While eyes and ears focus on Jay

And whatever he has to say

Poor Germany’s shrinking

And it’s wishful thinking

Japan’s kept inflation at bay

But fears about Jay have been growing

That rate cuts he will be foregoing

If that is the case

Most traders will race

To sell things while panic they’re sowing

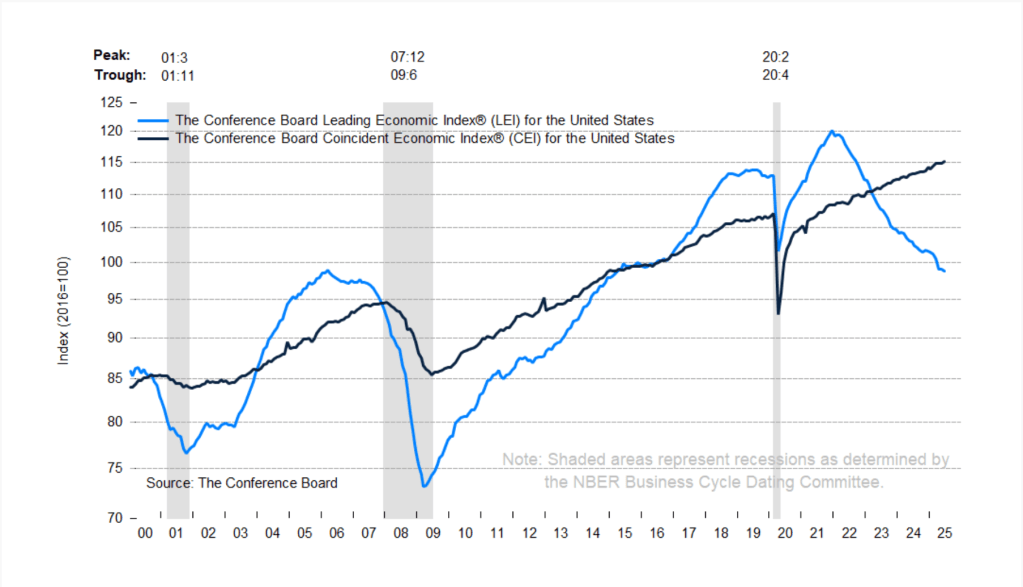

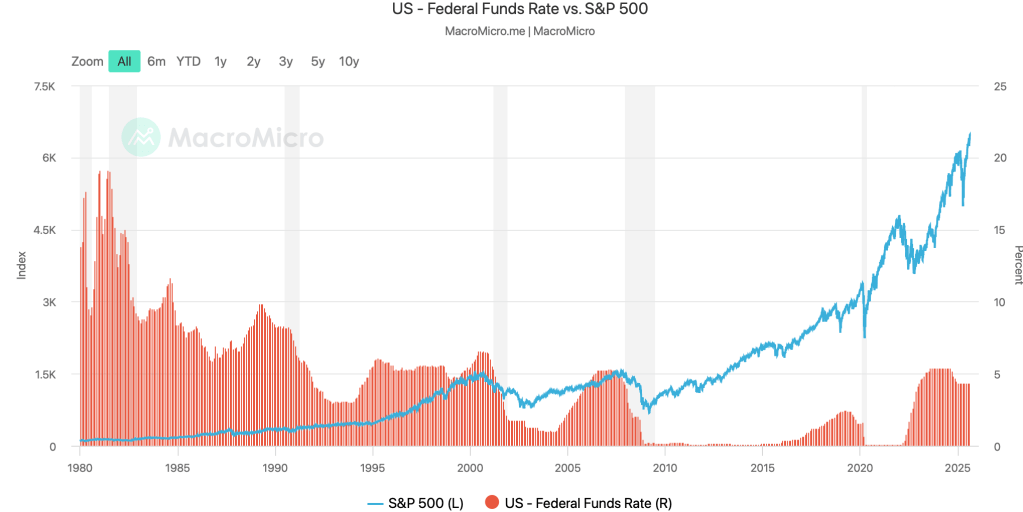

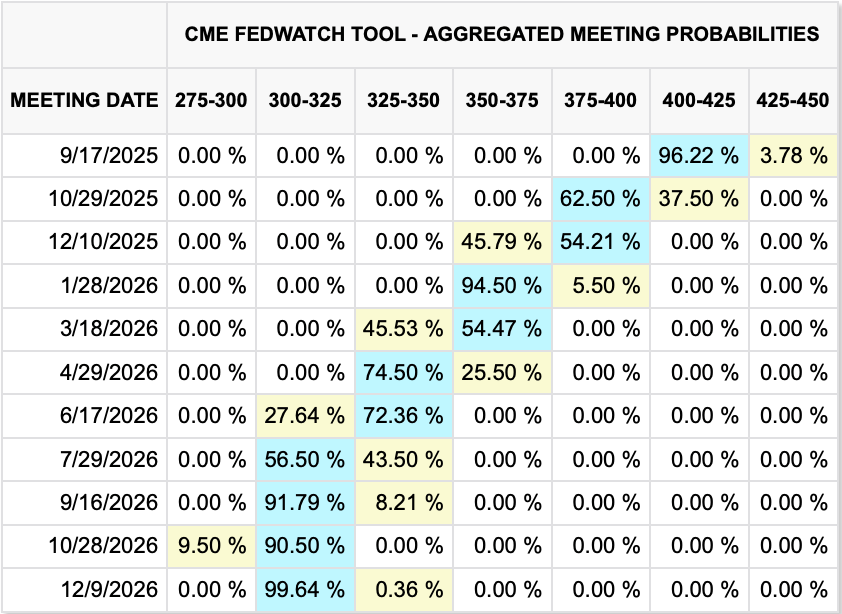

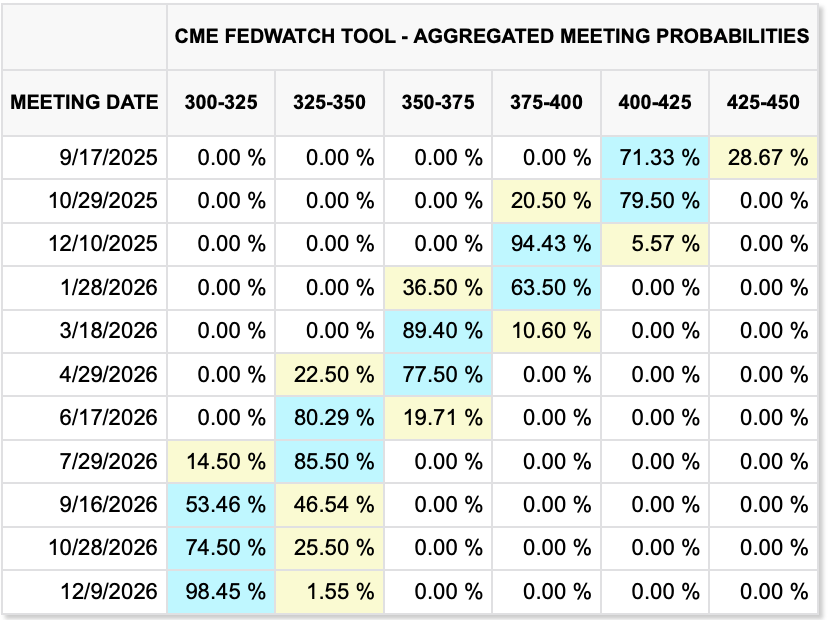

Clearly, the big story today is Chairman Powell’s speech with growing expectations that he will sound more hawkish than had previously been anticipated. Recall, after the much weaker than expected NFP data was released at the beginning of the month, it appeared nearly certain that the Fed was going to cut at the next meeting with talk of 50bps making the rounds. Now, a few hours before Powell steps to the podium, the futures market is pricing just a 71% probability of that rate cut with a just two cuts priced in for 2025 as per the CME’s own analysis below:

Arguably, this is one reason that equity markets have been having trouble moving higher as the Mag7 drivers of the market are amongst the longest duration assets around, so higher rates really hurt them. While there has been a rotation into more defensive names, if opinions start to shift regarding the magnificence of AI, or perhaps just how much money they are spending on it and the potential benefits they will receive, things could get ugly.

I also find it interesting that the Fed whisperer, Nick Timiraos at the WSJ, has been running flack for Chairman Powell in this morning’s article, trying to get people to focus on the Fed’s framework as the basis of today’s speech, rather than policy per se. Briefly, the current Fed framework, was designed right before COVID when for whatever reason they were concerned that low inflation was a problem, and they created Average Inflation Targeting (AIT) as a way to allow inflation to run above their target of 2.0% for a period if it had been below that level for too long. We all know how well that worked out and, in fact, we are all still paying for their mistakes every day! The word is they are going to scrap AIT although it is not clear what they will come up with next. It is exercises like this that foment the ‘end the Fed’ calls from a growing group of monetarist economists and pundits.

At any rate, comments from other Fed speakers indicate that most are not yet ready to cut rates, so Powell will be able to have a significant impact if he turns more dovish. But we have to wait a few more hours for that so let’s turn our attention elsewhere.

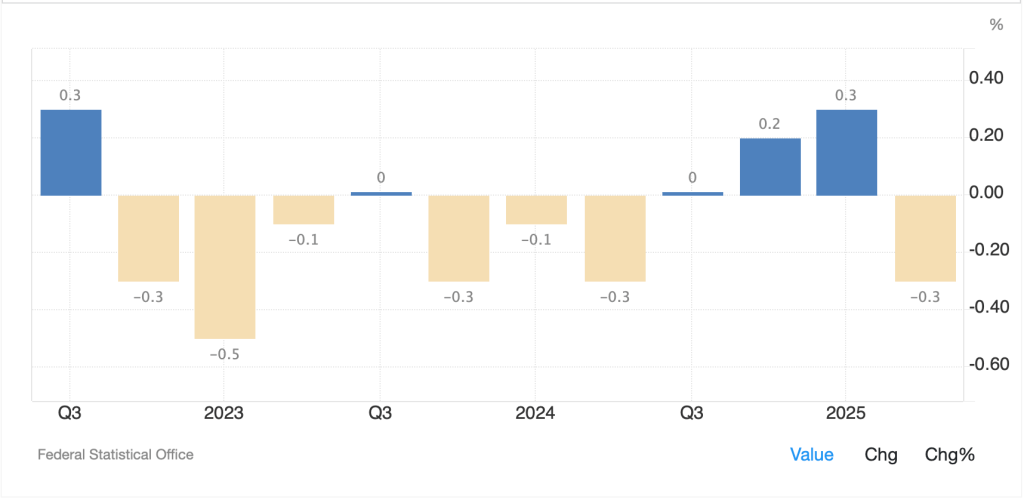

Germany GDP data (-0.3% Q/Q, +0.2% Y/Y) was a few ticks lower than expected and continues to point to an economy that has no positive momentum at all. In fact, a look at the quarterly GDP data from Germany paints a pretty awful picture if growing your economy is the goal.

Source: tradingeconomics.com

Clearly, the US tariff changes have been quite negative, but in fairness, Germany’s insane energy policy is likely a much bigger driver of their problems as they have the most expensive power costs in the EU. It is very difficult to have a manufacturing-based economy if you cannot power it cheaply. Again, while the euro is more than just Germany, this does not bode well for the single currency.

Turning to Japan, inflation continues to run far above their 2.0% target, printing last night at 3.1% on both the headline and core metrics, which while 2 ticks lower than June’s data, was still a tick higher than expected. It has now been 40 consecutive months that core CPI in Japan has been above the BOJ’s 2.0% target and Ueda-san continues to twiddle his thumbs regarding raising rates.

Source: tradingeconomics.com

It is very hard to watch this lack of policy response to a clear problem, that from all I read is becoming a much bigger political issue for PM Ishiba, and have confidence that the yen is going to strengthen any time soon. Back in May, the talk was of the unwinding of the carry trade. All indications now are that it is being put back on in significant size. FWIW I think we will see 150.00 before too long, especially if Powell sounds hawkish.

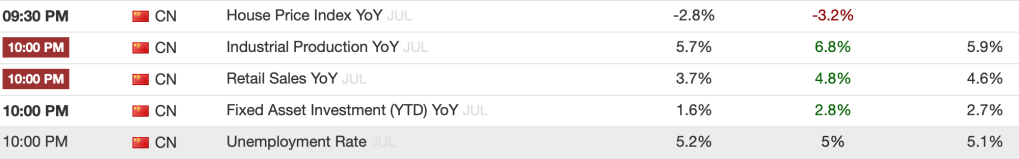

And those are really the stories today ahead of Powell and the NY open. So, let’s see how things behaved overnight. After a modest down day in the US yesterday, and despite the poor inflation data, Japan was unchanged overall. However, China (+2.1%) had a huge up move apparently on the idea that US-China trade tensions are easing and despite continued weak data from the country. Apparently, there has been a rotation from bonds to stocks by local investors driving the move. Hong Kong (+0.9%) also had a strong session as did Korea (+1.0%) although India, Taiwan and Australia all struggled with declines between -0.6% and -1.0%. In Europe, the. screens are green, but it is a pale green with muted gains (DAX +0.1%, CAC +0.25%, IBEX +0.4%) despite the weak German data. Perhaps the belief is this will encourage the ECB to ease policy further. Meanwhile, at this hour (7:15) US futures are pointing higher by 0.25% or so.

In the bond market, after climbing a few basis points yesterday, Treasury yields are unchanged, trading at 4.33%, so still range bound. European sovereign yields are softer by -1bp to -2bps, again likely on the softer German data with hopes for a more aggressive ECB. JGB yields edged higher by 1bp in the 10-year but the longer end of the curve there has seen yields move to new all-time highs with 30-year yields up to 3.216%. it feels like things are starting to unravel in Japanese bond markets.

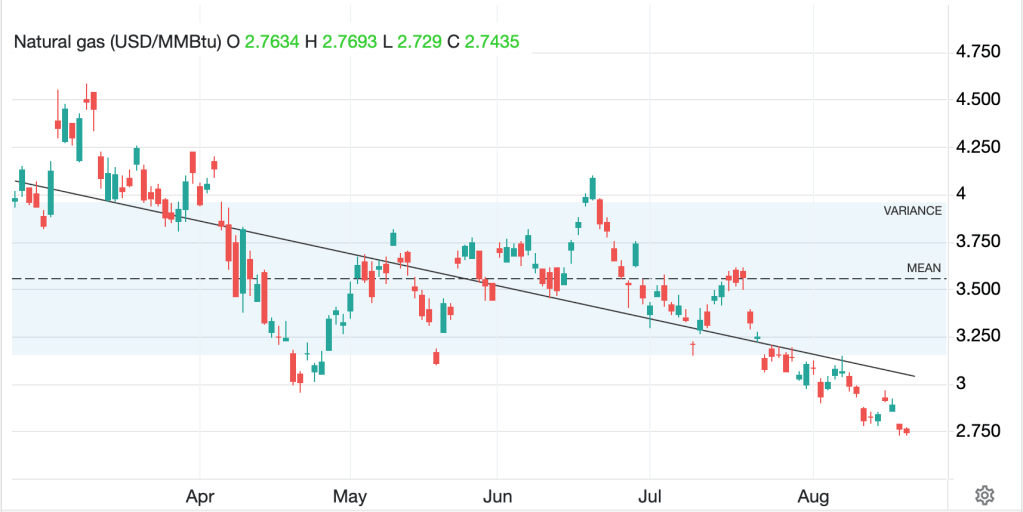

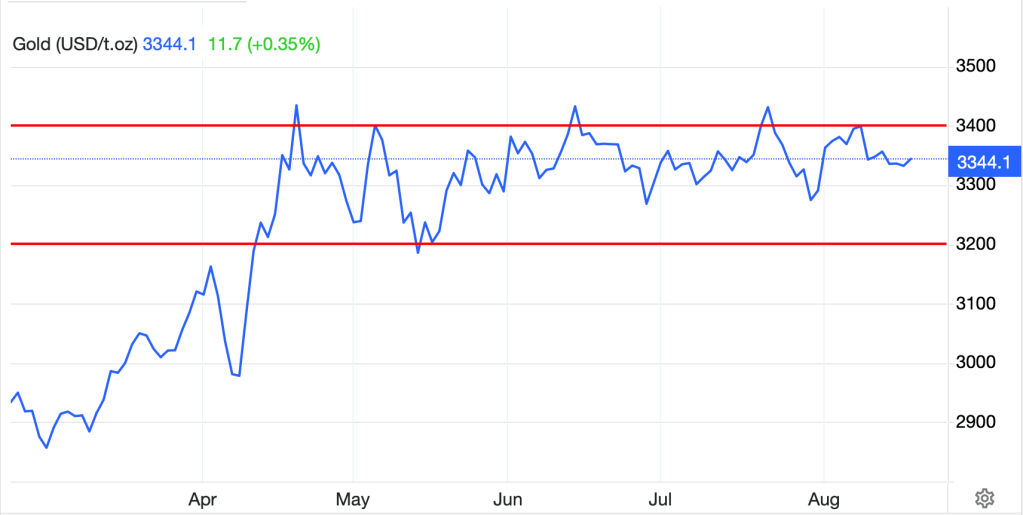

Turning to commodities, oil (+0.4%) is creeping higher again this morning but remains in its downtrend and activity is lacking. Meanwhile, the metals markets (Au -0.35%, Ag -0.5%, Cu -0.3%) are all under pressure from a combination of a strong dollar and a lack of investor interest, at least in the West.

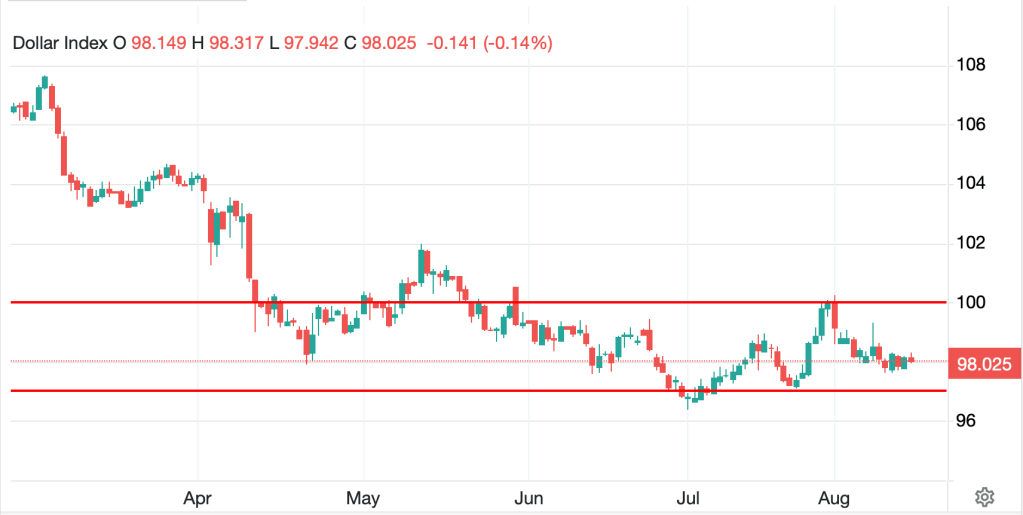

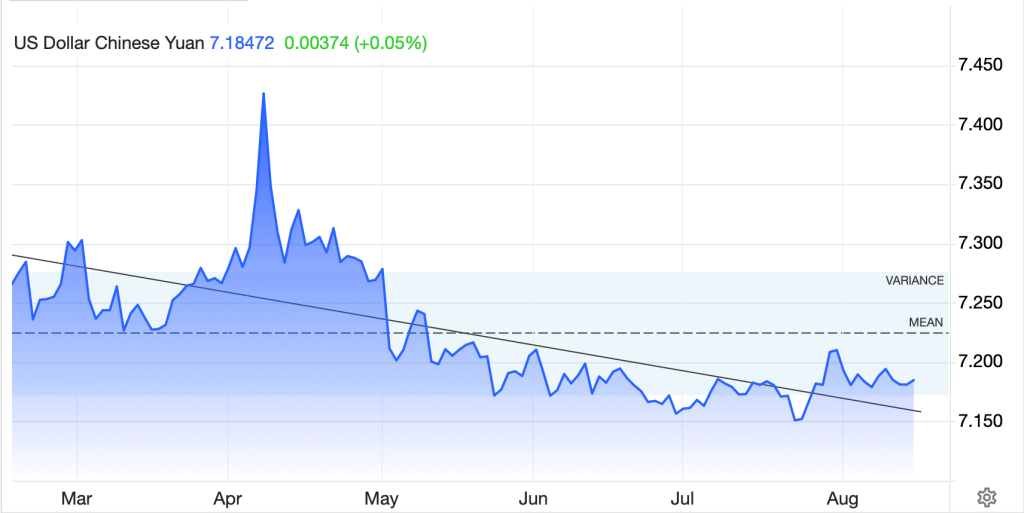

Speaking of the dollar, it rallied yesterday and is largely continuing this morning with one notable exception, KRW (+0.75%) which benefitted from trade data showing exports rose 7.6% in the first 20 days of the month on strong semiconductor sales. But otherwise, +/-0.3% or less is the story of the day, with most currencies within 0.1% of yesterday’s closing levels.

And that’s really it. There is no data so we are all awaiting Powell and then anything that may come from the White House regarding trade deals, or peace, I guess. As the summer comes to a close, unless Powell says rate hikes are coming or promises cuts, I expect that traders will have gone for the weekend by lunch time and it will be a very quiet market.

Good luck and good weekend

Adf