All eyes will be on NFP

As pundits are hoping to see

A modest result

That can catapult

The market to its apogee

If strong, the concern is that growth

Will strengthen and Jay will be loath

To cut rates once more

Which bulls will deplore

Implying a future quite noeth

If weak, then the problem for stocks

Is earnings will suffer a pox

So even if rates

Are cut in the States

The NASDAQ may still hit the rocks

It’s payroll day and especially after yesterday’s day of respect for the late President Carter closed equity markets in the US, investors are anxious to get back to business. Here are the latest consensus estimates for the key figures to be released

| Nonfarm Payrolls | 160K |

| Private Payrolls | 135K |

| Manufacturing Payrolls | 5K |

| Unemployment Rate | 4.2% |

| Average Hourly Earnings | 0.3% (4.0% Y/Y) |

| Average Weekly Hours | 34.3 |

| Participation Rate | 62.8% |

| Michigan Sentiment | 73.8 |

Source: tradingeconomics.com

As well, there will be annual revisions to the household report today, which is the portion of the process that calculates the Unemployment Rate. Next month we will see the annual revisions to the NFP, where estimates are already circulating that the number of jobs created in 2024 will be revised down by more than 1 million, nearly one-half of the claimed number (~2.2 million) created.

But ultimately, the reason this data point gets so much press is that it is half of the Fed’s mandate and so is closely watched by the FOMC as they consider any policy stance. Yesterday, St Louis Fed president Musalem became the seventh or eighth Fed speaker since the last meeting to explain that more caution was warranted as the Fed tries to reduce what they still believe is a modest tightening bias. “… [rate reductions] have to be gradual – and more gradual than I thought in September,” according to Musalem. So, caution remains the watchword for every member of the FOMC and accordingly, the market is pricing just a 5% probability of a rate cut later this month.

The thing that has really changed over the past several months is the market’s reaction function to the data. Part of this is based on the fact that it appears the Fed’s reaction function has changed a bit, and part of this is because the economic situation remains so confusing.

Regarding the Fed, given the fact that the data since they started cutting rates in September has been quite robust and given the fact they no longer have a political/partisan motive to cut rates, it strikes me it will be far harder for Powell and friends to justify further rate cuts from here. After all, if GDP is growing at 3.0% and inflation is running at 3.3%, absent all other information, that data would truthfully argue for rate hikes. However, there remains a large camp of analysts that continue to expect a significant slowdown in economic activity, with a number of well-respected voices claiming that we are already in a recession and have been in one since sometime in 2024.

My view is that this confusion remains best explained by the concept of the K-shaped recovery where a smaller portion of the population, notably those with assets and investments in the markets, have been huge beneficiaries of Fed policies as they not only have seen their portfolios climb in value, but their cash is earning a nice return. Meanwhile, a much larger percentage of the population, although a group that receives far less press from the financial reporters, continues to struggle given still rising prices and less overall opportunity for advancement. This is the genesis of the labor strife we have seen, but there are many who remain left behind. The problem for the Fed is they don’t really see this second cohort as their constituents, at least based on their policy actions.

As to today’s release, if we look at the recent Initial Claims data, it is consistent with a stronger number rather than a weaker one. However, from a market perspective, I believe that a strong NFP number, something like 200K, will see a risk sell-off as the market continues to remove pricing for any rate cuts in 2025. This will hurt stocks and likely bonds, although it will help the dollar and, surprisingly, commodities, as the market is likely to see increased demand forthcoming.

Elsewhere, aside from the wildfires in LA, which are a terrible tragedy, the other story in markets today revolves around the ongoing, slow motion disintegration of any remaining credibility in the UK government and its ability to address the many problems there. Gilt yields continue to rise sharply, although I continue to hear many rationales as to why this is NOT like the October 2022 Gilt crisis. Alas, while certainly the speed of this decline in Gilts is not quite as dramatic as we saw back then, the duration of the problem is far greater, and we have moved further now than then. As you can see from the below chart, Gilt yields have risen 110bps since the middle of September, outpacing even Treasury yields and 10yr Gilts now yield 15bps more than Treasuries.

Source: tradingeconomics.com

In fact, UK 10-year yields are the highest in the G10, although in fairness, they are not yet approaching levels like Mexico (10.6%), Brazil (14.75%) or Turkey (26.4%). Perhaps Chancellor Reeves has those targets in mind.

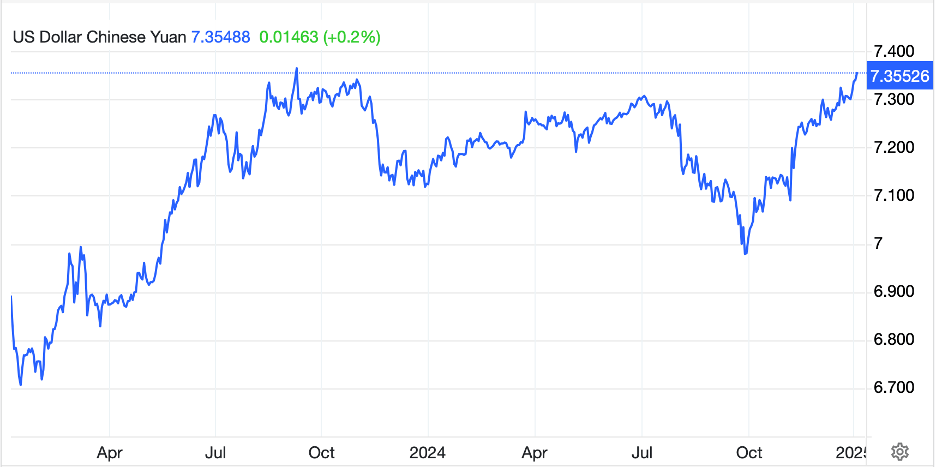

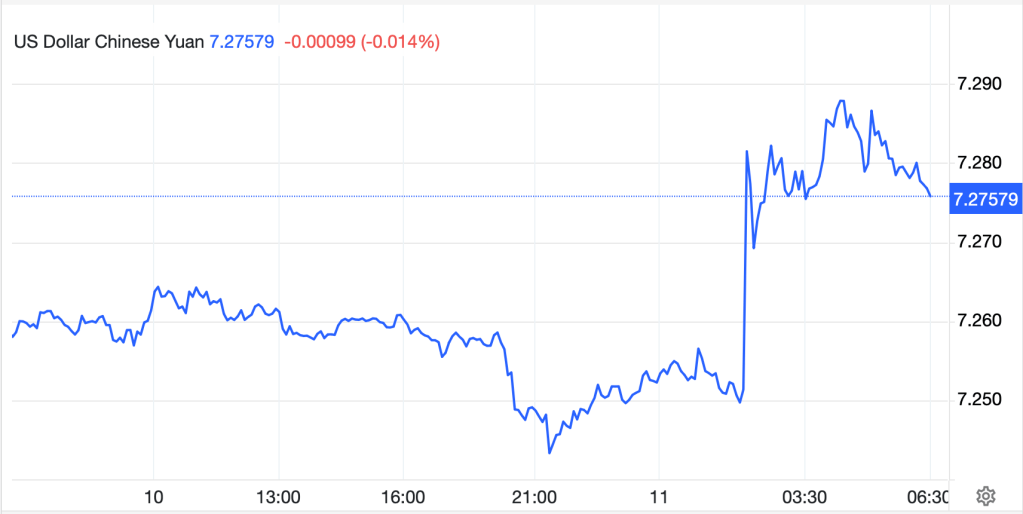

OK, let’s see how markets behaved in the lead-up to the data this morning. There was no joy in Mudville Asia last night as the Nikkei (-1.05%) slid amid new stories that the odds of a BOJ rate hike in two weeks are rising, while Chinese shares (Hang Seng -0.9%, CSI 300 -1.2%) were also under pressure amid news that the PBOC would stop buying bonds (ending QE) and additionally might be selling some to reduce liquidity in Hong Kong as they attempt to slow the decline of the renminbi. The rest of the region was similarly under pressure across the board.

In Europe, the picture is more nuanced with the DAX (+0.4%) and CAC +0.3%) showing some modest gains after slightly better than expected French IP data. However, the FTSE 100 (-0.4%) and other continental bourses (IBEX -0.9%) are not quite as positive, with the FTSE clearly feeling pressure from the overall negative sentiment on the UK, while mixed data elsewhere is undermining any investor sentiment. US futures at this hour (7:15) are pointing lower by about -0.25% across the board. Fears of a strong number?

In the bond market, Treasury yields continue to climb, as they are holding onto yesterday’s rise of 5bps and this morning we are seeing European sovereign yields all creep higher by 1bp to 2bps. JGB yields also rose 2bps overnight as part of that BOJ rate hike story. In fact, the only market that didn’t see yields rise is China, where they remain within 2bps of their recent all-time lows

In the commodity markets, oil (+3.2%) is skyrocketing as continued cold weather increases heating demand while the reduction in inventories in Cushing, Oklahoma (the main point for NYMEX contract settlements) has raised concern over available supply of crude. Meanwhile, metals prices continue to climb steadily with gold (+0.3%) continuing its run alongside silver (+0.8%) and copper (+0.45%). The demand for “stuff” remains strong as nations around the world slowly lose confidence in government bonds as an effective store of value.

Finally, the dollar is, net, little changed this morning with some gains and some losses although few large moves. On the dollar’s plus side we see KRW (-0.5%), ZAR (-0.55%) and BRL (-0.35%) while the yen and renminbi have both seen modest gains (+0.1%) on the back of the liquidity reduction stories in both nations. However, we must keep in mind the dollar, as measured by the DXY, remains above 109 and continues to strongly trend higher. My take is the highs seen in autumn 2022 are the next target, so look for the euro to sink below parity and the pound well below 1.20, probably 1.15, before too long.

There are no Fed speakers on the schedule today, although I imagine we will hear from somebody after the data since they cannot seem to shut up. However, after today, they head into their quiet period ahead of the next FOMC meeting, so until then we will need to rely on Nick Timiraos from the WSJ to understand what Powell is thinking.

While nothing is that clear, and we could easily see a weak NFP report, my take is we are far more likely to see a strong one with stocks and bonds selling off and the dollar rising further.

Good luck and good weekend

Adf