The Fed is positioned quite well

To leave rates alone for a spell

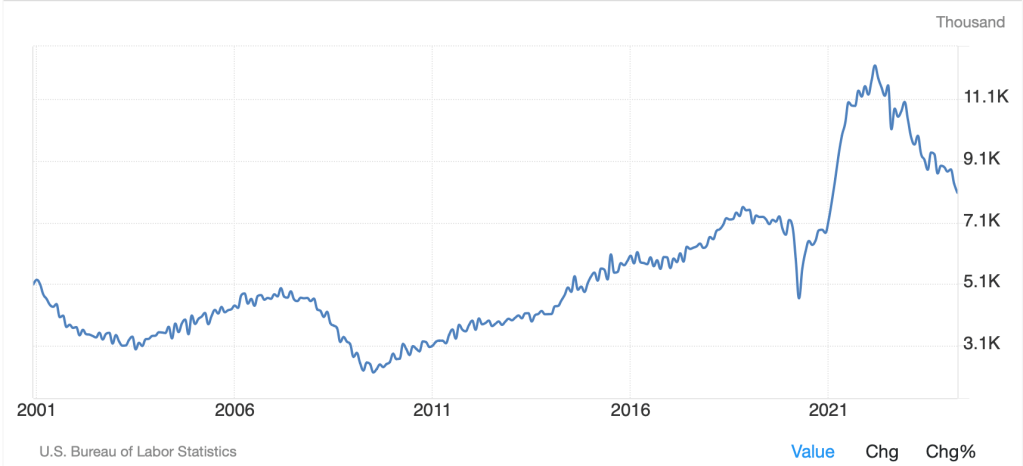

Employment is stable

Which means they are able

To try, high inflation, to quell

“In discussing the outlook for monetary policy, participants observed that the Committee was well positioned to take time to assess the evolving outlook for economic activity, the labor market, and inflation, with the vast majority pointing to a still-restrictive policy stance. Participants indicated that, provided the economy remained near maximum employment, they would want to see further progress on inflation before making additional adjustments to the target range for the federal funds rate.”

I would say that this paragraph effectively summarizes the Fed’s views during the January FOMC meeting and based on the comments we have heard since, nothing has really changed much. If anything, there appeared to be more concern over the upside risks to inflation than worries over a much weaker employment picture. As well, there was some discussion regarding the potential of tariffs impacting prices and economic activity, although they would never be so crass as to actually use the word.

I would argue we don’t know anything more about their views now than we did prior to the Minutes. Interestingly, they continue to believe that the current policy rate is restrictive even though Unemployment has been sliding, inflation is sticky on the high side and equity and other financial markets continue to make record highs. Personally, I would have thought the appropriate view would be policy is slightly easy, but then I’m no PhD economist, just a poet. If we learned anything it is that they are not about to change the way they view the world. This merely tells me they have the opportunity to double down on previous mistakes.

It’s almost as if

Japanese markets now see

Future yen glory

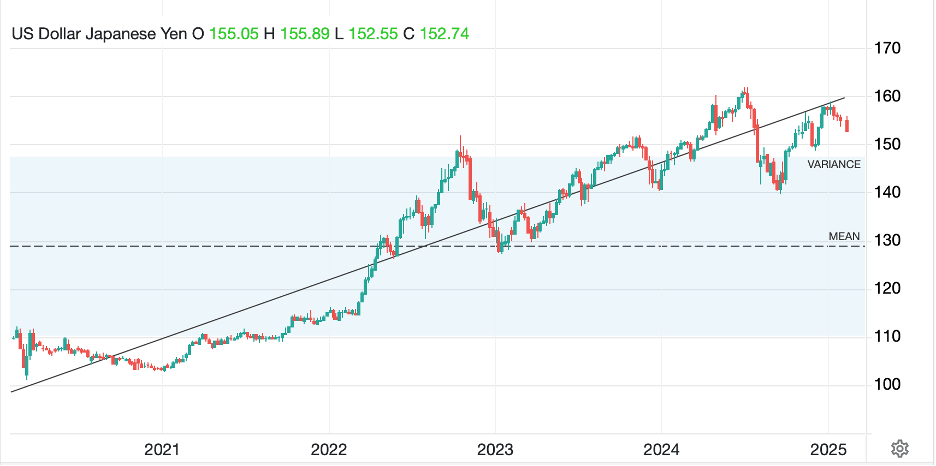

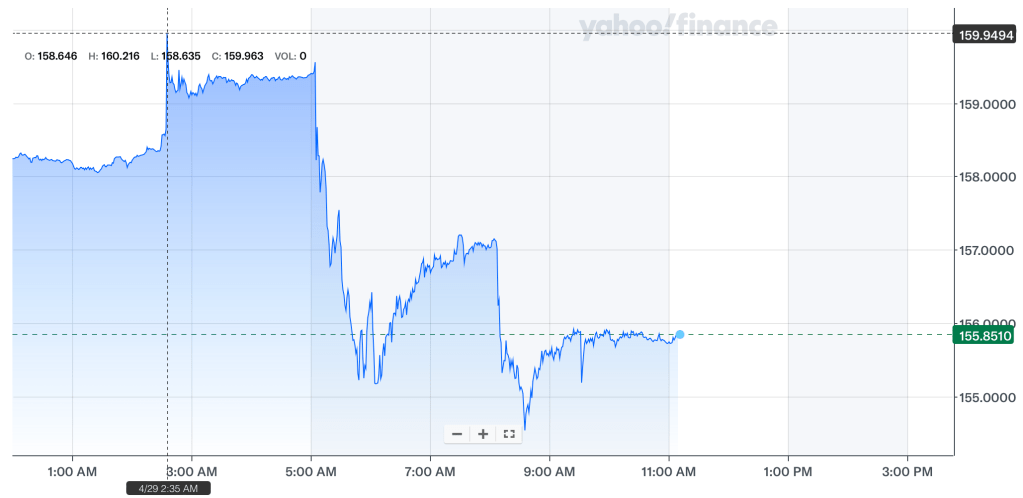

Meanwhile, away from the machinations and procrastinations of the Fed, if we turn East, we can see that last night the yen, for a brief moment, traded through the key 150 psychological level, although it has since edged back higher. This is the strongest the yen has been in more than two months and, in a way, is somewhat surprising given the strong belief that tariffs imposed against a nation will result in that nation’s currency declining. But that is not the case right now, where despite mooted tariffs on steel, autos and semiconductors, three things the Japanese export to the US, the yen is climbing again.

Source: tradingeconomics.com

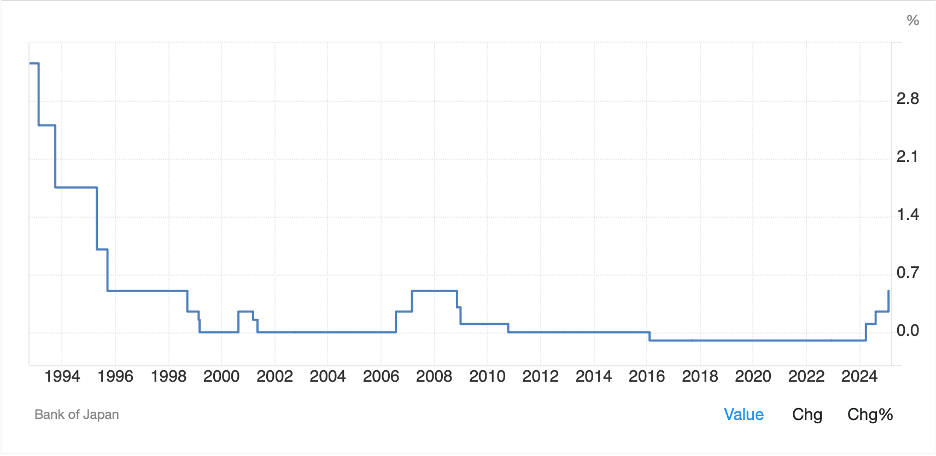

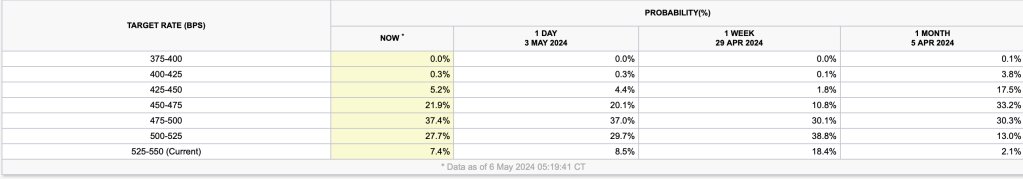

One of the interesting things about the interest rate market’s response to the FOMC Minutes is that there continues to be an expectation of 39bps of rate cuts this year in the US. But then, I read the Minutes as somewhat hawkish, obviously a misconception right now. Meanwhile, in Tokyo, we continue to hear comments from former BOJ members that further rate hikes are coming and the futures market there is pricing 36bps of rate hikes by the end of this year. So, for now, the direction of travel is diametrically opposed between the Fed and the BOJ. Last night also saw JGB yields edge higher by another 1bp, to 1.43% and another new high level for this move. Add it all up and the rate movements are sufficient to be the current FX drivers.

Now, as per my opening discussion regarding the Fed, while I believe that the next move should be a hike, and that gained support from a WSJ article this morning telling us to expect higher rent prices ahead which implies that the shelter portion of US inflation is not going to decline anytime soon, perhaps this is another reason to consider that the dollar may decline. After all, the textbooks all explain that a high inflation economy results in a weaker currency. If the Fed is truly going to continue to try to ‘normalize’ rates lower despite rising inflation, that will change my broad view of the dollar, and I suspect it will weaken dramatically. While the yen is the first place to watch this given the opposing actions by the Fed and BOJ, it could easily spread.

Too, it is important to remember that while we have lately become accustomed to the yen trading in the 140-160 range vs. the dollar, for many years USDJPY traded between 100 and 120 as per the below chart. While the world has certainly changed, it doesn’t mean that we cannot head back to those levels and spend another decade at 110 give or take a bit.

Source: tradingeconomics.com

Ok, with that in mind, let’s take a look at how markets have handled the new information. Clearly US equity markets are not concerned about a Fed volte-face as they closed at yet new record highs yesterday, albeit with very modest gains of about 0.2%. Asian markets, however, were not so sanguine with red the dominant color as the Nikkei (-1.25%) suffered amid that strengthening yen while both the Hang Seng (-1.6%) and mainland (CSI 300 -0.3%) fell despite PBOC promises of more support for the economy and the property market. If I’m not mistaken, this is the third time the PBOC has said they will be increasing support for property markets and prices there continue to decline. In fact, every major index in Asia fell overnight, mostly impacted by tariff fears.

Meanwhile, European bourses are all modestly firmer save the UK (-0.4%) as we see a rebound after yesterday’s declines and earnings data from Europe continues to show decent outcomes. While there is much talk and angst over the Ukraine situation and tariffs, right now given the uncertainty of the timing of any tariffs, as well as the possibility that they may be delayed further or deals may be struck, investors seem to be laying low. Remember, though, that European equity markets have been outperforming US markets for the past several months, although that could well be because their valuations had become so cheap, we are seeing a rotation into them for now. As to the US markets, futures are pointing slightly lower at this hour (7:15) down about -0.25%.

In the bond market, yesterday saw Treasury yields cede their early gains and slip 2bps on the session and this morning they have fallen a further 2bps. Meanwhile, European sovereign yields, after jumping yesterday across the board, are falling back slightly with declines on the order of -1bp or -2bps.

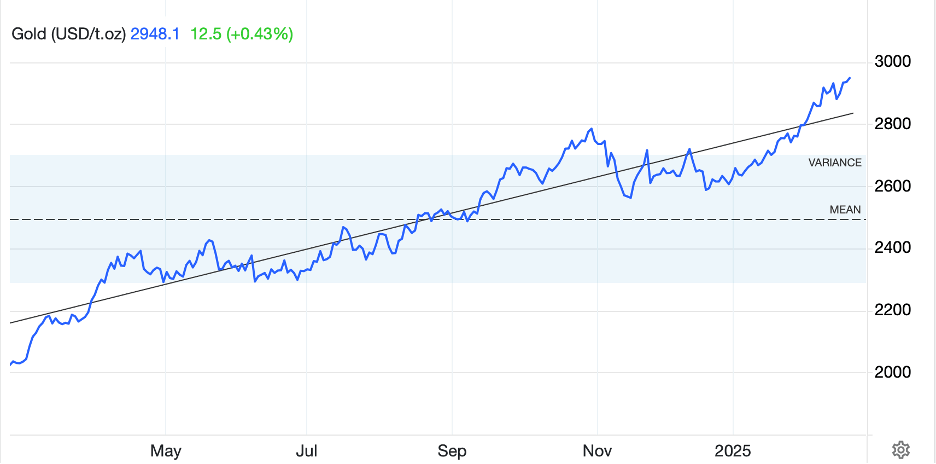

In the commodity market, the one constant is that the price of gold (+0.4%) continues to climb. Whether it is because of growing global uncertainty, concerns over rising inflation, or technical questions regarding deliveries in NY, it is not clear. Price action is not volatile, rather it has been a steady climb for more than a year. just look at the chart below.

Source: tradingeconomics.com

As to the other metals, both silver and copper are also continuing their climb and higher by 1.0% this morning. Oil (+0.2%) is also edging higher which seems a bit odd given the fundamental news I keep reading. First, OPEC+ is going to begin increasing production later this year, second, the prospects of a peace deal with Russia seems likely to result in Russian oil coming back on the market sans sanctions, and third, despite talk of Chinese economic stimulus, demand from the Middle Kingdom has not been growing. Add to this the fact that supply is expected to grow by upwards of 1mm bpd from Guyana, Brazil and Canada, and it seems a recipe for falling prices. Just goes to show that markets are perverse.

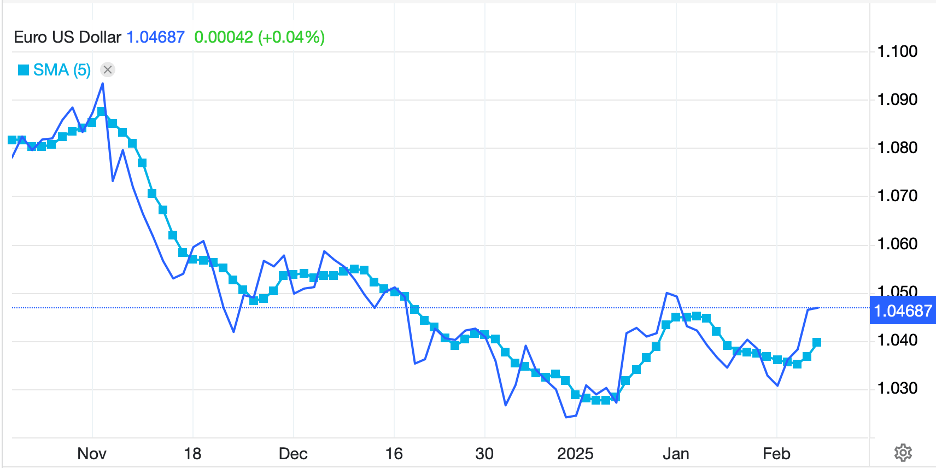

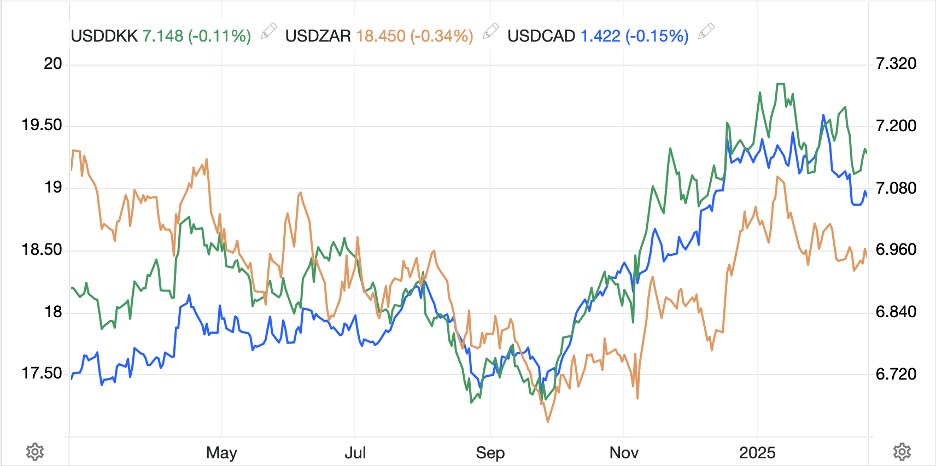

Finally, the dollar is under pressure across the board this morning with the yen (+0.95%) leading the way but commodity currencies (AUD +0.5%, NZD +0.5%, ZAR +0.4%) also showing strength. In fact, virtually every currency has strengthened vs. the greenback this morning. Looking at the charts, there is a strong similarity across almost all currencies vs. the dollar and that is the dollar put in a peak back in early January and has been gradually declining since then. This is true across disparate currencies as seen below and may well represent the market deciding that President Trump would like to see the dollar decline and will enact policies to achieve that end. (I used USDDKK as a proxy for EURUSD since the two are linked quite closely with a correlation of about 0.99.)

Source: tradingeconomics.com

As I wrote above, my strong dollar thesis is based on the Fed continuing to fight inflation. If they abandon that fight, then the dollar will certainly decline!

On the data front, this morning brings Initial (exp 215K) and Continuing (1870K) Claims as well as the Philly Fed (20.0). In addition to the Minutes yesterday we saw Housing Starts tumble although Permits were solid. However, there is clearly some concern over the housing market writ large, with fewer first-time buyers able to afford a new home, hence the rent story above. We have 3 more Fed speakers today but again, I ask, are they going to change their tune? I don’t think so. I find it hard to believe that the Fed will allow inflation to rebound sharply, but if they remain focused on rate cuts while inflation continues to creep higher, I fear that will be the outcome. And that, as I said above, will be a large dollar negative. We shall see.

Good luck

Adf