Like a stone toward earth

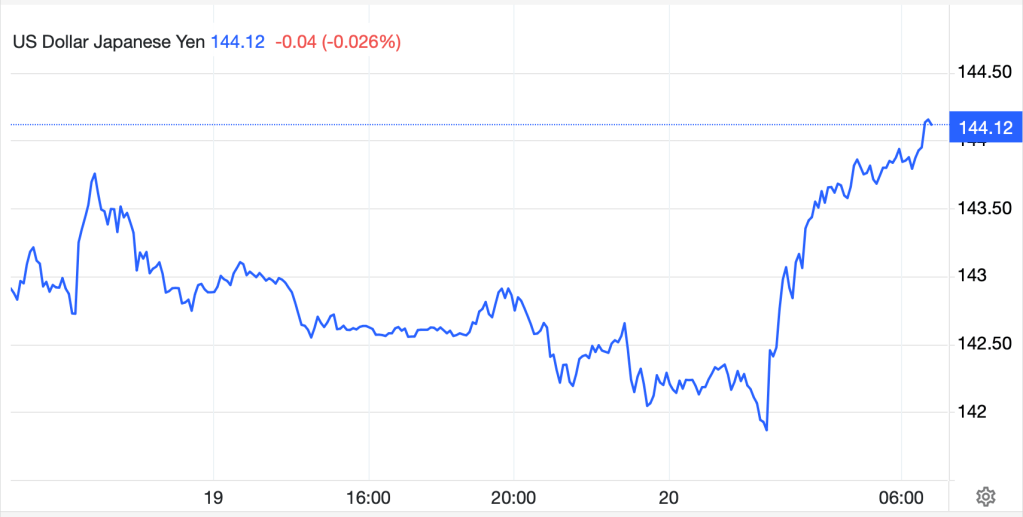

The yen keeps falling further

Beware Kato-san

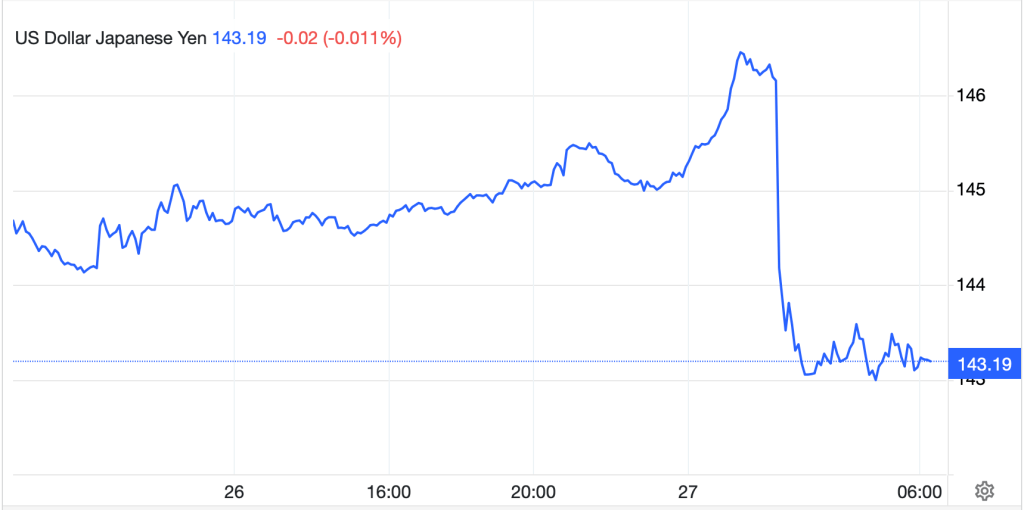

While we have not discussed the yen much lately, its recent weakness, in concert with the dollar’s broad strength, has begun to cause some discomfort in Japan. Last night, Japanese FinMin Katsunobu Kato explained, “We will take appropriate action if there are excessive movements in the currency market.” He went on that he is “deeply concerned” by the recent weakness, especially moves driven by those evil pesky speculators.

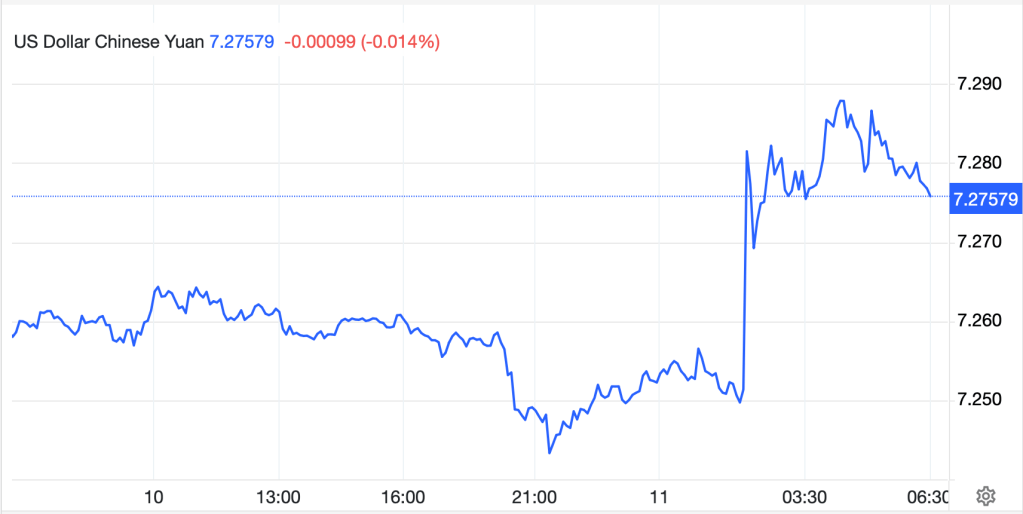

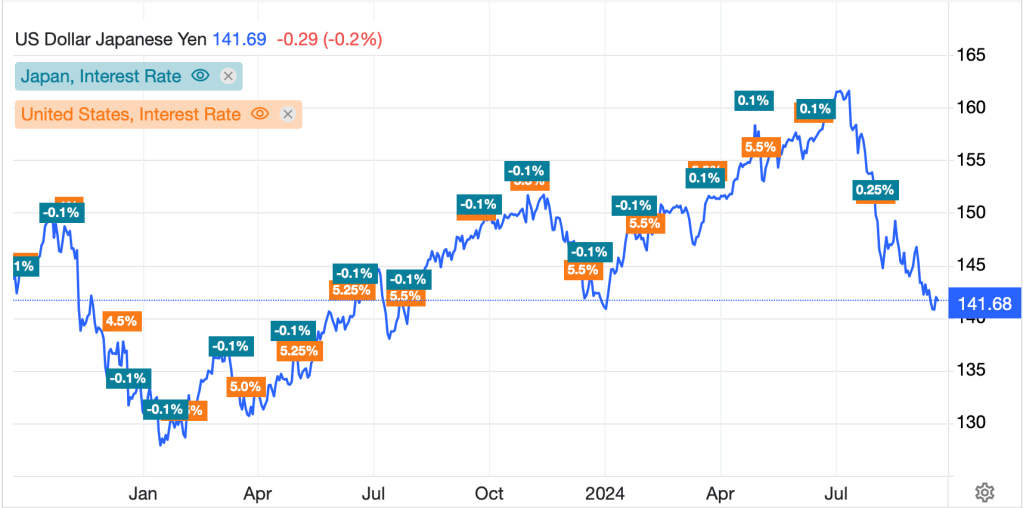

The problem, of course, is that all those expectations that the BOJ would be tightening policy to fight domestic inflation while the Fed would continue to ease policy since they “beat” inflation, with the result being the yen would regain its footing, have proven to be false hope. Instead, as you can see from the below chart, since the Fed first cut rates back in September, the yen has tumbled nearly 13% and very much looks like it is going to test the previous four-decade highs seen last summer.

Source: tradingeconomics.com

Last year, the MOF/BOJ spent about $100 billion in their efforts to stem the yen’s weakness. They still have ample FX reserves to continue with that process, but ultimately, history has shown that maintaining a cap on a currency that is weakening for fundamental reasons is nigh on impossible. If a weak yen is truly seen as existential in Tokyo, then Ueda-san needs to be far more aggressive in tightening monetary policy. This is especially so given the Fed continues to back away from earlier expectations that it would be aggressively loosening policy. Now, while JGB yields have moved higher over the past several sessions, trading now at 1.18%, which is their highest level since April 2011, that is not going to be enough to stem this tide. From what I read, inflation is an issue, but not the same as it was in the US in 2022, so Ueda-san is not getting the same pressure to address it as Powell did back then. My read is the BOJ remains on hold this month and hikes rates in March while the yen continues its decline. Look for another bout of intervention when we test the 162 level, but that will not stop the rot. Nothing has changed my view of 170 or higher in USDJPY by year end.

Though Treasury yields have been rising

Most credit spreads have been downsizing

So, corporate supply

Is ever so high

An outcome that’s somewhat surprising

In the bond market, government bond yields continue to rise around the world (China excepted) as investors increase their demands in order to hold the never-ending supply of new bonds. Ironically, despite this ongoing rout in government bonds across the board, corporate debt issuance looks as though it will set new records this month. One thing to remember here is that corporates have a lot of debt coming due over the next two years as all that issuance during the ZIRP period needs to be rolled over. But the other thing to recognize is that corporate credit spreads, the amount of yield investors require to own risky corporate bonds vis-à-vis “safe” government bonds, has fallen to its lowest levels in years, and as can be seen in the chart below, the extra yield available for high-yield investors is shrinking faster than for investment grades.

Potentially, one reason for this is the dramatic increase in the amount of Private Credit, the latest investment fad where weaker credits go directly to funds designed to lend money rather than to their banks, and investors ostensibly remove one of the middlemen from the process. As such, there is less of this debt around than there otherwise might be, hence increasing demand and reducing that credit spread. But the other reason is that there continues to be a significant amount of investable assets looking for a home, and with global yields near the highest they have been in a decade or more, and with the equity market dividend yield down to just 1.27% or so, a record low, there are lots of investors who are comfortable with clipping 5% or 5.5% coupons on BBB corporate bonds.

The question I would ask is, if government bond yields continue to climb, and I see no reason for that to stop given the trend in inflation and necessary issuance, at what point are investors going to get scared? We are likely still a long way from that point, but beware if the new Treasury Secretary, Scott Bessent, follows through with his hinted views of reducing T-bill issuance and increasing coupon issuance, yields could go much higher absent the Fed implementing QE. That would cause some serious market ructions!

Ok, let’s see how things look around markets this morning after yesterday’s sell-off in the US equity markets. It seems Japanese stocks were caught between the weaker yen (generally a stock positive) and the tech sell-off (generally a stock negative) with the Nikkei closing lower by -0.25% on the session. Meanwhile, the Hang Seng (-0.9%) suffered a bit more on the tech move, although Mainland shares (-0.2%) were not as badly affected. An interesting story here is that the chief economist at state-owned SDIC Securities made comments at an international forum run by the Peterson Institute that really pissed off President Xi. Gao Shanwen said the quiet part out loud when he claimed that actual GDP growth in China for the past several years has likely been much closer to 2% than the 5% published. That story has been widespread in the West, although has never been given official credence. And for Xi, 2% growth is not going to get it done, what with the property bubble still imploding and consumption declining despite promises of more stimulus. Stay tuned to this story to see if we start to see more Western analysts reduce their expectations. Elsewhere in Asia, the picture was mixed with gainers (Korea, Australia, Singapore) and laggards (Taiwan, Malaysia, Philippines).

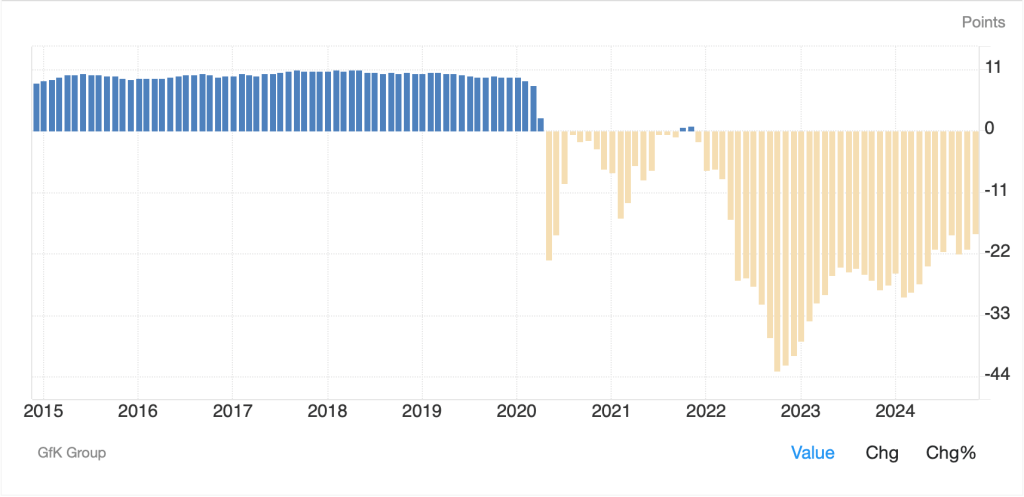

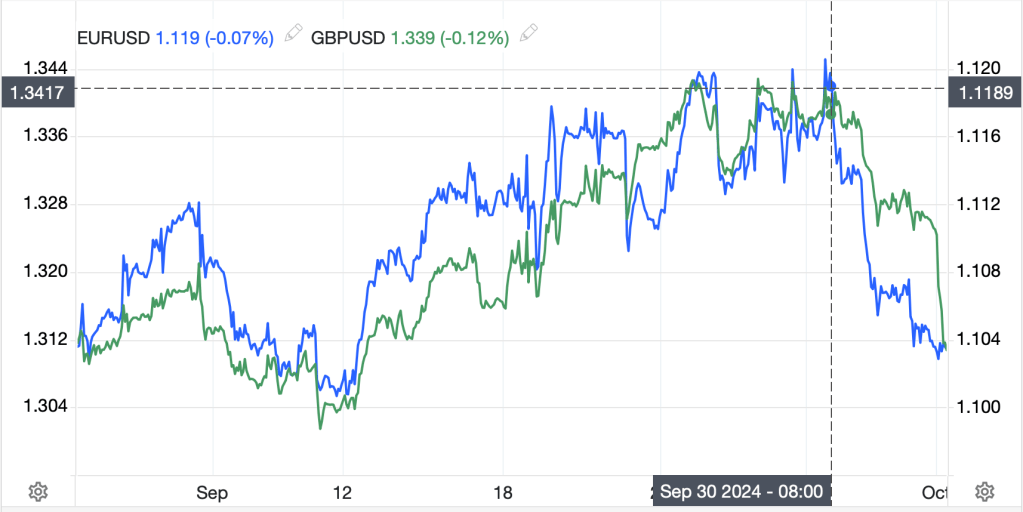

In Europe, red is today’s color, led by the CAC (-1.0%) although we are seeing losses across the board. Eurozone data showed declining Consumer Confidence, Economic Sentiment and Industrial Sentiment all while inflation expectations remain stubbornly high. That stagflationary hint is typically not an equity market benefit so these declines should be expected. The story on the continent is not a positive one and I maintain that the ECB is going to have to cut rates more aggressively than their inflation mandate would suggest. That might support equities a bit, but it will be hell on the euro! Finally, US futures are a touch softer (-0.2%) at this hour (7:05) although they were higher most of the overnight session before this.

As mentioned above, bond yields are higher with Gilts (+9bps) leading the way as not only is the economy suffering from some very poor policy decisions by the Starmer government, but it seems that the ongoing political crisis regarding grooming gangs has investors shying away. But yields continue to rise across the board with continental yields up between 3bps and 6bps, Treasury yields higher by another 1bp this morning after a 10bp rise in the previous two sessions, and JGB yields, as mentioned, higher by 5bps. This trend is very clear!

In the commodity markets, oil (+0.5%) keeps on keeping on, as API data showed a greater than 4mm barrel draw on inventories, far more than expected and indicating a reduced supply around. Cold temperatures are keeping NatGas (+5.0%) firm as well. In the metals markets, both precious and base are under a touch of pressure this morning, down less than -0.2%, largely in response to the dollar’s rebound.

Speaking of the dollar, it is higher against all its counterparts this morning with the pound (-1.2%) the G10 laggard although weakness on the order of 0.5% is pretty common this morning. In the EMG bloc, ZAR (-1.5%) is the worst performer, after weaker than expected PMI data called into question the economic path forward. But here, too, we are seeing weakness like MXN (-0.9%), CLP (-0.8%), PLN (-0.8%) and KRW (-0.5%). I would be remiss to ignore CNY (-0.25%), which is trading below (dollar above) 7.3600 in the offshore market, and is now 2.4% weaker than last night’s fixing rate. This is also the weakest the renminbi has been since it touched this level back in September and then November 2007 prior to that. Those Chinese problems are coming home to roost for President Xi.

On the data front, ADP Employment (exp 140K) leads the day followed by Initial (218K) and Continuing (1870K) Claims. These are being released this morning because of tomorrow’s quasi holiday regarding the late President Carter, when US markets will be closed. This afternoon, the FOMC Minutes arrive and will be scrutinized closely to see just how hawkish they have become. We also hear from Governor Waller this morning with caution being the watchword from virtually every Fed speaker of late.

It is all playing out like I anticipated, with the ISM data showing strength yesterday, not just in the headline number, but also in the Prices Paid number. The Fed will have no chance to cut rates again, and I look for the dollar to continue to rise.

Good luck

Adf