The usual story today

Would be NFP’s on its way

But with BLS

On furlough, I guess

The story on jobs is passe

But ask yourself, if we don’t get

A data point always reset

That’s only a fraction

Of total job action

Is this something ‘bout we need fret?

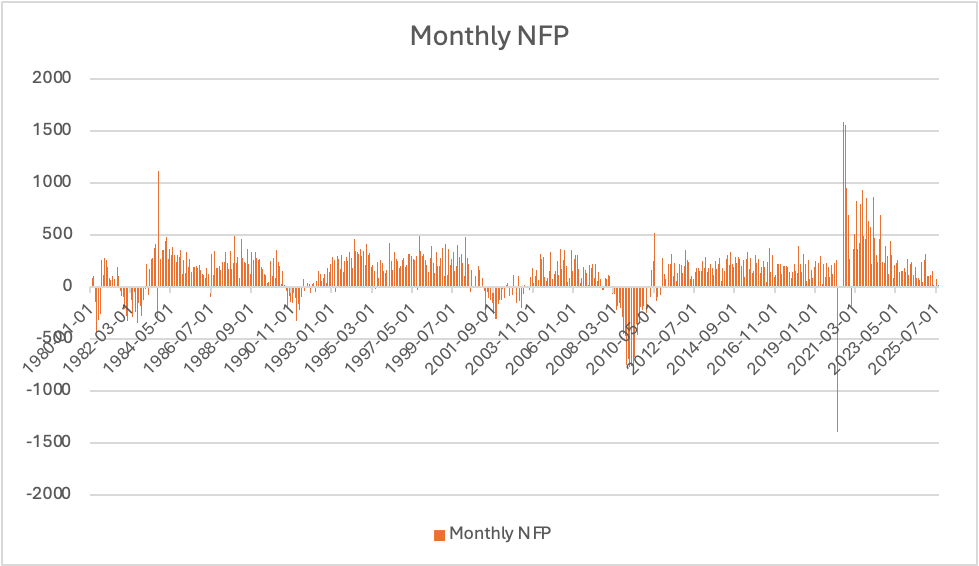

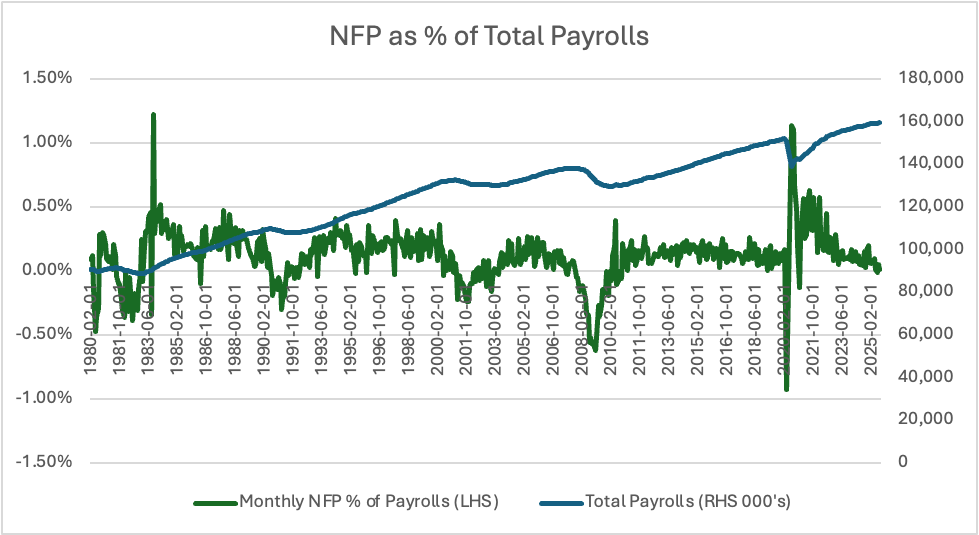

With NFP in particular, the monthly number, which since 1980 has averaged 125K with a median of 179K seems insignificant relative to the number of people actually employed, which as of August 2025 was recorded as 159.54 million. Now I grant, that the employed population has grown greatly in the past 45 years, so when I take it down to percentages, the average monthly NFP result is 0.10% of the workforce during that period, with the median a whopping 0.14%. The idea that business decisions are made, and more importantly, monetary policy decisions are made on such a tenuous thread is troublesome, to say the least. Did this report really tell us that much of importance? Especially given its penchant for major revisions.

Below is a graphic history of NFP (data from FRED) having removed the Covid months given they really distorted the chart.

And below is a chart showing total payrolls (in 000’s) on the RHS axis with the % of total payrolls represented by the monthly change in NFP on the LHS. Notice that almost the entire NFP series, as a %age of total employment, remains either side of 0 with only a few outcomes as much as even 0.5%. My point is, perhaps the inordinate focus on this data point by markets and policymakers alike, has been misguided, especially as the accuracy of the initial releases seems to have worsened over time. Maybe everybody will be able to figure out that they can still do their jobs even without this data. (Ken Griffiin excepted. 🤣)

Food for thought.

Like swallows return

To Capistrano, Japan

Votes again this year

The other notable news story is tomorrow’s election in Japan’s LDP for president of the party and the likely next Prime Minister. While there are technically 5 candidates, apparently, it is really between two, Sanae Takaichi, a former economic security minister and a woman who would be the first female PM in the nation’s history, and Shinjiro Koizumi, son of former PM Junichiro Koizumi, and a man who would become the nation’s youngest prime minister. There are several others, but these are the front runners. From what I gather, Takaichi-san is the defense hawk and the more conservative of the two, an updated version of Margaret Thatcher, to whom she will constantly be compared if she wins. Meanwhile, Koizumi is more of the same they have had in the past.

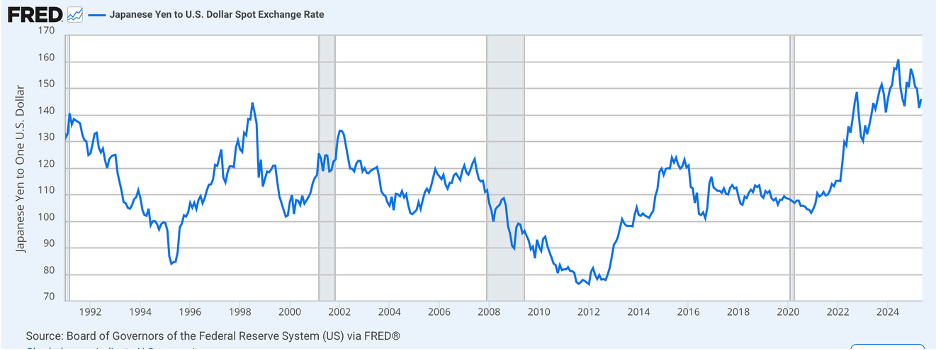

There are some analysts who are trying to make the case that this election has had a major impact on Japanese markets, and one might think that makes sense. But if I look at USDJPY (0.0% today), as per the below chart, I am hard pressed to see that the election campaign has had any impact of note.

Source: tradingeconomics.com

If we turn to the Nikkei (+1.9%) which made a new high last night, it seems that is tracking US technology shares and is unconcerned over the election.

Source: tradingeconomics.com

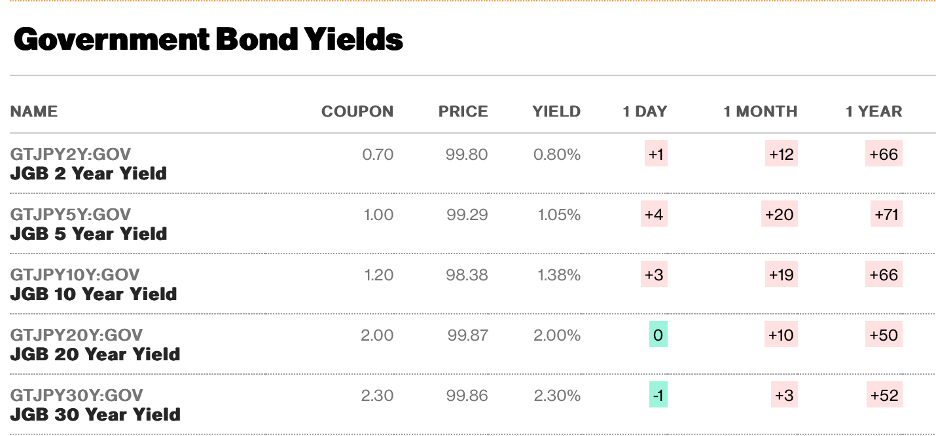

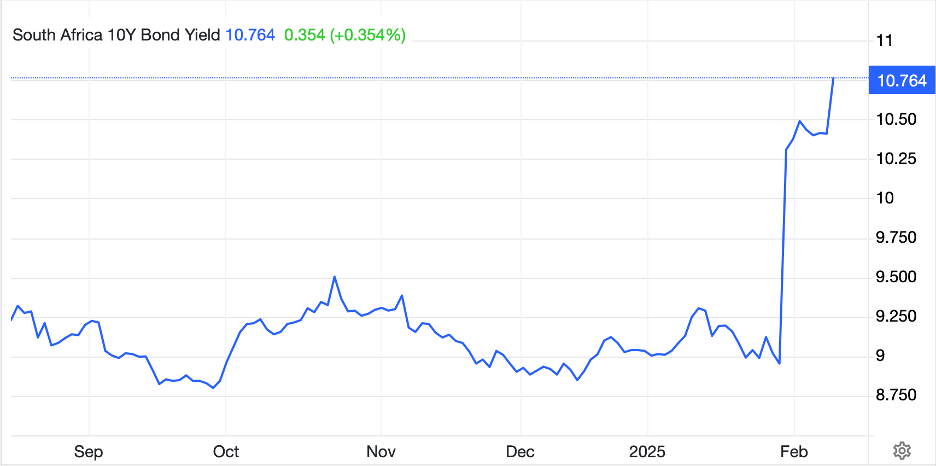

Arguably, if the equity market is forward looking (which I think is true) investors are indifferent to the next PM. Finally, a look at JGBs shows that yields continue to climb there, albeit quite slowly, but consistently make new highs for the move and are back to levels last seen in 2008.

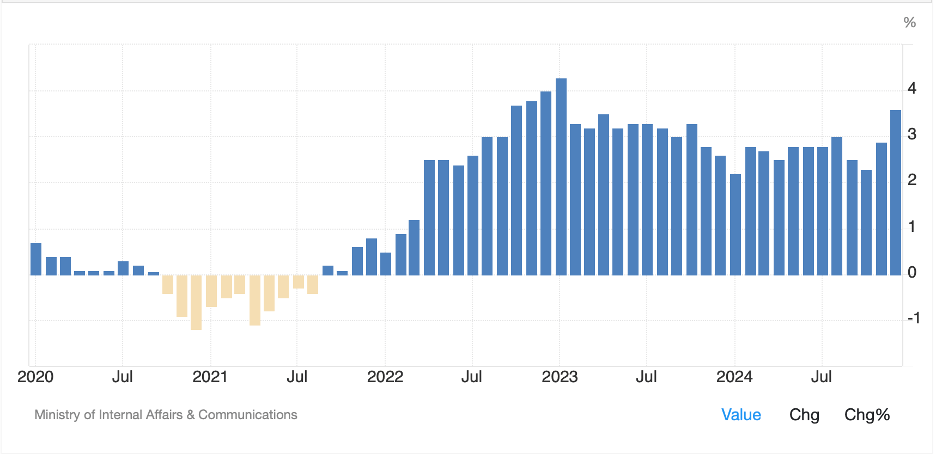

In fact, like almost everything since the GFC, perhaps the recent run of incredibly low yields in Japan is the aberration, not the rule! But the argument for higher Japanese yields is more about the fact that inflation there is running at 3.5% and the base rate remains at 0.50%. Investors remain concerned that the recent history of virtually zero inflation in Japan may be a thing of the past and so are demanding higher yields to hold Japanese debt.

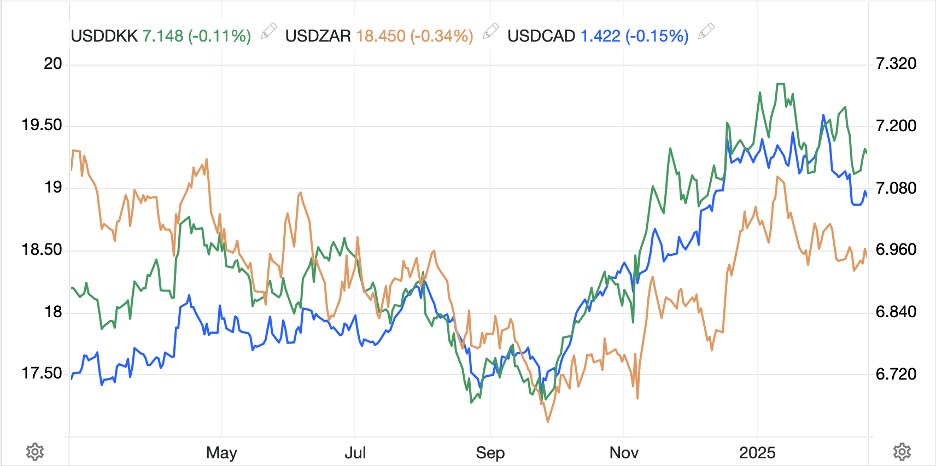

I have no idea who will win this election, although I suspect that Takaichi-san may wind up on top. But will it change the BOJ? I don’t think so. And the fact that the LDP does not have a working majority means not much may get done afterwards anyway. All told, it is hard to be excited about holding yen in my eyes.

Ok, let’s look at the rest of the world quickly. Despite a soft start, US equity markets managed to close in the green and this morning all three major indices are pointing higher by 0.25%. Away from Japan, Chinese markets are closed for their holiday, and most of the rest of Asia followed the US higher, notably Korea (+2.7%) and Taiwan (+1.5%). The only outlier was HK (-0.5%) which looked to be some profit taking after a sharp run higher in the past week. In Europe, Spain (+0.8%) and the UK (+0.6%) are the best performers despite (because of?) slightly softer PMI Services data. Either that, or they are caught up in the US euphoria.

The bond market saw yields slip a few basis points yesterday and this morning, while Treasury yields are unchanged at 4.08%, European sovereigns are sliding -1bp across the board. I think the slightly softer data is starting to get some folks itching for another ECB rate cut, or at least a BOE cut.

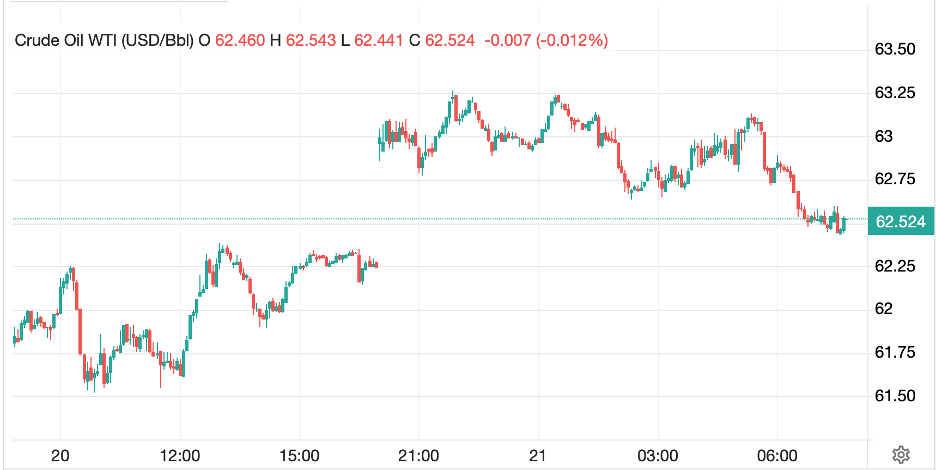

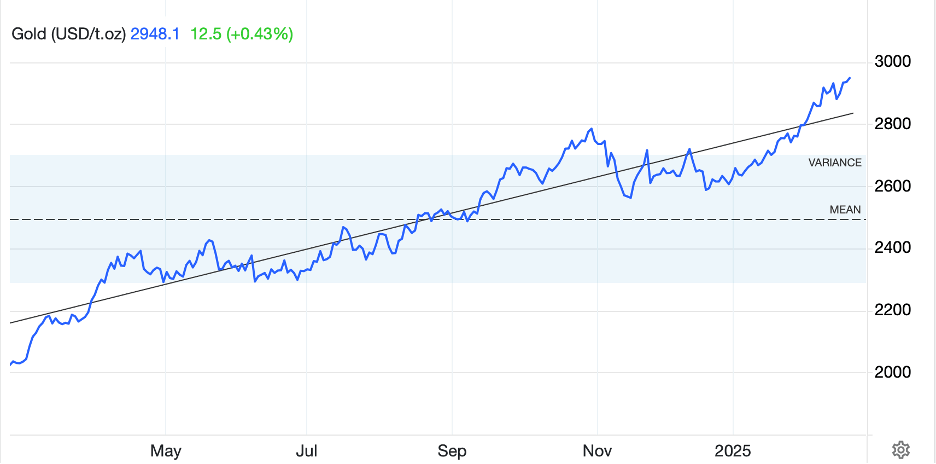

In the commodity markets, oil (+0.4%) which continued to fall throughout yesterday’s session to just above $60/bbl, looks like it is trying to stabilize for now. There continues to be discussion about more OPEC+ production increases, and it seems that whatever damage Ukraine has done to Russia’s oil infrastructure is not considered enough to change the global flows. As to the metals, gold (+0.2%) and silver (+1.2%) absorbed a significant amount of selling yesterday in London, which may well have been one account, as they reversed course late morning and have been climbing ever since. Copper (+1.1%) is also pushing higher and the entire argument about the defilement of fiat currencies remains front and center. I guess JP is now calling it the debasement trade as Gen Z, if I understand correctly, is selling other assets and buying a combination of gold and bitcoin.

Finally, the dollar is…the dollar. Back on April 20, DXY was at 98.08. This morning it is 97.75. look at the chart below from tradingeconomics.com and tell me you can get excited about any movement at all. We will need a major outside catalyst, I believe, to change any views and right now, I see nothing on the horizon.

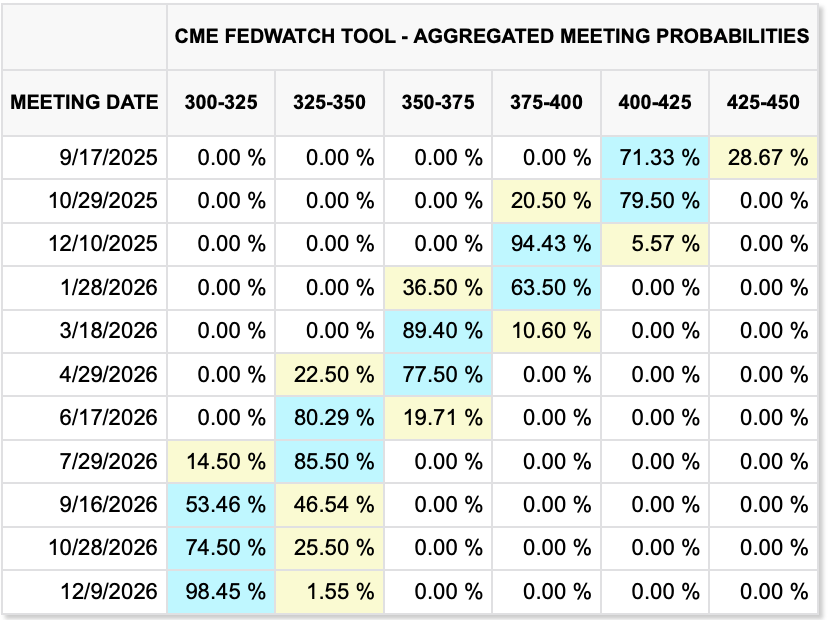

And that’s really all there is. We do get ISM data this morning as it’s privately compiled and released (exp 51.7) and Fed speakers apparently will never shut up. What is interesting there is that Lorrie Logan, Dallas Fed president, has come out much more hawkish than some of her colleagues. That strikes me as a disqualification for being elevated to Fed chair.

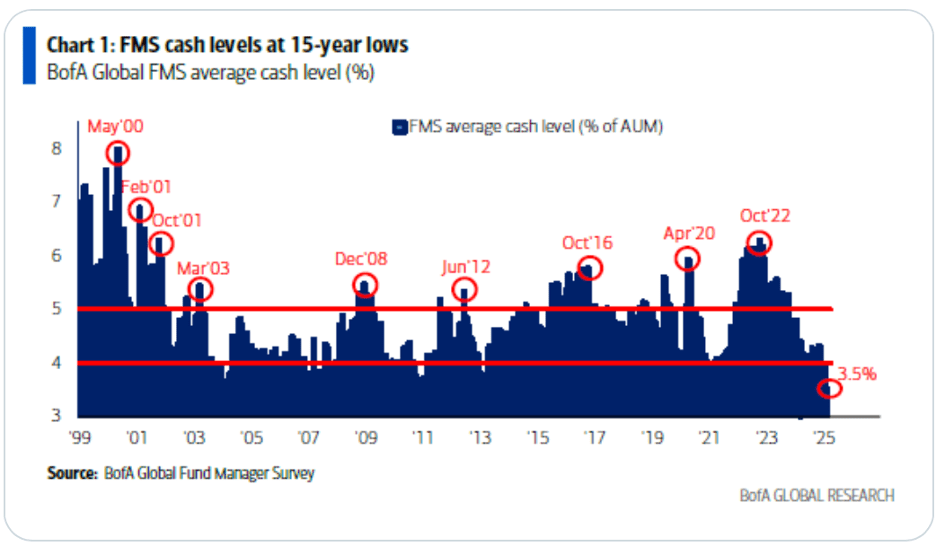

I continue to read lots of bear porn and doom porn, and it all sounds great and markets clearly don’t care. The government shutdown has been irrelevant and that should make a lot of people in Washington nervous given this administration. President Trump has been angling to reduce government, and if it is out of action and nobody notices, it will make his job a lot easier. But for now, nothing stops this train with higher risk assets the way forward.

Good luck and good weekend

Adf