It seems that there’s still quite some tension

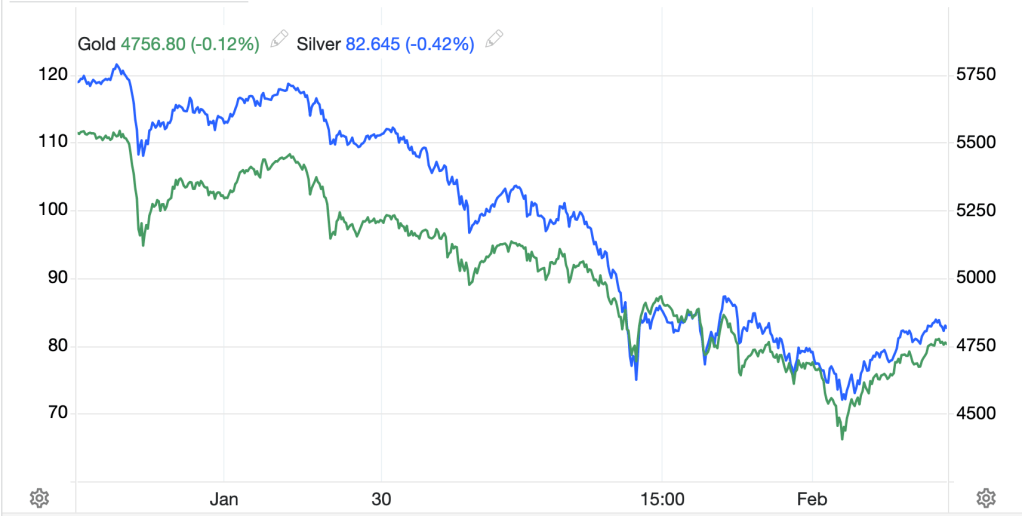

As metals and stocks show dissension

Though Friday both puked

Of late, metals juked

Much higher, to stocks contravention

So, what can we learn from this split?

That tech stocks all now trade like sh*t

While silver and gold

Are what folks will hold

And bonds? No one just gives a whit

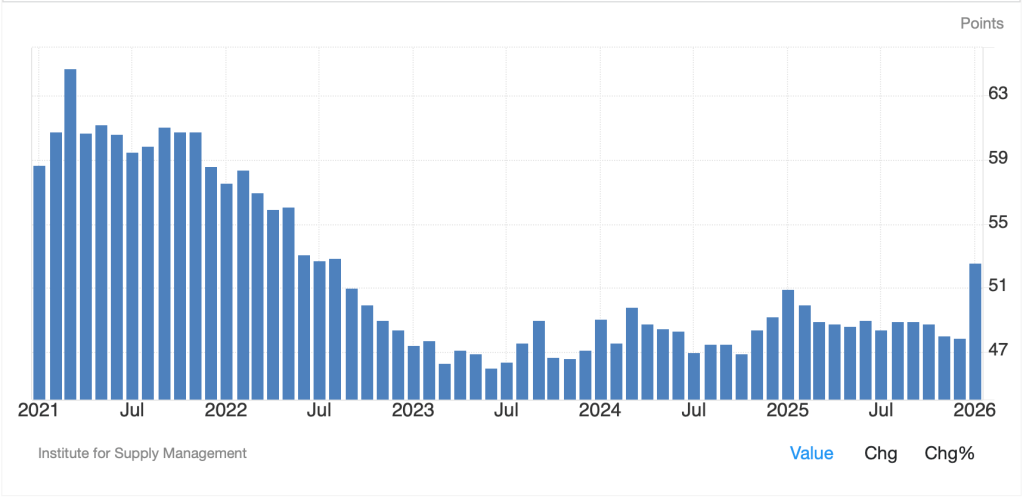

It seems the government shutdown has ended, just as quickly as it began and the only people impacted are traders who were looking forward to the NFP data on Friday. Given the shutdown was only for a few days, and that apparently, all the data was already collected, it was the compilation that was being delayed, I presume we will get the numbers next week. Of course, this is a government bureaucracy, so it may take a bit longer. Nonetheless, this morning we see the ADP Employment number (exp 48K) and analysts will have to work from that, plus the reports like the ISM hiring data, to give their views of the economy. It really all does seem like theater, I must admit.

Anyway, away from that, the only other news of note that is impacting markets has been an increase in tensions in Iran after the US shot down an Iranian drone heading toward the US aircraft carrier, Abraham Lincoln. However, it appears that talks are still scheduled for Friday, so oil (+0.2% today, +1.4% since yesterday morning) is creeping back higher, although remains well below the levels seen last week when concerns over a US attack there were mounting.

Source: tradingeconomics.com

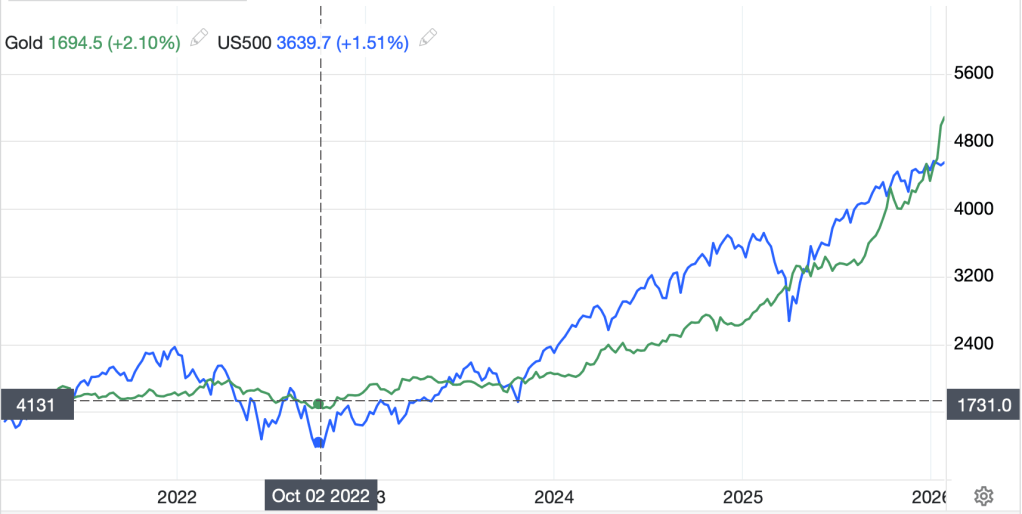

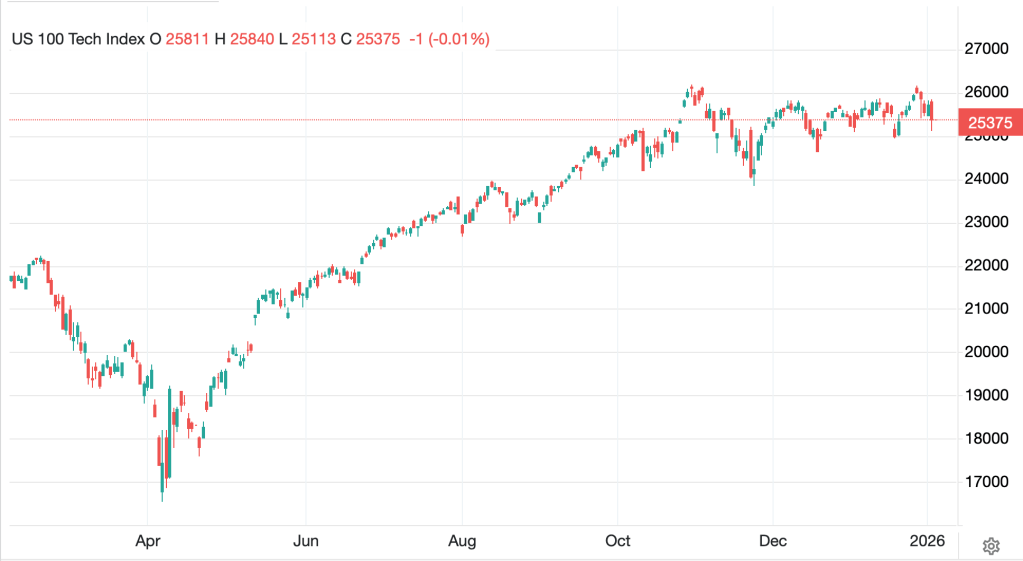

Which takes us to markets and what appear to be the key internal drivers. Starting today with stocks, the narrative revolves around concern that AI is going to destroy software companies and SaaS models since their user base will no longer need those companies. As well, there are the lingering concerns about the AI investment bubble and the circular dealing between Nvidia and its customers being an indication of the end of the era. This is akin to what happened during the tech bubble in 2000-01 and has been highlighted by numerous analysts for several months, although is gaining more traction of late. Finally, the Business Development Companies (BDC’s) and PE firms are under increasing pressure as their portfolio of loans and positions, many of which are being hurt by AI, are starting to hemorrhage cash. This trifecta has been weighing on the NASDAQ, preventing any significant strength, although other sectors, notably energy and materials, have been doing pretty well.

The funny thing is, while the NASDAQ (-1.4%) fell yesterday amid widespread US equity weakness, if I look at the chart (below from tradingeconomics.com) it doesn’t seem that negative, rather it seems to be consolidating ahead of another leg higher. But then, I am no technician, so don’t pay attention to me.

However, the narrative is strong here that the world is about to end because Nvidia hasn’t made a new high in the past three months. I am no tech stock expert, but my take from the cheap seats is that future equity market outcomes are going to continue to be reliant on the success of the Trump administration’s plans regarding reshoring and changing the nature of trade. It is likely to be bumpy, especially if the Fed does not cut rates to support equity markets, especially since that has been the MO for the past 40 years. But I remain positive overall.

Looking around the rest of the world, last night saw a mixed picture, although definitely more green than red. While Tokyo (-0.8%) slid along with Malaysia and the Philippines, the rest of the region had a nice session led by Korea (+1.6%), China (+0.8%) and Australia (+0.8%). It appears the tech fears were less concerning there, either that or PE and BDC companies aren’t yet so prevalent. In Europe, meanwhile, despite mixed PMI Services data, there are more gainers than laggards led by the UK (+1.0%), which does have miners, benefitting from the rebound in metals prices. But France (+0.9%) and Spain (+0.15%) are also higher although Germany (-0.2%) is lagging after a modest miss in the PMI data. As to US futures, at this hour (7:15), they are pointing higher by about 0.25%.

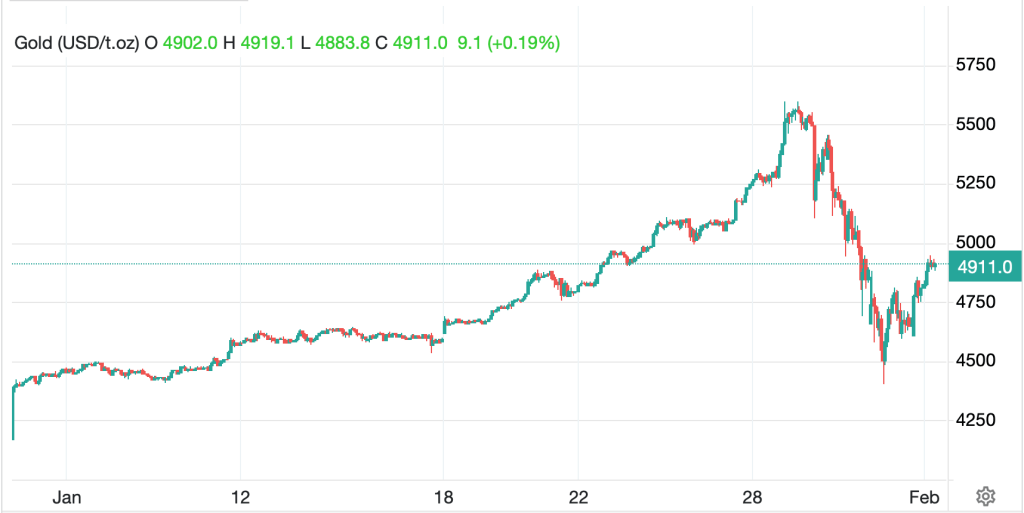

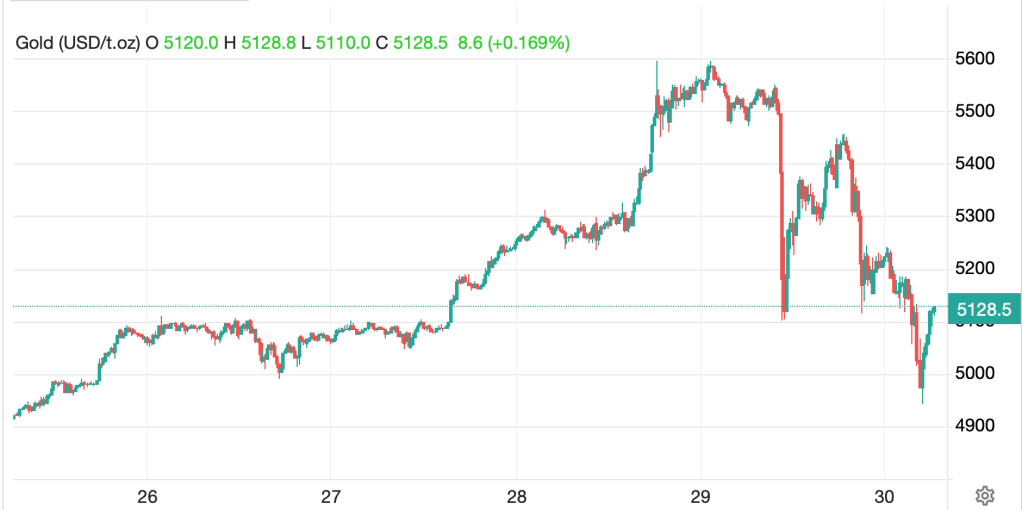

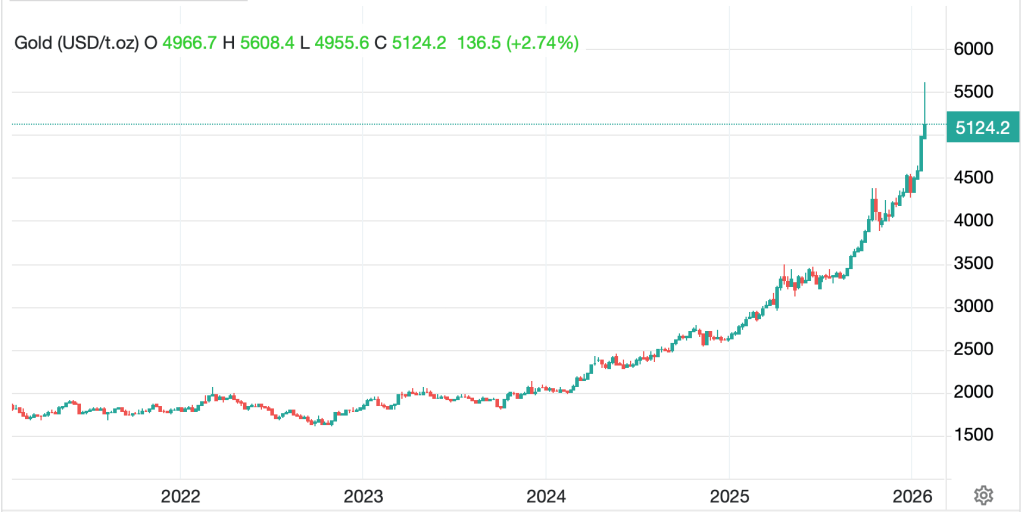

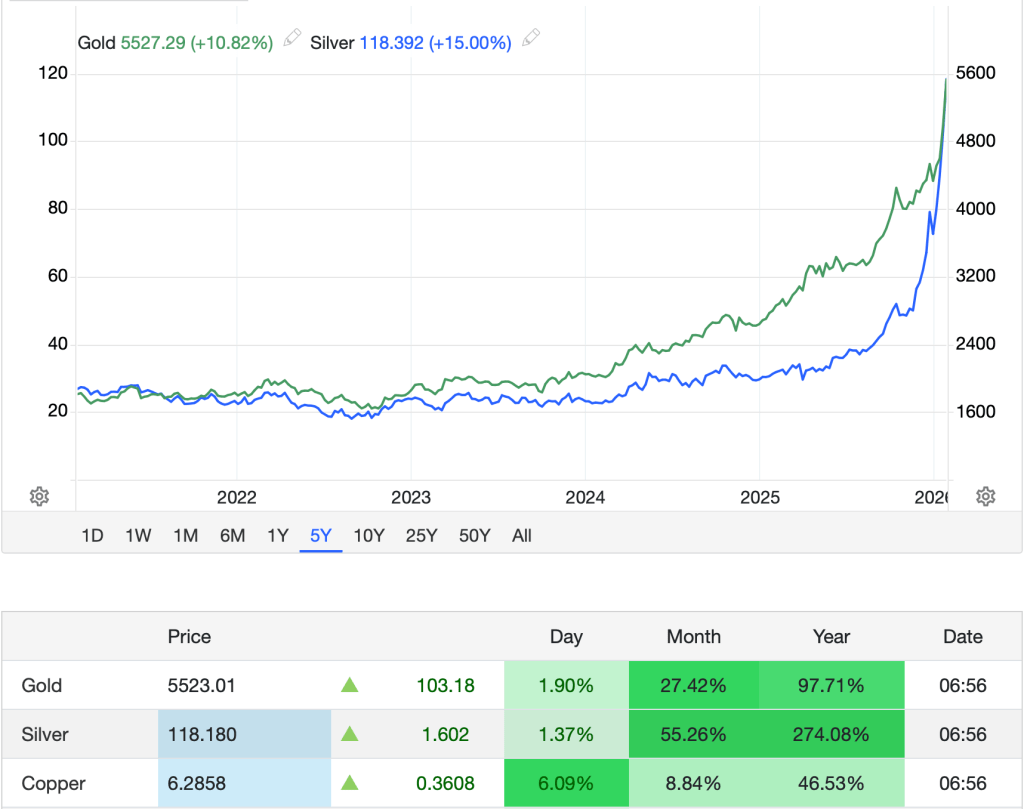

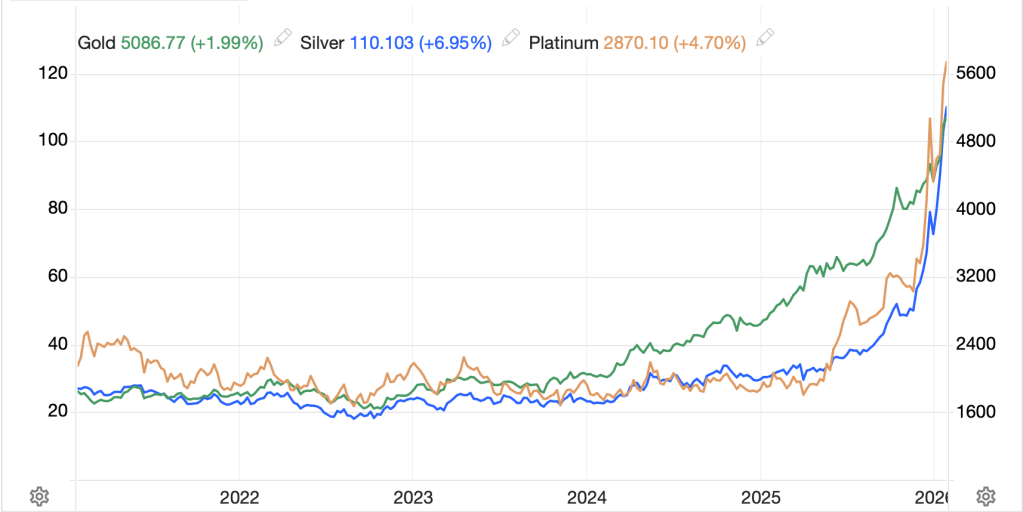

Back to metals, which continue to be THE story these days, gold (+2.0%) has reclaimed the $5000/oz level and while it is lower in the past week, remains nearly 17% higher YTD. Silver (+6.0%) is also rebounding nicely along with platinum (+3.8%) as more and more discussions have ascribed last Friday’s rout to month end delivery and position issues amongst a few very large players who were able to prevent some major damage to their own balance sheets. However, as I have maintained all along, the fundamentals are unchanged; there is a shortage of silver for industrial use and has been for several years. As to gold, there is no indication that central banks have stopped buying. These continue to be long-term plays and will likely drag the entire metals sector along for the ride.

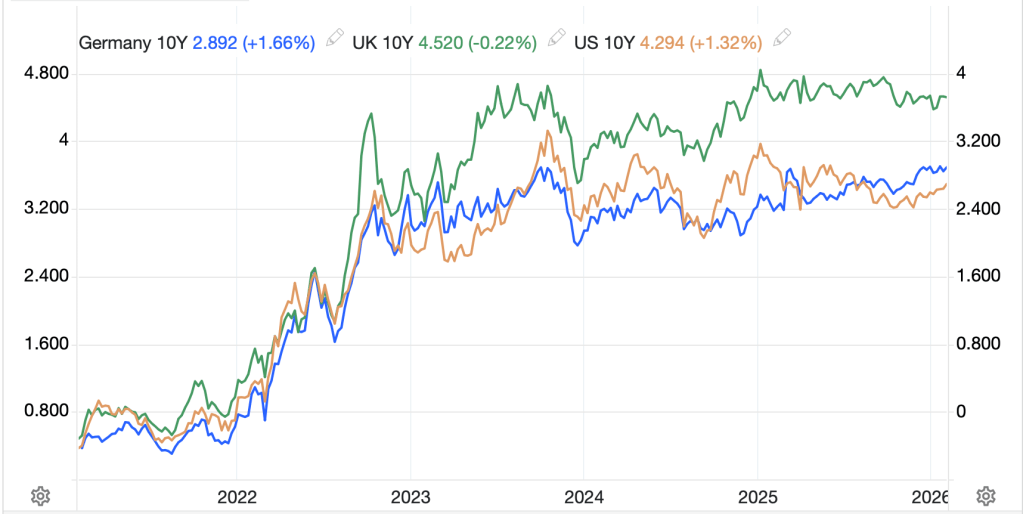

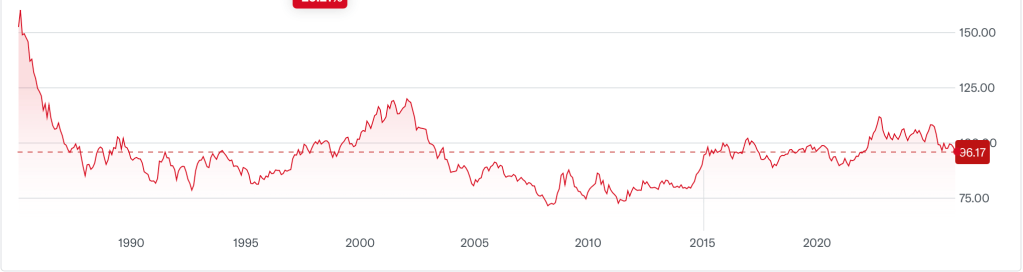

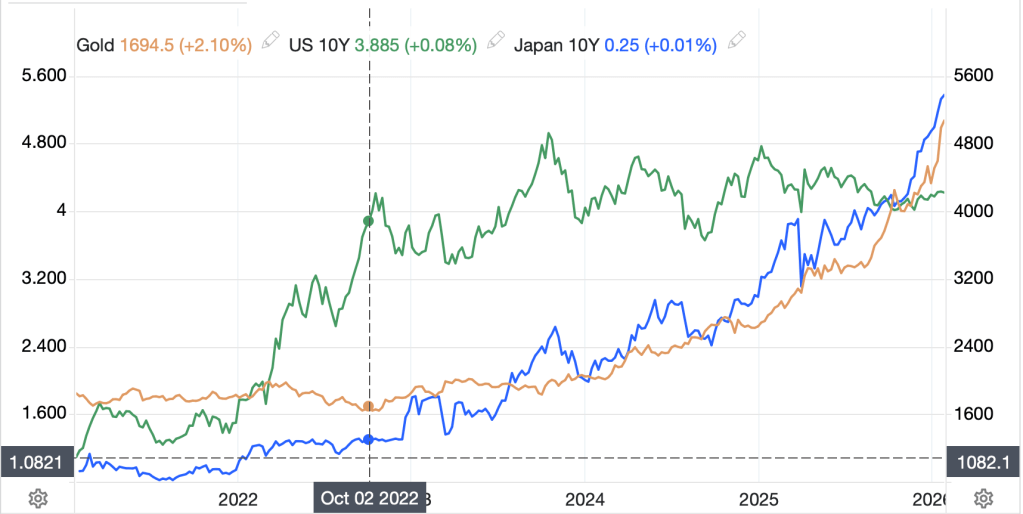

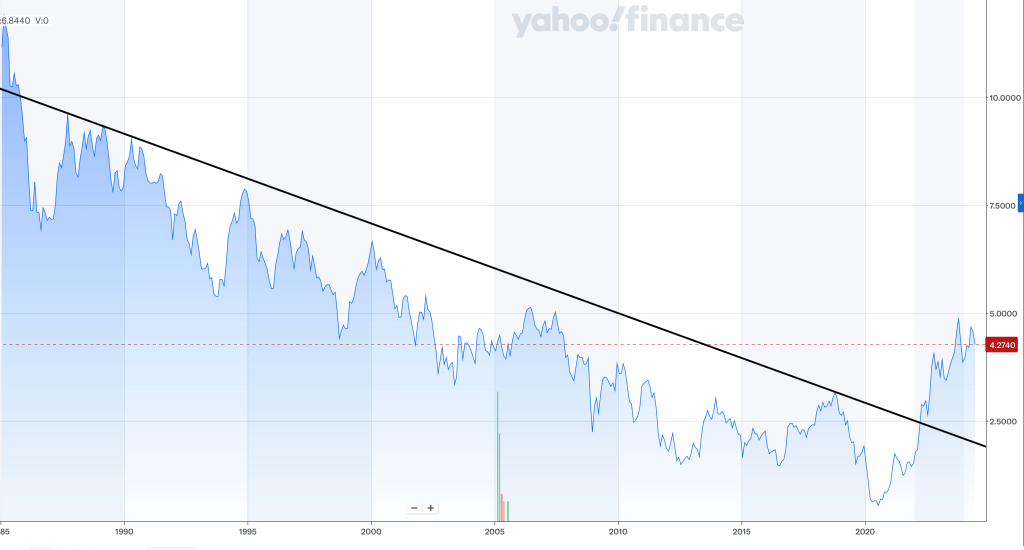

What about bonds, you may ask? Well actually, nobody is asking about bonds! They remain mired in a tight range with dueling narratives about the long-term view. On the one hand, there are those who continue to look at the US debt load, and the expectation of fiscal deficits as far as the eye (or the CBO) can see, and expect supply issues to dominate, forcing the government to seek inflation to create the soft default necessary to pay back the debt. They will point to the long-term trend, which saw yields decline for 40 years and then reverse back in 2020 (see chart below from finance.yahoo.com) as evidence that yields are going to trend higher for the next decades.

On the other side, you have those who believe the future is deflationary, with AI driving massive increases in productivity and driving down prices, while focusing on Truflation’s recent readings of 1.0% and claiming that is the way. Personally, I have more sympathy for the former view than the latter, as it is increasingly difficult for me to understand the view that AI will be able to achieve all its currently stated desires without sufficient energy and materials, whose increasing prices are going to limit any downside in inflation. As well, while a Warsh Fed chairmanship may strive to change the current central bank model of QE whenever needed, there is zero evidence any other central banks are going to follow suit.

In the meantime, the tension between those two views has kept yields in a very tight range for a while, and we need an exogenous catalyst to break that range. Peace in Ukraine? War in Iran? I’m not sure.

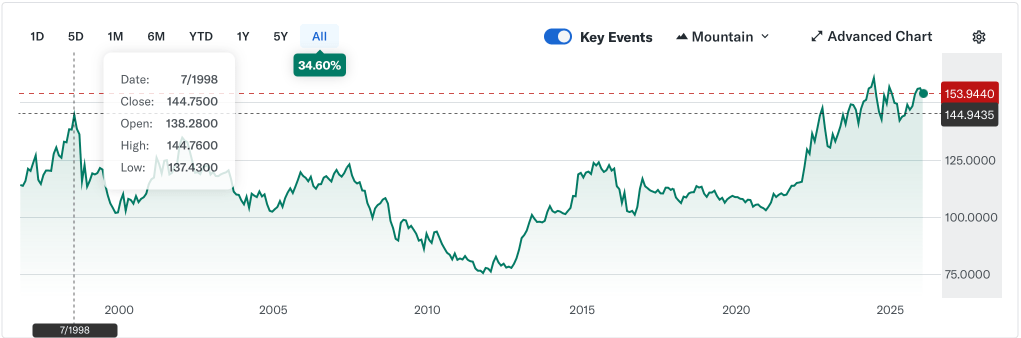

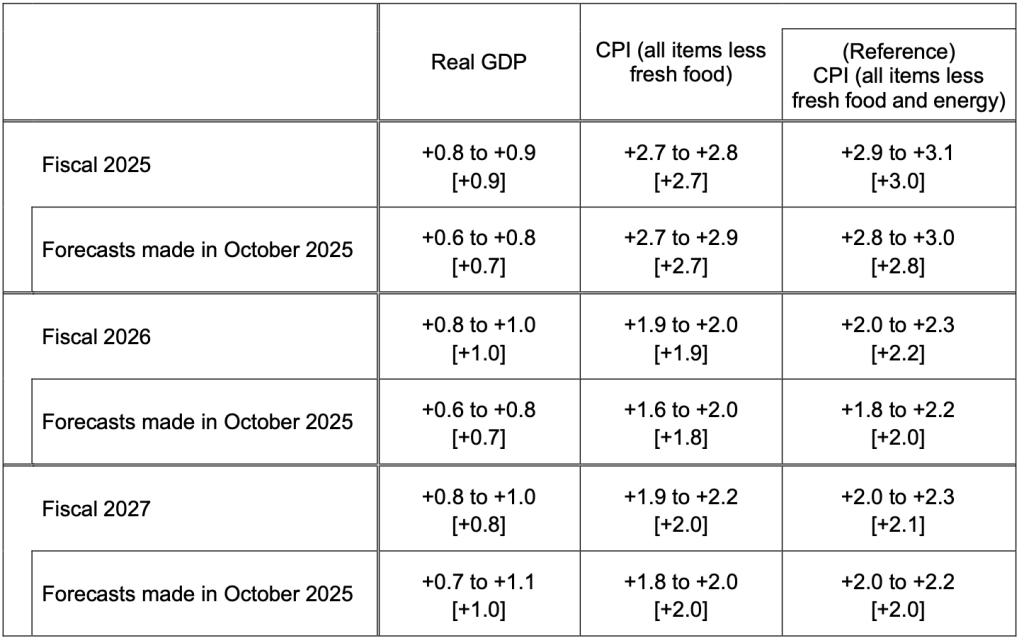

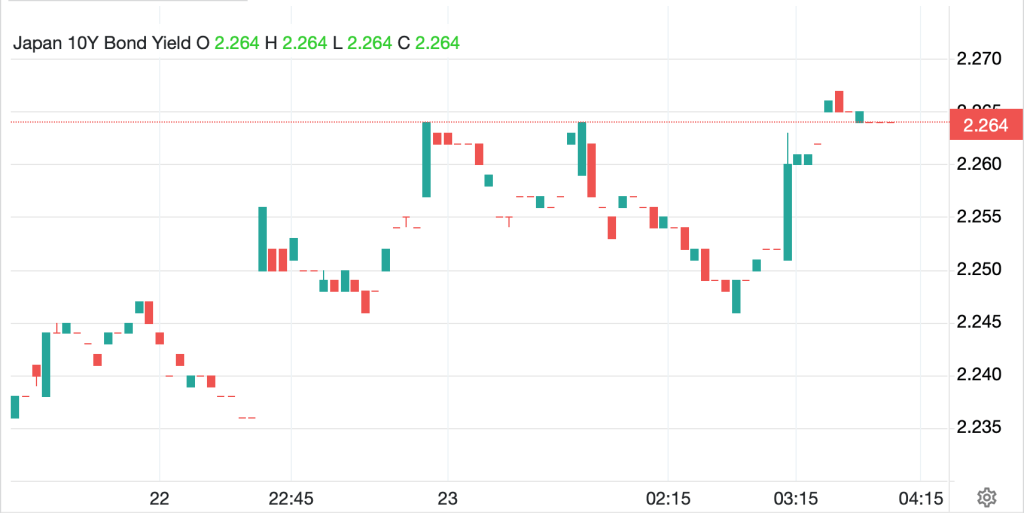

Finally, the dollar is a touch firmer this morning, notably against the yen (-0.6%), which continues to give back its gains from two Friday’s ago when the Fed ‘checked rates’ in the NY session as seen in the chart below.

Source: tradingeconomics.com

However, the point was made this morning, and it is a good one, that while Japanese 10-year yields are at 2.24%, 10-year yields, 10-years forward are about 4.10%, which would be a devastating yield for the Japanese government given its debt/GDP ratio remains above 230%. It is difficult to get excited about owning the yen with that backdrop, especially given the demographic implosion of population that is ongoing there. As to the rest of the currency market, Zzzzz. Aside from the narrative of the dollar is dead, which gets recycled by somebody every day, it is very hard to look at recent price action and think something remarkable is going to happen. We will need major monetary and fiscal policy changes, which while they may arrive, are going to take quite some time to get here.

And that’s really it this morning. Aside from ADP, we get the ISM Services (exp 53.5) and we get the Quarterly Treasury refunding announcement, which will garner a great deal of attention only if Secretary Bessent explains he is going to issue more bonds and less bills, which seems unlikely. Monday’s ISM data was quite strong. Strength today could well portend that the US economy has a bright future ahead, in the near term, and that should support stocks and the dollar, while commodities will benefit from the increased demand. Bonds? Well, we’ll see which side of that argument is correct. And what happens if the deficits are smaller than expected? That is the question nobody is asking because the ‘smart’ folks don’t believe it is possible. Remember, the dollar is still king.

Good luck

Adf