The US and China have shaken

Their hands, as trade talks reawaken

And while it’s a start

It could fall apart

For granted, not much should be taken

So, markets have turned their attention

To ‘flation with some apprehension

This morning’s report

Might help, or might thwart

Chair Powell’s rate cutting pretension

Starting with the trade talks between China and the US, both sides have agreed that progress was made. Here is a quote from a report on China’s state broadcaster, CCTV, last night. “China and the US held candid and in-depth talks and thoroughly exchanged views on economic and trade issues of mutual concern during their first meeting of the China-US economic and trade consultation mechanism in London on Monday and Tuesday. The two sides have agreed in principle the framework for implementing consensus between the two heads of state during their phone talks on June 5, as well as those reached at Geneva talks. The first meeting of such consultation mechanism led to new progress in addressing each other’s economic and trade concerns.” I highlight this because it concurs with comments from Commerce Secretary Lutnick and tells me that things are back on track.

Clearly, this is a positive, although one I suspect that equity markets anticipated as they have been rallying for the past several sessions prior to the announcements. Certainly, this is good news for all involved as if trade tensions between the US and China diminish, it should be a net global economic positive. While anything can still happen, we must assume that a conclusion will be reached going forward that will stabilize the trade situation. However, none of this precludes President Trump’s stated desire to reindustrialize the US, so that must be kept in mind. And one of the features of that process, at least initially, is likely to be upward price pressures in the economy.

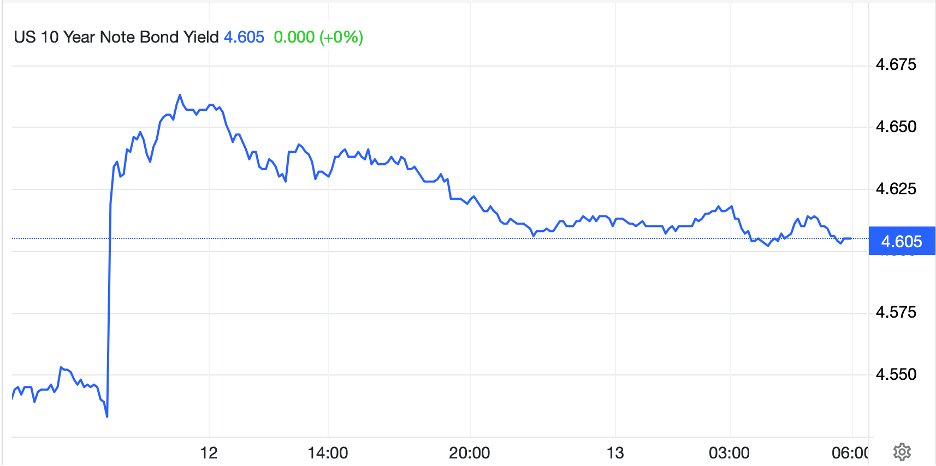

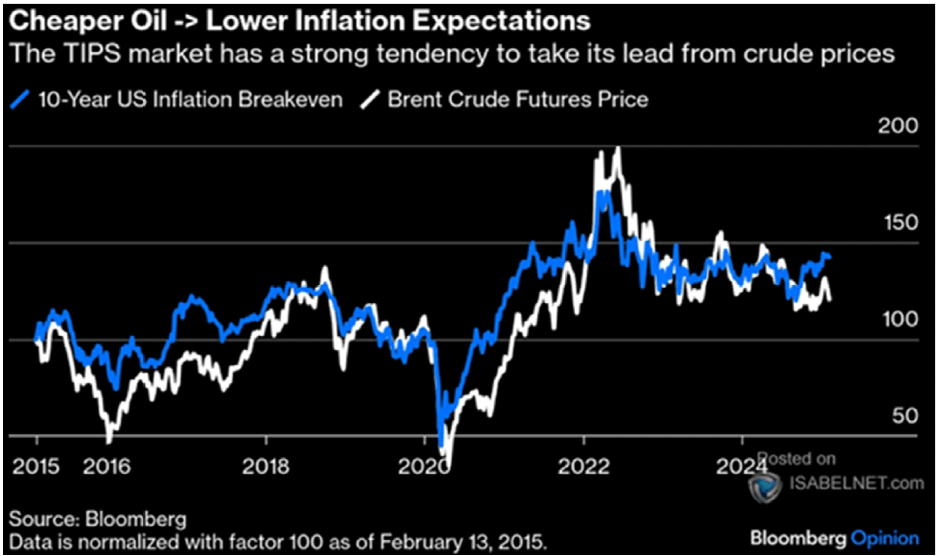

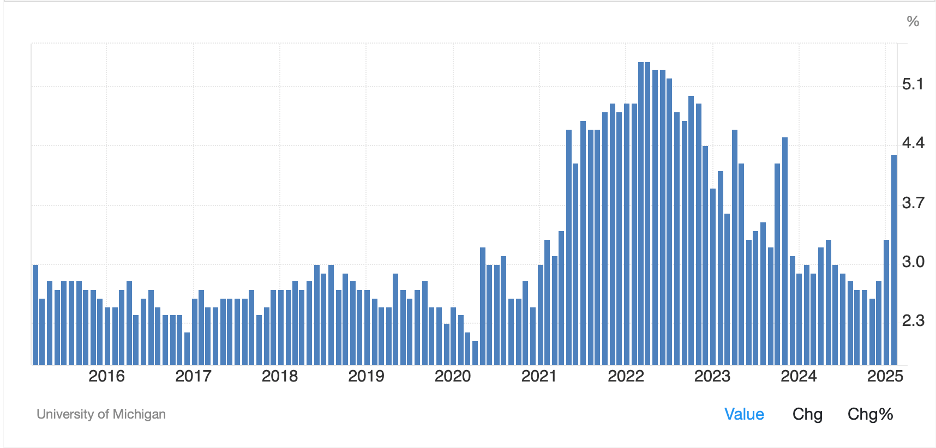

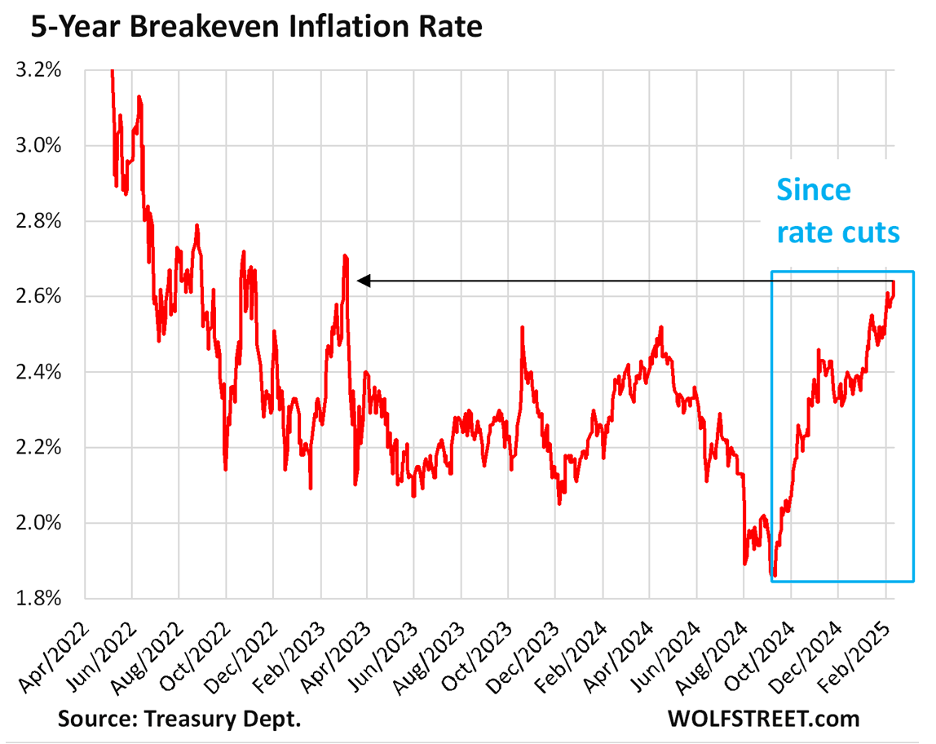

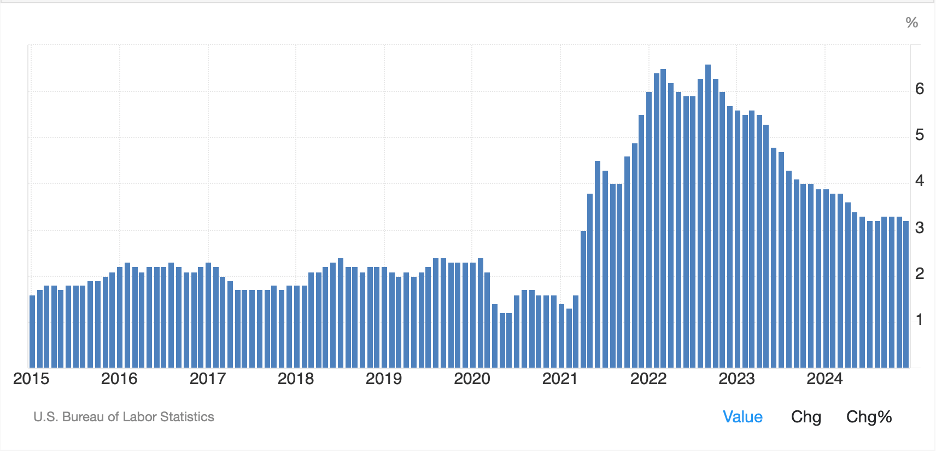

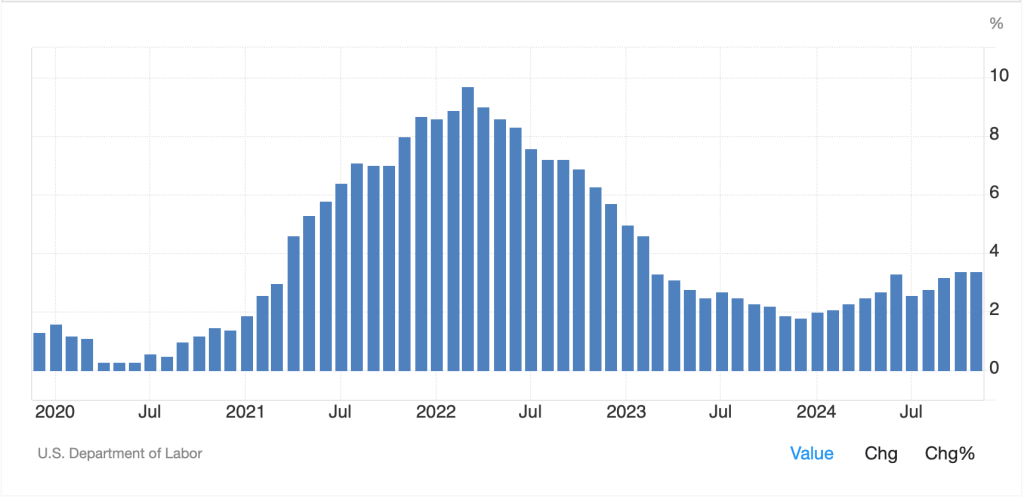

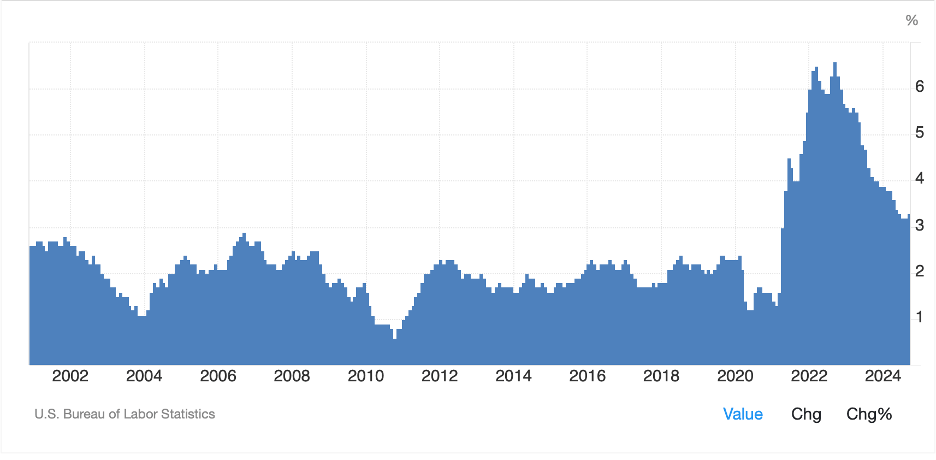

Which brings us to the other key story today, this morning’s CPI report. Expectations for headline (0.2% M/M, 2.5% Y/Y) and core (0.3% M/M, 2.9% Y/Y) are indicating that the bottom of the move lower in inflation may have been seen last month. However, these readings, while still higher than the Fed’s target (and I know the Fed uses Core PCE, but the rest of us live in a CPI world) remain well below the 2022 highs and inflation seems to be seen as less of a problem. Yes, there are some fears that the newly imposed tariff regime is going to drive prices higher, and I have seen several analysts explain that we are about to see that particular process begin as of today’s data.

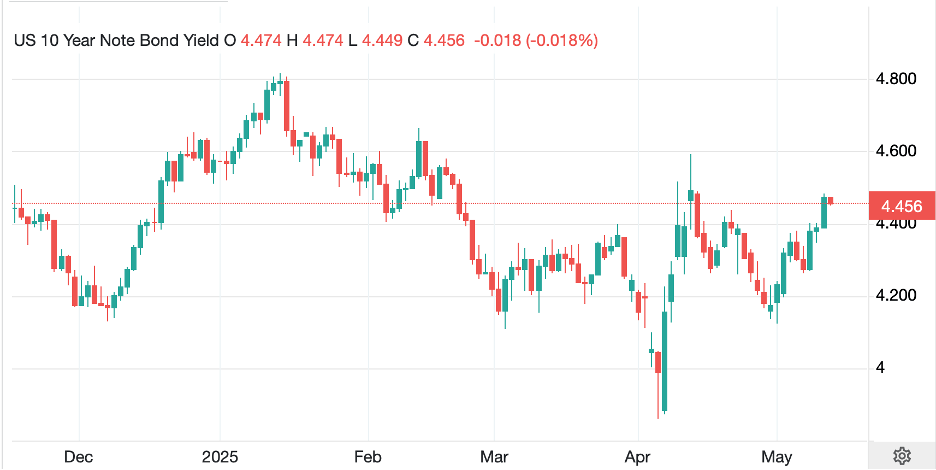

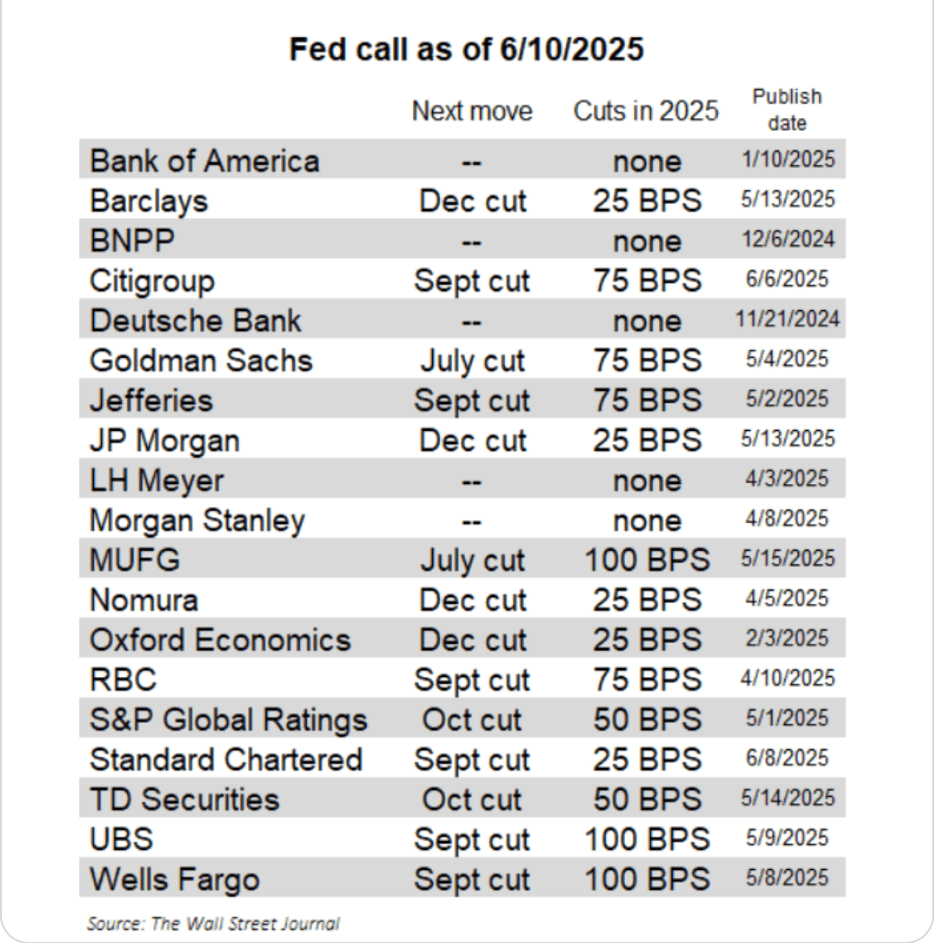

Of course, from a markets perspective, the key issue with inflation is how it will impact interest rates. In this case, I think the following chart from Nick Timiraos in the WSJ is an excellent description of how there is NO consensus view at all.

At the same time, Fed funds futures markets are pricing in the following probabilities as of this morning.

Source: cmegroup.com

The thing about the Fed is they have proven to be far more political than they claim. First, it is unambiguous that there is no love lost between President Trump and Chairman Powell. Interestingly, the Fed is strongly of the belief that when they cut rates, they are helping the federal government, and more importantly, the population’s impression of what the federal government is doing. Hence, the 100bps of cuts last summer/fall never had an economic justification, they appeared to have been the Fed’s effort to sway the electorate to maintain the status quo. With that in mind, absent a collapse in the labor market with a significantly higher Unemployment Rate, I fall into the camp of no Fed action this year at all. And, if as I suspect, inflation readings start to pick up further, questions about hikes are going to be raised.

Consider if the BBB is passed and it juices economic activity so nominal GDP accelerates to 6% or 7%, the Fed will be quite concerned about inflation at that point and the market will need to completely reevaluate their interest rate stance. My point is the fact that rate cuts are currently priced does not make them a given. Market pricing changes all the time.

So, let’s take a look at how things behaved overnight. After a modest US rally in equities yesterday, Asia had a solid session, especially China (+0.75%) and Hong Kong (+0.8%) as both responded to the trade news. Elsewhere in the region, things were green (Nikkei +0.5%), but without the same fanfare. I have to highlight a comment from PM Ishiba overnight where he said “[Japan] should be cautious about any plans that would deteriorate already tattered state finances. Issuing more deficit financing bonds is not an option.” That sounds an awful lot like a monetary hawk, although that species was long thought to be extinct in Japan. It will be interesting to see how well they adhere to this idea.

Meanwhile, in Europe, the only equity market that has moved is Spain (-0.6%) which is declining on idiosyncratic issues locally while the rest of the continent is essentially unchanged. As to US futures, at this hour (7:30) they are pointing slightly lower, about -0.15% across the board.

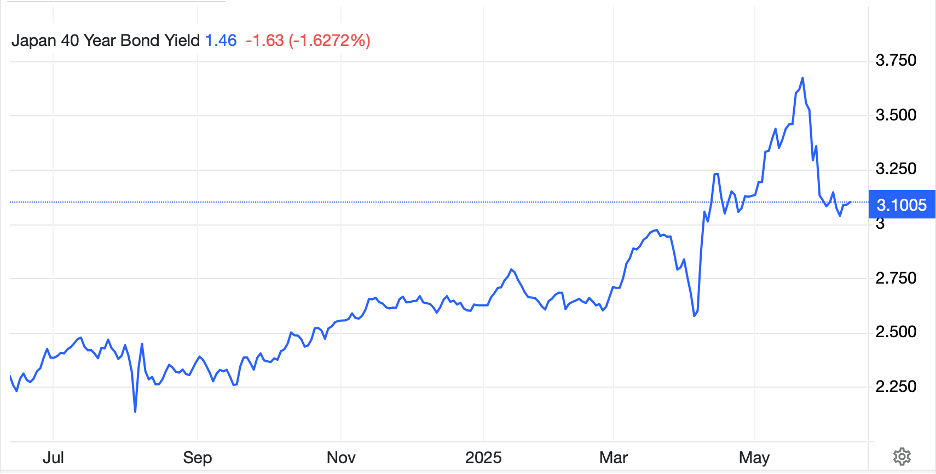

In the bond market, the somnolence continues with yields backing up in the US (+2bps) and Europe, (virtually all sovereign yields are higher by 2bps) with only UK Gilts (+5bps) under any real pressure implying today’s 10-year auction was not as well received as some had hoped. In Japan, yields slipped -1bp overnight and I thought, in the wake of the Ishiba comments above, I would highlight Japan 40-year bonds, where yields have collapsed over the past three weeks. Recall, back in May there was a surge in commentary about how Japanese yields were breaking out and how Japanese investors would be bringing money home with the yen strengthening dramatically. I guess this story will have to wait.

Source: tradingeconomics.com

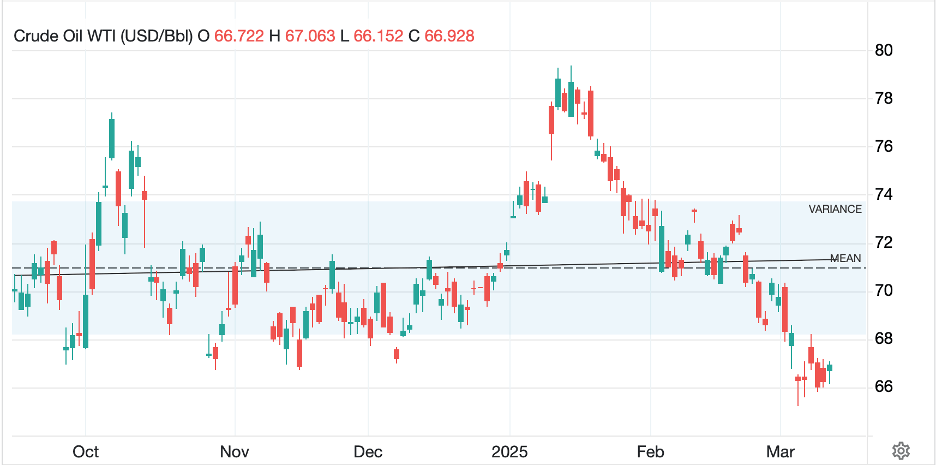

Turning to commodities, oil (+1.5%), which reversed course during yesterday’s session, has regained its mojo and is very close to closing that first gap I showed on the chart yesterday. Above $65, I understand most shale drilling is profitable so do not be surprised to hear that narrative pick up again. In the metals markets, gold (+0.2%) now has the distinction of being the second largest reserve asset at central banks around the world, surpassing the euro, although trailing the dollar substantially. I expect this process will continue. Silver (-0.8%) and copper (-2.1%) are both under pressure this morning although I have not seen a catalyst which implies this is trading and position adjustments, notably profit taking after strong runs in both.

Finally, the dollar is slightly stronger this morning with the euro and pound essentially unchanged, AUD, NZD and JPY all having slipped -0.25%, and some smaller currencies (KRW -0.55%, ZAR -0.5%) having fallen a bit further. However, for those who follow the DXY, it is unchanged on the day. The thing about the dollar is despite a lot of discussion about a break much lower, it has proven more resilient than many expected and really hasn’t gone anywhere in the past two months. If the Fed turns hawkish as inflation rebounds, I suspect the dollar bears are going to have a tougher time to make their case (present poets included.)

In addition to the CPI at 8:30, we see EIA oil inventory data with a modest build expected although yesterday’s API data showed a draw that surprised markets. I must admit I fear inflation data is going to start to rebound again which should get tongues wagging about next week’s FOMC meeting. However, for today, a hot print is likely to see a knee-jerk reaction lower in stocks and bonds and higher in the dollar. But the end of the day is a long way away and could be very different, especially given the always present headline risk.

Good luck

Adf