We’ve not even gone through a week

Yet Trump, so much havoc did wreak

This poet will claim

That in this ballgame

It’s top first, one down, so to speak

The impact of what has been done

Is widespread and hits everyone

So, please understand

Whatever you’ve planned

May, by events, be overrun

Venezuela continues to be the primary discussion point in both the media and the markets. Mostly along political lines there are calls that the weekend’s action was illegal or not, and as Brent Donnelly, a very good follow on X (@donnelly_brent), explained after reading voluminous material, the raid was either all about the oil or had nothing to do with the oil. I feel like that sums things up pretty well.

While this poet has views on the ongoing issues, they are set from afar with no inside knowledge so keep that in mind. But ultimately, my take is the opportunity for real change has come to Venezuela, something that did not exist while Maduro was still there. If nothing else, the ability for the US to exfiltrate him must have made a strong impression on acting president Rodriguez and the generals overseeing the army and police forces there and ought push decision making in a positive direction, at least for a while. What seems abundantly clear, however, is that most of the population is ecstatic at his removal and have hope for a future, something missing for decades.

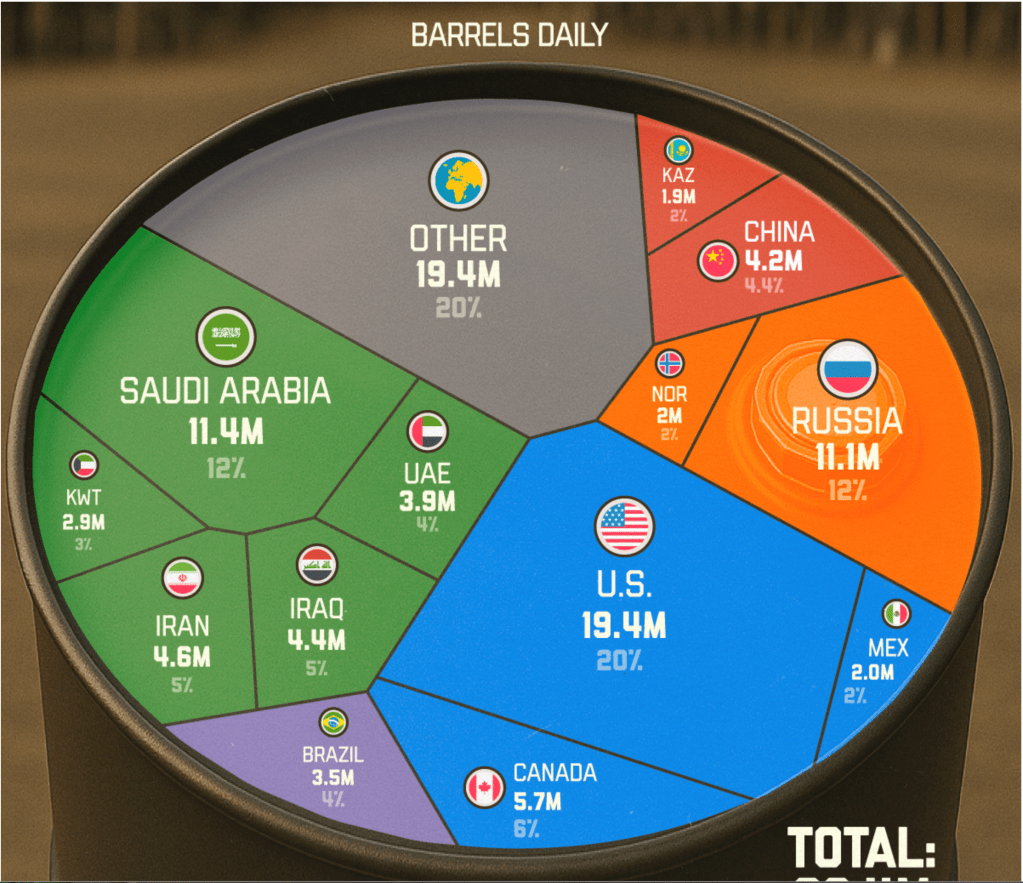

As to the oil, it is heavy, sour crude, something Gulf coast refineries are tuned to use, but the infrastructure there is a disaster. My take is the one thing that is underestimated is just how remarkable the technology of oil exploration and production has become, and its ability to solve problems in efficiency to reduce the cost of extraction. I will take the under on the time it takes to increase production there, although a key bottleneck is the electric grid which must be addressed as well. Nonetheless, despite the rise in oil prices during yesterday’s session, I maintain my view that the trend is lower.

Other than domestic political news there seems little else to discuss but market activity, so let’s go there. A strong session in the US yesterday was followed by plenty of strength in Asia with Japan (+1.3%), China (+1.6%) and HK (+1.4%) all having excellent outcomes. Too, Korea (+1.7%) and Taiwan (+1.6%) had strong showings with many more gainers than losers in the region. The one market that has not partaken in the early year rally is India (-0.4%), which I can only ascribe to the fact they may be losing a source of cheap oil. Or perhaps, more accurately, all the buyers of sanctioned oil may find themselves in more difficult straits, paying full price, as the dark fleet of tankers is suddenly having more trouble making the rounds.

On this note, one other place to watch is Iran, where it appears that the regime may be set to collapse as protests grow and some cities may have been completely taken over by the protesters. If the theocracy falls, I would expect that, too, will pressure oil prices lower, as sanctions could be swiftly lifted.

Turning to Europe, does anybody really care anymore? No, seriously, markets there are mixed this morning with France (-0.4%) lagging while the UK (+0.7%) is gaining on the back of BP and Shell and the general euphoria about the oil majors now. Meanwhile, other major markets have seen modest gains (Italy +0.4%, Spain +0.3%, Germany +0.2%) but there is one outlier, Denmark (+2.1%) which, given all the talk of the US seeking to take control of Greenland, seems odd to me. I can find no specific news either for the economy or any companies (Novo Nordisk being the only one of note), but something is going on. As to US futures, at this hour (6:50) they are little changed.

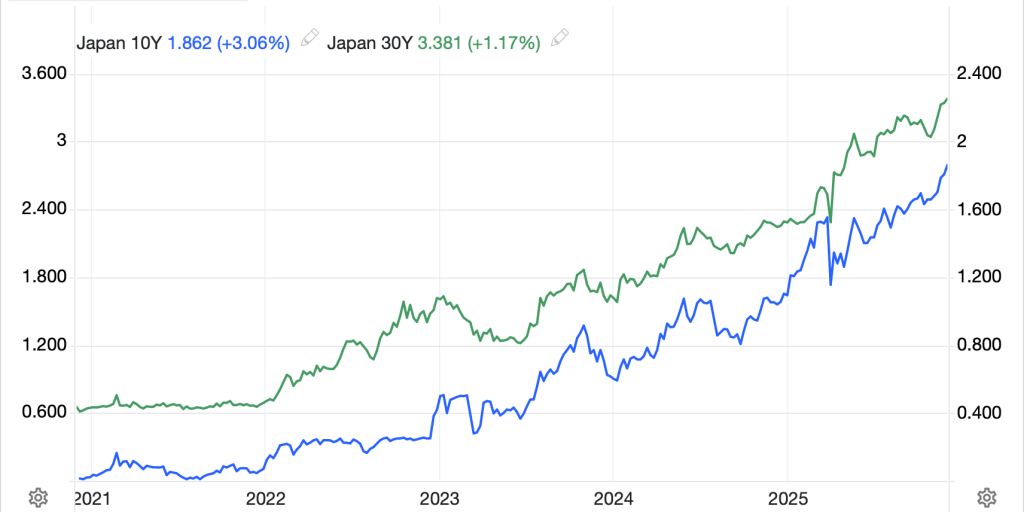

Turning to the bond market, the below chart of the 10-year offers a great picture of what it means when traders say nothing is going on. Since early September, the bond has been trading within a 20 basis point range despite all the huffing and puffing of the punditry and the FOMC’s rate cuts.

Source: tradingeconomics.com

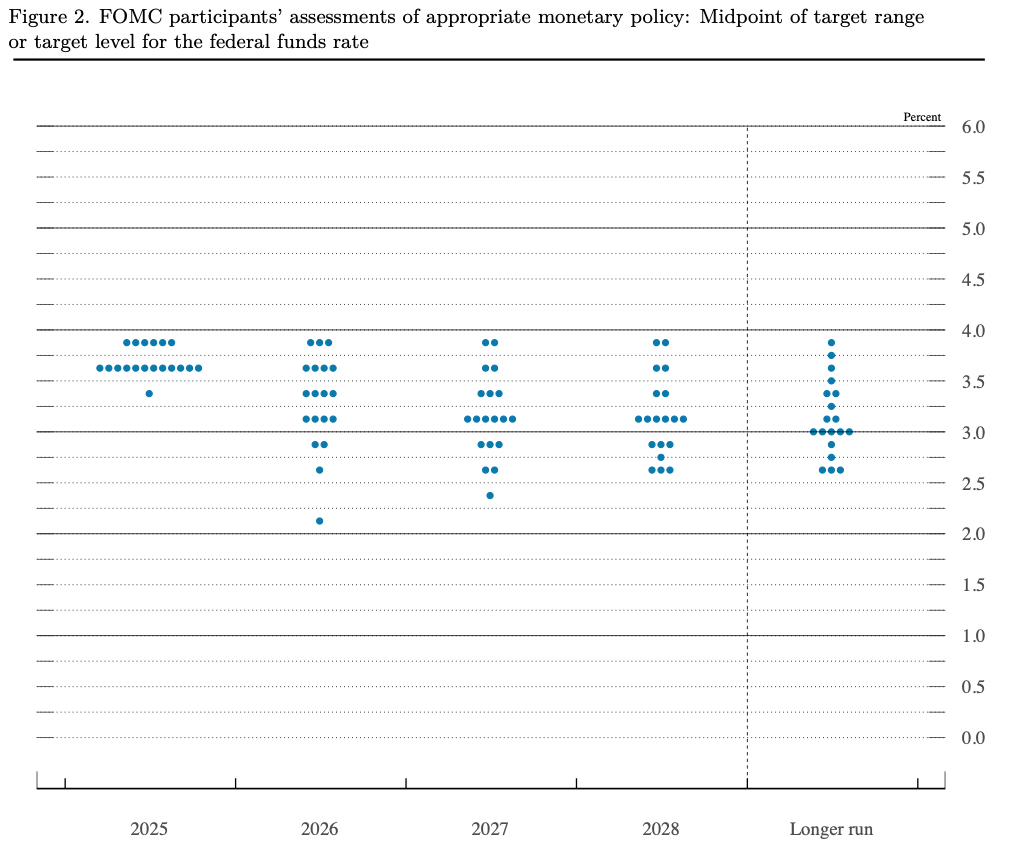

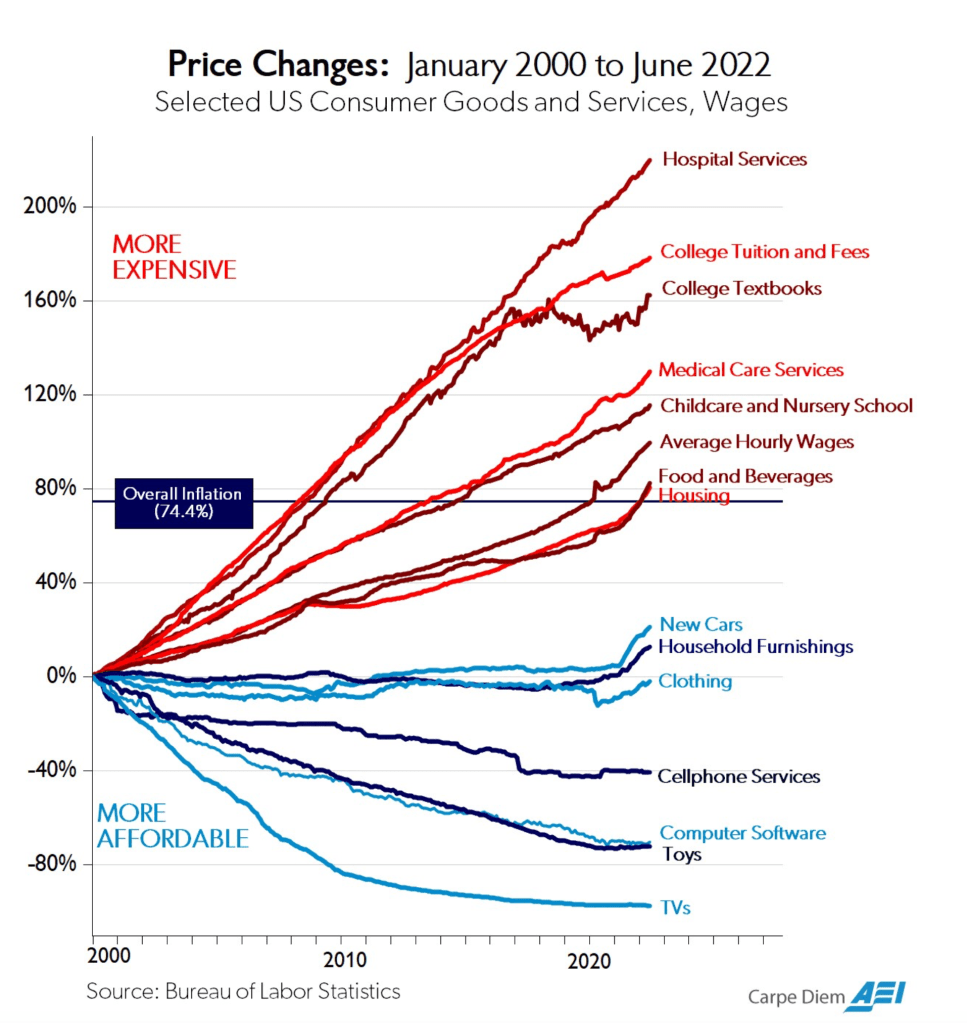

If bond investors are the “smart” money, I would argue that right now they have no opinion, or perhaps their opinion is that the economy is going to continue to tick along at a decent rate, with limited extra inflationary pressure. To that last point, an article in the WSJ this morning explained that several recent studies, one by the SF Fed, demonstrated that tariffs have virtually no inflationary impact. That probably doesn’t help Powell’s talking points. While I continue to be concerned that inflation will maintain a 3+% level, I also believe the Fed is going to suppress interest rates going forward, net, bonds don’t seem that exciting. As to the overnight price action, Treasury yields backed up 2bps, while European sovereigns slipped between -1bp and -2bps. I couldn’t help but also notice that yesterday saw a massive issuance of USD bonds by non-US corporates, over $60 billion, an indication to me, at least, that calls for the death of the dollar are somewhat premature.

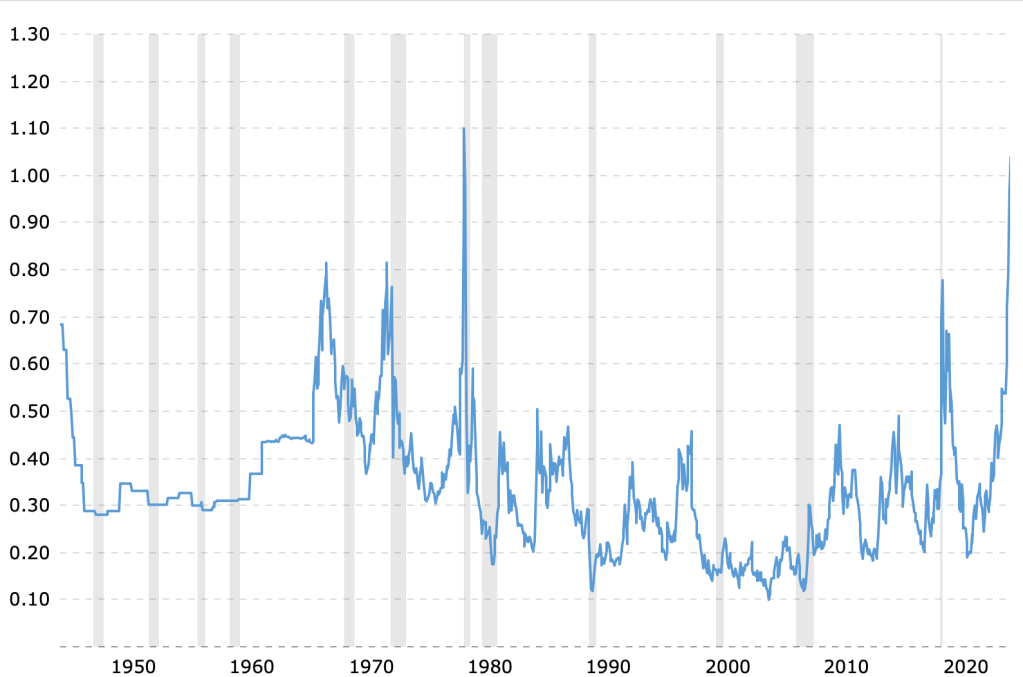

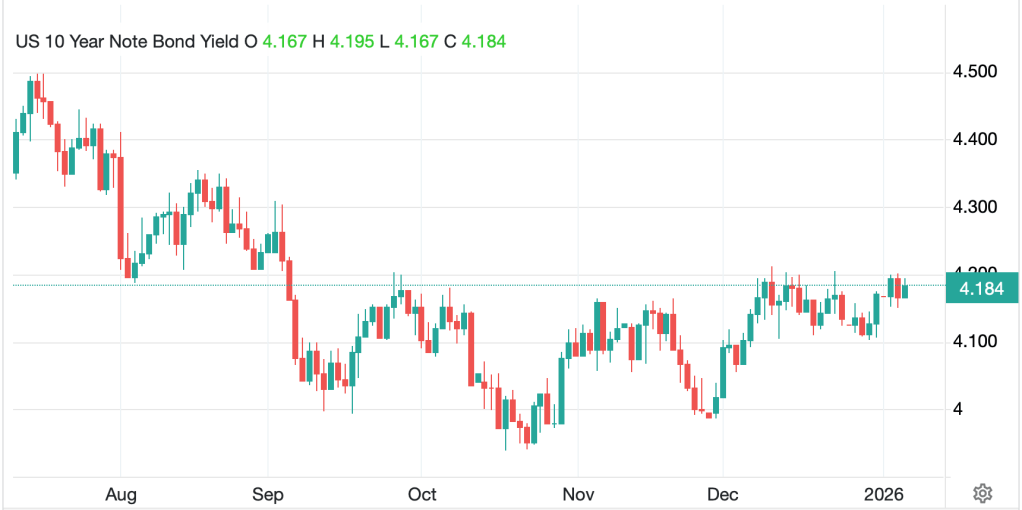

Commodities continue to be where all the action is, or perhaps more accurately, metals markets. After massive rallies yesterday, we are seeing follow through with gold (+0.4%), silver (+2.4%), copper (+1.0%) and platinum (+3.2%) all strong again. Unlike the bond market, and truly FX, which is also dull and boring, the below chart shows just how much things in the metals space have changed over time.

Source: tradingeconomics.com

My take is that investors are still trying to figure out the implications of the fact that old relationships like the dollar falling when metals rise, or metals falling when real interest rates rise, are broken and what that implies for the future. The reality is that other than gold, which is the calmest of them all, these metals are indicating actual shortages for users. Consider that, according to Grok, the typical catalytic converter uses between 0.1 and 0.25 troy ounces of platinum, so at today’s price, between $230 and $575. Given the average price of a new car is ~$50K, paying up for platinum is not going to change the equation that much, certainly relative to not having the platinum and therefore not being able to complete and sell the vehicle. I suspect that metals, while likely to be volatile in their price action, have much further to run higher.

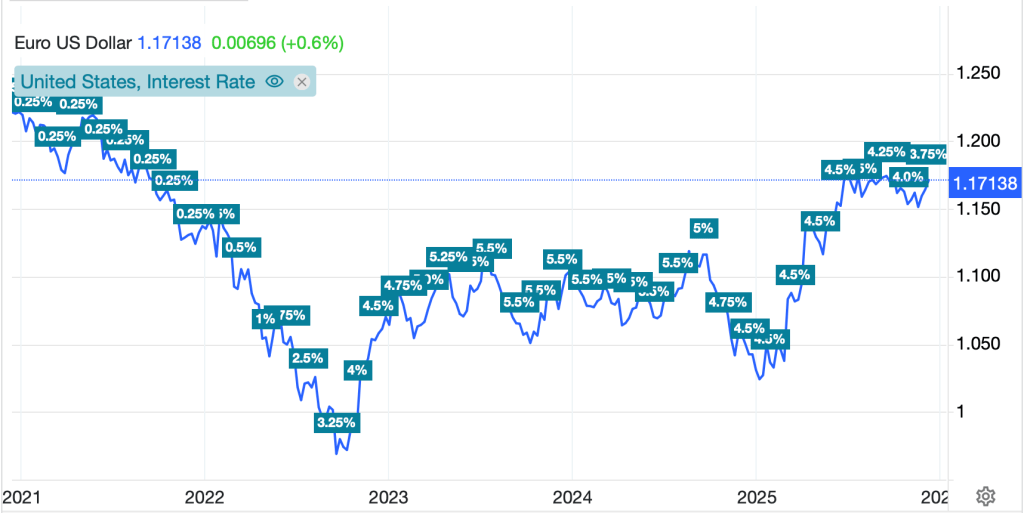

Lastly, the dollar…is still there. Using the DXY as my proxy this morning, you can look at the chart below for the past year and see, it has basically not moved since it stopped declining in late April 2025. It is hard to get excited about things right now. However, I maintain that the US will remain the cleanest dirty shirt and benefit accordingly over time.

Source: tradingeconomics.com

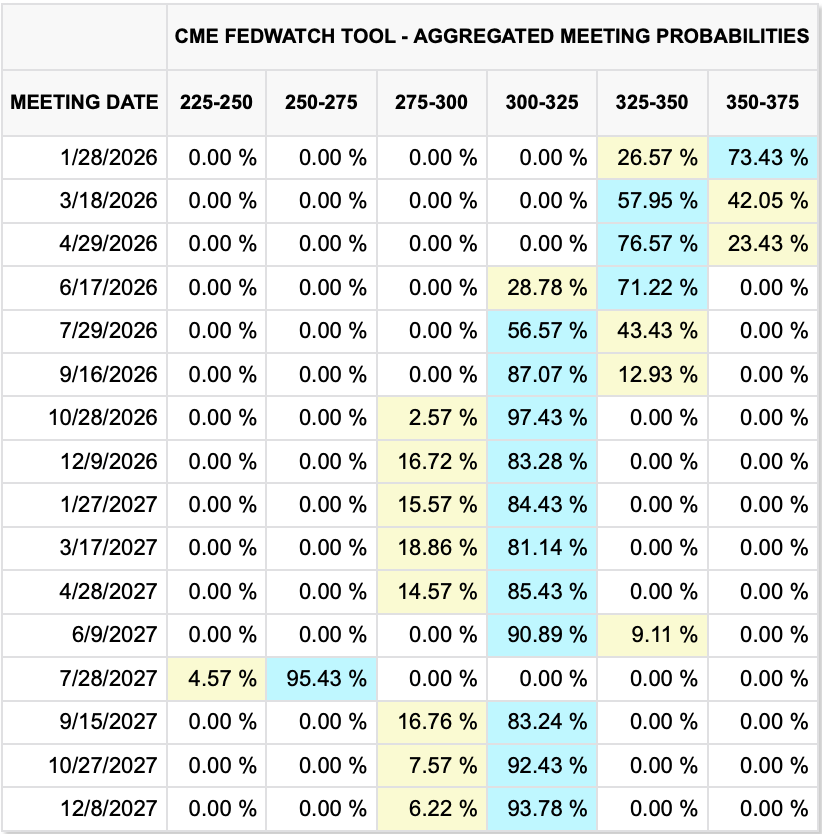

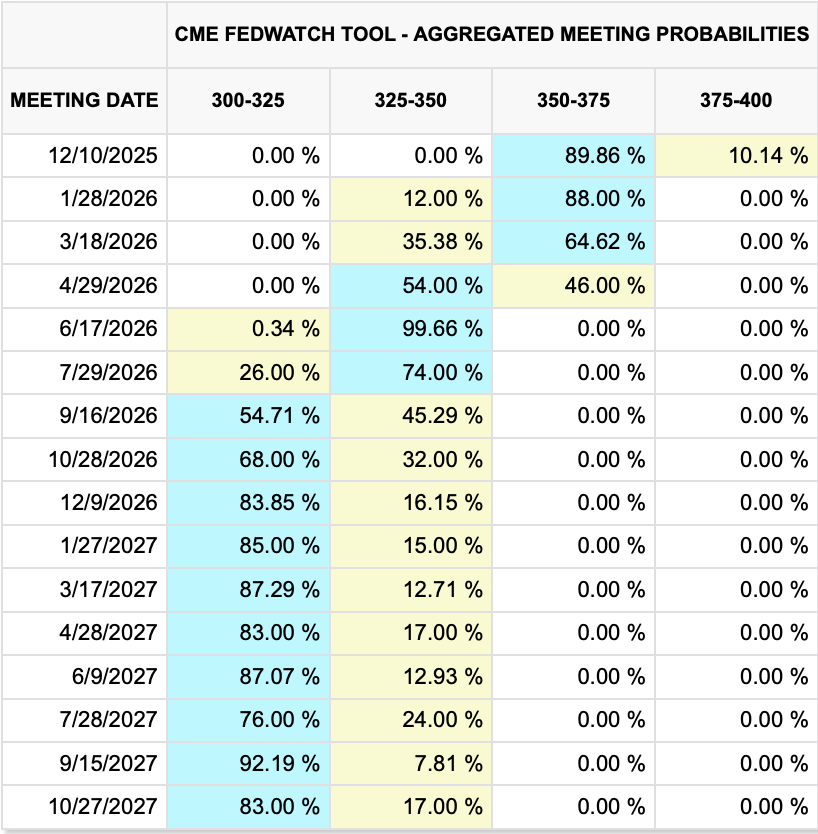

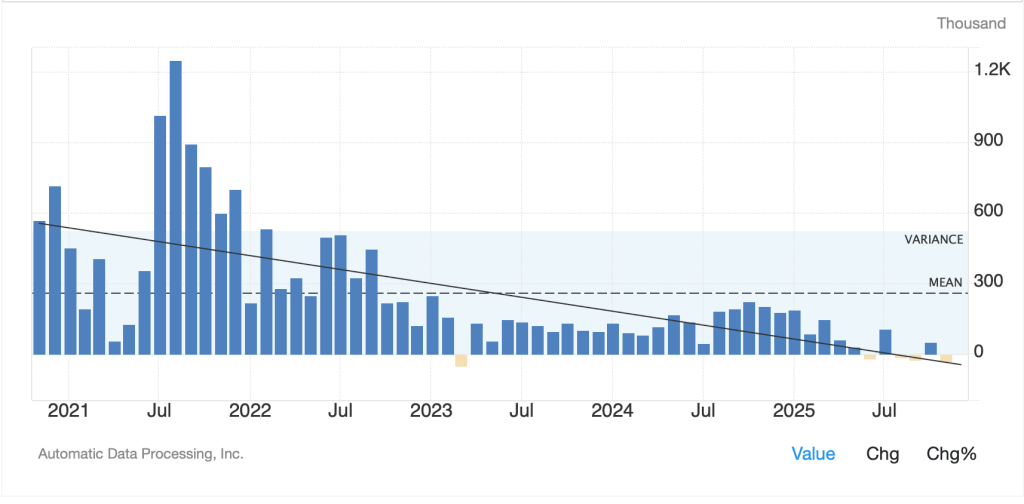

On the data front, Services (exp 52.9) and Composite (53.0) PMI are released this morning with both expected lower than last month, but still in expansion territory. We also hear from Richmond Fed governor Barkin, but it seems the Fed has taken a back seat to Venezuela lately, at least with respect to what is driving markets. As of this morning, there is just a 16% probability of a rate cut priced in for the end of the month with a 53% probability priced for the March meeting. But two more cuts are seen as a certainty by September, although if GDP continues to perform like it has, I imagine that will change. According to the Atlanta Fed’s GDPNow model, Q4 is forecast at 2.7%. We shall see how that evolves over time.

Summing it all up, the dollar is an afterthought in markets right now and seems unlikely to move very much in the near term. Metals remain the place to be, and nothing indicates those trends have ended.

Good luck

Adf