The Japanese tale

Now sees brighter times ahead

Yen buyers rejoice

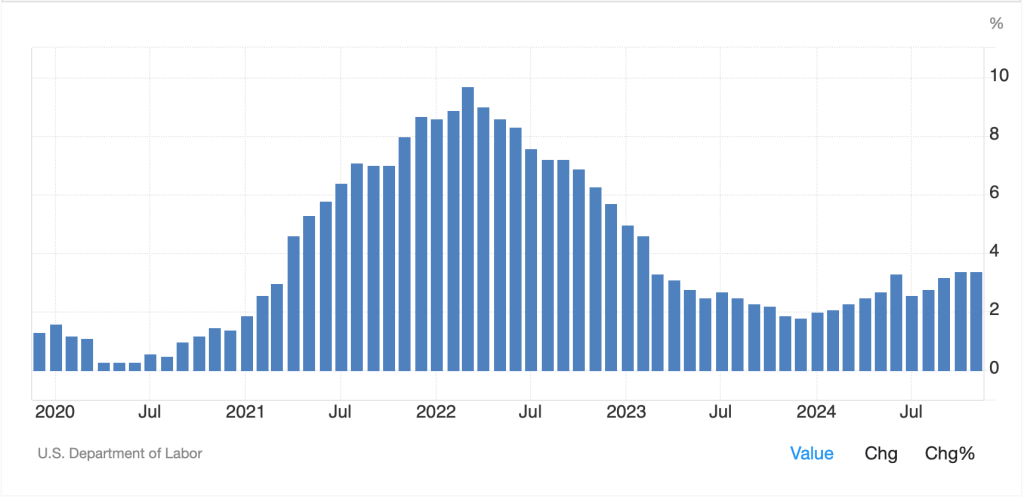

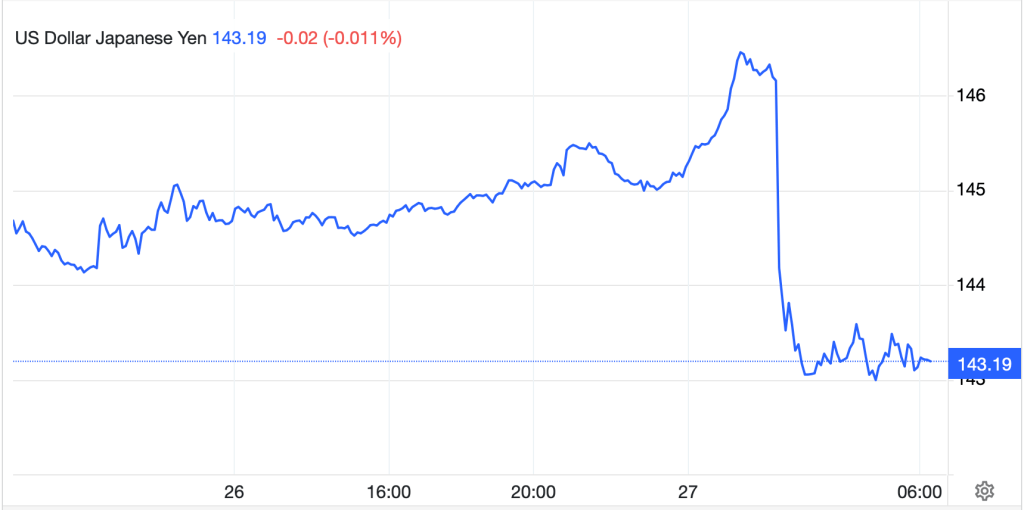

While its movement has been somewhat choppy, for the past month, the yen has been the best performing currency in the G10, gaining more than 3.0% during that time. This strength seems to have been built on several different themes including a more hawkish BOJ, better growth prospects based on PMI data, rising wages, and some underlying risk aversion. A quick look at the chart shows that the trend is clearly lower and there have been far more down days for the dollar than up days during this period.

Source: tradingeconomics.com

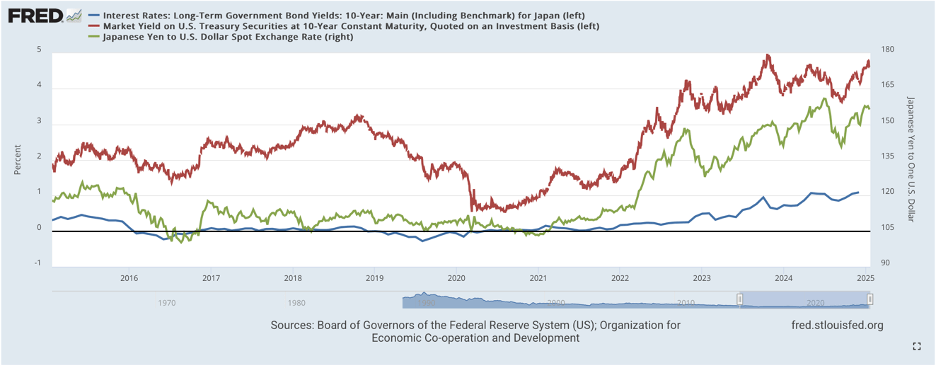

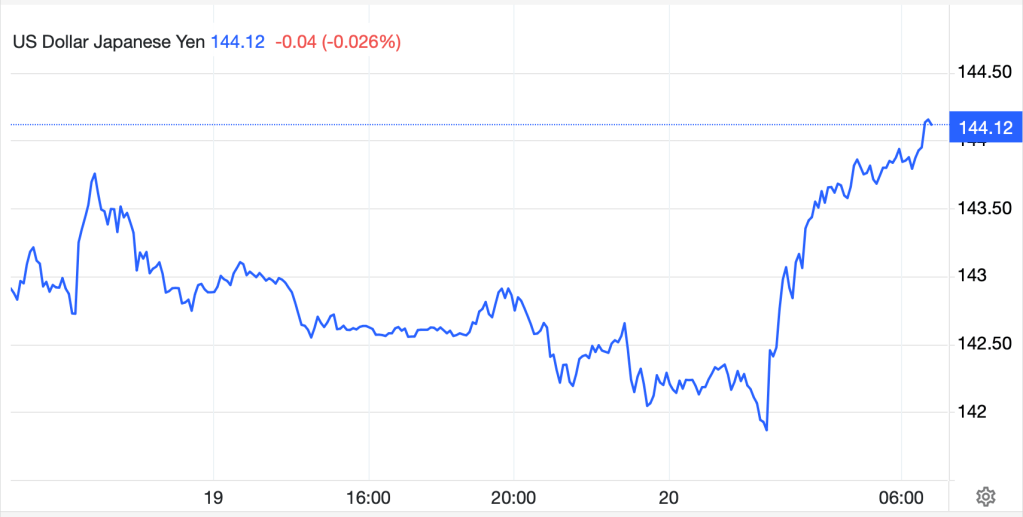

Of course, as I regularly remind myself, and you my good readers, perspective is an important thing to keep in mind, especially when making statements about longer term prospects of a currency. When looking at USDJPY over a longer term, say the past 5 years where long-term trends have been entrenched based on broad macroeconomic issues as well as the day-to-day vagaries of trading, the picture looks quite different. In fact, as you can see from the below chart, the past month’s movement barely registers.

Source: tradingeconomics.com

My point is that we must be careful regarding the relative importance of information and news and keep in mind that short-term movements may very well be just that, short-term, rather than major changes in long-term trends. The latter require very significant macro changes regarding interest rate policy and economic activity, at least when it comes to currencies, not simply a single central bank policy move.

So, the question at hand is, are we at the beginning of a major set of policy shifts that will change the long-term trajectory of the yen? Or is the yen’s recent strength merely normal noise?

While almost everybody has their own opinion on how the Fed is going to proceed going forward, I think it is instructive to look at the Fed funds futures market and the pricing for future rate activity. For instance, a look at the current market, especially when compared where these probabilities were one month ago tells us that expectations for Fed rate cuts have diminished pretty substantially, arguably implying that there is more reason to hold dollars.

Source: CME.org

You can see in the lower right-hand corner of the chart that the probability of a rate cut has fallen from nearly 44% to just 16.5% over the past month. However, during that same period, the BOJ has not only raised interest rates by 25bps, but they have made clear that further rate hikes are coming based on wage settlements and sticky inflationary readings. One potential way to incorporate this relative movement is to look at the change in forecast interest rates, which in the US have risen by ~7bps (27% *25bps) while Japanese interest rates have risen by 25bps with expectations for another 25bps coming soon. That is a powerful incentive to be long yen or at least less short yen, than previous positioning. And we have seen that play out as the yen has strengthened as per the above.

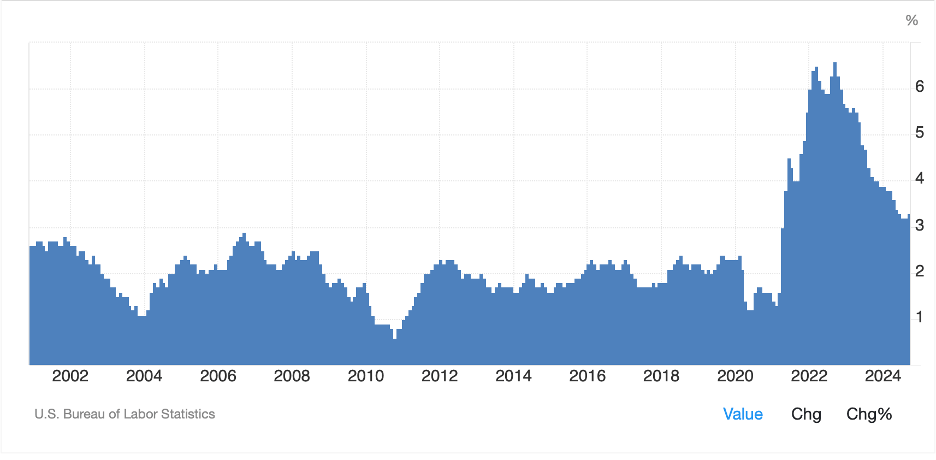

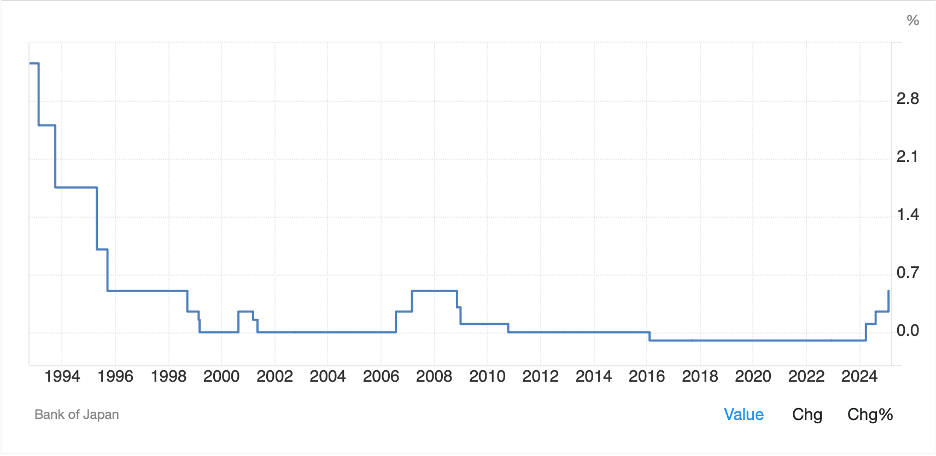

The real question is, can we expect this to continue? Or have we seen the bulk of the movement? Here, much will depend on the future of the Fed’s actions as the market is seeing a bifurcation between those who believe rates are destined to fall further once inflation starts to ease again, vs. those, like this poet, who believe that inflation is showing no signs of easing, and therefore the Fed will be hard-pressed to justify further rate cuts. While I am not the last word on the BOJ, from every source I see, expecting their base rate to be raised above 1.00% anytime in the next several years is aggressive. Just look at the below chart showing the history of the BOJ base rate. The last time the rate was above 0.50%, its current level, was September 1995. That is not to say they cannot raise it, just that as you can see, several times in the intervening years they tried to do so and were forced to reverse course as the economy fell back into the doldrums with inflation quickly falling as well.

Source: tradingeconomics.com

Is past prologue? Personally, my take is above 1.0% is highly unlikely any time in the next several years. Meanwhile, if inflation remains the problem it is in the US, Fed cuts will be much harder to justify. This is not to say that the yen cannot strengthen somewhat further, but I am not of the opinion we have had a sea change in the long-term trend.

Ok, after spending way too much time on the yen, given that there hasn’t even been any tariff discussion on Japanese products, let’s look elsewhere to see how things moved overnight.

Yesterday saw further relief by equity investors that tariffs are a key Trump negotiating tactic rather than an effort to raise revenue and US markets all gained, especially the NASDAQ. However, the movement in Asia was more muted with the Nikkei (+0.1%) barely higher while both Hong Kong (-0.9%) and China (-0.6%) fell amid the Chinese tariffs remaining in place. As to the regional markets, there were some notably gainers (Korea and Taiwan), but away from those two a more mixed picture with less absolute movement was the order of the day. In Europe, Spain’s IBEX (+1.0%) is the standout performer after the PMI data showed only a modest slowing, and a much better result than the rest of the continent. Perhaps this explains why the rest of the continent is +/- 0.2% on the session. As to US futures, they are lower at this hour (7:30) on the back of weaker earnings data from Google after the close last night.

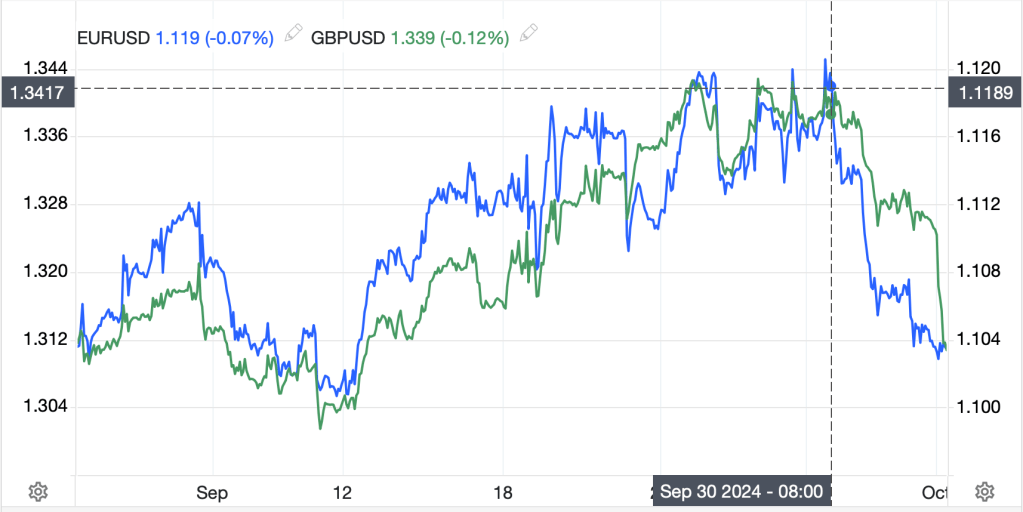

In the bond market, yields have fallen across the board (except in Japan where JGB yields made a run at 1.30%) with Treasury yields lower by 4bps this morning and 12bps from the highs seen yesterday morning. European sovereign yields are all lower as well, between -4bps and -7bps, as the weaker PMI data has traders convinced that the ECB is going to respond to weakening growth rather than sticky inflation and are now pricing in 100bps of cuts this year with the first 25bps coming tomorrow.

In the commodity space, gold (+1.0%) is the god of commodities right now, rallying more than $100/oz over the past five sessions. There continue to be questions as to whether this is a major short squeeze as COMEX contracts come up for delivery, but it is not hard to write a narrative that there is increased uncertainty in the world and gold is still seen as the ultimate safe haven. This gold rally continues to pull other metals higher (Ag +0.8%, Cu +0.2%) although I have to believe this is going to come to a halt soon. Meanwhile, energy prices have fallen again (oil -1.0%, NatGas -1.5%) as fears over supply issues have dissipated completely.

Finally, the dollar is under pressure overall, certainly one of the reasons the yen (+1.0%) has performed so well overnight, but elsewhere in the G10, we are seeing the euro, pound and Aussie all gain 0.4% or so. In the EMG bloc, CLP (+1.0%) is gaining on that renewed copper strength while ZAR (+0.5%) is shaking off the Trump threats regarding recent legislative changes and benefitting from gold’s massive rally. The one outlier is MXN (-0.4%) which seems to be caught between the benefits of stronger silver prices (Mexico is a major exporter of silver) and weaker oil prices.

On the data front today, we start with ADP Employment (exp 150K) then the Trade Balance (-$96.6B) and get ISM Services (54.3) at 10:00. We also see the EIA oil inventory data with a modest build anticipated across all products. Four more Fed speakers are on the docket but as we continue to hear from more and more of the FOMC, the word of the moment is caution, as in, the Fed needs to move with caution regarding any further rate cuts.

I don’t blame the Fed for being cautious as President Trump has the ability to completely change perspectives with a single announcement. While yesterday was focused on Gaza, not really a financial market concern, who knows what today will bring? It is for this reason that I repeatedly remind one and all, hedging is the best way to moderate changes in cash flows and earnings, and consistent programs, regardless of the situation on a particular day, are very valuable.

Good luck

Adf