The story is that the Chinese

Will speed up their policy ease

Creating for Yuan

A new denouement

Of currency weakness disease

Their problem is that in the past

That weakness could happen too fast

So, how far will Xi

Be willing to see

Renminbi decline at long last?

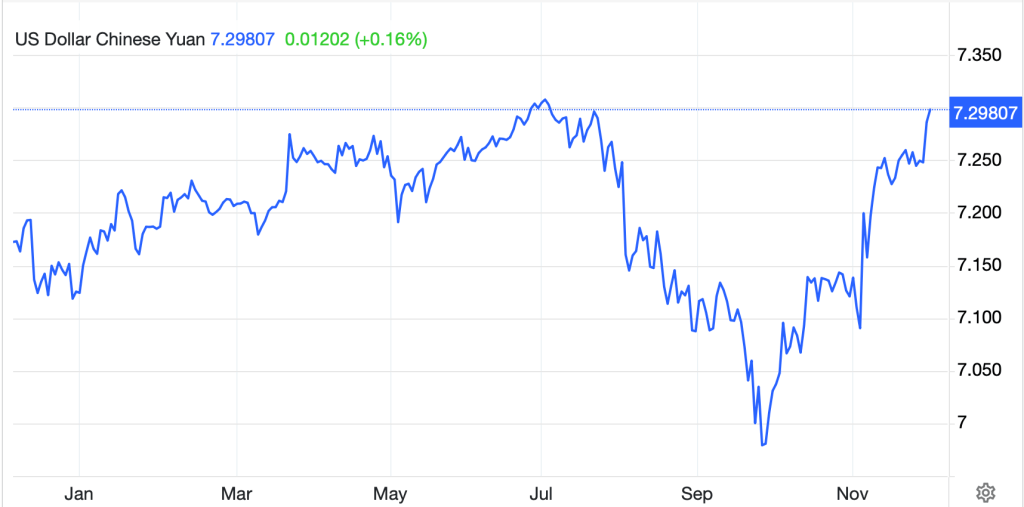

As we await the US CPI data this morning, the story du jour in markets revolves around the Chinese renminbi and whether President Xi will allow, or encourage, the PBOC to weaken the currency. Strategically, Xi has made a big deal to the rest of the world that the Chinese currency will remain strong and stable as he seeks other nations to increase their use of the renminbi in commercial transactions as well as a store of value. I believe part of this is a legitimate goal but that there is also a significant fear underlying these actions as history has shown the Chinese people will flee the currency if it starts to weaken too quickly. It is the latter issue that has been the primary driver of the PBOC’s efforts to continuously fix the renminbi at stronger than market levels.

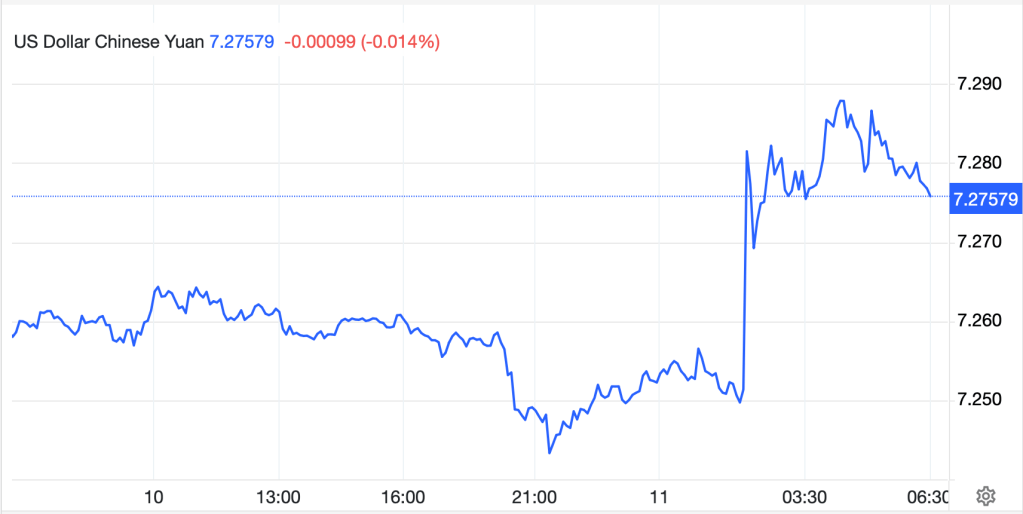

This process worked well enough for the past four years as the Biden administration, while certainly not friendly to China, was not aggressively attacking the nation’s efforts to expand its influence. However, that situation is about to change with the Trump administration and as Mr Trump has already threatened numerous new tariffs on various parts of China’s production economy, Xi’s calculus must change. This puts Xi in a difficult situation; allow the currency to weaken more aggressively to offset the impact of any tariffs and suffer through capital flight or maintain the renminbi’s value and see exports decline along with overall economic activity. It is easy to see in the chart below when the story about allowing a weaker currency hit the tape. However, there is not nearly enough information to take a longer-term view on the subject.

Source: tradingeconomics.com

One other thing to remember is that Chinese interest rates are continuing to decline with 10-year yields trading to yet another new low last night at 1.88%. As the spread between US and Chinese yields continues to widen, by itself that will put pressure on the renminbi to decline. The problem for Xi is that no matter the control the PBOC has over the FX markets in China, now that there is an offshore market, if the Chinese people become concerned over the value of the renminbi, it has the ability to decline far more quickly than the government would want to allow.

For those of you with Chinese assets on your balance sheet or Chinese denominated revenues, I would be looking to maximize my hedges for now. As an aside, there were a number of forecast changes by major banks overnight with many calls for USDCNY to reach 7.50 or higher by the end of next year now.

The market’s convinced

A rate hike is on the way

Why won’t the yen rise?

The other story overnight focused on Japan, or more precisely the BOJ meeting to be held in one week’s time. It seems that there is a lot of dissent amongst the analyst community regarding whether or not the BOJ will hike rates. As an example of how thin all the analyst gruel really is, one of the key rationales for the belief in a rate hike was that last week, Toyoaki Nakamura, perceived as the most dovish BOJ board member, indicated he didn’t object to a rate hike, although wanted to see more data before declaring one was appropriate for December. However, just last night the BOJ added a speech and press briefing to their calendar for Deputy Governor Ryozo Himino right before the January meeting. This has the punditry now expecting the BOJ to wait until then rather than move next week. The below chart shows the change in the market’s expectations for a rate hike over the past week.

As I said, the tea leaves that the punditry are reading really don’t say very much at all. Perhaps we can look at the economic data to get a sense. Over the past month, we have seen CPI for both the nation and Tokyo print higher than forecast and continue to slowly climb. As well, PPI printed higher and GDP continues to grow, albeit at a modest pace. Of greater concern is that earnings data is lagging the CPI data.

A look at the FX market would indicate that traders are losing their taste for a rate hike next week, at least as evidenced by the yen’s recent weakness. As you can see in the past week, it has slipped nearly 2%, hardly a sign that higher Japanese rates are expected. But something that is not getting much press is the potential Trump impact, where the incoming president would like to see the yen, specifically, strengthen as it is truly historically undervalued. FWIW, which is probably not that much, I am in the rate hike camp for next week and expect the yen will find some support soon.

Source: tradingeconomics.com

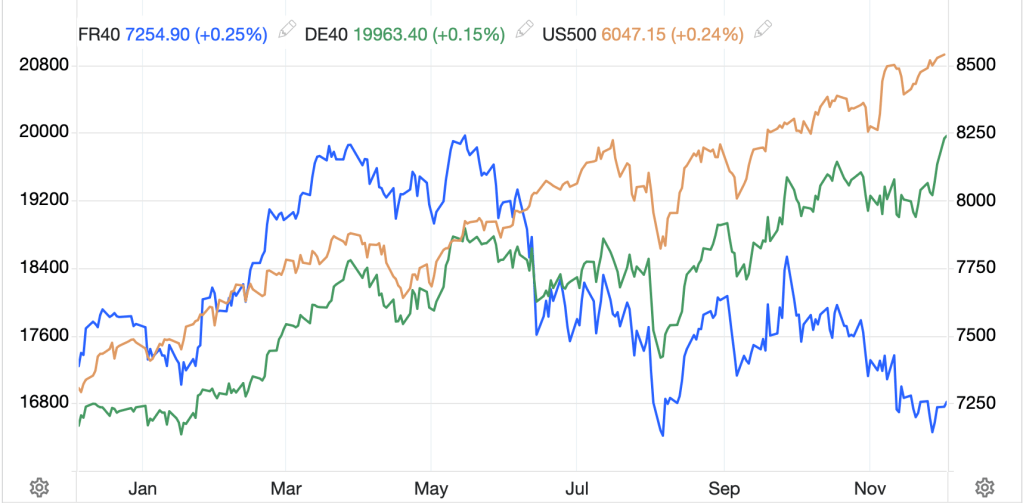

Ok, enough Asian currency talk. Let’s see how everything else behaved ahead of this morning’s data. Yesterday’s modest US equity declines were followed by virtually no movement in Japanese shares although most of the rest of Asia followed the US lower. Hong Kong (-0.8%) and Taiwan (-1.0%) were the worst performers and the one outlier the other way was Korea (+1.0%) as the KOSPI continues to recoup the losses made after the martial law fiasco. European bourses are mostly little changed on the day with Spain’s IBEX (-1.1%) the lone exception which has been negatively impacted by Q3 results from Inditex (the parent company of Zara). As to US futures, at this hour (7:25) they are little changed.

In the bond market, yields continue to edge higher in Treasuries (+2bps) and European sovereigns with gains on the order of 1bp to 2bps across the board. While there is some discussion regarding fiscal questions in Europe, ultimately, nothing has broken the connection between US and European yields, and I would contend they are all awaiting this morning’s CPI.

In the commodity markets, oil (+1.4%) is rebounding although remains below $70/bbl, which seems to be a trading pivot for now. The China stimulus story remains the key in the market with a growing belief that if China does successfully stimulate, oil demand will increase. Meanwhile in the metals markets, gold is unchanged this morning after another nice rally yesterday while both silver and copper are under modest pressure. I would contend, however, that the trend for all metals remains slightly upward.

Finally, the dollar is firmer against virtually all its counterparts this morning with most G10 currencies softer on the order of -0.3% or so although CAD and CHF are little changed on the session. In the EMG bloc, KRW (+0.3%) is rebounding alongside the KOSPI as the excesses from the martial law story last week continue to be unwound, but elsewhere in the bloc, modest weakness, between -0.2% and -0.4%, is the rule. However, this is all dollar focused today.

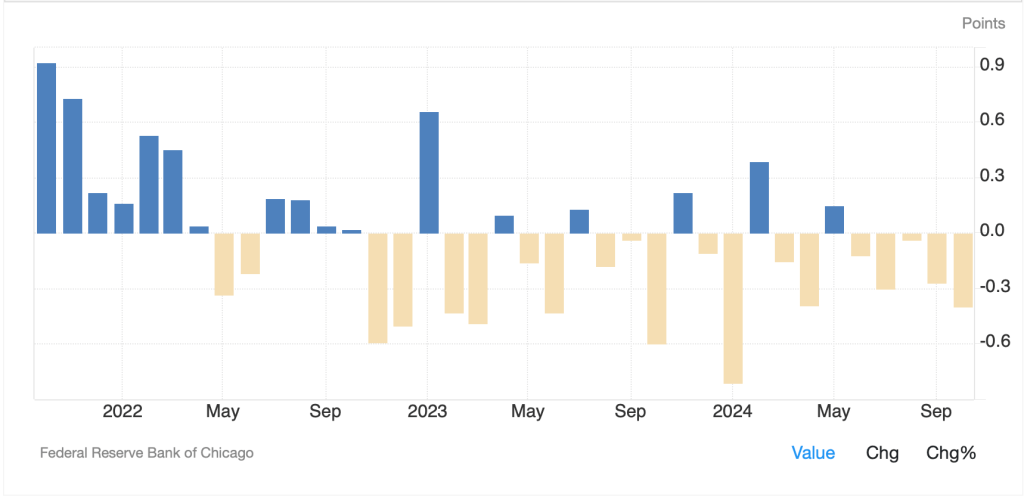

On the data front, it is worth noting that yesterday’s NFIB Small Business Optimism Index shot higher in November in the wake of the election results, heading back toward its long-term average just above 100. As to this morning, forecasts for Headline (exp 0.3%, 2.7% Y/Y) and Core (0.3%, 3.3% Y/Y) CPI continue to indicate that the Fed may be overstating the case in their belief that inflation pressures are ebbing. Rather, I continue to believe that we have seen the bottom in the rate of inflation and a gradual increase is in our future. Two other things of note are the BOC rate decision (exp 50bps cut) this morning and then the Brazilian Central Bank rate decision (exp 75bp HIKE) this afternoon. The latter is clearly an attempt to rein in the BRL’s recent dramatic decline.

With no Fed speakers, if the data this morning is significantly different than expectations, I would look for the Fed Whisperer, Nick Timiraos, to publish something before the end of the day in order to get the Fed’s latest views into the market. Absent that, nothing has gotten in the way of the higher dollar at this stage so stay sharp.

Good luck

Adf