Remarkably, metals are still

The story that no one can kill

The rally refuses

To stop, as gold cruises

And silver gives traders a thrill

The funny thing about financial markets is that it goes through periods where a single story dominates the narrative so completely that everything else gets viewed through the lens of that story. We have seen this happen many times with recent situations like tariffs, the Fed, Covid, Brexit, Russia, etc. Well, these days, precious metals are the story through which everything else is defined.

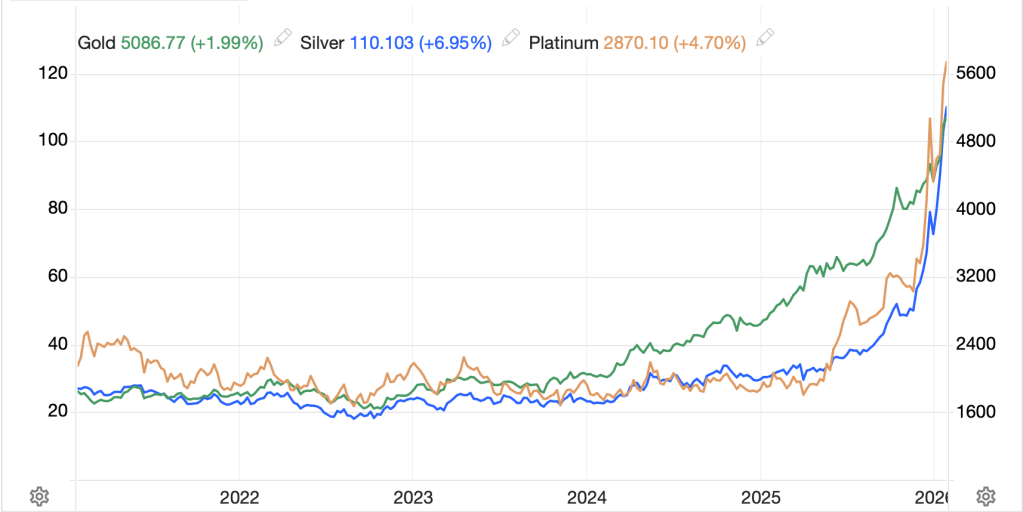

Consider, for those who are inherently bearish the dollar, the remarkable rally in precious metals serves as proof positive of the theory. For those who have been antagonistic to the equity rally, and let’s face it, there has been a huge amount of discussion about the equity bubble and overvaluation of the Mag7 stocks, it is a huge relief that precious metals have now outperformed equities on numerous timescales, whether looking over the past week, month, quarter, year or decade. You see, they will claim, metals have been the best investment.

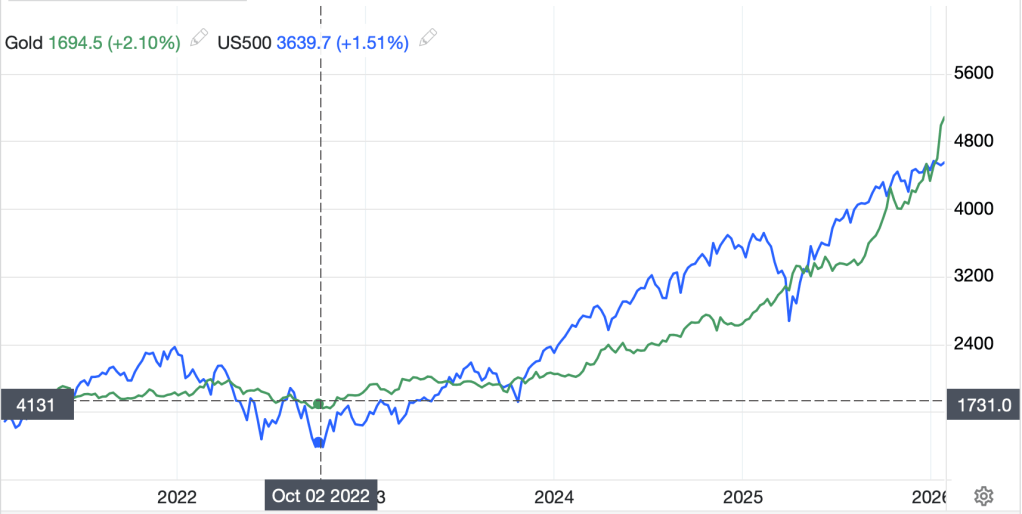

Source: tradingeconomics.com

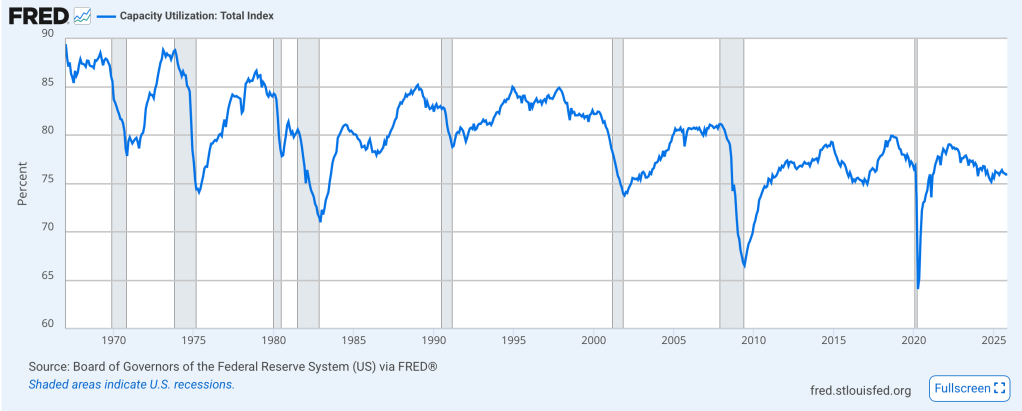

In the above chart, I have randomly selected Oct 2, 2022, as it appeared to be a local low over the past 5 years in both the S&P 500 and gold. Since then, while the S&P has gained very impressive 190%, gold is up an even more remarkable 300%.

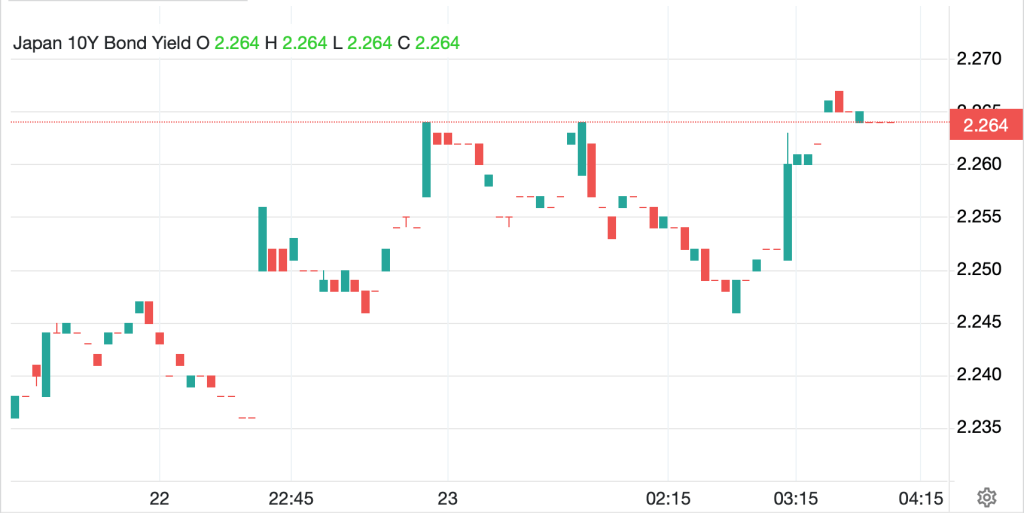

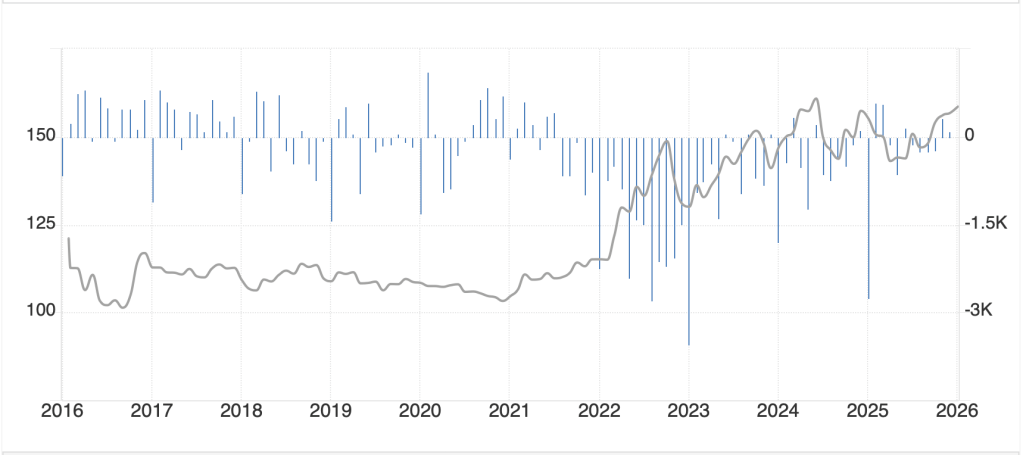

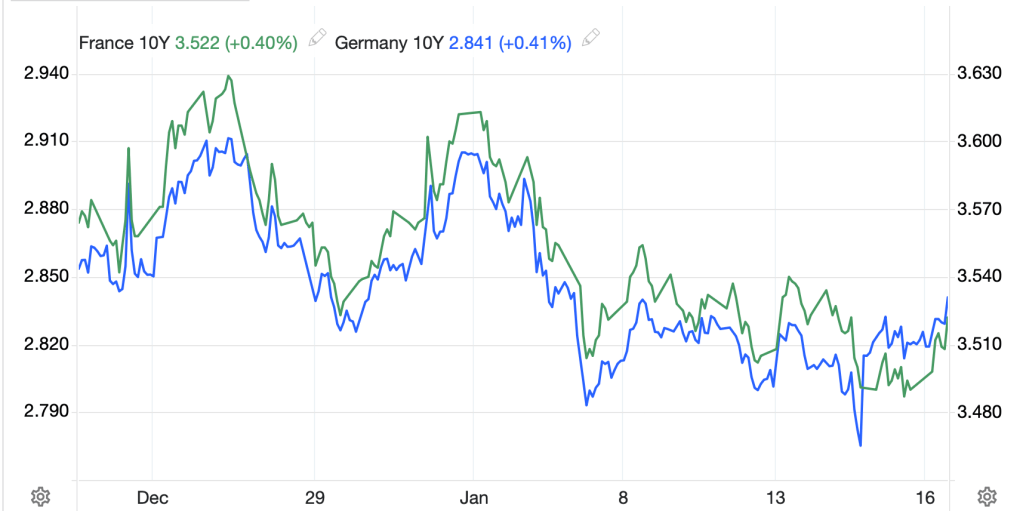

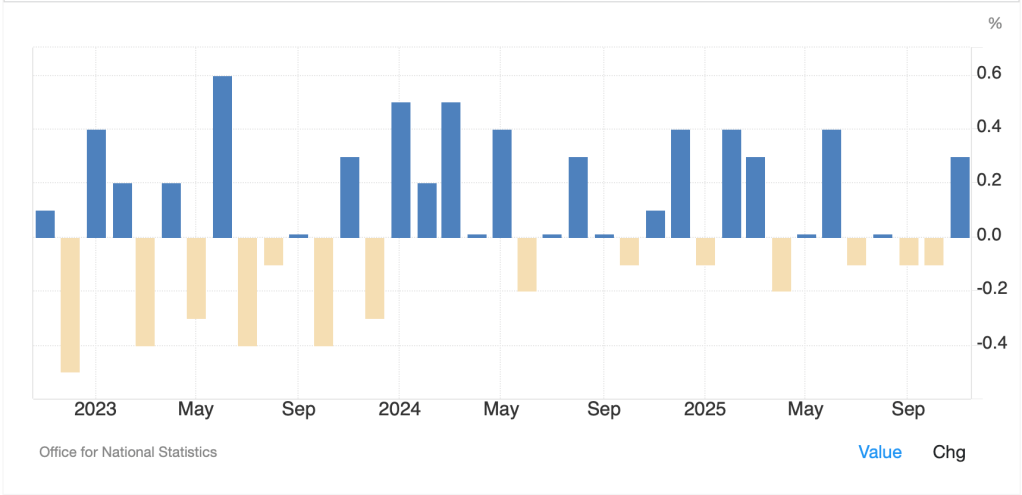

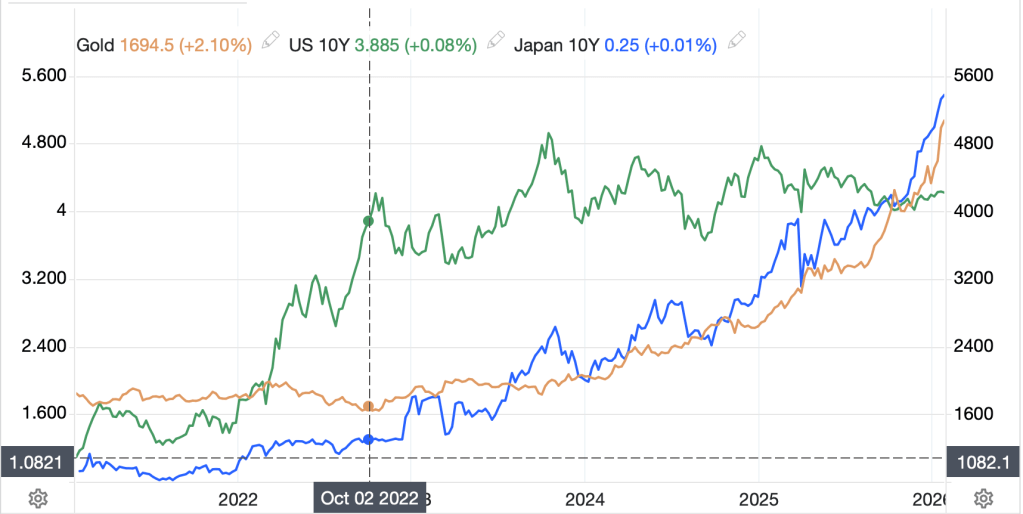

The bond story is more interesting as, usually, throughout history there has been an inverse relationship between yields and metals as higher yields foregone were an additional ‘cost’ of holding metals and traders generally sought to prevent that outcome. Yet, if we go back to that same random date, the relationship has essentially broken down. In fact, as you can see from the chart below, yields have edged modestly higher while gold has exploded. And if we turn to JGB yields, which we all know are rising sharply, they are almost following gold’s trajectory directly.

Source: tradingeconomics.com

My point is, these days you cannot read an analysis about anything, whether the markets or the global economy, without the framework entailing the price of gold and silver.

As such, the major question facing all market participants is what is driving this extraordinary performance. At this point my take is gold, and silver, have essentially become a Rorschach test for the viewers investing and political framework. So, we are going to see a lot of different explanations as to the cause of this movement.

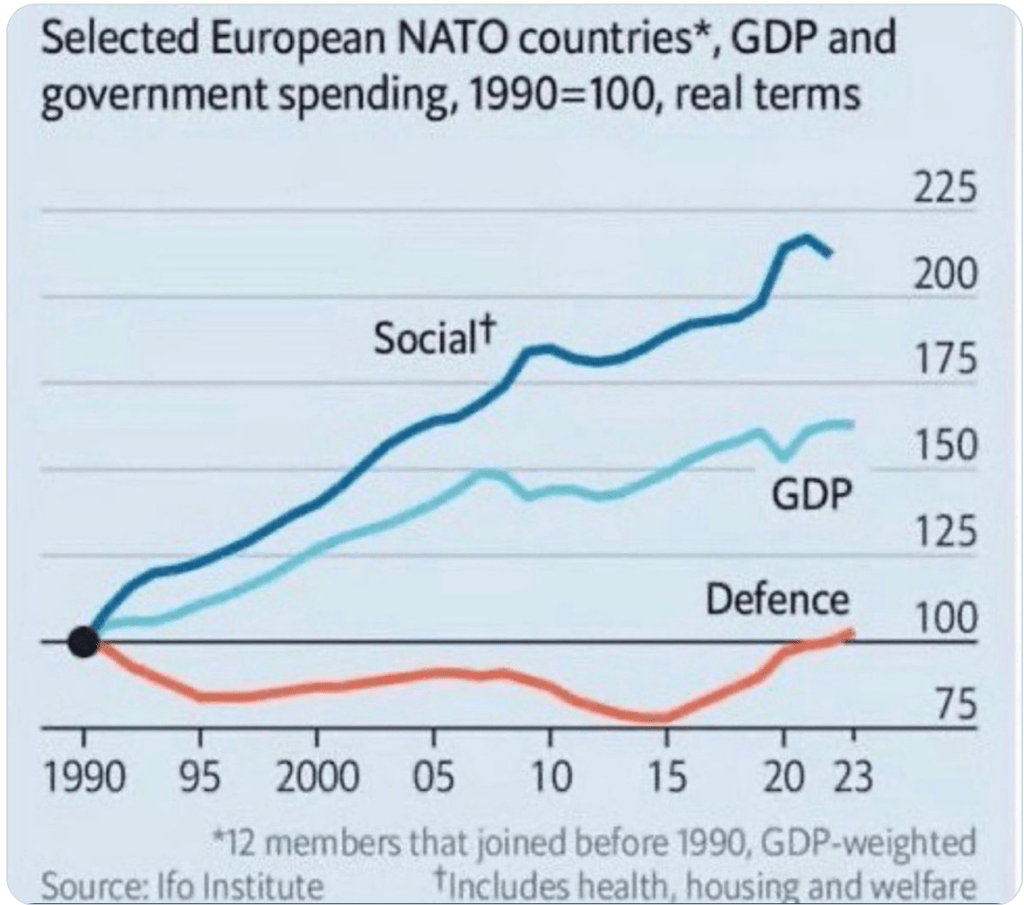

FWIW, my take, which is all that you get here, is there are a few things combining to juice this move. First, the overriding theory of fiat currency debasement continues to gain adherents, not that economists are moving from the Keynesian to Austrian school of economics, but with M2 around the world growing at 12% while global GDP grows at 3%, the fundamental of too much money chasing too few goods has even broken through the Keynesians’ armor. This leads to the natural next step that, those who are aware and are charged with maintaining the real value of their holdings, see gold as a better long-term investment given its history. Enter central banks, who were, of course, further encouraged once the US froze Russian assets after their invasion of Ukraine.

This has bled into an increasing discussion of the overall geopolitical situation, notably tensions driven by the US interdiction in Venezuela, the uprising in Iran and the ongoing stress between the US and Europe and Canada over trade. All these things have forced many to consider that traditional haven assets, notably Treasuries, may not be so haven-like after all. Yet another reason to like gold.

And when any story gains traction like this has, we then get inundated with the ‘tourists’ who flood social media with their views, especially as to whether this is a blow-off top and the move is over, or whether there is much further to run. I particularly like the below chart as an encapsulation of the market.

It is remarkable to me that the same folks who have demonstrated their expertise on Venezuelan oil production and the legality of Trump’s tariffs are now so clearly expert on the price of gold and silver, why they haven’t moved like this in the past and whether this is, or isn’t the top of the market. Thank goodness we have them all!!

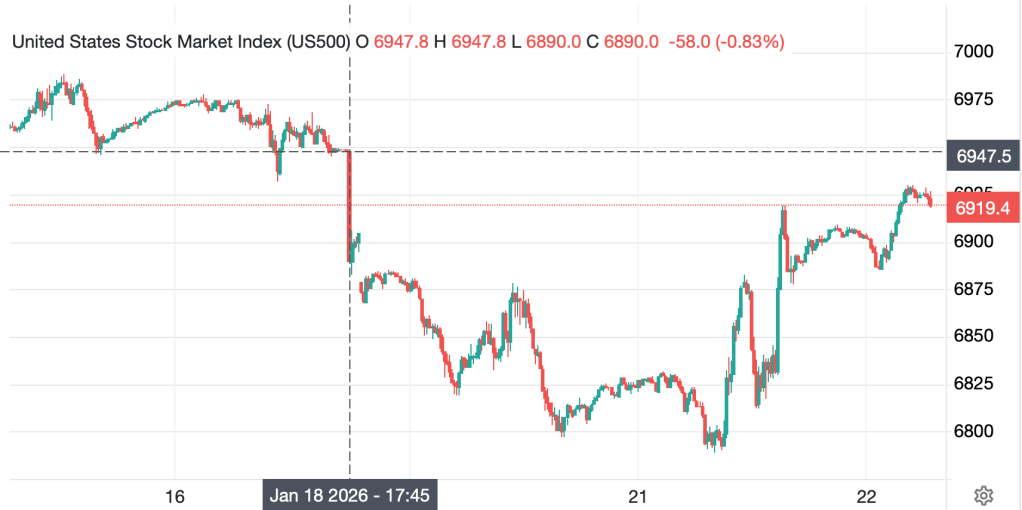

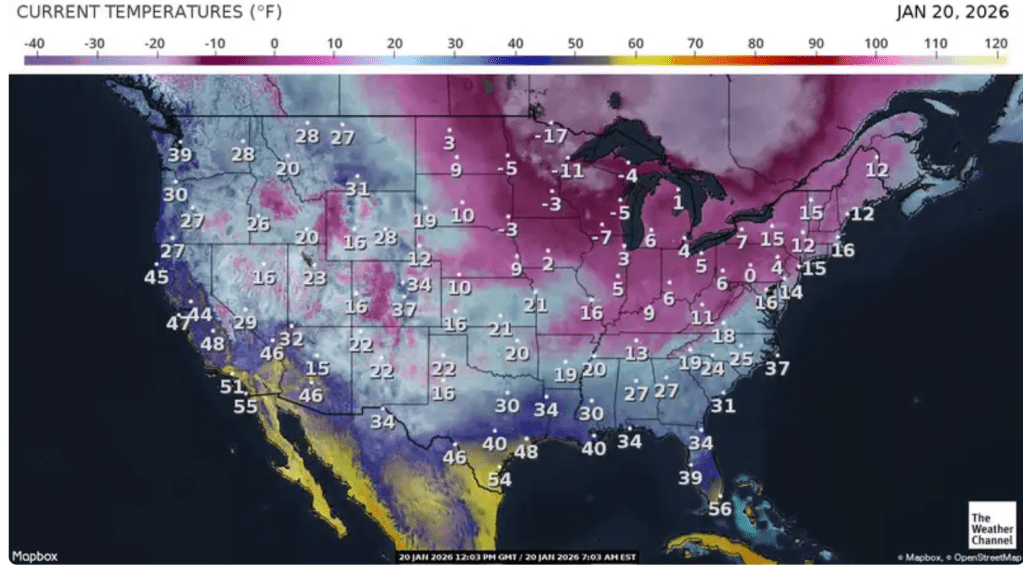

In the meantime, let’s turn to the market price action to see how things have behaved overnight. starting, sensibly, with the precious metals, despite a late day pullback from its highs yesterday, gold (+1.3%) and silver (+6.7%) show no signs of stopping yet. Personally, I remain in the camp that structural industrial shortages combined with China’s gating of exports of silver are likely to maintain a bid under the stuff for quite a while yet. The fact that the US has listed it as a strategic metal is something not widely discussed nor remembered but is quite important as a demand signal. Copper (-2.1%), however, is backing off its recent highs, although remains within spitting distance of its recent all-time highs. As to oil (-0.15%) which used to be the belle of the commodity ball, it is stuck around $60/bbl with no obvious driver in the short-term in either direction. Don’t forget NatGas (-4.8%), which is higher by 65% this week on the back of the polar conditions forecast to remain at least through the end of the week.

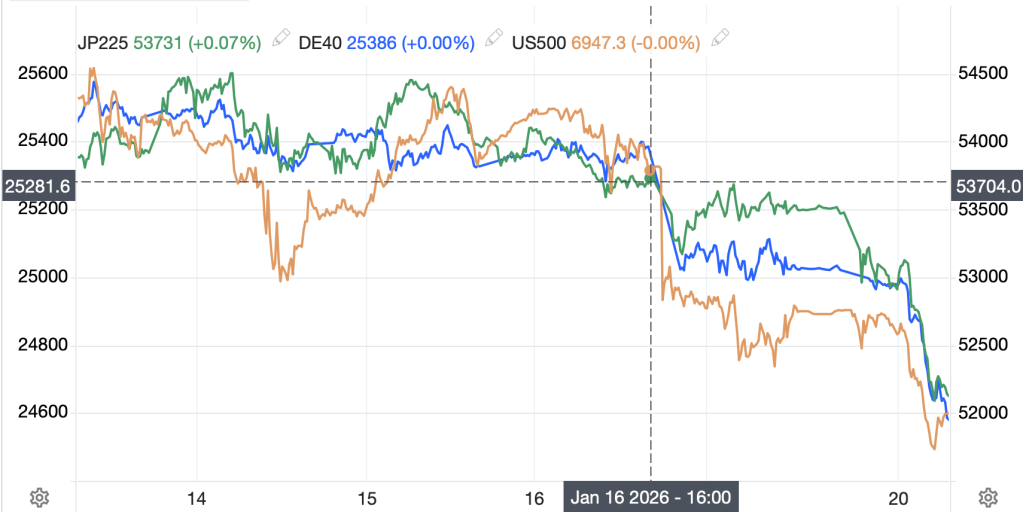

Turning to equities, yesterday’s US gains were followed by gains almost everywhere else in the world. Tokyo (+0.85%), HK (+1.35%), Australia (+0.9%), Korea (+2.7%), India (+0.4%) after they signed their FTA with Europe, and Taiwan (+0.8%) were all in fine fettle last night. Only China (0.0%) missed the boat, although there was no obvious reason for that outcome. In Europe, too, we see almost all green on the screen with only Germany (0.0%) not taking part in the fun. Otherwise, modest gains of 0.3% are the order of the day elsewhere in the UK and on the continent. As to US futures, they are also pointing higher, about 0.5% at this hour (7:35).

In the bond market, JGB yields (+5bps) are the story, as the leadup to the election and its potential outcome dominate discussion. My take is higher yields implies the market is anticipating PM Takaichi to win and improve her margin in the Diet, thus allowing more unfunded spending. But in the US and Europe, yields have edged higher by 1bp to 2bps amid lackluster trading.

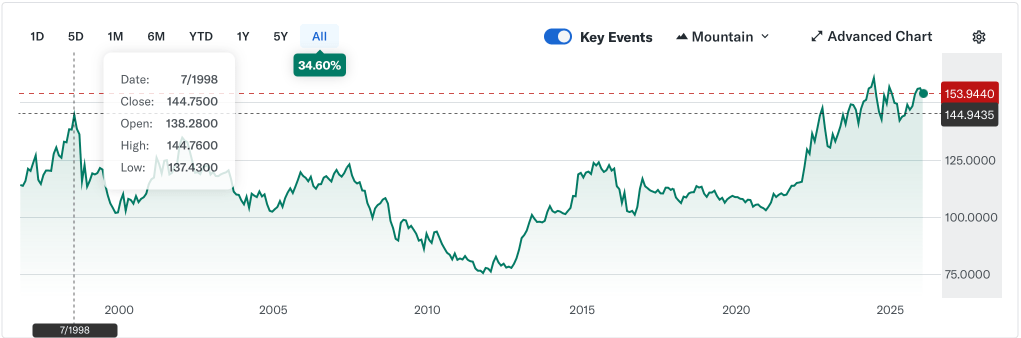

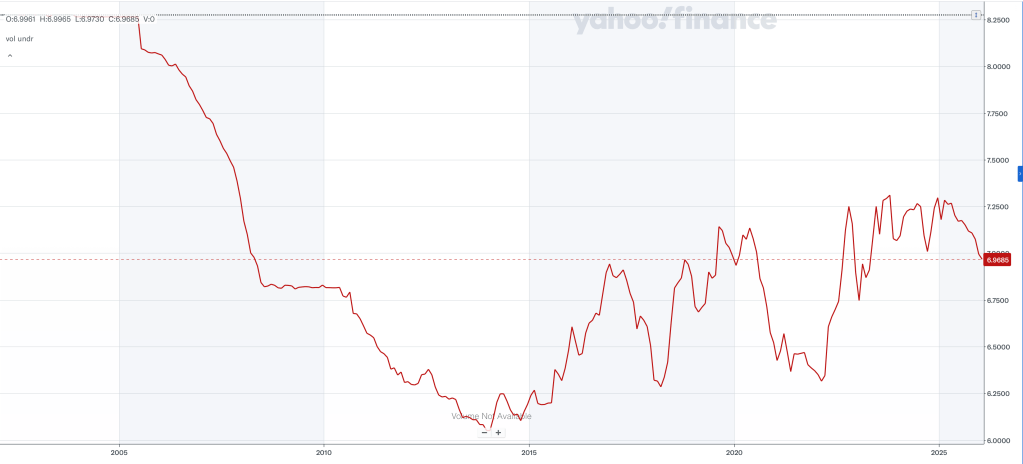

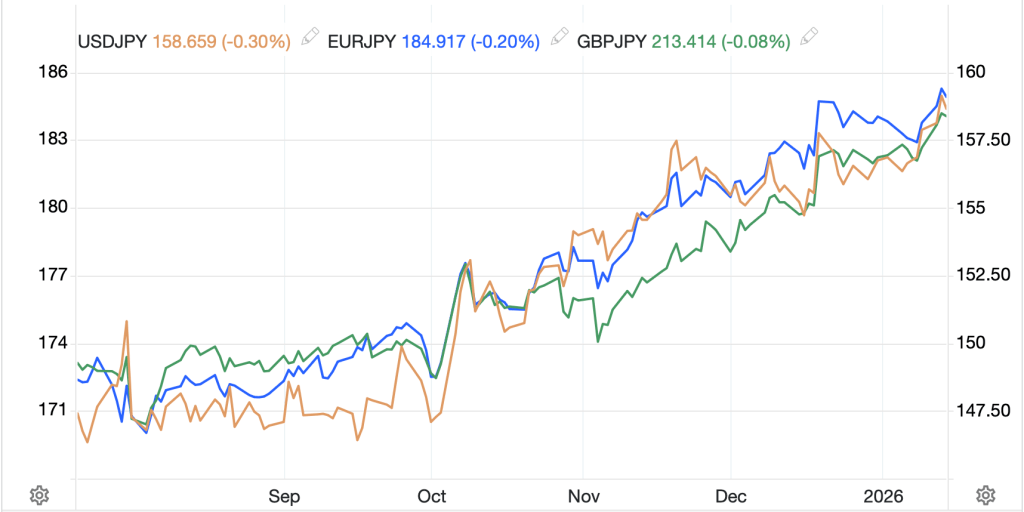

Finally, the dollar is under pressure yet again with the DXY (-0.3%) slipping, and as you can see in the below chart, now approaching a double bottom, a break of which seems likely to open up a more substantial decline.

Source: tradingeconomics.com

The dollar weakness is broad based this morning, with most currencies gaining by that 0.3% amount and only CHF (+0.75%) showing real leadership. The yen (+0.4%) has been hanging around the post ‘rate check’ levels and I would contend today’s movement is about the dollar writ large rather than the yen in particular. I did read that option traders are bidding up short-dated USD puts across numerous currencies as either fear is growing, or they think that DXY break is going to open a major move. We shall see,

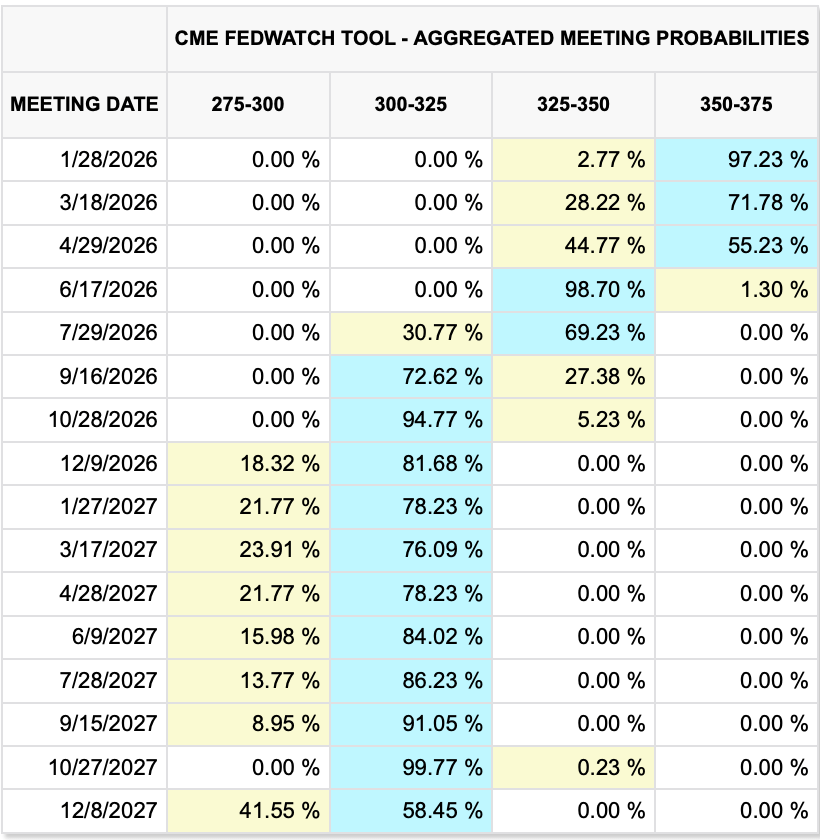

On the data front, yesterday say a huge Durable Goods print, another sign of economic strength. This morning, we see Case Shiller Home Prices (exp 1.2%) and Consumer Confidence (90.9). As well, the FOMC meeting starts with current expectations of no policy change at tomorrow’s meeting.

Gold and silver continue to dominate the conversation and I freely admit, I have been along for the ride and am getting nervous, at least in the short term. As to the dollar, it does look awful right now, and if DXY breaks that line at 96.22 with any impetus, we could be in for another sharp leg lower.

Good luck

Adf