Though stocks worldwide this year are higher

Investors have sought to inquire

If their dreams of riches

Might have a few glitches

And if they all sell, who’s the buyer?

Meanwhile, the key news of the day

Revolves around government pay

Will seven Dems buck

The warnings of Chuck

Or will the “resistance” hold sway?

Midnight tonight is the deadline for Congress to pass a continuing resolution to keep the government funded. Democratic leaders, Representative Hakeem Jeffries and Senator Chuck Schumer, met with President Trump yesterday but came to no agreement. The House has passed a clean CR, meaning it continues funding exactly as currently laid out, but the Senate needs 60 votes and Minority leader Schumer wants to increase spending by upwards of $1.5 trillion over the next 10 years to support the CR.

Looking at the list of Senators, I count 9 democrats in states that President Trump won in the 2024 election and who may feel it is in their best interest to consider voting for the resolution than shutting down the government although history shows elected Democrats vote the party line regardless of the consequences.

I asked Grok what happens in a shutdown and reading through what occurs in each cabinet department, it will take several weeks, I believe, before anybody really notices. The War Department and Homeland Security continue to function, so ICE agents are not going to disappear from the streets anytime soon. Too, Social Security, Medicare and Medicaid are untouched. I would argue those are the biggest issues. The FBI and prisons remain active as does the FAA and TSA. Maybe the biggest short-term issue is economic data will be delayed so there will be no NFP on Friday. Given its recently demonstrated inaccuracies, that may be a benefit, although I’m sure that’s not the case.

Of course, the most important question is, will a government shutdown cause the stock market to decline, as we all know a rising stock market is the MOST important thing ongoing! Thus far, it doesn’t appear investors are that worried, but perhaps that will change today. After all, all the major US indices rallied yesterday although as of this morning (6:25) futures are pointing lower by about -0.1%.

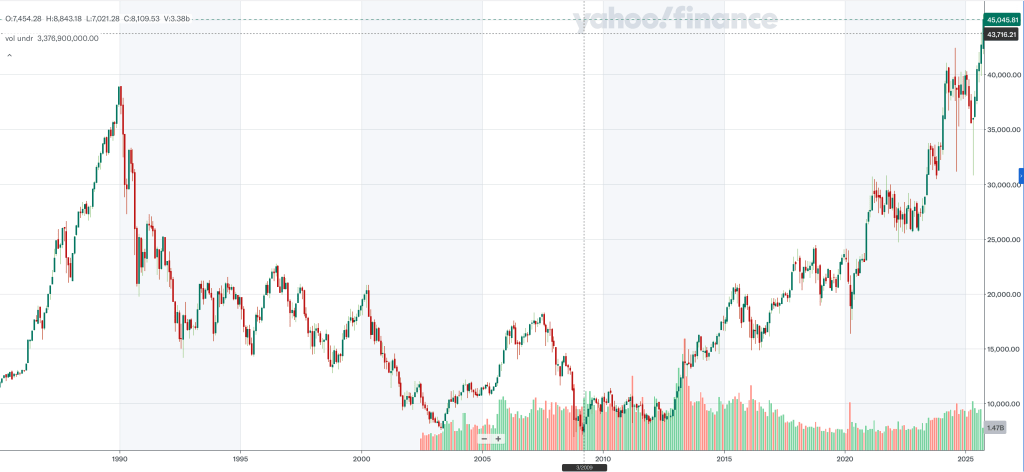

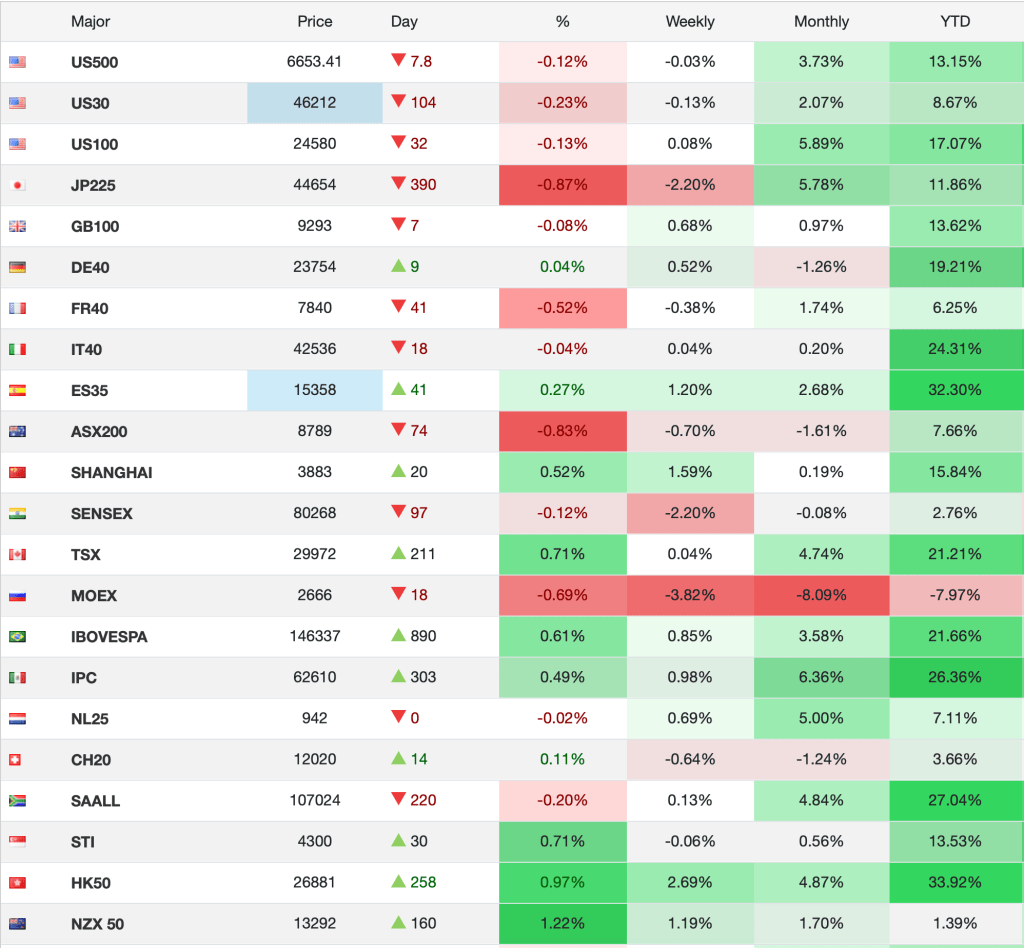

But here’s the thing about stocks, no matter how much angst some folks have had, and how many calls for recession have been made, and how much people may hate President Trump, below is a table from tradingeconomics.com showing most major stock market indices and their performance YTD at the far right. Take away Russia, which isn’t really major, and there is an awful lot of green!

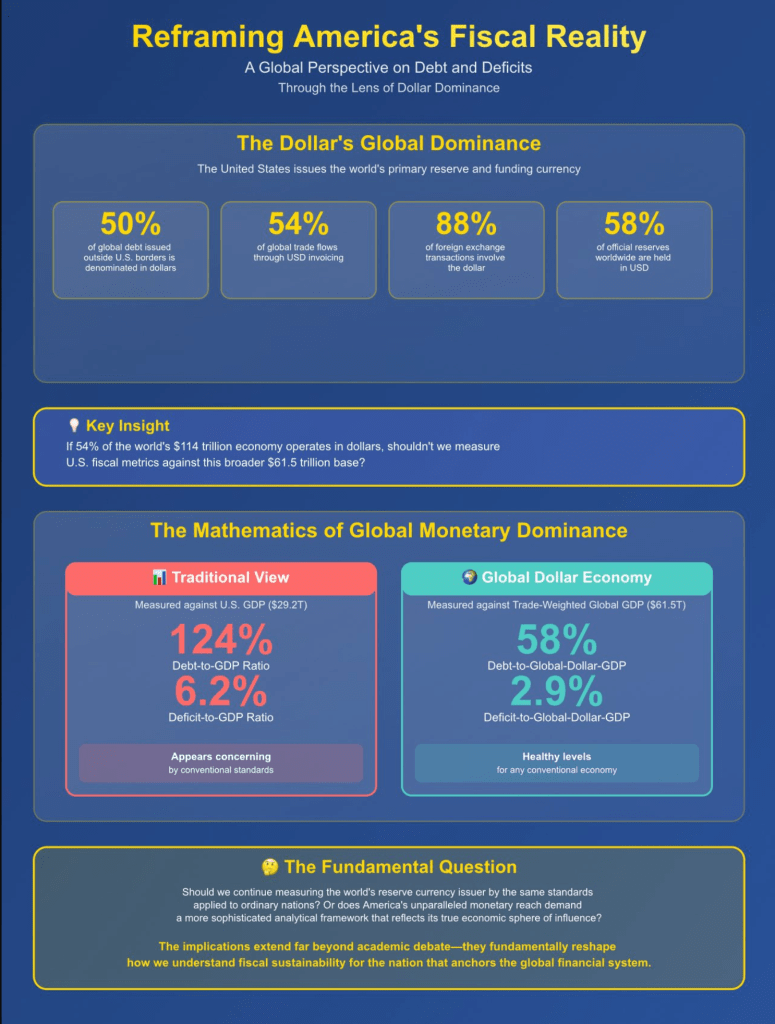

Perhaps the proper question is, why has this been the case and can it continue? Certainly, the fiscal underpinnings of almost every nation are deteriorating as debt grows rapidly alongside government spending while the prospects of repaying said debt diminishes. So, the macroeconomic backdrop in many nations is shaky, at best (France, UK, US, Germany, Australia, Japan, to name a few).

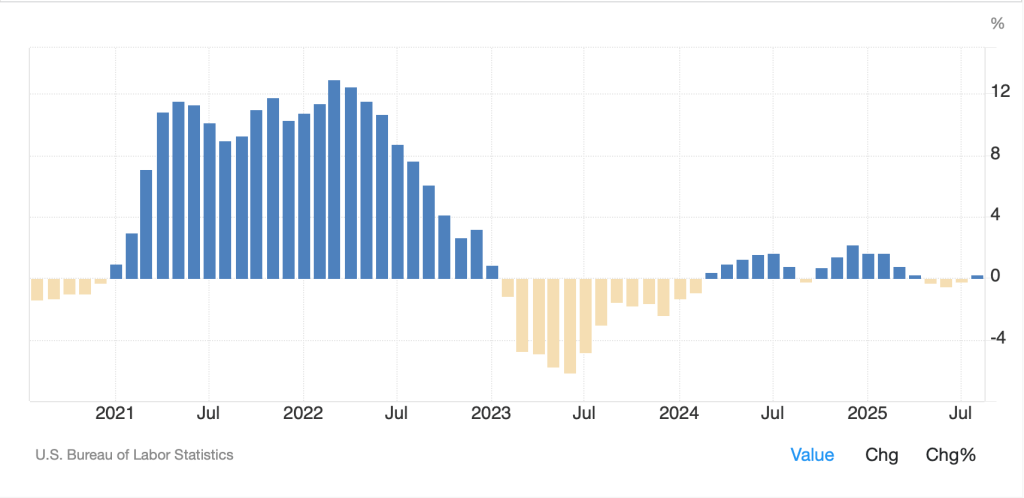

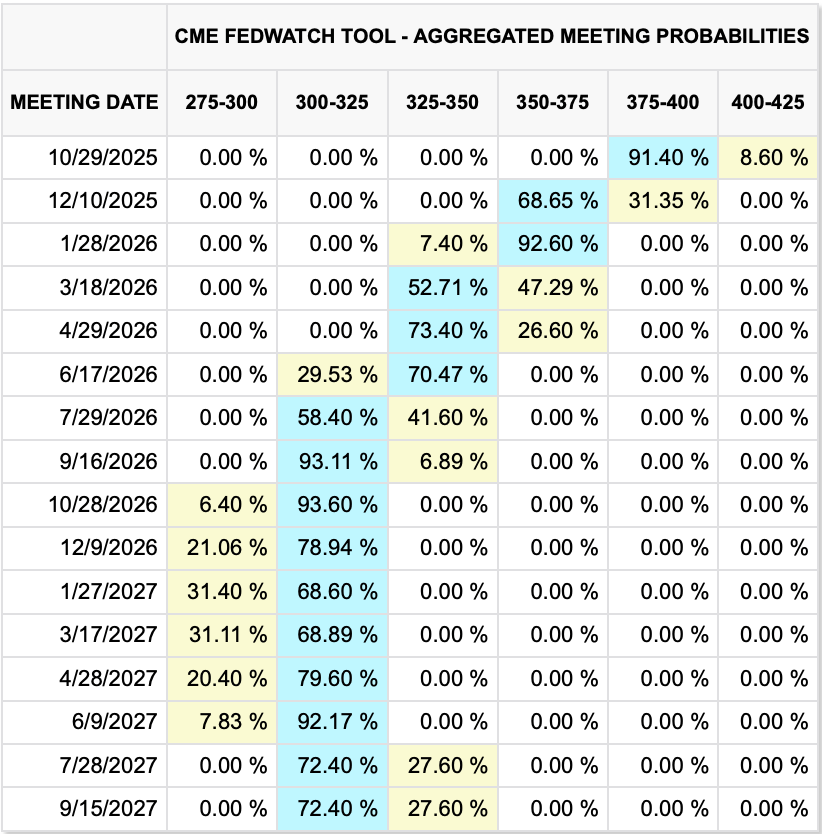

Of course, any individual company will typically reflect the prospects of that company, the very fact that markets have rallied so strongly this year continues to support the rally. Remember, there have been numerous recession calls, and even the Fed has begun to look at the employment situation as becoming a bigger issue than inflation, indicating they, too, are concerned over future economic growth prospects. Hence, the widespread expectations for further rate cuts. in fact, looking at the futures market, not only is it pricing two more cuts this year, but a further two more by September 2026, and then a long period of 3.0% Fed funds afterwards.

Thus, it appears the equity market is counting on rate cuts to support future earnings even though those rate cuts imply weaker economic activity which will undermine future earnings. Quite the balancing act! But then, I’m just an FX guy, so the intricacies of equities are clearly lost on me.

Ok, you’ve already seen the overnight equity movement with Chinese shares the largest beneficiary of PMI data showing modest growth. Combining that with the news of further stimulus yesterday and things in China look pretty good right now.

Turning to bonds, yields fell yesterday despite any noteworthy data. Perhaps it was the Fed speakers who highlighted the need to ease policy further as their concerns grow over slowing employment. At any rate, this morning, 10-year Treasury yields are unchanged at 4.14%, while a few bps above the lows seen last week, hardly demonstrating a major move higher. European sovereign yields have edged higher by 1bp this morning across the board, also not really demonstrating much concern about things. We did see some Eurozone data this morning with French inflation soft (1.2% Y/Y) while German Unemployment rose slightly and German state inflation data has generally been higher than last month. The nationwide number is released at 8:00 this morning. Meanwhile, Italian inflation was a bit softer than forecast (1.6%), so bond investors seem satisfied for now.

As has been the case for a while now, the biggest moves have come in the commodity space with oil (-0.7%) falling back to the middle of its trading range as per the below chart from tradingeconomics.com.

For whatever reason, the end of last week had oil bulls out in force, but they are an unhappy lot this morning. Apparently, President trump and Israeli PM Netanyahu have agreed a Gaza peace plan, although the Palestinians were not privy to the details. Perhaps peace there is reducing concerns in the oil market although I would have thought the Russia/Ukraine situation has a more direct impact. As to metals, after another series of new highs across the precious space yesterday, this morning we are finally seeing a bit of profit taking (Au -0.7%, Ag -1.7%, Pt -2.8%, Cu -1.0%). However, it is difficult to look at the chart and sense that this is over.

Source: tradingeconomics.com

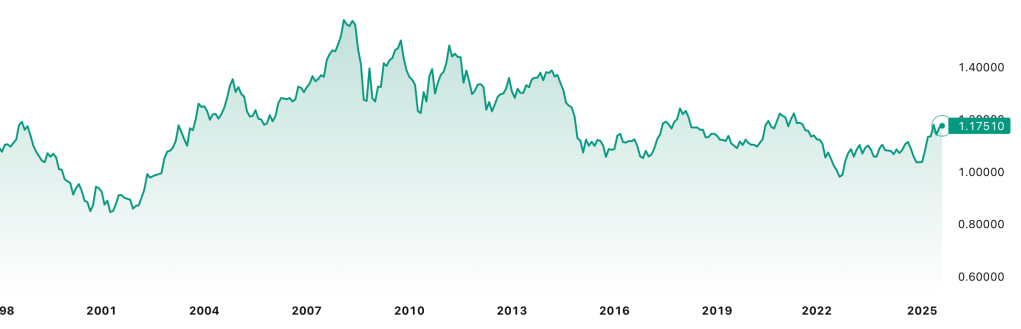

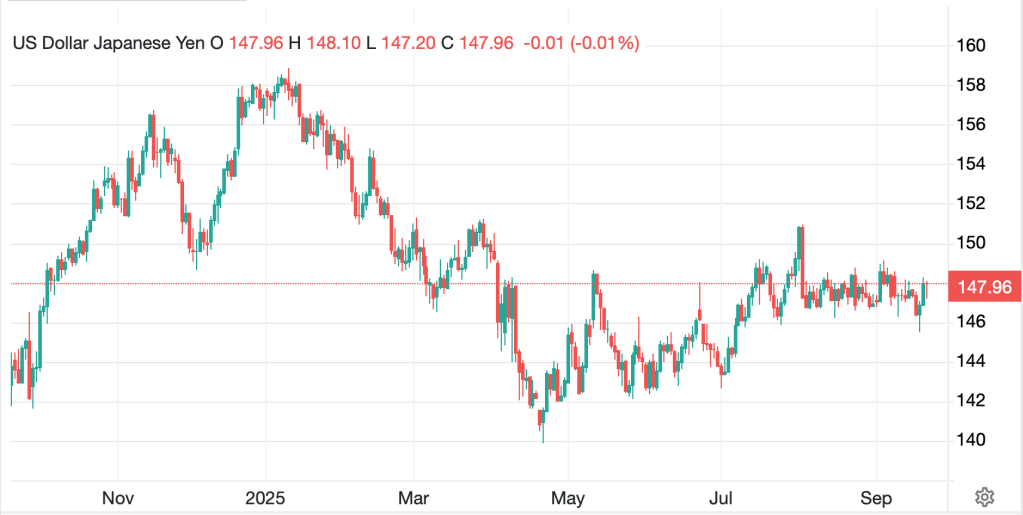

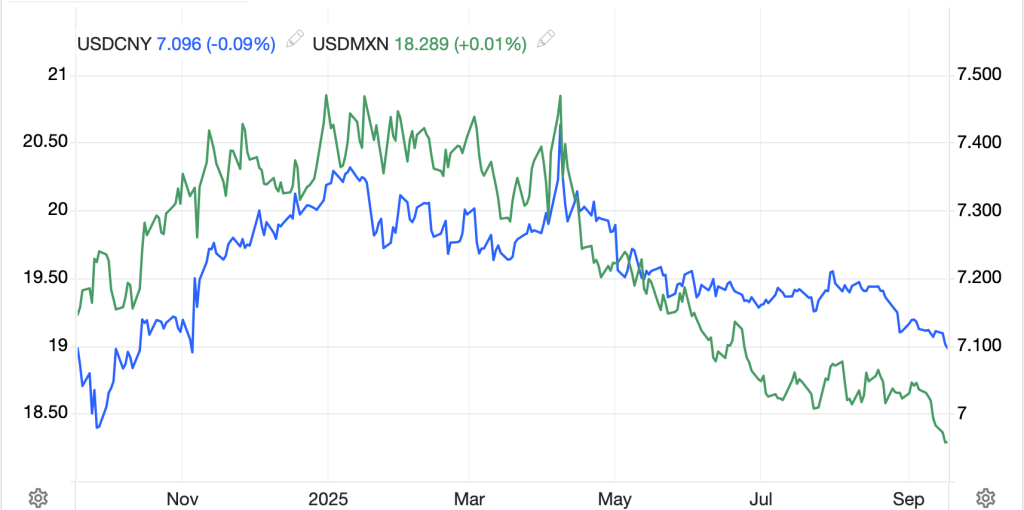

Finally, the dollar is a touch softer this morning, essentially unchanged vs. the euro and pound although the yen (+0.4%) and Aussie (+0.4%) have both managed to rally. The RBA met last night and left rates on hold, as expected, although their commentary afterwards had a hawkish tilt regarding the future of inflation which undermined equities and helped the currency. As to the yen, their ‘Minutes’ were released and indicated there was growing support for a rate hike in October, although I will believe it when I see it. But away from those two, there was virtually no movement and no news of note.

On the data front, I will lay out the alleged releases, although with the shutdown, the BLS and BEA ones will likely be delayed.

| Today | Case Shiller Home Prices | 1.6% |

| Chicago PMI | 43.0 | |

| JOLTs Job Openings | 7.2M | |

| Consumer Confidence | 96.0 | |

| Wednesday | ADP Employment | 50K |

| ISM Manufacturing | 49.0 | |

| ISM Prices Paid | 63.2 | |

| Thursday | Initial Claims | 223K |

| Continuing Claims | 1930K | |

| Factory Orders | 1.4% | |

| -ex Transport | 0.1% | |

| Friday | Nonfarm Payrolls | 50K |

| Private Payrolls | 60K | |

| Manufacturing Payrolls | -7K | |

| Unemployment Rate | 4.3% | |

| Average Hourly Earnings | 0.3% (3.7% Y/Y) | |

| Average Weekly Hours | 34.2 | |

| Participation Rate | 62.3% | |

| ISM Services | 51.7 |

Source: tradingeconomics.com

Today’s data will be released, and tomorrow’s is privately sourced, so shouldn’t be a problem, but come Thursday and Friday, that’s when things will go missing. Ironically, the biggest impact will be on options traders who frequently place trades in anticipation of a data point, and with that data point missing, those premia are likely to diminish quickly. Too, spare a moment for the algorithms who won’t have anything to trade against without data. Poor programs 🤣.

History has shown the dollar tends to decline through government shutdowns, if they last any length of time (>3 or 4 days), so if we shut down and are still that way next week, I expect we could see some weakness. But I’m sure there will be one more vote today to see if it will happen. My take is a shutdown is in the cards but for how long, I have no idea.

Good luck

Adf