For months, I was calmly assured

A weak dollar must be endured

The US had peaked

And money had leaked

Elsewhere, so it could be secured

But suddenly, it’s not so clear

The end of the dollar is near

Instead, other nations

Have seen expectations

Decline, saying, here, hold my beer

The long holiday weekend is behind us now and with China on holiday all week, it seems there may be fewer interesting stories to consider. However, one of the things that tickled my fancy is the sudden, recent adjustment in several pundits’ views on the dollar.

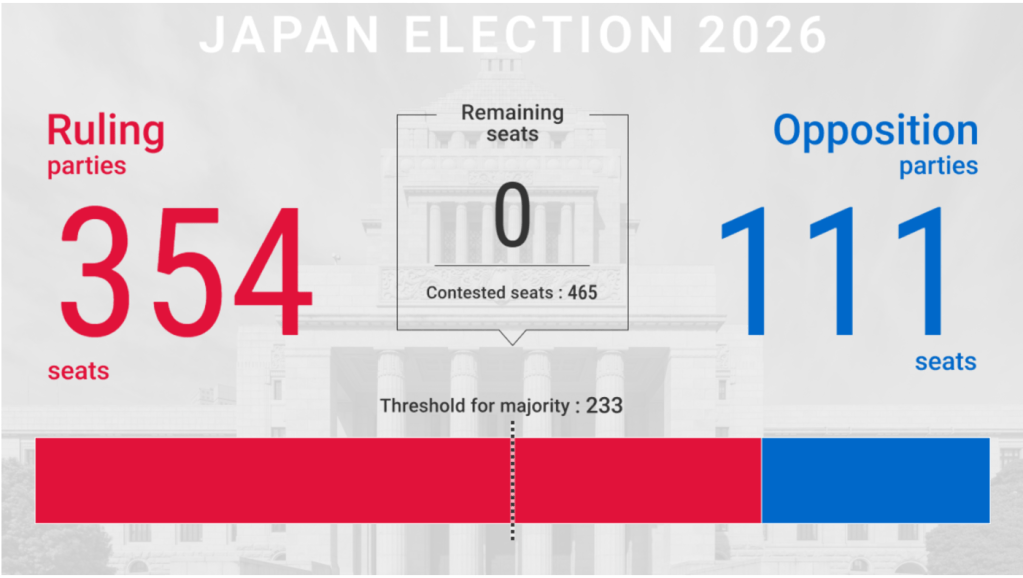

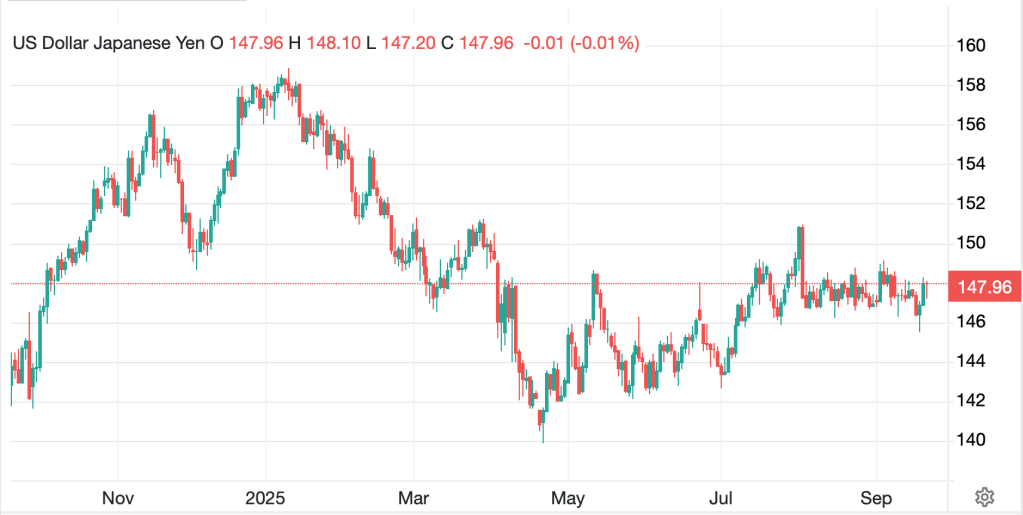

By now you are all aware that I have been more bullish than consensus on the basis of the US economic situation relative to that of Europe and the UK (Japan may have changed their stripes in the wake of Takaichi-san’s recent landslide election, so we will need to revisit that). After all, the combination of stronger GDP growth, higher interest rates and ostensibly calming inflation in the US relative to Europe and the UK (as well as numerous other nations) seemed to offer better investment opportunities, and therefore more demand for the dollar. And this was outside the need for dollars simply to service the enormous amount of USD debt outstanding around the world, estimated at between $60 trillion and $80 trillion.

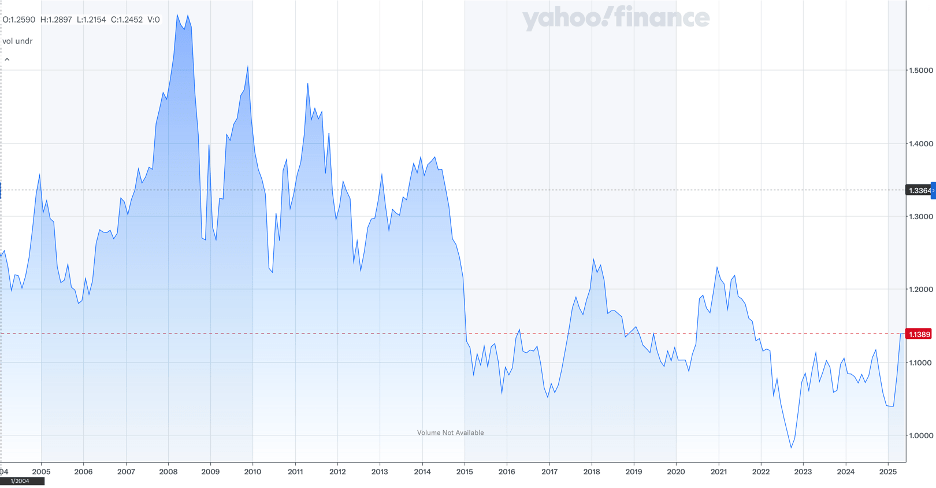

I will use the euro (-0.1%) today, rather than the DXY (+0.35%), as my dollar proxy because there is some deliciously ironic news from Bloomberg on the single currency. But below, you can see the past year’s trading pattern, where, like the DXY, it has largely been range bound since June. Sure, we saw a little spike up at the end of January, during the metals/equity market correction, but that story has passed.

Source: tradingeconomics.com

But I couldn’t help but chuckle at the following two headlines on Bloomberg.com this morning, literally right next to each other.

Briefly, the first story describes how the FinMins throughout the Eurozone want to expand the use of the euro globally and are considering offering swap lines to other nations that have difficulty accessing the single currency (although I cannot imagine why they would have such difficulty). The second story highlights the French explaining that if the first story is true, the euro might gain strength and that would hurt their export industries, something the current government can ill afford right now. It’s almost as if there is no agreement at all.

Just remember, Eurozone GDP is growing at ~1.0%, its base rate is 2.0% and inflation is at 2.3%. In the US, GDP is growing at 3+%, its base rate is 3.75% and inflation was just released at 2.4%. Add to this the fact that energy costs in Europe, which is a price taker producing less than 15% of its energy needs domestically, are more than 2X higher than in the US, and in some countries, 3X higher, and it becomes increasingly difficult to say, damn, euros are the place to be!

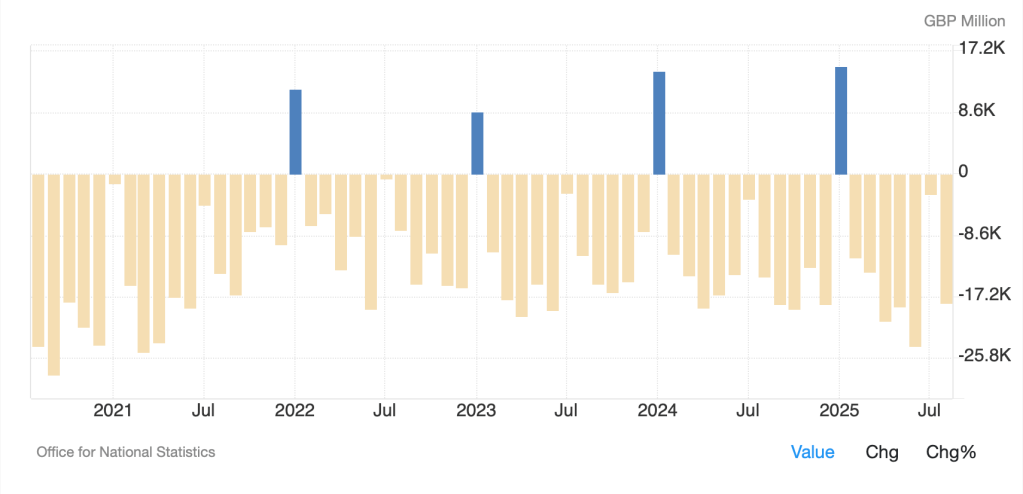

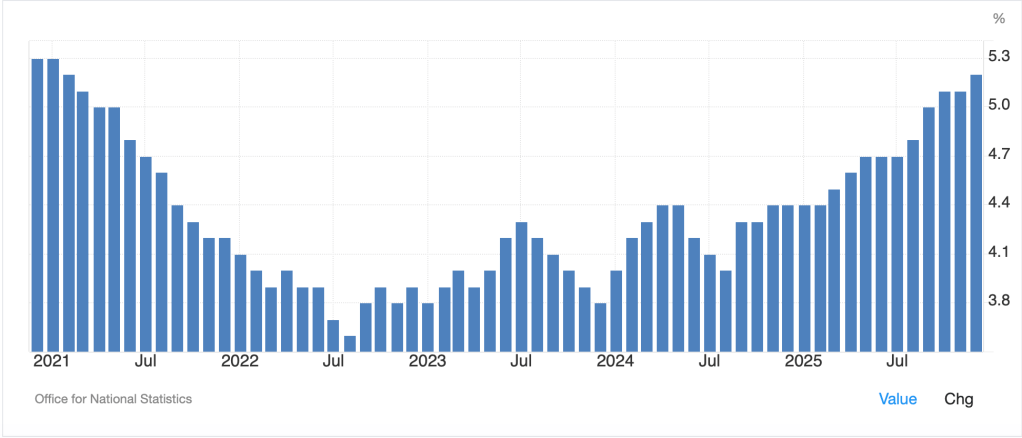

And for the UK, where this morning they reported the highest Unemployment Rate in five years (see chart below) with wages slipping, slowing growth and a worse inflation and energy picture, arguably, things are even worse.

Source: tradingecomomics.com

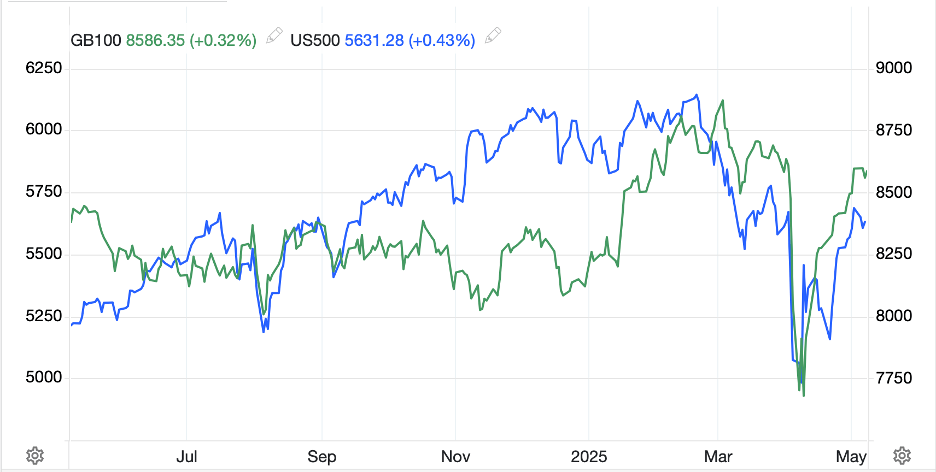

It continues to be difficult for me to understand the relative merits of owning euros or pounds (-0.5%) in the current macroeconomic environment. The fact that equity multiples remain lower there than in the US has certainly peaked some investor interest, but prospects just don’t appear that great.

There are certainly emerging markets whose currencies had been extremely weak, and which have significantly higher real interest rates than in the US (Mexico, Brazil, South Africa) where I can see the attraction, although this morning’s South African Unemployment report (31.4%!) might still give one pause as to the prospects.

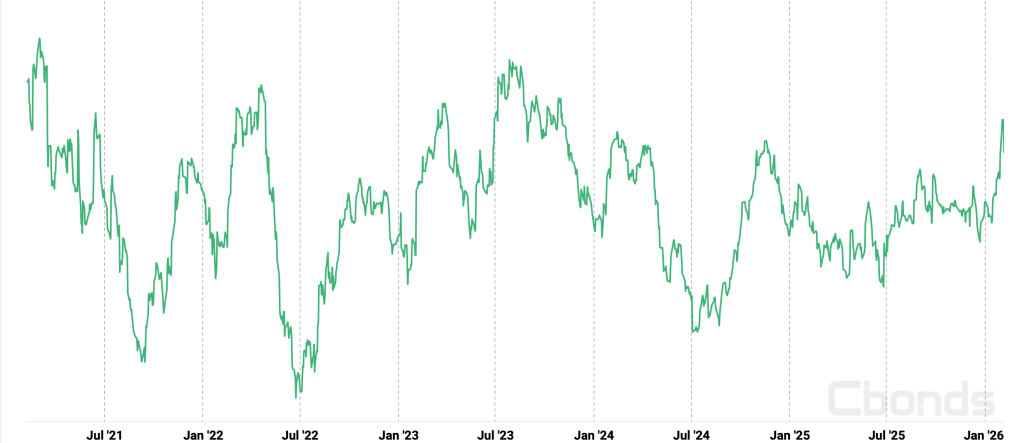

One other place where the currency has been strengthening is China, where the PBOC has been walking the renminbi higher (dollar lower) for the past year (see below), as President Xi seems to want to show the world the renminbi is a strong and stable currency.

Source: tradingeconmics.com

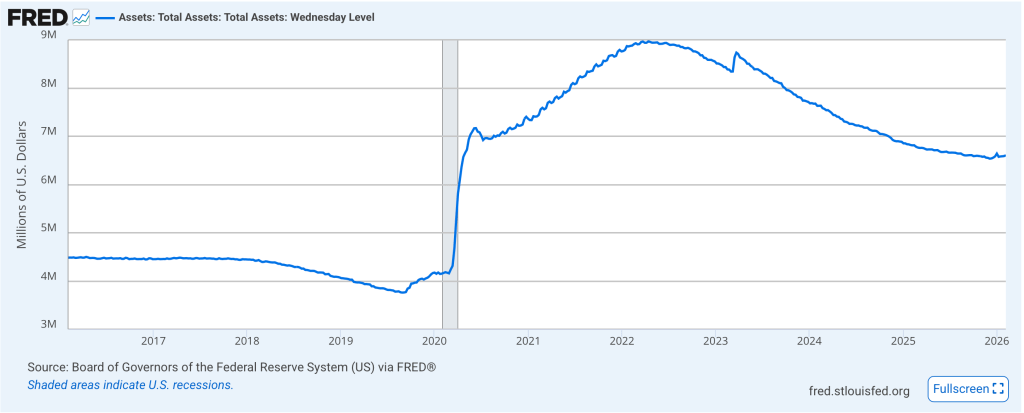

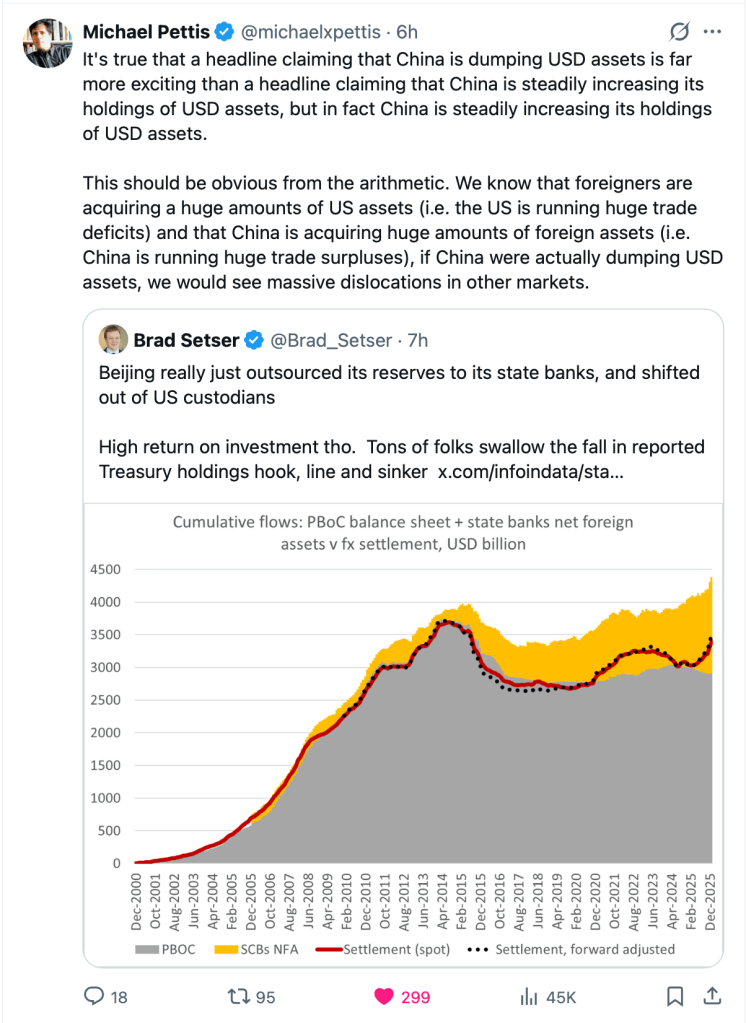

And of course, a large part of this particular currency discussion is that the Chinese are ‘dumping’ US assets, notably Treasuries. Alas, recent data as per the below from two of the best-informed analysts regarding China and its activities shows that the PBOC has basically been offloading Treasuries to State owned Chinese banks and their US assets are, in fact, growing. The CNY is a completely managed currency and can be set at any level the PBOC chooses. Exclaiming the dollar is falling against it is not a very good representation.

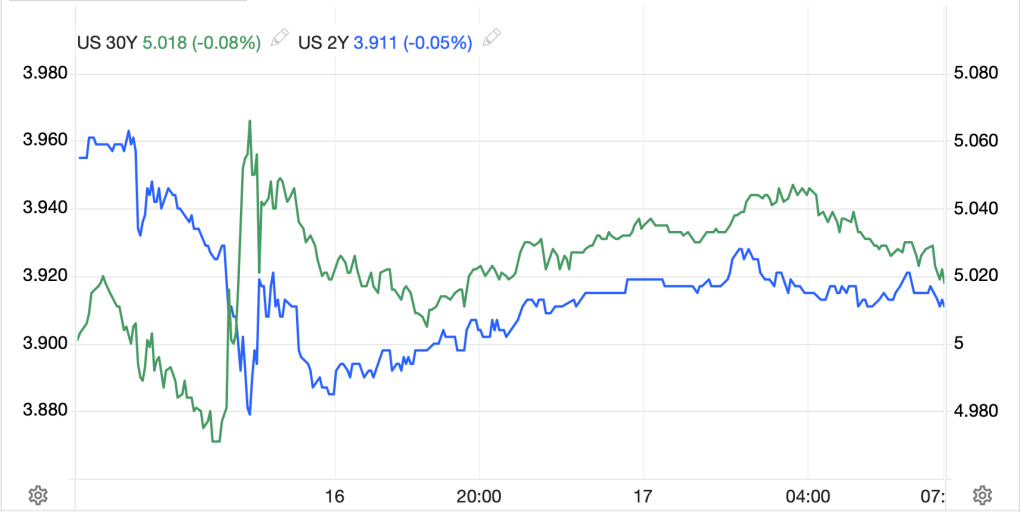

Ok, I will stop repeating myself regarding my view on the dollar and turn to other markets. In equities, Asia was very quiet as numerous nations observed the lunar new year so really, all we saw was Japan (-0.4%), India (+0.2%) and Australia (+0.2%), with China, Korea and Taiwan all closed. I would argue we did not learn very much from the session. Europe, though, is edging higher this morning with Spain (+0.6%) and the UK (+0.45%) leading the way. The latter seems to be benefitting from the bad news is good scenario, as the weak employment data has investors looking for a BOE rate cut at the next meeting, while Spain has not seen any economic data to help drive things. Perhaps, the ZEW data, where both Germany and the Eurozone printed at lower levels than last month and much lower levels than expected, has more belief in an ECB cut coming forward. Net, however, activity here is muted. As to US futures, at this hour (7:25), they are softer with the NASDAQ (-0.7%) the laggard by far.

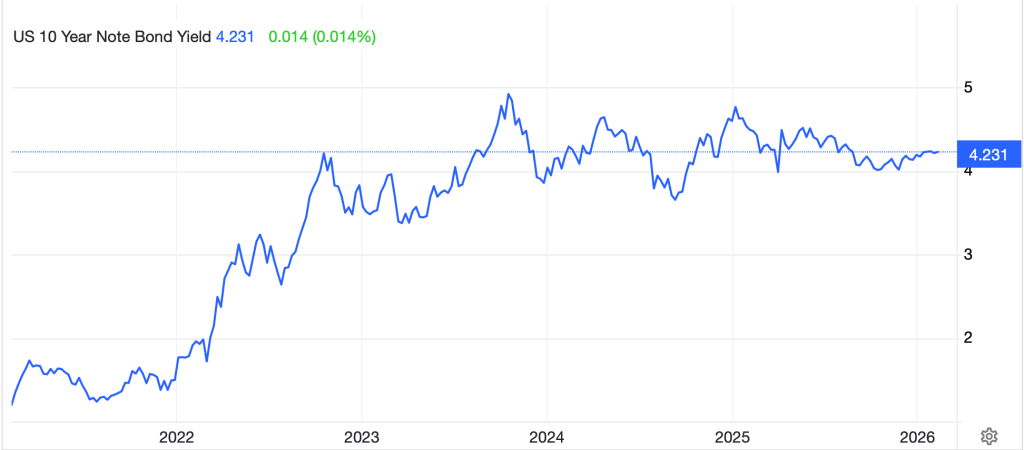

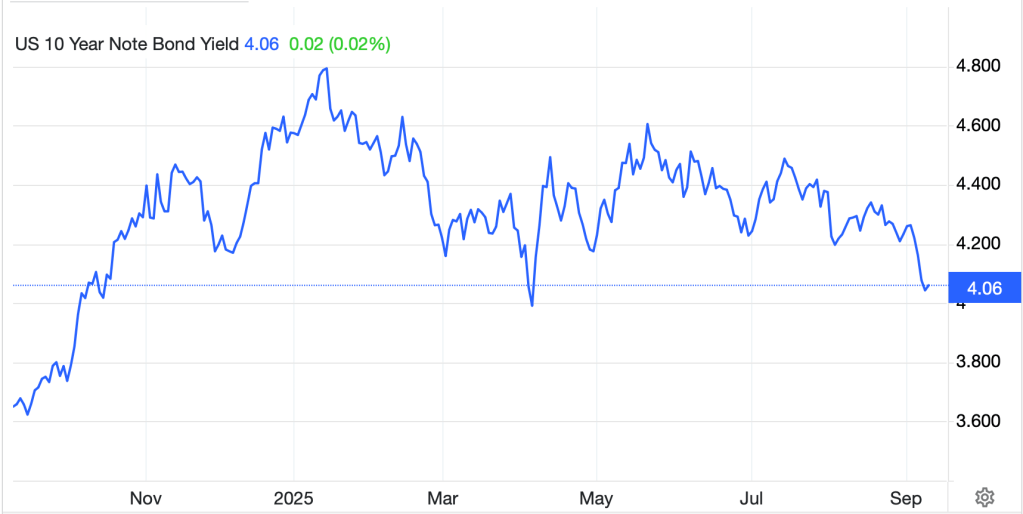

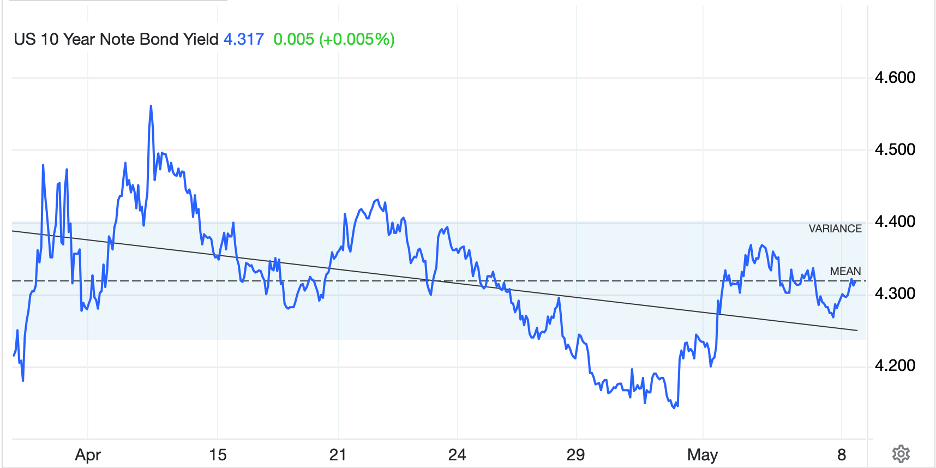

In the bond market, right now, the inflationistas are having a hard time explaining the decline in yields. Treasury yields (-2bps and back to 4.03%) have been marching lower for the past two weeks as per the below, and we have seen similar price action elsewhere.

Source: tradingeconomics.com

European sovereign yields have also slipped -2bps across the board while UK gilt yields have fallen -4bps. But the big winner is Japan (-8bps) where investors apparently no longer fear unfunded spending and aggressive fiscal policy by PM Takaichi, as the 5-year auction last night was extremely well received and investors are looking forward to the 20-year auction later this week.

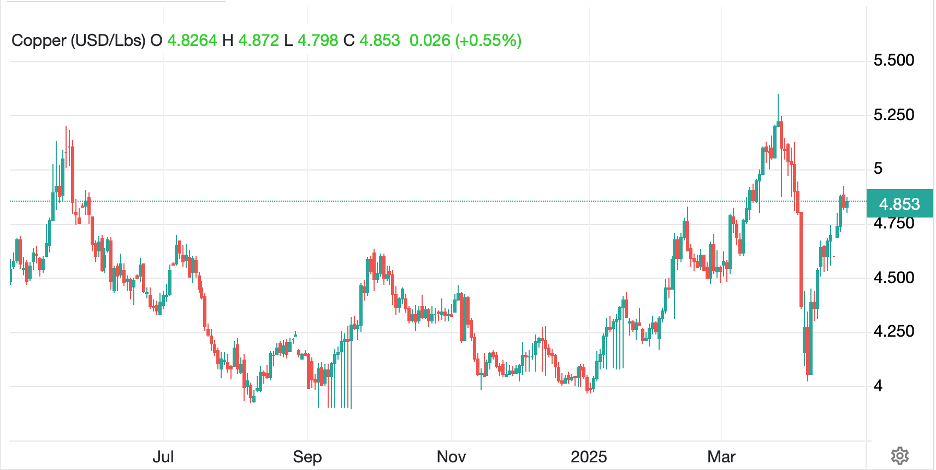

In the commodity bloc, oil (+1.5%) has moved up after Iran closed part of the Strait of Hormuz, restricting traffic there. This seems odd to me as they desperately need that to remain open to deliver their oil, but perhaps they are trying to show their strength. A second round of discussions are ongoing between the US and Iran as I type, so we shall see what happens here. Meanwhile, in the metals markets, with China on holiday, and given they have been the source of the most demand, it cannot be surprising that all are lower this morning (Au -1.0%, Ag -0.75%, Cu -1.3%, Pt -1.7%). My take is these markets are likely to spend the next several months consolidating before any leg higher (and I believe that is the direction) will be evident.

Finally, we discussed the dollar above and the only noteworthy move beside the pound is SEK (-0.6%) which appears more to be a function of its higher beta to the rest of Europe than any specific news.

On the data front, this week brings a bunch as follows:

| Today | Empire State Manufacturing | 6.0 |

| Wednesday | Housing Starts | 1.33M |

| Building Permits | 1.40M | |

| Durable Goods | -2.0% | |

| -ex Transport | 0.3% | |

| IP | 0.4% | |

| Capacity Utilization | 76.5% | |

| FOMC Minutes | ||

| Thursday | Initial Claims | 225K |

| Continuing Claims | 1870K | |

| Trade Balance | -$56.0B | |

| Phiily Fed | 9.3 | |

| Friday | Q4 GDP | 3.0% |

| Personal Income | 0.3% | |

| Personal Spending | 0.4% | |

| PCE | 0.3% (2.8% Y/Y) | |

| -ex food & energy | 0.3% (2.9% Y/Y) | |

| Flash Mfg PMI | 52.6 | |

| Flash Service PMI | 53.0 | |

| Michigan Confidence | 57.0 | |

| New Home Sales | 730K |

Source: tradingeconomics.com

In addition, we hear from 5 more Fed speakers, but as I have consistently said, I don’t think they matter that much at this point. Overall, my take is that sector rotation in the equity markets is the key activity there, that bond markets are beginning to get more comfortable with a lower inflation outlook since the recent data has been pointing in that direction, and that the dollar, despite its many detractors, is not dead yet. We have seen an awful lot of volatility for the past several weeks. As I have repeatedly reminded you, that cannot continue forever. While I am sure that we will see more bouts of volatility this year, it does feel like for the next several sessions, things will be pretty quiet. Let’s be thankful for that.

Good luckA