While many, last night, were dismayed

By Jensens’s results as displayed

Most markets worldwide

Absorbed them in stride

As buyers keep up their crusade

Meanwhile, Europeans still fear

That things won’t get better this year

The war in Ukraine

Is at it again

While sentiment points to more drear

Please understand, I only write about Nvidia because it is topic number one in the markets overall, albeit not very important in FX for now. So, briefly, despite record revenues and earnings, the numbers were slightly below expectations, and the immediate result was for the share price to decline about 3% or so. As I type this morning, though, it has already begun to recoup some of those losses and while there are many commentators claiming this was a disaster and forecasts are unrealistic, my sense is the company is going to continue to churn out chips and profits. I read that their gross margins are 72%, a remarkably high number. In the end, it is hard for me to look at these results and think the end is nigh. So, let’s move on.

A moment, first, to remember the tragedy in Minneapolis where two children were killed in a church shooting on the first day of school there as well as the increase in hostilities in Ukraine where last night Russia launched a massive aerial attack on Kyiv, sending 629 missiles and drones of which 40 got through and 14 were killed along with 38 injured. At this time, it certainly doesn’t look like hostilities in Ukraine are about to end and I think it is fair to say that the only one seeking that result is President Trump. Clearly Putin is determined to conquer Ukraine, clearly Zelenskiy is determined to resist and apparently the entire EU wants to continue the fight regardless of the costs.

My sense is the problem for Europe is that it is a theoretical construct, not a nation. As such, it cannot make decisions on a timely basis as a group. So, while some want to rearm and fight, others are reluctant to do so and would rather free ride. This lack of cohesion makes the EU a very unstable partner and will hinder their efforts to do more than continue to shovel money to Zelenskiy and Ukraine. The war has been ongoing for more than three years and I have become of the opinion that it will not end until one side runs out of resources. Ukraine’s attacks on Russia’s oil infrastructure are starting to have an impact, but it remains to be seen if they can keep those up while Russia continues to bombard population centers.

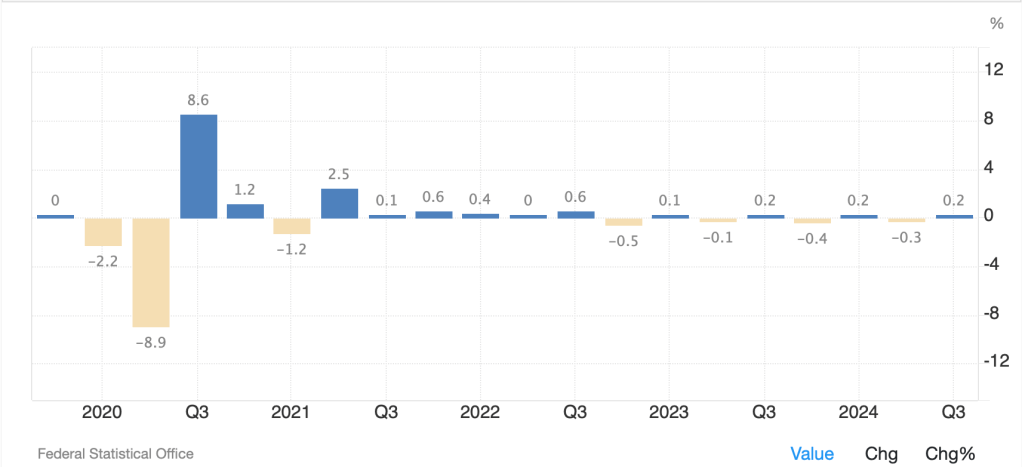

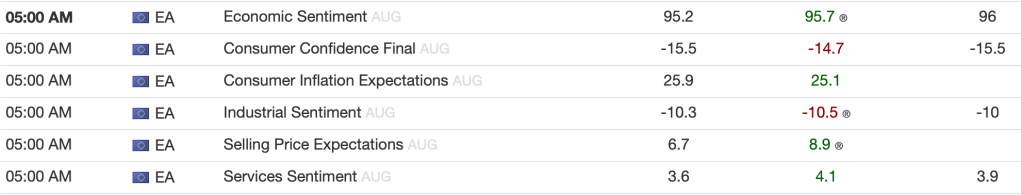

With that as backdrop, perhaps we should not be surprised that the data released this morning from the Eurozone showed Confidence and Sentiment indicators for both businesses and consumers falling compared to last month and relative to expectations. Looking at the data from tradingeconomics.com, you can see that the August results were worse for everything with confidence falling but concerns over inflation rising.

Actual Previous Estimate

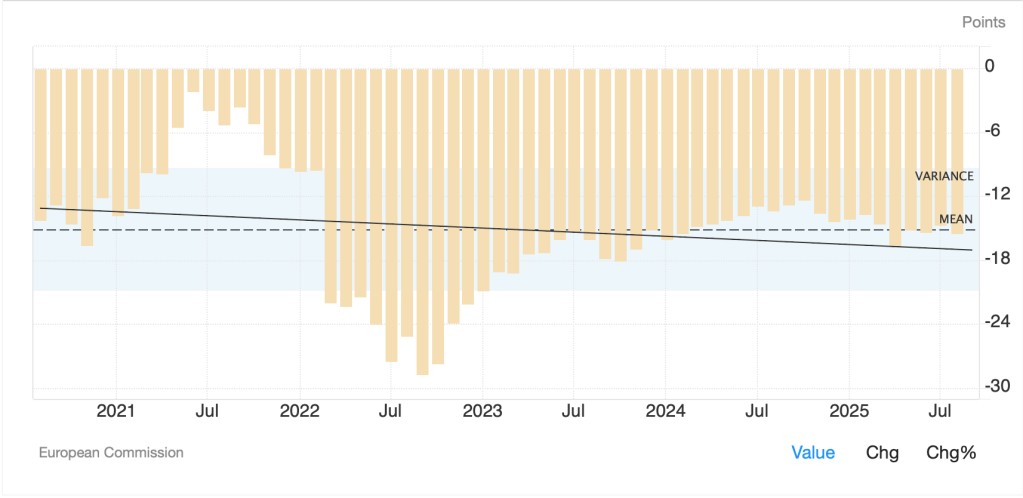

While these numbers are not devastating in themselves, the trend is not positive. Selecting just one, Consumer Confidence in this case, you can see that while not the worst it has been over the past 5 years (the initial invasion of Ukraine marked the nadir), the trend is not very friendly. And pretty much all the charts are the same, not the worst but trending the wrong way.

Source: tradingeconomics.com

I make these points because I continue to read about negative sentiment regarding US assets and the dollar, and yet I cannot help but look at the Eurozone and see a negative situation. I agree that if the Fed starts to get aggressive cutting rates, which seems unlikely as long as Powell remains Chair, the dollar will fall, but is Europe really where you want to be? I’m not convinced.

Away from that, not much else has been happening (it is the last week of August, and it appears almost everyone is on holiday) so let’s look at overnight price action. Leading up to the Nvidia earnings, equities in the US rallied, and despite the Nvidia disappointment, futures are currently (7:15) unchanged across the board. Last night in Asia, China (+1.8%) was the leader, reversing yesterday’s declines with the talk of the town still AI and China’s new AI Plus strategy. Meanwhile, the Hang Seng (-0.8%) disagreed with the mainland although there was no separate news. Tokyo (+0.7%) was solid, but elsewhere in the region there were more laggards (India, Taiwan, Philippines) than winners (Korea, Australia) with the winners just barely so.

With that Eurozone data, you will not be surprised that European shares are generally softer, with the major bourses lower by between -0.2% and -0.4% and only the CAC (+0.1%) bucking the trend. Perhaps this is because the French FinMin, Eric Lombard, claimed France would be able to pay its bills although it seems clear the current government is going to fall when the confidence vote is held on September 8th.

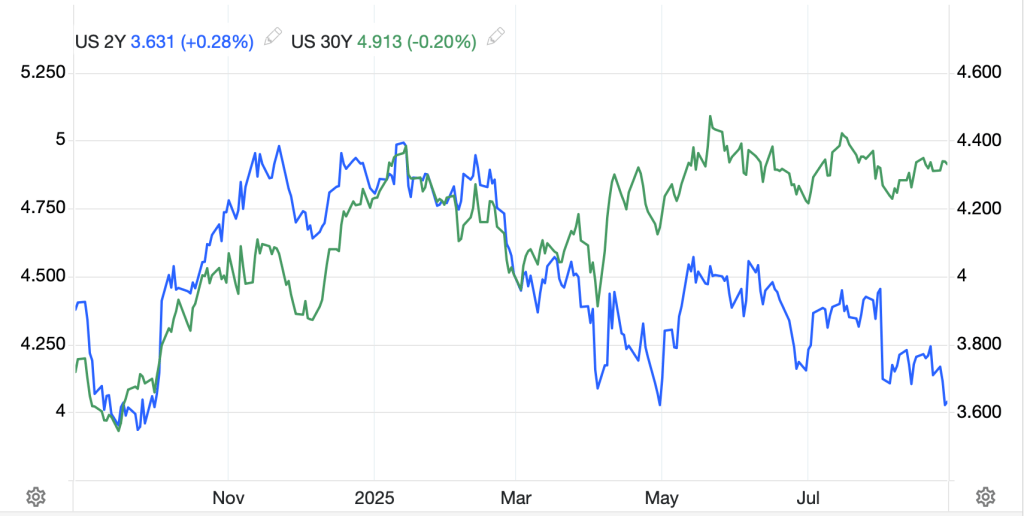

In the bond market, 10-year Treasury yields are unchanged this morning and edging toward the lower end of their recent trading range, with no indication that there is a funding problem for the US. However, it is worth noting that the yield curve is steepening in the US (and everywhere else) as the 2yr-30yr spread is now 128bps and as you can see from the chart below, that spread has been widening all since July. (30yr yields are in green and the LHS Y-axis).

Source: tradingeconomics.com

When the yield curve inverted back in 2020, there was much talk of its prowess as a prognosticator of coming recessions. However, we are still awaiting that recession. In fact, I believe history shows it is when the curve steepens sharply that more problems occur. It is easy to look at this and see the market is expecting inflation to continue to rise especially given the Fed seems to have put inflation in the back seat of their mandate. Beware!

In commodities, oil (-0.1%) is stabilizing after a solid rally yesterday as the EIA data was a somewhat larger draw on inventories than expected and perhaps Ukraine’s recent successes regarding attacks on Russian oil infrastructure has some folks concerned. However, as my friend JJ who writes Market Vibes notes, open interest is declining fast, and activity remains very slow in the space. At the same time, gold (+0.3%) rallied all day yesterday and is continuing this morning and dragging silver (+1.1%) along for the ride. Spot gold is back above $3400/oz, a level that had seemed toppish for quite a while. Perhaps this is the long-awaited break higher the gold bugs have been talking about, but I think we need to see another $100/oz to make that commitment and that likely would entail a much weaker dollar, something that has not yet been happening.

Turning to the dollar, while it is a touch softer this morning, -0.3% as per the DXY, if you look at the chart below (which resembles so many charts these days) since the post-Liberation Day volatility, it is hard to get excited about a move in either direction. We will need a new out of the box catalyst and I just don’t know what that will be.

Source: tradingeconomics.com

While the dollar’s weakness this morning is universal, the biggest mover overnight was KRW (+0.6%) which rallied after BOK governor Rhee defended their intervention, even indicating it is part of the trade deal with the US. Otherwise, 0.1% to 0.3% describes the entire slate of currency gains vs. the greenback.

We get some real data this morning as follows: Initial (exp 230K) and Continuing (1970K) Claims; Q2 GDP (3.1%); Q2 Real Consumer Spending (1.4%); and Q2 GDP Sales (6.3%), although this is the second look at all these numbers. Tomorrow’s Personal Income and Spending as well as PCE data will be far more interesting. We hear from Governor Waller as well, but we already know his views are to cut right away.

It is difficult to get too excited about much these days and there are valid arguments for movement in most markets in both directions (remember the idea that the goods and services economies are out of sync). Net, until it is clear the Fed is going to cut aggressively, assuming that happens, the dollar is likely to drift.

Good luck

Adf