Since Thursday, the world has adjusted

Its views about what can be trusted

The safety of gold

Is memory-holed

As retail becomes more disgusted

Perhaps we should not be surprised

That China has now advertised

A latent desire

The yuan should move higher

As status, reserve’s, emphasized

And one last thing, can it be true

That markets have taken their cue

From Fed Chair-select

I am circumspect

I guess, though, that’s what traders do

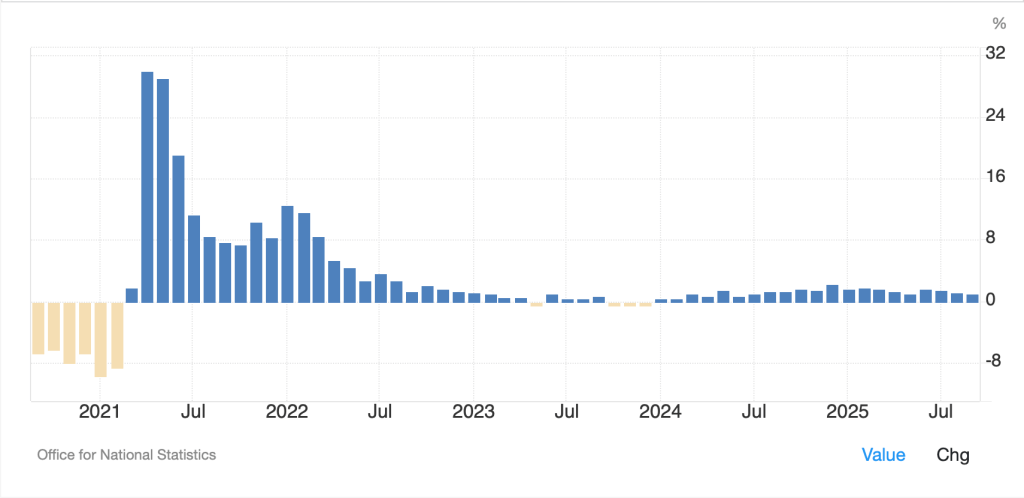

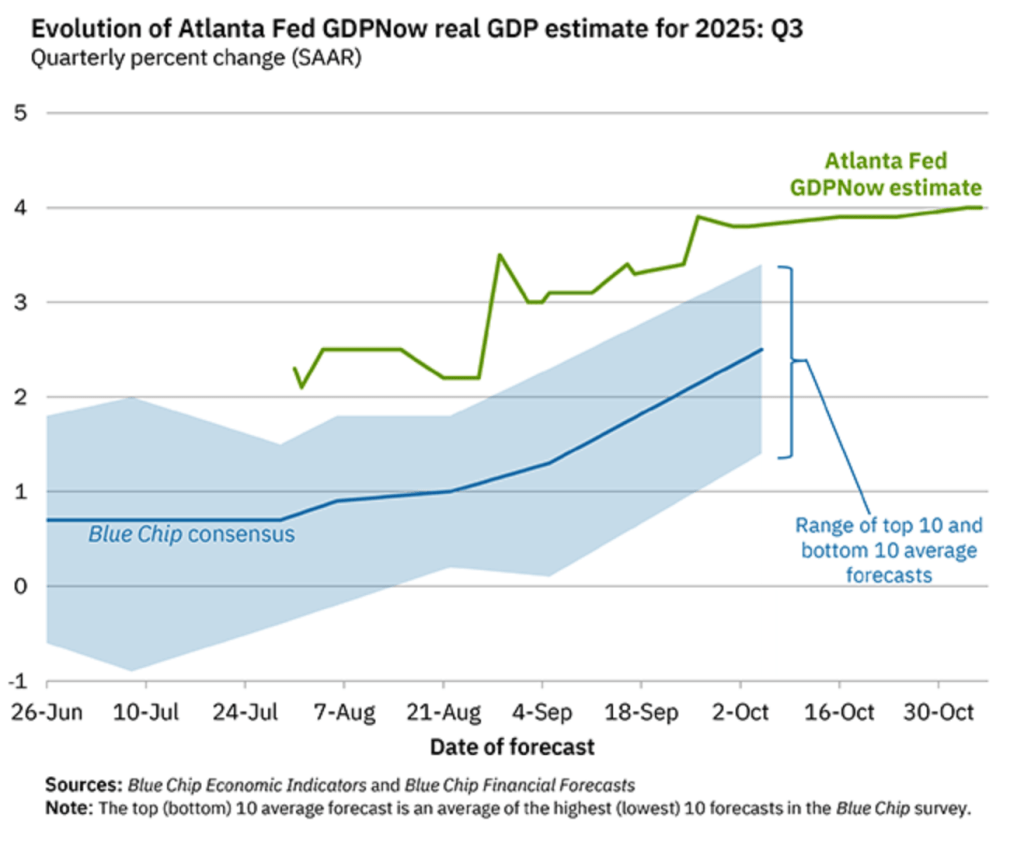

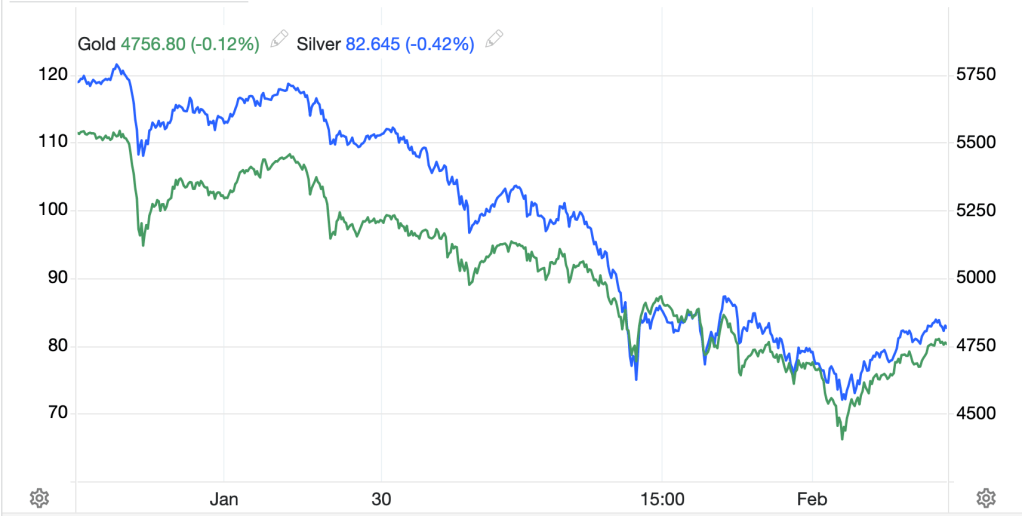

Wow! It has been a remarkable couple of trading sessions, that’s for sure. As we start this morning, precious metals remain the story, with both gold (-2.25%) and silver (-1.25%) still sliding, although both have rebounded from their worst levels of the overnight session as you can see in the chart below.

Source: tradingeconomics.com

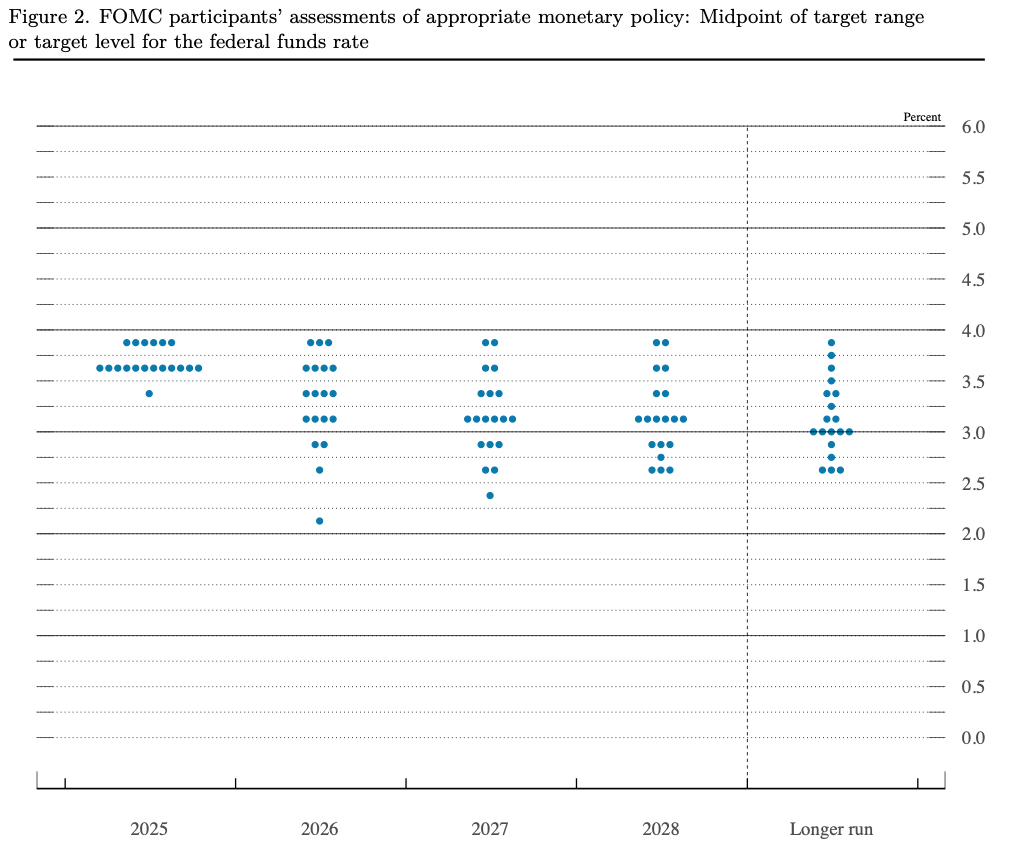

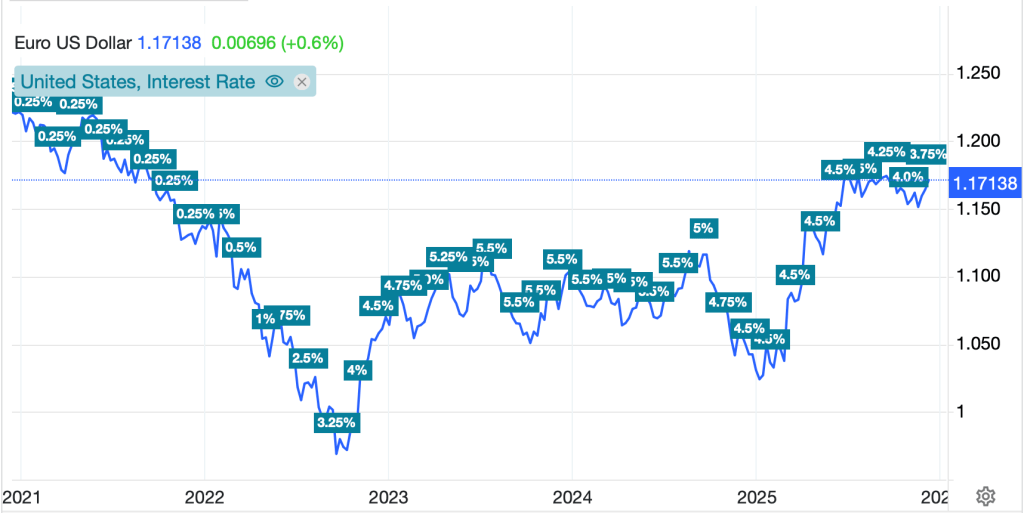

Certainly, the debasement trade had gotten awfully crowded, but ask yourself, do you believe that people suddenly decided fiat currencies are great again? Me neither. As we have learned many times in the past, markets overshoot in both directions when something changes sentiment. Which brings me to my second question, is this really all about Kevin Warsh? If so, what a harsh introduction to his new role. I understand the idea that Warsh’s perceived hawkish bias runs contra to how the narrative had evolved, but my experience is that it is rarely a single catalyst that causes a market adjustment of the type we have just seen. The one time that comes to mind was the Plaza Accord, but at that time, the G7 nations all came out and declared they were adjusting monetary policy toward a particular goal. Assuming a new Fed chair is going to make changes of that nature seems aggressive.

Nonetheless, this is where we are. Thursday’s narratives have all been destroyed and new ones have yet to be written. So, for now, I anticipate choppy trading, although nothing has changed the underlying fundamentals for metals, the dollar or the economy, at least not yet.

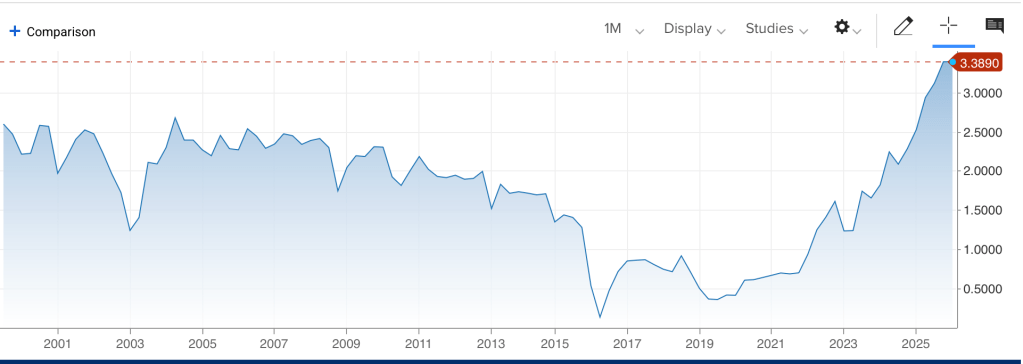

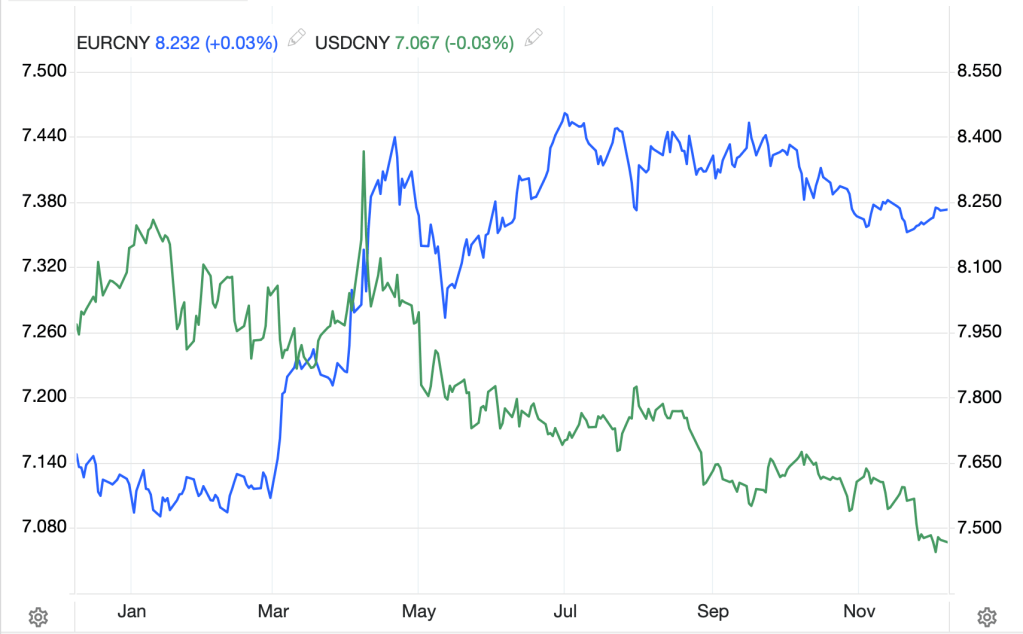

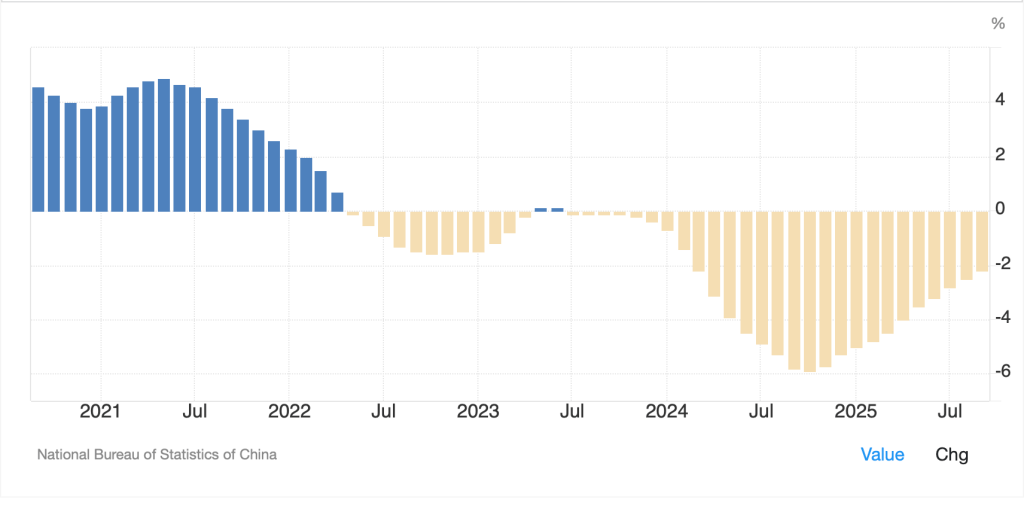

Which brings me to another interesting development over the weekend. Apparently, back in 2024, Chinese President Xi Jinping made a speech to a group of provincial officials, that had heretofore not been publicized, where he declared his ambition to have the yuan become a reserve currency. This is an interesting idea, but one that I believe will be very difficult for him to achieve, at least given his apparent desire to control every aspect of the Chinese economy. After all, for other nations to hold a currency as part of their reserves, they will want complete, unfettered access to convert it at any time they desire. Otherwise, as a reserve manager, why would you even consider holding it as part of your national wealth.

One thesis is that China is going to back the CNY with gold, but I challenge that thesis. Let’s do a little thought experiment here.

- China claims CNY is gold backed, so it is safer than USD which is backed only by the full faith and credit of the US government.

- Saudi Arabia sells China lots of oil and gets paid in CNY

- Since the Saudis can’t really do anything with their CNY, they go to the PBOC and say, here’s your CNY, give me gold.

- China says

- no problem, or

- no way

Which do you think is more likely, a) or b)?

China claiming that CNY is backed by gold because they have bought a bunch lately is no different than the US claiming the USD is backed by gold because we hold a bigger bunch in Ft Knox. It is meaningless unless those who hold bank notes, or their digital form, can convert it. Even at the government level, and I find it difficult to believe that China will ever permit that type of transaction. But it sure makes for good headlines to offset the debasement trade debacle that just played out!

As we have observed over the past months, things do change quickly these days, so who knows what tomorrow will bring. But for now, let’s look at how the rest of the markets behaved overnight.

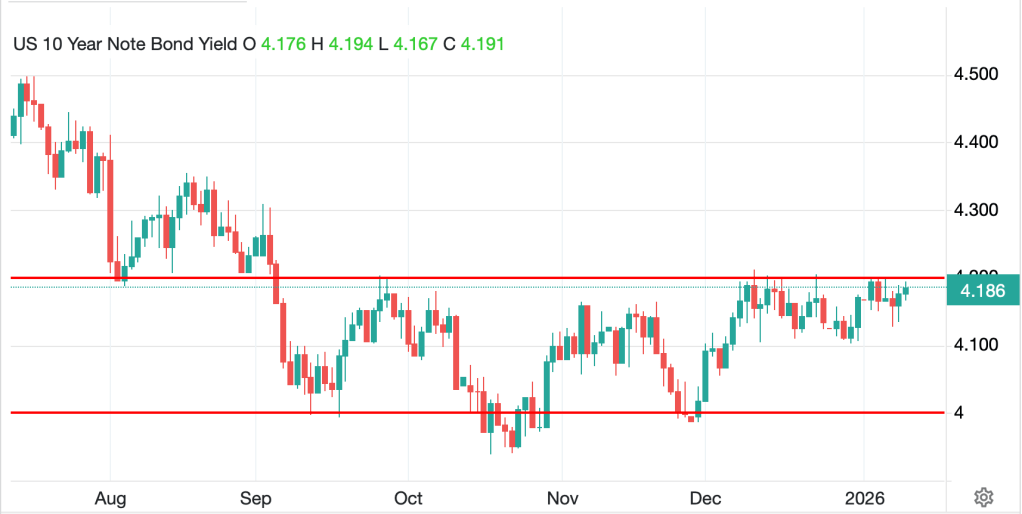

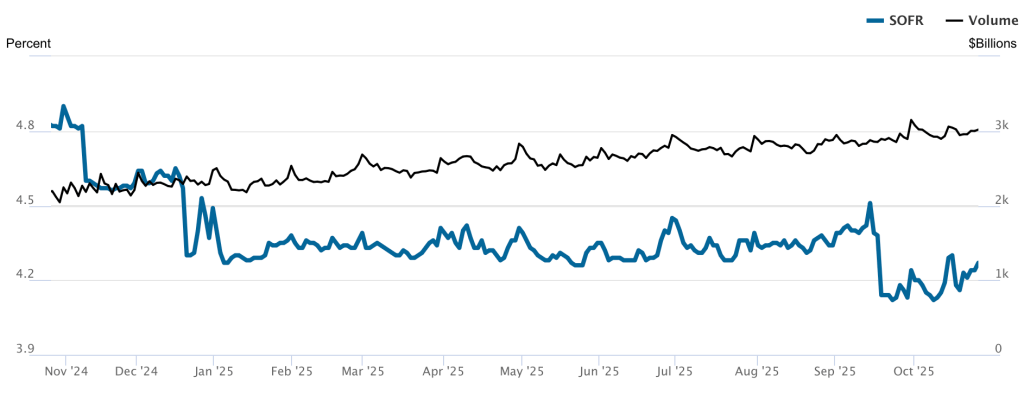

I’m going to start with bonds because they are the easiest. Virtually nothing has happened for weeks. Treasury yields (-1bp) have slipped slightly, as have JGB yields (-1bp) while European sovereign yields have edged higher by 1bp across the board. I would think if risk views had really changed, there would be more activity here. Perhaps the biggest surprise is JGB’s where the most recent poll for the election coming Sunday has her LDP coalition winning a landslide 300 seats. If that is the case, based on the earlier concerns of her apparent willingness to increase unfunded spending, I would have thought JGB’s would suffer. But not today.

Turning to stocks, while Friday’s US performance was lackluster, it was a virtual star relative to the metals space. As to Asia last night, it was ugly with Japan (-1.25%), China (-2.1%), HK (-2.2%) and Australia (-1.0%) all under pressure as it appears a combination of fears over changing global dynamics mixed with weakness in mining company shares after the metals rout. Korea (-5.3%) meanwhile, really took it on the chin with a sharp reversal of recent gains that had outpaced almost all other major markets. Indonesia (-4.9%) also got crushed, but then they have had problems since the threat of reduced status. India (+1.2%) was the only market gainer of note.

Europe, though, has neither tech nor mining companies of note and so is higher across the board this morning, led by Spain (+0.8%) and Germany (+0.6%) after very slightly better than expected PMI data this morning. As to US futures, at this hour (7:30) they are slightly softer with the NASDAQ (-0.5%) the laggard.

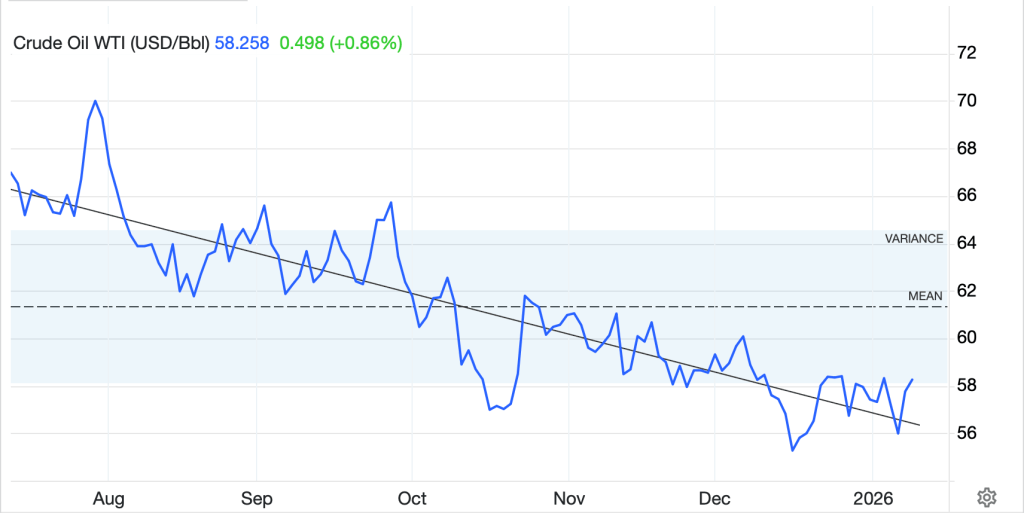

Oil (-4.75%) is backing off significantly this morning as there appears to have been a reduction in the rhetoric between President Trump and Iran, with negotiations mooted for some time this week or next, ostensibly in Turkey. Nat Gas (-17.1%) is giving back some of its recent gains as US temperatures exit the polar vortex and come back to more normal winter temps.

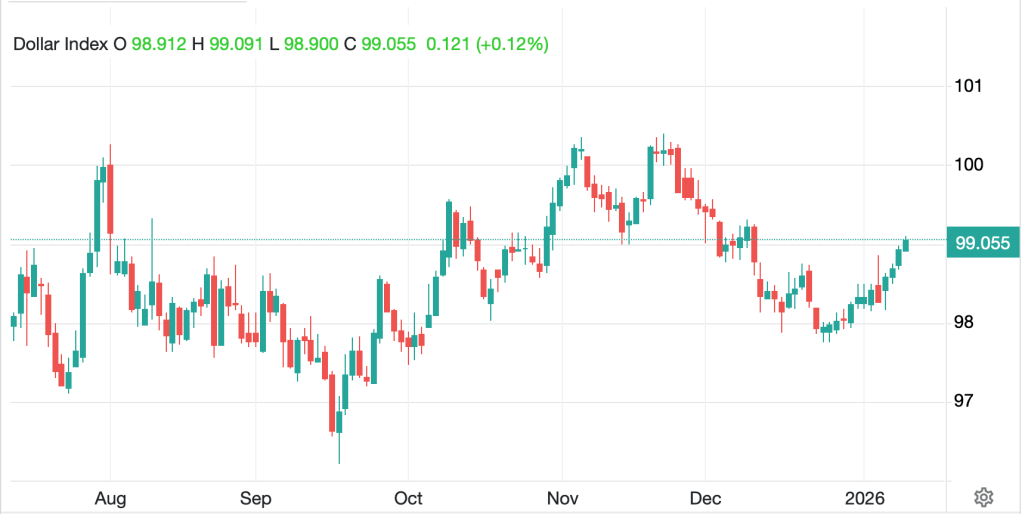

Finally, the dollar is doing little this morning. Friday saw a solid rebound across the board, about 1%, but today, the biggest movers are ZAR (+0.8%) which is shocking given the move in gold, MXN (+0.5%), where traders believe the Banco de Mexico is likely to be a bit more hawkish than previously thought and CNY (+0.25%) I guess on the reserve currency story. But the G10 are all little changed and the one other thing of note is that Secretary Bessent ruled out US intervention in the yen, although it remains little changed on the session near 155.00.

On the data front, as it is the first week of the month, we finish off with NFP. Here’s what else is coming:

| Today | ISM Manufacturing | 48.5 |

| ISM Prices Paid | 60.5 | |

| Tuesday | JOLYs Job Openings | 7.1M |

| Economic Optimism Index | 47.9 | |

| Wednesday | ADP Employment | 40K |

| ISM Services | 53.5 | |

| Thursday | Initial Claims | 210K |

| Continuing Claims | 1825K | |

| Friday | Nonfarm Payrolls | 70K |

| Private Payrolls | 60K | |

| Manufacturing Payrolls | -10K | |

| Unemployment Rate | 4.4% | |

| Average Hourly Earnings | 0.3% (3.6% Y/Y) | |

| Average Weekly Hours | 34..2 | |

| Participation Rate | 62.3% | |

| Michigan Sentiment | 55.8 |

Source: tradingeconomics.com

In addition, we hear from 5 more Fed speakers, but quite frankly, I expect that the only Fed voice that is going to matter for a while is Warsh, and he is not on the slate that I can see.

We have seen a dramatic change in market mindset since Thursday, but we have not seen any change at all in policy or economics. At this point, it is clear the market was overdone (remember, trees don’t grow to the sky), but that doesn’t mean the underlying thesis was wrong. I still think that the need for commodities is substantial, and we will see prices go higher. As to the dollar, there is no indication it is about to collapse, nor would I expect it. Until such time as other nations are clamoring to own CNY, the dollar remains the only game in town. Big picture, I still like it vs. other fiat currencies.

Good luck

Adf