The wonderful thing about Trump

Is traders no longer can pump

A market so high

That it can defy

Reality ere it goes bump

Since policies can change so fast

A long-term view just cannot last

So, Fed put or not

Positioning’s fraught

And larger ones won’t be amassed

As we await the NFP report this morning, I couldn’t help but ponder the uptick in complaints and concerns by traders that increased volatility in markets on the back of President Trump’s mercurial announcements has changed the trading game dramatically. Let me say up front that I think this is a much healthier place to be and explain why.

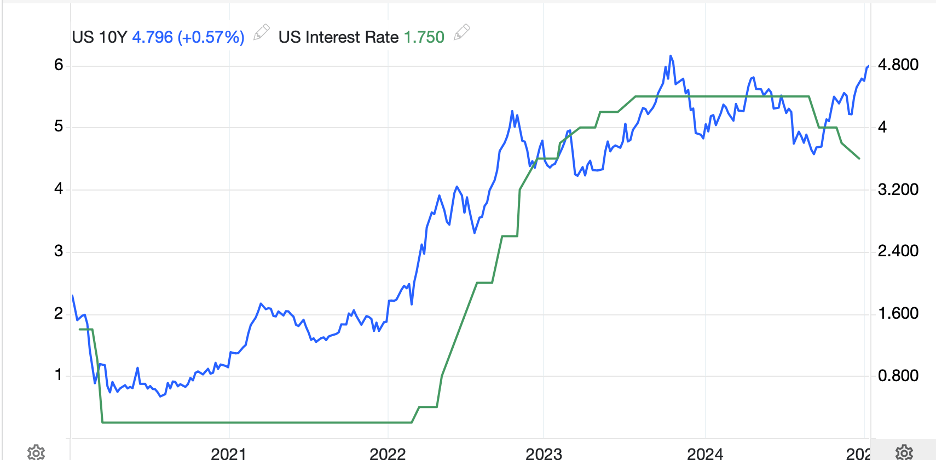

Pretty much since the GFC and, more importantly, then Chairman Bernanke’s first utilization of QE and forward guidance, the nature of financial markets had evolved into hugely leveraged one-sided views based on whatever the Fed was guiding. So, the initial idea behind QE and forward guidance was to assure all the traders and investors that make up the market that even though interest rates reached 0.0%, the Fed would continue to ease policy and would do so for as far out in time as you can imagine. Lower for longer became the mantra and every time there was a hiccup in the market, the Fed rushed in, added yet more liquidity to calm things down, and put the market back on track for further gains. This was true for both stocks and bonds, despite the fact that the Fed has no business or mandate involving the equity market.

This activity led to the ever-increasing size of trading firms as leverage was cheap and steadily rising securities prices led to lower volatility, both implied and real, in the markets. Risk managers were comfortable allowing these positions to grow as the calculated risks were minimized by the low vol. In fact, entire trading strategies were developed to take advantage of the situation with Risk Parity being a favorite.

However, a negative result of these actions by the Fed was that investors no longer considered the fundamentals or macroeconomics behind an investment, only the Fed’s stance. The only way to outperform was to take on more leverage than your competitors, and that was great while rates stayed at 0.0%. Alas, this persisted for so long that many, if not most, traders who learned the business prior to the GFC wound up retiring or leaving the market, and the next generation of traders and investors lived by two credos, number go up and BTFD.

The Fed remained complicit in this process as FOMC members evolved from background players to a constant presence in our daily lives, virtually preening on screens and in front of audiences and reiterating the Fed’s views of what they were going to do, implicitly telling traders that taking large, leveraged bets would be fine because the Fed had their back.

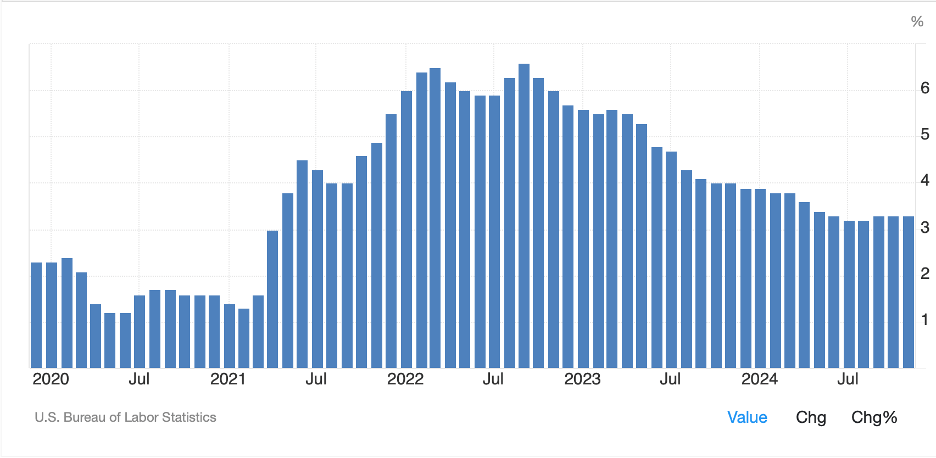

Of course, the pandemic upset that apple cart as the combination of Fed and government response imbued the economy with significantly more inflation than expected and forced the Fed to change their tune. The market was not prepared for that, hence the outcome in 2022 when both stocks and bonds fell sharply. But the Fed would not be denied and calmed things down and created a coherent enough message so that markets recovered the past two years. This has, naturally, led to increased position sizing and more leverage because that’s what this generation of traders understands and has worked.

Enter Donald J Trump as president, elected on a populist manifesto and despite his personal wealth, seemingly focused on Main Street, not Wall Street. The thing about President Trump is if an idea he proffers doesn’t work, he will drop it in a heartbeat and move on. As well, by wielding the full power of the United States when dealing in international situations, other nations can quickly find themselves in a difficult spot and, so far, have been willing to bend their knee. As well, his focus on tariffs as a primary weapon, with little regard for the impact on markets, and the way with which he uses them, threatening to impose them, and holding off at the last minute when other nations alter their policy, has kept markets off-balance.

The result is large leveraged positions are very difficult to hold and manage when markets can move up and down 2% in a day, every day (like the NASDAQ 100 chart below), depending on the headlines.

Source: tradingeconomics.com

The natural response is to reduce position size and leverage, and that, my friends, is a healthy turn in markets. This is not to say that there are not still many significant imbalances, just that as they continue to blow up, whether Nvidia, or FX or metals, my take is the next set of positions will be smaller as nimble is more important than large. It doesn’t matter how smart an algorithm is if there is no liquidity to adjust a position when the world changes. This poet’s opinion is this is a much healthier place for markets to live.

Ok, let’s see what happened overnight ahead of today’s data. Mixed is the best description as yesterday’s US closes saw a mixed outcome and overnight the Nikkei (-0.7%) fell while both Hong Kong (+1.2%) and China (+1.3%) gained ground. Korea and India slid, Taiwan rose, the picture was one of uncertainty about the future. That also describes Europe, where only Germany and Norway have managed any modest gains at all while the rest of the continent and the UK are all slightly lower. Apparently, yesterday’s BOE rate cut has not comforted investors in the UK, nor has the talk of more rate cuts by the ECB bolstered attitudes in Europe. As to US futures, at this hour (7:00) they are basically unchanged.

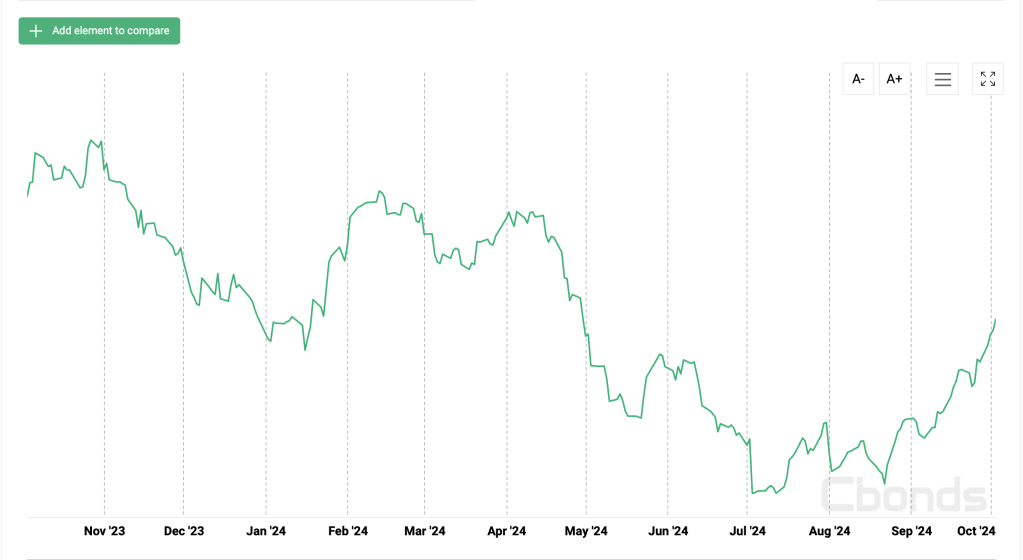

In the bond market, the biggest mover overnight was in Japan where JGB yields rose 3bps, once again touching that recent 30-year high. While some BOJ comments indicated inflation remained well-behaved, the market is clearly of the view that Ueda-san is getting set to hike rates further. In Europe, yields are basically lower by 1bp across the board and Treasury yields are unchanged on the session as investors and traders continue to focus on Treasury Secretary Bessent’s conversation that he cares about 10-year yields, not Fed funds. Perhaps the Fed will cut rates to recapture the spotlight they have grown to love.

Oil (+0.5%) prices continue to drift lower overall, although this morning they are bouncing from yesterday’s closing levels. Questions about sanctions policy on Iran, on Russia’s shadow fleet and about the state of the global economy and therefore oil demand remain unanswered. However, the fact that oil has been sliding tells me that there is some belief that President Trump may get his way regarding a desire for lower oil prices. In the metals markets, copper (+1.1%) is flying higher again, and seems to be telling us that the economy is in decent shape. Either that or there is a major supply shortage, although if that is the case, I have not seen any reporting on the subject. Both gold and silver are very modestly higher this morning after small declines yesterday as the London – NY arbitrage continues to be the hot topic and financing rates for both metals have gone parabolic.

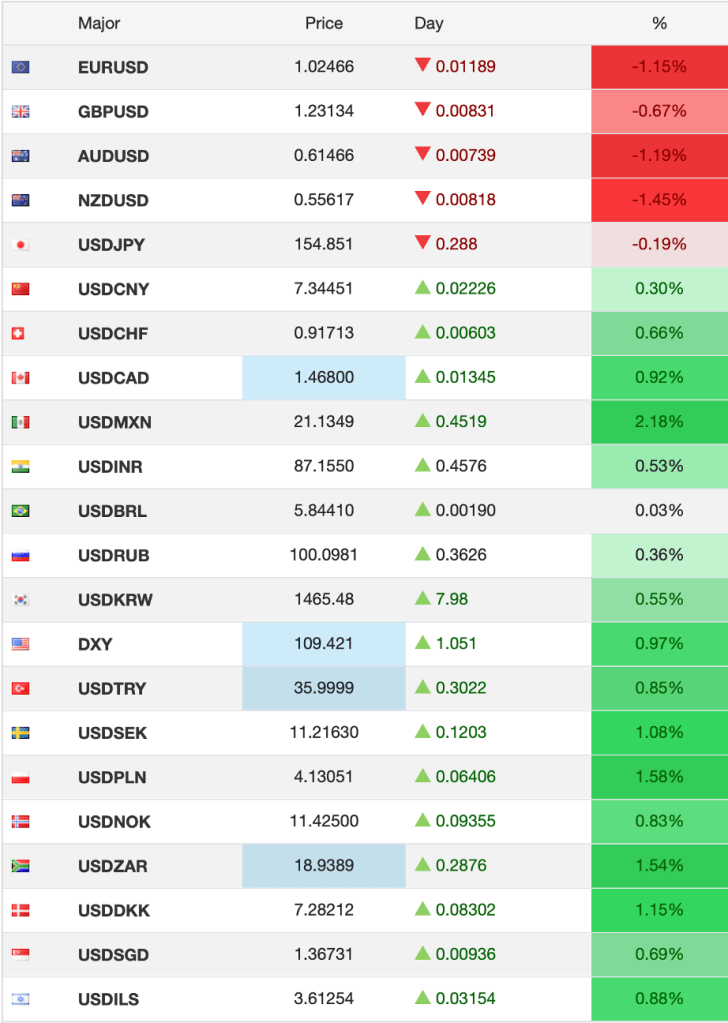

Finally, the dollar is mixed this morning, perhaps slightly firmer as JPY (-0.5%) is actually the worst performer around, despite the rise in JGB yields. There is a lot of chatter on how the yen is due to trade much higher, and it has rallied over the past month, but it is certainly not a straight line move. As to the rest of the space, virtually every other currency is +/-0.2% from yesterday’s close with CLP (+0.5%) the lone exception as the Chilean peso benefits from copper’s huge rally.

On the data front, here are the latest expectations for this morning’s employment report:

| Nonfarm Payrolls | 170K |

| Private Payrolls | 141K |

| Manufacturing Payrolls | -2K |

| Unemployment Rate | 4.1% |

| Average Hourly Earnings | 0.3% (3.8% Y/Y) |

| Average Weekly Hours | 34.3 |

| Participation Rate | 62.5% |

| Michigan Sentiment | 71.1 |

Source: tradingeconomics.com

Remember, though, the ADP number on Wednesday was much better than expected at 183K (exp 150K) with a major revision higher by 54K to the previous month). As well, this month brings the BLS adjustments for 2024 which will not be broken down, just lumped into the data. Recall, there are rumors of a significant reduction in the number of jobs created in 2024 as well as a significant increase in the population estimates with more complete immigration data, and that has led some pundits to call for a much higher Unemployment Rate. I have no insight into how those adjustments will play out although the idea they will be large seems highly plausible.

Ahead of the number, nothing will happen. If the number is strong, so NFP >200K, I expect that bonds will suffer, and the dollar will find some support. A weak number should bring the opposite, but the revisions are a wild card. As I stated this morning, the best idea is to maintain the smallest exposures possible for the time being, as volatility is the one thing on which we can count.

Good luck and good weekend

Adf