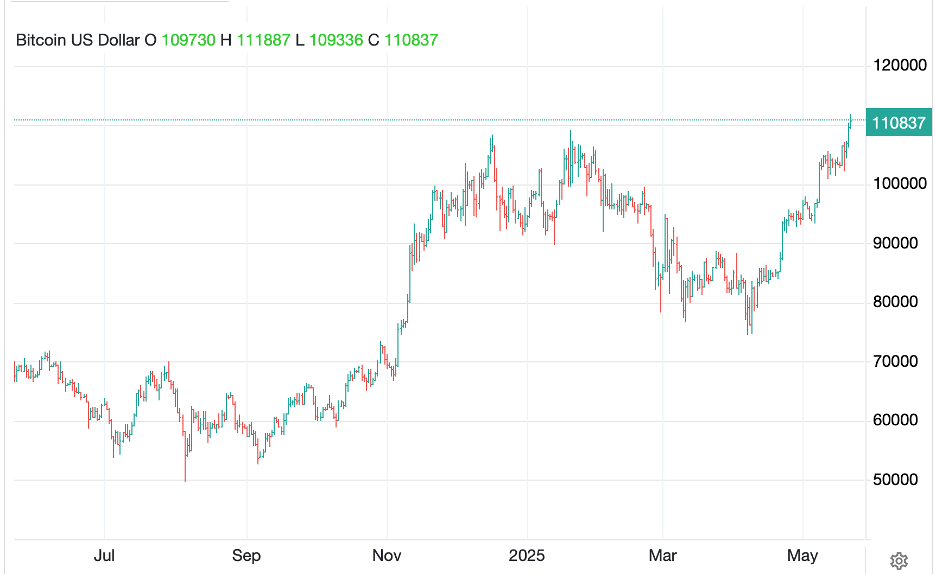

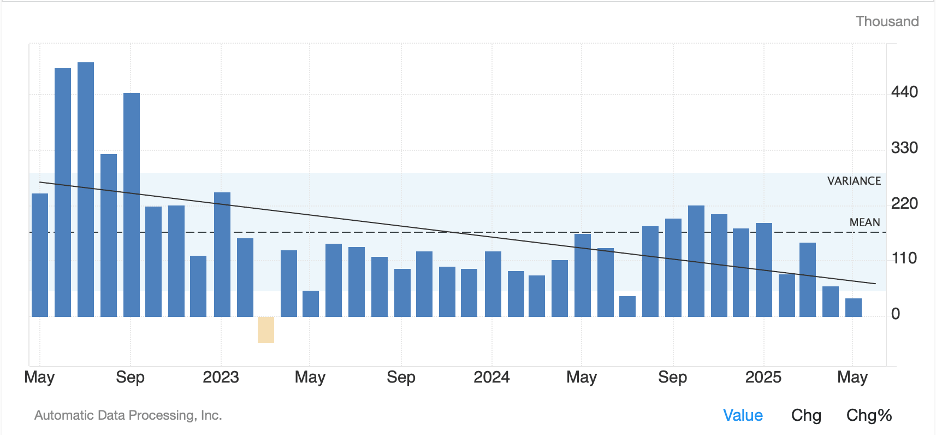

The ADP Labor report

On Wednesday, came up a bit short

Investors decided

That they would be guided

By this and bought bonds like a sport

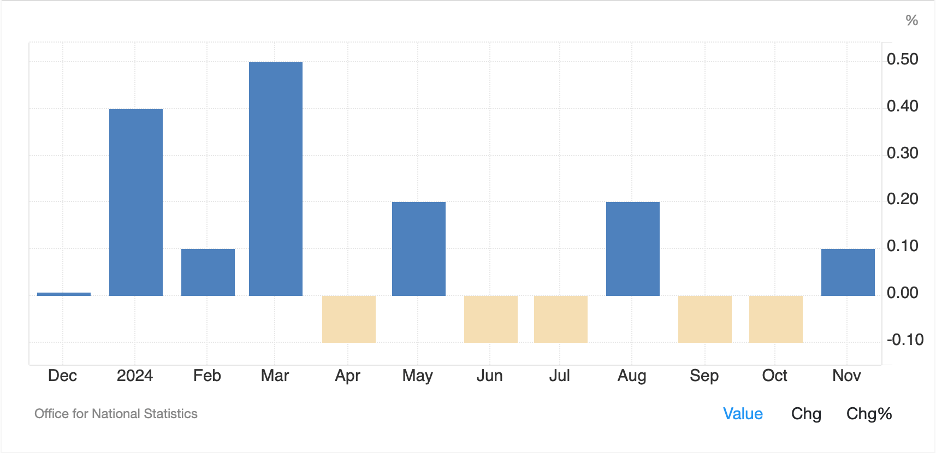

As well, there’s a story today

The BLS has gone astray

It seems that their data

Might have the wrong weight-a

So, CPI’s not what they say

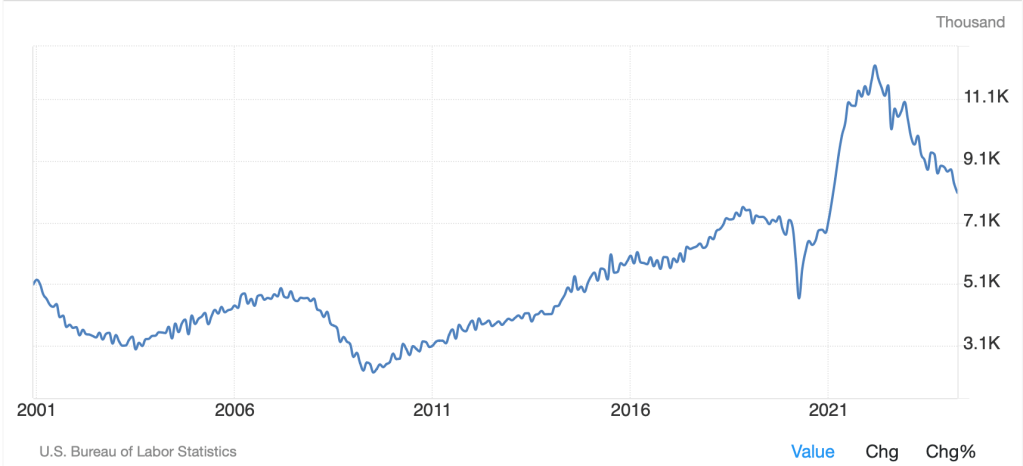

It has been another very dull session in most markets although yesterday did see a strong bond market rally after the ADP Employment Report was released much lower than expected at just 37K jobs created. Certainly, the trend has been lower for the past three years as you can see in the below chart from tradingeconomics.com, so I guess we cannot be that surprised.

You will also not be surprised that this data brought out the recessionistas as they jumped all over the release to make their case that recession was just around the corner, and quite possibly stagflation. Adding to their case was the ISM Services data which also disappointed at 49.9 and has also been trending lower for the past three years. As well, they were almost gleeful in their description of the Prices Paid sub index rising to 68.7, its highest print since November 2022. Alas, while Pries Paid have been rising for the past year or so, a look at the trendline shows they are continuing to retreat from the highs seen during the Bidenflation of 2022.

Source: tradingeconomics.com

In the end, although this data was unquestionably disappointing, it feels a bit too early, at least to me, to declare the recession has arrived. But not too early for the bond market where 10-year yields tumbled 11bps on the day and almost all the damage was done in the first hour after the ADP release although the ISM helped things along as well.

Source: tradingeconomics.com

Perhaps we are going into a recession, or even already in one, but overall, the data so far are just showing the beginnings of that. I imagine opinions will be strengthened one way or another tomorrow when the NFP report is released, but for now, the recessionistas appear to have the upper hand, at least in the bond market.

The other story that is getting a response, at least amongst the Twitterati (X-eratti?) is the WSJ article about how the BLS, due to President Trump’s hiring freeze, is suddenly calling into question the accuracy of their statistical releases, notably the CPI report due next week. I will let my friend, The Inflation Guy™, Mike Ashton, explain why this is a nothing burger. [emphasis added]

“WSJ story about how staff shortages at BLS are affecting how many estimates the staff has to make instead of collecting actual data. It is very hard to make these errors accumulate to as much as 1-2bps on the monthly number.

UNLESS: there is bias in the estimating, or there are very large categories affected, or there are HUGE errors in some categories. Lots of random errors increases the overall error but is unlikely to affect the mean. And be honest. Do you have any idea what the MSE (mean standard error) of the CPI is?

People really should care about the error bars but even most economists almost never do. Unless it’s an opportunity to complain about budget cuts to economists, which is what this is. Nothing to see here.”

Otherwise, folks, another day in paradise with nothing else new, at least on the market front. At some point, domestic politics, or geopolitics or war or something else is going to catch the fancy of the algos and change trading, but right now, that does not appear to be the case. Perhaps Friday’s NFP data will be the catalyst to start a serious change in attitudes but I’m not holding my breath.

In the meantime, let’s survey market activity. Yesterday’s US session was quite dull with limited movement and low volumes. Asia saw a mixed picture with the Nikkei (-0.5%) slipping, ostensibly, on concerns that a weaker US would negatively impact their export sector, tariffs be damned. Hong Kong (+1.1%) though, rallied on Chinese PMI data holding on to recent levels rather than slipping further. The rest of the region was far more positive, led by Korea (+1.5%) although the gains were more on the order of +0.5%. Europe is all green this morning, with the CAC (+0.5%) leading the way, although the DAX (+0.4%) and FTSE 100 (+0.3%) are also holding up well on the back of positive German Factory orders data and solid UK Retail Sales. Meanwhile, at this hour (7:00), US futures are ever so slightly firmer, +0.15% or so.

In the bond market this morning, after the big rally yesterday discussed above, Treasury yields this morning have edged lower by 1bp and European sovereigns have seen yields slide by between -3bps and -5bps as inflation data on the continent continues to soften encouraging the belief that the ECB, later this morning, may even consider more than the 25bp cut that is priced in.

The one true consistency lately has been gold (+0.8%) which has no shortage of demand, especially in Asia, and certainly feels like it is going to test, and break, the previous high of $3500/oz, which is now just $100 away. But this has encouraged silver (+4.0%), copper (+2.65%) and now even platinum (+3.8%) has been invited to the party. Regardless of the macroeconomic statistics, the ongoing global monetary policy of fiat debasement seems set to continue which can only help these metals. As to oil (+0.3%), it continues to sit near its recent highs with not much activity in either direction. It feels like we will need a major event/pronouncement of some sort, whether wider war in the Middle East or a change in OPEC policy to move this thing.

Finally, the dollar can best be described, again, as mixed. While the euro and pound are marginally higher, the yen is marginally weaker. In the EMG bloc, both KRW (+0.4%) and ZAR (+0.5%) are showing gains this morning, but nothing else of note is moving. And when looking at the broad DXY, unchanged is where it’s at. As with most markets right now, metals excepted, doing nothing seems the best choice.

On the data front, this morning brings the weekly Initial (exp 235K) and Continuing (1910K) Claims as well as the Trade Balance (-$94.0B) which if correct will almost certainly bring on a lot of White House crowing but is likely inconsequential with respect to the overall scheme of things. We also see Nonfarm Productivity (-0.7%) and Unit Labor Costs (+5.7%) a combination of expectations that does speak to stagflation. The ECB meeting will get some eyeballs, but unless they cut 50bps, a very low probability event based on current market pricing, it is hard to see much impact there either.

We are in a rut for now. Whatever the catalyst that is required to change views substantially, it is not obvious at this point. Bigger picture, nothing indicates any government is going to slow their spending or their money printing. There is too much debt to ever be repaid, so a slow inflationary debasement is very likely our future. I still think the dollar slides further, but it could be a few months before the current range breaks.

Good luck

Adf