It’s beautiful and it’s quite big

Though more complicated than trig

But President Trump

Got over the hump

Though sans views that he is a Whig

As well, Friday’s Canada rift

Has ended, boy that was sure swift

Now, this week we’ll learn

If there’s still concern

‘Bout jobs, or if there’s been a shift

The weekend news revolves around the fact that the Senate has passed the BBB with a 51-49 vote, and it now moves to committee so both Houses of Congress can agree the final details before it gets to President Trump’s desk for signature and enactment. This is another victory for the President, adding to last week’s wins and remarkably there have been several others as well. The Supreme Court ended the ability of a single district court judge to injunct the entire nation based on a single case, a move that will prevent judges who disagree with the president from stopping his policy efforts. Then, Canada announced they were going to impose a tax on US technology companies (the one that the Europeans just killed) and after Mr Trump ended the trade dialog quite vociferously, Canada backed down from that stance and is back at the negotiating table.

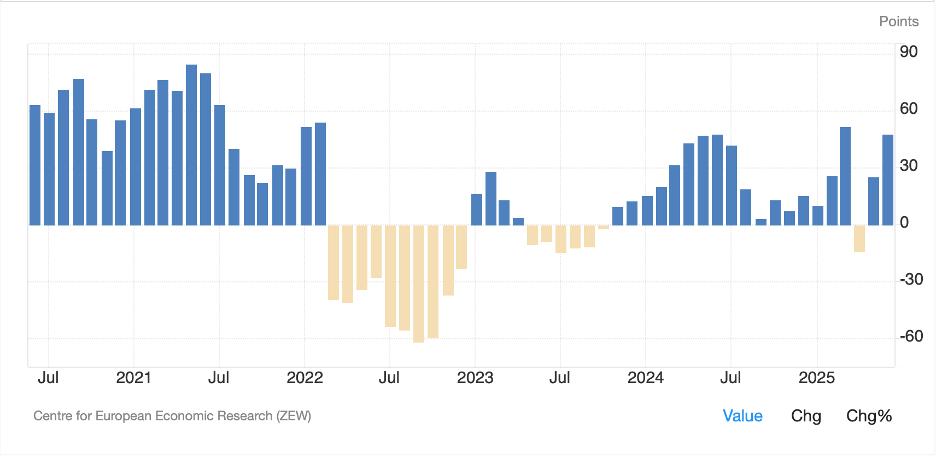

I mention this not to be political but as a backdrop to what is helping to drive the improved sentiment in US markets for both equities and bonds. While a quick look at YTD performances of US equity indices vs. Europeans shows the US still lags, that gap is narrowing as the news cycle continues to point to positive things happening in the US. Certainly, my understanding of the BBB is that it is quite stimulative, although it is changing priorities from the previous administration.

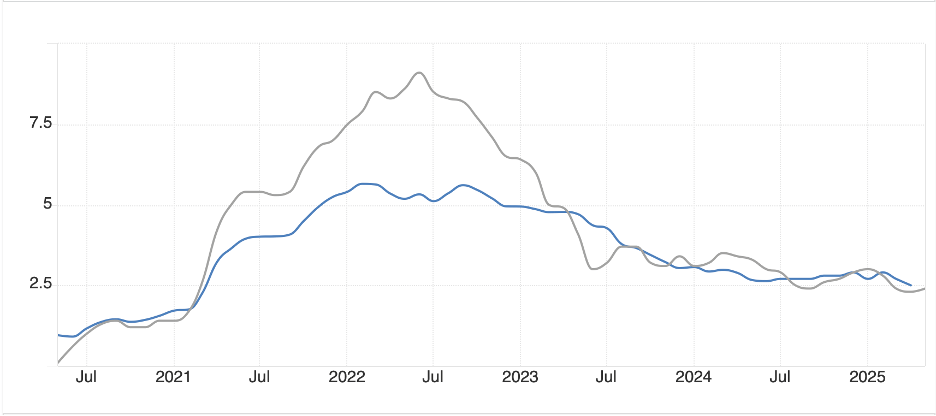

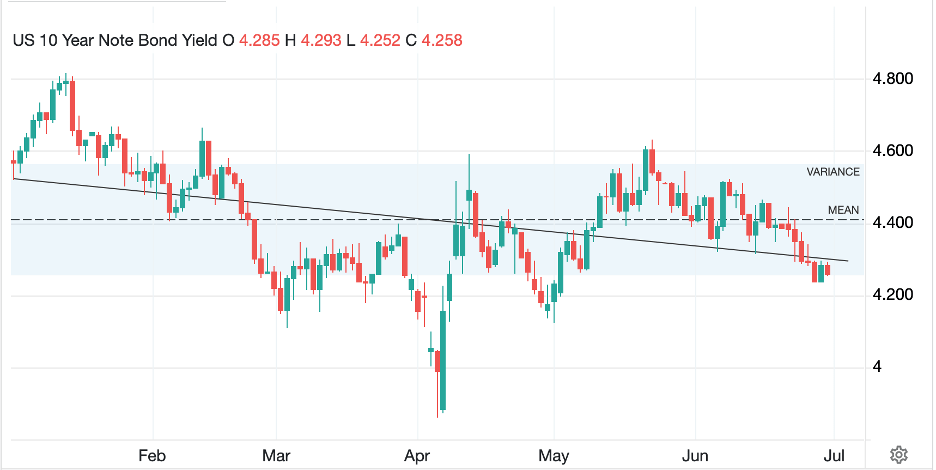

More interestingly, the Treasury market, which has been the subject of many slings and arrows lately from the part of the analyst community that continues to worry about refinancing the growing US debt pile, continues to behave remarkably well. A quick look at the chart below shows that 10-year yields have been trending lower for the past 6 months, at least, and this morning are continuing that trend, slipping another -3bps.

Source: tradingeconomics.com

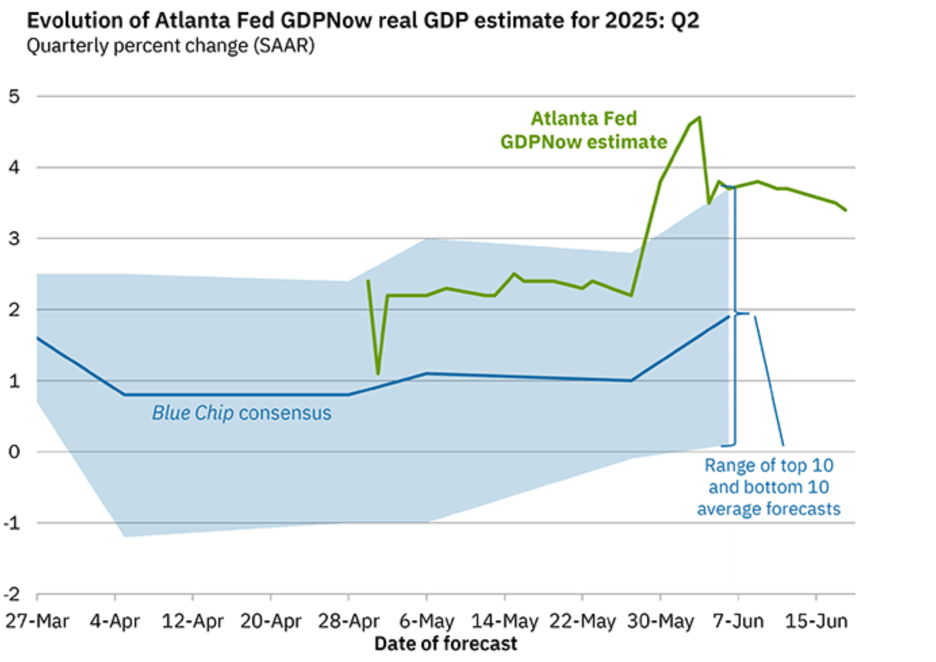

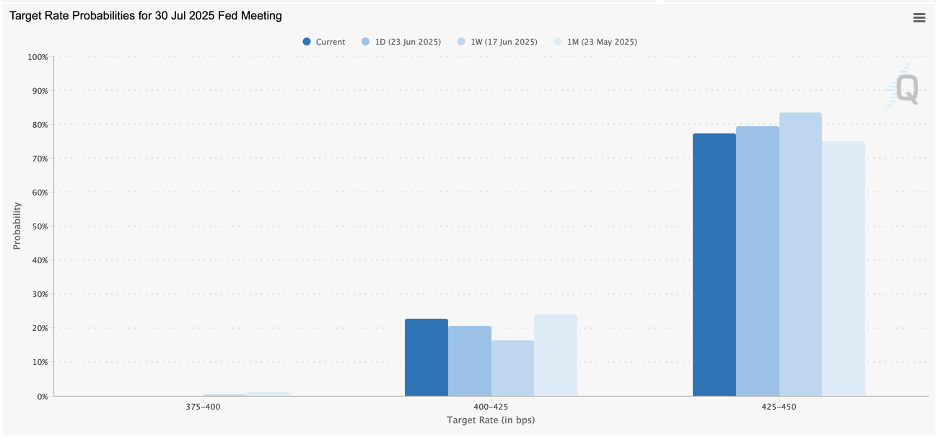

My point is that despite relentless doom porn regarding the economy, the big picture continues to point to ongoing growth in economic activity. There are many anecdotes regarding the impending weakness, (the latest I saw was the increase in the number of credit card purchases that have been rejected is rising rapidly) and yet, the main data has yet to crack and roll over to point to a clear sign of significant slowing. Perhaps this week when the NFP report is released on Thursday (Friday is July 4th holiday), we will see that long-awaited decline. However, as of this morning, the Fed funds futures market continues to price just a 21% probability of a July rate cut as forecasts for NFP show the median to be 110K.

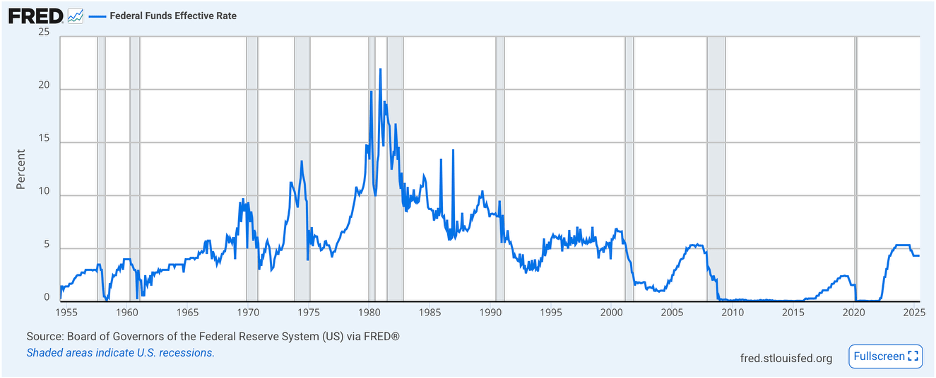

While I completely understand the concerns that the doomers recite, I have come to understand that the idea of a recession is a policy choice, not a natural phenomenon. While in the past, the business cycle was more powerful than the government, that is no longer the case. Rather, what we have observed over the past 15 years at least, since the GFC and the onset of QE, is that the government has become a large enough part of the total economy to drive it at the margin. And I assure you, if a recession is a policy choice, there is not a politician that is going to choose one. Perhaps we will reach a point where the imbalances get beyond the control of the central banks and their finance ministries, but we are not there yet.

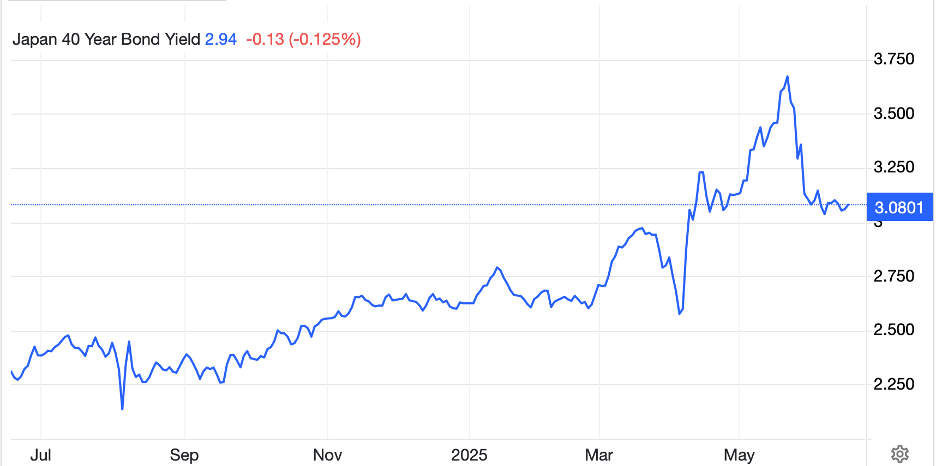

Ok, let’s take a peek at the overnight price action. Despite all the spending promises by governments around the world, yields have slipped everywhere with all European sovereigns taking their lead from the US and lower this morning by -2bps to -3bps. Even JGB yields (-1bp) have managed to decline slightly. If inflation fears are building, they are not obvious this morning.

In the equity markets, Friday’s US rally was followed by most Asian bourses rising (Nikkei +0.8%, Australia +0.3%, China +0.4%) although HK (-0.9%) slipped after Chinese PMI data was released that indicated things weren’t collapsing, but that future monetary stimulus may not be coming after all. The worst of both worlds for stocks. Meanwhile, European exchanges are mostly a touch softer, but only on the order of -0.2%, so really very little changed amid light volume overall. Interestingly, US futures are solidly higher at this hour (7:00), rising by 0.55% across the board.

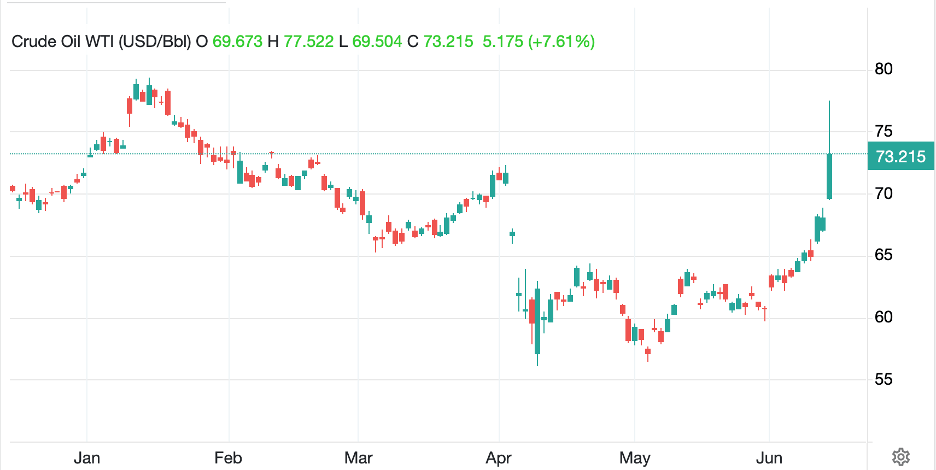

In the commodity markets, oil (-0.35%) is slipping a bit, but is basically hanging around near its recent lows as the market remains unconcerned about an escalation of fighting between Iran and Israel and any possible closure of the Strait of Hormuz. Meanwhile, gold (+0.4%) is bouncing from a weak performance Friday which appears to have been a bit oversold, although copper and silver are not following suit this morning with the former (Cu -0.7%) the laggard. However, all the metals remain sharply higher this year and in strong up trends.

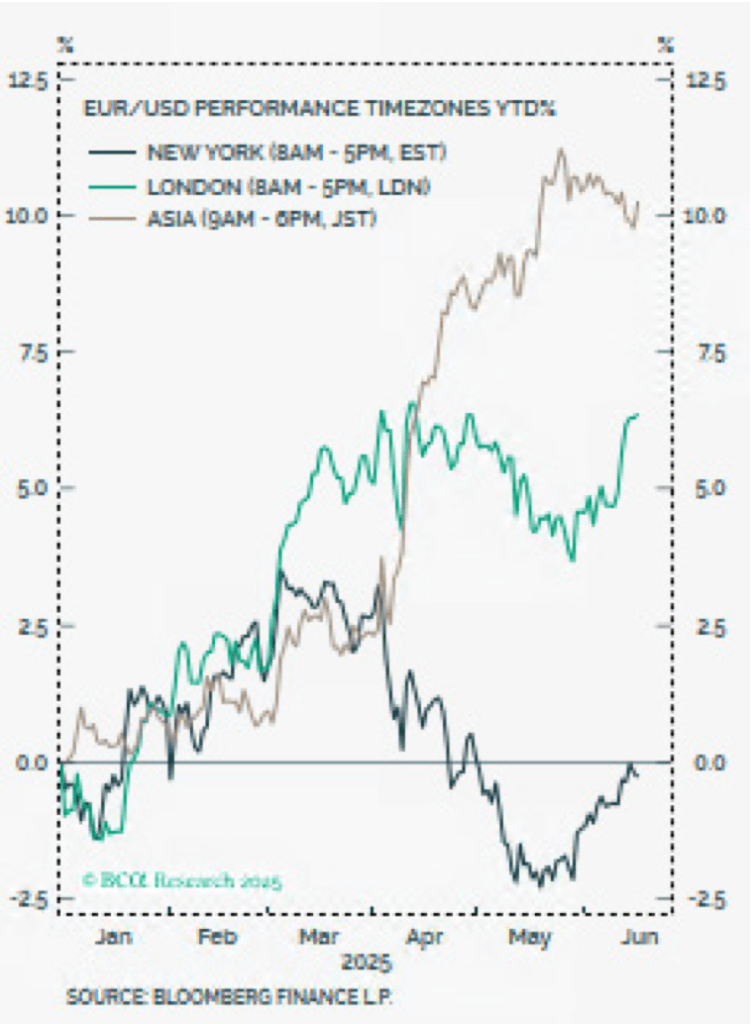

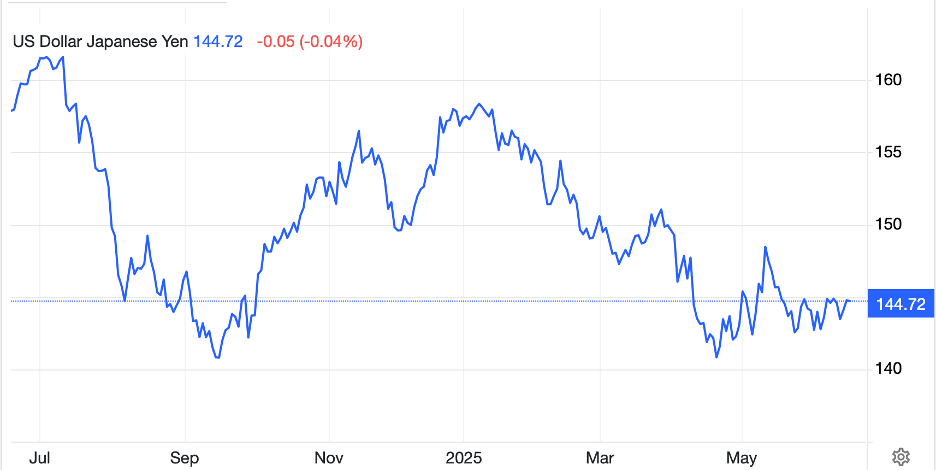

Finally, the dollar is modestly softer again this morning with KRW (+0.9%) the biggest mover, by far, while the entire G10 complex is showing gains on the order of 0.1% to 0.2%. This trend lower in the dollar remains strong (see chart below), but as I continue to remind everyone, we are nowhere near an extreme valuation in the dollar. If, and it’s a big if, we see substantial weakening in the employment data, I think the Fed could decide to act and that would increase the speed of the downtrend (as well as goose inflation higher), but absent that, I do not see a sharp decline, rather a slow descent. Remember, this is exactly what Trump and Bessent want, a more competitive dollar for the manufacturing sector.

Source: tradingeconomics.com

As it is the first week of the month, there is plenty of data to digest.

| Today | Chicago PMI | 43.0 |

| Tuesday | ISM Manufacturing | 48.8 |

| ISM Prices Paid | 69.0 | |

| JOLTs Job Openings | 7.3M | |

| Wednesday | ADP Employment | 85K |

| Thursday | Nonfarm Payrolls | 110K |

| Private Payrolls | 110K | |

| Manufacturing Payrolls | -6K | |

| Unemployment Rate | 4.3% | |

| Average Hourly Earnings | 0.3% (3.9% y/Y) | |

| Average Weekly Hours | 34.3 | |

| Participation Rate | 62.3% | |

| Initial Claims | 240K | |

| Continuing Claims | 1960K | |

| ISM Services | 50.5 | |

| Factory Orders | 8.0% | |

| -ex Transport | 0.9% |

Source: tradingeconomics.com

In addition to the payrolls, we hear from Chairman Powell again on Tuesday and Atlanta Fed president Bostic twice. I guess the rest of the FOMC took a long holiday week(end).

As it’s a holiday week, I expect that activity will be light, although headline bingo remains a key part of the markets today. I feel like the trends are well entrenched though, with the dollar slipping, equities and commodities rallying and bonds currently leaning toward lower yields, although that seems out of sync with the other markets. But in the summer, with less liquidity and activity, anomalies can continue for a while.

Good luck

Adf