The Fed has a banker named Jay

Who last week was quick to betray

His fervent belief

He can’t come to grief

If Trump wants to force him away

This morning his Journal lickspittle

Wrote glowingly ‘bout Jay’s committal

To stand strong and firm

And finish his term

No matter how much he’s belittled

First, on this Veteran’s Day holiday, let us all pause a minute and remember those veterans who gave their lives for our nation.

The reverberations of Donald Trump’s re-election last week continue to be felt around the world with comments from virtually every walk of life explaining their joy/distress at the outcome and trying to prognosticate what will play out in the future. I will tell you that I have no idea how things will evolve, although I am hopeful that his administration will be able to reduce the size of the federal government as that can only be a benefit.

But one of the things that we learn about people during times of change, especially people who believe they are crucially important to the world, is just how much they believe they are crucially important to the world. Nothing highlights this quite like the lead article in this morning’s WSJ titled, If Trump Tries to Fire Powell, Fed Chair Is Ready for a Legal Fight. This is not to say that Powell doesn’t have an important role, he certainly does. But this pre-emption of the entire question is a testimony of just how important he thinks he is.

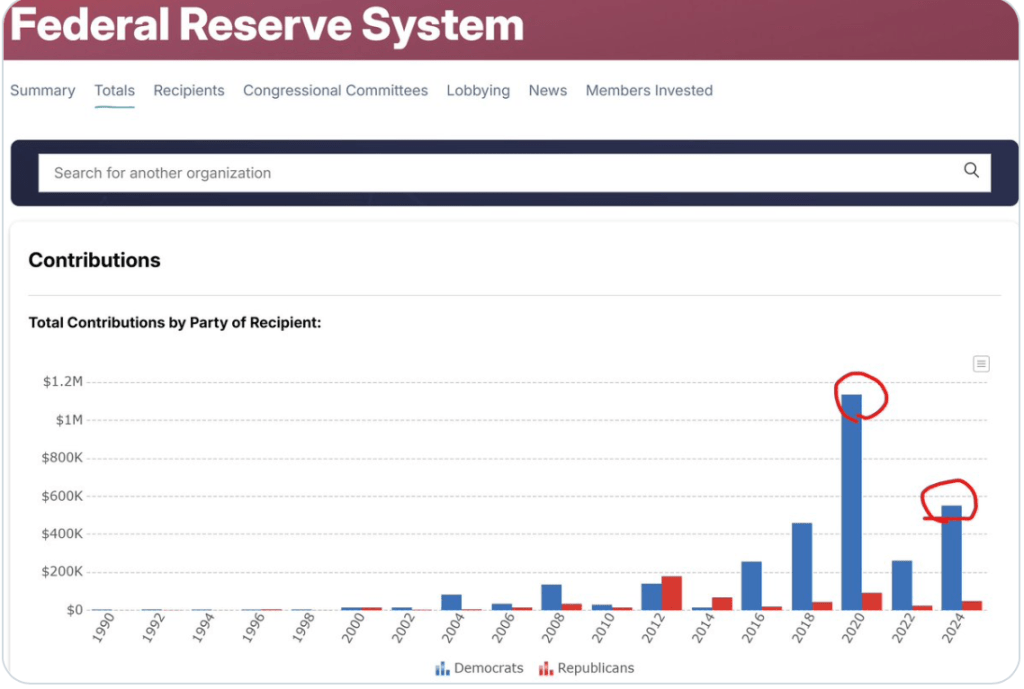

My one observation on this is that despite all the discussion that the Fed isn’t political, it is clearly a very political institution. Nothing highlights that better than this Tweet from Joseph Wang (aka @FedGuy12), a commentator who spent a dozen years at the Fed and understands its inner workings quite well. Under the rubric that a picture is worth 1000 words, take a look at Federal Reserve political contributions below and then ask yourself if the Fed is not only political, but partisan.

Source: X @FedGuy12

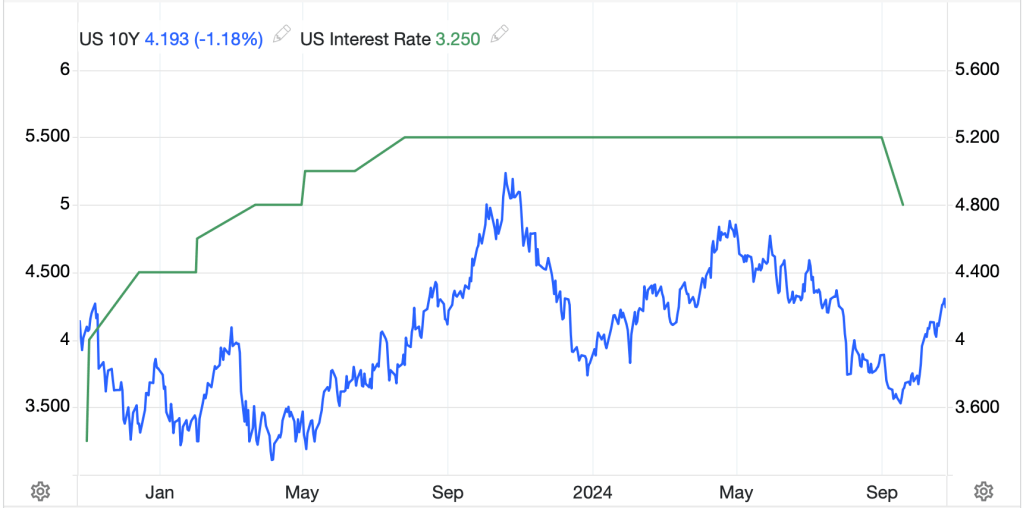

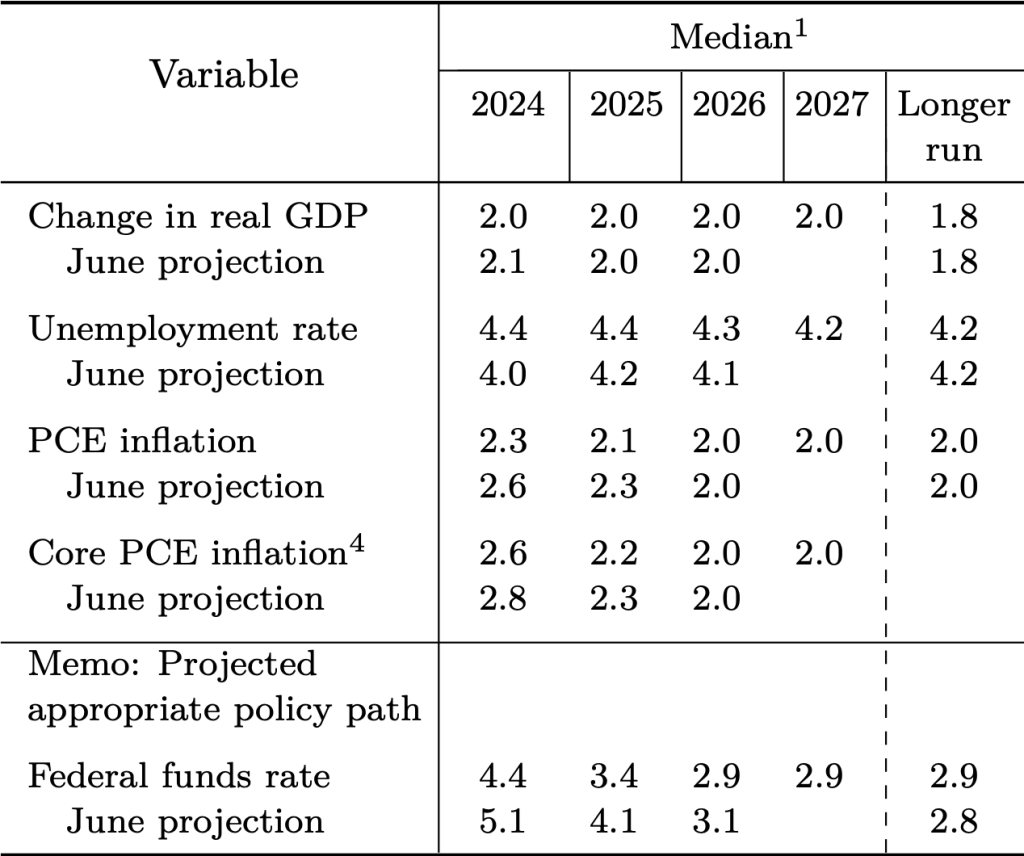

It is important to recognize this as it also may help explain why the Fed is cutting interest rates despite GDP (currently 2.8%) and Core PCE (currently 2.7%) running far above their long-term expectations and Unemployment (currently 4.1%) running below their long-term expectations as per the below SEP from the September FOMC meeting. If anything, I might argue they should be raising interest rates!

Source: fedreserve.gov

At any rate, the ramifications of this election outcome are likely to drive the market narrative for a while yet.

But overnight, there just wasn’t that much of interest, at least not that much new. So, let’s take a look at overnight market activity. After Friday’s latest record high closes in the US, the picture in Asia was less robust with Japanese equities basically unchanged on the day after Shigeru Ishiba was elected PM to run a minority government, while Hong Kong (-1.5%) and mainland Chinese (+0.7%) shares went in opposite directions. Chinese financing data was released that was mildly disappointing, but there are several stories about how the government is going to reacquire land that is currently in private hands but not being used and repurpose it for benefit. The rest of the region had many more laggards than gainers, perhaps on concerns that Trump will be imposing tariffs throughout the region. As to Europe, despite all the pearl clutching by the leadership there, equity investors are excited with gains seen across the board (DAX +1.3%, CAC +1.2%, FTSE 100 +0.8%). US futures at this hour (7:30) are continuing their ride higher, up 0.4%.

In the bond market, Treasuries aren’t really trading today with banks closed. In Europe, sovereign yields have edged down between 1bp and 2bps, perhaps feeling a little of that equity euphoria, as there was precious little in the way of news or commentary to drive things.

In the commodity space, oil (-1.7%) is under further pressure as broadly slower global growth undermines demand while prospects of the Trump administration fostering significant additional drilling opportunities helps build the supply side. However, NatGas (+7.0%) is soaring this morning as Europe, notably Germany, is suffering from dunkelflaute (maybe the best word I have ever heard) which means ‘a period of low wind and solar power generation because it is cloudy, foggy and still’, and so they need to buy a lot more NatGas to power the economy. In fact, NatGas is higher by nearly 15% in the past month although remains substantially cheaper in the US than in Europe and Asia. My take is this discrepancy cannot last forever. As to the metals markets, they are under pressure again this morning with both precious (Au -0.9%, Ag -0.3%) and industrial (Cu -0.5%, Al-1.4%) feeling the pain.

A key driver in the metals space is the dollar, which is rallying against all its counterparts this morning quite robustly. The euro (-0.6%) is back to levels last briefly touched in April, but where it spent more time a year ago, as it seems to be heading to 1.05 and below. Meanwhile, JPY (-0.8%) is also feeling the heat while NOK (-0.7%) is pressured by both the dollar’s general strength and the oil weakness. In the EMG bloc, MXN (-1.3%) is having a rough go as the tariff talk heats up, but we have also seen weakness in EEMEA with ZAR (-1.4%), PLN (-1.0%) and HUF (-1.2%) all under pressure this morning. Not to be outdone, Asian currencies, too, are selling off with CNY (-0.3%) back above 7.20 for the first time since August while THB (-0.9%), MYR (-0.7%) and SGD (-0.6%) demonstrate the breadth of the move.

With the holiday, there is no data to be released today, but this week brings CPI amongst other things.

| Tuesday | NFIB Small Biz Optimism | 91.9 |

| Wednesday | CPI | 0.2% (2.6% Y/Y) |

| Ex food & energy | 0.3% (3.3% Y/Y) | |

| Thursday | PPI | 0.2% (2.3% Y/Y) |

| Ex food & energy | 0.3% (2.9% Y/Y) | |

| Initial Claims | 224K | |

| Continuing Claims | 1895K | |

| Friday | Retail Sales | 0.3% |

| -ex autos | 0.3% | |

| Empire State Mfg | -1.4 | |

| IP | -0.3% | |

| Capacity Utilization | 77.2% |

Source: tradingeconomics.com

In addition to this data, we hear from 11 different Fed speakers this week, including Chairman Powell again at 3:00pm on Thursday afternoon. It is difficult to believe that the message from last week is going to change, but you never know. However, I expect that every one of them is going to be explaining that things are good, but they are cutting rates to ensure things remain that way as they consistently congratulate themselves on having slain inflation. I hope they are right…I fear they are not.

For now, though, the US economy remains the strongest in the world (7% budget deficits will help prop up growth after all) and capital continues to flow in this direction. I see no reason for the dollar to fall anytime soon. Whatever problems lie ahead, I believe they are over the metaphorical horizon and other than a few doomporn purveyors, not in the market’s view.

Good luck

Adf