The story is yesterday’s trauma

As risk assets traded with drama

For stocks, it was news

AI could abuse

More sectors, that triggered the bomb-a

For gold and the metals, however,

It seemed an alternative lever

A bear raid, perhaps

Or filling chart gaps

No matter, twas quite the endeavor

Which leads to today’s CPI

Where narratives that with AI

Deflation is coming

As all jobs but plumbing

We’ll no longer need to apply

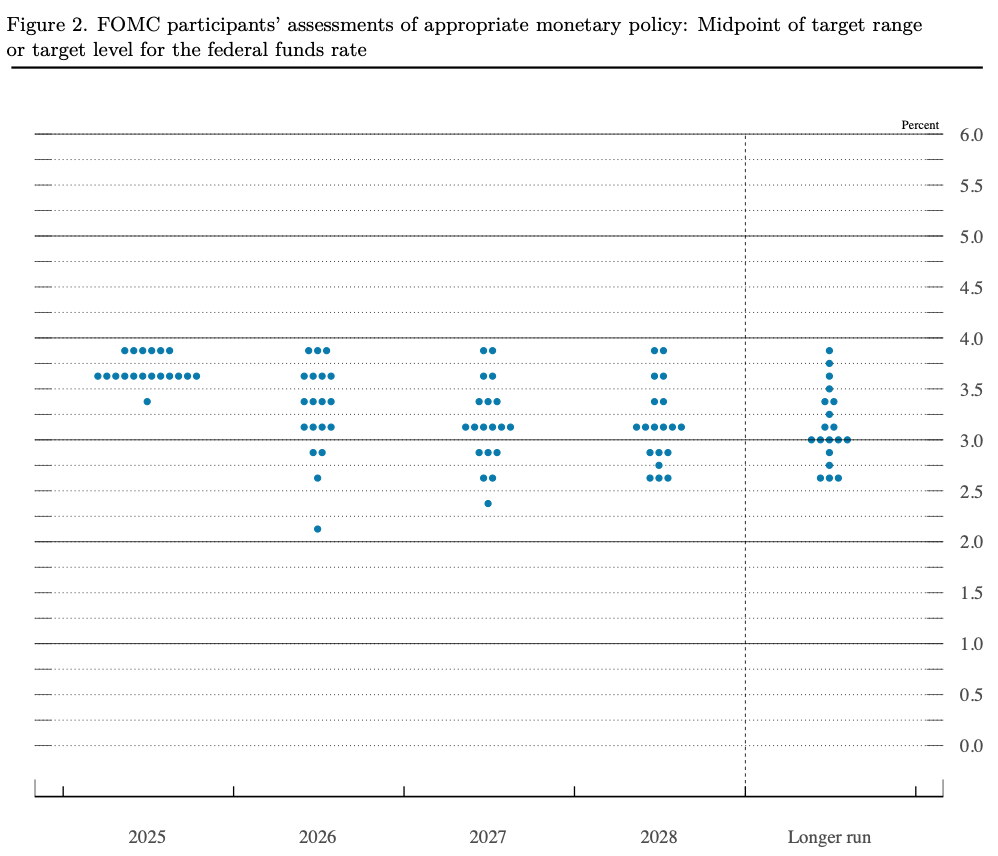

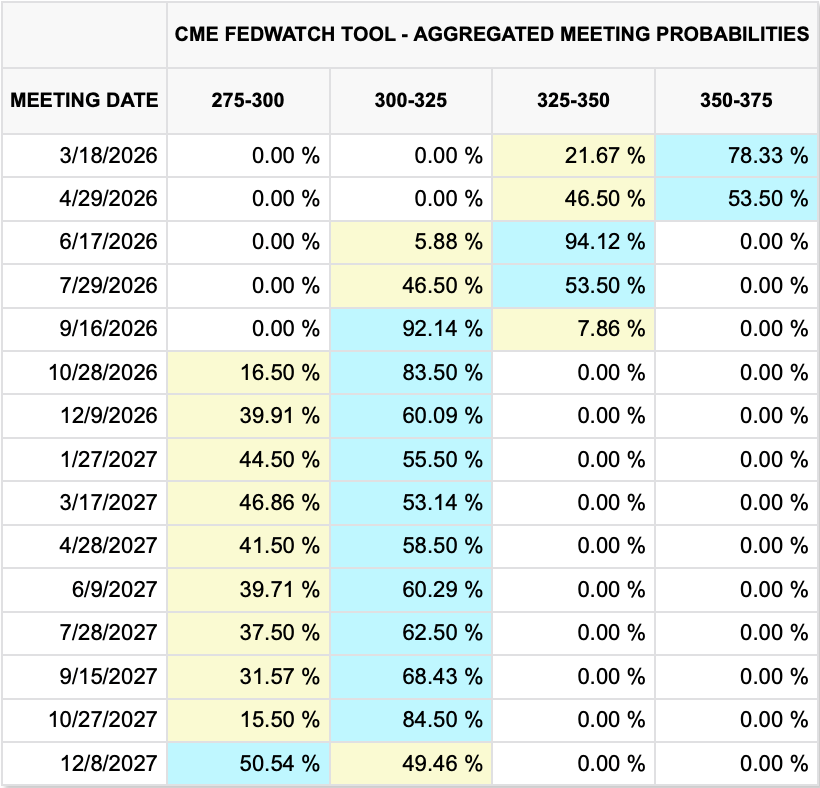

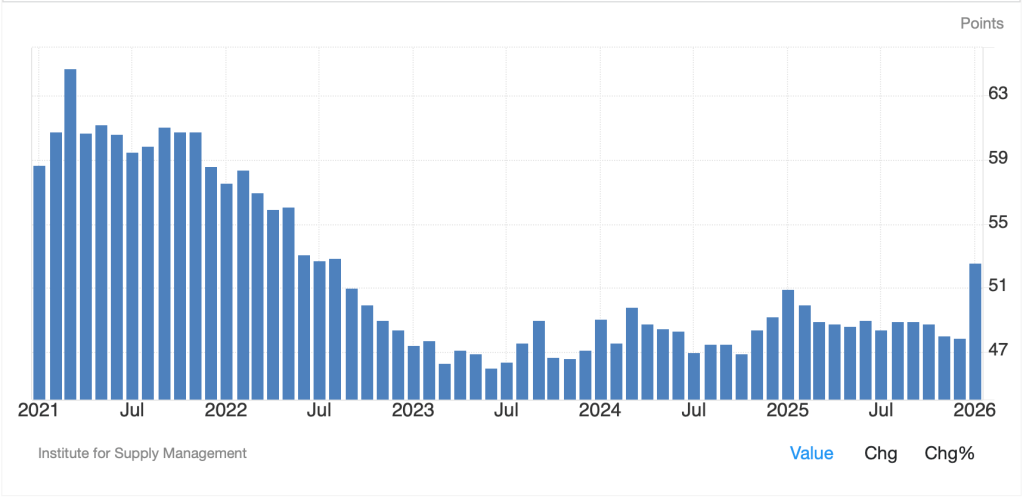

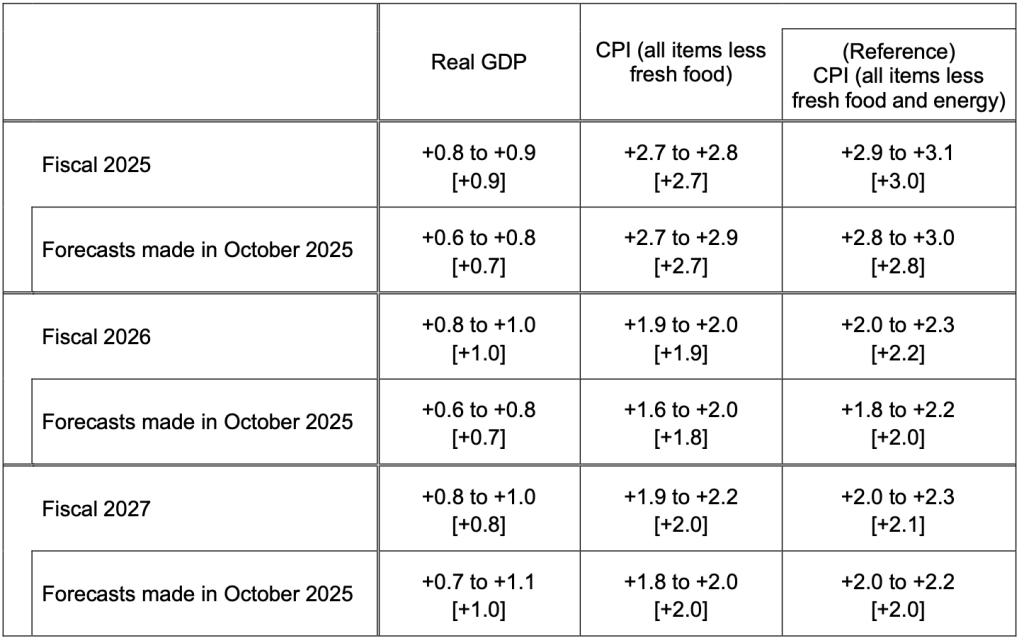

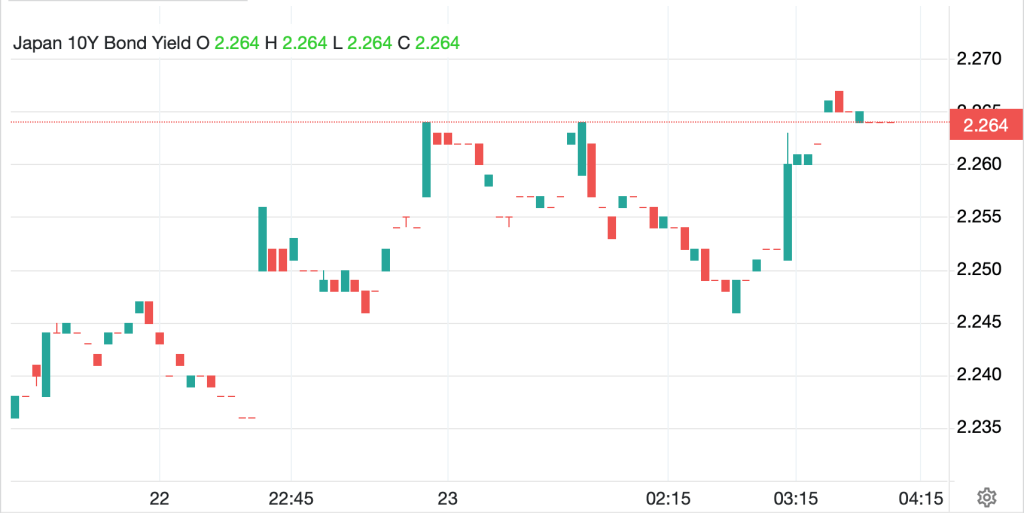

Let’s start with this morning’s CPI data as in some ways, I feel like that is a key part of the overall market discussion regarding yesterday’s dramatic declines. Expectations are for both Core and Headline prints of 0.3% M/M and 2.5% Y/Y. If we feed those numbers into the current narrative, the implication might be that the Fed is continuing to see a slowdown here and it would open the door to further rate cuts. Remember, despite the comments of two Fed speakers earlier this week, Logan and Hammack, the most recent information we have is that the neutral rate is believed to be 3.0%, a full 75bps lower than the current Fed funds rate. Interestingly, if we look at the Fed funds futures market, it shows that even after yesterday’s abysmal Existing Home Sales data (-8.4%), the probability of 3 cuts doesn’t hit 50% until the end of 2027!

Source: cmegroup.com

Remember, too, that the payroll report was strong on Wednesday, but that major annual revisions took much of the shine off that. And of course, we cannot forget that since everything is political these days, certain FOMC members who dislike the President may be against rate cuts simply because the President wants them. The point here is that the appearance of pretty solid economic activity combined with gradually decreasing inflation could argue for rate cuts but could also argue to leave things as they are since they seem to be working. And let’s face it, the Fed doesn’t really know anyway, nor do any of us.

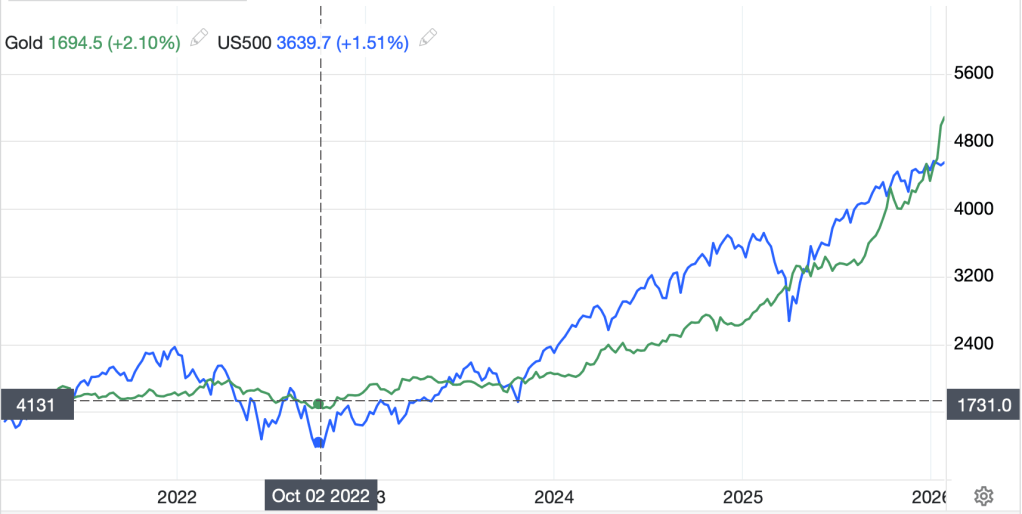

Which takes us to the broader narrative about what is driving stock market activity and why we saw such dramatic declines in the US yesterday, and pretty much everywhere else overnight. It appears the proximate cause is the idea that recent AI announcements have indicated that there are entire service industries that may be destroyed because AI will serve as an effective replacement for their customers. We have seen it for law firms, accountants and consultants and now logistics and software companies are under the gun.

Adding to the narrative is Elon Musk, who continuously claims that AI and robots will replace virtually all human labor and create enormous wealth for us all while driving prices ever lower. The flip side of that claim is that throughout history, every major technological advance, while initially destroying jobs in the areas it was used, resulted in more, and better paying, jobs to help advance the overall economic situation. Of course, historically, these changes took at least a generation, if not several to play out, while things appear to be happening a bit faster this time.

I have not done a deep dive on AI so take this for what it’s worth. I use Grok as it is convenient for me given I have X open on my computer all the time. I use it for quick research as it responds to my poorly worded questions with the information I seek and, happily, cites its sources. But I am looking for data questions (e.g. the GDP of China or the size of European holdings of Treasuries) and I have never even considered using it to write my poetry. Is it ready to make intuitive leaps in thought? Maybe, but that seems a stretch. As with all computers, its advantage over the human brain is its ability to ‘brute force’ a solution by making so many calculations in such a short time that no human can match. However, my take is breakthroughs have come from intuitive leaps from one topic to another, not from simply doing more math on the same topic. And it is not clear to me that AI programs, as they currently exist, are intuitive.

Of course, for our purposes, it doesn’t really matter right now if AI is that capable or not, it only matters if investors and traders believe that to be the case and invest accordingly. That was yesterday’s story, as well as well as the story at the beginning of last week, at least based on the way the NASDAQ traded as per the below chart.

Source: tradingeconomics.com

We had six different significant drawdowns within a given hour since the end of January, and virtually all were described as a consequence of some industry sector being decimated by AI. The thing is, valuations are pretty high in the tech sector (the area most likely to be hit) and it may simply be that investors have decided to sell the rich stuff and buy cheap stuff instead, like defensives and materials companies. Just a thought. But be prepared for a lot more of this narrative about AI eating some other company’s/industry’s lunch as we go forward.

Ok, let’s look at the overnight now. First, remember, China is going on holiday all next week, and we will see much less activity from Asia accordingly. But last night, Asia basically followed the US lower with Japan (-1.2%), HK (-1.7%), China (-1.25%) and Australia (-1.4%) headlining. India (-1.25%) and Singapore (-1.6%) also suffered and you are hard pressed to find any markets that rose there. As this was very tech focused, it should be no surprise. (PS India is also suffering on AI as much of the business that had been outsourced to India could well be replaced by AI.)

In Europe, too, red is today’s color, and not simply because they lean more communist every day. While tech is not a major part of the markets there, watching Italy (-1.5%), Spain (-1.0%), Norway (-1.1%) and Greece (-2.1%) all slide sharply tells the story, I think. As it happens, France (-0.35%) and Germany (-0.1%) are the continental leaders and the UK (+0.1%) is the only market of note showing gains at all. As to US futures, ahead of the data at this hour (7:30) they are softer by -0.2% across the board.

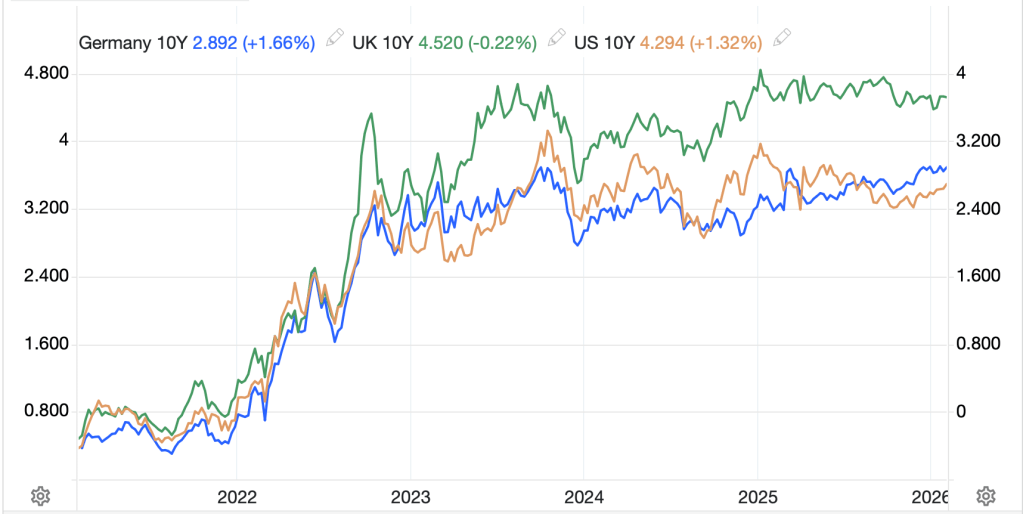

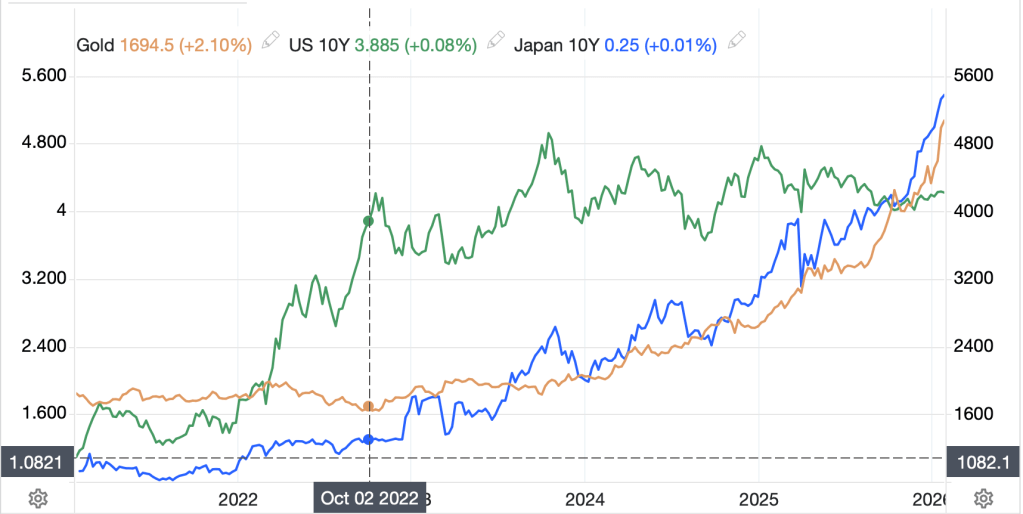

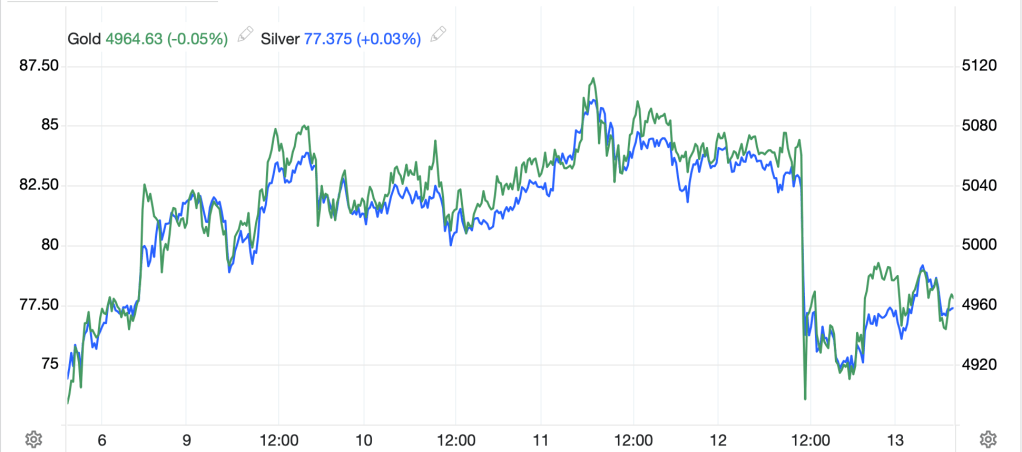

In the bond market, yesterday saw Treasury yields slip -4bps after the Housing data and this morning, they have recouped just 1bp. European sovereign yields are all lower by between -1bp and -2bps as data releases continue to show a ‘muddle-through’ economy rather than one either growing strongly or falling sharply. We did hear from ECB member Kazaks, telling us that the euro’s strength over the past year could have a negative impact on the economy there, implying the ECB may need to ease further. Meanwhile, JGB yields (-2bps) continue to demonstrate virtually no concern about PM Takaichi’s plans for unfunded fiscal expansion.

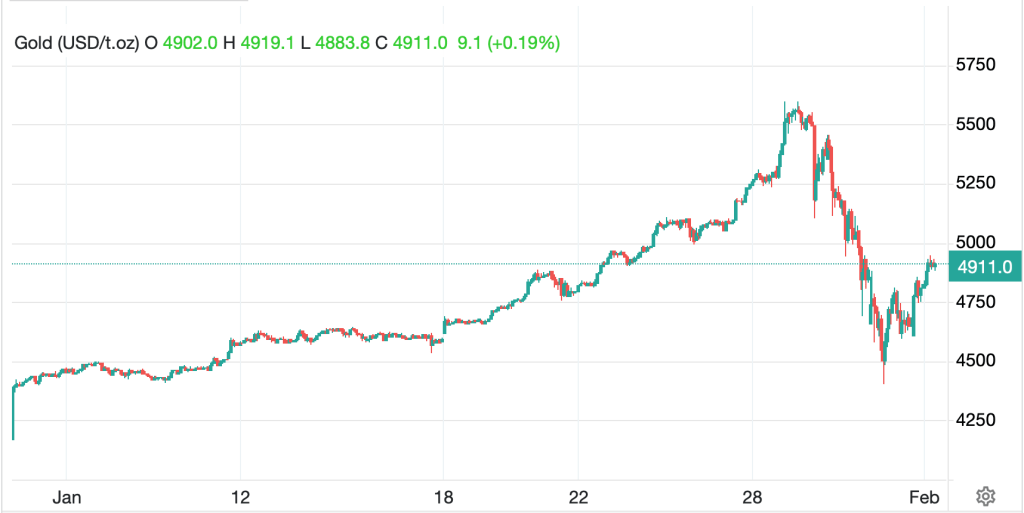

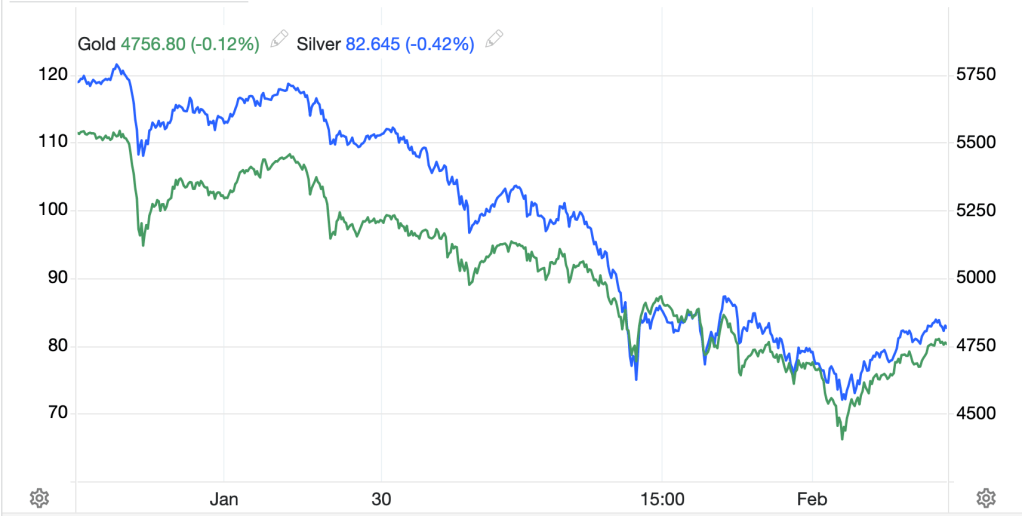

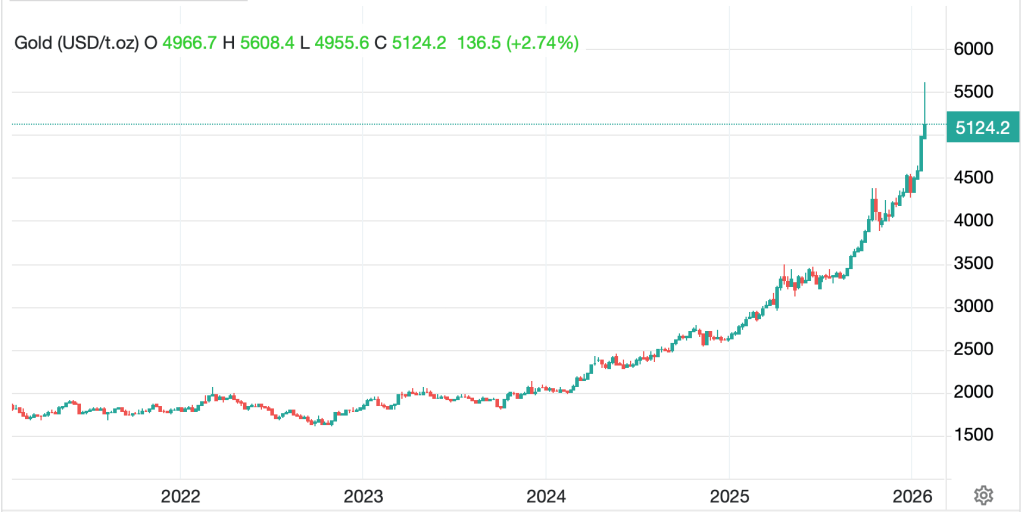

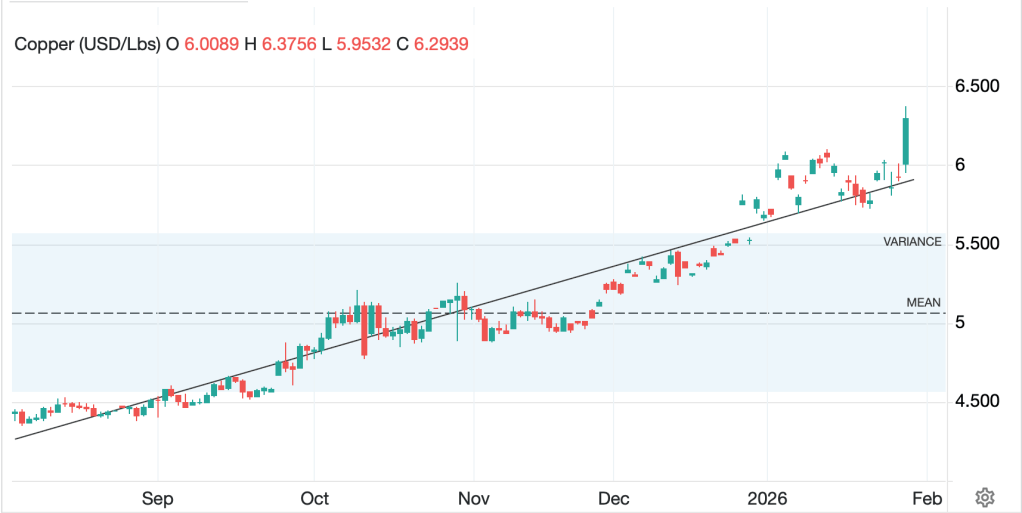

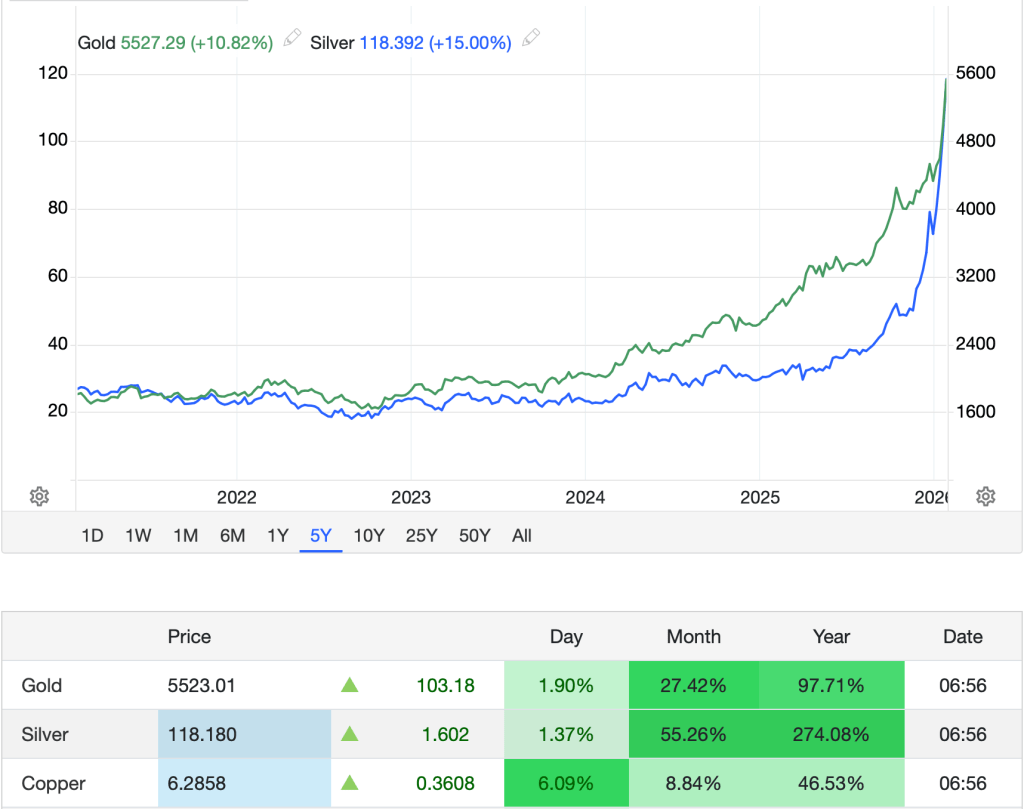

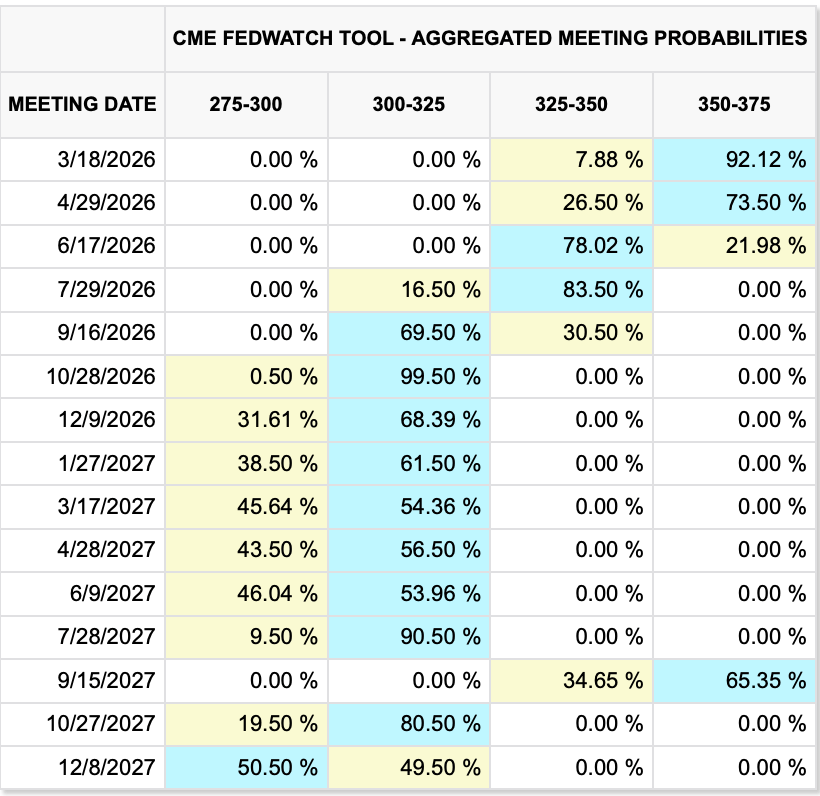

Metals markets were the other noteworthy place yesterday with some very dramatic declines happening simultaneously in both gold and silver just after 11:00am. (see below) My friend JJ who writes Market Vibes, explained last evening that the timing was impeccable as London had closed and the US is the least liquid metals market around, so if a large speculator was seeking to drive prices lower, that was when to do it. And somebody did!

Source: tradingeconomics.com

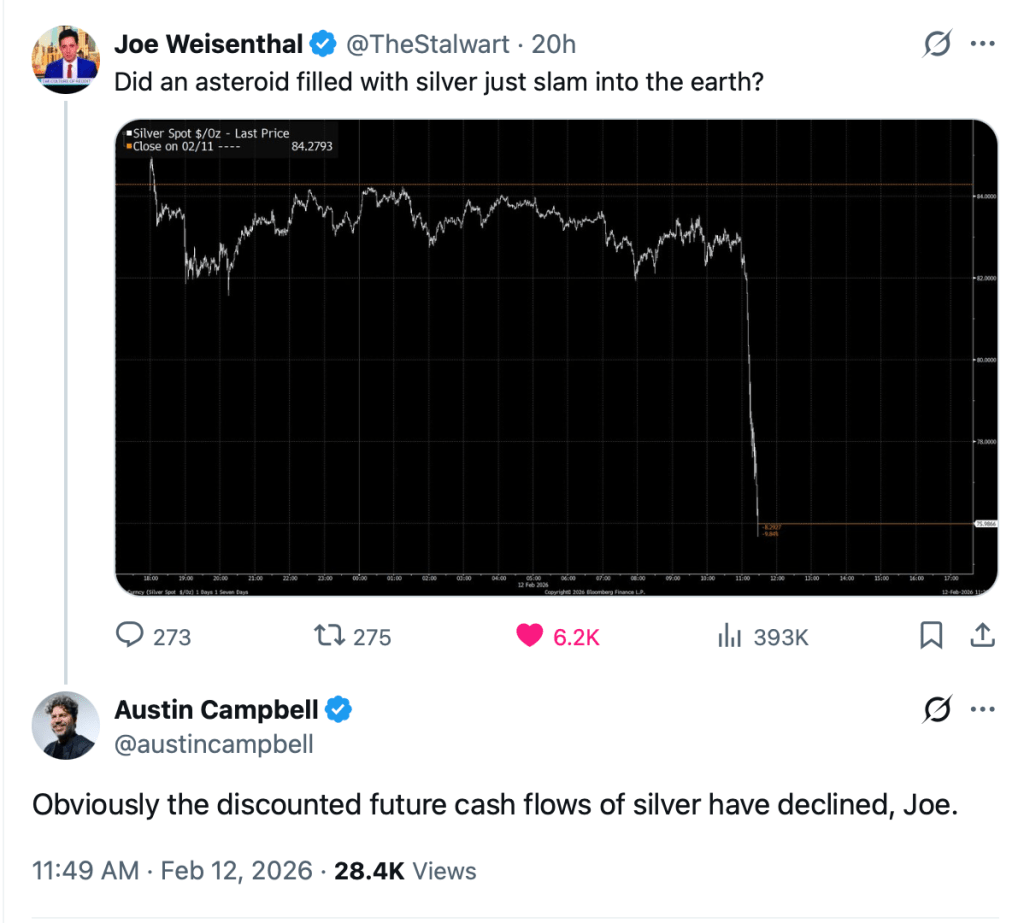

But that was then, and this is now. As you can see from the chart, the market is already rebounding with gold (+1.0%) and silver (+3.2%) simply demonstrating that they remain incredibly volatile. In truth, this was the best take I saw on the subject yesterday.

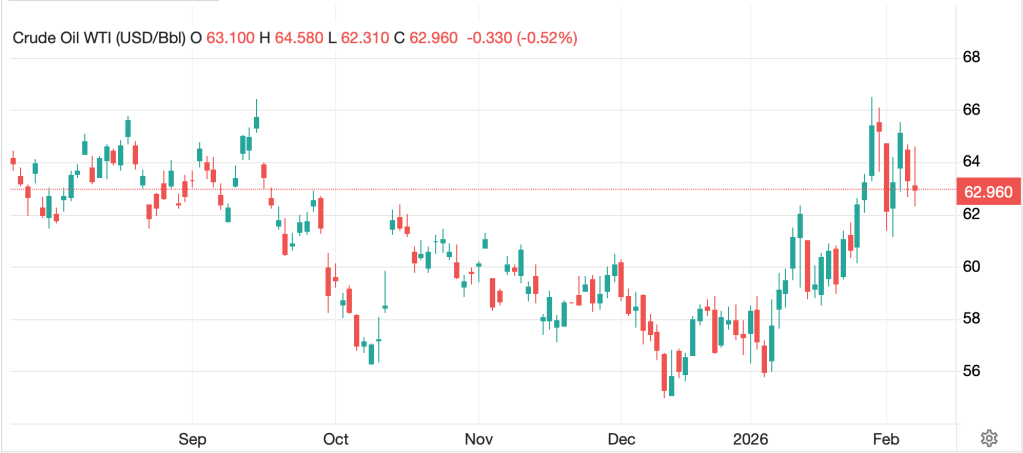

Turning to oil, President Trump indicated that talks with Iran may go on for weeks, so it is unlikely that things will combust there for a while. At the same time, the IEA continues to try to convince everyone that peak oil is here and there is a huge glut, but net, Texas Tea slipped -2.8% yesterday and is lower by another -0.35% this morning.

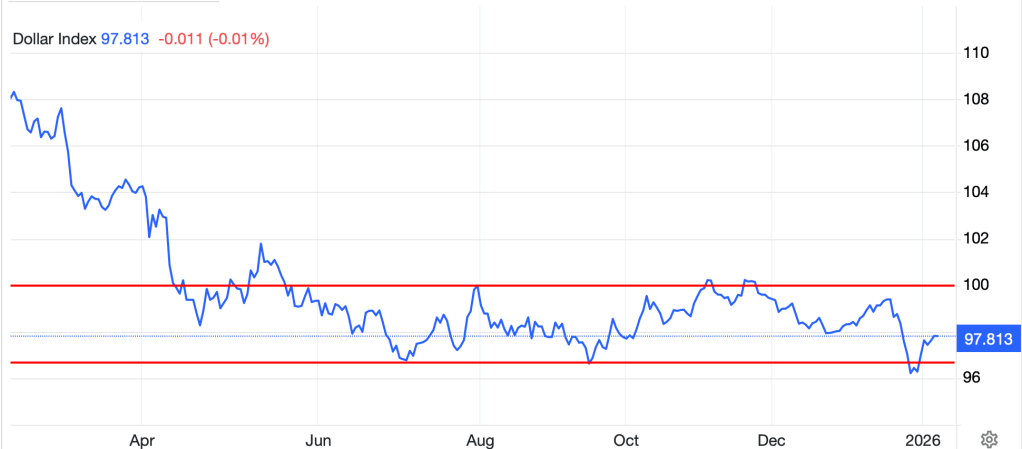

Finally, the dollar…well nothing has changed. the DXY (+0.1%) is clinging to 97 with no impetus to move in either direction. JPY (-0.4%) may be softer this morning but is far enough away from 160, the perceived intervention level, that nobody cares. AUD (-0.6%) slipped on the weak commodities pricing, although remains near its highest levels in three years as the RBA turned hawkish last week. We are also seeing weakness in the EMG bloc (KRW -0.4%, ZAR -0.5%, CLP -0.6%) with yesterday’s tech and metals sell-offs the proximate drivers. The narrative remains that the dollar is set to collapse, but I still don’t see it. Maybe I’m just blind. I cannot get past the economic growth outperformance and inward investment plans, as well as the need for dollars to continue the global USD debt flywheel as the key demand points.

And that’s really it. Volatility is with us and likely to stay for a while. This is a global regime change with respect to economic statecraft rather than the previous rules-based order, and frankly, nobody really knows how it’s going to ultimately play out. This is why gold remains in demand, because history has shown it has maintained its value on a purchasing power basis for millennia, whatever the terms of the relevant currency may be. But in the fiat world, I’m waiting for someone to make a better argument for something other than the dollar over time.

Good luck and good weekend

Adf