The data continues to be

Uncertain, and so what we see

Is both bulls and bears

Just splitting more hairs

Til markets reach their apogee

Meanwhile, throughout Europe concern

Is building, that no one did learn

Their energy dreams

Are nought but grift schemes

And growth’s in a long-term downturn

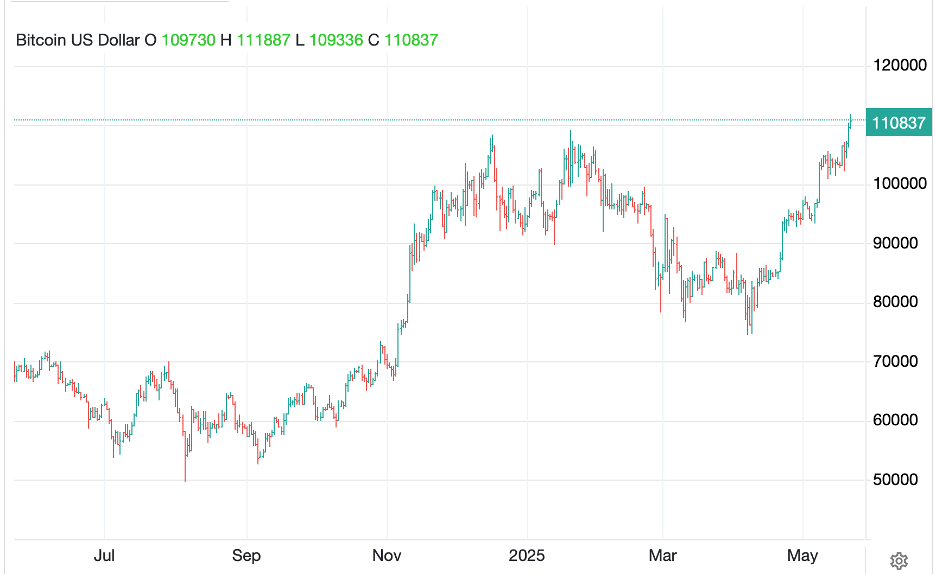

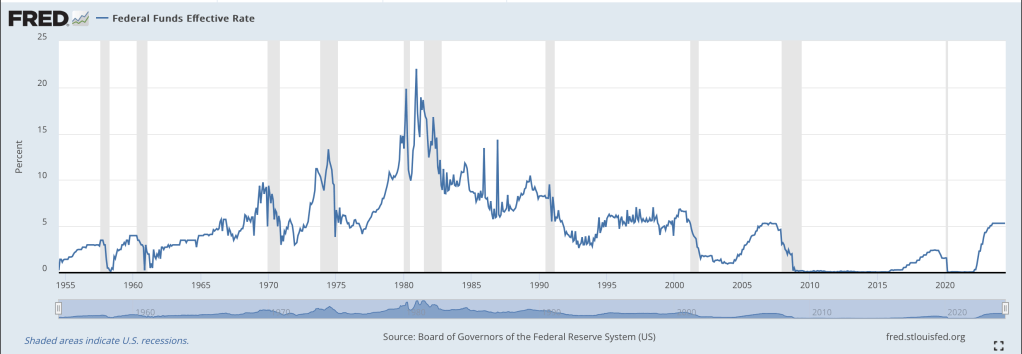

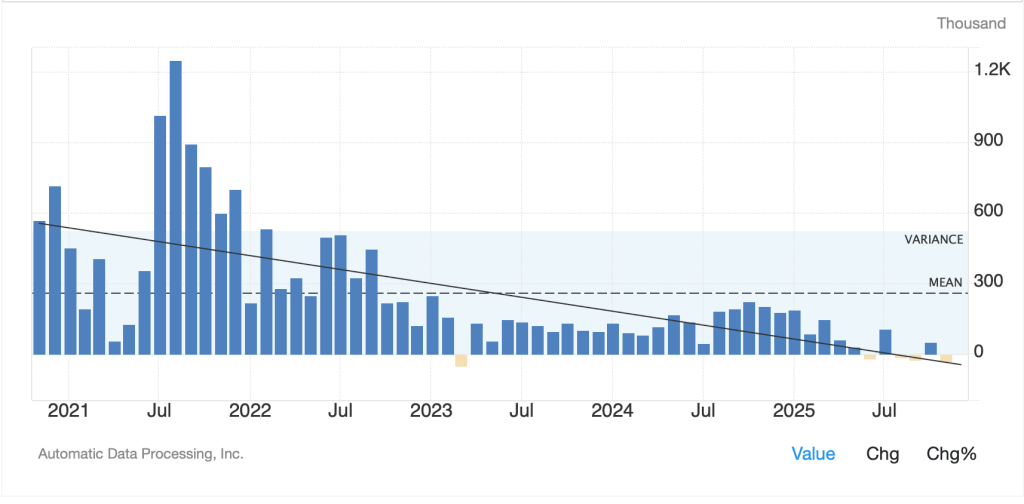

Once again, macroeconomic stories are light on the ground with no overarching theme atop the headlines. As data continues to be released in the US post the government shutdown, we are seeing a similar pattern as before the shutdown, namely lots of conflicting data. Yesterday was a perfect example as ADP Employment data was far weaker than expected printing at -32K (exp +10K) and indicative of a slowing economy. At the same time, ISM Services showed unexpected strength, printing 52.6 with every sub indicator printing higher than last month except prices, which slipped 5 points. While there was September IP and Capacity Utilization data, given it was so old, it just didn’t seem relevant.

Depending on your underlying view, it was once again easy to point to recent data and make either the bull case on the economy and stocks or the bear case. But there’s more. A look at the last 5 years of ADP data shows a very distinct downward trend in employment as per the below.

Source: tradingeconomics.com

But as with so many things in the economy lately, it is fair to ask if the data we have known in the past is reflective of the current economic situation. After all, if the Trump administration has deported 500K individuals, and another 1.5 million have self-deported, as the administration claims, it ought not be surprising that employment numbers are declining. The implication is that population is declining, which would make sense. So, I ask, does the declining ADP data signal what it did 5 years ago or 10 years ago? I don’t believe the answer is that straightforward.

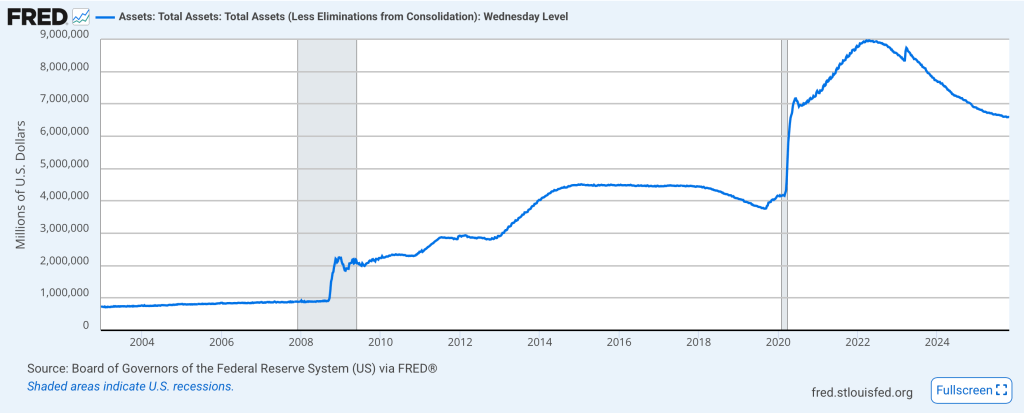

One of the things that has concerned me lately is the measurement of GDP. My thesis has been that counting government spending in Keynes’s equation Y = C + I + G + (X-M) is double counting because, after all, if the government spends money, it goes into the economy and is recorded by the people/companies who receive it. But perhaps my queasiness over the GDP idea is caused by something else instead, the fact that GDP measures credit creation, not economic activity. This article by Alasdair Macleod, a pretty well-known economic analyst with a long career observing markets and economies, does an excellent job of identifying some really interesting problems that get accepted and assumed by many in their analysis of the current situation.

For a while we have all seen, and probably felt, there is a disconnect between the data published and the feeling we get with respect to the current situation. I highlighted the cost-of-living problem last week with the Michael Green articles. This is another arrow in the quiver of things are not what they appear and that’s why so many people are so unhappy (even taking away TDS).

For me, where I try to synthesize a market view based on the information available, it is a very difficult time because of all the inconsistencies relative to what I have known in the past. As well, I am being forced to reconfigure my mental models as the world has changed. I suggest everyone do the same, as there is no going back to pre-Covid, let alone pre-GFC.

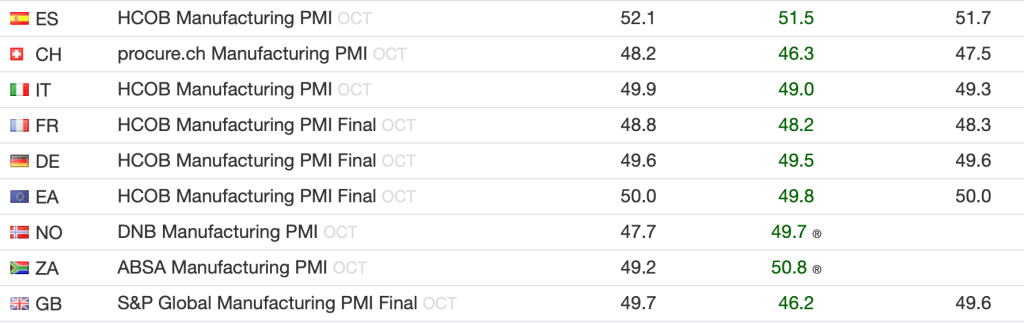

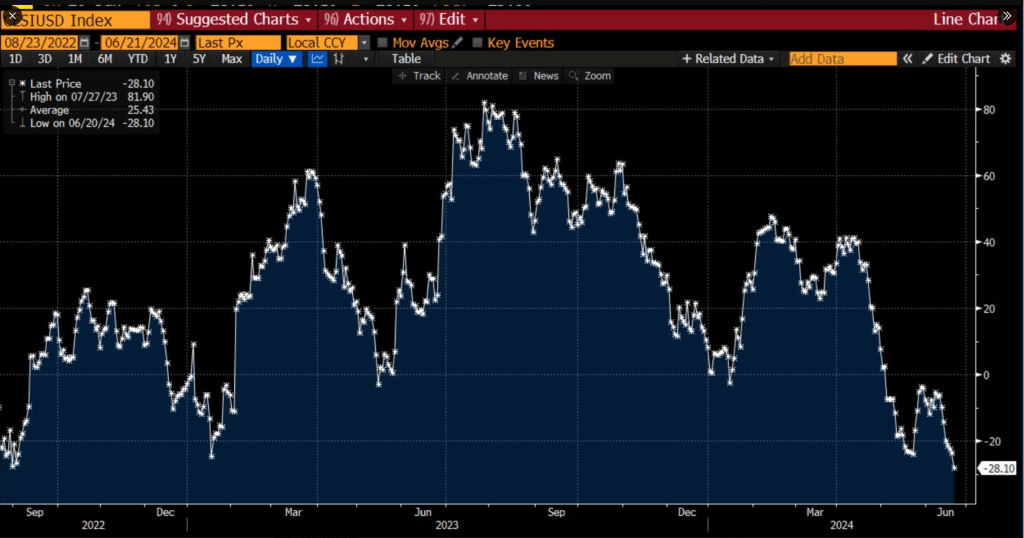

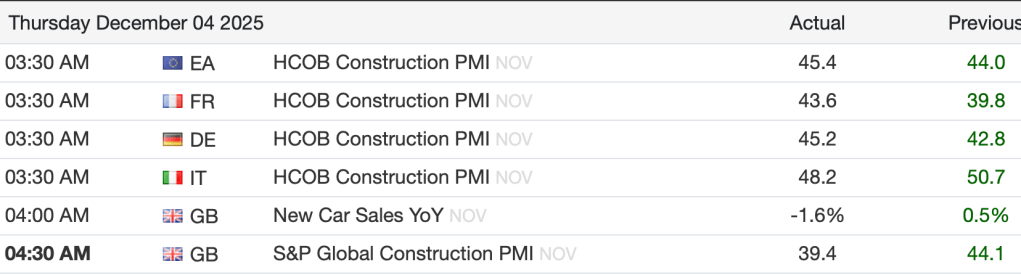

But the US is relatively well-off compared to most of the rest of the G10 as evidenced by this morning’s Eurozone data where Construction PMIs were, in a word, dreadful as can be seen below:

Source: tradingeconomics.com

No matter how you slice it, the fact that every reading is below 50 is a telling statement on the economic situation in Europe. Adding to this problem is the fact that it appears, the EU, under the guidance(?) of President Ursula von der Leyen, is getting set to force the appropriation of Russian assets that were frozen at the outset of the Ukraine war, an act that Russia has indicated would, itself, be an act of war and they would respond in kind. The US has unequivocally said they will not defend Europe if that is their decision, although we will continue to sell them weapons.

For 80 years, NATO has been the defense umbrella allowing Europe to spend their money on butter, not guns. Despite all the plans of rearmament, if Europe goes down this road, I suspect that there is nothing they can do to defend themselves without the US. Once again, it is difficult to look at fiat currencies around the world, especially in Europe, and think they have more staying power than the dollar.

Ok, let’s tour markets. A solid day in the US was followed by strength virtually across the board in Asia (Japan +2.3%, HK +0.7%, China +0.3%) with the rest of the region +/- 0.3%, so not overwhelmingly positive or negative. The Japanese outlier was based on news about Fanuc signing a deal with Nvidia to make AI industrial robots and that took the whole tech sector in Tokyo higher. In Europe, green is also today’s theme as despite the weak data shown above, we started to get the first hints that the ECB may consider rate cuts after all. While Madame Lagarde has been on her high horse saying there is no need to adjust rates, Piero Cipollone, a board member has highlighted concerns over further potential economic weakness going forward. I look for others to come to the same conclusion and talk of an ECB cut to start to increase although swaps markets do not yet reflect any changes. And at this hour (7:40) US futures are pointing slightly higher, 0.15% or so.

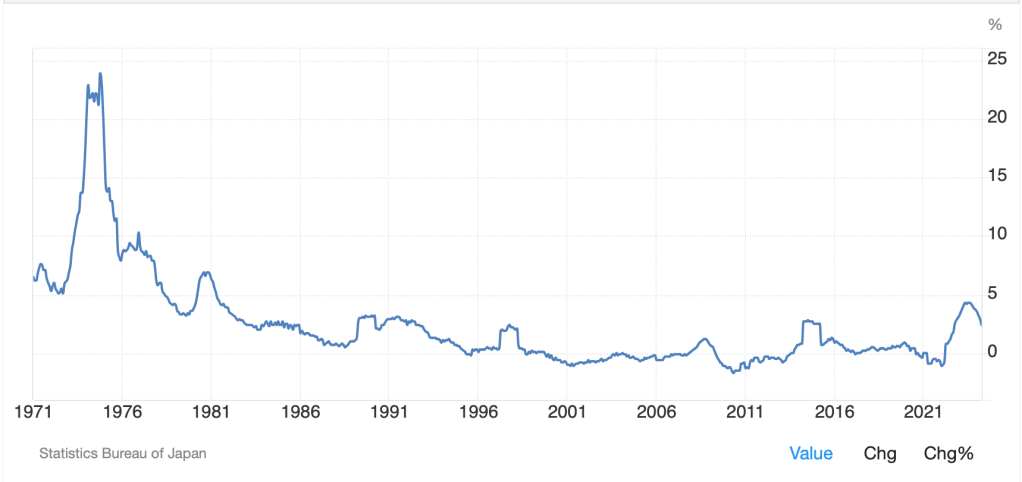

In the bond market, Treasury yields are reversing some of yesterday’s modest decline, rising 2bps this morning and that has helped pull European sovereign yields higher by similar amounts across the board. The one exception here is UK gilts, which given the ongoing weak data seem to be anticipating a greater chance of a BOE cut than before. in Asia, JGB yields rose 4bps and now sit at 1.93%, a new high for the move, but there is no indication we are near a top. There is growing confidence the BOJ will hike rates later this month, although I would expect that should help slow the rise as at least it will have a modest impact on inflation readings going forward.

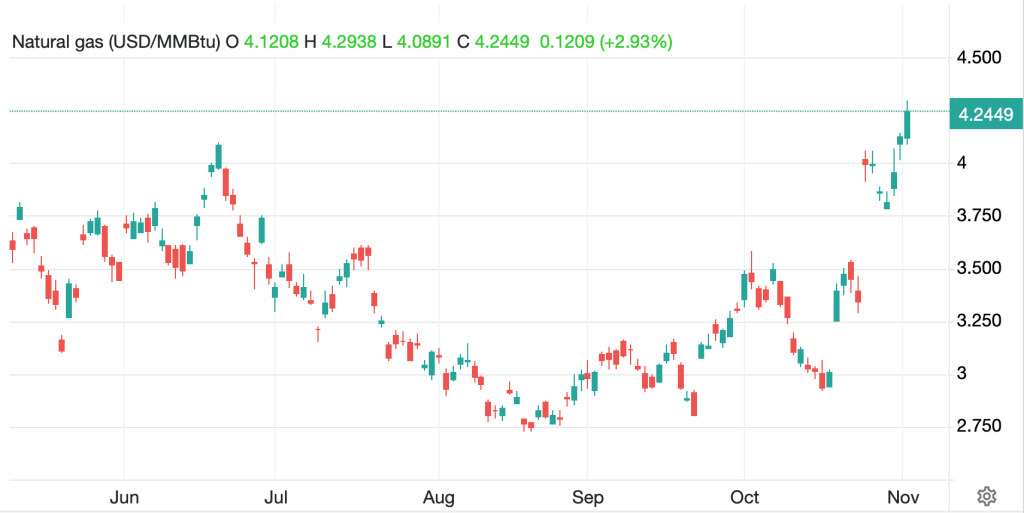

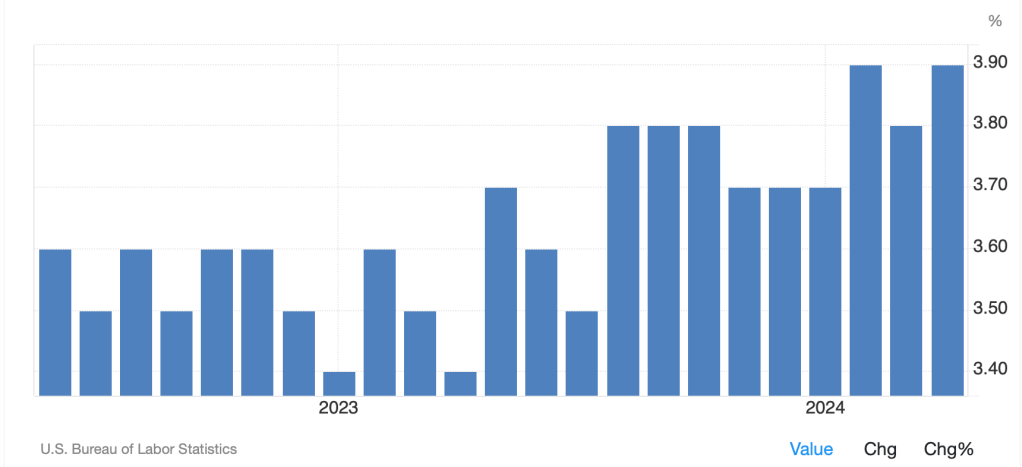

In the commodity markets, oil (+0.5%) continues to chop back and forth making no new ground in either direction. Stories about peace in Ukraine don’t seem to matter much, nor do stories about a US invasion of Venezuela. In fact, nothing seems to matter too much to this market other than actual supply and demand, and that seems pretty balanced, at least as evidenced by the fact that for the past 2+ months, we have gyrated either side of $60/bbl with no impetus in either direction. (see below)

Source: tradingeconomics.com

Metals markets are slipping a bit this morning (Au -0.25%, Ag -1.8%, Cu -0.6%) but that is simply part of the recent consolidation. After all, metals have rallied forcefully all year, so taking a breather is no surprise.

Finally, the dollar is a nonevent today with the most noteworthy story the news that the PBOC fixing last night was 160 pips higher (weaker CNY) than forecast by the market. As well, there have been several stories that Chinese state-owned banks are buying dollars in the market to help slow down the yuan’s recent appreciation. I discussed the yuan yesterday so this should be no surprise. The tension on China to maintain a weak enough currency to support their export industries is huge, so a quick appreciation would be extremely negative for the nation’s trade balance and economic activity.

On the data front, Initial (exp 220K) and Continuing (1960K) Claims lead us off and then Factory Orders from September (0.5%) come at 10:00. There are still no Fed speakers, so markets remain subject to headline risk, notably from the White House. As we are in December, my sense is that things will become increasingly uninteresting from a market perspective absent a major new event. While price action will likely remain choppy, it is hard to see a major directional move until next year.

Good luck

Adf