Tis nearly a month since the vote

When President Trump, Harris, smote

So maybe it’s time

To sample the clime

Of what all his plans now connote

To many, his claims are just talk

With pundits believing he’ll balk

But history shows

That Trump will bulldoze

Detractors as he walks the walk

So, tariffs are likely to be

The first part of his strategy

But if that’s the case

The dollar may chase

Much higher than he’d like to see

It seems the conundrum we find

Is not all his thoughts are aligned

And this, my good friends

Is why dividends

Are paid to a hedge, well designed

I have tried to stay away from forecasting how things will evolve once Mr Trump is inaugurated, but this weekend, listening to a podcast (Palisades Gold Radio) I got inspired as there was some interesting discussion regarding the dollar. As I consider the issues, as well as what appears to be the current expectations, I thought it might be worthwhile to note my views, especially in the context of companies considering their hedging needs for 2025 and 2026.

Clearly, the watchword for Trump is tariffs as he has been boasting about implementing significant tariffs on trade counterparties on day 1. The latest discussion is 25% on Canada and Mexico and 60% on China with Europe in the crosshairs as well. (Remember, though, many believe these tariff threats are being used to encourage those countries to change their emigration policies and help stop the current influx of illegal immigration. So, if countries do their part, those tariffs may never materialize.)

The classical economic view is that tariffs are a terrible policy as impeding free trade negatively impacts all players. As well, you will hear a lot about how the countries in question will not pay them, but rather consumers in the US will pay those tariffs. As such, there is a great deal of talk about how tariffs will feed immediately into inflation. (Of course, this is in addition to the inflation that will allegedly come immediately on the heels of Trump’s promise to deport all illegal aliens in the country because it will decimate the workforce. On this subject, simply remember that the deportation will result in a significant decline in demand for things like housing which remain quite sticky in the pricing process.)

But let’s consider what Trump’ stated goals really are. I would boil them down to rebuilding America’s industrial capacity and creating good jobs throughout the nation for citizens and legal residents. If he is successful, the result will be a dramatic reduction in the trade deficit which will reduce the need to import so much foreign capital to fund things. And what are the knock-on effects there? Well, classical economics tells us that tariffs will be met with foreign currency depreciation (higher dollar) in an effort to offset the higher prices of those imports. However, one of Trump’s goals is to reduce the value of the dollar in order to make US exporters more competitive internationally while reducing demand for imports. Now, it seems that those two goals are at odds.

I think the thing we need to consider, though, is that the timing of these changes is very uncertain. My guess is Trump is thinking of a 4-year process, or at least a 3-year one, not a 6-month outcome. After all, these are tectonic shifts which will take time to play out. Based on his commentary, and I think we must pay it close attention as he is pretty clearly telling us what he wants to do, the market response to any tariffs imposed will likely be weakness in the currencies of the countries affected.

But, over time, it would not be surprising to see Trump lean effectively on the Fed to reduce policy rates (remember, he was quite upset the Fed never went negative). As well, if there is any success in the DOGE project, with significant reductions in spending and deficits, that seems likely to alleviate some of the concerns over the US fiscal stance. After all, if debt grows more slowly than the nominal pace of the economy, it remains quite manageable and should help remove some of the current hysteria. In fact, a look at the 10-year yield over the past month (see chart below) shows that it has fallen 25bps (although they are 4bps higher this morning) and may well be signaling a market that is willing to give DOGE a chance. If that is the case, it seems quite possible that the dollar will eventually start to recede from its current loftier levels.

Source: tradingeconomics.com

Bringing this back to the hedging issue, I might suggest that given the uncertainty of the timing of any movements, receivables hedgers will be well-served by using optionality here, whether outright purchases or zero-premium structures as they look to address 2025 and 2026 exposures. While the dollar may well continue its recent strengthening trend with the euro heading to parity or below for a time, and other currencies following, at some point in H2 25 or beyond, it is quite feasible that the dollar reverses course. Consider what could happen if Trump convenes a Mar-a -Lago accord, similar to the Plaza Accord of 1985, which saw the dollar decline dramatically in the ensuing three years, falling nearly 50% against a broad mix of trading partners’ currencies by the end of 1987.

Source: tradingeconomics.com

In that situation, those out-month hedges will want to have optionality to allow the weaker dollar to benefit the revenue line. Similarly, for those with payables hedges, care must be taken to hedge effectively there as well given the opportunity for much higher costs due to the potential dollar decline. Current market pricing (implied volatilities) is quite reasonable from a long-term perspective. While they are not near the lows seen in the past year, they very likely offer real value for hedgers of either persuasion.

I apologize for the extended opening, but it just seemed to be a good time to review the evolving Trump impact. Now onto markets. The first thing to recall is that last Wednesday’s PCE data continued to show that inflation, even in this measurement, appears to have stopped declining and is beginning to head higher again. This will continue to put pressure on the Fed as housing data was pretty dreadful last Wednesday. Add to the data conundrum the unknown unknowns of a Trump presidency and Chairman Powell will have his hands full until his term ends.

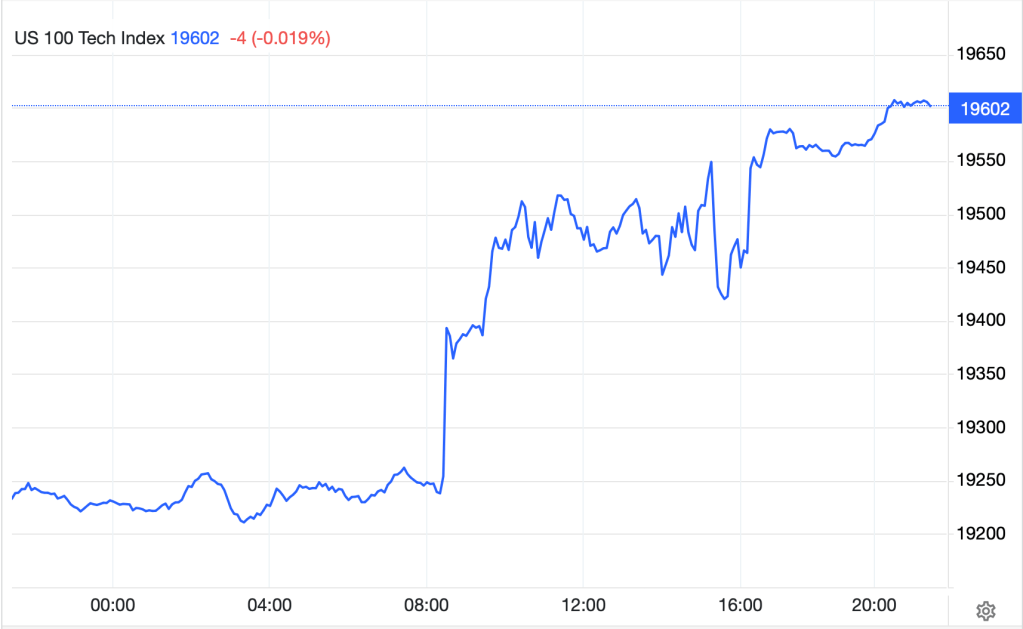

Friday’s abbreviated session in the US saw two of the three major indices trade to new all-time highs (NASDAQ is < 1.0% below its recent high) and that seemed to help support the Asian time zone markets with green outcomes nearly universal. Japan (+0.8%), China (+0.8%) and Hong Kong (+0.65%) all had solid sessions as did every regional exchange other than Indonesia (-0.95%) which has been suffering for the past several months in contrast to most other nations. In Europe, the picture is more mixed with most bourses in the green (DAX +0.8%, IBEX +0.9%) although the CAC (-0.35%) is feeling pain from increased worries that the government there will fall, and the fiscal situation will be a disaster going forward. French yields continue to climb vs. every other European nation as the country is leaderless for now. For the rest of the continent, slightly softer PMI Manufacturing data seems to have investors increasing their bets that the ECB is going to become even more aggressive in their rate cutting going forward. As to the US futures market, at this hour (7:00) it is mixed with the SPX (+0.5%) rising but the other indices little changed.

In the bond market, as mentioned above, US yields have rallied a bit although European yields are all lower by between -2bps and -4bps (France excepted at unchanged) as those hopes for an ECB rate cut are manifest here as well. As to JGB’s, 10yr yields are higher by 2bps this morning as there is increasing chatter that Ueda-san will be hiking rates later this month. One other interesting note here is that in the 30-year space, Chinese yields have fallen below Japanese yields for the first time ever. This seems to be an indication that market expectations of a Chinese rebound (despite solid Caixin PMI data overnight at 51.5) are limited at best.

In the commodity markets, oil is little changed on the day, remaining below the $70/bbl level but potentially seeing some support after a story surfaced that China would be reducing its purchases of Iranian oil in an effort to avoid US sanctions and tariffs under the Trump administration. If Trump is successful in isolating Iran again, that could well support prices. In the metals markets, this morning is seeing a little profit-taking in the precious space after last week’s late rally, but industrial metals are little changed.

Finally, the dollar is stronger again this morning, rallying against all of its counterparts in various degrees. The euro (-0.5%) is lagging along with SEK (-0.65%) in the G10 space as concerns over slowing growth weigh on the single currency. But the dollar is stronger across the board. In the EMG bloc, BRL (-0.75% and back above 6.00) is leading the way lower but we have seen declines across the board with MXN (-0.4%), KRW (-0.7%), ZAR (-0.6%) and HUF (-1.1%) just some of the examples. Despite that hotter than expected PCE data last Wednesday, the market is still pricing a nearly 62% probability of a cut by the Fed later this month.

On the data front, there is much to learn this week, culminating in NFP data on Friday.

| Today | ISM Manufacturing | 47.5 |

| ISM Prices Paid | 55.2 | |

| Tuesday | JOLTS Job Openings | 7.48M |

| Wednesday | ADP Employment | 150K |

| ISM Services | 55.6 | |

| Factory Orders | 0.3% | |

| Fed’s Beige Book | ||

| Thursday | Initial Claims | 215K |

| Continuing Claims | 1905K | |

| Trade Balance | -$75.1B | |

| Friday | Nonfarm Payrolls | 195K |

| Private Payrolls | 200K | |

| Manufacturing Payrolls | 15K | |

| Unemployment Rate | 4.2% | |

| Average Hourly Earnings | 0.3% (3.9% Y/Y) | |

| Average Weekly Hours | 34.3 | |

| Participation Rate | 62.6% | |

| Michigan Sentiment | 73.3 |

Source: tradingeconomics.com

In addition to all the data, we hear from 10 different Fed speakers, most notably Chairman Powell on Wednesday afternoon. Given that the recent data does not seem to be going according to their plans, at least not the inflation data, it will be very interesting to hear what Powell has to say about things.

As the end of the year approaches with many changes certain to come alongside the Trump inauguration, I will once again express my view that hedging is crucial for risk managers here. While I see the dollar benefitting in the near term, as discussed above, the longer-term situation is far less certain.

Good luck

Adf