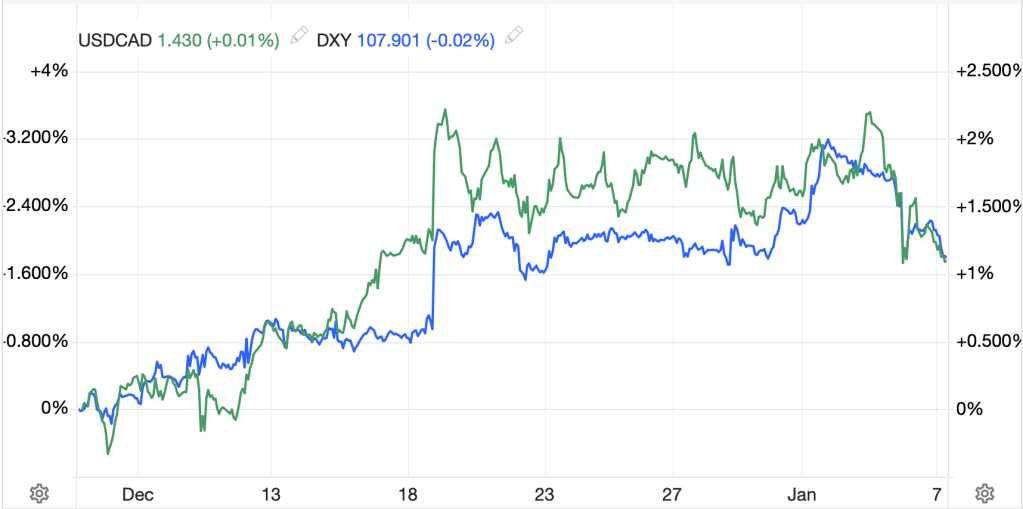

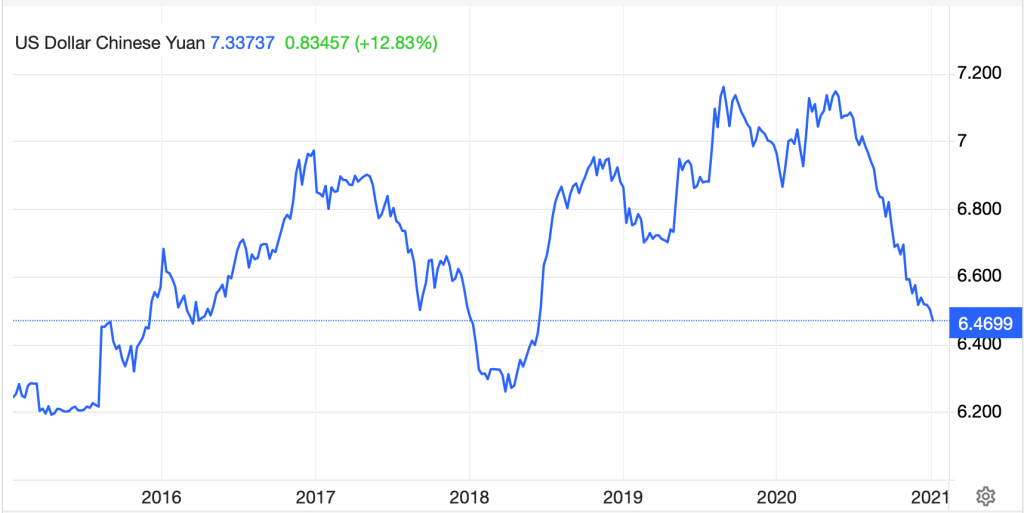

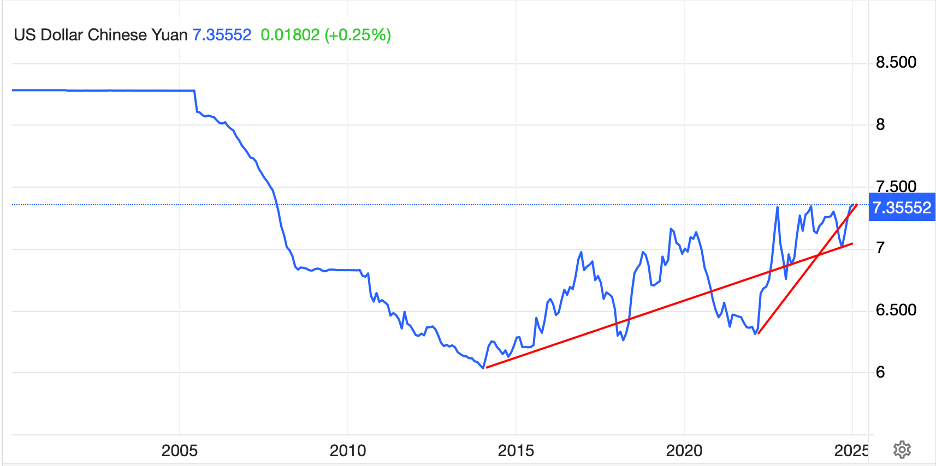

I raise these points in the context of the Chinese renminbi and how we might expect it to behave going forward. The question of tariffs remains open at this stage, although I daresay we will learn more next week. If they are imposed, there is a strong belief that the renminbi will weaken to offset the terms. As it is, the currency remains within pips of its weakest level in 18 years and the trend, both short-term and for the past decade, has been for it to weaken further.

Source tradingeconomics.com

Xi remains caught between the need for the currency to weaken to maintain competitiveness in the face of threatened tariffs from the US, and his desire to demonstrate that the renminbi is a stable store of value that other nations can trust to hold and use outside the global dollar network. In the end, I expect the immediate competitiveness needs are going to overwhelm the long-term aspirations, especially if it is true that Xi is feeling internal pressure because of an underperforming economy. Nothing has changed my view that we approach 8.00 by the end of the year.

Ok, and that’s really the big news overnight. As an aside, it was interesting to watch Mr Bessent dismantle the attempts by the Democrat senators for a ‘gotcha’ moment. As I wrote yesterday, it wasn’t really a fair fight given his intelligence, experience and understanding of markets and the economy compared to the Senators.

Let’s start in the equity world where US markets opened higher but ultimately slid all day long to close on their lows. An uninspiring performance to say the least. That performance weighed on much of Asia with the Nikkei (-0.3%) sliding alongside Australia, Korea and India. On the plus side, modest gains were shown in China (Hang Seng and CSI 300 both +0.3%) and some positive numbers were seen in Taiwan, Malaysia and Singapore. But overall, the movements were not substantial in either direction. In Europe, though, markets are starting to anticipate more aggressive ECB rate cuts as data continues to show weakness in economic activity. Weak UK Retail Sales data has the FTSE 100 (+1.3%) leading the way higher as hopes for a BOE cut grow. Meanwhile, the CAC (+1.0%) and DAX (+1.0%) are both rallying on the thesis that Chinese growth is going to attract imports from both nations. Meanwhile, US futures are higher by 0.4% at this hour (7:40).

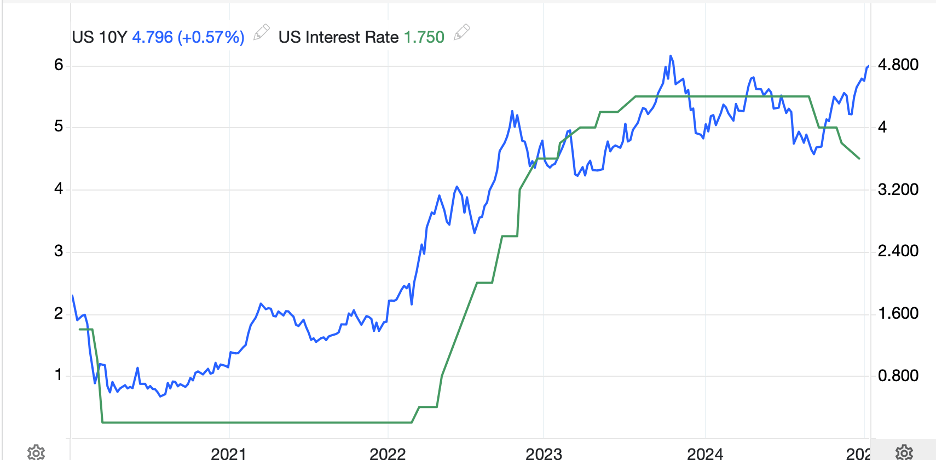

In the bond market, all the inflation fears seem to have abated. Either that or we continue to see a massive short squeeze and position unwinding. But the result is yields are lower across the board with Treasury yields down 3bps further, and below 4.60% while European sovereign yields have fallen between -3bps and -5bps as investors take heart that the ECB and BOE are going to be cutting rates soon. Perhaps the market is showing faith that Mr Bessent will be able to address the US fiscal financing crisis. After all, he did explain in no uncertain terms that the US would not default on its debt. But my sense is the market narrative about rising inflation and higher yields had really pushed too far, and this is simply the natural bounce back. While this week’s inflation data was not as hot as feared, nothing has changed my view that inflation remains a problem going forward.

In the commodity markets, oil is unchanged on the day, having given back some of its substantial gains over the past two sessions, although it remains right near $79/bbl this morning. Apparently, there are rumors Trump will end Russian oil sanctions as part of the Ukraine negotiations, but that doesn’t sound like something he would offer up initially, at least to me. Meanwhile, NatGas (-4.0%) though slipping this morning, remains above $4/MMBtu as the US prepares for a major arctic cold snap next week. In the metals markets, my understanding is there has been a lot of position adjustment and arbitrage between NY and London as we approach futures contract maturities, and that has been a key driver of the recent rally in metals (H/T Alyosha at Market Vibes, a very worthwhile trading Substack), but may be coming to an end in the next several sessions. However, here, too, nothing has changed my longer-term view of higher prices over time.

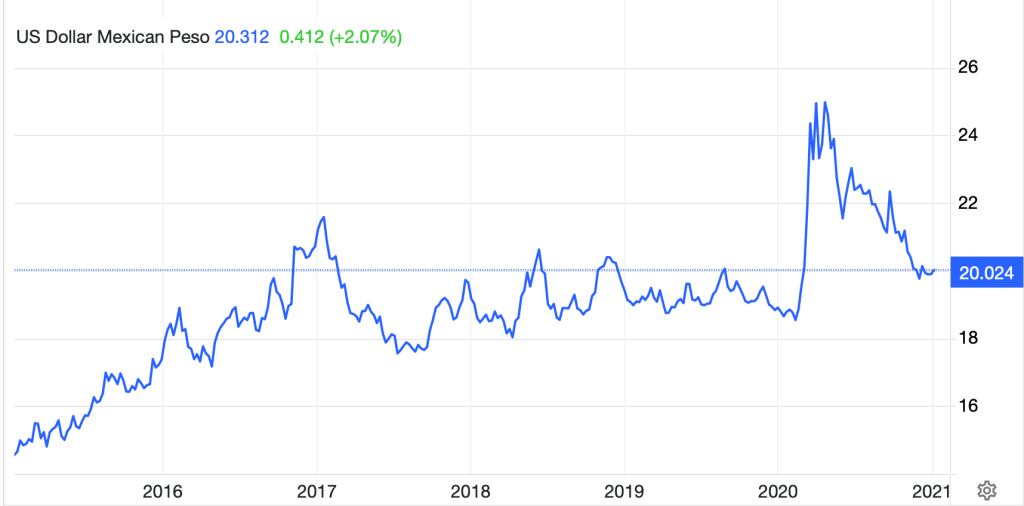

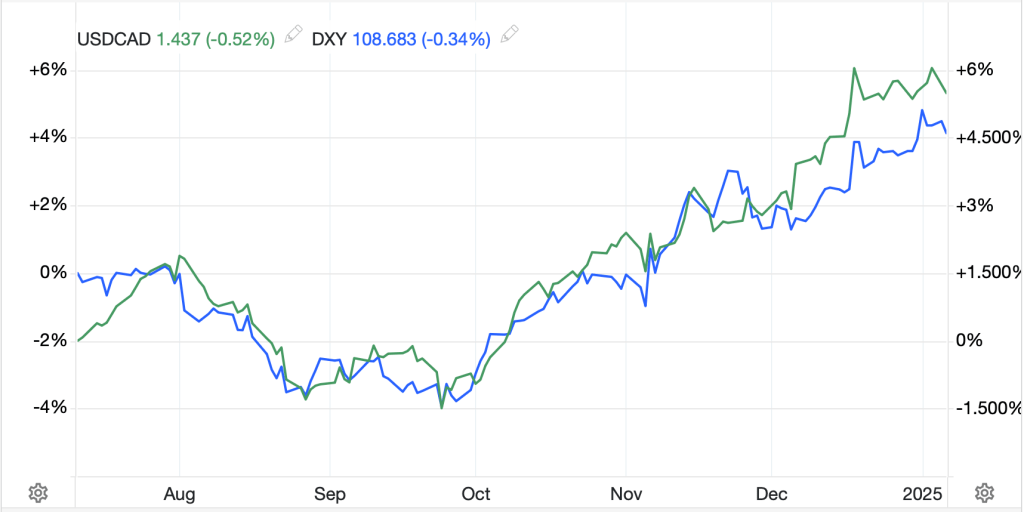

Finally, the dollar is a tad stronger this morning, rallying vs. the pound (-0.4%), Aussie (-0.4%), NOK (-0.5%) and NZD (-0.5%) as all those ECB and BOE rate cut stories weigh on those currencies. Interestingly, JPY (-0.3%) is also weaker this morning despite an article overnight signaling the BOJ will be raising rates next Friday. On the flip side, looking at the EMG bloc, I see very modest gains by many of the key players (MXN +0.15%, ZAR +0.1%), although those moves feel far more like position adjustments than fundamentally driven changes in view.

On the data front, this morning brings Housing Starts (exp 1.32M) and Building Permits (1.46M) and then IP (0.3%) and Capacity Utilization (77.0%) later on. There are no Fed speakers on the docket, and tomorrow is the beginning of the quiet period. The last thing we heard from Cleveland Fed president Hammack was that inflation remains a concern and they have not yet finished the job.

For the day, I don’t think the data will have much impact. Rather, as we are now in earnings season, I suspect that stocks will take their cues there and FX will remain in the background for now.

Good luck and good weekend

Adf