Remarkably few people care

That Jay and the Fed will soon share

Their latest impressions

On growth and recessions

An outcome, of late, that’s quite rare

Does this mean that ere the next meeting

There will be an increase in bleating

By every Fed speaker

Each one a fame seeker

As they realize stardom is fleeting?

I wonder how the atmosphere in the meeting room at the Marriner Eccles building has changed today vs. what it has been for the past decade at least. Usually, the FOMC meets, and financial markets are riveted by the potential and then everything comes to a virtual standstill as traders and investors await the wisdom of the Fed Chair to help determine where markets are likely to go. I am reminded of the crop report scene in Trading Places, where the entire pit stops to watch the news and then springs back into action.

One of the consequences of this evolution is that every member of the FOMC feels it is their duty to reiterate their views as frequently as possible, whether they are changing or not, because they are trying to increase their profile to ensure a lucrative future gig want to make sure that the American people understand just how much the Fed is doing to help them and the nation. This is why for the first four weeks after a Fed meeting, virtually every day we have at least one if not two or three FOMC members repeating themselves ad nauseum.

But suddenly, they have real competition for airtime. President Trump, no shrinking violet he, is incredibly adept at forcing all the world’s attention on himself, to the exclusion of formerly important voices like Alberto Musalem or Lisa Cook. Now, the fact that you can probably not remember who those two people are is exactly my point. FOMC members speak constantly, but it is the office, not the voice, to which people are listening. And right now, fewer and fewer people are listening to the Fed because President Trump is commanding all the attention. In fact, to the extent the Fed is discussed, it is generally in relation to how they are going to respond to Trump’s next moves.

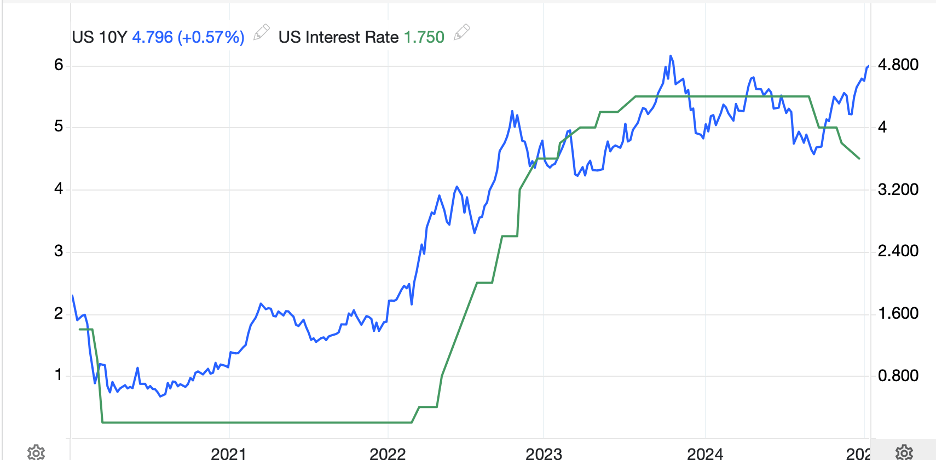

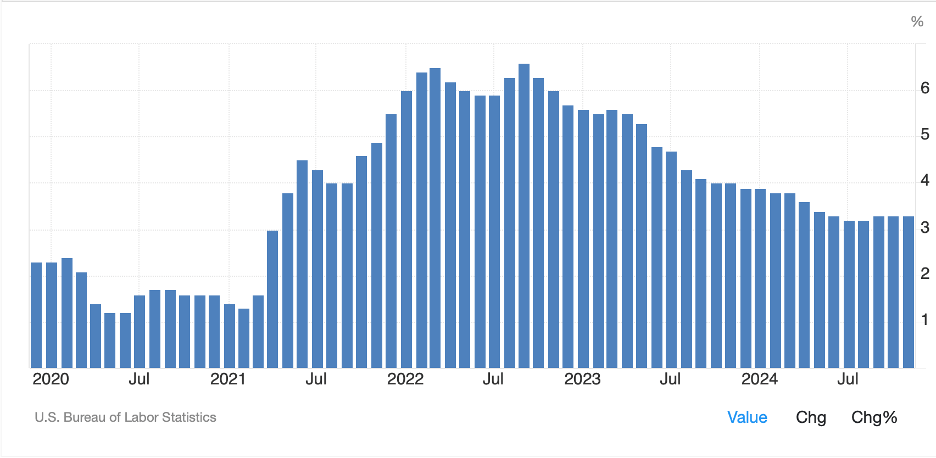

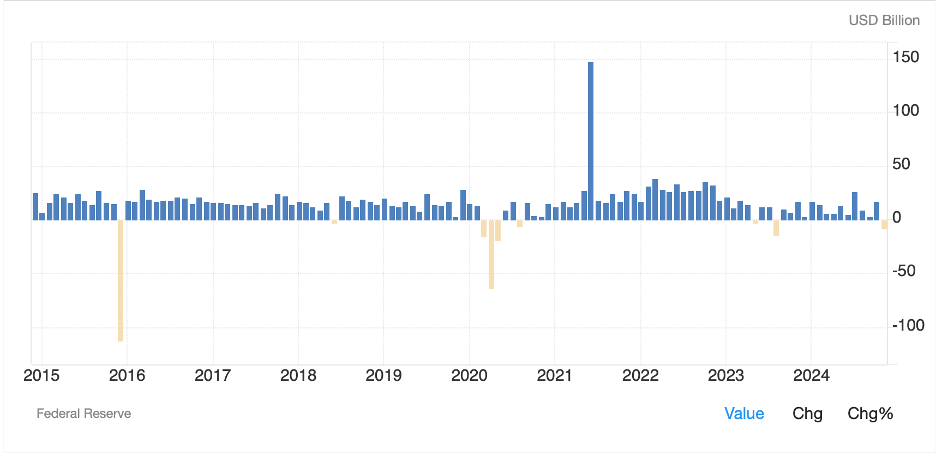

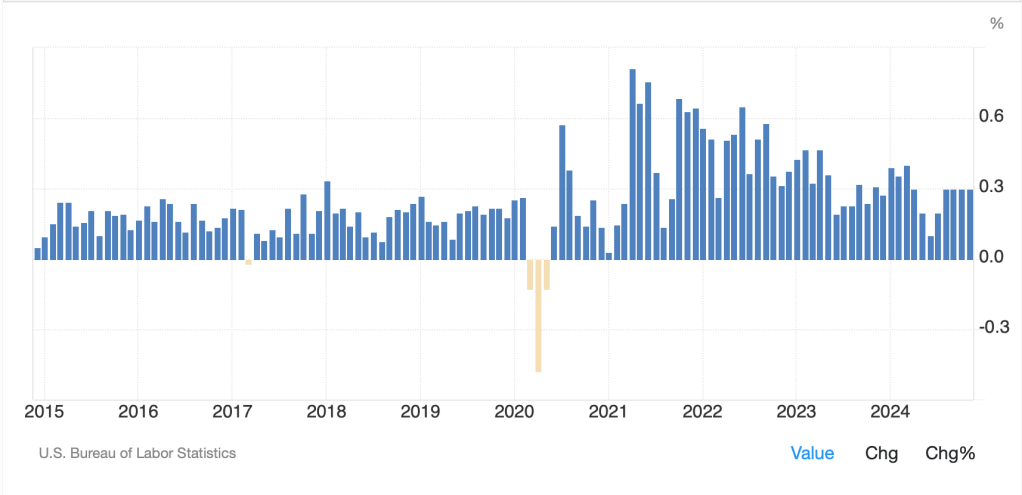

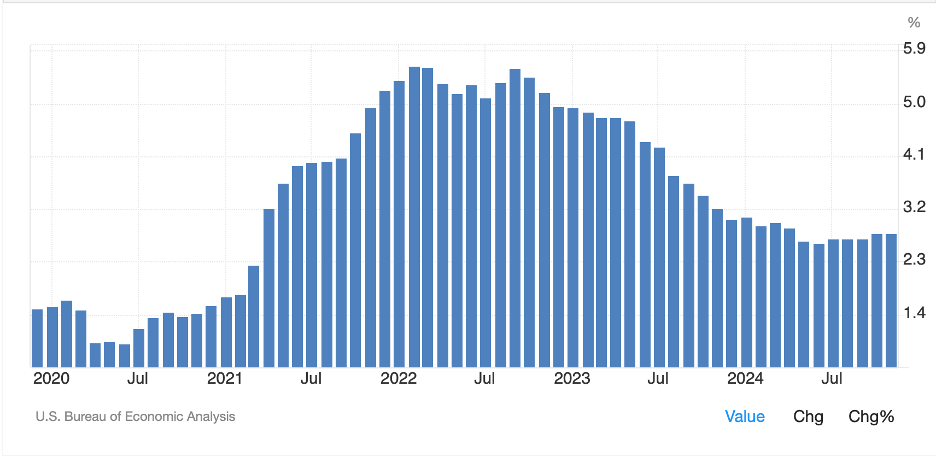

But, in an effort to maintain our focus on markets and not politics, to the extent that is possible right now, the Fed still has a role to play in both expectations of how things are going to evolve as well as actual pricing. A quick summation of where we have been with Powell and friends is that last year, starting in September they cut rates for the first time in nearly two years and have since reduced the Fed funds rate by 100bps. A key issue here is the fact that the economy is showing no signs of slowing down, unemployment remains modest at best, and inflation has been, at best, bottoming well above their 2.0% target, if not rising again. Hence, there have been many questions as to why they cut rates at all.

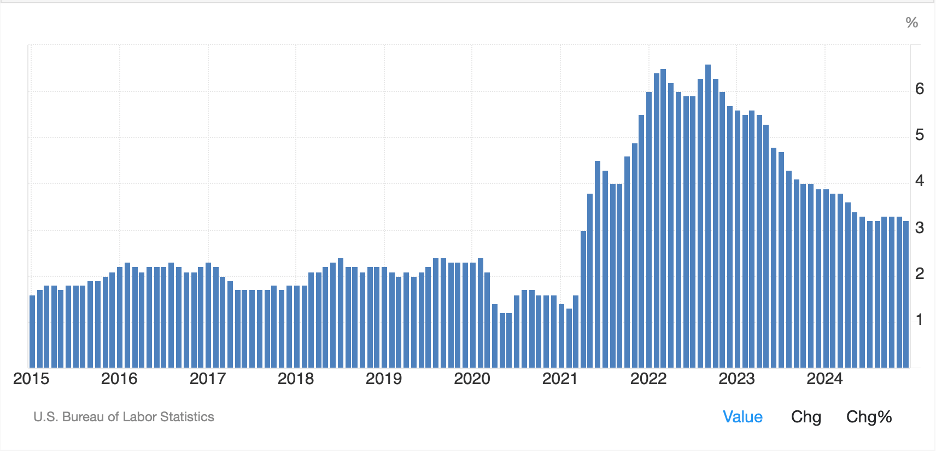

At this point, though, the Fed’s narrative prior to the quiet period, was one of increased caution that further rate cuts may not be necessary, or certainly not imminent, given the ongoing positivity in the economic situation. As such, there is no expectation for a rate cut today, and according to the Fed funds futures market, only a 30% probability of a March cut, with basically two full cuts priced in for all of 2025. I would argue that based on the data we have seen, it is not clear why there would be any further cuts, and, in fact, believe that by mid-year, we are likely to start to hear talk of a rate hike before the end of the year. This will be dependent on the data, but if inflation continues to remain sticky (see chart of Core PCE below), the bar for cuts will move higher still. Certainly, to my non-PhD trained eye, it doesn’t really look like their key metric is declining anymore.

Source: tradingeconomics.com

Perhaps the most remarkable thing about this Fed meeting is that I have seen virtually nothing regarding expectations of how the statement may change or forecasts may change. FWIW, which is probably not much, my take is the statement will be virtually identical given no real changes in the data trends, and that Chairman Powell will go out of his way to say absolutely nothing at the presser, especially when asked about President Trump and his policies. Of course, this will not prevent the cacophony of Fedspeak that will come between now and the next meeting, but there may be fewer folks paying attention.

Ok, let’s turn to markets. While Monday was a tech stock rout, yesterday was the reverse with the NASDAQ shaking off the DeepSeek fears or actually embracing them based on Jevon’s Paradox (the idea that the more efficient something becomes, the greater the need/desire for it and therefore the increase in its price) leading to the new narrative that Nvidia’s chips will be in more demand. But regardless, everybody was happier! Asian markets responded with the Nikkei (+1.0%) regaining some luster on the tech story as well as the weaker JPY, which saw the dollar rally a full yen on the session, although it is little changed overnight. While not universal, there was a lot more green than red in Asia, although Chinese shares (-0.4%) did not participate.

In Europe, most bourses are showing gains this morning although the CAC (-0.3%) is lagging after luxury goods makers saw weaker growth than expected. But the DAX (+0.75%) and IBEX (+1.0%) are both stronger as is the FTSE 100 (+0.3%) as Chancellor Reeves continues to try to explain that growth is Labour’s goal despite all their policies that seem to point in the other direction. As to US futures, at this hour (7:30) they are higher led by the NASDAQ (+0.5%).

In the bond market, the fear from Monday is gone although the bounce in yields was modest yesterday and this morning Treasury yields are unchanged on the session. I suspect that there is some waiting for the Fed involved here. European sovereign yields, though, are all a bit lower, down between -2bps and -3bps, as investors anticipate tomorrow’s ECB rate cut and are looking for a dovish message going forward.

In the commodity space, yesterday modest rebound in oil (-0.6%) is being reversed this morning while NatGas (0.0%) is consolidating after a dramatic decline in the past week of more than 20% given the latest weather models are now calling for much warmer temperatures in the northern hemisphere. In the metals markets, gold (-0.2%) is consolidating yesterday’s gains as is silver (+0.2%) and copper (-0.1%). For now, these are not all that interesting.

Finally, in the FX markets, the dollar continues to regain momentum higher with the euro (-0.3%) sliding back below 1.04 this morning and the DXY (+0.2%) back above 108.00. However, looking across both the G10 and EMG blocs, while the dollar’s strength is widespread, it is not dramatic, with AUD (-0.5%) and PLN (-0.5%) the biggest movers of the session. It should be no surprise that there is confusion here given the uncertainty sown by President Trump and his tariff discussions.

On the data front, the only numbers today, aside from the FOMC meeting and the BOC meeting (expected 25bp cut) is the Goods Trade Balance (exp -$105.4B). We also get the EIA oil data with inventory builds anticipated. But really, despite the seeming lack of interest leading up to today’s FOMC meeting, it is the only game in town. To me, the risk is something more dovish as that part of the narrative seems to be ebbing lately, so will be a real surprise. If that is the case, then I suspect the dollar will suffer somewhat.

Good luck

Adf