The chaos is starting to spread

As traders, when they look ahead

Have come to the view

More debt will accrue

And fear that the dollar is dead

So, gold and its ilk rise unchecked

While fiat is totally wrecked

Most bonds have a pox

But hope lives for stocks

And crypto? They’re still circumspect

I cannot possibly cover all the things ongoing in the markets right now as it would take a 5000 word note to do so adequately. As such, I will try to give a high level take in far fewer words.

Headlines –

- Minneapolis continues to consume most of the domestic press, but is only tangentially, if at all, related to markets. Perhaps it questions President Trump’s authority and that is a negative for US assets and the dollar.

- Xi Jinping purges his most senior military leader, accused of spying and selling state nuclear secrets to the US. Xi has removed virtually his entire military leadership, probably reducing near term risk of a Taiwan invasion, but ignores economic issues

Currencies –

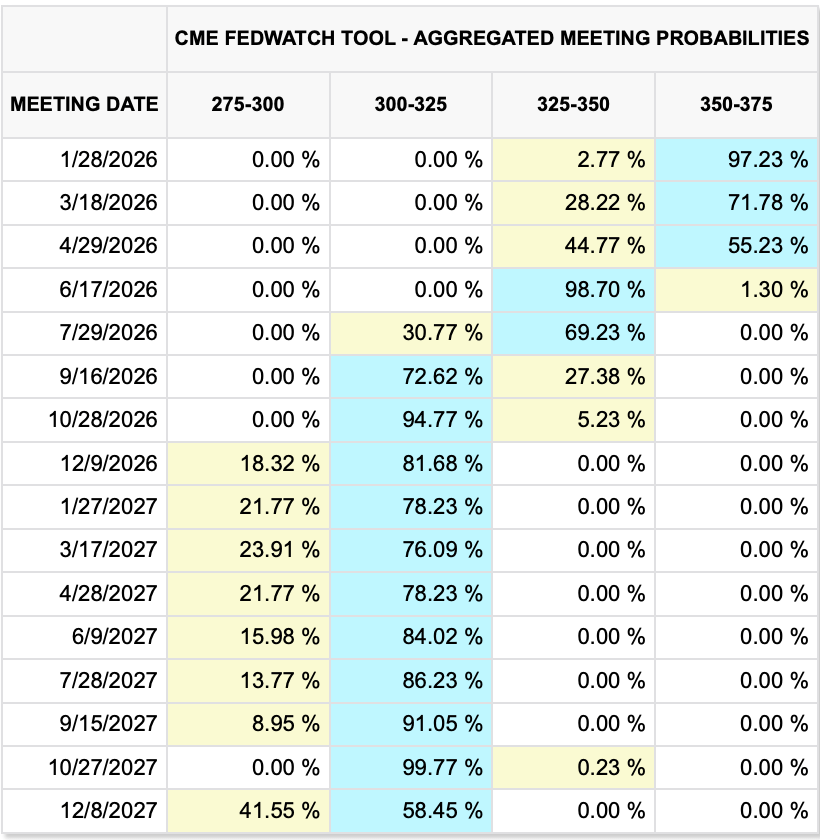

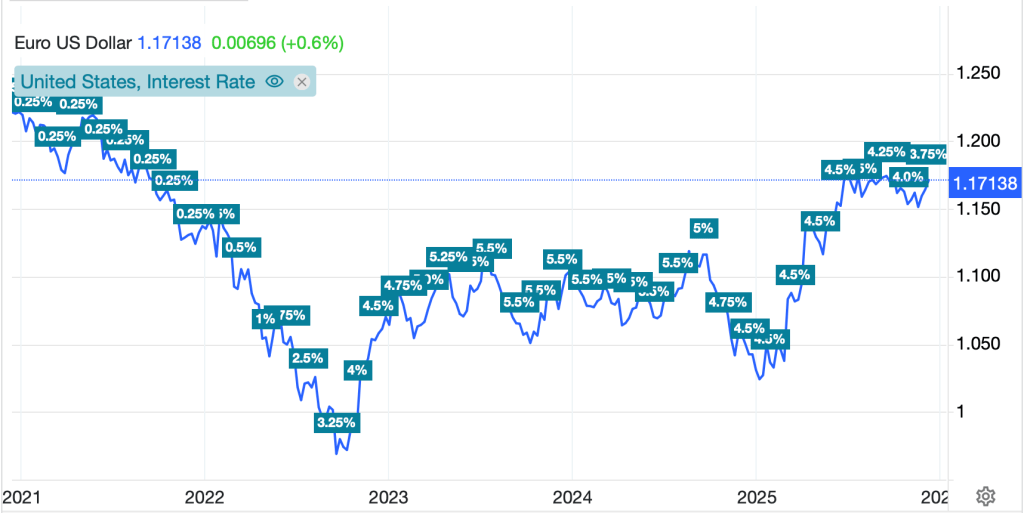

- JPY (+1.2%) remains the top story as speculation remains rife that the BOJ stepped into markets on Friday (I don’t think so) and questions arise as to how soon they will do so.

Source: tradingeconomics.com

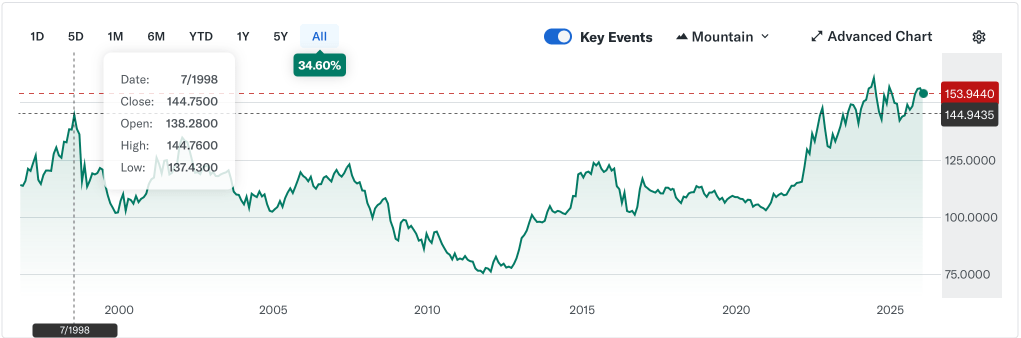

There is a great deal of talk of joint intervention with the US, but I remain skeptical there. It is critical to understand exactly what joint intervention is and what it represents. Joint intervention means that the US Treasury is selling its own dollars alongside those of Japan. That is very different than the Fed, acting on behalf of the Treasury-MOF-BOJ connection executing sales for the MOF. The former implies a US effort to change the dollar; the latter is simply assisting an ally in our time zone. I can only think of two times the US intervened, 1985 and 1998. In the second chart, I highlighted the shape of the move from 1998, which was obviously far sharper than anything we have seen so far.

Source: finance.yahoo.com

- DXY (-0.5%) is falling as well, obviously dragged lower by the dollar’s decline vs. the yen, but the dollar’s weakness is universal today. As you can see from the chart, the DXY has fallen through the bottom of the trading range at 98.00 and the bears are celebrating the end of the dollar. But just looking at the chart below, we need to see a more substantial extension, in my view, before concluding the dollar is dead.

Source: tradingeconomics.com

Precious Metals –

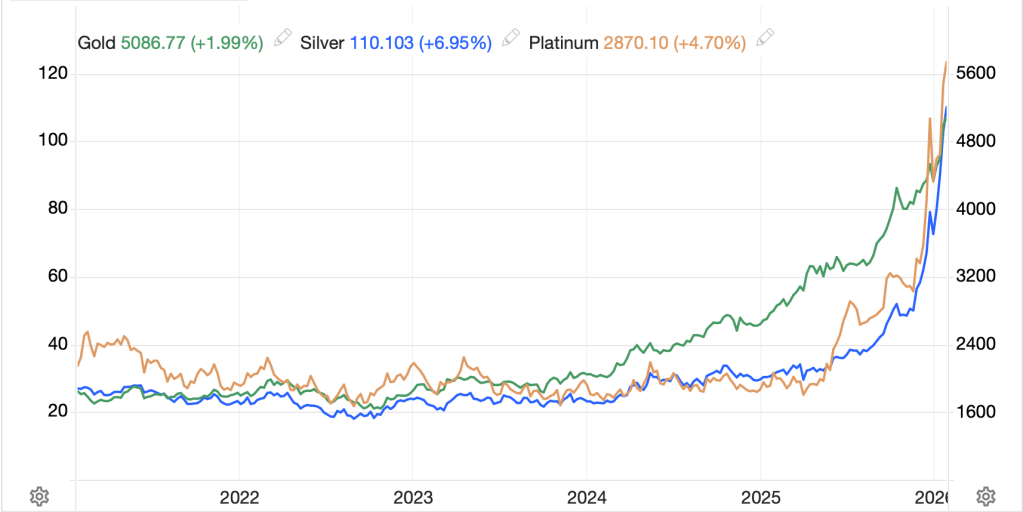

| Metal | Price | Day | % | Weekly | Monthly | YTD | YoY |

| Gold | 5090.47 | 101.85 | +2.0% | 8.9% | 17.6% | 17.95% | 85.85% |

| Silver | 110.34 | 7.38 | +7.2% | 16.7% | 53.15% | 55.05% | 266.2% |

| Copper | 5.9942 | 0.048 | +0.8% | 1.6% | 8.4% | 5.45% | 42.2% |

| Platinum | 2867.20 | 128.8 | +4.65% | 21.75% | 35.2% | 39.7% | 205.3% |

Source: tradingeconomics.com

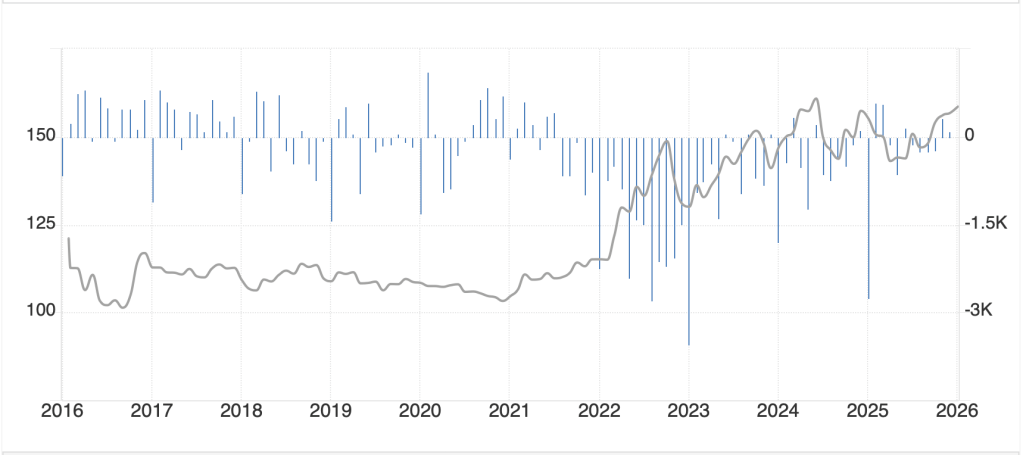

I think this table tells the entire story eloquently. The combination of supply shortages in trading venues, as well as for industrial users, and fears over the collapse of fiat currencies as every government in the world runs it hot and issues massive amounts of debt, has an increasing number of both individuals and institutions looking for someplace to maintain their purchasing power. Precious metals earned their name and reputation for this very reason. If anything, the fear is that the speed of the move has been so extraordinary that it must slow down at some point, but so far, that has not been the case. As you can see in the chart below, the moves in all three have become parabolic, or certainly in silver and platinum. Historically, prices like this do not continue in this vein, but that doesn’t mean they cannot continue to rise further for a while yet.

Source: tradingeconomics.com

As to energy, oil (-0.2%) is trading above $60/bbl, but doesn’t show a great deal of interest in breaking in either direction right now. I imagine a US action in Iran would push prices higher, but do not discount a breakthrough on the Russia/Ukraine war that could have the opposite effect. However, NatGas (+14.6%) continues to be in massive demand as the 15° temperature outside my window this morning is indicative of what is happening across most of the country. As well, it seems Germany, which is now hugely reliant on US LNG exports, has run their storage down to a dangerously low 40% or so, far below normal for this time of year. Until this cold-snap ends, demand will remain exceedingly high.

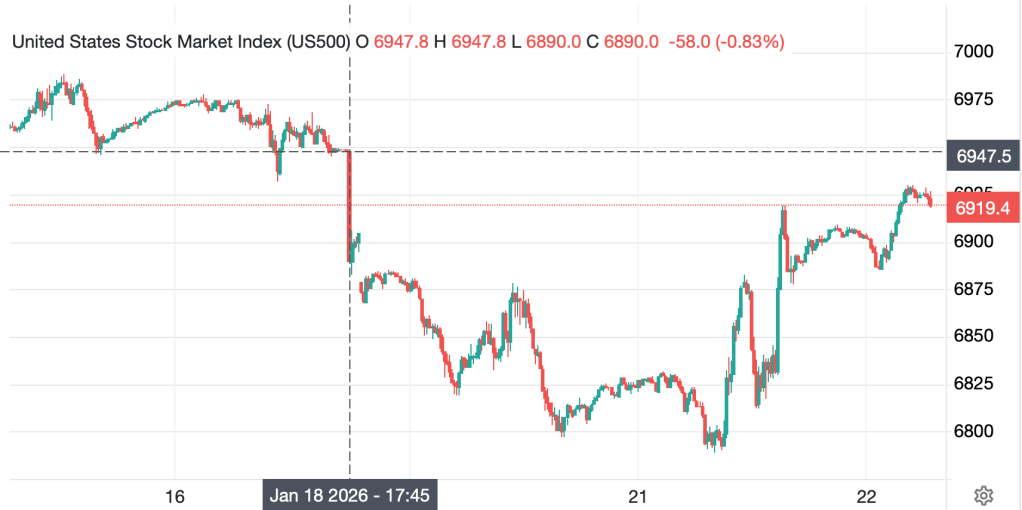

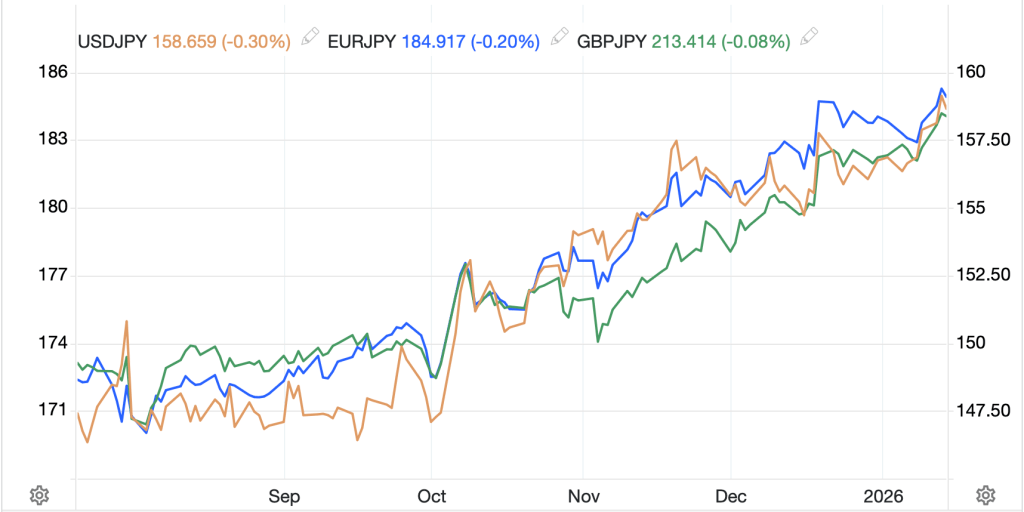

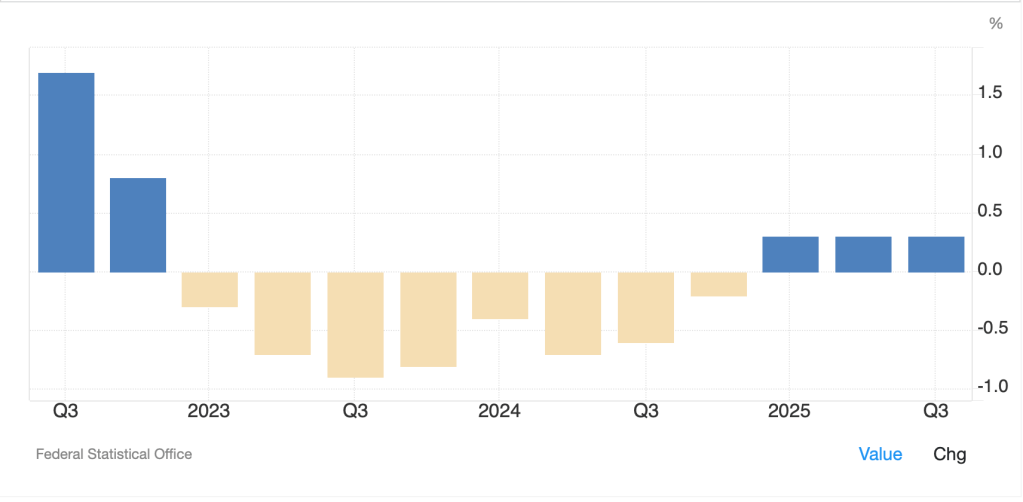

Stocks – the biggest mover overnight was Tokyo (-1.8%) as the much stronger yen weighed heavily on Japanese exporters like Toyota. Too, both South Korea (-0.8%) and India (-0.9%) slipped with the former showing concern that there would be intervention in the KRW market and negatively impact Korean exporters while the latter continues to see international capital outflows, with another $3 billion coming out so far this month (which has undermined the INR as well). But otherwise, not much price action in China, HK or elsewhere in the region. In Europe, most major bourses are little changed, although there have been modest gains in Spain (+0.5%) and Italy (+0.4%). The only data of note was German Ifo Business Climate (87.6) which remained unchanged, falling below expectations for a modest gain. And at this hour (7:45), US futures are virtually unchanged.

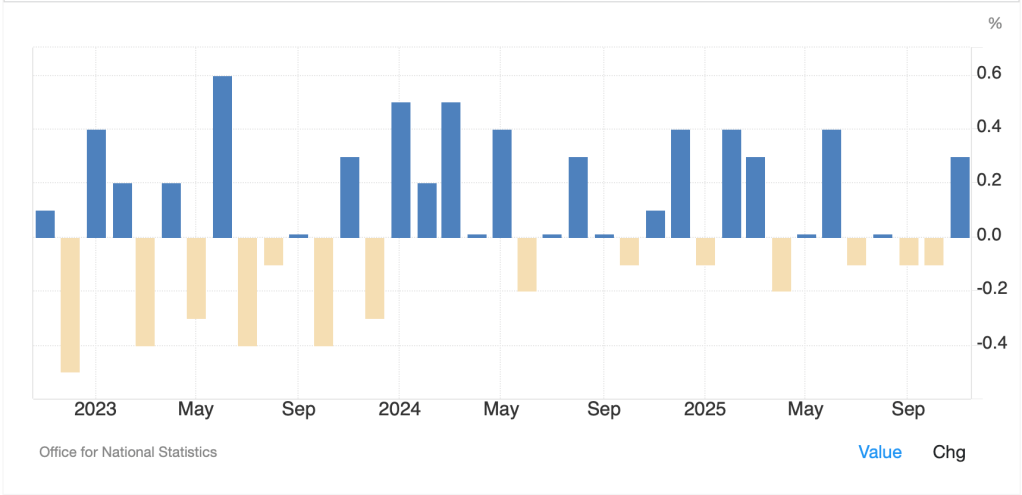

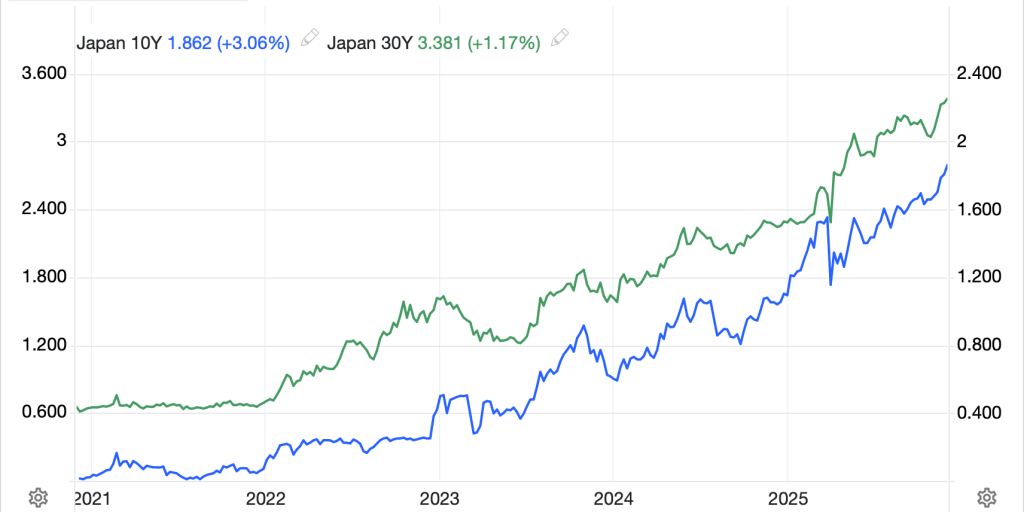

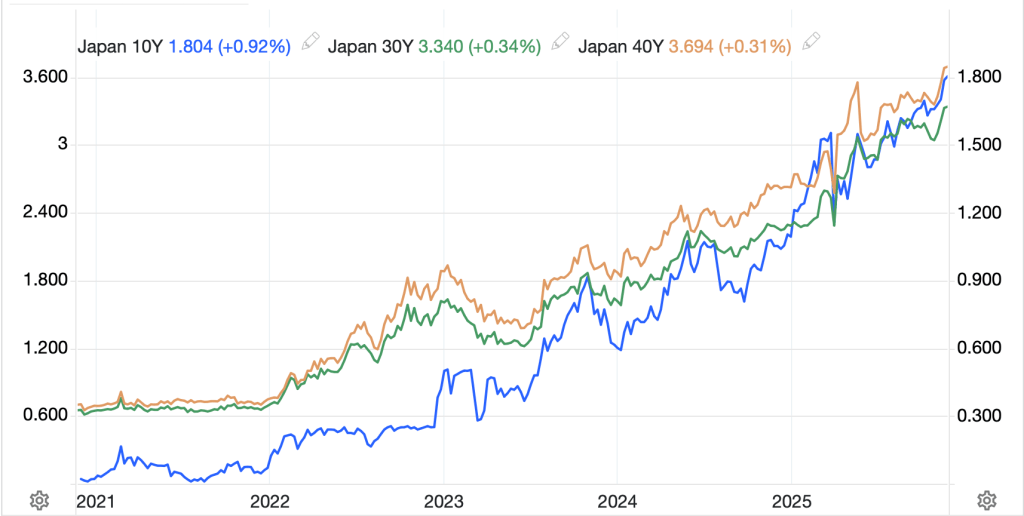

Bonds – yields have slipped modestly this morning with Treasuries (-1bps) not really showing signs of serious degradation. European sovereign yields have fallen further between -3bps (Germany) and -5bps (France) with the latter benefitting from the idea that France would actually pass a budget soon. JGB yields (-2bps) also slipped as polls show Takaichi-san’s approval ratings are slipping and some are assuming she won’t be able to run it quite as hot if she wins the election in two weeks.

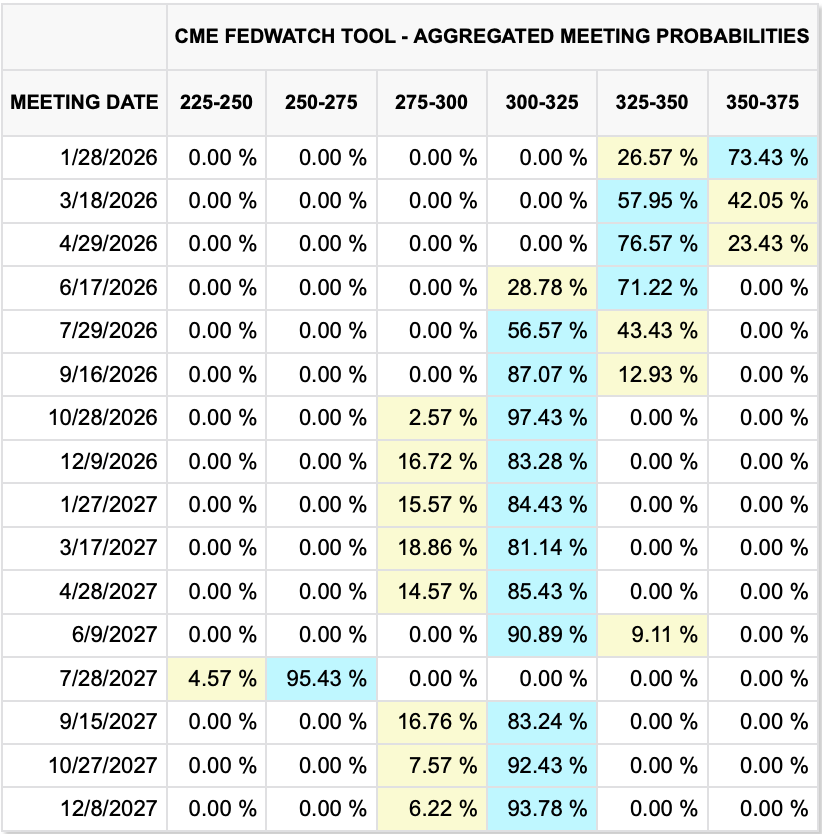

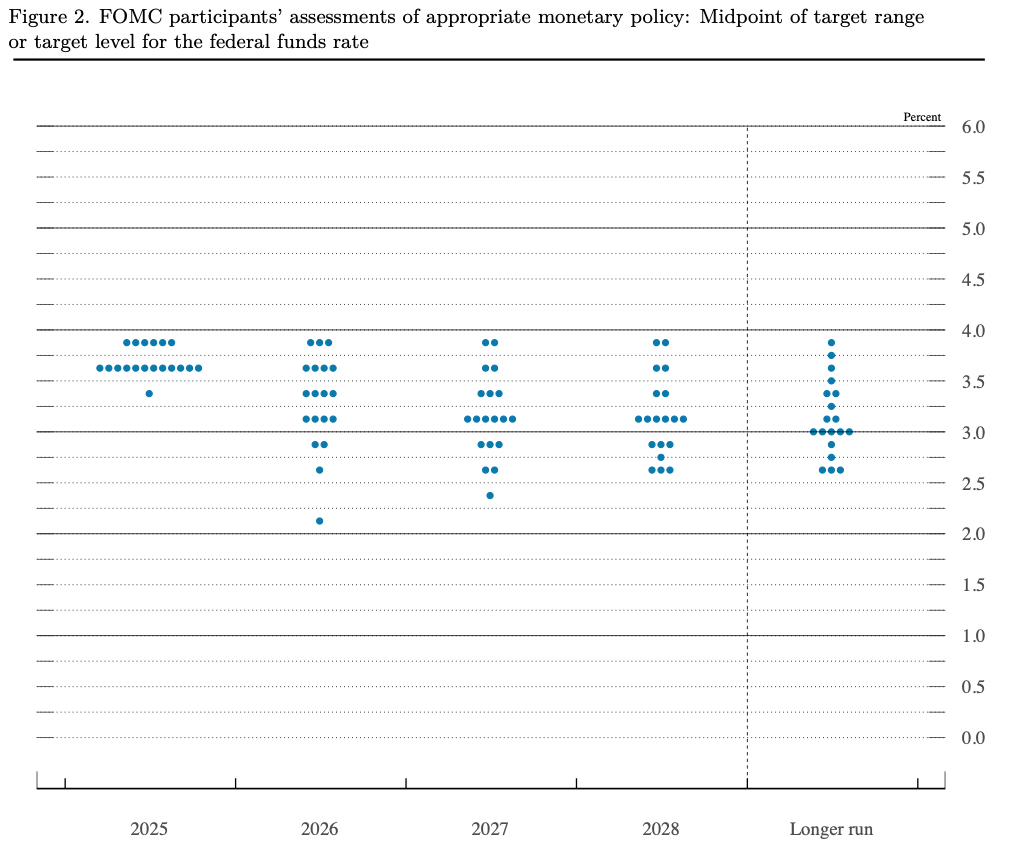

Data this week is dominated by the Fed meeting on Wednesday, although as I have said from the beginning of the year, I think the Fed’s importance has waned relative to the market overall.

| Today | Durable Goods | 3.7% |

| -ex Transport | 0.3% | |

| Tuesday | Case Shiller Home Prices | 1.2% |

| Consumer Confidence | 90.9 | |

| Wednesday | FOMC Rate Decision | 3.75% (unchanged) |

| Thursday | Initial Claims | 205K |

| Continuing Claims | 1860K | |

| Trade Balance | -$42.1B | |

| Nonfarm Productivity | 4.9% | |

| Unit Labor Costs | -1.9% | |

| Factory Orders | 1.7% | |

| -ex Transport | 0.3% | |

| Friday | Dec PPI | 0.2% (2.8% Y/Y) |

| -ex food & energy | 0.3% (2.9% Y/Y) | |

| Chicago PMI | 43.8 |

Source: tradingeconomics.com

And that’s pretty much what we have right now. Clearly, the biggest signal comes from the precious metals space and indicates, to me at least, that there is huge concern over the way of the world right now. I guess this is what the 4thTurning looks like. As I said, if the Treasury is actually going to intervene of their own accord, working alongside the Japanese, that is a distinct negative for the dollar against all currencies and needs to be carefully assessed. However, if the Fed sells dollars on the BOJ’s behalf, that is likely to have just a temporary impact on the FX markets. Keep that in mind as we go forward.

Good luck (we all need that right now!)

Adf