It seems there’s a deal on the table

To end the shut down and enable

The chattering classes

To force feed the masses

A story that’s quite like a fable

Both sides will claim they have achieved

Their goals, though they were ill-conceived

But markets will love

The outcome above

All else, and we’ll all be relieved

While the shutdown is not technically over as the House of Representatives need to reconvene (they have been out of session since September 19th when they passed the continuing resolution) and adjust the bill so that it matches the one the Senate agreed last night and can be voted on in the House, it certainly appears that the momentum, plus President Trump’s imprimatur, is going to get it completed sometime this week.

The nature of the deal is unimportant for our purposes here and both sides will continue to claim that they were in the right side of history, but the essence is that there appeared to be some movement on health care funding so, hurray!

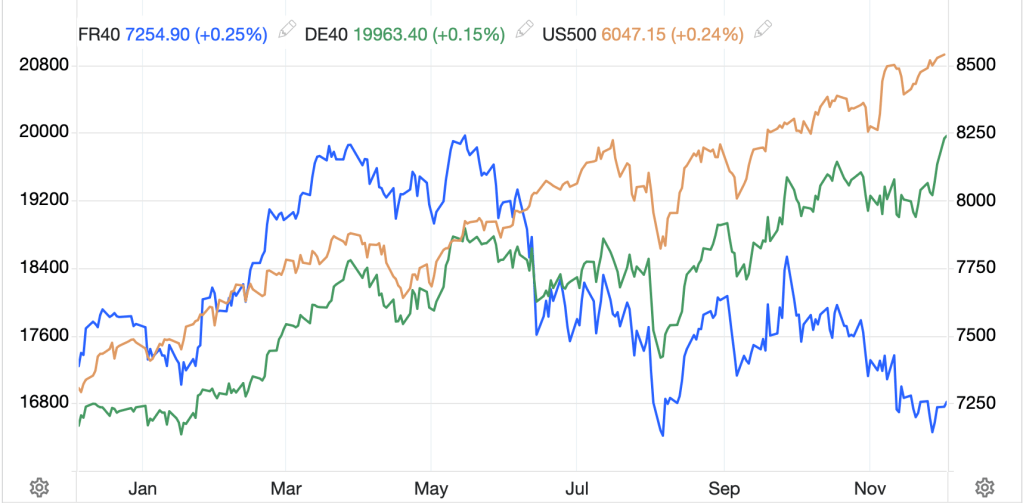

As you can see in the chart below, while the story broke late yesterday afternoon and futures responded on the open in the evening session, the reality is the market sniffed out something was coming around noon on Friday. In fact, the S&P 500 has rallied 2.4% since noon Friday.

Source: tradingeconomics.com

So, everything is now right with the world, right? After all, this has been the major topic of conversation, not just by the talking heads on TV, but also in markets as analysts were trying to determine how much damage the shutdown was doing to the economy. While I have no doubt that there were many people who felt the impact, my take is there were many, many more who felt nothing. After all, the two main features were air travel and then SNAP benefits. Let’s face it, on average (according to Grok) about 2.9 million people board airplanes in the US, well less than 1% of the population, although SNAP benefits, remarkably, go to 42 million people. However, those have only been impacted for the past week, not the entire shutdown.

I’m not trying to make light of the inconveniences that occurred, just point out that from a macroeconomic perspective, despite the fact that the shutdown lasted 6 weeks, it probably didn’t have much of an impact on the statistics as all the money that wasn’t spent last month will be spent next month. Different analyst estimates claim it will reduce Q4 GDP by between 0.2% and 0.5% with a concurrent impact on the annual result. I am willing to wager it is much less. However, it appears it will have ended by the end of the week and so markets are back to focusing on other things like AI, unemployment and QE.

Now, those three things are clearly important to markets, but I don’t think there is anything new to discuss there today. Rather, I would like to focus on two other issues, one more immediate and one down the road, which may impact the way things evolve going forward.

In the near term, as winter approaches, meteorologists are forecasting a much colder winter in the Northern Hemisphere across both North America and Europe, something that is going to have a direct impact on NatGas. Bloomberg had a long article on the topic this morning with the upshot being that the Polar Vortex may break further south early this year and bring a lot of cold weather along for the ride. This is clearly not new news to the NatGas market, as evidenced by the fact that its price has exploded (no pun intended) higher by 43% in the past month!

Source: tradingeconomics.com

While oil prices have remained stuck in a narrow range, trading either side of $60/bbl for the past 6 weeks amid a longer-term drift lower as you can see in the below chart, oil is only utilized by ~4% of homeowners for heating with 46% using NatGas.

Source: tradingeconomics.com

Ultimately, I suspect that we are going to see this feed through to inflation as not only are there the direct costs of heating homes, but NatGas is also the major source of generating electricity, with 43% of the nation’s electricity using that as its source. We have already seen electricity prices rise pretty sharply over the past months (I’m sure you have all felt that pain) and if NatGas prices continue to climb, that will continue. Remember, the current price ~$4.45/MMBtu is nowhere near significant highs like those seen just 3 years ago when it traded as high as $10/MMBtu. With all this price pressure, will the Fed continue down their path of rate cuts? Alas, I believe they will, but that doesn’t make our lives any better.

Which takes me to the second, longer term issue I wanted to mention, European legislation that is seeking to effectively outlaw the utilization of cash euros. This substack article regarding recent Eurozone legislation is eye-opening as the ECB and Europe try to combat the coming irrelevance of the euro. For everyone who either lives in Europe or does business there, I cannot recommend reading this highly enough. There are many changes occurring in financial architecture, and by extension financial markets. Keep informed!

Ok, enough of that, let’s see how markets have responded to the Senate deal. Apparently, US politics matters to the entire global equity market. Green is today’s color with Japan (+1.25%), HK (+1.55%) and China (+0.35%) all performing well, although not as well as Korea (+3.0%) which really had a good session. Pretty much all the other regional markets were also higher. In Europe, the deal has everyone excited as well with gains across the board (Germany +1.8%, France +1.4%, Spain +1.4%, UK +1.0%). As to US futures, at this hour (7:45) they are higher by about 1% across the board.

I guess with that much excitement about more government spending, we cannot be surprised the yields have edged higher. This morning Treasury yields are up by 3bps, which is what we saw from JGB markets last night as well, although European sovereign yields are little changed on the day. I suspect, though, if equities continue to rally, we will see yields there edge higher.

In the commodity space, oil (+0.5%) continues to trade in its recent range. The most interesting thing I saw here was that the IEA is set to come out with their latest annual assessment of the oil market and for the first time in more than a decade they are not going to claim that peak fossil fuel demand is here or coming soon. The climate grift is truly breaking down. But the commodity story of the day is precious metals which are massively higher (Au +2.5%, Ag +3.3%, Pt +2.6%) with copper (+1.6%) coming along for the ride. The narrative here is that with the government shutdown due to end soon, President Trump talking about $2000 tariff rebate checks and the Fed likely to cut rates in December (65% probability), debasement is with us and metals is the place to be!

Interestingly, the dollar is not suffering much at all despite the precious metals story. While AUD (+0.6%), ZAR (+0.6%) and NOK (+0.6%) are all stronger on the commodity story, the euro is unchanged, JPY (-0.4%) continues to decline and the rest of the G10 is not doing enough to matter. In truth, if I look across the board, there are more currencies strengthening than weakening vs. the greenback, but overall, at least per the DXY, the dollar is little changed.

There is still no data at this point, although it will start up again when the government gets back to work. Actually, there has been much talk of the weakness in Consumer sentiment based on Friday’s Michigan Index which fell to 50.3, the second lowest in the history of the series with several subindices weakening substantially. However, that was before the news about the end of the shutdown, so my take is people will regain confidence soon. As well, we hear from 9 Fed speakers this week, with 5 of them on Wednesday! Both dissenters from the October meeting will speak, so perhaps things have changed in their eyes, but I doubt it.

At this point, all is right with the world as investors anticipate the US government getting back to work while the Fed will continue to support markets by easing policy further. In truth, the dollar should not benefit here, but I have a feeling that any weakness will be short-lived at best. Longer term, I continue to believe the dollar is the place to be.

Good luck

Adf