According to those in the know

The BBB’s ready to go

The vote is this morning

So, this is your warning

That President Trump will soon crow

As well, ere the Fourth of July

The NFP may quantify

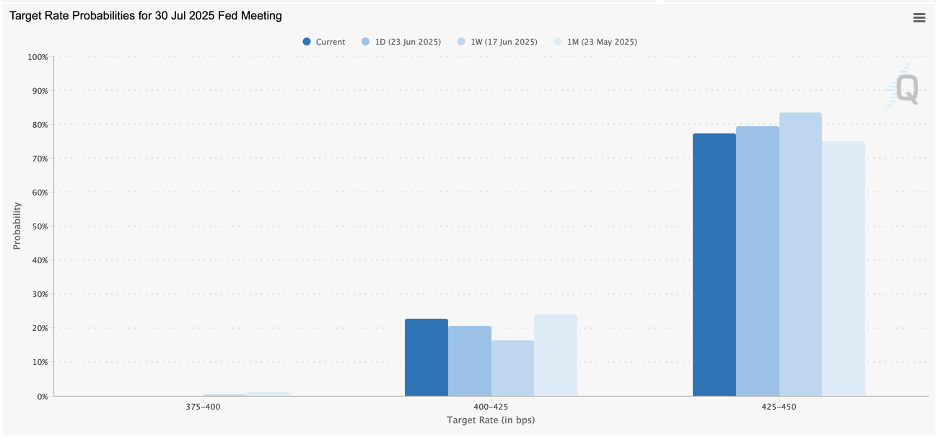

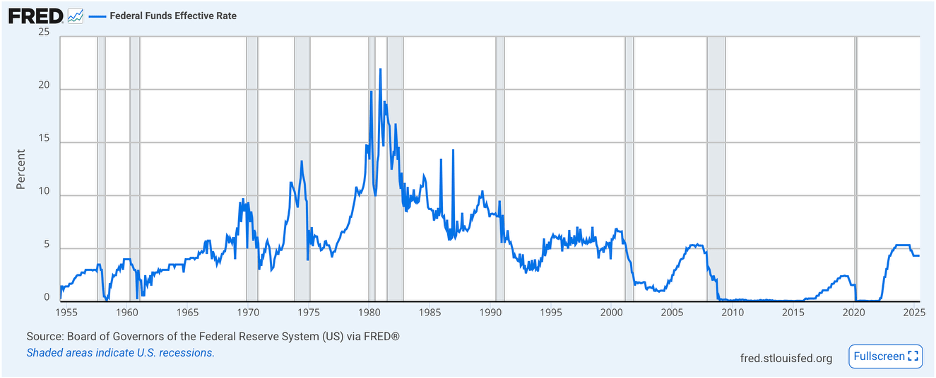

If rate cuts are coming

(A subject, mind-numbing)

Or whether Fed funds will stay high

Perhaps this will be the last day we hear about the Big Beautiful Bill, or at least the last day it leads the news, as it appears that by the time you read this, the House will have voted on the changes and by all accounts it is set to pass. If so, the President will sign it tomorrow amidst great fanfare and then it will just be a secondary story when somebody complains about something that was in the bill. However, the drama over passage will have finally ended.

(I guess what has really led the news was that Diddy was found not guilty of the RICO charges and Kohburger in Idaho got a plea deal avoiding the death penalty, but neither of those are market related.)

At any rate, the question now to be asked is will the BBB perform as advertised by either side of the aisle? Experience tells us that while the economy will not take off rapidly while inflation collpases, neither will there be people dropping in the streets because of the changes in Medicare, although if you listened to the pundits on both sides of the aisle, that is what you might expect. While this is not quite as bad as Nancy Pelosi’s immortal words, “we have to pass the bill to find out what’s inside it”, the fact that it approaches 1000 pages in length implies there is a lot inside it.

From what I have read, and it has not been extensive, it appears that there is some stimulus in the bill in the form of tax relief on tips and overtime as well as reductions for seniors, and spending on defense and the border. It also appears there have been several previous subsidies, notably for wind and solar, that are being removed. The fact that the CBO is claiming it will increase the budget deficit by $1.5 trillion, and given the fact that Jim Cramer is the only one with a worse track record than the CBO, tells me it will have limited impact on the nation’s fiscal stance initially, although if growth does pick up, that will clearly help things.

Which takes us to the other story this morning, the payroll report. Here are the current median forecasts by economists for the results, as well as the rest of the data to be released:

| Nonfarm Payrolls | 110K |

| Private Payrolls | 105K |

| Manufacturing Payrolls | -5K |

| Unemployment Rate | 4.3% |

| Average Hourly Earnings | 0.3% (3.9% Y/Y) |

| Average Weekly Hours | 34.3 |

| Participation Rate | 62.3% |

| Initial Claims | 240K |

| Continuing Claims | 1960K |

| ISM Services | 50.5 |

| Factory Orders | 8.2% |

| -ex Transport | 0.9% |

Source: tradingeconomics.com

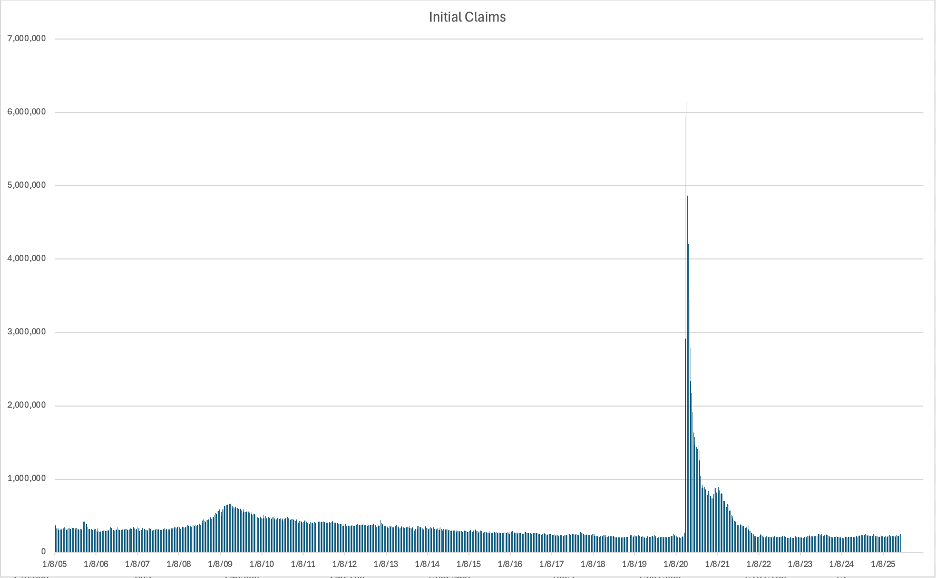

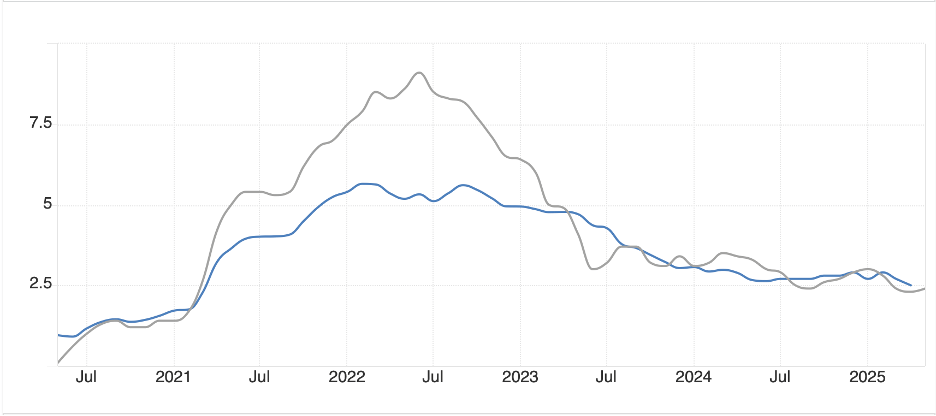

Some will point to yesterday’s ADP Employment report which showed a decline of -33K, the first decline in more than 2 years, as a harbinger of a bad number, but as you can see from the chart below, there has been a pretty big difference between ADP (grey bars) and NFP (blue bars) for a while now.

Source: tradingeconomics.com

Perhaps of more concern is the Unemployment Rate, which is forecast to rise a tick to 4.3%, which would be its highest print since October 2021 and if I look at the chart below, it is not hard to see a very gradual trend rising higher here. While markets really focus on NFP, I learned a long time ago from a very smart economist, Larry Kantor, that the Unemployment Rate was the best single indicator of economic activity in the US, and that when it is rising, that bodes ill for the future.

Source: tradingeconomics.com

You may recall there was a great deal of discussion about a year ago regarding the Sahm Rule, which hypothesized that when the Unemployment Rate rose more than 0.5% above its cycle average within 12 months, the US was already in a recession. The discussion centered on whether it had been triggered although the final claim was it hadn’t when extending the readings out to the second decimal place. Now, for the past year, the Unemployment Rate has hovered between 3.9% and 4.2%, so there doesn’t seem to be any chance of a trigger here, although if it does rise, you can be sure you will hear about it.

And that’s what is on tap ahead of the long holiday weekend. With that in mind, let’s look at the market action overnight. Excitement is clearly lacking in the equity markets these days as the summer doldrums are universal. Yesterday’s new closing highs in the S&P 500 seem like they should be exciting but were anything but amid low volume. As to Asia, Japan was flat, China (+0.6%) and Hong Kong (-0.6%) offset each other and in the rest of the region, other than Korea (+1.3%) which is starting to see a steady stream of foreign investment on the premise that the country is set to improve the regulatory structure for equities there, things were +/- a bit.

Meanwhile, in Europe, there is little net movement on the continent but the UK (+0.4%) is bouncing off recent lows after PM Starmer reiterated his support for Chancellor Reeves. A story I missed yesterday was that when she was trying to make a case in parliament for spending cuts, the back bench liberals revolted, literally bringing her to tears. The market response was that the UK would blow up its fiscal situation which saw Gilts tumble and yields rise 15bps yesterday at one point, while stocks fell. But that problem has been addressed for now. However, looking at the statement Starmer made, it reminded me of a baseball GM’s comments supporting his manager right before he fires him.

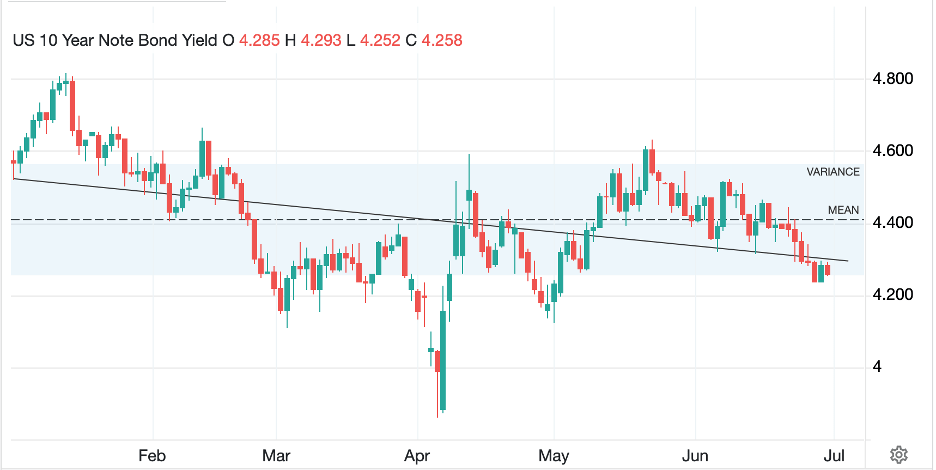

In the bond market, yields are declining, led by Gilts (-9bps) which are retracing yesterday’s gains on the above story. But Treasury yields are down (-2bps) and European sovereigns are all seeing yields lower by between -4bps and -5bps. In Japan, JGB yields are unchanged as PM Ishiba grapples with a trade deal where the US is keen to be able to export rice to the nation and Japan has a rice shortage with prices rising sharply but doesn’t want to accept imports. Go figure.

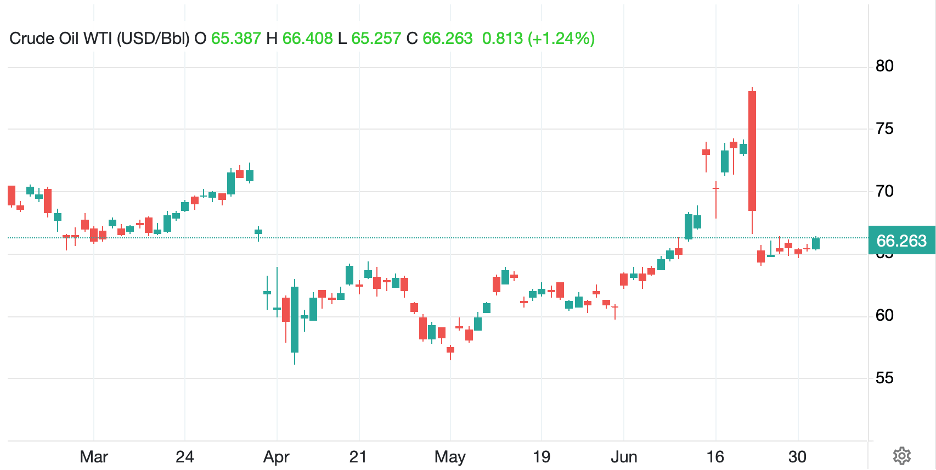

In the commodity markets, oil (-0.2%) is slipping slightly after a solid rally over the past seven sessions where it rose over $3.50/bbl. Gold (-0.3%) continues to trade around its pivot level of $3350/oz while silver (+1.0%) continues its longer run rally.

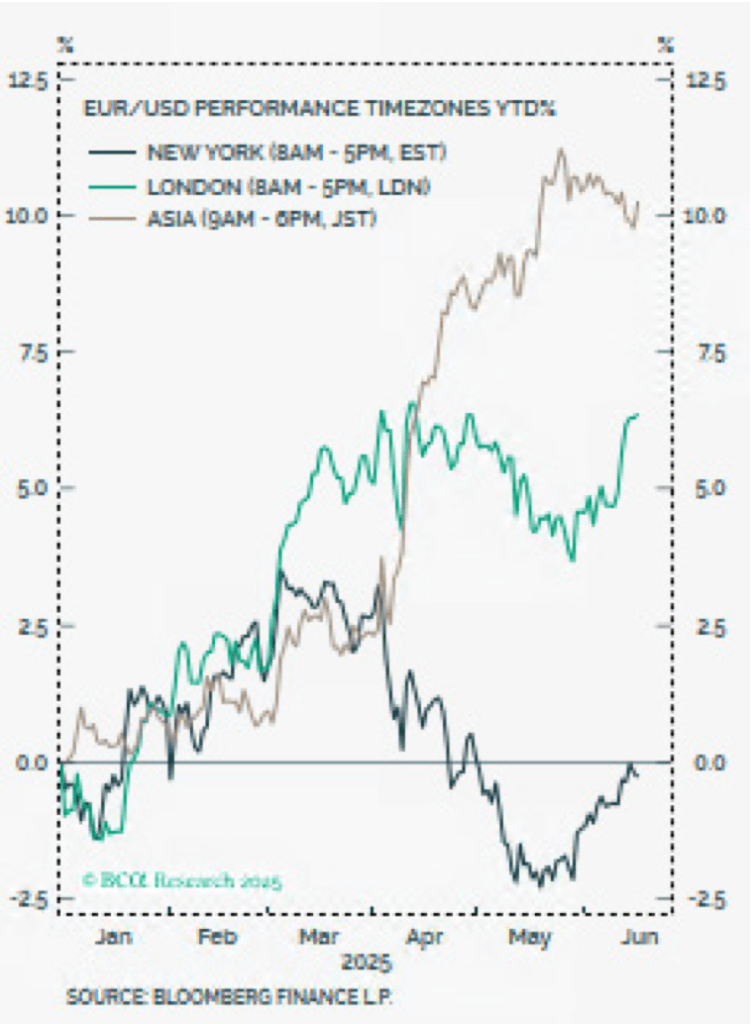

Finally, the dollar, which fell during yesterday’s session after I wrote, is effectively unchanged net this morning ahead of the data with very modest moves of +/-0.2% or less almost universal. KRW (+0.4%) is the outlier here and based on equity inflows discussed above, that makes sense.

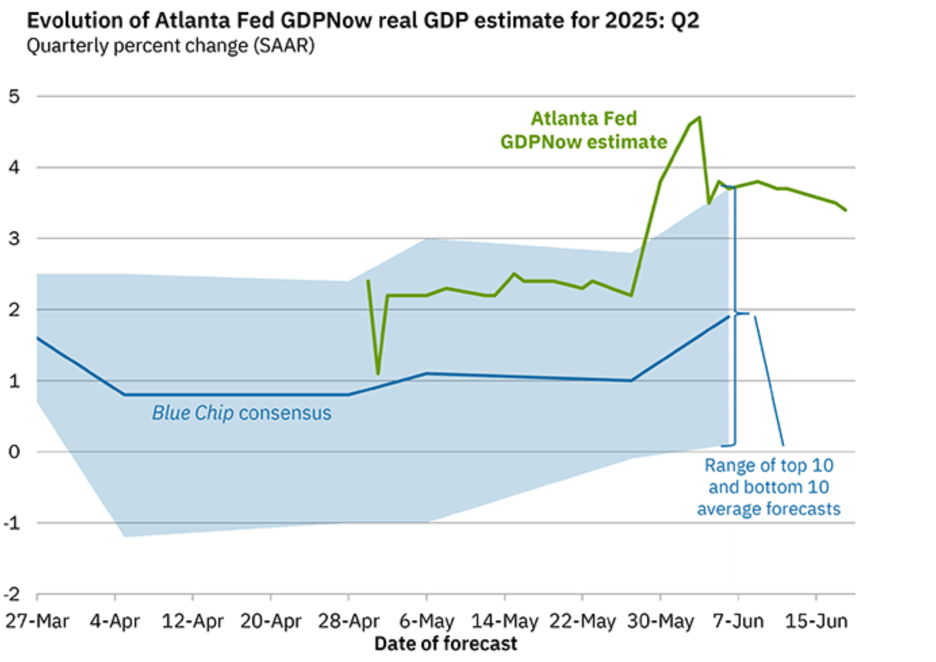

So, that’s where we stand heading into the payroll report and the long weekend. If pressed on the NFP outcome, I expect a weak outcome, 50K or so, as the birth/death model continues to be revised. But remember, the error bars on this number are huge. However, if it is weak, look for the probability of a July rate cut (currently 25.3%) to rise and the equity market to follow that higher. As to the dollar, I think for now, lower is still the trend.

Good luck and have a wonderful long weekend

Adf