The focus has turned to the data

And whether it’s good or it’s bad-a

We all want to see

Today’s NFP

Then listen to punditry chat-a

It’s funny, cause generally speaking

Most pundits are strongly critiquing

The numbers released

Declaring they’re greased

To help Trump and havoc he’s wreaking

It’s NFP day today, which given it is Wednesday is a bit odd, but that’s what happens when the government shuts down for a few days. At any rate, this is the biggest data week we’ve had in a while as not only did we see Retail Sales yesterday, which disappointed at 0.0% despite showing the largest actual jump, $80 billion, ever between November and December, although that was completely removed by the largest seasonal adjustment ever, (Read about it here at WolfStreet.com) we also get CPI on Friday. For good order’s sake, here are the current consensus forecasts for NFP:

| Nonfarm Payrolls | 70K |

| Private Payrolls | 70K |

| Manufacturing Payrolls | -5K |

| Unemployment Rate | 4.4% |

| Average Hourly Earnings | 0.3% (3.6% Y/Y) |

| Average Weekly Hours | 34.2 |

| Participation Rate | 62.3% |

Source: tradingeconmomics.com

As the market continues to adjust to the recent gyrations, there is hope that the data will lead to unequivocal conclusions about the economy, which could drive Fed decisions and then coalesce around a clear direction of travel. I’m not holding my breath.

The first thing to remember is that the data is revised virtually every month, and when the economy is at an inflection point, or even when it is showing more pronounced activity in one sector than another, those revisions can tell a very different story than the original print. But even beyond that, while the algorithms are clearly programmed to respond to the data, longer term investors have a much tougher time discerning what is happening. All that is a long way of saying, nobody still has any idea where things are headed!

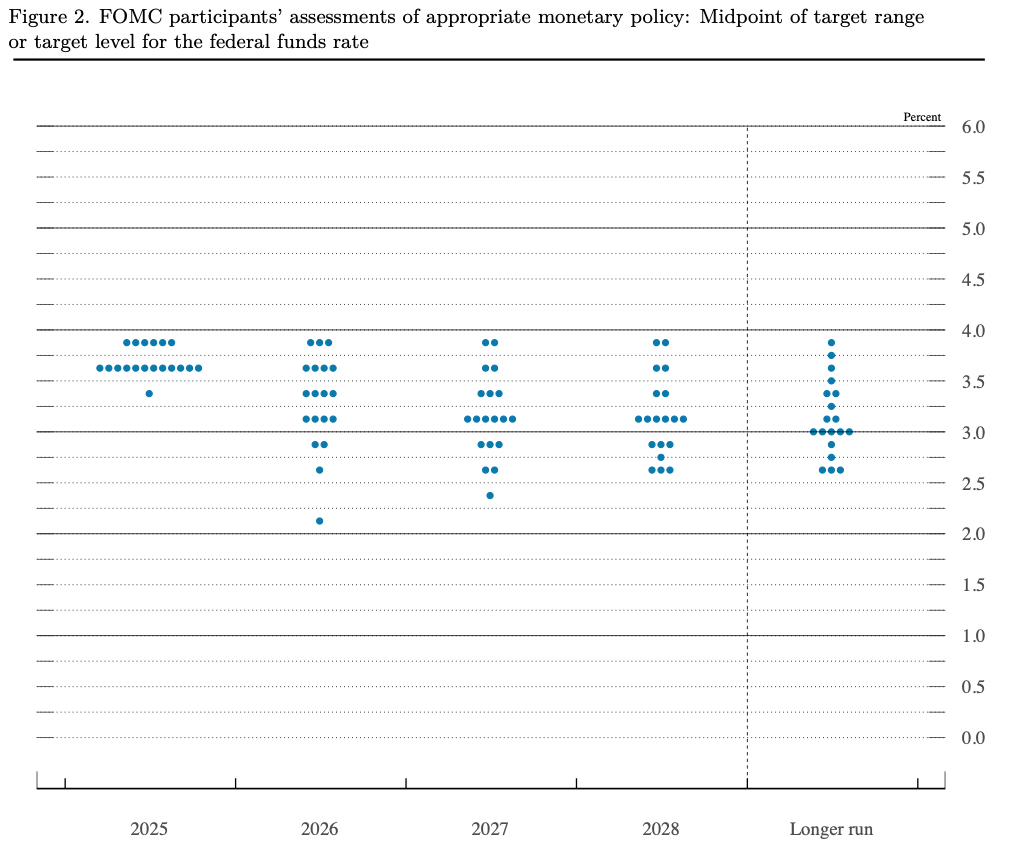

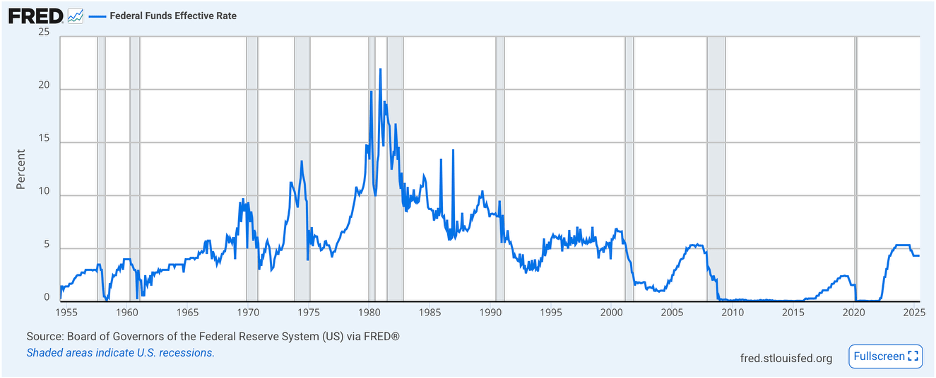

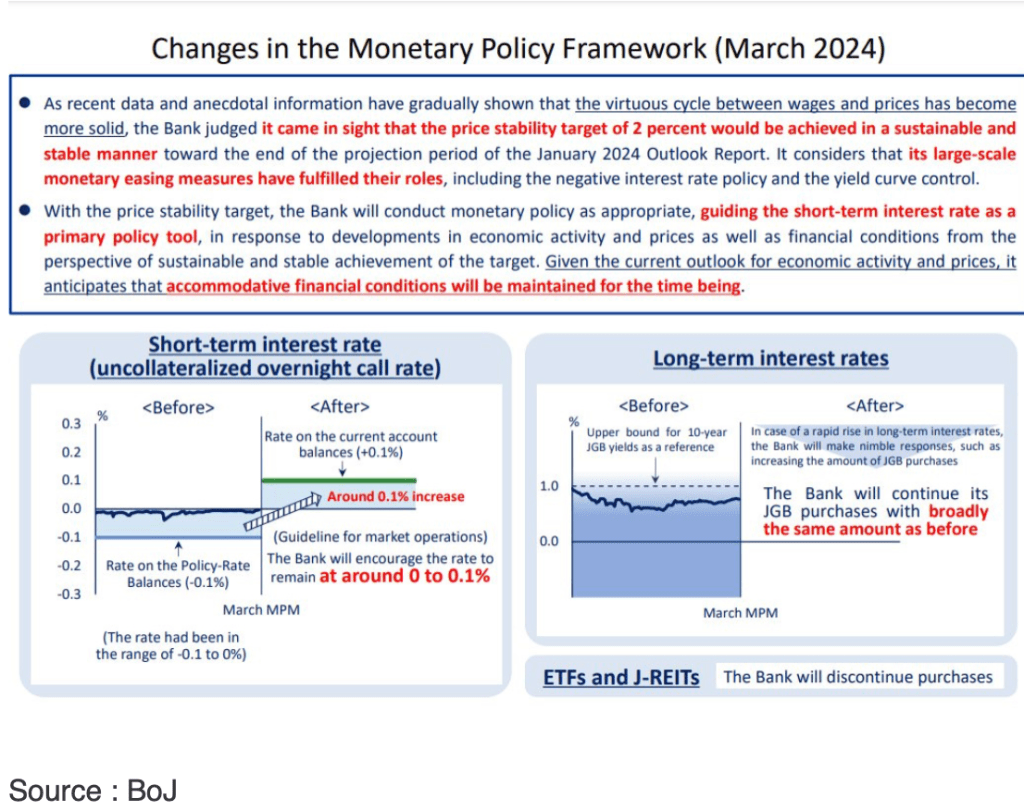

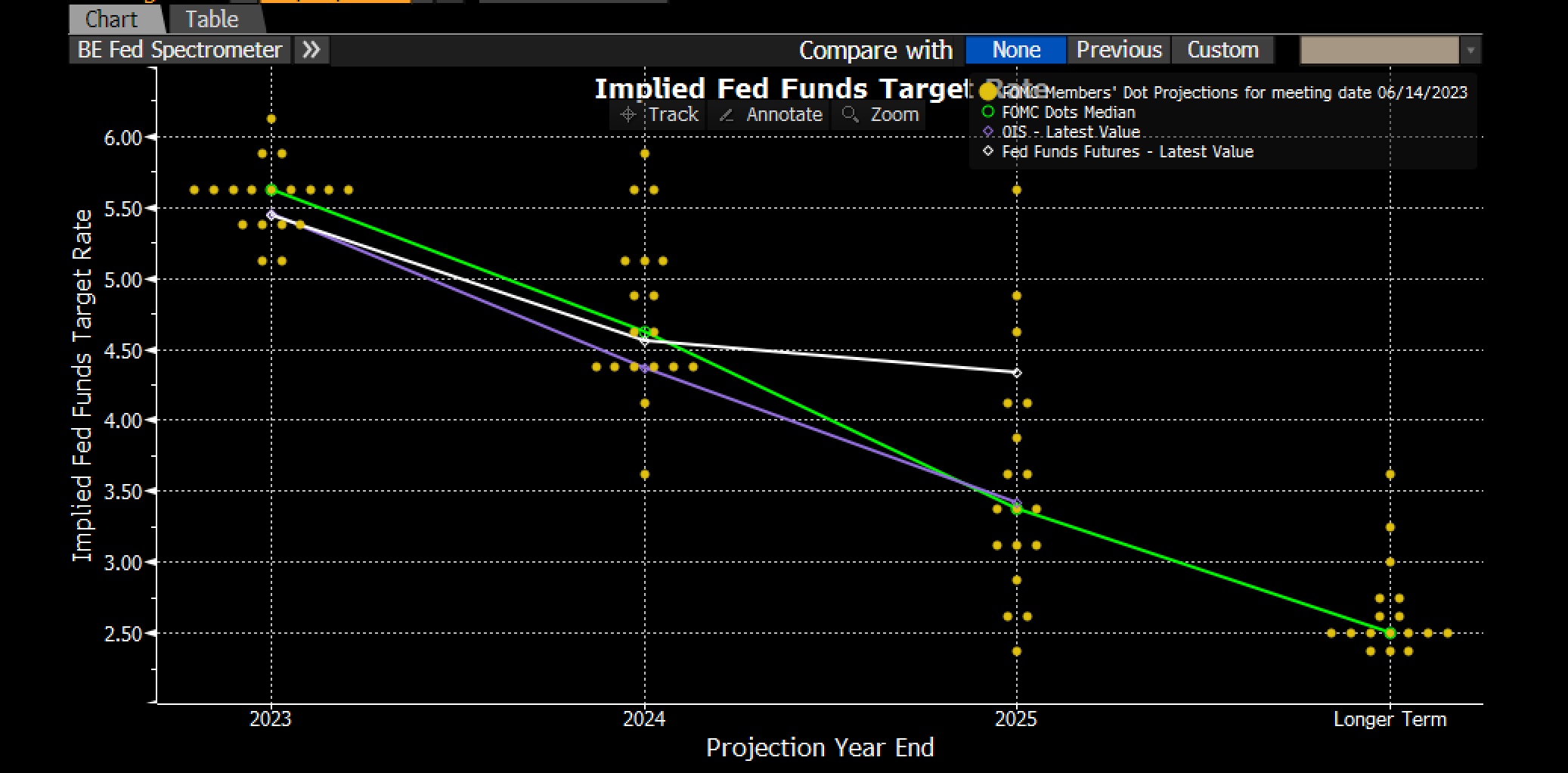

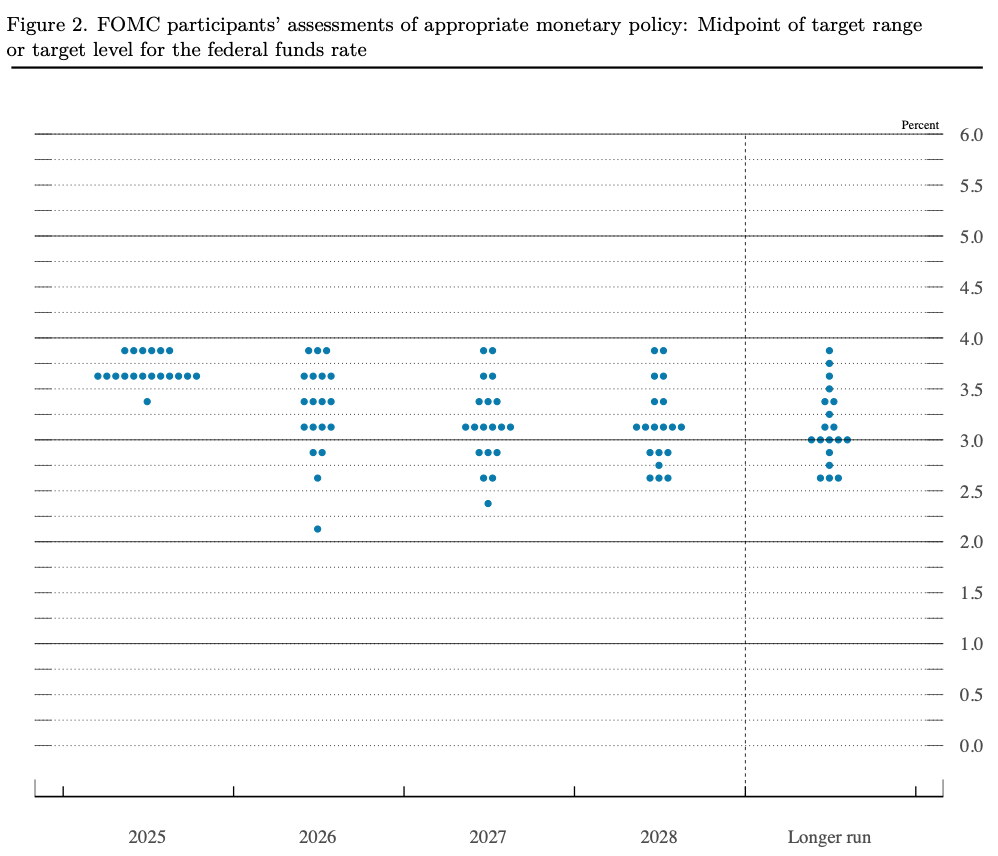

While I dismiss the FOMC speaking circuit, yesterday’s two speakers, Logan and Hammack, who are both voting members this year, said that they felt the current rate is at neutral. Remember, right now Fed funds are 3.75%, which is a far cry from the Longer run neutral rate they have been feeding us in the Dot Plot!

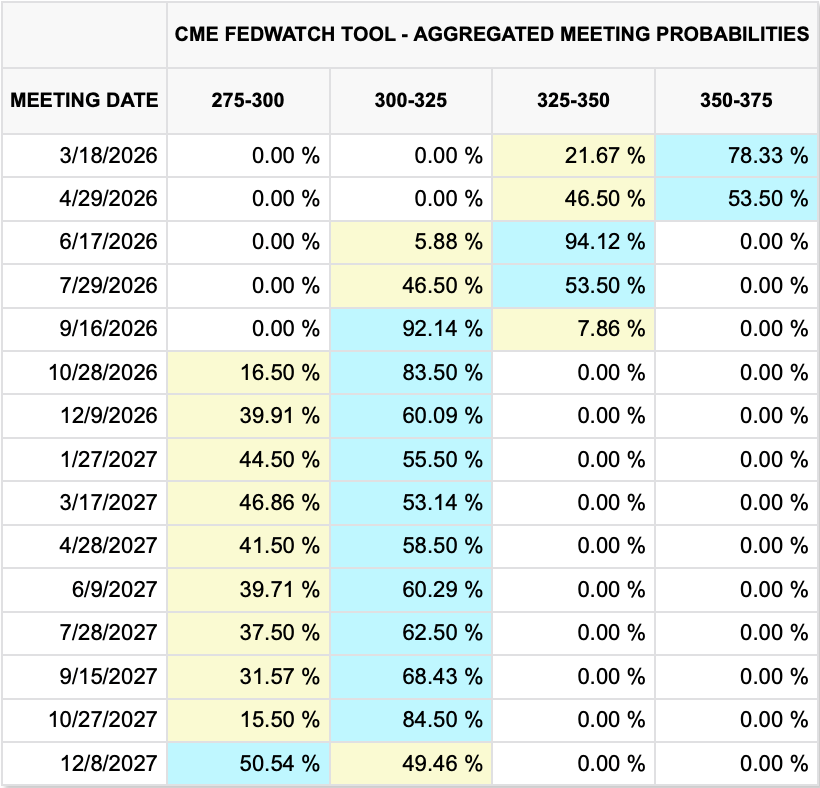

In fact, their median expectation is 3.0%, so the fact that two voting members think 3.75% is neutral is somewhat confusing especially as both indicated they expected inflation to continue to decline and exhibited concern over the employment situation. My views of where things are headed don’t matter nearly as much as theirs do, but there seems to be a little inconsistency involved here. As it happens, the current Fed funds futures market pricing shows that there is a 22% probability of a rate cut in March and then it’s 50:50 in April as per the below chart fromcmegroup.com.

At this point, I suspect we will need to see negative NFP numbers along with continuing declines in CPI/PCE for the Fed to cut as I think Chairman Powell is so miffed at President Trump, he doesn’t want to do anything that Trump wants. It would also not surprise me if that attitude has suffused the bulk of the FOMC. The irony remains that Governors Cook and Jefferson are raging doves but would rather keep policy tight to stymy Trump rather than act as they otherwise would. At least that’s my take.

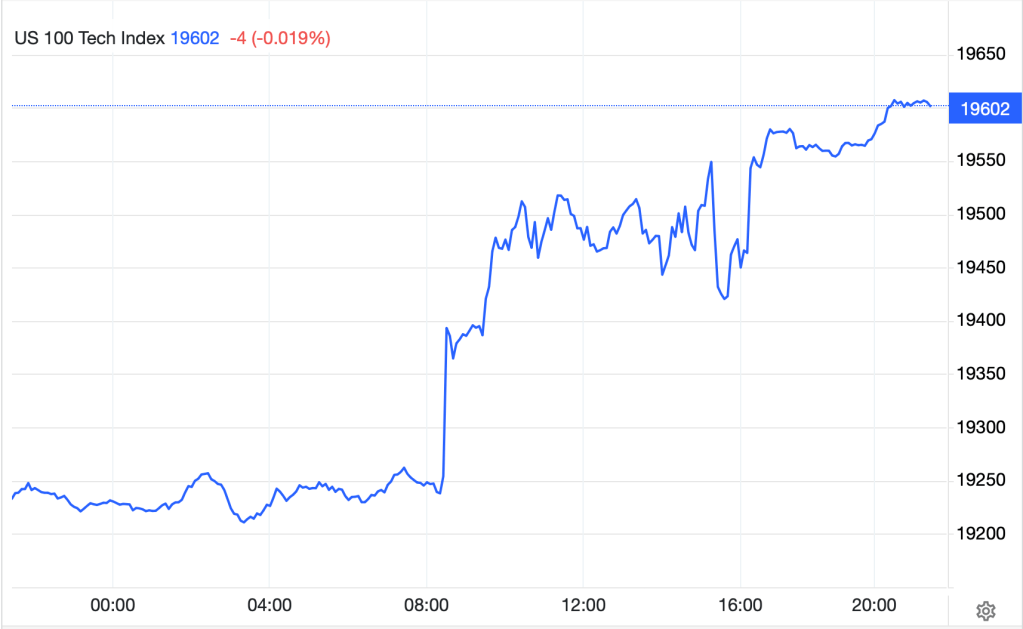

Anyway, that’s what we have to look forward to this morning. So, how have things behaved overnight? Let’s look. Tokyo (+2.3%) continues to be the star of the show, continuing to rally on excitement and optimism that PM Takaichi is going to solve Japan’s problems. Maybe she will, but they have a lot of them, so it will take time. But the tech story is strong there and it appears that foreign buying is picking up, which has been one of the drivers of the JPY (+0.5%) lately. In fact, this week, the yen is leading all currencies having gained more than 2.3% so far.

Source: tradingeconomics.com

As to the rest of Asia, China (-0.2%) and HK (+0.3%) did little although the tech-based Korean (+1.0%) and Taiwanese (+1.6%) exchanges did well, as did Australia (+1.6%) on the back of stronger metals prices. One other interesting note is Indonesia (+2.0%) where the government just restricted mining of Nickel (+1.7%) in order to raise the price of their largest export!

Europe is a lot less interesting with the continent under some pressure (France -0.2%, Spain -0.3%, Germany -0.2%) although the UK (+0.7%) is performing well on the back of strength in mining and natural resource shares. US futures at this hour (7:35) are pointing slightly higher, about 0.15%.

In the bond market, things have gone back to sleep with 10-year yields lower by -1bp pretty much throughout the US and Europe. JGB yields also did nothing last night, and it appears that despite the massive debt that continues to grow around the world, bond investors are comfortable right now. Perhaps they see deflation in our future, but that doesn’t feel right to me.

Turning to the markets that continue to show the most volatility, commodities, let’s start with oil (+2.1%) which is demonstrating concern over re-escalating tensions regarding Iran, the negotiations and the potential for military activity there. There are reports that the US may intercept Iranian tankers and if you look at the chart below, a pretty good uptrend has developed over the past two months. You won’t be surprised that NOK (+0.6%) has benefitted from today’s move either.

Source: tradingeconomics.com

As to the precious metals, after yesterday’s modest decline, we are back on the rise with gold (+0.85%), silver (+5.5%), copper (+2.1%) and platinum (+3.3%) all nicely higher. The silver story is about declining inventories in Shanghai, which was the last place that can afford it since both the COMEX and London are already light on available ounces. While we saw a dramatic decline nearly two weeks ago, I have to say things appear to be shaping up to recoup all those losses and then some!

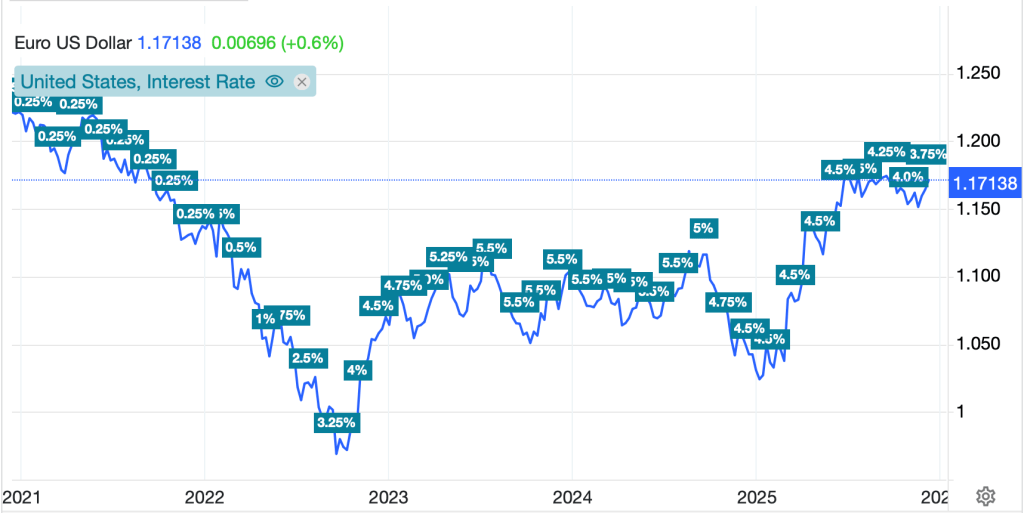

Finally, the dollar is back under pressure this morning across the board. I’ve already mentioned the two biggest movers and AUD (+0.5%) joins the list on the back of commodity strength. Otherwise, the movements are not terribly large here, with the euro (+0.1%), pound (+0.3%), KRW (+0.3%), and ZAR (+0.2%) indicative of the situation. I expect that the dollar will be responsive to today’s NFP data with a strong print helping the dollar and a weak one pushing it down a bit further. However, remember that it remains within its trading range, albeit nearer the bottom than the top of that range as per the below.

Source: tradingeconomics.com

And that’s really it for today. The NFP should drive the first movement and after that, there is still White House bingo for fun and surprises. While the dollar is soft, I don’t see a collapse coming, and in the end, the more I read about EU energy policy, I can only expect that any collapse will be that of the euro, not the dollar. But that is a ways into the future I think.

Good luck

Adf