Today is a day to give thanks

To those who flew planes and drove tanks

In multiple wars

And too many tours

No matter which service or ranks

Now, turning to markets at hand

The bulls, yesterday, had command

So, risk assets rose

While pundits compose

A narrative, things are just grand

And the thing is, there is just not that much new of note to discuss this morning. As it is Veteran’s Day here in the US, banks and the bond market are closed, although equities and commodities markets are open. But the news cycle overnight was led by the fact that Softbank sold their NVDA stake for a $5.8 billion profit. And that’s pretty thin gruel for someone who writes about market activities. Everything else is about who won/lost regarding the shutdown and frankly, that is something markets tend to ignore.

With that in mind, and given the absence of any substantive data, let’s go right into market activity overnight. Asian equity markets were mixed although I would say there was more red (Japan, China, Taiwan, Australia, Indonesia, Thailand, Philippines) than green (HK, Singapore, Malaysia, Korea, India) but it appears most of the activity had limited volumes and there are few stories of note as drivers.

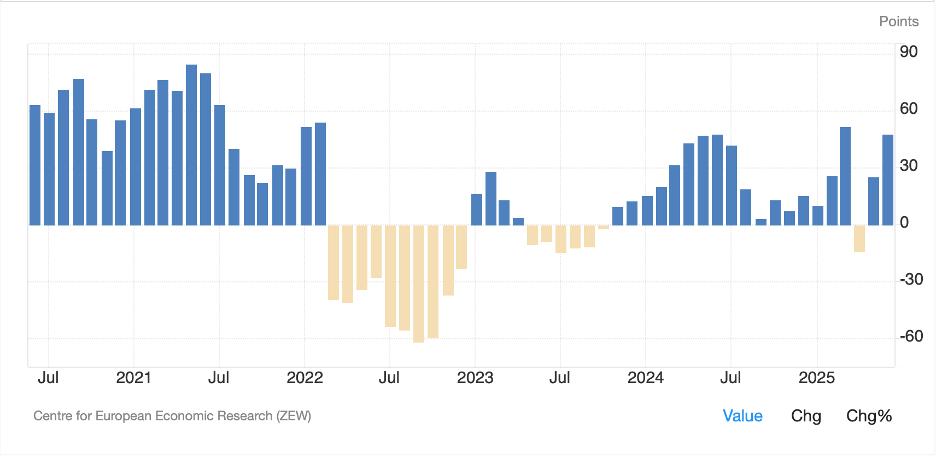

In Europe, though, things are looking better with all the major bourses higher this morning, led by the UK (+0.8%) where bad news was good for stocks as the Unemployment Rate ticked higher, to 5.0%, which has markets now pricing an 80% probability of a rate cut by the BOE next month. This has been enough to help most European markets higher (CAC +0.65%, IBEX +0.5%) except for the DAX (0.0%) which is lagging after the ZEW Sentiment Index was released at a weaker than forecast 38.5, which was also down from last month’s reading.

I think it might be worthwhile, though, to take a longer-term perspective on this sentiment survey. As you can see from the chart below (data from ZEW.de), the current level is very middle of the pack. In fact, the long-term average reading is 21.3, but of course, that includes numerous negative readings during recessions. I might argue that things in Germany are not collapsing, but nowhere near robust. My concern, if I were a German policymaker, is that it appears the survey has peaked at a much lower level than history, an indication that the best they can hope for is still mediocre.

Finally, US futures are pointing slightly lower, -0.2% or so, at this hour (7:50), arguably a little hangover from yesterday.

In the bond market, of course, Treasury yields aren’t trading, but European sovereigns are essentially unchanged as well, except for UK Gilts, which have seen yields slip -7bps on that higher Unemployment data driving rate cut expectations. Given the ongoing fiscal issues in the UK, where they cannot seem to come up with a budget and all signs point to a worsening debt position, I’m not sure why yields there would decline, but that’s what’s happening.

Turning to the commodity markets, oil (+0.5%) continues to trade either side of $60/bbl, making no headway in either direction. I listened to an excellent podcast yesterday with Doomberg, who once again highlighted his view that the long-term direction of the price of oil is lower. The case he makes is that on an energy basis, NatGas, even though it is up 48% in the past year, remains significantly cheaper than oil, one-quarter the price, and that the arbitrage will close driving the price of oil lower and the price of NatGas higher. Remember, politics is far more impactful on oil drilling than geology. Ask yourself what will happen to the price of oil if Venezuela’s government falls and is replaced by a pro-US government allowing the oil majors in to help tap the largest oil reserves on the planet. I assure you that is not bullish for the price of oil.

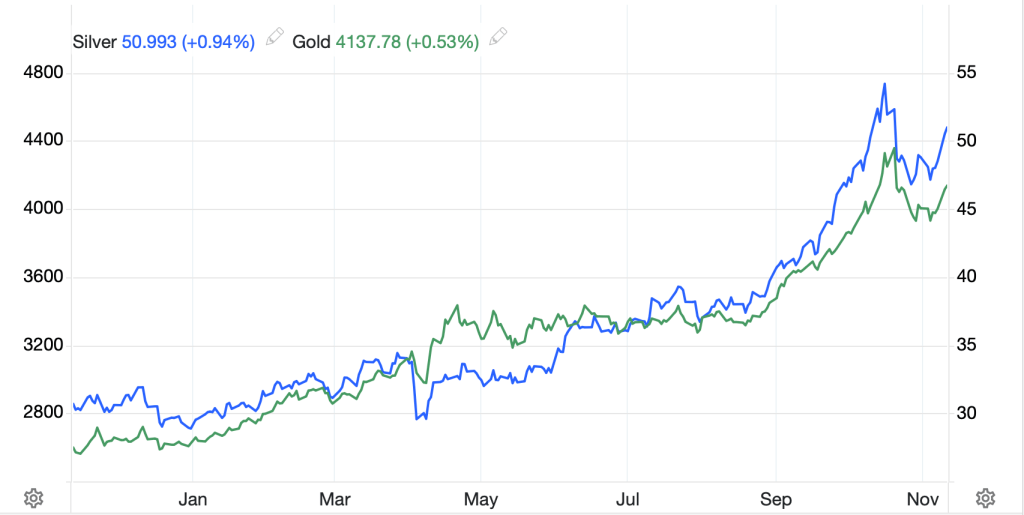

As to the metals markets, after yesterday’s very impressive moves, they are continuing higher this morning, at least the precious metals are with gold (+0.5%), silver (+0.8% and now over $50/oz) and platinum (+0.75%) all extending their gains. These are the same charts in the metals, and my take is we had a blowoff run which has now corrected, and we could easily see another leg higher of serious magnitude.

Source: tradingeconomics.com

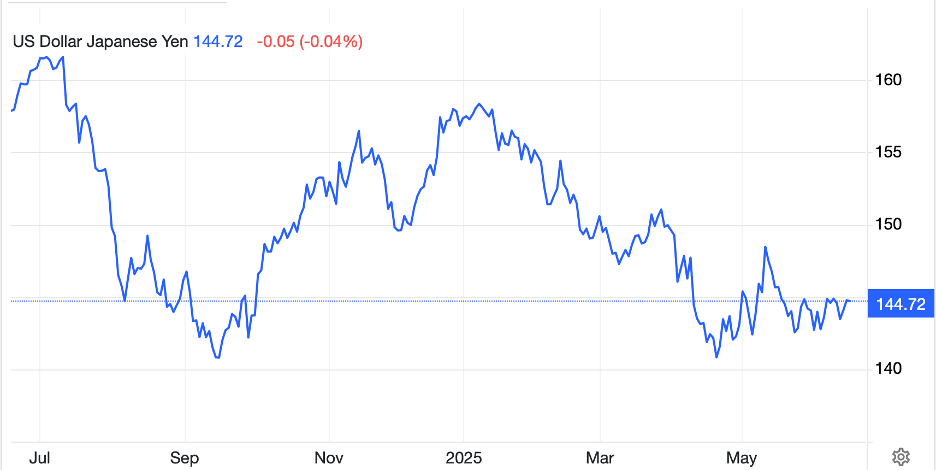

Finally, the dollar is mostly drifting lower this morning, although not universally so. While the euro (+0.15%), CHF (+0.6%) and Scandies (NOK +0.6%, SEK +0.4%) are all firmer, the pound (-0.2%) and Aussie (-0.2%) are suffering a bit. Yen is unchanged along with CAD. In the EMG bloc, it is also a mixed bag with INR (+0.25%) and PLN (+0.25%) having solid sessions although KRW (-0.6%) is going the other way and the rest of the bloc is +/- 0.1% or so different. Again, the dollar is just not that exciting in its own right.

There is a new data point coming out, ADP Weekly Employment change, seemingly in an effort to fill in gaps until the BLS gets back to work. However, given its newness, it is not clear what value it will have to markets. There is also a speech by Governor Barr but tomorrow is when the Fedspeak really hits.

It is shaping up to be a quiet day, and I suspect absent a major equity move, or some White House bingo, FX markets are going to drift nowhere of note.

Good luck

adf