The virtue of patience remains

The key to our policy gains

Though tariffs and trade

May one day, soon, fade

It’s still ‘nuff to scramble our brains

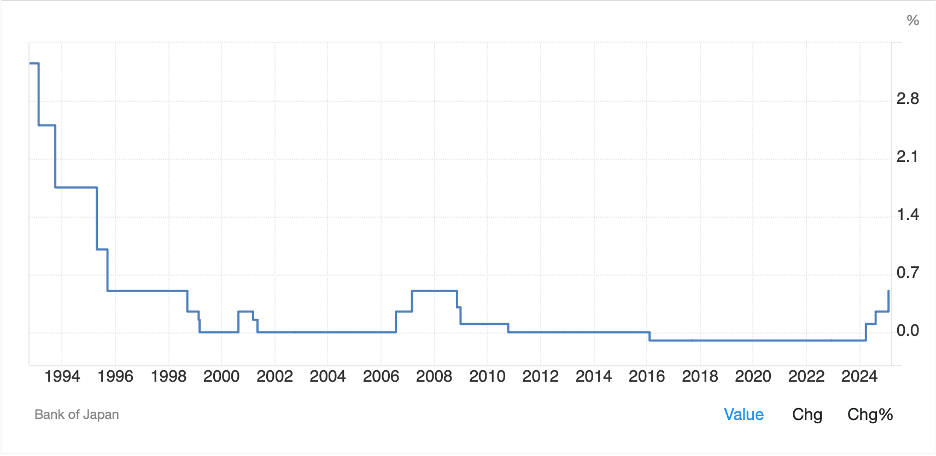

In a bit of a surprise, Chairman Powell resurrected the term ‘transitory’ in his press conference yesterday with respect to the potential impact on prices from President Trump’s tariff policies. He explained, “We now have inflation coming in from an exogenous source, but the underlying inflationary picture before that was basically 2½% inflation, 2% growth and 4% unemployment.” In addition, he said, “It’s still the truth if there’s an inflationary impulse that’s going to go away on its own, it’s not the right policy to tighten policy because by the time you have your effect, you’re in effect, by design, you are lowering economic activity and employment.” It is this mindset that returned ‘transitory’ to the discussion. Now, while mainstream economics would agree to that characterization, with the idea being it is a one-off price rise, not the beginning of a trend, given the Fed’s history of using the word to describe the impact of monetary and fiscal policies in the wake of the pandemic, it caught most observers off guard.

But in the end, the Fed’s only policy change was a reduction in the pace of runoff of Treasuries from the Balance Sheet on a temporary basis. Previously, they had been allowing $25B per month to run off without being replaced and starting April 1, that will be reduced to $5B per month. The runoff of Mortgage-backed assets will continue as before. This has been a widely discussed idea as the Fed approaches their target of “ample” reserves on the balance sheet, an amount they still characterize as “abundant”.

As to changes in the dot plot and SEP forecasts, they were, at the margin, modest, with the median dot plot ‘forecast’ continuing to call for 2 rate cuts this year. Fed fund futures are now pricing in 65bps of cuts, so marginally tighter than the 75bps seen last week. The SEP also showed slightly different forecasts for growth, inflation and unemployment, but just a tick or two different, hardly enough about which to get excited.

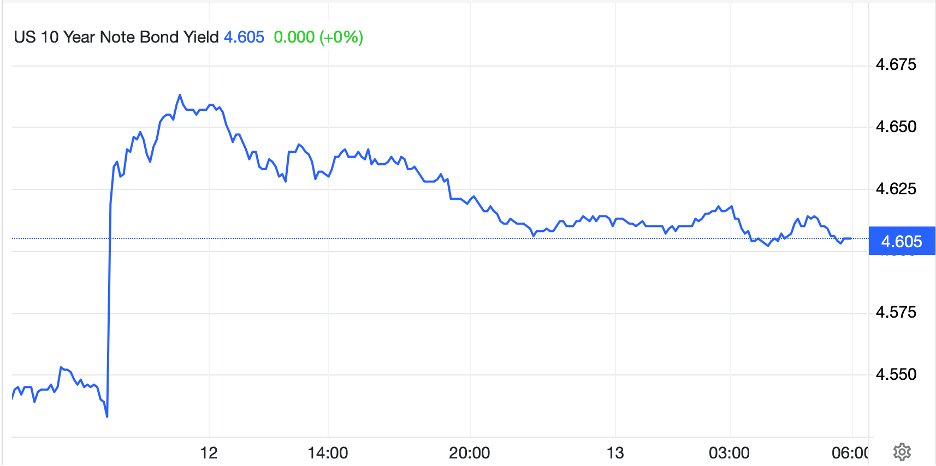

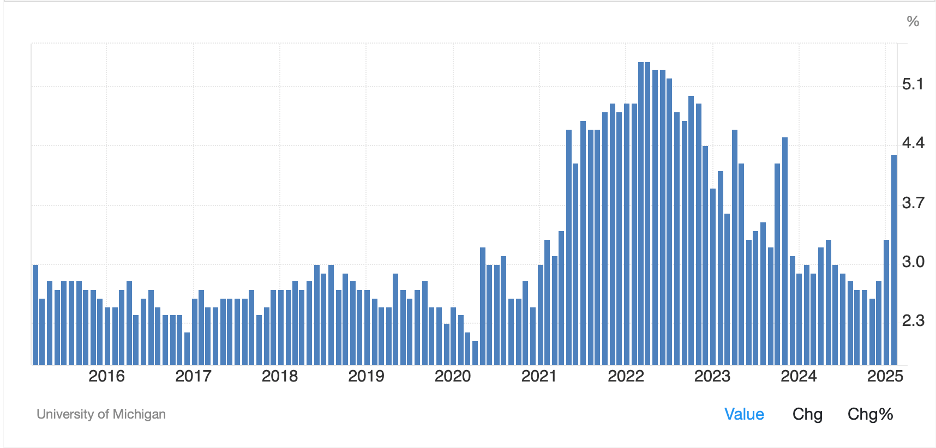

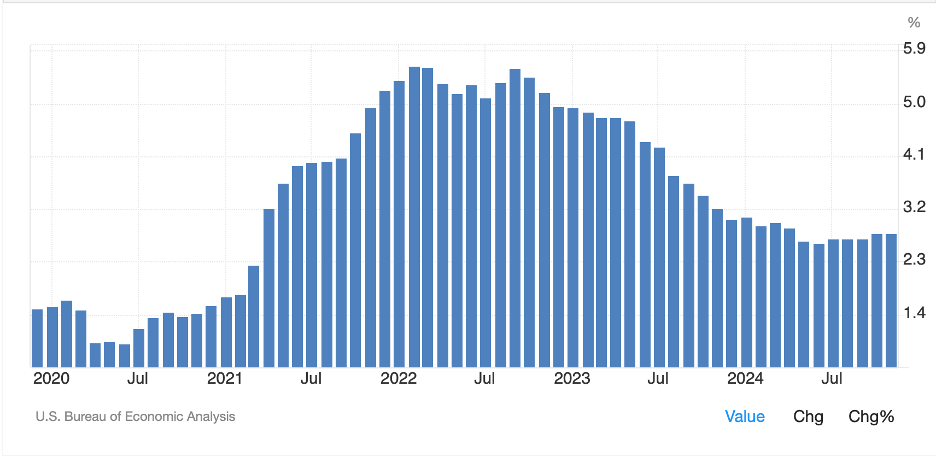

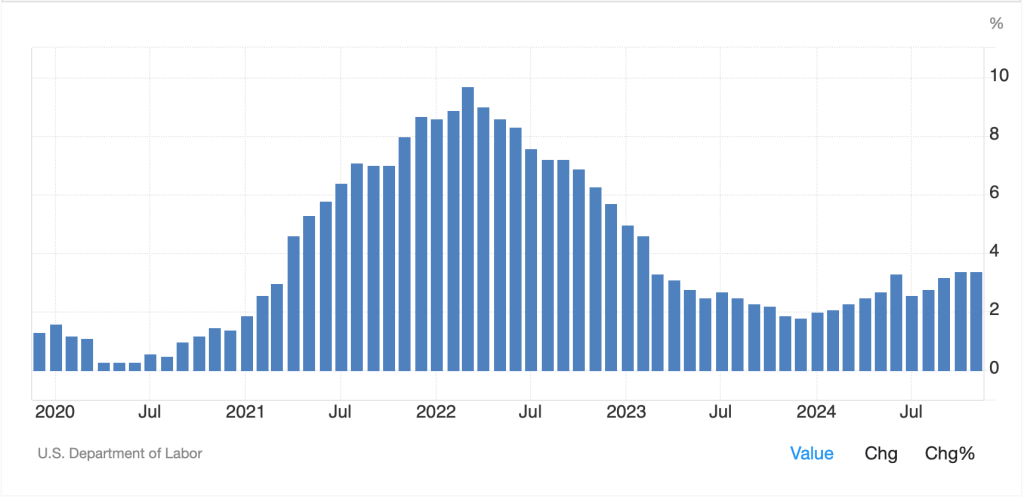

Certainly, Mr Powell said nothing to upset equity markets as the response was a continuation of the modest rally that began in the morning. As well, bond yields slid almost 9bps from their level just before the Statement was released. Net, I expect the only people who are unhappy with the Fed’s performance are the hundreds of millions of Americans who have seen the inflation rate remain above the 2.0% target for the past 48 months (see chart below), but then Powell doesn’t really respond to them directly, now does he?

Source: tradingeconomics.com

Oh yeah, President Trump also published a little note on Truth Social that Powell should cut rates, but I don’t think that had any impact at all. For now, Trump’s attention is elsewhere, and if 10-year yields continue to slide, I suspect he will be fine, certainly Secretary Bessent will be.

In Europe, the leaders are meeting

Again, as they keep on repeating

They need to spend more

To maintain the war

In Ukraine, ‘cause there’s no retreating

Back in the real world, the diverging points of view between President Trump, and his attempts to end the Ukraine War, and the EU, which seems hell-bent on continuing it ad infinitum were highlighted again today as yet another summit meeting is being held in Brussels to discuss the process and progress on rearming the continent as well as how they envision the future of Ukraine. This matters to markets as the continuous calls for more fiscal military spending is going to be a driver of equity prices in Europe, and given it is going to be funded by issuing more debt, on both a national and supranational basis, yields are likely to rise as well over time.

There has been much talk lately of the end of US exceptionalism, and certainly there has been a shift of investment into European shares, especially defense firms, and out of US tech shares. This has helped support the single currency, which while it has slipped the past two days, remains higher by 4.5% since the beginning of the month. Ex ante, there is no way to know how this situation will evolve, but if history is a guide at all, the US continues to hold all the defense cards in the deck, and so even with European protests, I suspect the war will come to an end.

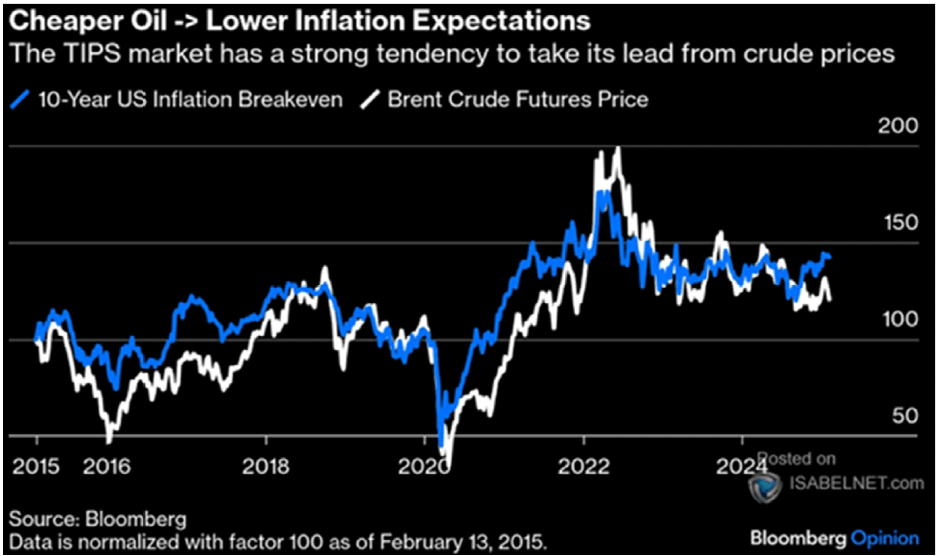

But here’s a thought, perhaps even if the war ends, the pre-war energy flows may not resume. This would not be because Europe doesn’t want cheap Russian gas, but perhaps because Russia doesn’t want to sell it to those who will use it to build armaments that can be used against Russia. The world has moved to a different place both politically and economically, than where it was pre-Covid. My sense is many old models may no longer work as proxies for reality, which takes me back to my favorite theme, the one thing on which we can count is more volatility!

Ok, let’s take a turn through markets overnight. After the US rally, Asia was far more mixed with the Nikkei (-0.25%) slipping a bit and both China (-0.9%) and Hong Kong (-2.2%) falling more substantially on fears that US tariffs could slow growth there more than previously feared. But elsewhere in the region there were far more gains (Korea, Australia, India, Taiwan) than losses (Malaysia, Thailand).

Europe, though, is having a tougher session with losses across the board. The continent is particularly hard hit (Germany -1.7%, France -1.2%, Spain -1.2%) although the UK (-0.3%) is holding up better after decent employment data was released. We did see the Swiss National Bank cut its base rate by 25bps, as expected, while Sweden’s Riksbank left rates on hold, also as expected. In fairness, European stocks have had quite a good run, so a pullback should not be a surprise, but it is disappointing, nonetheless. As to US futures, at this hour (7:10), they are pointing lower by -0.5% or so.

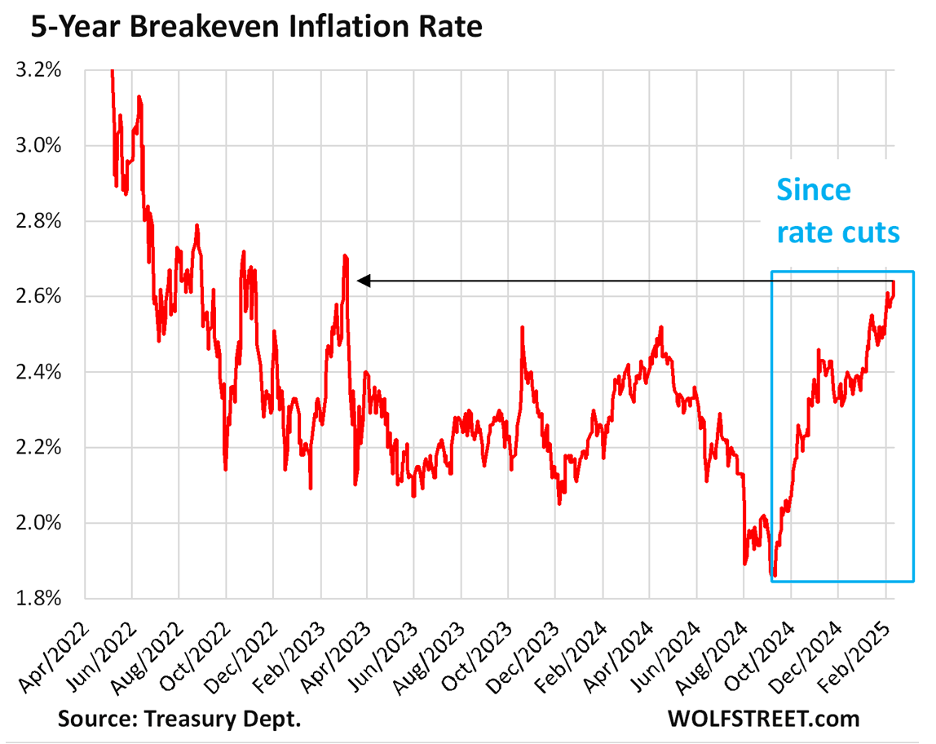

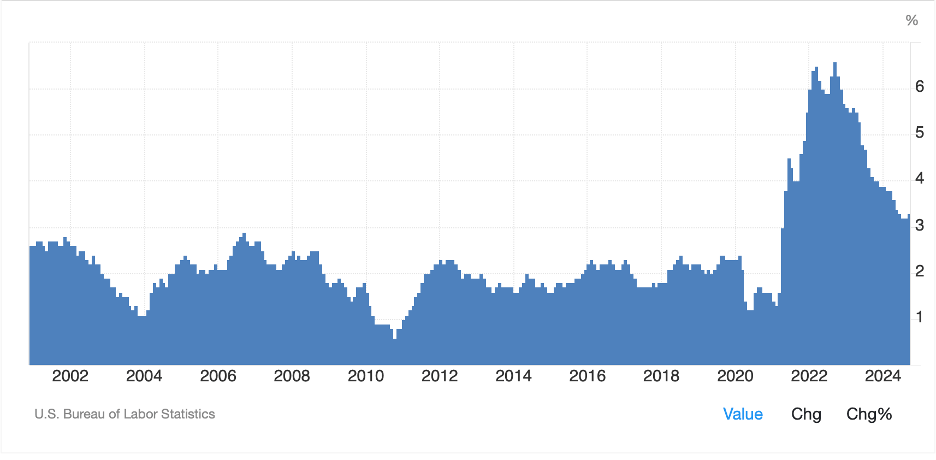

In the bond market, Treasury yields are lower by a further -4bps this morning and down to 4.20%, still well within the recent trading range (see chart below). As to European sovereigns, they too are lower by between -3bps and -5bps, as despite concerns over potential new issuance, fear seems to be today’s theme. Oh yeah, JGB yields are still pegged at 1.50%.

Source: tradingeconomics.com

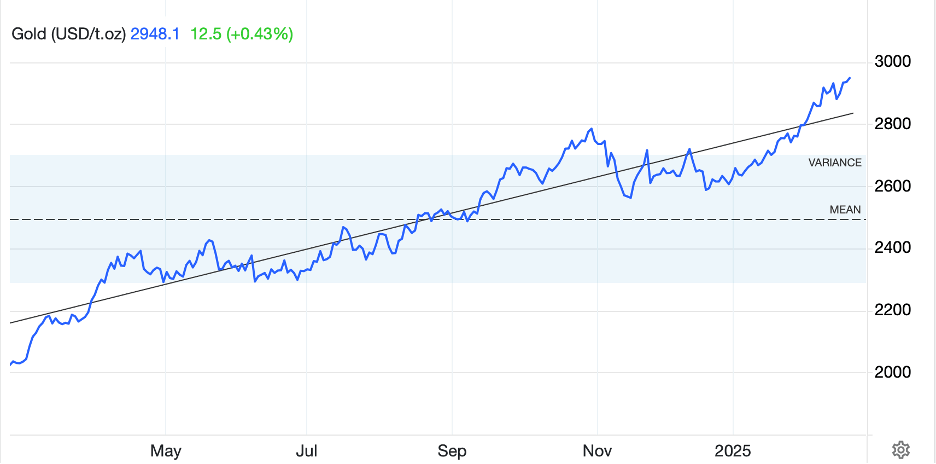

In the commodity bloc, oil is little changed this morning, and net, on the week little changed as well. It is difficult to see short-term drivers although I continue to believe we will see it drift lower over time as supply continues apace while demand, especially in a slowing growth scenario, is likely to ebb. Gold (-0.6%) is having its worst day in more than a week, but the trend remains strongly higher. Arguably a bit of profit taking is visible today. This is dragging silver (-1.8%) along for the ride although copper (+0.1%) is sitting this move out.

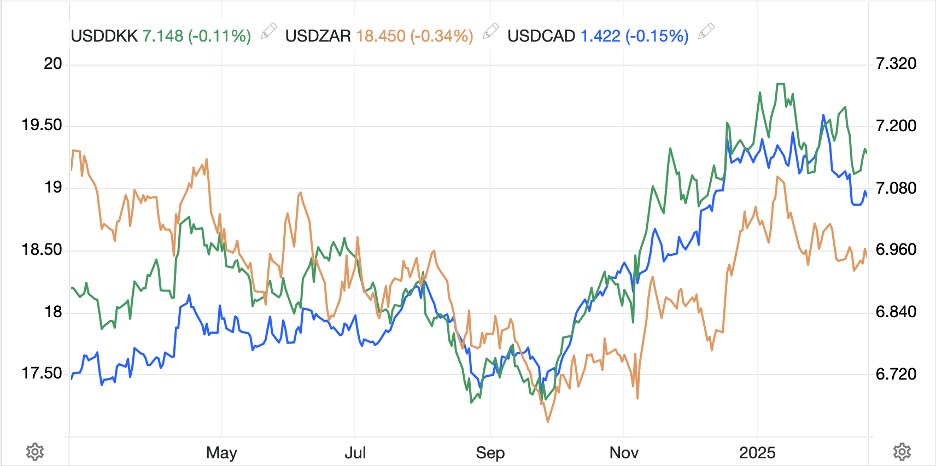

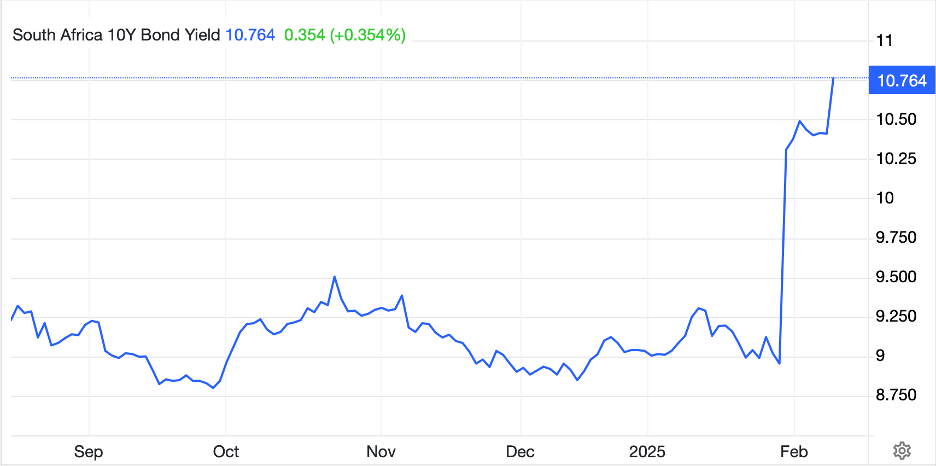

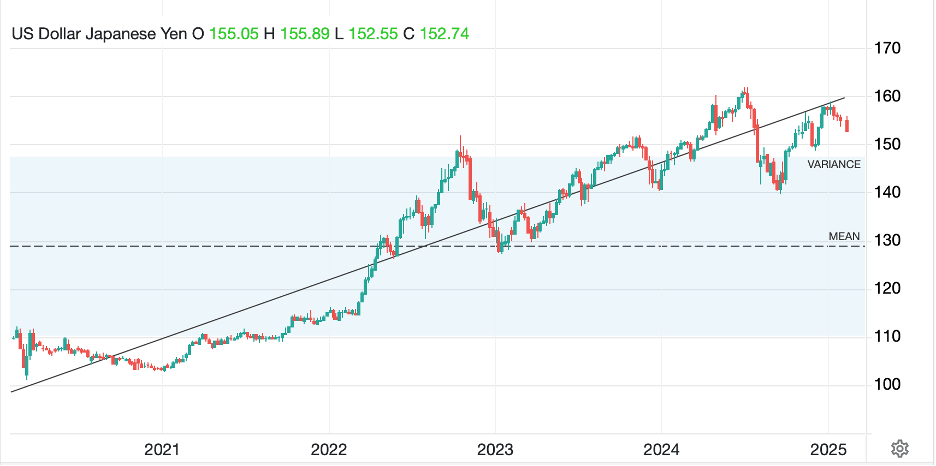

Finally, the dollar is firmer again this morning, higher by 0.5% according to the DXY, with the biggest currency laggards the AUD (-1.1%), SEK (-0.8%) and ZAR (-0.75%). But the dollar’s strength is universal this morning. One possibility is that traders have decided Powell is not going to cut rates, hence more pressure on US equities, and more support for the dollar. I don’t agree with that thesis, as I believe Powell really wants to cut rates, but for now, the other argument has the votes.

On the data front, we get the weekly Initial (exp 224K) and Continuing (1890K) Claims as well as the Philly Fed (8.5) all at 8:30. Then at 10:00 we see Existing Home Sales (3.95M) and Leading Indicators (-0.2%). Also, at 8:00 we will get the BOE rate decision, with no change expected. However, as I have been explaining, central bank stories are just not that important, I believe. Investors in the UK are far more worried about the Starmer fiscal disaster than the BOE.

There are no Fed speakers on the schedule today, so, I suspect it will be headline bingo. While the dollar has outperformed for the past two sessions, I continue to believe the trend is lower for the buck and higher for commodities. Perhaps today is a good day to take advantage of some dollar strength for payables hedgers.

Good luck

Adf