The US has not yet been drawn

To war, though it’s not yet foregone

That won’t be the case

While Persians now brace

For busters of bunkers at dawn

But until such time as we learn

That outcome, the current concern

Is Jay and the Fed

And what will be said

At two o’clock when they adjourn

So, every top headline this morning discusses the idea that President Trump is considering whether to initiate US military action in Iran, specifically to drop the so-called bunker buster bombs to destroy Iran’s nuclear enrichment and bomb-making facilities. There is certainly a lively discussion on both sides of the argument with the best description of the problem that I’ve seen being a poll showing that 74% approve Trump’s position that Iran must not get nuclear weapons, but 60% oppose US involvement in the war. I’m glad I don’t have to thread that needle!

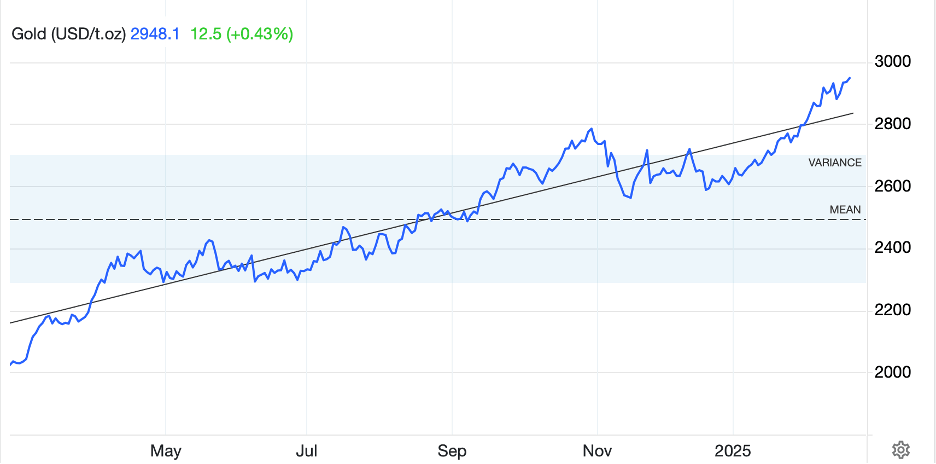

Obviously, there are market implications if the US does get involved but given the complete lack of clarity on the situation at this point, I do not believe I can add much to the discussion. The only thing I will say is that the longer-term trends for both oil (lower) and metals (higher) are still intact, but we are likely to see some significant volatility along the way.

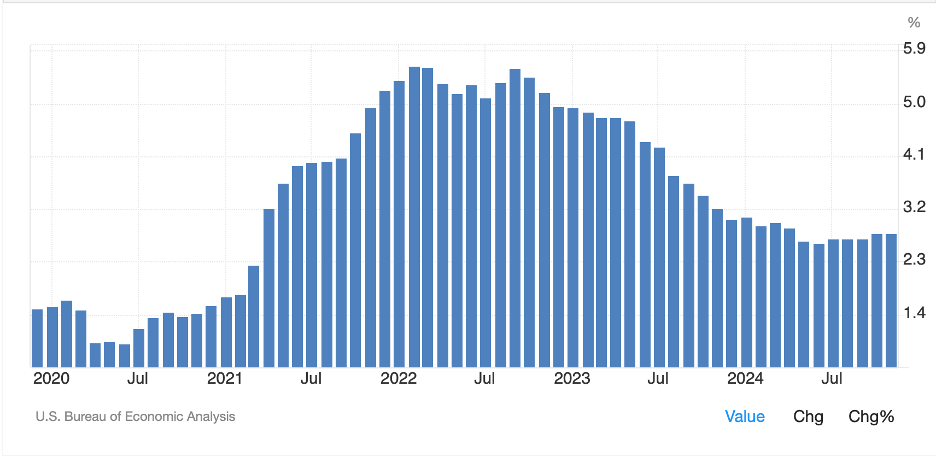

Which takes us to the next most important market discussion, the FOMC meeting that ends today and the potential market impacts. It is universally assumed that there will be no policy change at the meeting, either interest rates or QT, which means that now the punditry is focused on the arcana of Fed policy. As this is a quarter end meeting, the Fed will release its latest SEP (summary of economic projections) and dot plot, and with nothing else to discuss until the war in Iran either ends or intensifies, those are the key discussion points in the market.

I have long maintained that one of the greatest blunders of the Bernanke era was the institution of forward guidance. While it may have served its purpose initially, it has now become a major distraction. Far too much attention is paid to the dot plot, where if one member adjusts their view by 25bps, it can impact markets which have built algorithms to respond to the median outcome.

Below is the March dot plot which showed a median “expectation” of Fed funds for the end of 2025 at 3.875%, or 50 basis points lower than the current level. However, if two more FOMC members (out of 17) thought there was only going to be one cut, that would have shifted the median “expectation” as well as the narrative.

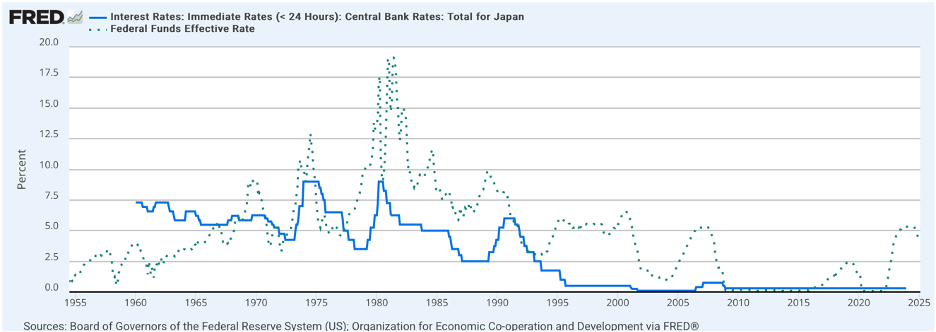

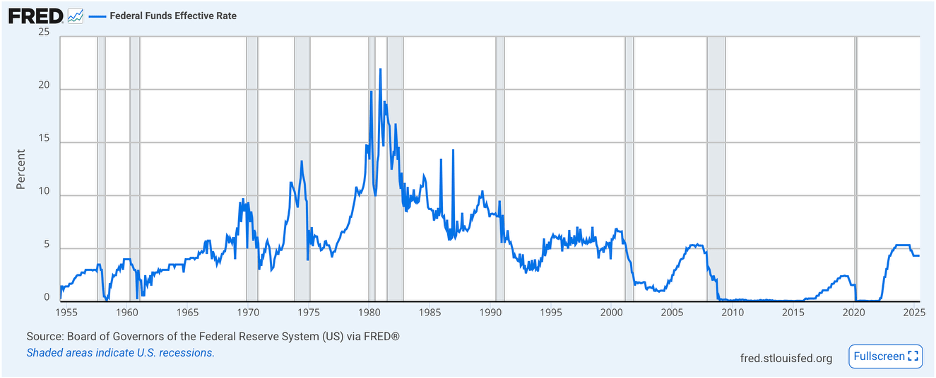

As such, the importance of the dot plot feels overstated compared to its actual value. After all, no FOMC member has an impressive track record with respect to their analysis of the economy and its future outcomes, let alone what the appropriate rate structure should be at any given time. In fact, nobody has that, which is the argument for restricting the Fed’s duties to be lender of last resort and allow markets to determine the proper level of interest rates based on the supply and demand of money. But this is the world in which we live. My one observation is that the post GFC era has greatly distorted views on the economy and appropriate monetary policy. It is hard not to look at the below history of Fed funds and see the anomaly that occurred during the initial QE phase.

Concluding, regardless of my, or anyone not on the FOMC’s, views on appropriate policy, it doesn’t matter one whit. They are going to do what they deem appropriate, and while I don’t doubt their sincerity, I do doubt they have the tools for the mission. Perhaps the most interesting thing that could come from this meeting is further information on their assessment of the current Fed process, including their communication policy. I remain strongly in favor of them all shutting up and letting markets do their job although that seems unlikely. But perhaps they will get rid of the dots which seem to have outlived any value they may have had initially.

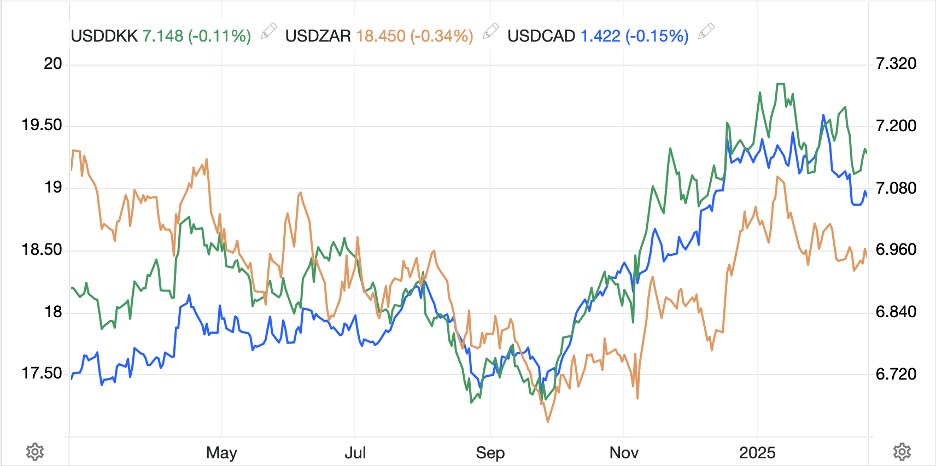

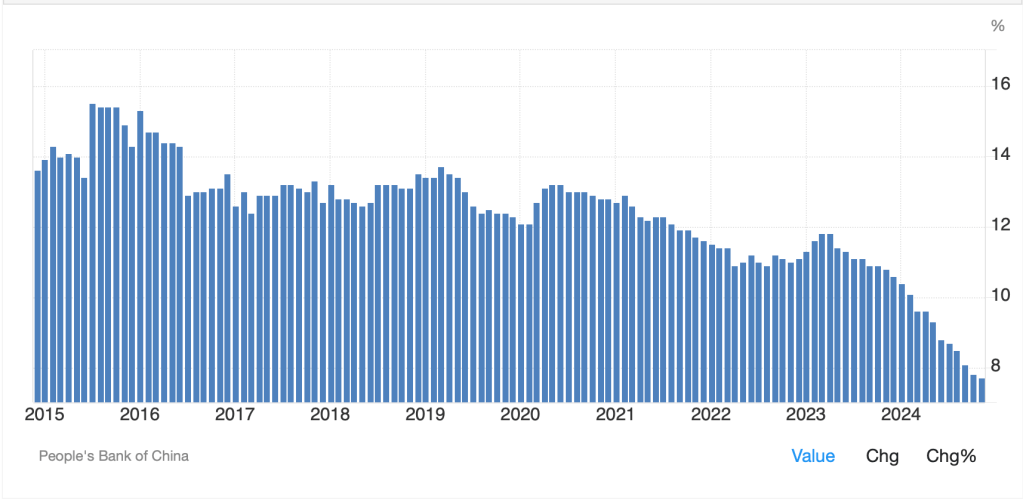

Before we go to markets, I have to highlight one other market discussion this morning with Bloomberg publishing two different articles, here and here, on the end of the dollar’s hegemony. The first highlights a speech by PBOC governor Pan Gongsheng and his vision of a multicurrency world which, of course, includes the renminbi as a major part of the process. I will believe that is a possibility as soon as China opens its capital accounts completely and allows flows into and out of the country with no restrictions. (I’m not holding my breath.) The second takes the Michael Bloomberg Trump hatred in the direction of the president is destroying the dollar’s reign because of his policies and to highlight the dollar has fallen 10% already this year! But let us look at a long-term chart of the dollar, using the DXY as a proxy, and you tell me if you can see the recent move as being outsized in any sense of the word. In fact, the dollar’s recent price action is indistinguishable from anywhere in its history, and it is not anywhere near to its historic lows. In fact, it is just a few percent below its long-term average.

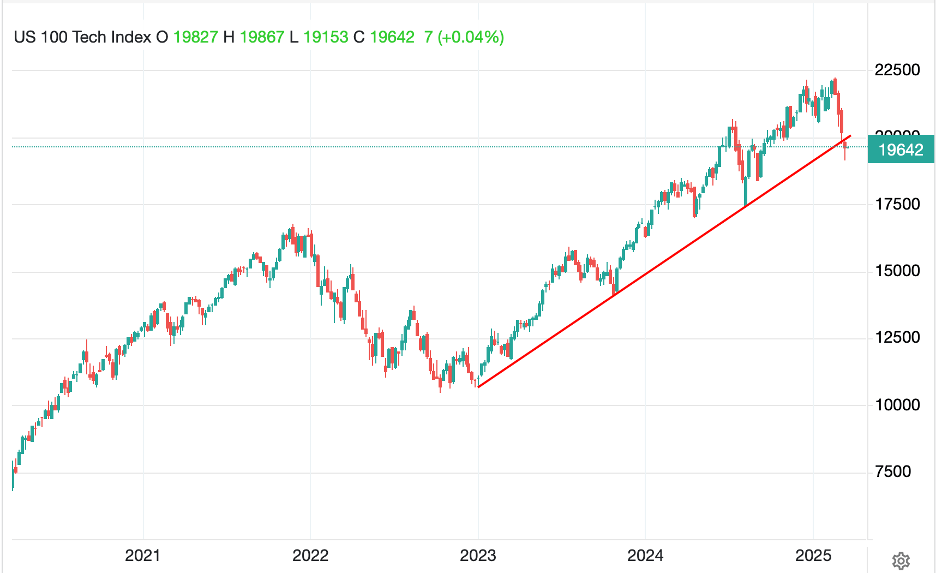

Ok, now let’s look at markets. Yesterday’s selloff in equities seemed to be based on concerns over the escalation in Iran, but as that drags out, traders don’t know what to do. They are certainly not pushing things much further. In fact, overnight saw the Nikkei (+0.9%) have a solid gain although HK (-1.1%) followed the US lower. Elsewhere in the region, South Korea and Taiwan performed well, while India and Indonesia lagged and the rest were +/-20bps or less. Europe, though, is softer this morning with declines on the order of -0.4% on the continent across the board. I think investors here are also waiting on the potential events in Iran. But US futures are actually pointing slightly higher at this hour (7:30).

In the bond market, yields around the world are slipping with Treasuries falling -2bps and most of Europe seeing declines between -1bp and -3bps. This is after a few basis point decline yesterday as well. I guess the fear of too much US debt is in abeyance this morning.

In commodity markets, oil, which rallied sharply yesterday on fears of the US entering the war, is little changed on the day after that climb as while there has been lots of talk, oil continues to flow through the Strait of Hormuz, and everybody is pumping nonstop to take advantage of the current relatively high prices. Gold is unchanged although the other metals (Ag +0.25%, Cu +0.7%, Pt +2.4%) continue to see significant support. In fact, platinum this morning has broken above the top of an 11-year range and many now see an opportunity for a significant rally from here.

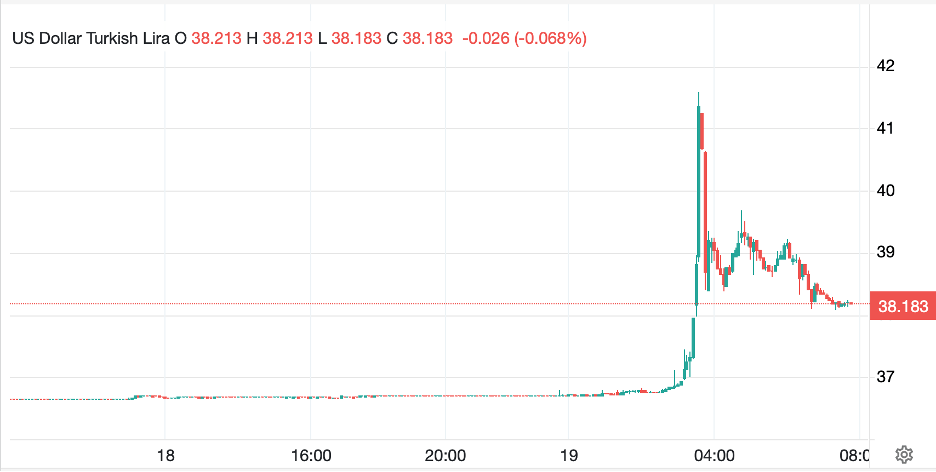

Finally, the dollar is somewhat softer this morning, slipping about 0.2% against the pound, euro and yen, with similar declines against most other currencies. The exceptions to this are the KRW (+0.45%) which seems to be benefitting from a growing hope that a trade deal will be completed between the US and Korea shortly, and ZAR (-0.5%) as CPI data release there this morning shows inflation under control and no reason for SARB to consider tightening policy further.

On the data front, because of tomorrow’s Juneteenth holiday, we see Initial (exp 245K) and Continuing (1940K) Claims as well as Housing Starts (1.36M) and Building Permits (1.43M). And of course, at 2:00 it’s the Fed. My sense is absent a US escalation in Iran, it will be quiet until the Fed, and probably thereafter as well given the lack of reason for any policy changes. After all, there is no certainty as to either war or trade policy right now, so why would they do anything.

If I had to opine, I would say the dollar is likely to decline over the next year, but that in the longer run, it will be firmer than today.

Good luck

Adf