The rumor is Madame Lagarde

Who, through her incompetence, scarred

The ECB, now

Is set to, out, bow

To run for French Prez, no-holds barred

The fear that this move does display

Is Madame LePen’s making hay

So, globalists now

Will hardly allow

Their efforts to just go away

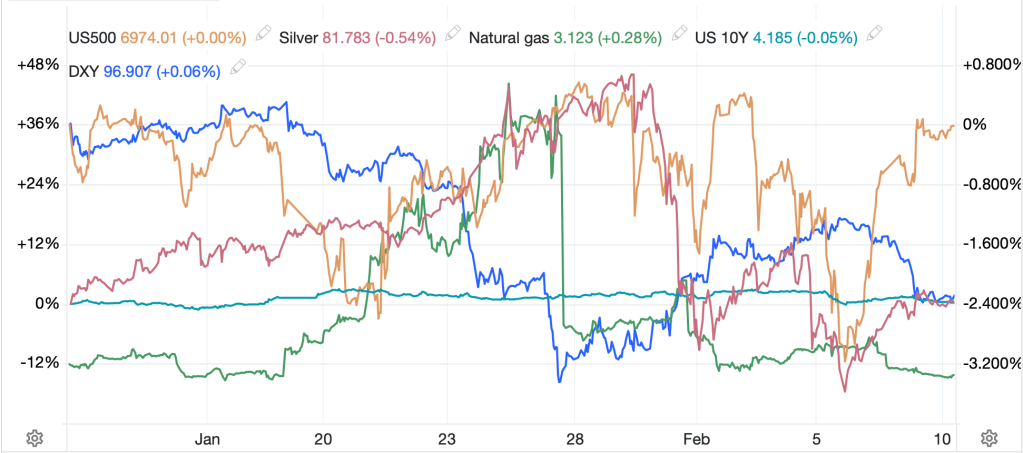

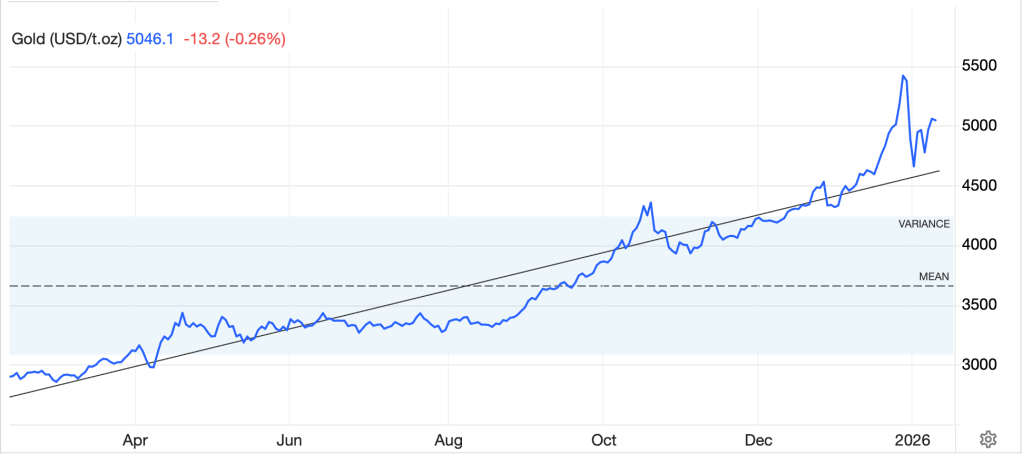

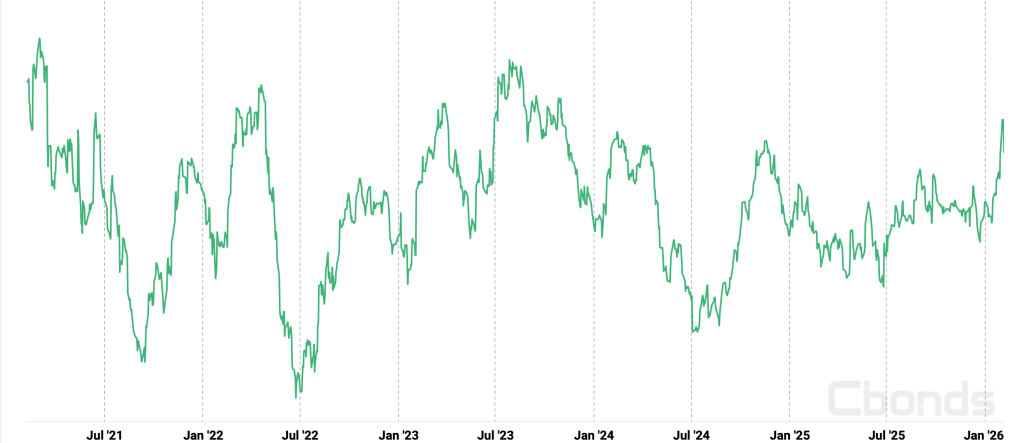

We continue to trade in recent ranges across most products in financial markets as investors and traders seek the next catalyst for secular movement. Even precious metals, which have shown the most volatility of any sector, are now developing a new range as per the chart below.

Source: tradingeconomics.com

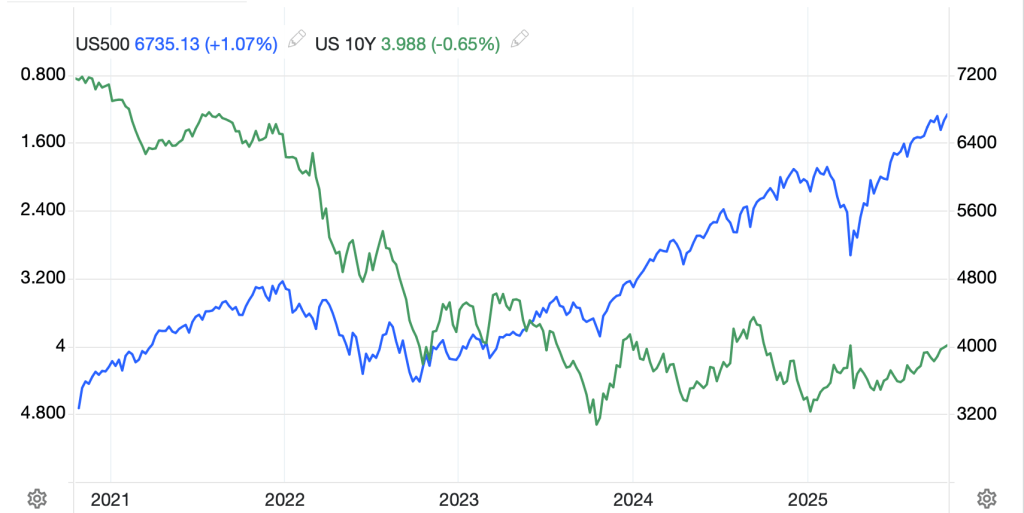

Now, I will grant the range in gold (+0.7%) is wider than many other products, but the chart clearly looks, at least to me, like an ongoing consolidation awaiting the next big thing. As to other products, I have shown bonds, the dollar and even stocks doing the same thing lately, consolidating, and as of this morning, none of them are breaking out in either direction. (As an aside, there is still a very loud group claiming the dollar is about to collapse, but thus far, their views have been unrequited). In fact, if we use the DXY as today’s dollar proxy, we appear to be heading back to the middle of the range rather than breaking lower.

Source: tradingeconomics.com

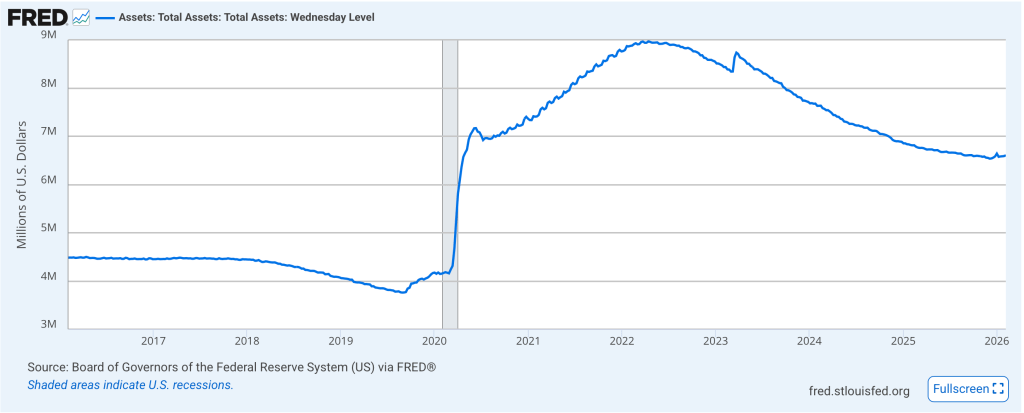

Net, there is not much to discuss in the markets which leads me to the most interesting topic, what will be the catalyst to break these ranges? Historically, there are two types of things that act as a market catalyst, a change in the data trajectory or a geopolitical shift. Right now, the former does not appear to be in the cards. We know this because there are vocal proponents of both substantial economic strength and economic weakness in the future. The lesson from this is that the data remains quite mixed, with some areas of the economy performing well, while others are struggling, but not enough on either side to expect a major trend.

For instance, in the US, recent data showed relative employment market strength while inflation data continues to compress. Now, you can quibble with the construction of both data sets, and there are many valid concerns, but for policymakers, especially those steeped in the view that strong growth necessarily drives inflation higher and vice versa, the current data set does not argue for any policy shift.

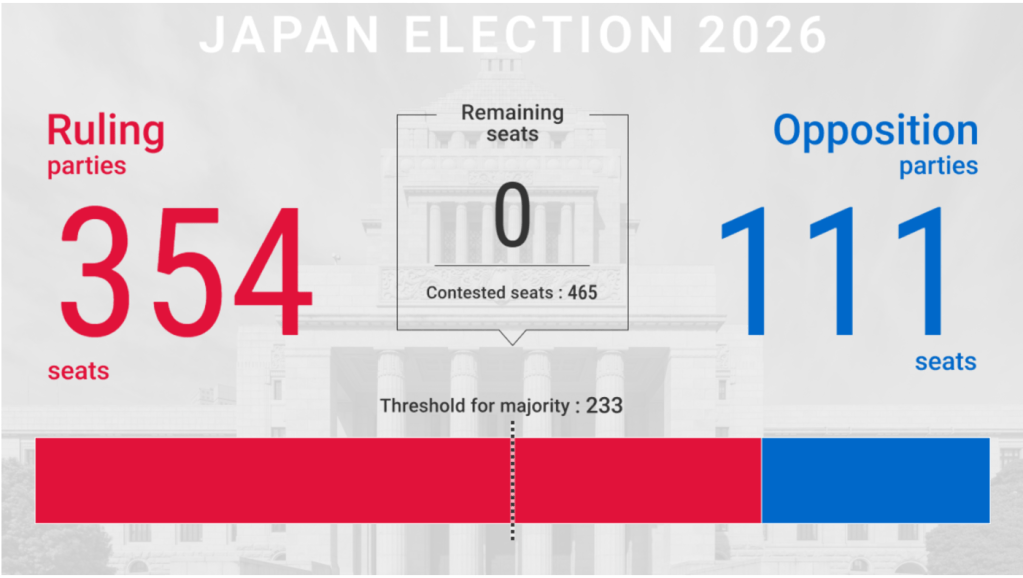

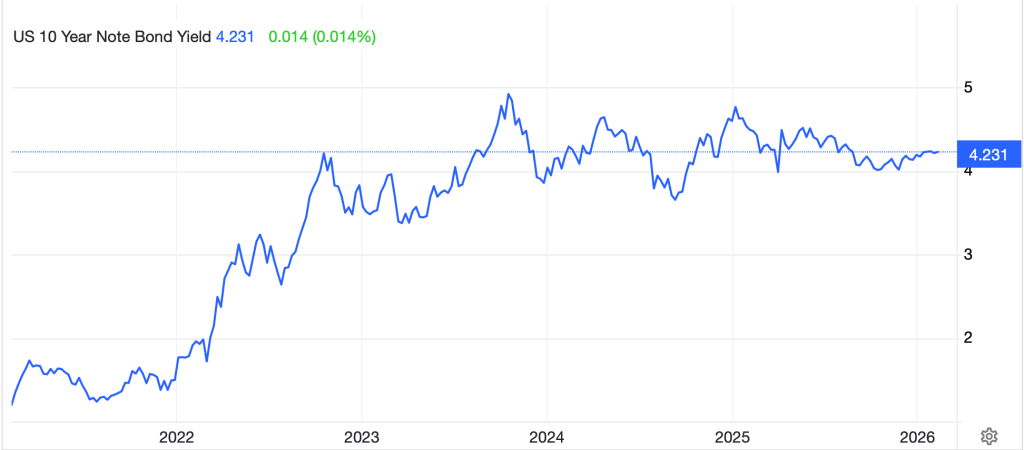

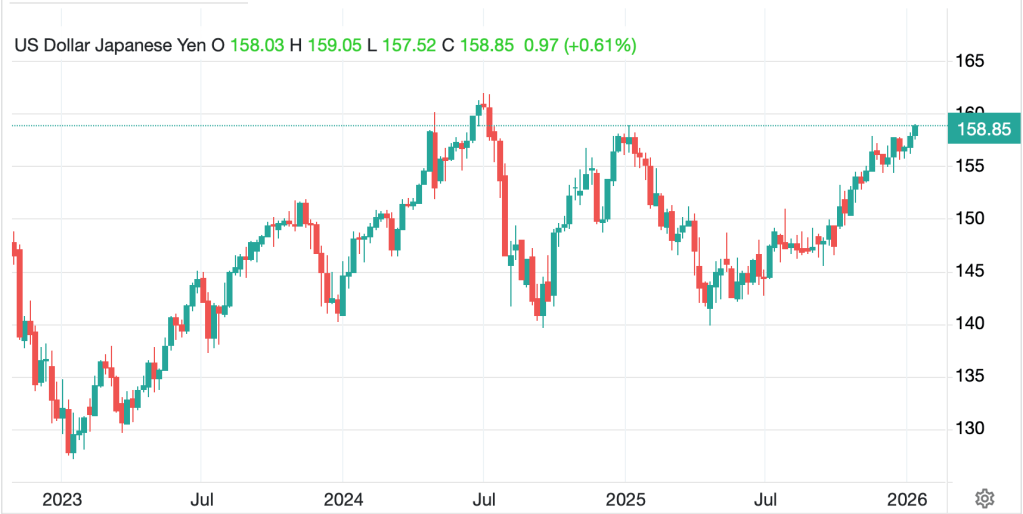

Arguably the biggest geopolitical change of late was the dramatic Takaichi-san victory in Japan, which has enabled her to impose her will on the economy. As such, we can expect more ‘run it hot’ actions there. However, thus far, the JGB market has not rebelled against further unfunded government spending. We are one month, and 20bps, removed from the recent peak in yields. We shall see how long that lasts and if, a change in that view impacts bond markets elsewhere in the world, but as you can see below, it does not look that scary right now.

Source: tradingeconomics.com

But otherwise, Russia/Ukraine continues apace with negotiations going nowhere and the US/Iran talks, with articles this morning claim progress is being made there. Arguably, some type of deal with Iran ought to be bearish oil as it would seemingly involve the lifting of sanctions on their oil sales, but who knows.

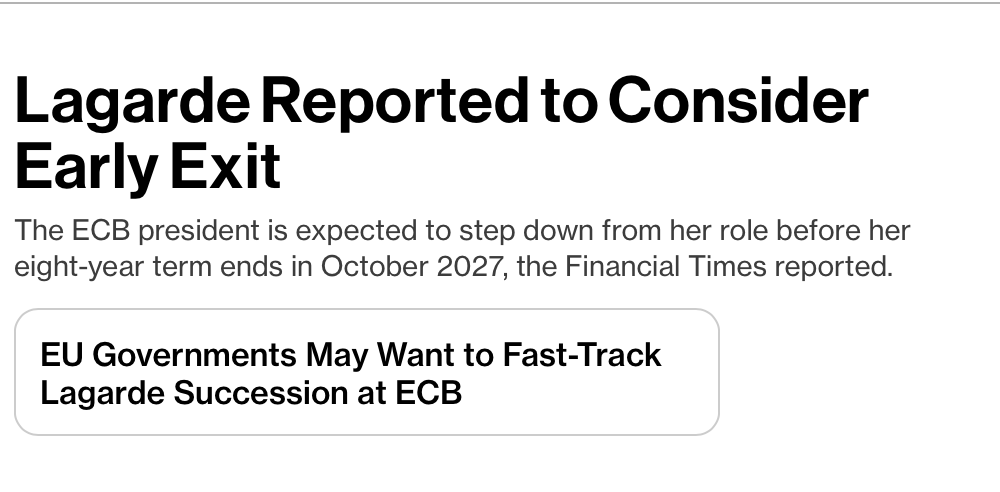

Which takes us to the most interesting headline this morning (see Bloomberg’s headline below), the story that Madame Lagarde is rumored to be stepping down as ECB president before her term expires next year. While, naturally, she has denied the story, there is certainly enough palace intrigue to dig a little deeper.

Ask yourself why, a woman who has spent her career striving to reach the pinnacle of geopolitics, would willingly give up a role at the top. While the initial punditry stories indicate she wants to allow President Macron to be involved in the discussions as to her replacement (if she serves out her term, he will be gone and they fear Marine LePen on the right will be able to influence the next decision), Occam’s Razor tells me it is far more likely she is going to prepare to run for president of France herself. After all, did she not just see her erstwhile colleague, Mark Carney, be elected PM of Canada? And as powerful as major central bank president is, it pales in comparison to national president. Added to her impetus was the resounding Takaichi victory, demonstrating that a woman can be elected in the CEO role, and I must believe, this is her motivation.

If you are of a globalist mindset, Christine Lagarde is the perfect French president, completely beholden to your ideals, and yet, as a woman, believed to be able to work effectively with others (notably President Trump) in order to prevent further damage to your goals. Mark my words, she will step down and announce her candidacy before the summer. Funnily enough, I expect if she leaves, it will be a benefit for the euro!

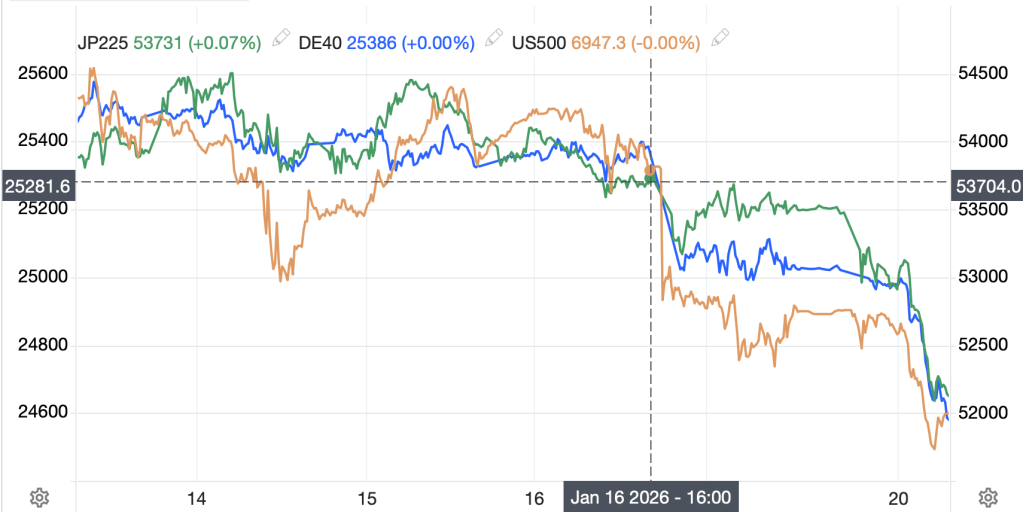

Ok, the briefest of turns around markets shows that Asian equities followed yesterday’s US market rally higher, at least those that were open, with New Zealand (+1.5%) leading the way after the RBNZ left rates on hold, as expected, but came across as more dovish than expected. Otherwise, Tokyo (+1.0%) and Australia (+0.5%) were the next best gainers with the former responding to the news that the first major Japanese investment into the US was announced, a $36 billion set of deals including a massive NatGas power project in Ohio.

European bourses (DAX +0.85%, CAC +0.55%, IBEX +1.25%) are also higher, rising on hopes that the announced increases in defense spending will be spent at home and boost European companies across the continent. As to the UK (+1.0%), softer inflation readings this morning have raised hopes that the BOE will be more aggressive easing policy soon. US futures are higher by about 0.5% this morning as it seems many of the fears about overinvestment in AI have suddenly waned.

Bond yields, which have fallen steadily over the past several weeks have all backed up 1bp, in the US, Europe and Japan. Overall, nothing really to mention here.

In the commodity markets, oil (+2.9%) just jumped after the Russia/Ukraine peace talks broke up abruptly after just 2 hours. Fears of more strikes on Russian infrastructure have risen.

Source: tradingeconomics.com

As to the metals, after yesterday’s declines, this morning they are all bouncing (Au +0.9%, Ag +2.8%, Cu +1.2%, Pt +1.6%) as they continue to consolidate.

Finally, the FX markets are showing very modest net USD strength with NZD (-0.7%) the laggard after the RBNZ while NOK (+0.7%) is the leader, jumping right after the oil news. Otherwise, +/- 0.15% is the order of the day.

On the data front, we get some second-tier information as follows: Durable Goods (exp -2.0%, +0.3% ex transport), Housing Starts (1.33M), Building Permits (1.40M), IP (0.4%) and Capacity Utilization (76.5%). (An interesting tidbit regarding Capacity is that I read China’s Capacity Utilization is just 74.3%. Based on their trade balance, I would have expected a much higher number. It tells me that over (mal?) investment there is even greater than I thought.).

Too, we hear from Fed Governor Michelle Bowman and get the FOMC Minutes at 2:00. Yesterday, Governor Barr said there was no reason to adjust policy for the reasons I stated above, nothing is clear, and I suspect Ms Bowman will be similarly inclined.

It is hard to get excited in today’s market, that’s for sure. In fact, I expect we will need to see something pretty dramatic to drive a break of these ranges, and I have no idea what that will be. Play it close to the vest for now.

Good luck

Adf