The zeitgeist, of late, has been leaning

Toward welcoming gov intervening

Because costs have soared

So, folks once abhorred

Like Socialists, seem more well-meaning

Perhaps, though, the story’s much deeper

And points to a latent grim reaper

Elites on one side

Claim Trump’s only lied

While Populists serve as gatekeeper

Quite frankly, I feel like markets have become very secondary to an understanding of what is happening in the economy, and while there is intrigue over who may be the next Fed Chair, and correspondingly, if Mr Powell will resign from the FOMC when his chairmanship is up, I believe that pales in comparison to much larger macroeconomic issues with which we all have to deal on a daily basis. Once again, my weekend reading has highlighted two key pieces that I believe do an excellent job of explaining much of what is going on, not just in the economy, but in the streets.

Last week, I highlighted Michael Green’s piece regarding a new estimate of what the poverty line looks like, putting paid to the idea that the official government level of $31,500 is appropriate, and that in suburban NJ (Caldwell to be exact) it is more like $140K. Now, you will not be surprised that his piece garnered a great deal of attention given its premise, but I will not go into that. However, he did write a follow-up piece which is worth reading and where he discusses the reaction. In brief, whatever number is correct, it is clear that $31.5K is laughably low. Ultimately, I believe this work has quantified the concept of the “vibecession” which has been making the rounds for a while. People are allegedly making a decent living and yet are living paycheck to paycheck because the cost of living (not inflation) has risen so remarkably over time and priced many folks out of previously ordinary levels of attainment.

Which brings me to the second key piece I read this weekend, this from Dr Pippa Malmgren, which does a remarkable job explaining how the nation (and not just in the US, but we are more familiar here) has (d)evolved into two groups; Elites and Populists. The former are the old guard politicians (both Democrats and Republicans), the global organizations like the World Bank, IMF, UN and WEF, and more perniciously in my mind, the so-called deep state. The latter are personified by President Trump, but include NYC Mayor-elect Mamdani, AfD in Germany, Marine LePen in France and Victor Orban in Hungary, and their followers, to name a few.

The frightening conclusion Dr Malmgren drew was that there is no ability for a nation to continue to operate successfully if the population is split in this manner, and that eventually, one side is going to wind up victorious. I would say this is the very definition of the 4th Turning and we are living through it.

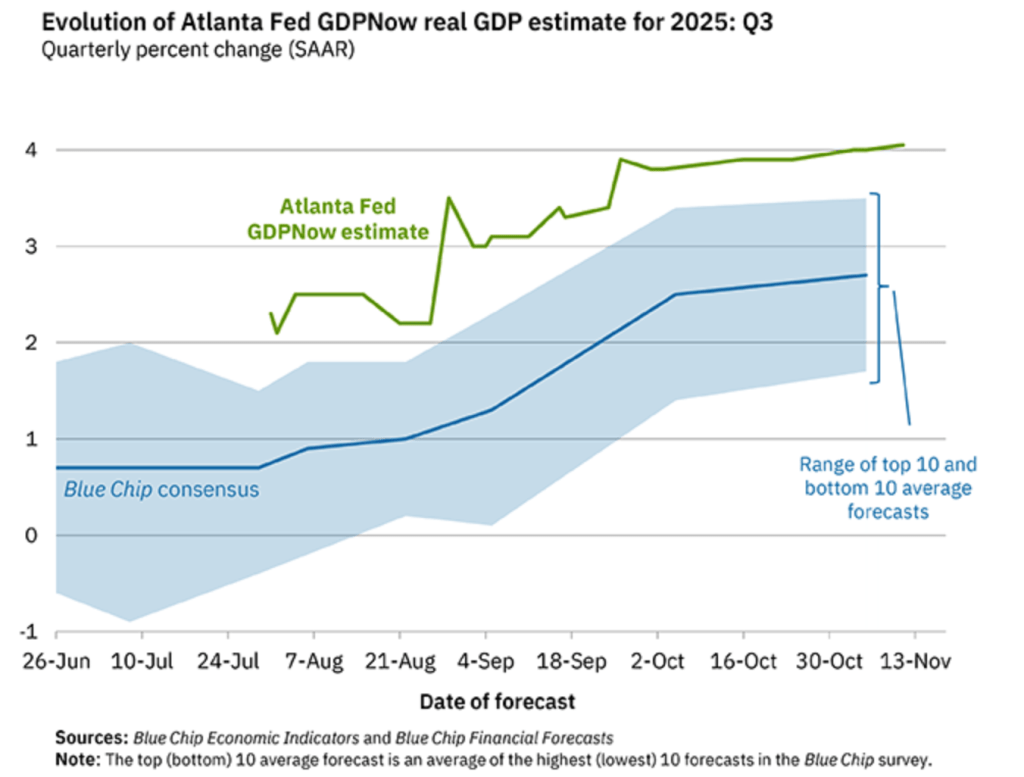

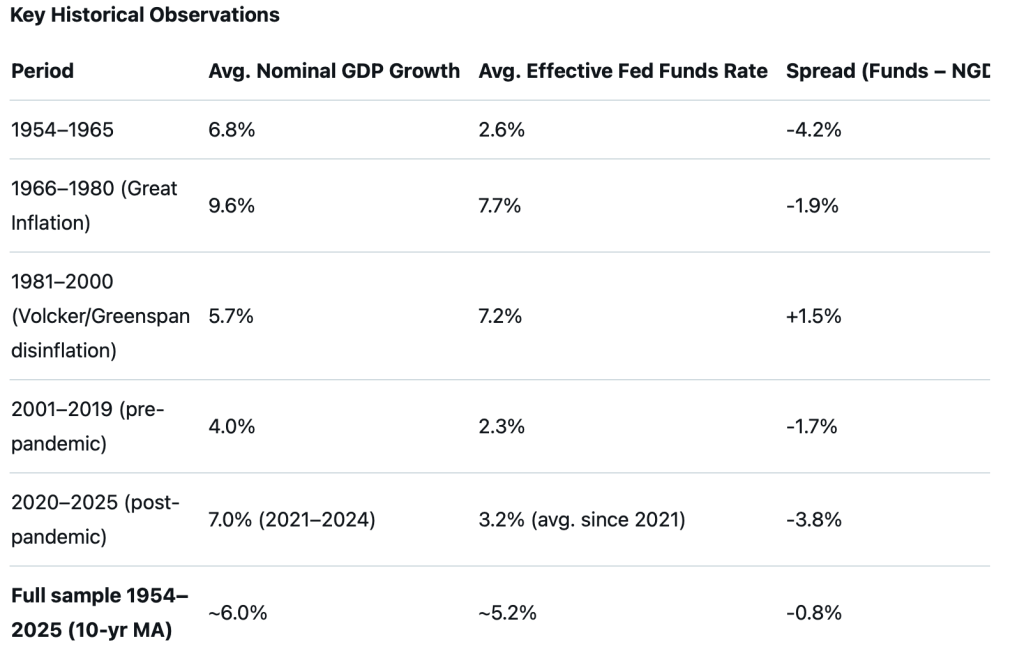

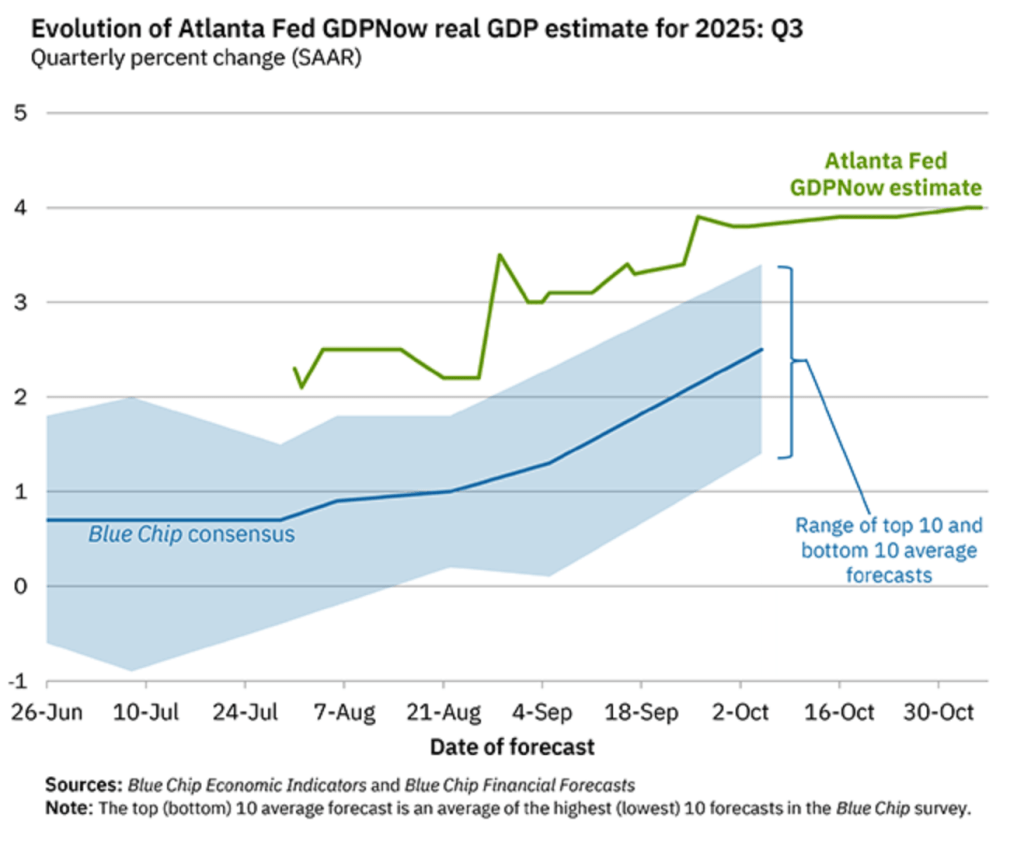

So, we must ask, what are the potential ramifications from a financial markets perspective with this backdrop? I have repeatedly highlighted that the Trump administration is going to “run it hot” going forward, meaning the goal will be to increase nominal GDP fast enough to outweigh the inevitable rise in prices. The idea is if incomes rise quickly enough, people will be able to tolerate rising prices more easily.

But the one thing of which I am increasingly confident is that prices and their rate of change are going to rise under this scenario. As central banks leave policy easy, or ease further in an effort to support their respective economies, that is going to be the outcome. A look at the chart below from the FRED data base of the St Louis Fed shows there is a very strong relationship between CPI and nominal GDP. In fact, I ran the numbers and the correlation for the past 75 years has been 0.975! Prices are going to rise friends, alongside M2.

What does this mean? It means that the debasement of fiat currency is going to continue apace and so commodities, notably precious metals, but also base metals and property are going to be recognized as better stores of wealth. If you wonder why gold (+0.9%) and silver (+2.2%) are continuing to rocket higher, look no further than this. What about equities? For now, I expect they will continue to perform well as all that liquidity will be looking for a home although this morning, not so much as US futures are lower by -0.5% across the board. Bonds? This is a tougher call, and I suspect that the yield curve will steepen further as central banks press short rates lower, but inflation undermines long duration fixed income assets. Finally, the dollar remains, in my view, one of the best of the fiat currencies, but like all of them, will continue to degrade vs. gold and hard assets.

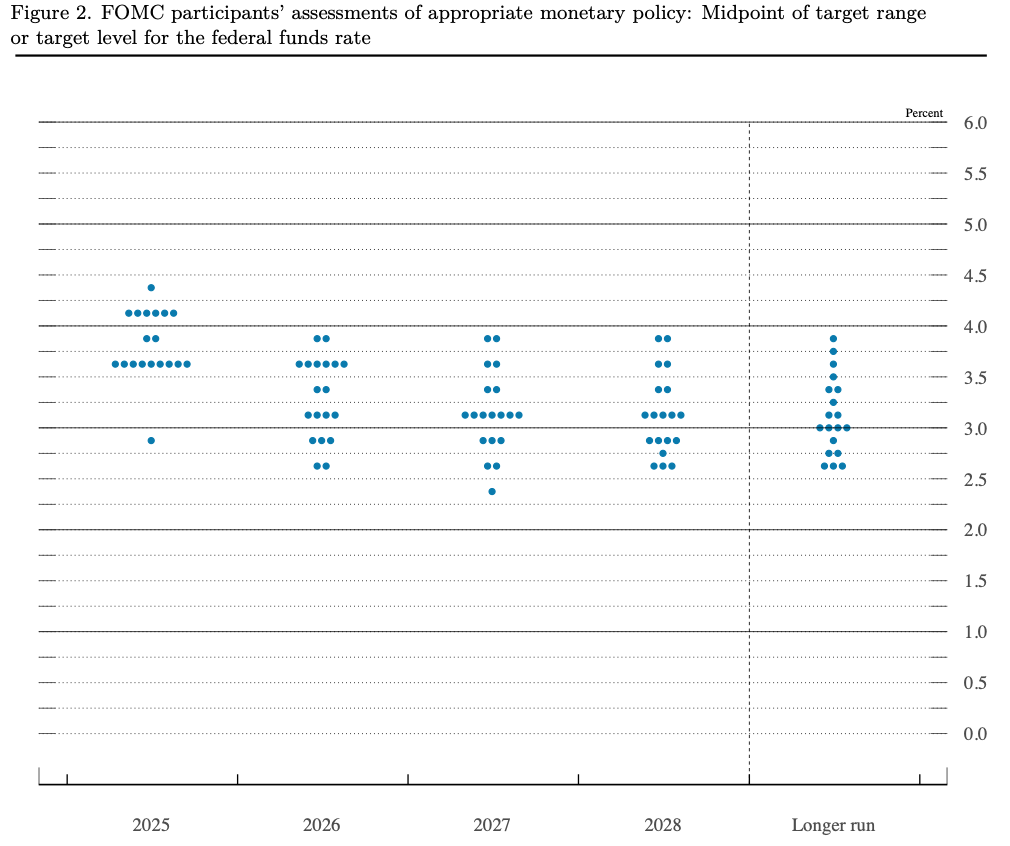

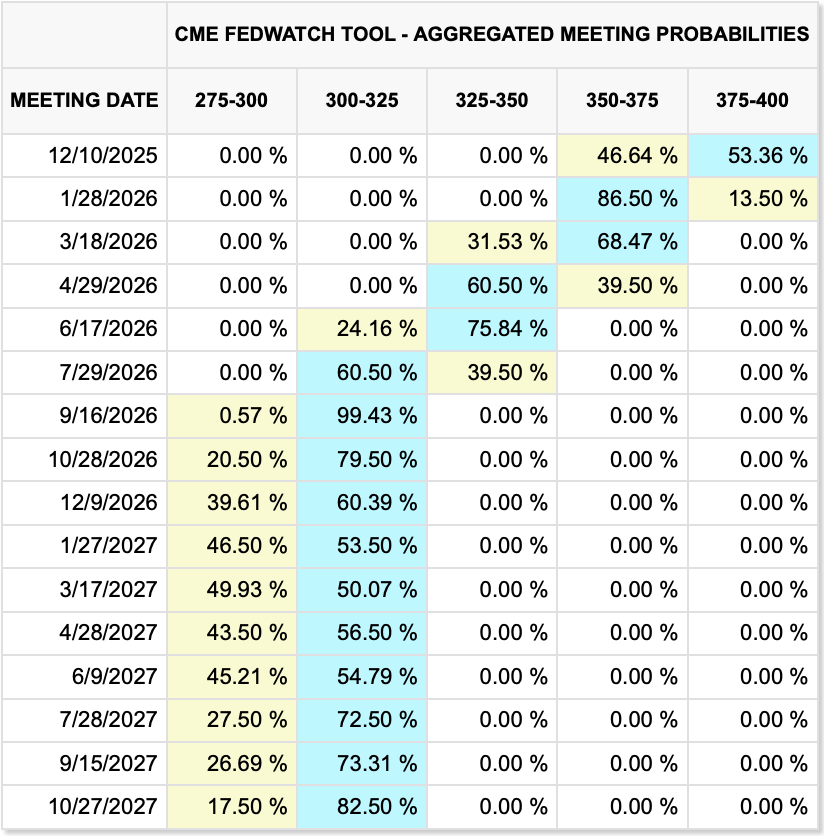

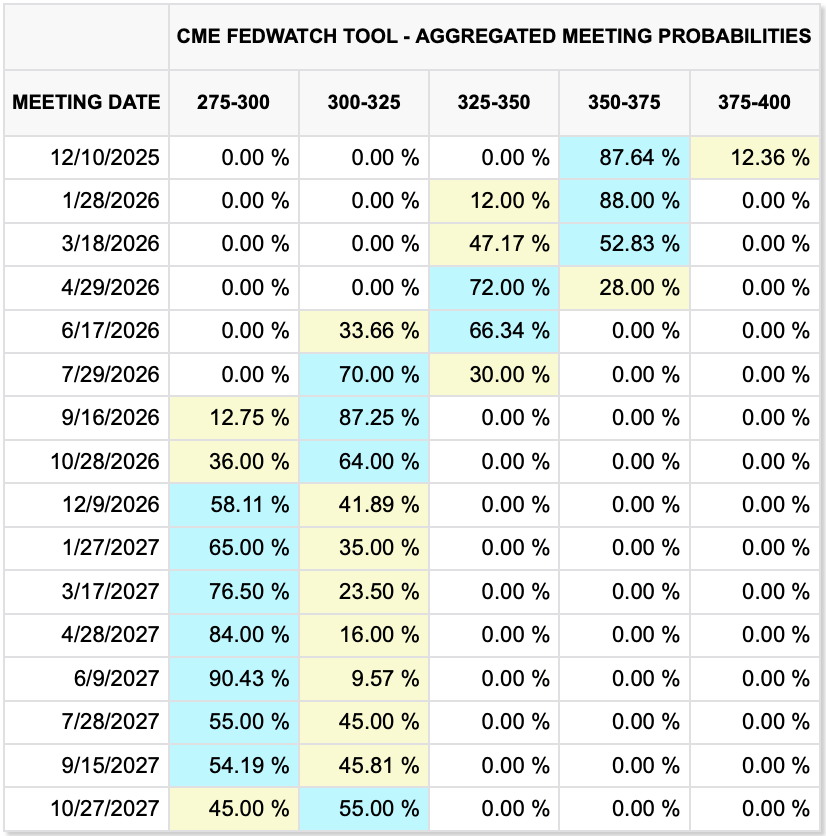

Keeping that in mind, there are two other stories of note this morning, only one of which is impacting markets. The non-impactful one is that apparently President Trump has selected Kevin Hassett, currently the White House Economic Council Director, as the man to succeed Jay Powell in the chair. He is a long-time political operative with deep ties in Washington and I presume will get through the vetting and be confirmed on a timely basis. As I wrote above, it is not clear to me the Fed matters as much as other things in the current environment, although we will continue to hear about it. In this light, the Fed funds futures market is currently pricing an 87.5% probability of a 25bp cut next week and is back to a 58% probability of a total of 100bps of cuts by the end of 2026 as per the below from the CME.

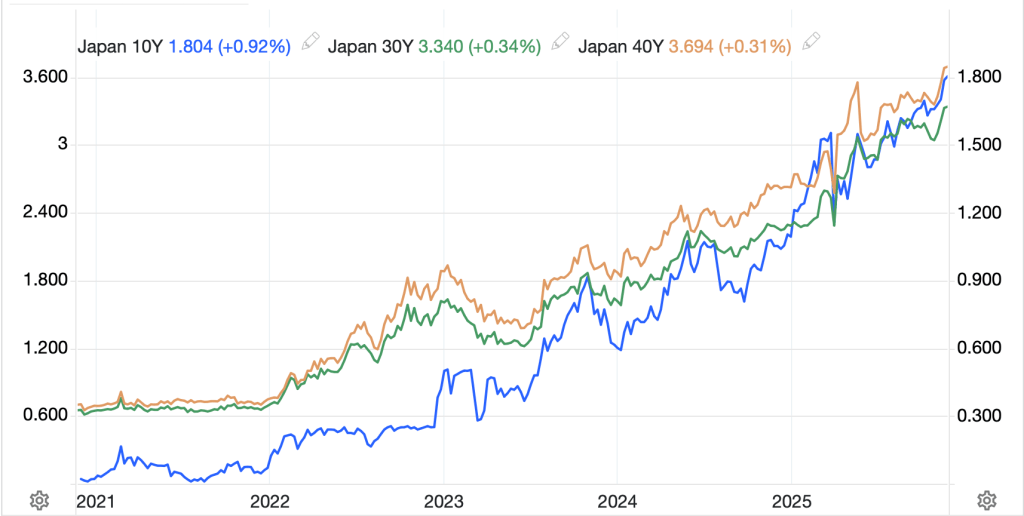

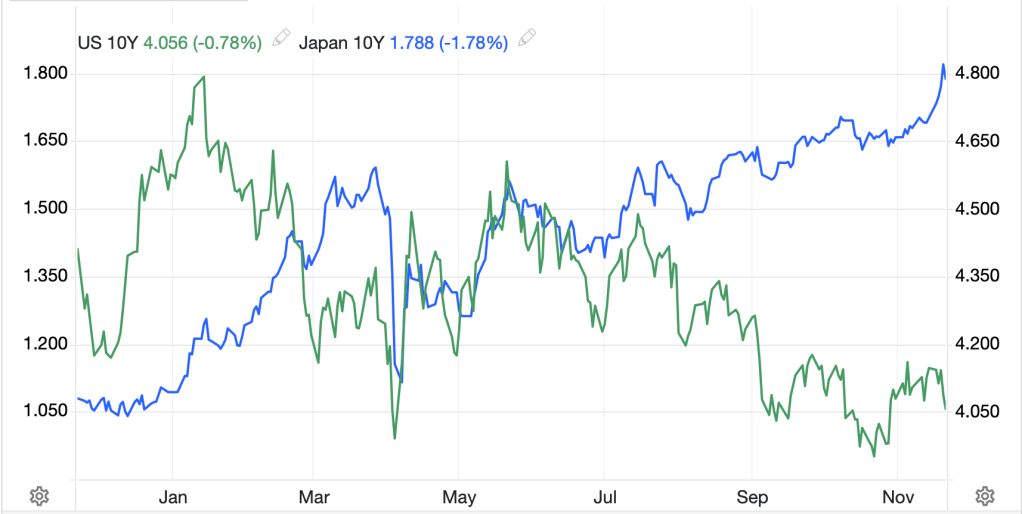

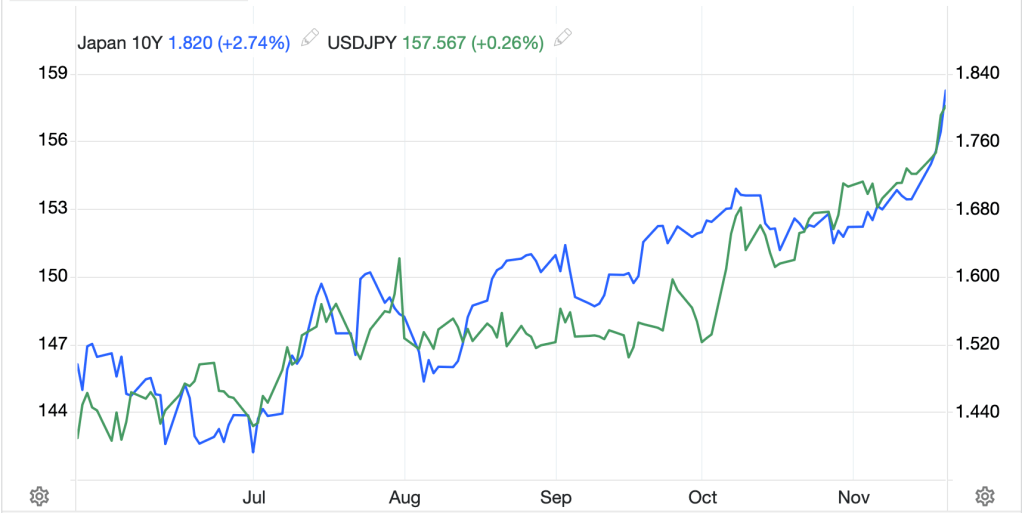

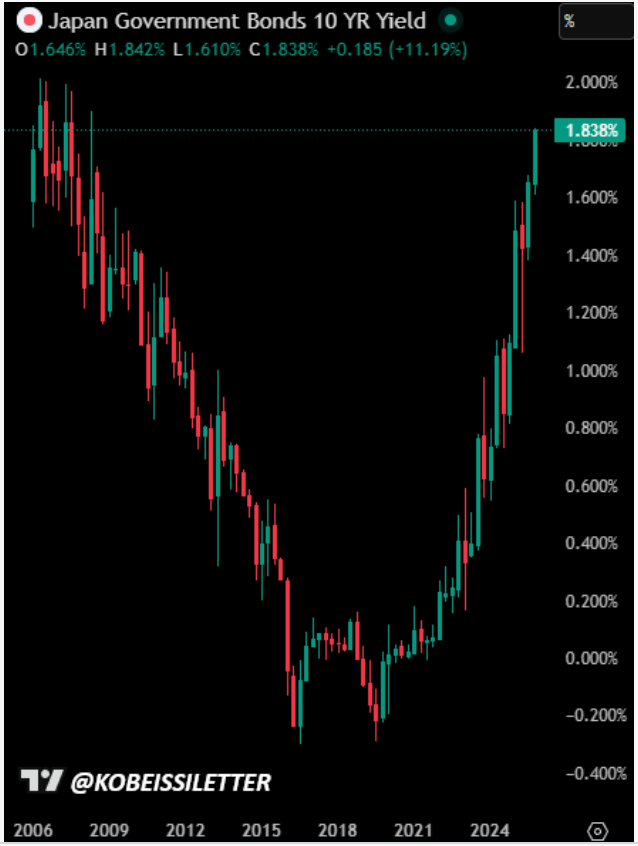

The other story of note, this one definitely impacting markets, is the news that Ueda-san hinted more definitively at a Japanese rate hike later this month, with Japanese swaps market raising the probability of that hike to 80% from about 60% last week. The knock-on effects were that 10-year JGB yields jumped 7bps, to 1.86%, their highest level since 2008 and as you can see from the chart below, continue to trend strongly higher. Of course, given that inflation in Japan remains well above target, it is not that surprising that yields are climbing.

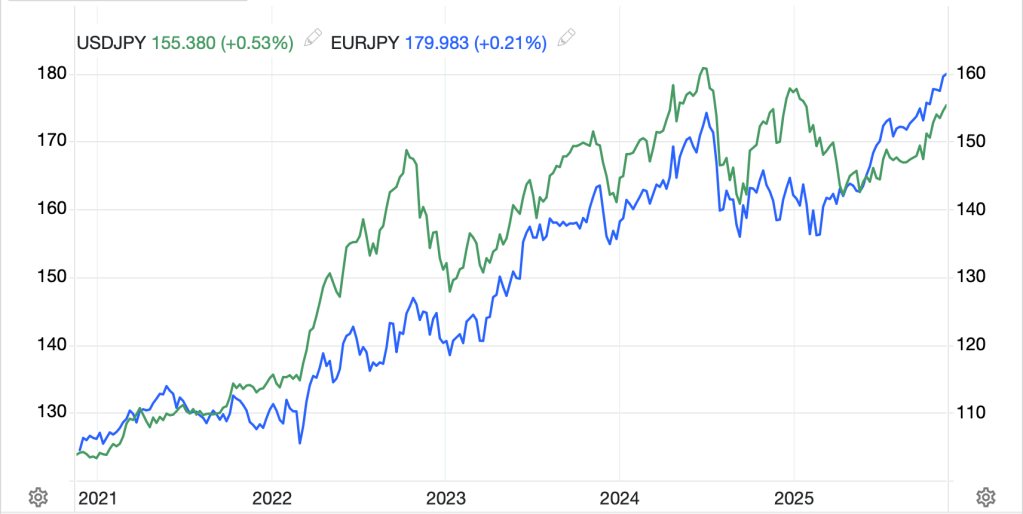

Too, the other outcome here has been the yen (+0.7%) gaining a little ground, as per the below chart from tradingeconomics.com, and perhaps we have seen a short-term low in the currency. Certainly, the increasing probability of US rate cuts is weighing on the dollar overall, so that is part of the story, but it remains to be seen if there are going to be wholesale changes in investment allocations that would be necessary to completely reverse the yen’s remarkable weakness over the past nearly four years.

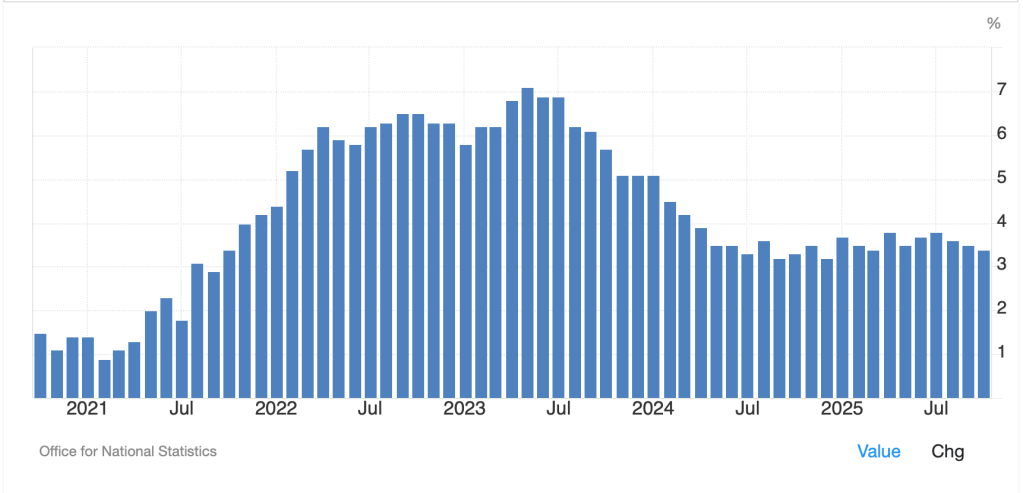

The move in JGB yields has been blamed for the rise in yields around the world with Treasury and European Sovereign yields uniformly higher by 3bps this morning while some other regional Asian yields climbed between 4bps and 6bps. In the end, inflation remains a problem almost everywhere in the world and I think that is what we are witnessing here.

As well, the JGB move was seen as the cause for Japanese equities’ (-1.9%) very weak performance which also dragged down some other regional markets (Taiwan, Australia, Philippines) but was not enough to undermine the rest of the region. The flip side of that weakness was China (+1.1%) and HK (+0.7%) where it appears that hopes for a Fed rate cut more than offset weaker than forecast PMI data from China. Another interesting story from the mainland was that the monthly Housing price data that was compiled by two key private companies was squashed by the Chinese government after China Vanke, one of the largest Chinese property companies, explained they would be late on an interest rate payment. One can only imagine what that data looked like!

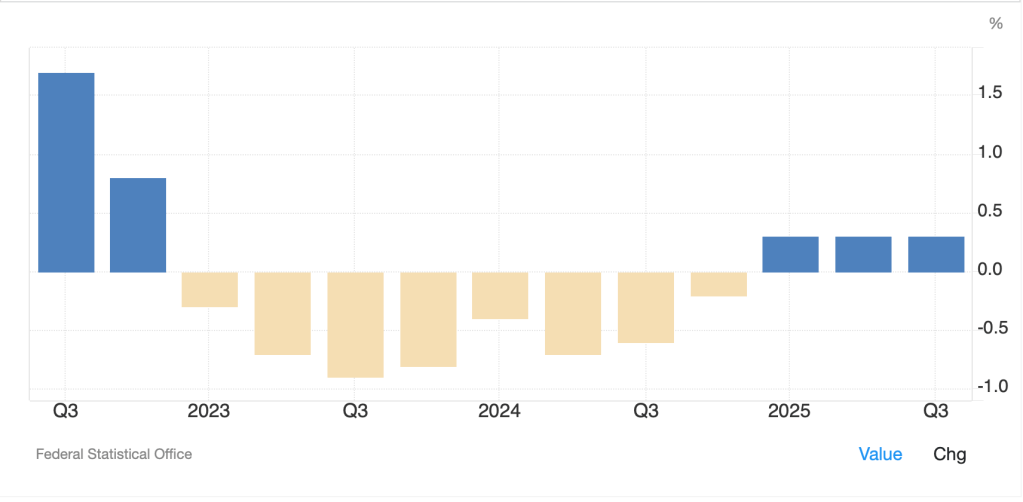

Meanwhile, in Europe, red is the color led by Germany’s DAX (-1.5%) although with weakness across the board (CAC -0.8%, IBEX -0.6%, FTSE MIB -0.9%). Apparently, the story that progress has been made regarding peace talks in Ukraine is not seen as a positive there. After all, if there is peace, will European governments still be so keen to build out their military, spending billions of euros at local defense and manufacturing firms? It seems after a very strong close to the month in November, there is a bit of profit taking underway this morning.

In the commodity space, oil (+1.3%) is bouncing back to its trend line after OPEC confirmed it will not be increasing production in Q1 next year at a meeting yesterday. I would expect that a real peace deal would be negative for this market as some part of that would be the relaxation of sanctions, I would assume. But maybe I’m wrong there. However, I continue to believe the trend is modestly lower going forward as there is far more supply available. As to the other metals, both copper (+0.6%) and platinum (+1.5%) are continuing their runs higher with no end currently in sight.

Finally, the dollar is softer overall this morning, and while the yen (+0.7%) is the leader, the euro (+0.3%), SEK (+0.3%) and CHF (+0.25%) are also nicely up on the day with the rest of the G10 little changed. The real movement, though, has been in the EMG bloc with CZK (+0.75%), HUF (+0.5%), PLN (+0.5%), and CLP (+0.4%) all benefitting from the Fed rate cut story as well as Chile’s benefits from copper’s rally. While a cut seems highly likely, I suspect the real dollar story will be about the dot plot and SEP as well as Powell’s presser next week.

I’ve already run too long so will just mention that ISM Manufacturing (exp 48.9) is due this morning and I will review the week’s data expectations tomorrow.

The world is changing and I expect that we will continue to see volatility across markets as investors come to grips with those changes, whether simple central bank rate decisions or more complex social movements and electoral outcomes that lead to major policy changes. Be careful out there.

Good luck

Adf