Ahead of the FOMC

The pundits were sure they would see

A cut come December

As every Fed member

Saw joblessness to some degree

But turns out, dissent did abound

And Jay, to the press, did expound

December’s not destined

“Far from it”, when pressed, and

The bond market fell to the ground

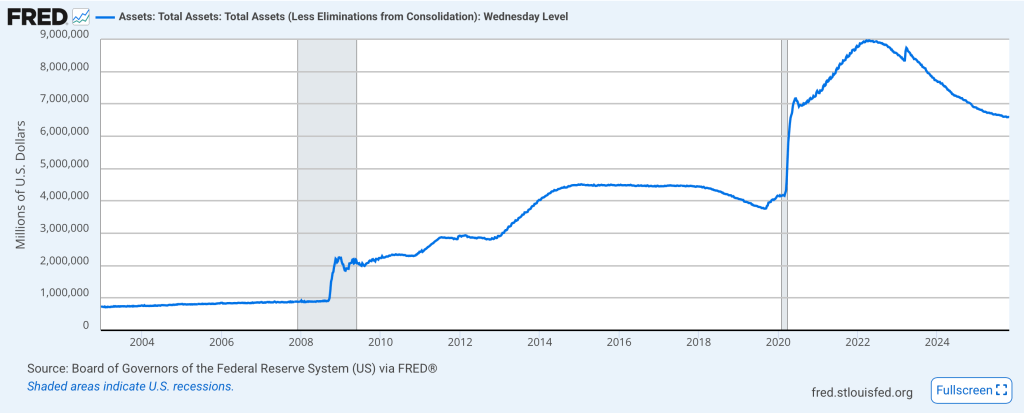

The Fed cut the 25bps that were priced and they said they would end QT, the balance sheet runoff beginning December 1st. As well, they indicated that as MBS matured, they would be replaced with T-bills. So far, all pretty much as expected. But…the vote was 7-2 for the cut. One dissent was Stephen Miran, once again looking for 50bps but the real shocker was KC Fed president Jeffrey Schmid, who wanted to stand pat! During the press conference, Powell explained [emphasis added], “there were strongly different views about how to proceed in December. A further reduction in the policy rate at the December meeting is not a foregone conclusion. Far from it!”

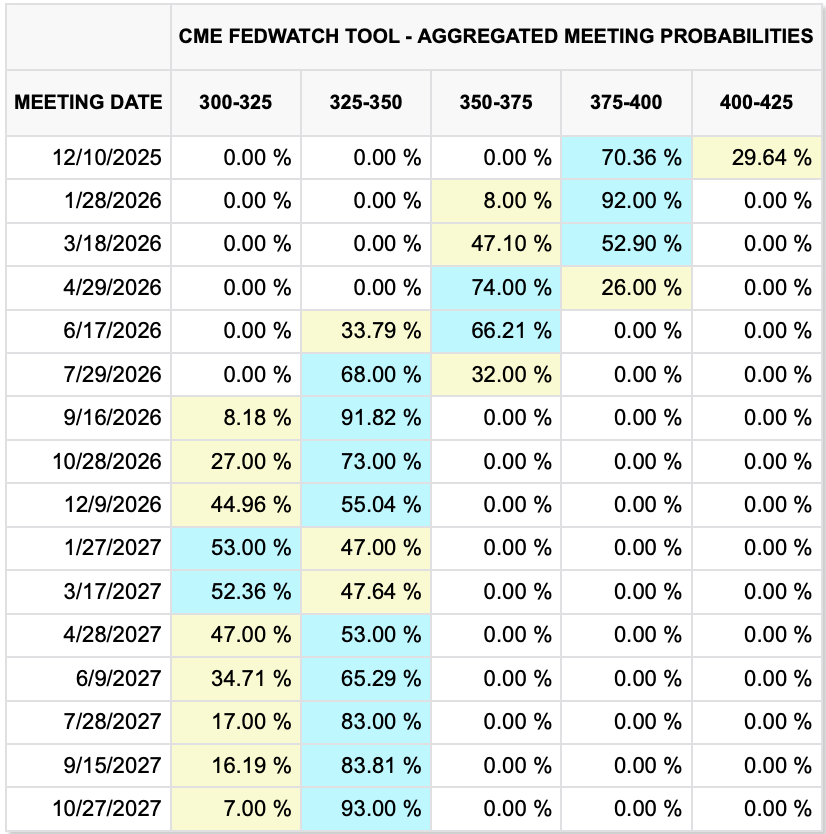

The Fed funds futures market jumped on that comment and as of this morning, the December probability fell from 92% to 70% with only a 3/4 probability of another cut after that by April, down from a near certainty by March previously.

You won’t be surprised by the fact that the bond market sold off hard, with yields rising 10bps on the day, with seven of those coming in the wake of the press conference.

Source: tradingeconomics.com

Stocks struggled, with the DJIA under modest pressure and the S&P 500 unchanged although the NASDAQ managed to rise yet again to a new high, as NVDA doesn’t pay attention to gravity.

So much has been written about this that I don’t think it is worth going into more detail. FWIW, my view is the Fed is still going to cut in December, and that will become clearer as the government reopens (which I think happens by the end of the week) and data starts to trickle out again. The employment situation remains their main focus, and it just doesn’t seem that positive right now. I suspect next year, when the OBBB policies begin to be implemented and we see the fruits of the dramatic increase in foreign investment in the US, that situation can change, but things feel slow for now.

In effect, that is why they are going to run the economy as hot as they can to try to prevent any recession and hopefully make it to the point where the government can back off and the private sector picks up the slack. At least, that’s my read for now. For the dollar, that means more support. For stocks, the same. And the inflation prospects will keep the precious metals supported. Bonds feel like the worst place to be.

In other central bank news, the Bank of Canada cut 25bps, as expected, and in their commentary explained rates were now “at about the right level” for the economy based on their projections. The market demonstrated they cared about this story for about 3 hours, as the initial move was modest CAD strength that evaporated as soon as Powell started speaking.

Source: tradingeconomics.com

The BOJ also met last night and left rates on hold, as widely expected, with the same two votes for a rate hike as the last meeting. During the press conference, Ueda-san explained, “We held today as we want to see more data on domestic wage-setting behaviors, while uncertainty remains high in overseas economies. If we’re convinced, we’ll adjust rates regardless of the political situation.” The yen (-0.6%) fared somewhat poorly, responding to Ueda-san’s comments regarding the relative lack of strength in the Japanese economy. Ultimately, as you can see in the below chart, the yen fell to its weakest point since last February, although I suspect if I am correct regarding the Fed continuing its policy ease, that weakness will abate somewhat.

Source: tradingeconomics.com

While Spinal Tap got to eleven

Said Trump, t’was a twelve, not a seven

The deal that he struck

To get things unstuck

With China, it’s manna from heaven

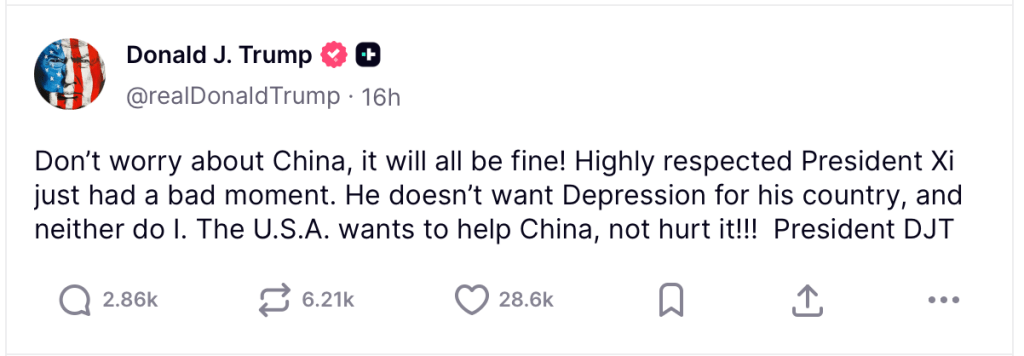

The last big story was the long-awaited meeting between Presidents Trump and Xi last night, where the two sat down and agreed to cool the temperature regarding trade. Key aspects include the US reducing tariffs on China, especially those regarding fentanyl, as well as rolling back the broad restrictions on Chinese companies, while China will purchase “tremendous amounts” of soybeans and pause their restrictions on the sale of rare earth minerals. Tiktok came up, and that will be settled and overall, it appears that a great deal of progress was made. This was confirmed by the Chinese as they announced the same things.

Clearly, this is an unalloyed positive for the global economy and while the situation is not back to its pre-Trump days, it offers the hope of some stability for the time being. But the surprising thing about these announcements was how little they seemed to help financial markets. For instance, both the Hang Seng (-0.25%) and CSI 300 (-0.8%) slipped during the session, as did India (-0.7%) and Australia (-0.5%) with the rest of the region basically unchanged. That is a disappointing performance for what appears to be a very positive outcome. I suppose it could be a ‘sell the news’ response, but in today’s markets, especially with the ongoing influx of central bank liquidity, I would have expected more positivity.

Turning to European markets, they are lower across the board led by Spain (-1.1%) and France (-0.6%) as the US-China trade deal had little impact, and investors responded to a plethora of data on GDP and inflation. The odd thing about this is that the Q/Q GDP data was better than expected across the board (France 0.5%, Netherlands 0.4%, Germany 0.0%, Eurozone 0.2%) which was confirmed by positive confidence data and modest inflation. While those growth numbers are hardly dramatic, at least they are not recessionary. You just can’t please some people! Meanwhile, at this hour (6:30) US futures are little changed to slightly softer.

If we turn to the bond markets, yesterday’s dramatic rise in Treasury yields is consolidating with the 10-year slipping -1bp this morning. In Europe, sovereign yields are higher by 3bps across the board as they catch up to yesterday’s Treasury move. At this hour, though, bond markets are doing little as investors and traders await Madame Lagarde’s announcements at 9:15 EDT although there is no expectation for any rate move. In fact, looking at the ECB’s own website, there is currently a 5% probability of a rate hike! (That ain’t gonna happen, trust me.)

In the commodity markets, oil (-0.5%) is softer this morning but is still right around $60/bbl with yesterday’s EIA inventory data showing a larger draw on inventories than expected. That is what helped yesterday’s modest gains, but those have since been reversed. In the metals markets, price action remains quite choppy, but this morning sees gold (+1.3%), silver (+1.0%) and platinum (+0.35%) all bouncing although copper (-0.2%) is a touch softer. Nothing has changed my longer-term views here, but it does appear that there is a lot more choppiness that we will need to work through before the trend reasserts itself.

Finally, the dollar, which rose yesterday on the relatively hawkish Fed commentary is mixed this morning as it shows strength vs. the yen (now -0.8%), ZAR (-0.4%), KRW (-0.35%), and INR (-0.4%) with even CNY (-0.2%) following suit, although the rest of the currency universe has moved only +/-0.1% from yesterday’s closes. Again, my view is the dollar is confined to a range, has been so for many months, and we will need to see some policy changes to break out in either direction. Right now, those policy changes don’t seem to be imminent.

With data still MIA, the only things to which we can look forward are the ECB and the first post-meeting Fed speak with Governor Bowman and Dallas Fed president Logan up today. I would have thought risk assets would be in greater demand this morning, but that is clearly not the case. Perhaps, as we approach month-end, we are seeing some window dressing, but despite the ostensible hawkish outcome from yesterday’s FOMC, I don’t think anything has changed with their future path of more rate cuts no matter what. As equity markets had a broadly positive October, rebalancing flows would indicate sales, but come Monday, I think the rally continues. As to the dollar, there is still no reason to sell that I can discern.

Good luck

Adf