The market response to the raid

In Vene has so far been staid

The black, sticky goo

Despite much ado

Shows traders have not yet been swayed

And frankly, that seems to make sense

‘Cause years will pass ere they commence

To pump much more oil

But that shouldn’t spoil

The truth their reserves are immense

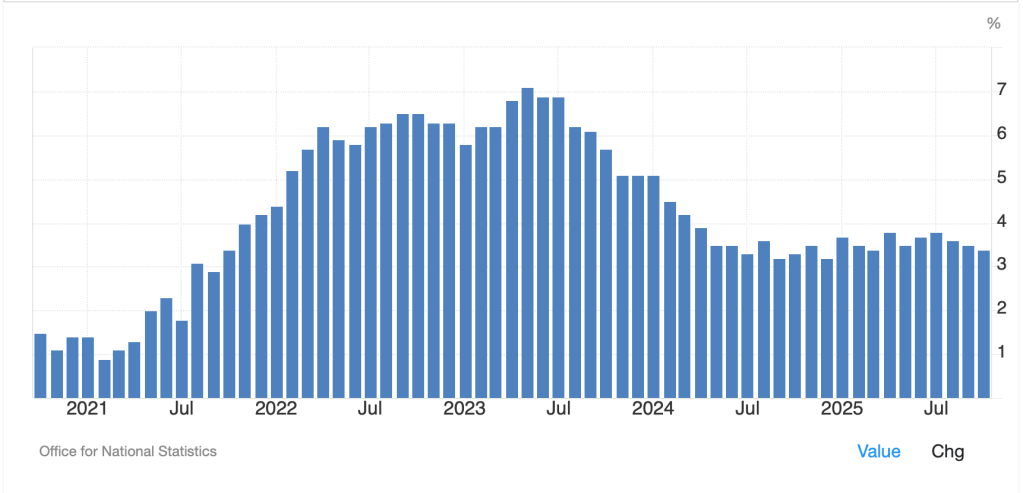

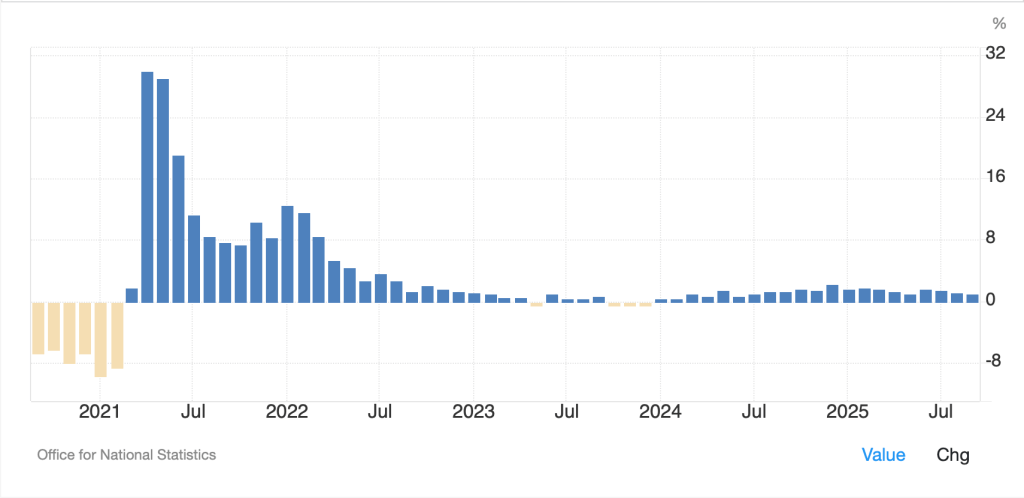

As of 9:00 last night, oil futures are essentially unchanged from Friday’s, pre-Venezuelan news, close. As you can see from the chart below, while there was an early blip higher of about 50¢, that quickly retraced.

Source: tradingeconomics.com

But, stepping back a bit, a look at the chart for the past year shows a very steady decline in the price and at this point, there seems to be little that will change that result.

Source: tradingeconomics.com

I have consistently made the case that oil supply exists all over the world, and that politics has been the chokepoint. Arguably, a new government in Venezuela has just removed one of those chokepoints, although from everything I can gather, given the decrepit state of the oil infrastructure in Venezuela after nearly 20 years of Socialist neglect, it will take quite a while to hit the market. But Guyana and Argentina are going to be growing their output considerably going forward, so, a slower rate of production here ought to not matter much.

One other thing I did read was that a key driver of the weekend’s events was growing concern by the US military that the Chinese were going to monopolize rare earth mining and processing from areas of southern Venezuela and that was too great a concern. Even if the timeline is long, it appears, at this stage, that the future of Venezuela’s oil production should start to trend higher, and that will simply add to pressures on prices. After all, we know that markets are forward looking.

One last thing to note is that acting president of Venezuela, Delcy Rodriguez, has called for “cooperation” with the US going forward, a very different tone than her initial comments of outrage. Perhaps she has figured out that this is a sweet deal for her, or perhaps she is simply afraid that she is not safe if she doesn’t cooperate. Whatever the reason, I suspect that things will progress positively from here.

In the meantime, let us try to turn our attention elsewhere, although it will be difficult as this action will clearly have many widespread, and at this point unforeseeable, impacts on markets other than oil. But try we must. With that in mind, let’s review markets overnight and see how the initial price action has evolved, and perhaps what it implies for the future.

Starting with equities, you’re hard pressed to find a market anywhere in the world that is suffering this morning despite the alleged increase in uncertainty. In fact, it appears that investors are pretty certain that today is a better day than Friday was given the new world order that is developing. Starting in Asia, the only market that fell overnight was India (-0.4%) seemingly on the idea that one source of their cheap oil may have been stopped. But elsewhere, Japan (+3.0%), China (+1.9%), Korea (+3.4%) and Taiwan (+2.6%) all had extremely strong sessions with HK, Australia and other smaller exchanges showing little to no gains. My only surprise here is China, which has invested significantly in Venezuela, lent them large sums of money and also had their advanced radar systems shown to be useless against US military aircraft. But in the end, fear was not on the agenda in Asia.

What about Europe? Well, here things are less excitable, with Germany (+0.65%) and Italy (+0.6%) the leaders as defense firms in both nations have performed well this morning. But otherwise, Europe is a nonevent this morning, which given their increasing global irrelevance, should be no surprise. The UK, France, and Spain have all barely moved and surprisingly, Switzerland (-0.7%) has fallen, although perhaps neutrality is not such a benefit anymore. US futures, though, are continuing their ride higher with the NASDAQ (+0.8%) leading the way in a sea of green. The net result here is, risk is still in vogue.

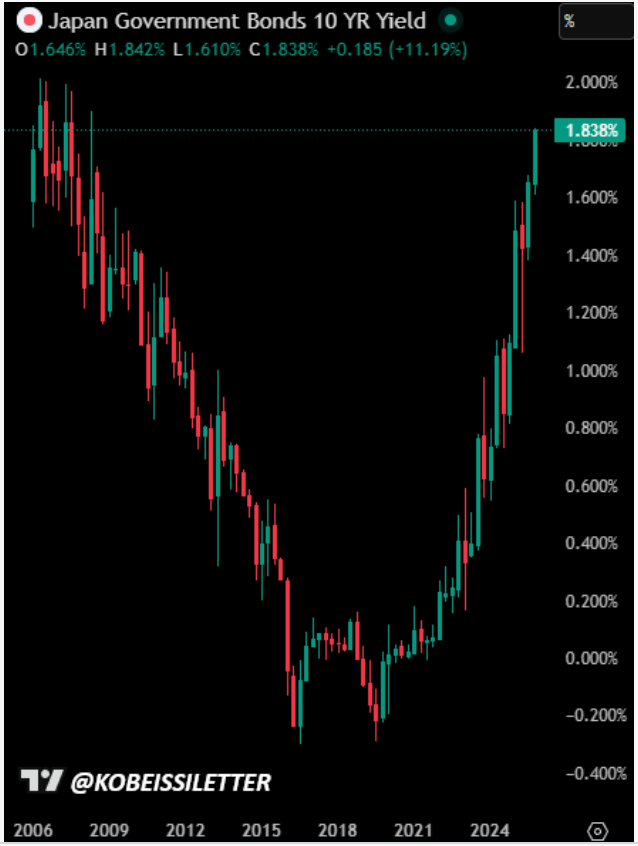

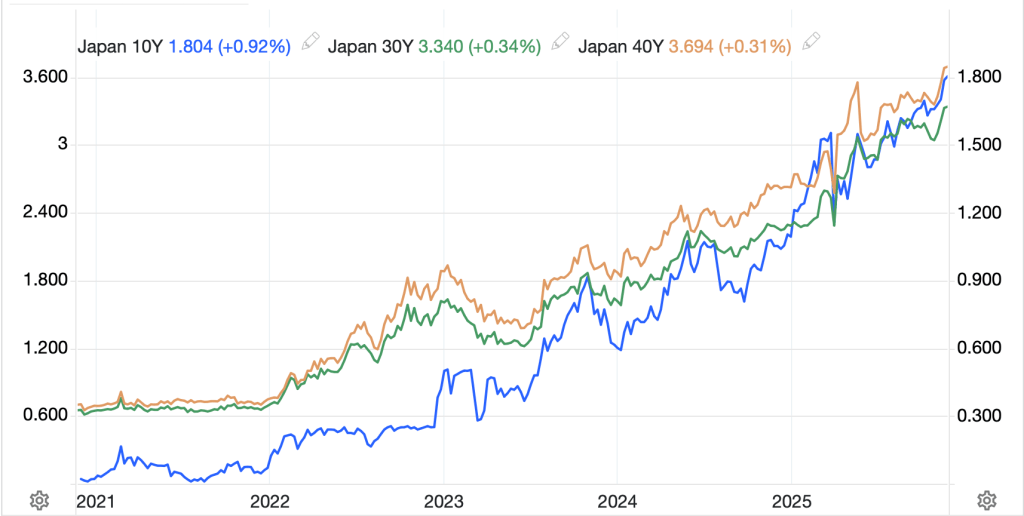

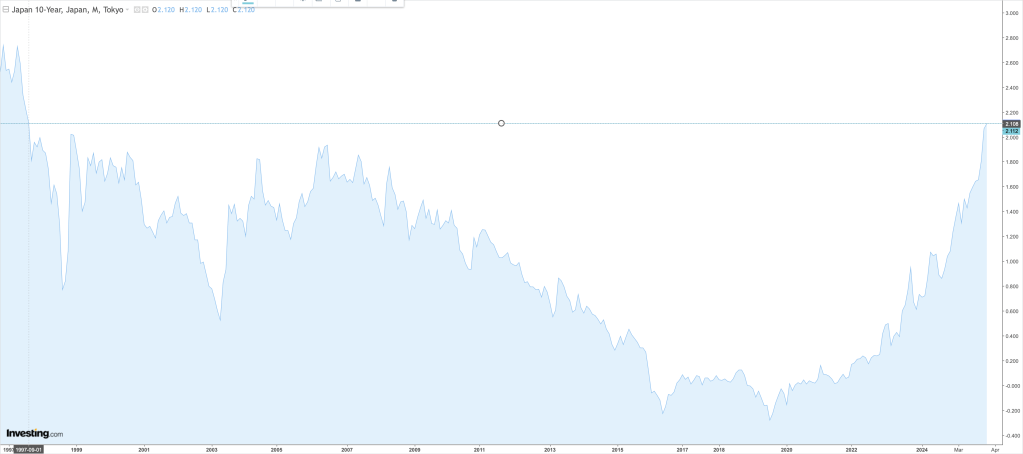

Turning to the bond market, only JGB yields (+6bps) are rising after PM Takaichi reiterated her call for more spending. Yes, this is a new 29-year high in 10-year JGB yields, but I suspect they have further to go. After all, as you can see from the below chart, yield suppression has been the game there for decades, so unwinding it will take some time.

Source: investing.com

But elsewhere in the fixed income world, yields are slipping across the board. Treasury yields (-3bps) are leading the way with all of Europe seeing declines between -2bps and -3bps. I might suggest this is a response to the prospect of declining oil and energy prices going forward, even though it will take time to see the increases in production.

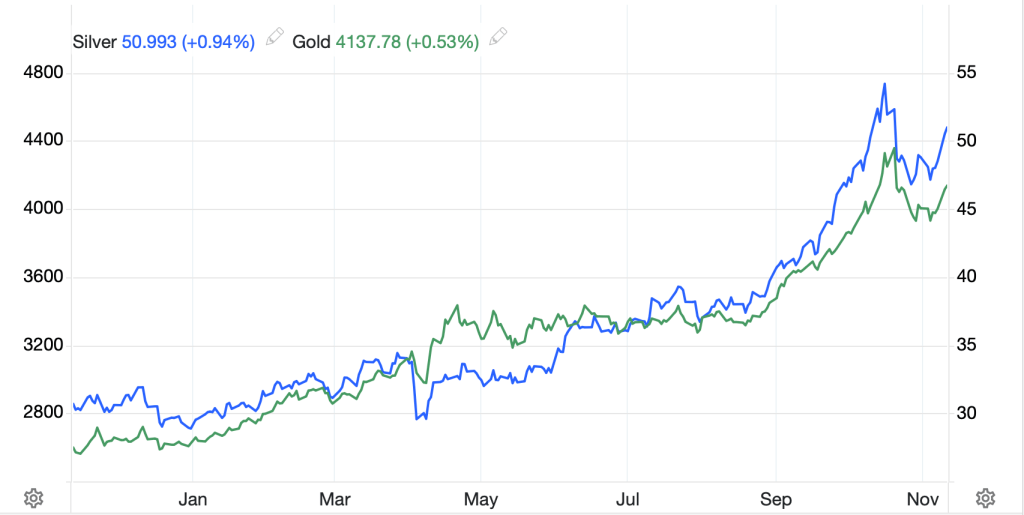

As to commodities, as of this morning at 7:30, oil has bumped up 0.5%, although as you can see in the above chart, remains in a longer-term downtrend that shows no signs of breaking soon. Metals, meanwhile, remain the story of stories with the entire periodic table looking good (Au +1.9%, Ag +3.3%, Cu +2.9%, Pt +2.5%). I continue to read about reasons as to why this rally in metals is going to end soon, with most focused on the speed of the ascent last year. But the difference in this market vs. any paper financial market is, physical supplies matter here, and by all accounts, Ag, Cu and Pt are all in short supply for their industrial uses (think catalytic converters for Pt) and as industrial users recognize the shortage, they continue to bid up the price. While I expect all these markets to remain volatile this year, I suspect that the trend higher has a lot of runway yet.

Finally, the dollar is firmer this morning, despite the rally in metals. The euro (-0.3%) is the laggard in the G10 space as the EU was shown to be completely powerless, useless and irrelevant over the weekend. However, they did issue a carefully considered statement to cement the idea that they are powerless, useless and irrelevant as seen below.

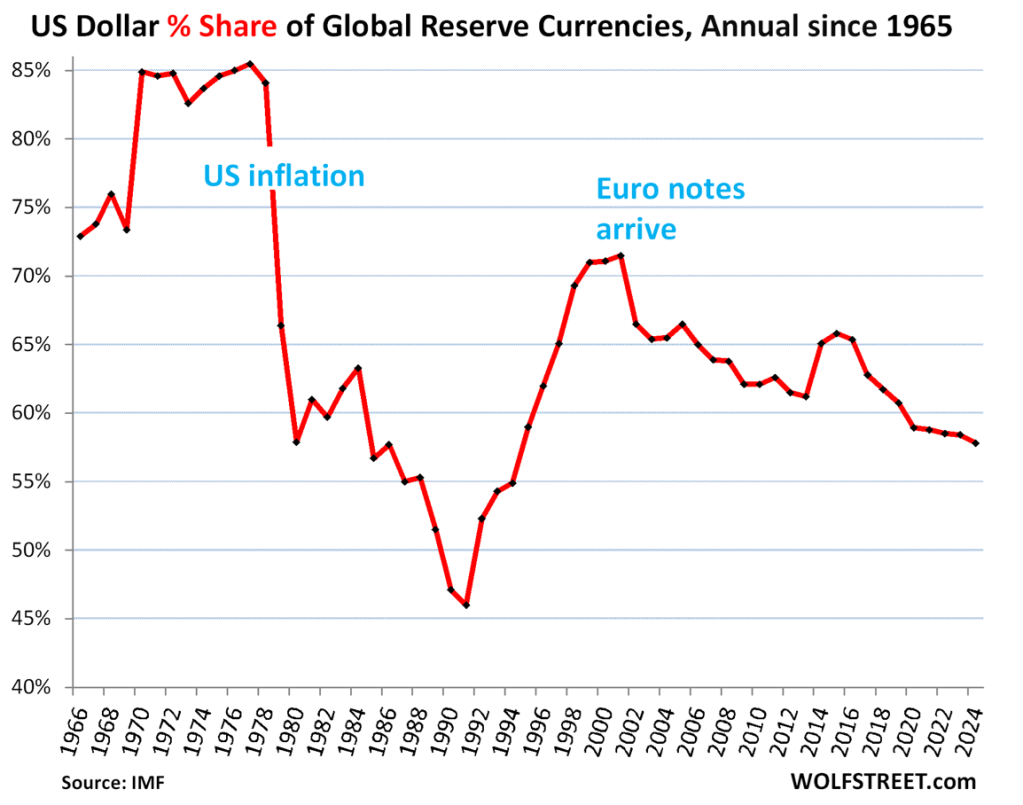

I know I feel safer now! In addition to this demonstration, the timeline for a digital euro seems to be speeding up, a decision that will further undermine the single currency in my view. Nothing has changed my opinion, except perhaps strengthening it, that the world is going to bifurcate into USD stablecoins and digital CNY over the next few years, with most of Europe opting for USD. Elsewhere in the G10, movement has been less pronounced, +/-0.2% or less with nothing of note to mention. In the EMG bloc, most of the currencies here are a bit weaker, -0.3% or so, with two key exceptions, ZAR (+0.1%) and CLP (+0.2%), both benefitting from the large gain in the metals complex. Interestingly, MXN (-0.35%) is amongst the worst performers as the natural thought process seems to be, is President Sheinbaum next unless she effectively shuts down the cartels. I keep searching for reasons to understand bearishness on the dollar but have yet to find any that make sense. One other thing to note, there has been a resurgence in the discussion of how the dollar is losing its traction amongst central banks with respect to reserves held. Many are highlighting that the percentage of reserves in USD has fallen to its lowest level since the mid 1990’s. but a look at the chart below shows that while the recent trend has declined, it remains far above its lows, and far below its highs over time. In fact, one might say it’s right in the middle of the range.

Turning to the data this week, with the government having been back in action for a while, we are back to a full slate of data for the first week of a month.

| Today | ISM Manufacturing | 48.3 |

| ISM Prices Paid | 59.0 | |

| Tuesday | PMI Services | 52.9 |

| PMI Composite | 53.0 | |

| Wednesday | ADP Employment | 45K |

| ISM Services | 52.3 | |

| JOLYs Job Openings | 7.64M | |

| Factory Orders | -1.2% | |

| -ex Transport | -0.3% | |

| Thursday | Initial Claims | 216K |

| Continuing Claims | 1851K | |

| Trade Balance | -$58.4B | |

| Nonfarm Productivity | 3.0% | |

| Unit Labor Costs | 1.0% | |

| Consumer Credit | $10.2B | |

| Friday | Nonfarm Payrolls | 55K |

| Private Payrolls | 60K | |

| Manufacturing Payrolls | -5K | |

| Unemployment Rate | 4.5% | |

| Average Weekly Hours | 34.3 | |

| Average Hourly Earnings | 0.3% (3.6% Y/Y) | |

| Participation Rate | 62.6% | |

| Housing Starts (Sept) | 1.31M | |

| Building Permits (Sept) | 1.35M | |

| Michigan Sentiment | 53.2 |

Source: tradingeconomics.com

While some data remains stale (housing), the jobs data is December’s and will get a great deal of attention. One thing to remember here is that if the deportation numbers discussed by the government are correct (~500K actual deportations and ~2.0MM self-deportations), then the economy doesn’t need to create that many new jobs to keep things ticking along. I have seen estimates of somewhere between 0 and 20K jobs each month being sufficient to keep the Unemployment Rate steady to declining. I am sure, however, this issue will be the subject of much discussion by the economics community going forward, but as I have said time and again, the models in use today do not seem to reasonably represent the reality today. Expect a lot of huffing and puffing about this data, largely along political lines.

And that’s really it. Obviously, Venezuela has changed a lot of calculations about many markets, but in the end, while I remain concerned over an eventual risk-off outcome, I don’t see that as an immediate threat. Remember, too, the OBBB has taken effect and tax situations are going to be changing now, something that will undoubtedly help the economic data going forward.

Good luck

Adf