This morning, we all must feel blessed

Nvidia is still the best

Its’s earnings were great

Which opened the gate

For buyers, much more, to invest

But contra to that piece of news

The Minutes showed divergent views

On whether to slash

Next month, rates for cash

Or else wait for more weakness clues

Whatever your view of AI and the entire discussion, one must be impressed with Nvidia’s performance as a company, and as an equity. Last night’s earnings release was clearly better than expected as CEO Jensen Huang indicated that revenues for Q1 should grow to ~$65 billion as there is still significant demand for the buildout of data centers. He also pushed back on the idea that AI was a bubble. Of course, he would do that given he is at the center of the discussion. Nonetheless, after modest gains in US equities yesterday, despite much more hawkish than expected FOMC Minutes (discussed below), US futures are rising sharply this morning, with NASDAQ futures currently higher by 1.6% (6:15) and taking all the indices with it. Life is good!

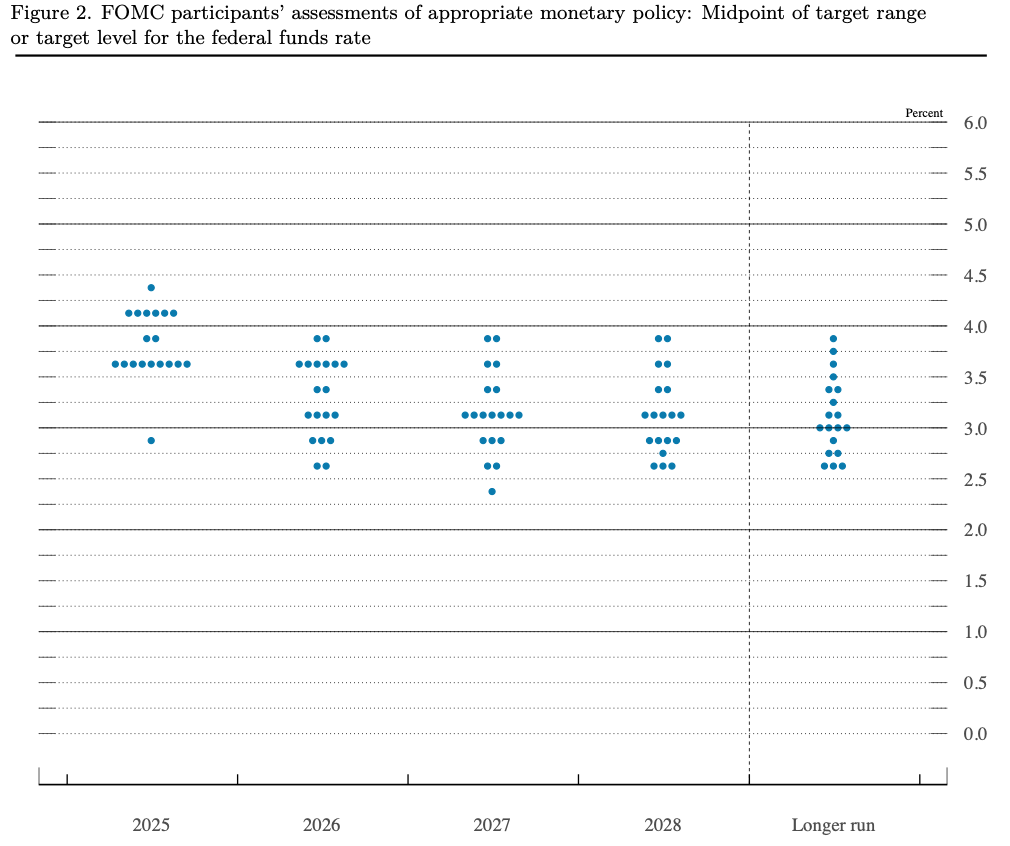

Which takes us to the FOMC Minutes and our first look at dissention in the Eccles building. I think the following paragraph, directly from the Minutes [emphasis added], does a good job in describing the wide range of views that currently exist around the table at the Fed, and make no mistake, I am hugely in favor of a wide range of views as I would contend it has been the groupthink in the past that led us to the current, unfavorable situation.

“In considering the outlook for monetary policy, participants expressed a range of views about the degree to which the current stance of monetary policy was restrictive. Some participants assessed that the Committee’s policy stance would be restrictive even after a potential 1/4 percentage point reduction in the policy rate at this meeting. By contrast, some participants pointed to the resilience of economic activity, supportive financial conditions, or estimates of short-term real interest rates as indicating that the stance of monetary policy was not clearly restrictive. In discussing the near-term course of monetary policy, participants expressed strongly differing views about what policy decision would most likely be appropriate at the Committee’s December meeting.”

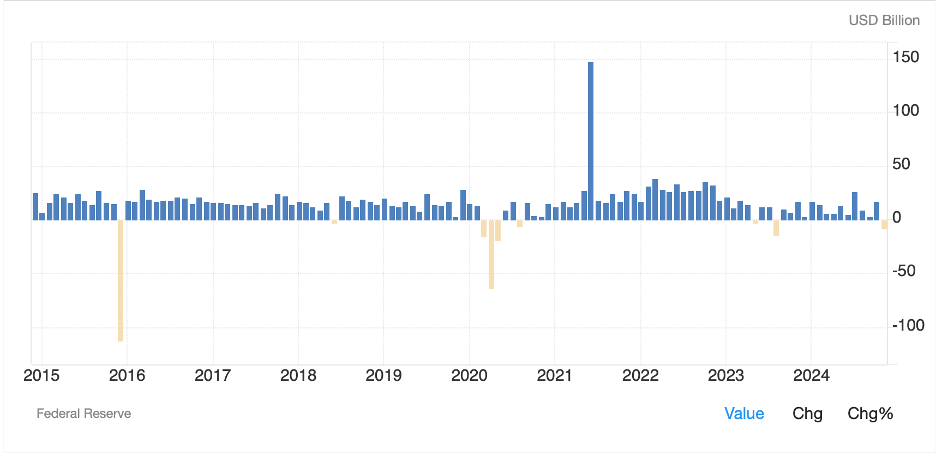

Below I have copied the dot plot from the September meeting, which contra to most previous versions shows a particularly wide range of views regarding the future level of Fed funds. I have to wonder, though, after reading the Minutes, if those dots will be stretched even wider apart from top to bottom in the December report.

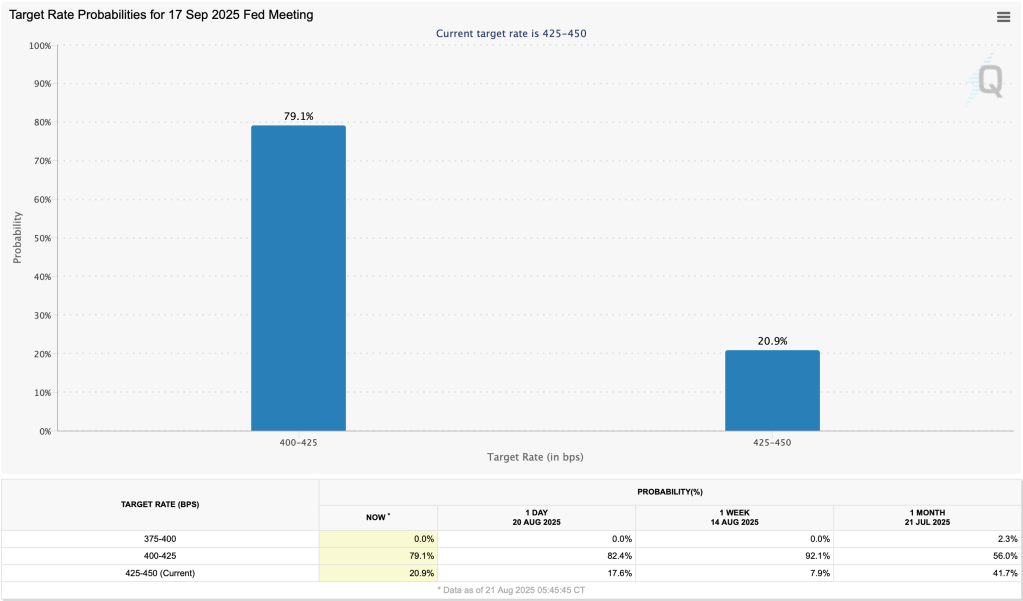

Of course, our interest is how did the market respond to this release? Well, it can be no surprise that the Fed funds futures market repriced further and is now showing just a 32% probability for a cut next month and 78% probability of the next cut coming in January. That said, the market remains convinced that rates must go lower over time, something that does not appear in sync with equity market growth expectations and seems to be completely ignoring the announced inward investment flows to the US from around the world.

Source: cmegroup.com

As to the equity market response, the two vertical lines show the release of the Minutes and then the release of Nvidia earnings. You can see for yourself which matters more to the market.

Source: tradingeconomics.com

Between the GDPNow data, which continues to show growth remains robust, and more announcements of inward investment on the back of trade deals, with the Saudis ostensibly promising $1 trillion after the recent White House dinner, I will take the over on future economic activity. Remember, too, the government is actively supporting mining, drilling and manufacturing and all of that is going to feed into economic growth here. My view is the Fed funds futures market is completely wrong, and we will not see rates back at the 3.0% level anytime in the next few years. I’m not suggesting we won’t see an equity market correction, just that the end is not nigh.

Each day the yen slides

Intervention creeps closer

Yen traders beware

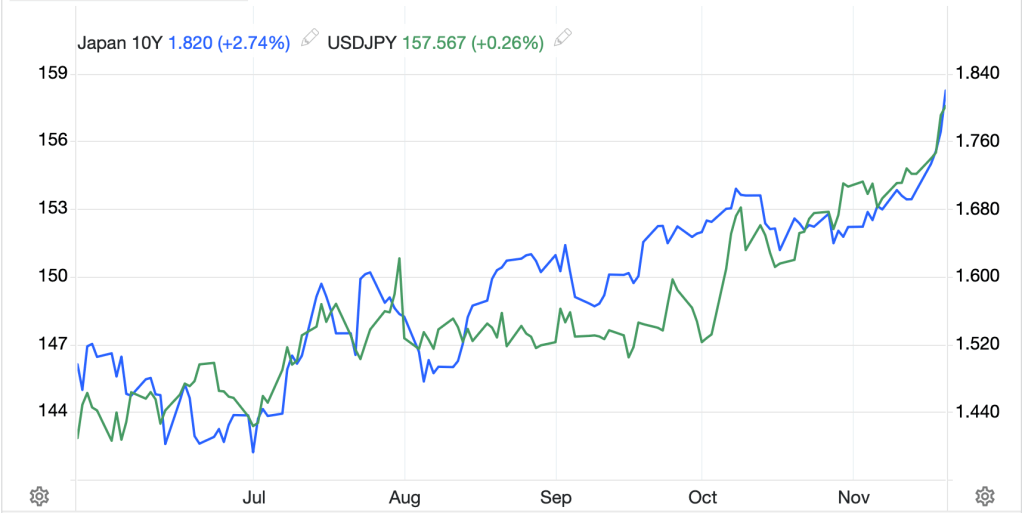

Turning to the dollar, it continues to strengthen across the board with the DXY trading back above 100 this morning, and now that the Fed seems more hawkish, looking like it may have legs. But let us focus on the yen, quite beleaguered of late, as it appears to be accelerating its downfall. Not only is this evident on the chart below, but we also have heard concerns for the third time, as per the following quotes from Minoru Kihara, the chief cabinet secretary:

“The yen is experiencing sudden, one-way movements that are concerning and which require close monitoring. Excessive fluctuations and disorderly movements in exchange rates must be monitored with vigilance. We are concerned about the recent one-way and sudden movements in the foreign exchange market. It’s important for exchange rates to remain stable, reflecting fundamentals.”

In the past six months, the yen has fallen >10% vs. the dollar and is lower by nearly 4% in the past month. At the same time, JGB yields are starting to accelerate higher, trading to yet another 20-year high at 1.82% and the price action there is remarkably similar to that of USDJPY as per the below chart. The problem for the JGB market is the BOJ already owns more than 50% of the outstanding debt, so buying more doesn’t seem to be a solution, whereas buying JPY in the FX market will have an impact, albeit short-term if they don’t change policies.

Source: tradingeconomics.com

The upshot of all this is the world is awash in debt, with global debt/GDP exceeding 3x. The lesson is that not all this debt will be repaid, in fact probably not that much at all. Be careful as to what you hold.

Ok, let’s briefly tour the markets I have not yet touched. Tokyo equities (+2.65%) loved the Nvidia earnings as did Korea (+1.9%), Taiwan (+3.2%) and most of Asia although China (-0.5%) and HK (0.0%) didn’t play along last night. I guess the ongoing restrictions on sales of Nvidia chips to China is still a negative there, as are recurring concerns over the property market as there is talk of yet another attempt to fix things by the government. Europe, too, is firmer this morning, although clearly not on tech bullishness given the lack of tech on which to be bullish. But there is talk of a Russia/Ukraine peace deal which may be a benefit. At any rate, gains are widespread on the order of +0.6% or so across the board.

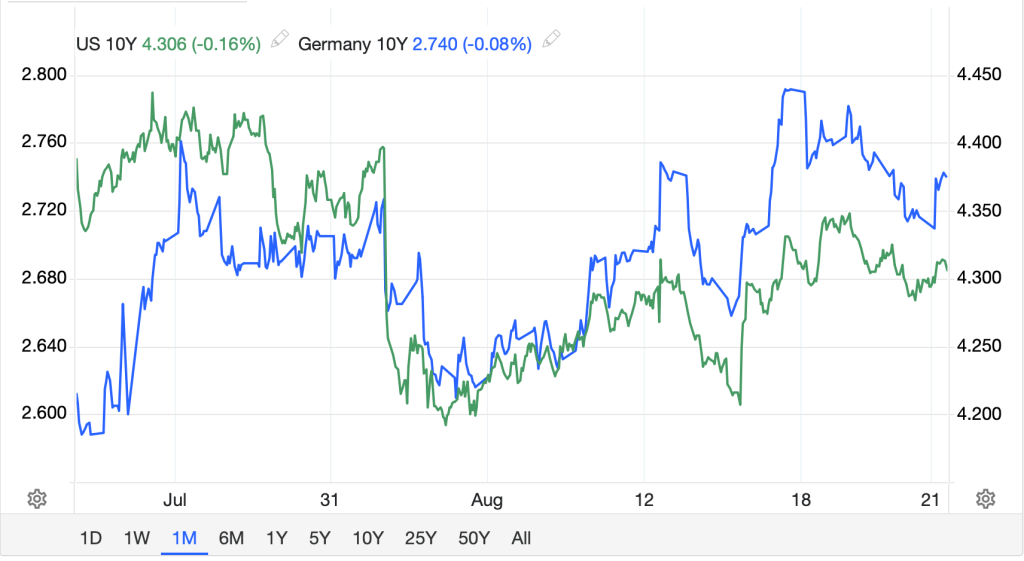

In the bond market, Treasury yields rose a couple of ticks yesterday and are higher by 1 more basis point this morning, but still at just 4.14%. The front of the curve rose by more on the back of the Minutes. European yields are also higher this morning, between 2bps and 3bps with UK gilts the outlier, unchanged on the day, as softer inflation has traders expecting a rate cut at the next BOE meeting on December 18th.

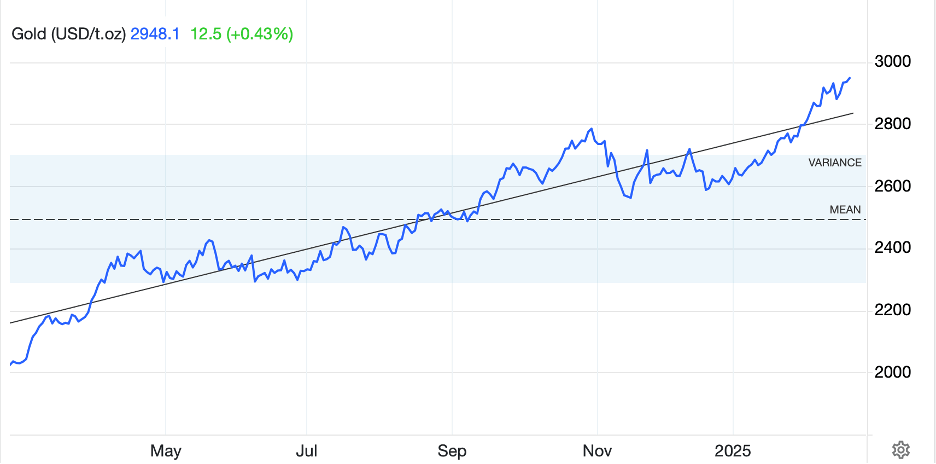

Oil (+1.0%) has rebounded off its recent lows and is trading back at…$60/bbl, the level at which it is clearly most comfortable these days. Meanwhile, gold (0.0%) gave back yesterday’s overnight rally to close mostly unchanged with the same true across the other metals although this morning silver (-0.7%) is slipping a bit further.

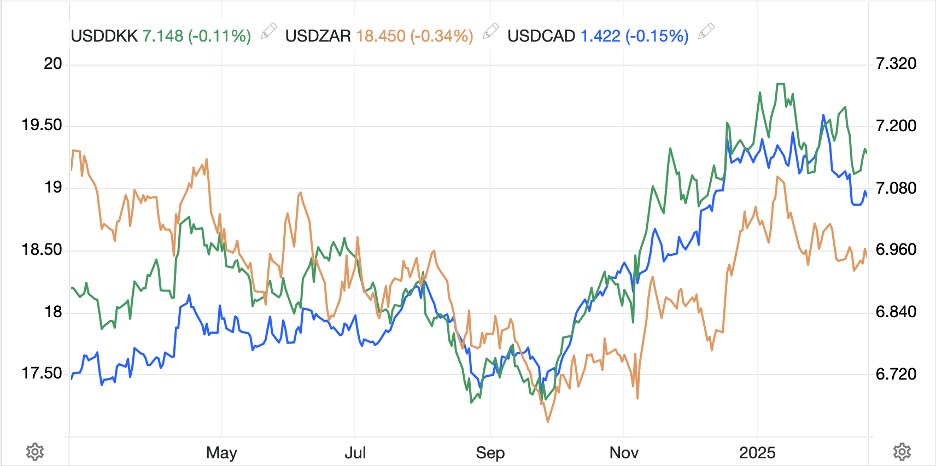

Finally, other currency movements beyond the yen (-0.3% today) are of a similar size across both the G10 and EMG blocs. Using the DXY as proxy, this is the third test above 100 since August 1st with many analysts are calling for a breakout at last.

Source: tradingeconomics.com

Perhaps this is true given the word is the Russia/Ukraine peace deal was negotiated entirely between the US and Russia without either Ukraine or Europe involved, demonstrating how insignificant Europe, and by extension the euro, have become. Just a thought.

On the data front, the big news is the September employment report is going to be released this morning along with some other data:

| Nonfarm Payrolls | 50K |

| Private Payrolls | 62K |

| Manufacturing Payrolls | -8K |

| Unemployment Rate | 4.3% |

| Average Hourly Earnings | 0.3% (3.7% Y/Y) |

| Average Weekly Hours | 34.2 |

| Participation Rate | 62.3% |

| Philly Fed | -3.1 |

| Existing Home Sales | 4.08M |

Source: tradingeconomics.com

On the one hand, the data is stale. On the other hand, it is all we have, so it will likely have greater importance than it deserves. I have a hard time looking at the economy and seeing substantial weakness, whether because of corporate earnings, inward investment announcements or the Fed’s growing concern over higher inflation. All that tells me the dollar is going to be in demand going forward.

Good luck

Adf