The president left in a flash

Completing a quick dine and dash

But so far, no word

On what, this move, spurred

Though I’ve no doubt he’ll make a splash

Then last night the BOJ passed

On hiking, though none was forecast

And Germany’s ZEW

Implied there’s a view

That growth there will soon be amassed

I have to admit that when I awoke this morning, I expected there to have been significantly more news regarding the Iran/Israel conflict based on President Trump’s early departure from the G-7 meeting. But, from what I see so far, while markets have reversed some of yesterday’s hope that a ceasefire was coming soon, my read is we are back to overall uncertainty in the situation. Of course, the concept of the fog of war is well known, and I expect that we will not find out very much until those in control of the information, whether the IDF or the US military, or Iranian sources, choose to publicize things. The one thing we know is that everything we learn will be biased toward the informants’ view, so needs to be parsed carefully. I do think that Trump’s comments to the press when he was leaving the G-7 about seeking “an end. A real end. Not a ceasefire, an end,” to the ongoing activities is telling. It appears the Israelis planned on a 2-week campaign and that is what they are going to complete.

From a market perspective, as we have already seen in the price of oil, and generally all asset classes, absent a significant escalation, something like a tactical nuclear strike by the Israelis to destroy the Iranian nuclear bomb-making capabilities, I expect choppiness on headlines, but no trend changes. At some point, the fighting will end, and markets will return their focus to economic and fiscal concerns and perhaps central banks will become relevant again.

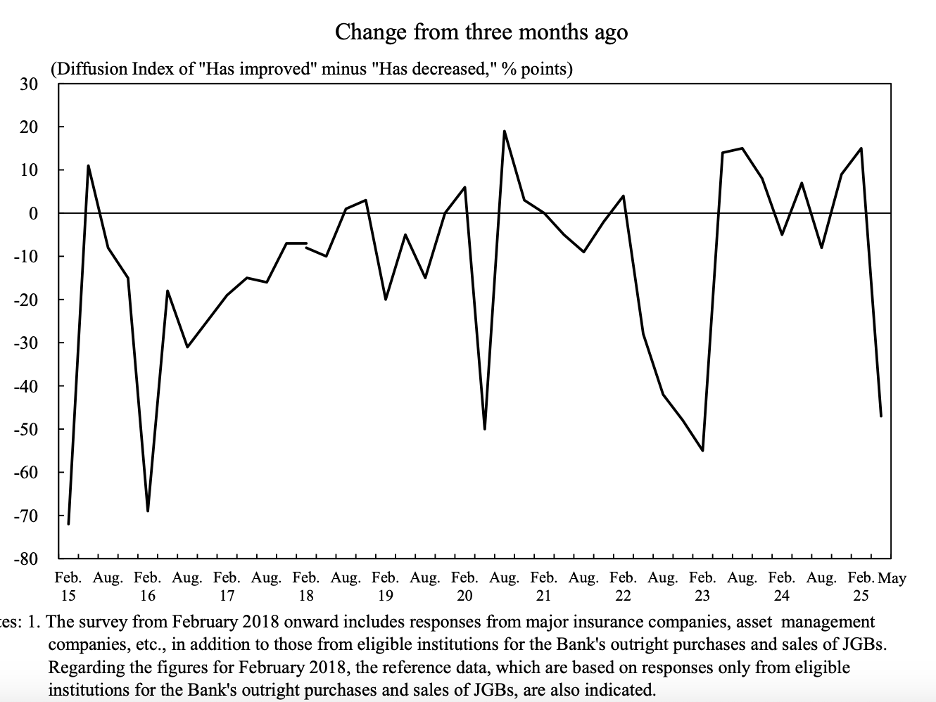

So, let’s turn to that type of news which leads with the BOJ leaving policy rates on hold, although they did reduce the amount of QE to ¥200 billion per month, STARTING IN APRIL 2026! You read that correctly. The BOJ, which has been buying ¥400 billion per month of JGBs while they raised interest rates in their alleged policy tightening, has decided that ten months from now it will be appropriate to slow the pace of QE. Yes, inflation has been running above their 2.0% target for more than three years (April 2022 to be exact) as you can see in the below chart, but despite a whole lot of talk, action has been slow to materialize.

Source: tradingeconomics.com

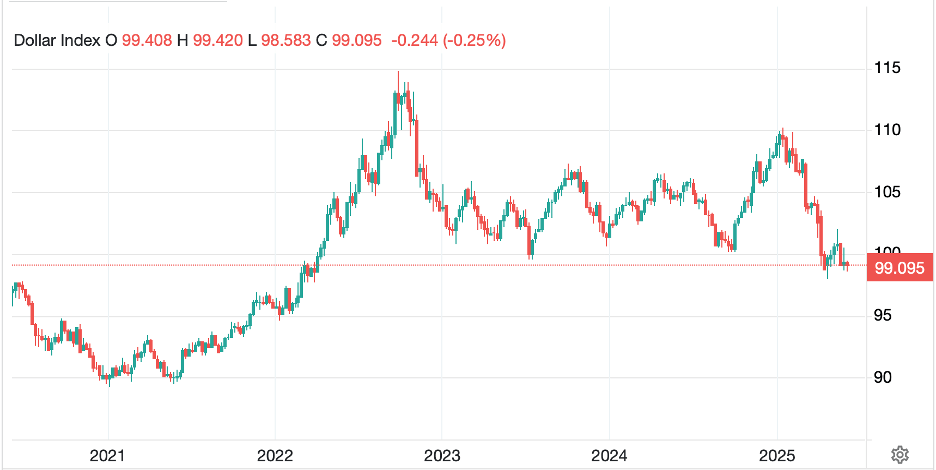

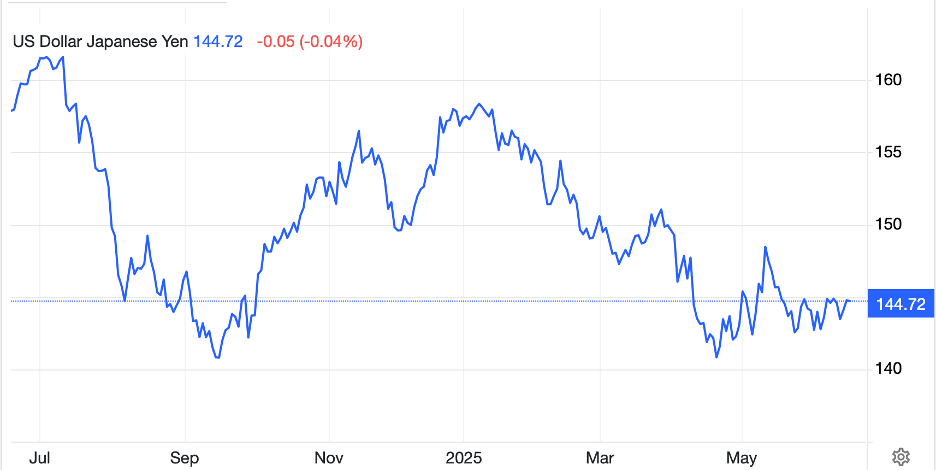

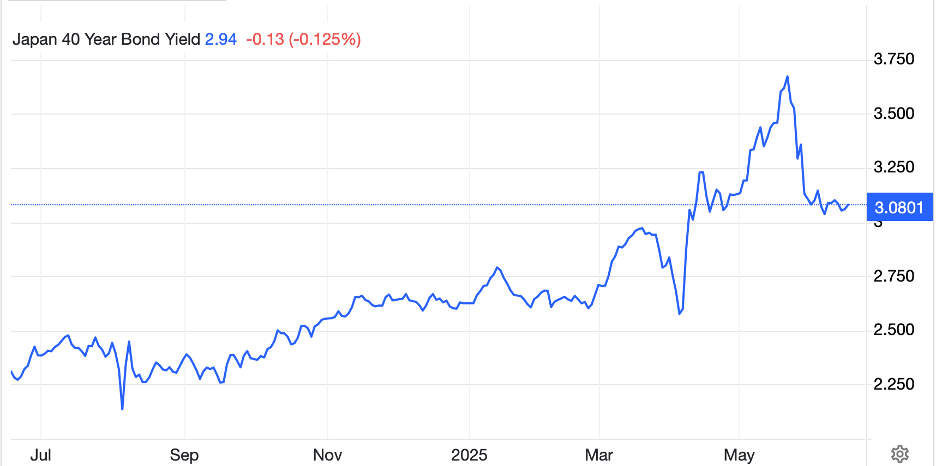

You may recall about a month ago when Japanese long-end yields, the 30-year and 40-year bonds, jumped substantially, to new all-time highs and there was much discussion about how there had been a sea change in the situation in Japan. Expectations grew that we would start to see Japanese institutions reduce their holdings of Treasuries and bring their funds home to invest in JGBs, leading to a collapse in the dollar. The carry trade was going to end, and this was another chink in the primacy of the dollar’s hegemony. Well, if that is the case, it is going to take longer than the punditry anticipated, at the very least, assuming it happens at all. As you can see from the charts below of both USDJPY and the 40-year JGB, all that angst has at the very least, been set aside for now.

Source: tradingeconomics.com

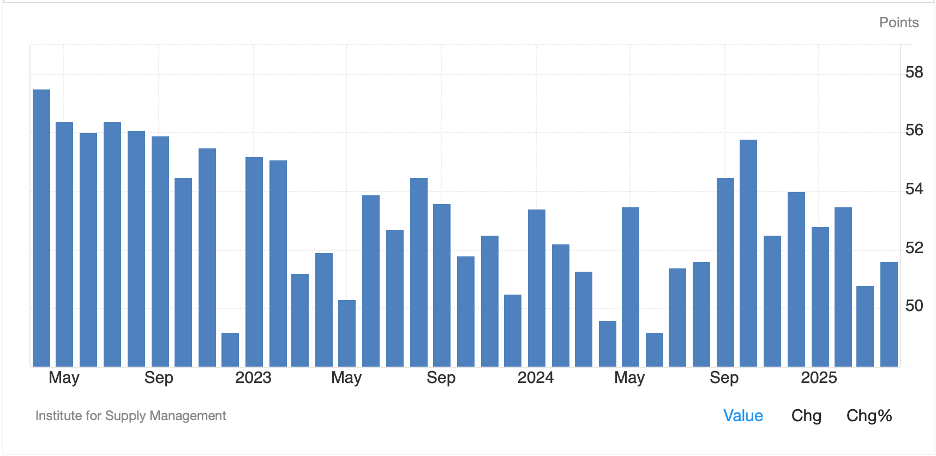

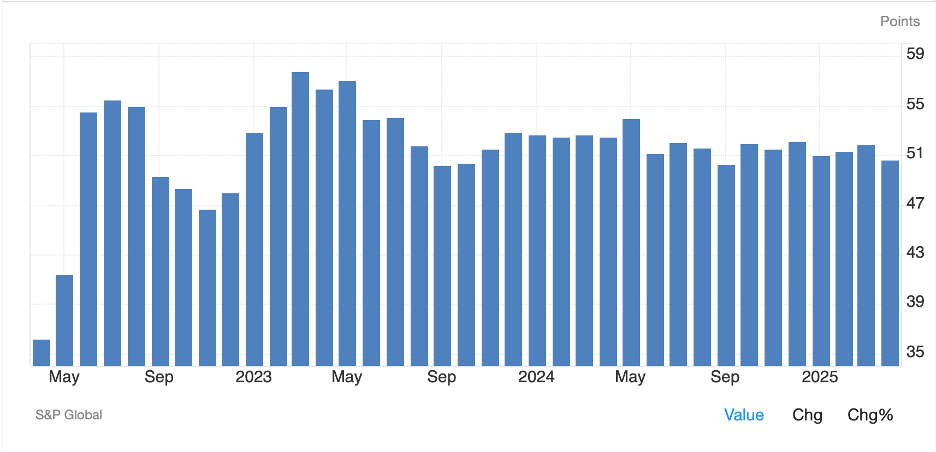

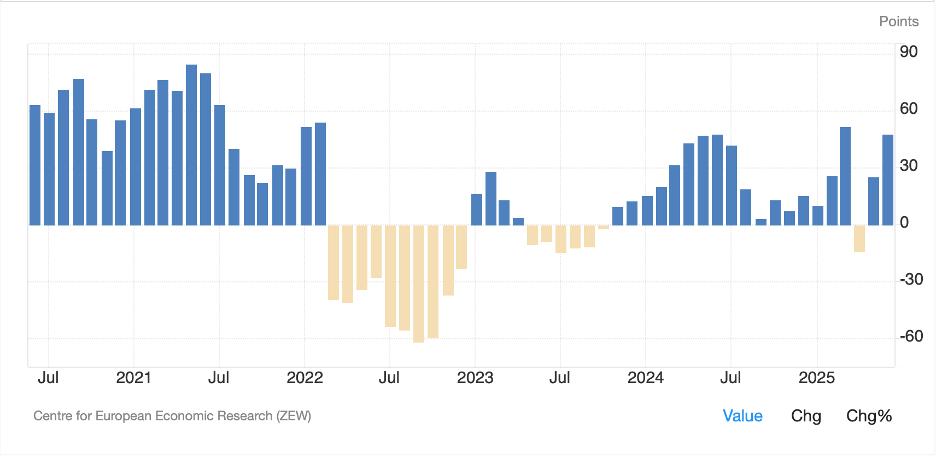

Elsewhere, the German ZEW data released this morning was substantially stronger than both last month and the forecasts for an improvement. As you can see from the chart below, it is back at levels that are consistent with actual economic growth, something Germany has been lacking for several years. It appears that a combination of the continued tariff truce, the promises of massive borrowing and spending by Germany to rearm itself and the ECB’s easy policy have German business quite a bit more optimistic that just a few months ago.

Source: tradingeconomics.com

Ok, while we await the next shoe to drop in Iran or Israel, let’s see how markets have behaved overnight. Yesterday’s nice rally in the US was followed by a mixed picture in Asia with the Nikkei (+0.6%) gaining after the BOJ showed that tighter policy is not coming that soon. Elsewhere in the region, China, HK and India were all down at the margin, less than 0.4% while Korea and Taiwan managed some gains with Taiwan’s 0.7% rise the biggest mover overall. In Europe, though, the excitement about a truce in Iran is gone with bourses across the continent lower (DAX -1.25%, CAC -1.05%, IBEX -1.5%, FTSE 100 -0.5%). Apparently, there is fading hope of trade deals between the US and Europe and concerns are starting to grow as to how that will impact European activity. I guess the ZEW data didn’t do that much to help. US futures at this hour (7:00) are all pointing lower by about -0.5%, largely unwinding yesterday’s gains.

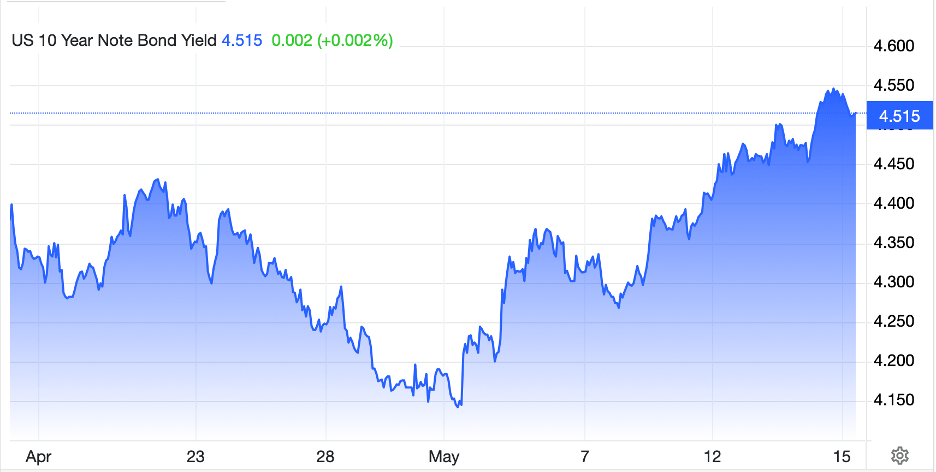

In the bond market, Treasury yields, which backed up yesterday, are lower by -3bps this morning, essentially unwinding that move. However, European sovereign yields have all edged higher between 1bp and 2bps with Italy’s BTPs the outlier at +3bps. Quite frankly, it is hard to have an opinion as to why bond yields move such modest amounts, so I’m not going to try to explain things.

In the commodity space, fear is back in play as oil (+1.7%) is rallying as is gold (+0.4%) which is taking the rest of the metals complex (Ag +2.3%, Cu +0.3%, Pt +3.0%) with it. These are the markets that are most directly responding to the ongoing ebbs and flows of the Iran/Israel situation, and I expect that will continue. In the end, I continue to believe the long-term trend for oil is toward lower prices while for gold and metals it is toward higher prices, but on any given day, who knows.

Finally, the dollar doesn’t know which way to turn with modest gains and losses vs. different currencies in both G10 and EMG blocs. The euro, pound and yen are all within 0.1% of yesterday’s closing levels while we have seen KRW (-0.4%) and INR (-0.3%) suffer and NOK (+0.4%) and SEK (+0.4%) both gain on the day. However, those are the largest movers across the board, so it is difficult to make a case that anything of substance is ongoing.

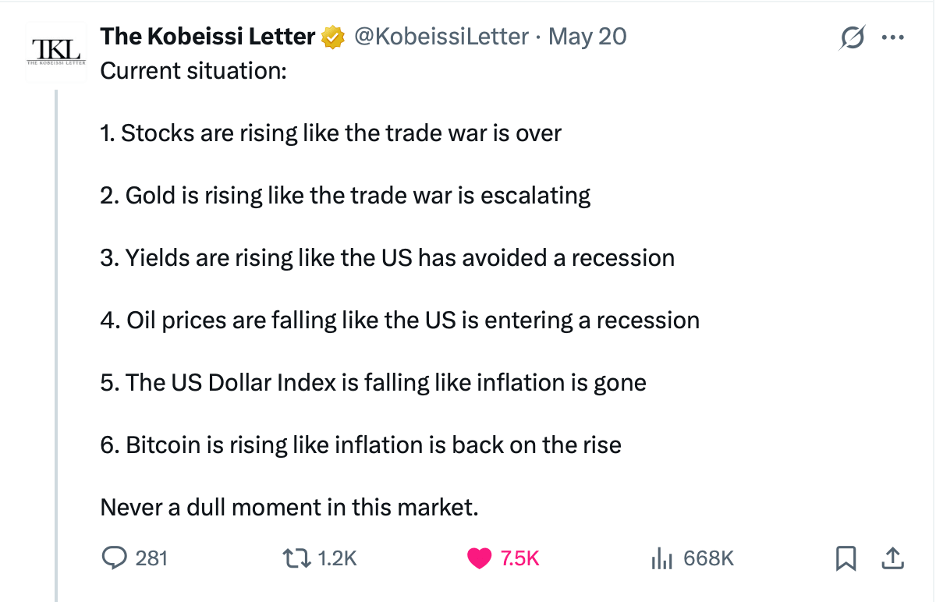

On the data front, yesterday’s Empire State Manufacturing index was quite weak at -16, not a good look. This morning, we see Retail Sales (exp -0.7%, +0.1% ex-autos), IP (0.1%), and Capacity Utilization (77.7%). As well, the FOMC begins their meeting this morning with policy announcements and Powell’s press conference scheduled for tomorrow. Helpfully, the Fed whisperer, Nick Timiraos, published an article this morning in the WSJ to explain why the Fed was going to do nothing as they consider inflation expectations despite the lack of empirical evidence that those have anything to do with future inflation. But it is a really good sounding theory.

For now, the heat of the Iran/Israel situation will hold most trader’s attention, but I suspect that this will get tiresome sooner rather than later. The biggest risk to markets, I think, is that the Iranian regime collapses and a secular regime arises, dramatically reducing risks in the Middle East and reducing the fear premium in oil substantially. If that were to be the case, I expect the dollar would suffer as abundant, and cheap, oil would help other nations more than the US on a relative basis given the US already has its own supply. But a major change of that nature would have many unpredictable outcomes. In the meantime…

Good luck

Adf