While jobs data Friday was fine

The weekend has seen a decline

In positive news

As riots infuse

LA with a new storyline

The protestors don’t like that ICE

Is doing their job in a trice

So, Trump played a card,

The National Guard

As markets search for the right price

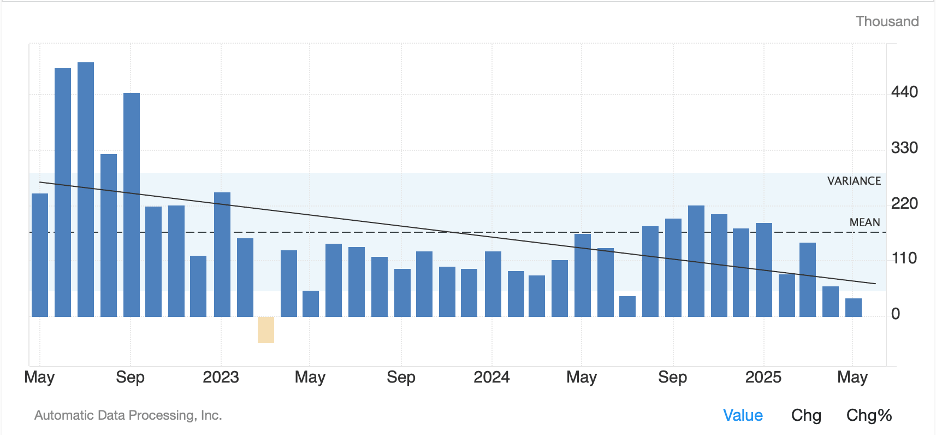

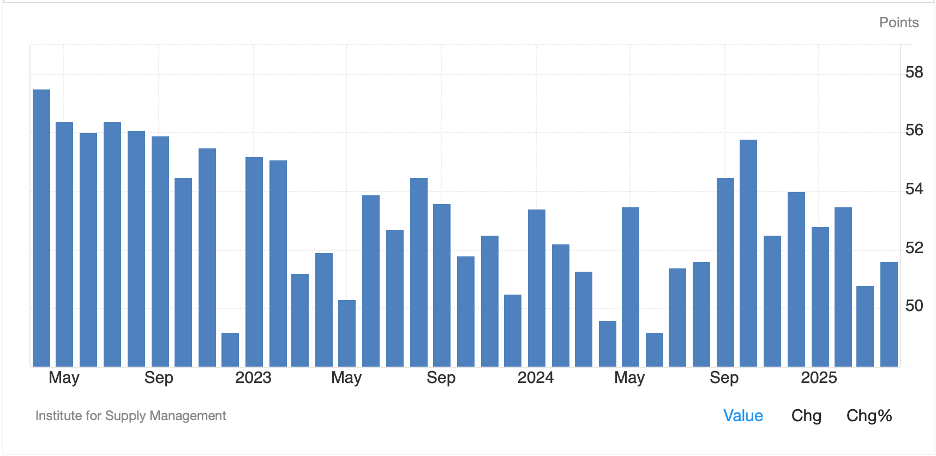

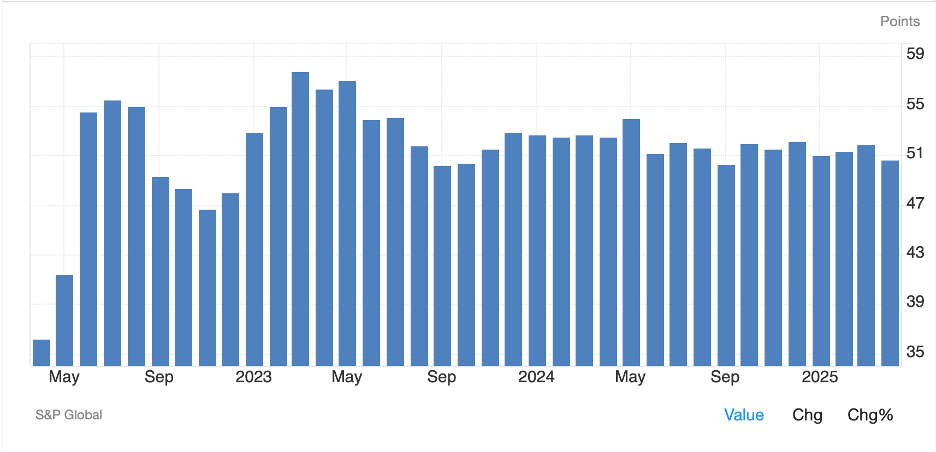

Despite all the anxiety regarding the state of the economy, with, once again, survey data like ISM showing things are looking bad, the most important piece of hard data, the Unemployment report, continues to show that the job market is in solid shape. Friday’s NFP outcome of 139K was a few thousand more than forecast, but a lot more than the ADP result last Wednesday and much better than the ISM indices would have indicated. Earnings rose, and government jobs shrunk for the first time in far too long with the only real negative the fact that manufacturing payrolls fell -8K. But net, it is difficult to spin the data as anything other than better than expected. Not surprisingly, the result was a strong US equity performance and a massive decline in the bond market with 10-year yields jumping 10bps in minutes (see below).

Source: tradingeconomics.com

But that is not the story that people are discussing. Rather, the devolution of the situation in LA is the only story of note as ICE agents apparently carried out a series of court-warranted raids and those people affected took umbrage. The face-off escalated as calls for violence against ICE officers rose while the LAPD was apparently told to stand down by the mayor. President Trump called out the National Guard to protect the ICE agents and now we are at a point of both sides claiming the other side is acting illegally. Certainly, the photos of the situation seem like it is out of hand, reminding me of Minneapolis in the wake of George Floyd, but I am not on site and can make no claims in either direction.

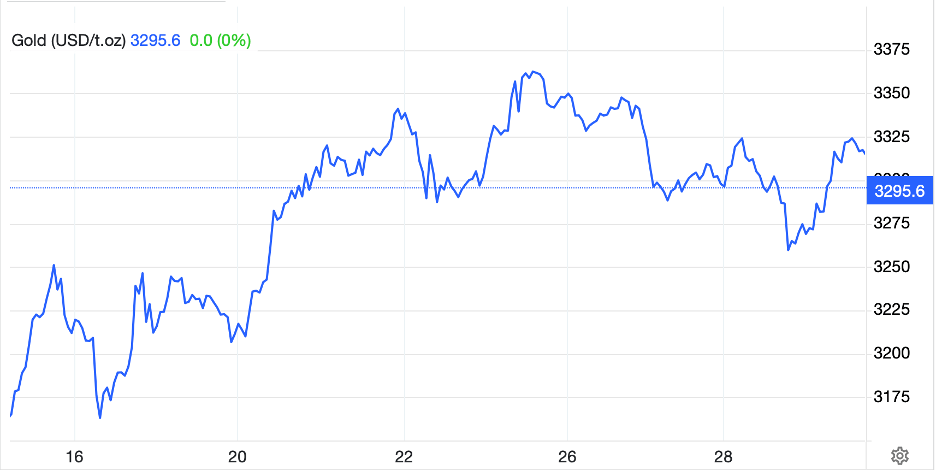

It strikes me that for our purposes here, the question is how will this impact markets going forward. A case could be made that the unrest is symptomatic of the chaos that appears to be growing around several cities in the US and could be blamed for investors seeking to move their capital elsewhere, thus selling US assets and the dollar. Equally, a case could be made that haven assets remain in demand and while US equities do not fit that bill, Treasuries should. In that case, precious metals and bonds are going to be in demand. The one thing about which we can be sure is there will be lawsuits filed by Democratic governors against the federal government for overstepping their authority, but no injunctions have been issued yet.

However, let’s step back a few feet and see if we can appraise the broader situation. The US fiscal situation remains cloudy as the Senate wrangles over the Big Beautiful Bill (BBB), although I expect it will be passed in some form by the end of the month. The debt situation is not going to get any better in the near-term, although if the fiscal package can encourage faster nominal growth, it is possible to flatten the trajectory of that debt growth. Meanwhile, the tariff situation is also unclear as to its results, with no nations other than the UK having announced a deal yet, although the administration continues to promise a number are coming soon.

If I look at these issues, it is easy to grow concerned over the future. While it is not clear to me where in the world things are that much better, capital flows into the US could easily slow. Yet, domestically, one need only look at the consumer, which continues to buy a lot of stuff, and borrow to do it (Consumer Credit rose by $17.9B in April) and recognize that the slowdown, if it comes, will take time to arrive. Remember, too, that every government, everywhere, will always err on the side of reflating an economy to prevent economic weakness, and that means that the first cracks in the employment side could well lead to Fed cuts, and by extension more inflation. (This note by StoneX macro guru Vincent Deluard discussing the Cancellation of Recessions is a must read). I have spoken ad nauseum about the extraordinary amount of debt outstanding in the world, and how it will never be repaid. Thus, it will be refinanced and devalued by EVERY nation. The question is the relative pace of that adjustment. In fact, I would argue, that is both the great unknown, and the most important question.

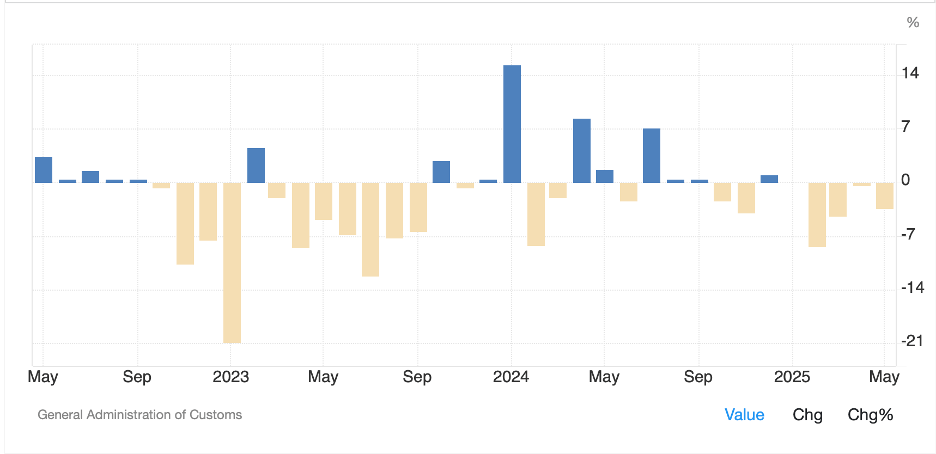

While answering this is impossible, a few observations from recent data are worth remembering. US economic activity, at least per the Atlanta Fed’s GDPNow continues to rebound dramatically from Q1 with a current reading of 3.8%. Meanwhile, Chinese trade data showed a dramatic decline in exports to the US (-35%) but an increased Trade Surplus of $103.2B as they shifted exports to other markets and more interestingly, imports declined-3.4%. in fact, it is difficult to look at this chart of Chinese imports over the past 3 years and walk away thinking that their economy is doing that well. Demand is clearly slowing to some extent, and while their Q1 GDP was robust, that appears to have been a response to the anticipated trade war. Do not be surprised to see Chinese GDP slowing more substantially in Q2 and beyond.

Source: tradingeconomics.com

Europe has been having a moment as investors listen to the promises of €1 trillion or more to build up their defense industries and flock to European defense companies that had been relatively cheap compared to their US counterparts. But as the continent continues to insist on energy suicide, the long-term prospects are suspect. Canada just promised to raise its defense spending to 2% of GDP, finally, a sign of yet more fiscal stimulus entering the market and the UK, while also on energy suicide watch, has seen its service sector hold up well.

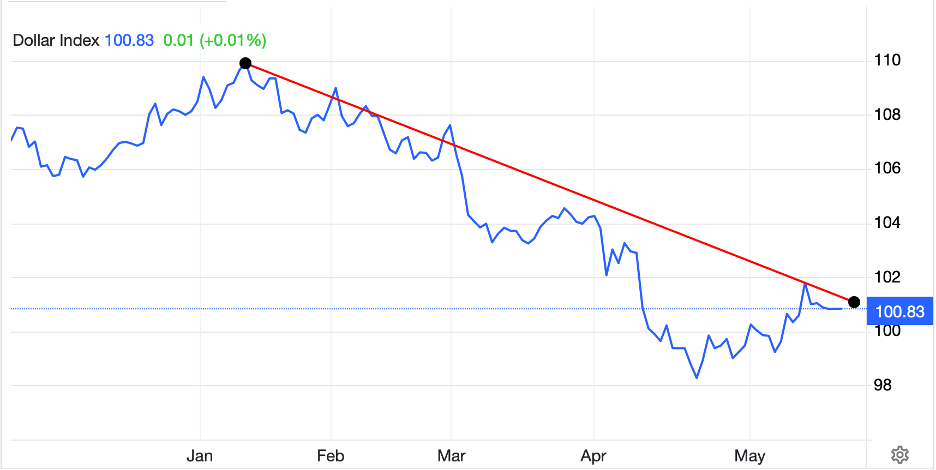

The common thread, which will be exacerbated by the BBB, is that more fiscal spending, and therefore increased debt are the future. Which nation is best placed to handle that increase? Despite everything that you might believe is going wrong in the US, ultimately the economic dynamism that exists in the US surpasses that of every other major nation/bloc. I still fear that the Fed is going to cut rates, drive inflation higher and undermine the dollar before the year is over, but in the medium term, no other nation appears to have the combination of skills and political will to do anything other than what they have been doing already. And that is why the long-term picture in the US remains the most enticing. This is not to say that US asset prices will improve in a straight line higher, just that the broad direction remains clear, at least to me.

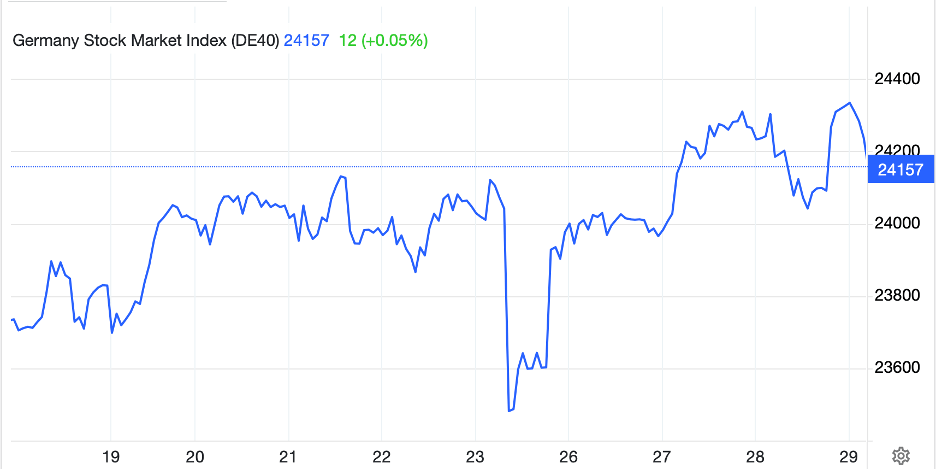

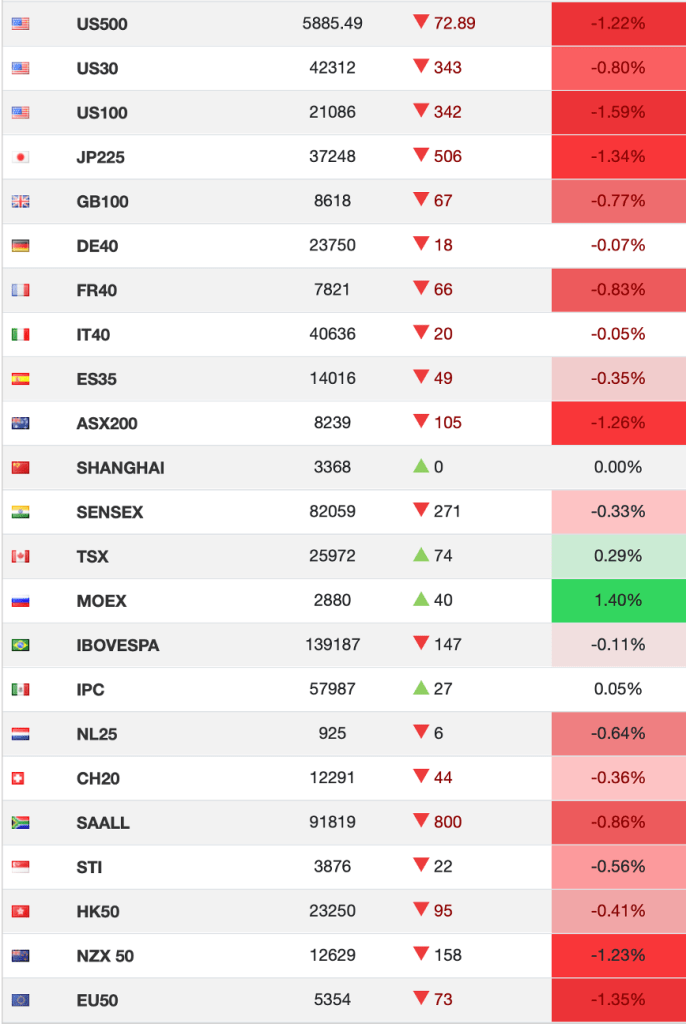

Ok, I went on way too long, sorry. As there is no US data until Wednesday’s CPI, we will ignore that for now. A market recap is as follows: Asia had a broadly stronger session with Japan, China, HK, Korea and India all following in the US footsteps from Friday and showing solid gains. Europe, though, is mostly in the red with only Spain’s 0.25% gain the outlier amongst major markets. As to US futures, they are essentially unchanged at this hour (7:00).

Treasury yields have backed off -2bps from Friday’s sharp climb and European sovereign yields are softer by between -3bps and -4bps as although there has been no European data released; the discussion continues as to how much the ECB is going to cut rates going forward. JGB yields were unchanged overnight.

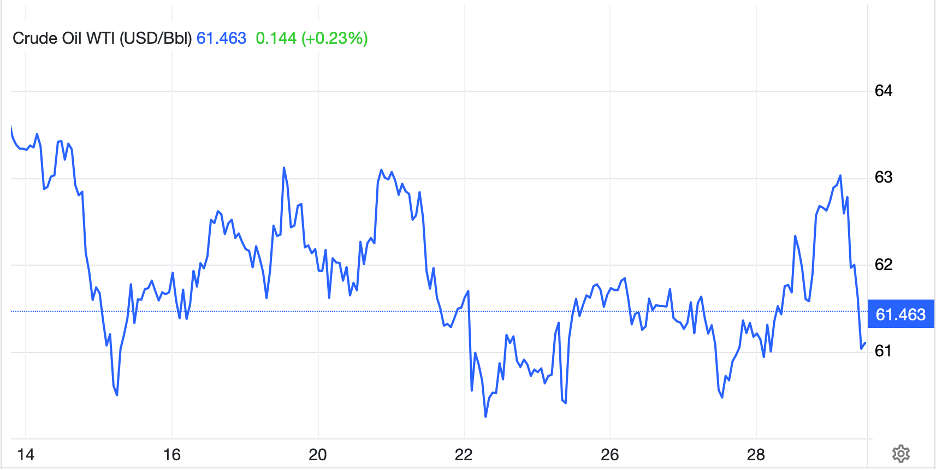

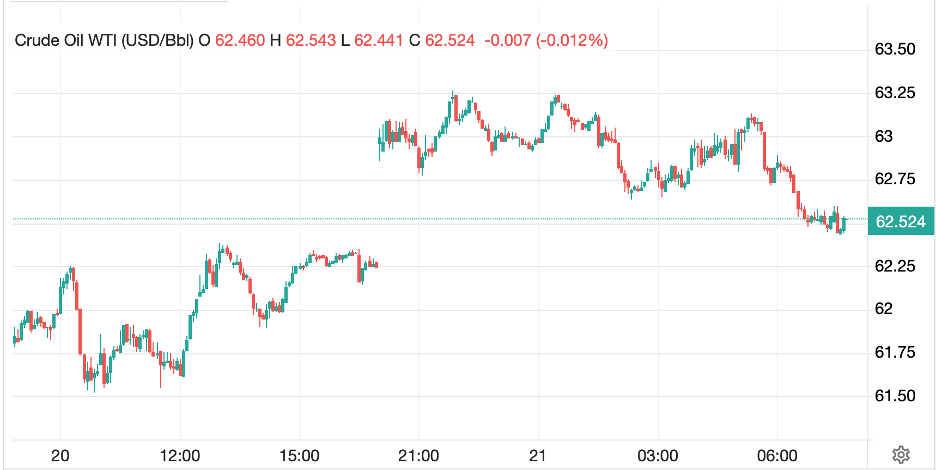

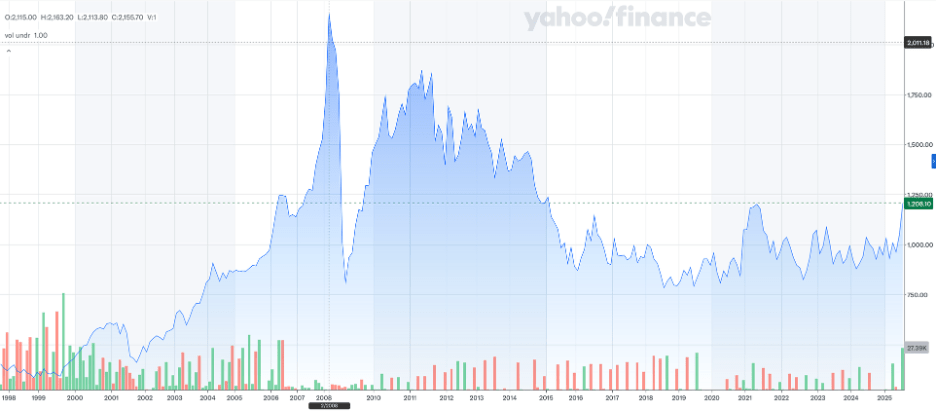

In the commodity space, while oil (+0.3%), gold (+0.1%) and even silver (+0.8%) are edging higher, platinum has become the new darling of speculators with a 2.8% climb overnight that has taken it up more than 13.5% in the past week and 35% YTD. Remarkably, it is still priced about one-third of gold, although there are those who believe that is set to change dramatically. A quick look at the chart below does offer the possibility of a break above current levels opening the door to a virtual doubling of the price. And in this environment, a run at the February 2008 all-time highs seems possible.

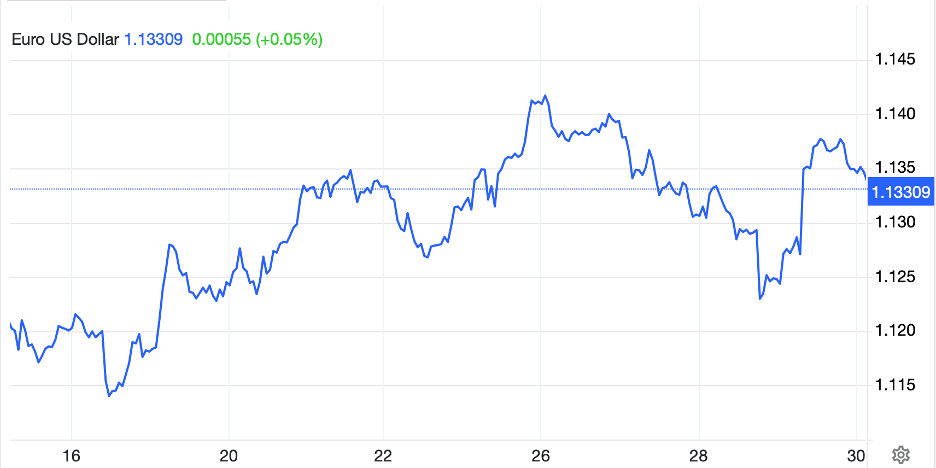

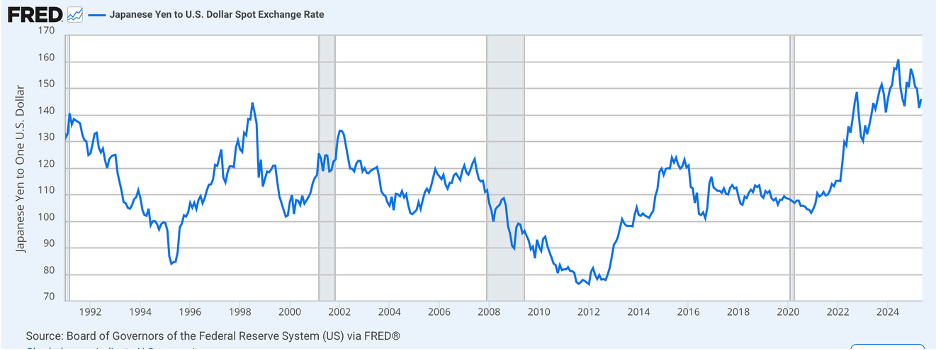

Finally, the dollar is softer across the board this morning, against virtually all its G10 and EMG counterparts. AUD (+0.55%) and NZD (+0.7%) are leading the way, but the yen (+0.5%) is having a solid session as are the euro and pound, both higher by 0.25%. In the emerging markets, PLN (+0.7%) is the leader with the bulk of the rest of the space higher by between +0.2% and +0.4%. BRL (-0.3%) is the outlier this morning, but that looks much more like a modest retracement of recent gains than a new story.

Absent both data and any Fedspeak (the quiet period started on Friday), we are left to our own devices. My take is there are still an equal number of analysts who are confident a recession is around the corner as those who believe one will be avoided. After reading the Deluard piece above, I am coming down on the side of no recession, at least not in a classical sense, as no politician anywhere can withstand the pain, at least not in the G10 and China. That tells me that while Europe may be the equity flavor of the moment, commodities remain the best bet as they are undervalued overall, and all that debt and new money will continue to devalue fiat currencies.

Good luck

Adf